Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-262415

Prospectus

Supplement

(To

Prospectus Dated May 12, 2022)

Up

to 1,457,700 Shares of Common Stock

Warrants

to Purchase up to 728,850 Shares of Common Stock

Up

to 728,850 Shares of Common Stock underlying such Warrants

Pursuant

to this prospectus supplement and the accompanying prospectus, we are offering (i) 1,457,700 shares of our common stock, $0.001 par value

per share, at an offering price of $7.00 per share, (ii) warrants to purchase up to 728,850 shares of our common stock (the “Warrants”),

at an exercise price of $9.50 per share and exercisable six months following their issuance for a term of three years from the date of

the initial issuance date, and (iii) 728,850 shares of our common stock issuable upon exercise of the Warrants. We have not retained

a placement agent in connection with this offering.

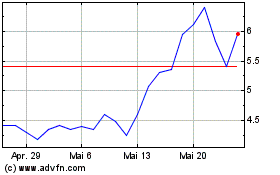

Our

common stock is traded on The Nasdaq Capital Market (“Nasdaq”) under the symbol “USAU.” On November 27, 2024,

the last reported sale price for our common stock was $8.22 per share. There is no established public trading market for the Warrants

and we do not expect a market to develop. In addition, we do not intend to list the Warrants on Nasdaq, or any other national securities

exchange or any other nationally recognized trading system.

As

of November 26, 2024, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $85.4 million,

based on 10,865,416 shares of outstanding common stock, of which 10,235,581 shares were held by non-affiliates, and a per share price

of $8.34 based on the closing price of our common stock on November 26, 2024.

The

gross proceeds to us before fees and expenses will be approximately $10.2 million. See “Plan of Distribution” on page S-21

of this prospectus supplement for more information.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement

and “Risk Factors” beginning on page 4 of the accompanying prospectus and in the documents incorporated by reference in this

prospectus supplement for a discussion of factors to consider before deciding to invest in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

| | |

Per Share | | |

Total | |

| Offering price and proceeds, before expenses, to us(1) | |

$ | 7.00 | | |

$ | 10,203,900 | |

| (1) |

The

amount of offering proceeds to us presented in this table does not give effect to the exercise, if any, of the Warrants being issued. |

We

anticipate that delivery of the shares of common stock offered hereby is expected to take place on or about December 2, 2024, subject

to satisfaction of certain conditions.

The

date of this prospectus supplement is November 27, 2024.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

BASE

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 (File No. 333-262415) that we

filed with the Securities and Exchange Commission (the “SEC”), utilizing a “shelf” registration process. Under

this shelf registration process, we may offer and sell from time to time in one or more offerings the securities described in the accompanying

prospectus. This prospectus supplement describes the specific details regarding this offering, including the price, the amount of our

common stock being offered, the risks of investing in our common stock and other items.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this securities offering

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein

and therein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus,

we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this

prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference herein or

therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided

that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies

or supersedes the earlier statement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You

should rely only on the information contained in this prospectus supplement and the accompanying prospectus, including any information

incorporated by reference. We have not authorized any other person to provide you with different information. If anyone provides you

with different or inconsistent information, you should not rely on it. You should not assume that the information appearing in this prospectus,

any prospectus supplement or any document incorporated by reference is accurate at any date other than as of the date of each such document.

Our business, financial condition, results of operations and prospects may have changed since the date indicated on the cover page of

such documents. Both this prospectus supplement and the accompanying prospectus include important information about us, our common stock

and other information you should know before investing. This prospectus supplement also adds, updates, and changes certain of the information

contained in the prospectus. This prospectus supplement contains summaries of certain provisions contained in some of the documents described

herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety

by the actual documents. You should read both this prospectus supplement and the accompanying prospectus as well as the additional information

described under the headings “Where You Can Find More Information” and “Incorporation by Reference” before investing

in our common stock.

We

are offering to sell, and seeking offers to buy, our securities offered by this prospectus supplement only in jurisdictions where offers

and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus or any free writing prospectus

and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into

possession of this prospectus supplement and the accompanying prospectus or any free writing prospectus must inform themselves about,

and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus supplement and the accompanying

prospectus or any free writing prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not

constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by

this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

Purchasers

of shares of common stock are advised that none of the shares of common stock will be qualified for distribution in any jurisdiction

of Canada, and may not be traded through the facilities of the TSX or any other Canadian stock exchange, or otherwise in a jurisdiction

of Canada. By purchasing shares of common stock hereunder, each purchaser thereof will be deemed to have represented and warranted to

the Company that such purchaser (i) is acquiring the securities solely for its own account and beneficial interest for investment purposes,

and not for sale or with a view to distribution in Canada, and (ii) has no present intention of selling the securities through the facilities

of the TSX or any other Canadian stock exchange, or otherwise in a jurisdiction of Canada, and does not presently have any reason to

expect a change in such intention.

Purchasers

are advised that the securities offered by this prospectus supplement have not been and will not be registered for sale to the public

in any jurisdiction other than the United States where registration for such purpose is required. Any purchaser of the securities offered

by this prospectus supplement that is located outside of the United States is responsible for complying with all applicable laws and

regulations in effect in any applicable jurisdiction. Any purchaser of the securities offered by this prospectus supplement will be deemed

to have agreed that it has or will comply with all such applicable laws and regulations in connection with such sales.

Unless

the context requires otherwise, references in this prospectus supplement to “the Company,” “we,” “us”

and “our” refer to U.S. Gold Corp. and its consolidated subsidiaries as a combined entity.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights certain information contained elsewhere in this prospectus supplement, the accompanying base prospectus

and the documents incorporated by reference herein and in the accompanying base prospectus. This summary does not contain all the information

you will need in making your investment decision. You should carefully read this entire prospectus supplement and, the accompanying base

prospectus that we have been authorized to use and the documents incorporated by reference herein and in the accompanying base prospectus.

