Valley National Bancorp Announces Pricing of Common Stock Offering

08 November 2024 - 4:28AM

Valley National Bancorp (“Valley”) (

NASDAQ: VLY),

the holding company for Valley National Bank, today announced the

pricing of a public offering of 42,780,748 shares of its

common stock, no par value (the “Common Stock”), at a public

offering price of $9.35 per share, for aggregate gross proceeds of

$400 million.

In addition, Valley has granted the underwriter a 30-day option

to purchase up to an additional 6,417,112 shares of its Common

Stock at the public offering price, less underwriting discounts and

commissions. The offering is expected to close on November 12,

2024, subject to the satisfaction of customary closing

conditions.

Valley intends to use the net proceeds from this offering for

general corporate purposes and for investments in Valley National

Bank as regulatory capital.

J.P. Morgan is acting as sole book-running manager for the

offering. Wachtell, Lipton, Rosen & Katz is serving as legal

counsel to Valley.

The Common Stock will be issued pursuant to an effective shelf

registration statement (File No. 333-278527) (including base

prospectus) and a preliminary prospectus supplement filed with the

Securities and Exchange Commission (the “SEC”), and a final

prospectus supplement to be filed with the SEC.

Copies of the preliminary prospectus supplement and accompanying

base prospectus relating to the Common Stock offering can be

obtained without charge by visiting the SEC’s website at

www.sec.gov, or may be obtained from: Valley National Bancorp, 70

Speedwell Avenue, Morristown, New Jersey 07960, Attention: Tina

Zarkadas, (973) 305-3380, or by contacting J.P. Morgan Securities

LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, New York 11717 or by email at

prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of the

Common Stock in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. Any offering of the Common Stock is being made only

by means of a written prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended.

About Valley

As the principal subsidiary of Valley National Bancorp, Valley

National Bank is a regional bank with over $62 billion in assets.

Valley is committed to giving people and businesses the power to

succeed. Valley operates many convenient branch locations and

commercial banking offices across New Jersey, New York, Florida,

Alabama, California and Illinois, and is committed to providing the

most convenient service, the latest innovations and an experienced

and knowledgeable team dedicated to meeting customer needs. Helping

communities grow and prosper is the heart of Valley’s corporate

citizenship philosophy.

Forward Looking Statements

This news release and other statements made by Valley in

connection with it may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements are not historical facts and include

statements regarding the completion of the offering, expressions

about management’s confidence and strategies and management’s

expectations about our business, new and existing programs and

products, acquisitions, relationships, opportunities, taxation,

technology, market conditions and economic expectations. These

statements may be identified by such forward-looking terminology as

“intend,” “should,” “expect,” “believe,” “view,” “opportunity,”

“allow,” “continues,” “reflects,” “would,” “could,” “typically,”

“usually,” “anticipate,” “may,” “estimate,” “outlook,” “project” or

similar statements or variations of such terms. Such

forward-looking statements involve certain risks and uncertainties.

Actual results may differ materially from such forward-looking

statements. A detailed discussion of factors that could affect our

results is included in Valley’s SEC filings, including Item 1A.

“Risk Factors” of its Annual Report on Form 10-K for the year ended

December 31, 2023. Valley undertakes no duty to update any

forward-looking statement to conform the statement to actual

results or changes in our expectations, except as required by law.

Although Valley believes that the expectations reflected in the

forward-looking statements are reasonable, Valley cannot guarantee

future results, levels of activity, performance or

achievements.

|

Contact: |

|

Travis Lan |

| |

|

Executive Vice President and |

| |

|

Deputy Chief Financial

Officer |

| |

|

973-686-5007 |

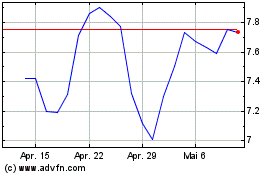

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

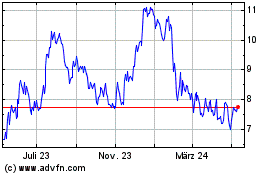

Valley National Bancorp (NASDAQ:VLY)

Historical Stock Chart

Von Nov 2023 bis Nov 2024