You should pay special attention to the information under “Risk Factors” beginning on page S-5 of this prospectus supplement

and page 4 of the accompanying base prospectus.

Overview

of the Company

U.S.

Gold Corp. and its subsidiaries are engaged in the gold mining industry. We are a U.S.-focused gold exploration and development company.

We own certain mining leases and other mineral rights comprising the CK Gold Project in Wyoming, the Keystone Project in Nevada and most

recently the Challis Gold Project in Idaho. The CK Gold Project is the only property that is currently material to our business.

We

are focused on the evaluation, acquisition, exploration and advancement of gold exploration and potential development projects, which

may lead to gold production or value added strategic transactions such as earn-in right agreements, option agreements, leases to third

parties, joint venture arrangements with other mining companies, or outright sales of assets for cash and/or other consideration. We

look for opportunities to improve the value of our gold projects through exploration drilling and/or technical studies focused on optimizing

previous engineering work. We do not currently generate any revenues or cash flows from mining operations.

Corporate

Information

Our

principal executive offices are located at 1910 E. Idaho Street, Suite 102-Box 604, Elko, NV 89801 and our telephone number at that address

is (800) 557-4550. Our web site address is www.usgoldcorp.gold. Information on our website is not incorporated in this prospectus supplement

and is not part of this prospectus supplement, unless otherwise stated.

U.S.

Gold Corp., formerly known as Dataram Corporation (the “Company”), was originally incorporated in the State of New Jersey

in 1967 and was subsequently re-incorporated under the laws of the State of Nevada in 2016. Effective June 26, 2017, the Company changed

its name to U.S. Gold Corp. from Dataram Corporation.

THE

OFFERING

| Common

stock offered by us |

|

1,457,700

shares of common stock, $0.001 par value per share, plus 728,850 shares of our common stock issuable upon exercise of the Warrants. |

| |

|

|

| Warrants

offered by us |

|

Warrants

to purchase up to 728,850 shares of our common stock, at an exercise price of $9.50 per share, exercisable six months following the

date of issuance, for a term of three years following the initial issuance date. |

| |

|

|

| Common

stock to be outstanding immediately after the offering (1) |

|

As

of November 26, 2024, we had 10,865,416 shares of common stock outstanding. Following this offering, we will have 12,323,116

shares of common stock outstanding (assuming that we sell the maximum number of shares of common stock offered and excluding the

shares issuable upon exercise of the Warrants). |

| |

|

|

| Use

of proceeds |

|

We

expect to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds”

on page S-17. |

| |

|

|

| Dividend

policy |

|

We

do not anticipate paying any cash dividends on our common stock in the foreseeable future but intend to retain our capital resources

for reinvestment in our business. |

| |

|

|

| Risk

factors |

|

Investing

in our securities involves a high degree of risk. You should read the “Risk Factors” section beginning on page S-5 of

this prospectus supplement and page 4 of the accompanying prospectus and in the documents incorporated by reference in this prospectus

supplement for a discussion of factors to consider before deciding to invest in our securities. |

| |

|

|

| Nasdaq

symbol |

|

USAU |

| |

|

|

| Transfer

agent |

|

Equity

Stock Transfer LLC |

| (1) |

The

number of shares of common stock to be outstanding immediately after this offering is based on 10,865,416 shares of our common stock

outstanding as of November 26, 2024, and excludes, as of such date: |

| |

● |

192,750

shares of common stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of $5.54 per

share; |

| |

● |

4,193,950

shares of common stock issuable upon exercise

of outstanding common stock purchase warrants with a weighted average exercise price of $6.84 per share; |

| |

● |

up

to 1,785,419 shares of common stock reserved for future issuance under our equity incentive plans, not inclusive of shares

of common stock issuable upon the conversion of 425,584 outstanding restricted stock units; and |

| |

● |

up

to 728,850 shares of common stock issuable upon exercise of the Warrants, at an exercise price of $9.50 per share. |

Except

as otherwise indicated, the information in this prospectus supplement assumes (i) no exercise of the Warrants and (ii) no exercise of

options or exercise of warrants described above.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the information incorporated by reference in this prospectus supplement and the

accompanying prospectus contain “forward-looking statements” within the meaning of

the United States Private Securities Litigation Reform Act of 1995, which include information relating to future events, future

financial performance, strategies, expectations, competitive environment and regulation. Words such as “may,” “should,”

“could,” “would,” “predicts,” “potential,” “continue,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,”

and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance

or results will actually be achieved. Forward-looking statements are based on information we have when those statements are made or our

management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could

cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important

factors that could cause such differences include, but are not limited to:

| |

● |

deviations

from the assumptions and projections set forth in the prefeasibility study for the CK Gold Project; |

| |

● |

unfavorable

results from our exploration activities; |

| |

● |

decreases

in gold, copper or silver prices; |

| |

● |

whether

we are able to raise the necessary capital required to continue our business on terms acceptable to us or at all, and the likely

negative effect of volatility in metals prices or unfavorable exploration results; |

| |

● |

whether

we will be able to begin to mine and sell minerals successfully or profitably at any of our current properties at current or future

metals prices; |

| |

● |

potential

delays in our exploration activities or other activities to advance properties towards mining resulting from environmental consents

or permitting delays or problems, accidents, problems with contractors, disputes under agreements related to exploration properties,

unanticipated costs and other unexpected events; |

| |

● |

our

ability to retain key management and mining personnel necessary to successfully operate and grow our business; |

| |

● |

economic

and political events affecting the market prices for gold, copper, silver, and other minerals that may be found on our exploration

properties; |

| |

● |

fluctuations

in interest rates and inflation rates; |

| |

● |

changes

in governmental rules and regulations or actions taken by regulatory authorities; |

| |

● |

our

ability to maintain compliance with Nasdaq’s listing standards; |

| |

● |

volatility

in the market price of our common stock; |

| |

● |

our

ability to fund our business with our current cash reserves based on our currently planned activities; |

| |

● |

our

ability to raise the necessary capital required to continue our business on terms acceptable to us or at all, and the likely negative

effect of volatility in metals prices or unfavorable exploration results; |

| |

● |

our

expected cash needs and the availability and plans with respect to future financing; |

| |

● |

our

ability to retain key management and mining personnel necessary to successfully operate and grow our business; and |

| |

● |

other

factors listed from time to time in registration statements, reports or other materials that we have filed with or furnished to the

SEC, including our most recent annual report on Form 10-K for the fiscal year ended April 30, 2023, which is incorporated by reference

into this prospectus. |

For

a more detailed discussion of such risks and other important factors that could cause actual results to differ materially from those

in such forward-looking statements and forward-looking information, please see “Risk Factors” below in this prospectus supplement

and on page 4 of the accompanying base prospectus as well as the risk factors included in the documents incorporated herein and therein

by reference. Although we have attempted to identify important factors that could cause actual results to differ materially from those

described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that these statements will prove to be accurate as actual results and future events

could differ materially from those anticipated in the statements. Except as required by law, we assume no obligation to publicly update

any forward-looking statements and forward-looking information, whether as a result of new information, future events or otherwise. We

qualify all forward-looking statements by these cautionary statements.

RISK

FACTORS

Investing

in the common stock involves a high degree of risk. Prospective investors should carefully consider the following risks, as well as the

other information contained in this prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference

herein and therein before investing in the common stock. You should also consider the risks, uncertainties and assumptions discussed

under the heading “Risk Factors” included in our most recent annual report on Form 10-K and the subsequent quarterly reports

on Form 10-Q and other reports that we file with the SEC which are on file with the SEC and are incorporated herein by reference, and

which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. If any of the

following risks actually occurs, our business could be harmed. The risks and uncertainties described below are not the only ones faced

by us. Additional risks and uncertainties, including those of which we are currently unaware or that are currently deemed immaterial,

may also adversely affect our business, financial condition, cash flows, prospects and the price of our common stock. Please also read

carefully the section above entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risk

Factors Related to our Financial Circumstances

There

is substantial doubt about whether we can continue as a going concern.

Our

continuation as a going concern is dependent upon our achieving a future financing or strategic transaction. However, there is no assurance

that we will be successful pursuing a financing or strategic transaction. Accordingly, there is substantial doubt as to whether our existing

cash resources and working capital are sufficient to enable us to continue our operations for the next 12 months as a going concern.

Ultimately, in the event that we cannot obtain additional financial resources, or achieve profitable operations, we may have to liquidate

our business interests and investors may lose their investment. The accompanying consolidated financial statements have been prepared

assuming that our company will continue as a going concern. Continued operations are dependent on our ability to obtain additional financial

resources or generate profitable operations. Such additional financial resources may not be available or may not be available on reasonable

terms. Our consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty. Such

adjustments could be material.

We

have a limited operating history on which to base an evaluation of our business and prospects.

Since

our inception, we have had no revenue from operations. We have no history of producing metals from any of our exploration properties.

Our properties are exploration stage properties. Advancing properties from the exploration stage requires significant capital and time,

and successful commercial production from a property, if any, will be subject to completing feasibility studies, permitting and construction

of the potential mine, processing plants, roads, and other related works and infrastructure. As a result, we are subject to all of the

risks associated with developing and establishing new mining operations and business enterprises including:

| |

● |

completion

of feasibility studies to verify potential mineral reserves and commercial viability, including the ability to find sufficient mineral

reserves to support a commercial mining operation; |

| |

● |

the

timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of

infrastructure, mining and processing facilities; |

| |

● |

the

availability and costs of drill equipment, exploration personnel, skilled labor and mining and processing equipment, if required; |

| |

● |

the

availability and cost of appropriate smelting and/or refining arrangements, if required; |

| |

● |

compliance

with environmental and other governmental approval and permit requirements; |

| |

● |

the

availability of funds to finance exploration activities, as warranted; |

| |

● |

potential

opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent

exploration activities; |

| |

● |

potential

increases in exploration, construction and operating costs due to changes in the cost of fuel, power, materials and supplies; |

| |

● |

inability

to secure fair and reasonable terms associated with mineral leases; and |

| |

● |

potential

shortages of mineral processing, construction and other facilities-related supplies. |

The

costs, timing and complexities of exploration activities may be increased by the location of our properties and demand by other mineral

exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs

and, if ever commenced, development, construction and mine start-up. Accordingly, our activities may not ever result in profitable mining

operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties.

We

will require significant additional capital to fund our business plan.

We

will be required to expend significant funds to continue exploration and if warranted, develop our existing exploration properties and

to identify and acquire additional properties to diversify our properties portfolio. We have spent and will be required to continue to

expend significant amounts of capital for drilling, geological and geochemical analysis, assaying and feasibility studies with regard

to the results of our exploration. We may not benefit from some of these investments if we are unable to identify any commercially exploitable

mineralized material.

Our

ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national

and worldwide economy and the price of gold and copper. We may not be successful in obtaining the required financing or, if we can obtain

such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result

in delay or indefinite postponement of further exploration operations, development activities and the possible partial or total loss

of our potential interest in our properties.

Risks

Related to our Business

We

do not know if our properties contain any gold or other minerals that can be mined at a profit.

Although

the properties on which we have the right to explore for gold are known to have historic deposits of gold, there can be no assurance

such deposits can be mined at a profit. Whether a gold deposit can be mined at a profit depends upon many factors. Some but not all of

these factors include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; operating costs

and capital expenditures required to start mining a deposit; the availability and cost of financing; the price of gold, which is highly

volatile and cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land use, importing and

exporting of minerals and environmental protection.

Most

of our projects are in the exploration stage.

Although

we have established an estimate of mineral reserves on the CK Gold Project, there are no current estimates of mineral resources or mineral

reserves at the Keystone Property or Challis Gold Project. There is no assurance that we can establish the existence of any mineral reserves

on those projects in commercially exploitable quantities. If we do not establish the existence of mineral reserves or mineral resources

on those projects, we may lose all of the funds that we expend on exploration.

The

commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade

and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as a smelter, roads and a point

for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase

costs and make extraction of any identified mineral deposit unprofitable.

We

have no history of producing metals from our current mineral properties and there can be no assurance that we will successfully establish

mining operations or profitably produce precious metals.

We

have no history of producing metals from our properties. We do not produce gold and do not currently generate operating earnings. While

we seek to advance our projects and properties through exploration, such efforts will be subject to all of the risks associated with

establishing new future potential mining operations and business enterprises, including:

| |

● |

the

timing and cost, which are considerable, of the construction of mining and processing facilities; |

| |

● |

the

availability and costs of skilled labor and mining equipment; |

| |

● |

compliance

with environmental and other governmental approval and permit requirements; |

| |

● |

the

availability of funds to finance exploration activities; |

| |

● |

potential

opposition from non-governmental organizations, environmental groups, local groups or local inhabitants that may delay or prevent

exploration activities; and |

| |

● |

potential

increases in construction and operating costs due to changes in the cost of labor, fuel, power, materials and supplies. |

It

is common in new mining operations to experience unexpected problems and delays. In addition, our management will need to be expanded.

This could result in delays in the commencement of potential mineral production and increased costs of production. Accordingly, we cannot

assure you that our activities will result in any profitable mining operations or that we will ever successfully establish mining operations.

We

may not be able to obtain all required permits and licenses to place any of our properties into future potential production.

Our

current and future operations, including additional exploration activities, require permits from governmental authorities and such operations

are and will be governed by laws and regulations governing prospecting, exploration, taxes, labor standards, occupational health, waste

disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in mineral property

exploration generally experience increased costs, and delays in exploration and other schedules as a result of the need to comply with

applicable laws, regulations and permits. We cannot predict if all permits which we may require for continued exploration and development

activities, will be obtainable on reasonable terms, if at all. Costs related to applying for and obtaining permits and licenses may be

prohibitive and could delay our planned exploration activities. Failure to comply with applicable laws, regulations and permitting requirements

may result in enforcement actions, including orders issued by regulatory or judicial authorities causing exploration operations to cease

or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial

actions.

Parties

engaged in exploration operations may be required to compensate those suffering loss or damage by reason of the exploration activities

and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws,

regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could

have a material adverse impact on our operations and cause increases in capital expenditures or production costs or reduction in levels

of exploration activities at our properties or require abandonment or delays in future activities.

We

are subject to significant governmental regulations, which affect our operations and costs of conducting our business.

Our

current and future operations are and will be governed by laws and regulations, including:

| |

● |

laws

and regulations governing mineral concession acquisition, prospecting, exploration and development and operation; |

| |

● |

laws

and regulations related to exports, taxes and fees; |

| |

● |

labor

standards and regulations related to occupational health and mine safety; and |

| |

● |

environmental

standards and regulations related to waste disposal, toxic substances, land use and environmental protection. |

Companies

engaged in exploration activities often experience increased costs and delays in exploration and other schedules as a result of the need

to comply with applicable laws, regulations and permits. Failure to comply with applicable laws, regulations and permits may result in

enforcement actions, including the forfeiture of mineral claims or other mineral tenures, orders issued by regulatory or judicial authorities

requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional

equipment or costly remedial actions. We may be required to compensate those suffering loss or damage by reason of our mineral exploration

activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. Existing and

possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation,

could have a material adverse impact on our business and cause increases in capital expenditures or require abandonment or delays in

exploration.

Our

business is subject to extensive environmental regulations that may make exploring, or related activities prohibitively expensive, and

which may change at any time.

All

of our operations are subject to extensive environmental regulations that can substantially delay exploration and make exploration expensive

or prohibit it altogether. We may be subject to potential liabilities associated with the pollution of the environment and the disposal

of waste products that may occur as the result of exploring and other related activities on our properties. We may have to pay to remedy

environmental pollution, which may reduce the amount of money that we have available to use for exploration, or other activities, and

adversely affect our financial position. If we are unable to fully remedy an environmental problem, we might be required to suspend exploration

operations or to enter into interim compliance measures pending the completion of the required remedy. We have not purchased insurance

for potential environmental risks (including potential liability for pollution or other hazards associated with the disposal of waste

products from our exploration activities) and such insurance may not be available to us on reasonable terms or at a reasonable price.

All of our exploration will be subject to regulation under one or more local, state and federal environmental impact analyses and public

review processes. It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory

interpretation could have significant impact on some portion of our business, which may require our business to be economically re-evaluated

from time to time. These risks include, but are not limited to, the risk that regulatory authorities may increase bonding requirements

beyond our financial capability. Inasmuch as posting of bonding in accordance with regulatory determinations is a condition to the right

to operate under specific federal and state exploration operating permits, increases in bonding requirements could prevent operations

even if we are in full compliance with all substantive environmental laws.

Regulations

and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material

adverse effect on our business.

A

number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to the potential impact

of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners

and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting

and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability

to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty

around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our

financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and

any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could

harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain and would be particular

to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities,

water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production and financial

performance of our operations.

The

values of our properties are subject to volatility in the price of gold and any other deposits we may seek or locate.

Our

ability to obtain additional and continuing funding, and our profitability in the event we commence future mining operations or sell

the rights to mine, will be significantly affected by changes in the market price of gold. Gold prices fluctuate widely and are affected

by numerous factors, all of which are beyond our control. Some of these factors include the sale or purchase of gold by central banks

and financial institutions; interest rates; currency exchange rates; inflation or deflation; fluctuation in the value of the United States

dollar and other currencies; speculation; global and regional supply and demand, including investment, industrial and jewelry demand;

and the political and economic conditions of major gold or other mineral producing countries throughout the world, such as Russia and

South Africa. The price of gold or other minerals have fluctuated widely in recent years, and a decline in the price of gold could cause

a significant decrease in the value of our properties, limit our ability to raise money, and render continued exploration activities

of our properties impracticable. If that happens, then we could lose our rights to our properties and be compelled to sell some or all

of these rights. Additionally, the future progression of our properties beyond the exploration stage is heavily dependent upon the level

of gold prices remaining sufficiently high to make the continuation of our properties economically viable. You may lose your investment

if the price of gold decreases. The greater the decrease in the price of gold, the more likely it is that you will lose money.

Our

property titles may be challenged, and we are not insured against any challenges, impairments or defects to our mineral claims or property

titles.

We

cannot guarantee that title to our properties will not be challenged. Title insurance is not available for our mineral properties, and

our ability to ensure that we have obtained secure rights to individual mineral properties or mining concessions may be severely constrained.

Our unpatented Keystone claims were created and maintained in accordance with the federal General Mining Law of 1872. Unpatented claims

are unique U.S. property interests and are generally considered to be subject to greater title risk than other real property interests

because the validity of unpatented claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state

laws and regulations under the General Mining Law. We have obtained a title report on our Keystone claims but cannot be certain that

all defects or conflicts with our title to those claims have been identified. Further, we have not obtained title insurance regarding

our purchase and ownership of the Keystone claims. Defending any challenges to our property titles may be costly and may divert funds

that could otherwise be used for exploration activities and other purposes. We cannot provide any assurances that there are no title

defects affecting our properties. In addition, unpatented claims are always subject to possible challenges by third parties or contests

by the federal government, which, if successful, may prevent us from exploiting our discovery of commercially extractable gold. Challenges

to our title may increase its costs of operation or limit our ability to explore on certain portions of our properties. We are not insured

against challenges, impairments or defects to our property titles, nor do we intend to carry extensive title insurance in the future.

Market

forces or unforeseen developments may prevent us from obtaining the supplies and equipment necessary to explore for gold and other minerals.

Gold

exploration, and mineral exploration in general, is a very competitive business. Competitive demands for contractors and unforeseen shortages

of supplies and/or equipment could result in the disruption of our planned exploration activities. Current demand for exploration drilling

services, equipment and supplies is robust and could result in suitable equipment and skilled manpower being unavailable at scheduled

times for our exploration program. The recent inflationary environment has also resulted in a significant increase in costs, including

fuel. If we cannot find the equipment and supplies needed for our various exploration programs, we may have to suspend some or all of

them until equipment, supplies, funds and/or skilled manpower become available. Any such disruption in our activities may adversely affect

our exploration activities and financial condition.

Joint

ventures and other partnerships may expose us to risks.

We

may enter into future joint ventures or partnership arrangements with other parties in relation to the exploration, of a certain portion

of the CK Gold, Keystone and Challis Gold Properties in which we have an interest. Joint ventures can often require unanimous approval

of the parties to the joint venture or their representatives for certain fundamental decisions such as an increase or reduction of registered

capital, merger, division, dissolution, amendments of consenting documents, and the pledge of joint venture assets, which means that

each joint venture party may have a veto right with respect to such decisions which could lead to a deadlock in the operations of the

joint venture. Further, we may be unable to exert control over strategic decisions made in respect of such properties. Any failure of

such other companies to meet their obligations to us or to third parties, or any disputes with respect to the parties’ respective

rights and obligations, could have a material adverse effect on the joint ventures or their properties and therefore could have a material

adverse effect on our results of operations, financial performance, cash flows and the price of our Common Shares.

We

may pursue acquisitions, divestitures, business combinations or other transactions with other companies, involving our properties or

new properties, which could harm our operating results, may disrupt our business and could result in unanticipated accounting charges.

Acquisitions

of other companies or new properties, divestitures, business combinations or other transactions with other companies may create additional,

material risks for our business that could cause our results to differ materially and adversely from our expected or projected results.

Such risk factors include the effects of possible disruption to the exploration activities and mine planning, loss of value associated

with our properties, mismanagement of project development, additional risk and liability, indemnification obligations, sales of assets

at unfavorable prices, failure to sell non-core assets at all, poor execution of the plans for such transactions, permit requirements,

debt incurred or capital stock issued to enter into such transactions, the impact of any such transactions on our financial results,

negative stakeholder reaction to any such transaction and our ability to successfully integrate an acquired company’s operations

with our operations. If the purchase price of any acquired businesses exceeds the current fair values of the net tangible assets of such

acquired businesses, we would be required to record material amounts of goodwill or other intangible assets, which could result in significant

impairment and amortization expense in future periods. These charges, in addition to the results of operations of such acquired businesses

and potential restructuring costs associated with an acquisition, could have a material adverse effect on our business, financial condition

and results of operations. We cannot forecast the number, timing or size of future transactions, or the effect that any such transactions

might have on our operating or financial results. Furthermore, potential transactions, whether or not consummated, will divert our management’s

attention and may require considerable cash outlays at the expense of our existing operations. In addition, to complete future transactions,

we may issue equity securities, incur debt, assume contingent liabilities or have amortization expenses and write-downs of acquired assets,

which could adversely affect our profitability.

We

may experience difficulty attracting and retaining qualified management to meet the needs of our anticipated growth, and the failure

to manage our growth effectively could have a material adverse effect on our business and financial condition. In addition, we are dependent

upon our employees being able to safely perform their jobs, including the potential for physical injuries or illness.

We

are dependent on a relatively small number of key employees, including our President and Chief Executive Officer, our Chief Financial

Officer and our Vice President - Exploration and Technical Services. The loss of any officer could have an adverse effect on us. We have

no life insurance on any individual, and we may be unable to hire a suitable replacement for them on favorable terms, should that become

necessary.

Our

success is also dependent on the contributions of highly skilled and experienced consultants and contractors. Our ability to achieve

our operating goals depends upon our ability to retain such consultants and contractors in order to execute on our strategy. There continues

to be competition over highly skilled consultants and contractors in our industry. If we lose key consultants, contractors, or one or

more members of our senior management team, and we fail to develop adequate succession plans, our business, financial condition, results

of operations and cash flows could be harmed.

Our

business is dependent upon our consultants and contractors being able to safely perform their jobs, including the potential for physical

injuries or illness. If we experience periods where our consultants and contractors are unable to perform their jobs for any reason,

including as a result of illness, our business, financial condition, results of operations and cash flows could be adversely affected.

We

may have exposure to greater than anticipated tax liabilities.

Our

future income taxes could be adversely affected by earnings being lower than anticipated in jurisdictions that have lower statutory tax

rates and higher than anticipated in jurisdictions that have higher statutory tax rates, changes in the valuation of our deferred tax

assets or liabilities, or changes in tax laws, regulations, or accounting principles, as well as certain discrete items. We are subject

to review or audit by tax authorities. As a result, we may in the future receive assessments in multiple jurisdictions on various tax-related

assertions. Any adverse outcome of such a review or audit could have a negative effect on our operating results and financial condition.

In addition, the determination of our provision for income taxes and other tax liabilities requires significant judgment, and there could

be situations where the ultimate tax determination is uncertain. Although we believe our estimates are reasonable, the ultimate tax outcome

may differ from the amounts recorded in our financial statements and may materially affect our financial results in the period or periods

for which such determination is made.

Our

activities may be adversely affected by unforeseeable and unquantifiable health risks, whether those effects are local, nationwide or

global. Matters outside our control may prevent us from executing on our exploration programs, limit travel of Company representatives,

adversely affect the health and welfare of Company personnel or prevent important vendors and contractors from performing normal and

contracted activities.

The

risks we face related to contagious disease, or policies implemented by governments to protect against the spread of a disease, are unforeseeable

and unquantifiable by us. We, or our people, investors, contractors or stakeholders, may be prevented from free cross-border travel or

normal attendance to activities in conducting Company business at trade shows, presentations, meetings or other activities meant to promote

or execute our business strategy and transactions. We may be prevented from receiving goods or services from contractors. Decisions beyond

our control, such as canceled events, restricted travel, barriers to entry or other factors may affect our ability to accomplish drilling

programs, technical analysis of completed exploration actions, equity raising activities, and other needs that would normally be accomplished

without such limitations.

We

use a variety of outsourced contractors to execute our exploration programs. Drilling contractors need to be able to access our projects

and ensure social distancing recommended safety standards While our contractors are currently able to access our projects, there can

be no assurances that this access will continue if subsequent waves of the infection or variant strains appear.

As

an exploration and development company with no revenues, we are reliant on constantly raising additional capital to fund our operations.

A continuation or worsening of the levels of market disruption and volatility seen in the recent past could have an adverse effect on

our ability to access capital, on our business, results of operations and financial condition, and on the market price of our common

stock. There are no assurances we will be able to raise additional capital on favorable terms in the foreseeable future.

Risks

Related to the Mineral Exploration Industry

Exploring

for gold is an inherently speculative business.

Natural

resource exploration and exploring for gold in particular is a business that by its nature is very speculative. There is a strong possibility

that we will not discover gold or any other resources which can be mined or extracted at a profit. Although we have established the existence

of mineral reserves at the CK Gold Project, we may be unsuccessful in bringing it into production on a profitable basis. Few properties

that are explored are ultimately developed into producing mines. Unusual or unexpected geological formations, geological formation pressures,

fires, power outages, labor disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain suitable or adequate

machinery, equipment or labor are just some of the many risks involved in mineral exploration programs and the subsequent expansion of

potential gold deposits.

Estimates

of mineral reserves and mineral resources are subject to evaluation uncertainties that could result in project failure.

Our

exploration and future potential mining operations, if any, are and would be faced with risks associated with being able to accurately

predict the quantity and quality of mineral resources or mineral reserves within the earth using statistical sampling techniques. Estimates

of mineral resources or mineral reserves on our properties are made using samples obtained from appropriately placed trenches, test pits

and underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate

samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be

unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our

properties. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating potential mineral

resources/reserves. If these estimates were to prove to be unreliable, we could implement an exploitation plan that may not lead to any

commercially viable operations in the future.

We

may be denied the government licenses and permits which we need to explore or mine on our properties.

Exploration

activities usually require the granting of permits from various governmental agencies. For example, exploration drilling on unpatented

mineral claims requires a permit to be obtained from the United States BLM, which may take several months or longer to grant the requested

permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration

activities can be undertaken. Prehistoric or Native American graveyards, threatened or endangered species, archeological sites or the

possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional

permits before exploration activities can commence. As with all permitting processes, there is the risk that unexpected delays and excessive

costs may be experienced in obtaining required permits. The needed permits may not be granted at all. Delays in or our inability to obtain

necessary permits will result in unanticipated costs, which may result in serious adverse effects upon our business.

Possible

amendments to the General Mining Law and other regulations could make it more difficult or impossible for us to execute our business

plan.

In

recent years, the U.S. Congress has considered a number of proposed amendments to the General Mining Law, as well as legislation that

would make comprehensive changes to the law. Although no such comprehensive legislation has been adopted to date, there can be no assurance

that such legislation will not be adopted in the future. If adopted, such legislation, if it includes concepts that have been part of

previous legislative proposals, could, among other things, (i) limit on the number of millsites that a claimant may use, (ii) impose

time limits on the effectiveness of plans of operation that may not coincide with mine life, (iii) impose more stringent environmental

compliance and reclamation requirements on activities on unpatented mining claims and millsites, (iv) establish a mechanism that would

allow states, localities and Native American tribes to petition for the withdrawal of identified tracts of federal land from the operation

of the General Mining Law, (v) allow for administrative determinations that mining would not be allowed in situations where undue degradation

of the federal lands in question could not be prevented, (vi) impose royalties on gold and other mineral production from unpatented mining

claims or impose fees on production from patented mining claims, and (vii) impose a fee on the amount of material displaced at a mine.

Further, such legislation, if enacted, could have an adverse impact on earnings from our exploration operations, could reduce future

estimates of any reserves we may establish and could curtail our future exploration activity on our unpatented claims.

Our

ability to conduct exploration, and related activities may also be impacted by administrative actions taken by federal agencies.

We

may not be able to maintain the infrastructure necessary to conduct exploration and development activities.

Our

exploration and development activities depend upon adequate infrastructure. Reliable roads, bridges, power sources and water supply are

important factors which affect capital and operating costs. Climate change or unusual or infrequent weather phenomena, sabotage, government

or other interference in the maintenance or provision of such infrastructure could adversely affect our exploration activities and financial

condition.

We

compete against larger and more experienced companies.

The

mining industry is intensely competitive. Many large mining companies are primarily producers of precious or base metals and may become

interested in the types of deposits and exploration projects on which we are focused, which include gold, silver and other precious metals

deposits or polymetallic deposits containing significant quantities of base metals, including copper. Many of these companies have greater

financial resources, experience and technical capabilities than we do. We may encounter increasing competition from other mining companies

in our efforts to acquire mineral properties and hire experienced mining professionals. Increased competition in our business could adversely

affect our ability to attract necessary capital funding or acquire suitable mining properties or prospects for mineral exploration in

the future.

We

rely on contractors to conduct a significant portion of our exploration operations.

A

significant portion of our exploration operations are currently conducted in whole or in part by contractors. As a result, our exploration

operations are subject to a number of risks, some of which are outside our control, including:

| |

● |

negotiating

agreements with contractors on acceptable terms; |

| |

● |

the

inability to replace a contractor and its operating equipment in the event that either party terminates the agreement; |

| |

● |

reduced

control over those aspects of operations which are the responsibility of the contractor; |

| |

● |

failure

of a contractor to perform under its agreement; |

| |

● |

interruption

of exploration operations or increased costs in the event that a contractor ceases its business due to insolvency or other unforeseen

events; |

| |

● |

failure

of a contractor to comply with applicable legal and regulatory requirements, to the extent it is responsible for such compliance;

and |

| |

● |

problems

of a contractor with managing its workforce, labor unrest or other employment issues. |

In

addition, we may incur liability to third parties as a result of the actions of our contractors. The occurrence of one or more of these

risks could adversely affect our results of operations and financial position.

Our

exploration activities may be adversely affected by the local climate or seismic events, which could prevent us from gaining access to

our property year-round.

Earthquakes,

heavy rains, snowstorms, wildfires and floods could result in serious damage to or the destruction of facilities, equipment or means

of access to our property, or may otherwise prevent us from conducting exploration activities on our property. There may be short periods

of time when the unpaved portion of the access road is impassible in the event of extreme weather conditions or unusually muddy conditions.

During these periods, it may be difficult or impossible for us to access our property, make repairs, or otherwise conduct exploration

activities on them.

We

may be unable to secure surface access or to purchase required surface rights.

Although

we acquire the rights to some or all of the minerals in the ground subject to the mineral tenures that it acquires, or has a right to

acquire, in most cases it does not thereby acquire any rights to, or ownership of, the surface to the areas covered by such mineral tenures.

In such cases, applicable mining laws usually provide for rights of access to the surface for the purpose of carrying on exploration

activities, however, the enforcement of such rights through the courts can be costly and time consuming. It is necessary to negotiate

surface access or to purchase the surface rights if long-term access is required. There can be no guarantee that, despite having the

right at law to access the surface and carry on exploration activities, we will be able to negotiate satisfactory agreements with any

such existing landowners/occupiers for such access or purchase of such surface rights, and therefore we may be unable to carry out planned

exploration activities. In addition, in circumstances where such access is denied, or no agreement can be reached, we may need to rely

on the assistance of local officials or the courts in such jurisdiction the outcomes of which cannot be predicted with any certainty.

Our inability to secure surface access or purchase required surface rights could materially and adversely affect our timing, cost or

overall ability to develop any potential mineral deposits we may locate.

Risk

Factors Related to this Offering and our Common Stock

If

you purchase securities in this offering, you will suffer immediate dilution of your investment.

The

offering price of our common stock in this offering is substantially higher than the net tangible book value per share of our common

stock. Therefore, if you purchase securities in this offering, you will pay a price per share of our common stock that substantially

exceeds our net tangible book value per share after giving effect to this offering. Based on an offering price of $7.00 per share of

our common stock, if you purchase securities in this offering, you will experience immediate dilution of $5.09 per share, representing

the difference between the offering price per share of our common stock and our pro forma as adjusted net tangible book value per share

after giving effect to this offering. Furthermore, if any of our outstanding options or warrants are exercised at prices below the offering

price, or if we grant additional options or other awards under our equity incentive plans or issue additional warrants, you may experience

further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution

you would incur if you participate in this offering.

Our

stock price may be volatile.

The

market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors,

many of which are beyond our control, including the following:

| |

● |

results

of our operations and exploration efforts; |

| |

● |

fluctuation

in the supply of, demand and market price for gold; |

| |

● |

our

ability to obtain working capital financing; |

| |

● |

additions

or departures of key personnel; |

| |

● |

limited

“public float” in the hands of a small number of persons whose sales or lack of sales could result in positive or negative

pricing pressure on the market price for our common stock; |

| |

● |

our

ability to execute our business plan; |

| |

● |

sales

of our common stock and decline in demand for our common stock; |

| |

● |

regulatory

developments; |

| |

● |

economic

and other external factors; |

| |

● |

investor

perception of our industry or our prospects; and |

| |

● |

period-to-period

fluctuations in our financial results. |

In

addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the

operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of

our common stock. As a result, you may be unable to resell your shares of our common stock at a desired price.

Volatility

in the price of our common stock may subject us to securities litigation.

As

discussed above, the market for our common stock is characterized by significant price volatility when compared to seasoned issuers,

and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs

have often initiated securities class action litigation against a company following periods of volatility in the market price of its

securities. We may in the future be the target of similar litigation. Securities litigation could result in substantial costs and liabilities

and could divert management’s attention and resources.

There

is currently a limited trading market for our common stock and we cannot ensure that one will ever develop or be sustained.

Although

our common stock is currently quoted on Nasdaq, there is limited trading activity. We can give no assurance that an active market will

develop, or if developed, that it will be sustained. If an investor acquires shares of our common stock, the investor may not be able

to liquidate our shares should there be a need or desire to do so. There can be no assurance that there will be an active market for

our shares of common stock either now or in the future. The market liquidity of our common stock is limited and may be dependent on the

market perception of our business, among other things. We may, in the future, take certain steps, including utilizing investor awareness

campaigns, press releases, road shows and conferences to increase awareness of our business and any steps that we might take to bring

us to the awareness of investors may require we compensate consultants with cash and/or stock. There can be no assurance that there will

be any awareness generated or the results of any efforts will result in any impact on our trading volume. Consequently, investors may

not be able to liquidate their investment or liquidate it at a price that reflects the value of the business and trading may be at an

inflated price relative to our performance due to, among other things, availability of sellers of our shares. If a market should develop,

the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms or clearing firms

may not be willing to effect transactions in the securities or accept our shares for deposit in an account. Even if an investor finds

a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees,

taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of

low-priced shares of common stock as collateral for any loans.

Management

will have broad discretion as to the use of proceeds from this offering and we may use the net proceeds in ways with which you may disagree.

We

intend to use the net proceeds of this offering for working capital and general corporate purposes. Our management will have broad discretion

in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations

or enhance the value of our common stock. Accordingly, you will be relying on the judgment of our management with regard to the use of

net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used

appropriately. Our failure to apply these funds effectively could have a material adverse effect on our business and cause the price

of our common stock to decline.

You

may experience future dilution as a result of future equity offerings or other equity issuances.

We

cannot assure you that we will not need to raise substantial capital in addition to the amounts we may raise in this offering. In order

to raise such capital, we may in the future offer and issue additional common stock or other securities convertible into or exchangeable

for our common stock. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per

share that is equal to or greater than the price per share paid by investors in this offering from time to time, and investors purchasing

shares or other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional

common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower

than the price per share in this offering.

Our

articles of incorporation allow for our Board to create new series of preferred stock without further approval by our stockholders, which

could adversely affect the rights of the holders of our common stock.

Our

board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of directors

also has the authority to issue preferred stock without further stockholder approval. As a result, our board of directors could authorize

the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation, the right

to receive dividend payments before dividends are distributed to the holders of our common stock and the right to the redemption of the

shares, together with a premium, prior to the redemption of our common stock. In addition, our board of directors could authorize the

issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock,

which could decrease the relative voting power of our common stock or result in dilution to our existing stockholders.

Anti-takeover

provisions may impede the acquisition of our Company.

Certain

provisions of the Nevada Revised Statutes have anti-takeover effects and may inhibit a non-negotiated merger or other business combination.

These provisions are intended to encourage any person interested in acquiring us to negotiate with, and to obtain the approval of, our

board of directors in connection with such a transaction. However, certain of these provisions may discourage a future acquisition of

us, including an acquisition in which the stockholders might otherwise receive a premium for their shares. As a result, stockholders

who might desire to participate in such a transaction may not have the opportunity to do so.

We

do not anticipate paying dividends on our common stock in the foreseeable future.

We

currently plan to invest all available funds, including the proceeds from this offering, and future earnings, if any, in the development

and growth of our business. We currently do not anticipate paying any cash dividends on our common stock in the foreseeable future. As

a result, a rise in the market price of our common stock, which is uncertain and unpredictable, will be your sole source of potential

gain in the foreseeable future and you should not rely on an investment in our common stock for dividend income.

If

securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price

and trading volume could decline.

The

trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about

us or our business. We have relatively little research coverage by securities and industry analysts. If no additional industry analysts

commence coverage of the Company, the trading price for our common stock could be negatively impacted. If one or more of the analysts

who cover us downgrades our common stock or publishes inaccurate or unfavorable research about our business, our stock price would likely

decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, demand for our common stock

could decrease, which could cause our stock price and trading volume to decline.

We

may not meet the continued listing requirements of Nasdaq, which could result in a delisting of our common stock.

Our

common stock is listed on Nasdaq. We have in the past, and may in the future, be unable to comply with certain of the listing standards

that we are required to meet to maintain the listing of our common shares on the Nasdaq. For instance, on November 7, 2019, we received

a letter from the Listing Qualifications Department of the Nasdaq Stock Market indicating that, based upon the closing bid price of our

common stock for the 30 consecutive business day period between September 26, 2019, through November 6, 2019, we did not meet the minimum

bid price of $1.00 per share required for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2). On April 3, 2020, we

received notice from the Nasdaq indicating that we have regained compliance with the minimum bid price requirement under Nasdaq Listing

Rule 5550(a)(2), and the matter is now closed.

If

Nasdaq delists our common stock from trading on its exchange for failure to meet the listing standards, we and our stockholders could

face significant material adverse consequences including:

| |

● |

a

limited availability of market quotations for our securities; |

| |

● |

a