As filed with the Securities and Exchange

Commission on September 20, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

___________________

TRANSCAT, INC.

(Exact name of registrant as specified in its charter)

|

Ohio

(State or other

jurisdiction of incorporation or organization) |

|

16-0874418

(I.R.S. Employer Identification Number) |

35 Vantage Point Drive

Rochester, New York 14624

(585) 352-7777

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lee D. Rudow

President and

Chief Executive Officer

Transcat, Inc.

35 Vantage Point Drive

Rochester, New York 14624

(585) 352-7777

(Name, address, including zip code and telephone number, including area code, of agent for service)

___________________

COPIES TO:

|

James M. Jenkins, Esq.

Chief Legal and Corporate Development Officer

Transcat, Inc.

35 Vantage Point Drive

Rochester, New York 14624

(585) 352-7777 |

|

Alexander R. McClean,

Esq.

Kayla E. Klos, Esq.

Harter Secrest & Emery LLP

1600 Bausch & Lomb Place

Rochester, New York 14604

(585) 232-6500 |

Approximate date of commencement

of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐:

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities

offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☒

Registration Number 333-250135

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

|

|

Accelerated

filer |

☒ |

| Non-accelerated filer |

☐ |

|

|

Smaller reporting company |

☐ |

| Emerging growth company |

☐ |

|

|

|

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

This Registration Statement shall become effective upon filing in accordance

with Rule 462(b) under the Securities Act of 1933, as amended.

EXPLANATORY

NOTE

This Registration Statement is being filed by Transcat, Inc. (the "Registrant")

with the Securities and Exchange Commission (the "Commission") pursuant to Rule 462(b) under the Securities Act of 1933, as

amended.

This Registration Statement relates to the Registration Statement on Form

S-3 (File No. 333-250135) (the "Prior Registration Statement"), declared effective on November 27, 2020 by the Commission, and

is being filed for the purpose of registering additional securities in an amount that does not exceed 20% of the proposed maximum aggregate

offering price of securities remaining available for issuance under the Prior Registration Statement. The Registrant hereby incorporates

by reference into this Registration Statement on Form S-3 in its entirety the Prior Registration Statement, including each of the documents

filed by the Registrant with the Commission and incorporated or deemed to be incorporated by reference therein and all exhibits thereto.

The required opinion and consents are listed on the Exhibit Index included herein, and are filed with this Registration Statement.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Rochester, State of New York, on this 20th day of September 2023.

| |

|

TRANSCAT, INC. |

| |

|

|

| |

By: |

/s/ Lee D.

Rudow |

| |

|

Lee D. Rudow |

| |

|

President and Chief Executive Officer |

Pursuant

to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and

on the dates indicated.

| Signatures |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Lee D. Rudow |

|

Director, President and Chief Executive

Officer |

|

September 20, 2023 |

| Lee D. Rudow |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Thomas L.

Barbato |

|

Senior Vice President of Finance, Chief

Financial Officer and Treasurer

(Principal Financial Officer) |

|

September 20, 2023 |

| Thomas L. Barbato |

| |

|

|

|

|

| /s/ Scott D. Deverell |

|

Controller and Principal Accounting Officer |

|

September 20, 2023 |

| Scott D. Deverell |

|

(Principal Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ * |

|

Chairman of the Board of Directors |

|

September 20, 2023 |

| Gary J. Haseley |

|

|

|

|

| |

|

|

|

|

| |

|

Director |

|

|

| Craig D. Cairns |

|

|

|

|

|

|

|

|

|

| /s/ * |

|

Director |

|

September 20, 2023 |

| Oksana S. Dominach |

|

|

|

|

| |

|

| |

|

Director |

|

|

| Christopher P. Gillette |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

September 20, 2023 |

| Charles P. Hadeed |

|

|

|

|

| Signatures |

|

Title |

|

Date |

| |

|

| |

|

| |

|

Director |

|

|

| Mbago M. Kaniki |

|

|

|

|

| |

|

|

|

|

| |

|

Director |

|

|

| Cindy Langston |

|

|

|

|

| |

|

| /s/ * |

|

Director |

|

September 20, 2023 |

| Paul D. Moore |

|

|

|

|

| |

|

| * By: |

/s/ Lee

D. Rudow |

|

| |

Lee D. Rudow |

|

| |

Attorney in Fact |

|

Exhibit 5.1

|

|

|

Calfee, Halter & Griswold LLP

Attorneys at Law

The Calfee Building

1405 East Sixth Street

Cleveland, Ohio 44114-1607

216.622.8200 Phone |

September 20, 2023

Transcat, Inc.

35 Vantage Point Drive

Rochester, NY 14624

We have acted as special Ohio counsel for Transcat, Inc. (the

“Company”) in connection with the filing with the Securities and Exchange Commission (the “Commission”) of a Registration

Statement on Form S-3 (the “Additional Registration Statement”) pursuant to Rule 462(b)

promulgated under the Securities Act of 1933, as amended (the “Securities Act”), relating to an aggregate of up to $15,000,000

of shares (the “Shares”) of common stock, $0.50 par value per share (the “Common Stock”). The Shares are being

registered for possible offer and sale from time to time pursuant to Rule 415 under the Securities Act. The Additional Registration Statement

incorporates by reference the Registration Statement on Form S-3 (File No. 333-250135) (the “Original Registration Statement”

and, together with the Additional Registration Statement, the “Registration Statement”), which was filed with the Commission

on November 17, 2020, including the prospectus which forms a part of the Registration Statement. Terms used and not defined

herein shall have the meanings given to them in the Registration Statement.

We have examined or are otherwise familiar with the Company’s

Articles of Incorporation, as amended, the Company’s Code of Regulations, as amended, the Registration Statement, and such other

documents, records and instruments as we have deemed necessary or appropriate for the purposes of this opinion.

Based on the foregoing, we are of the opinion that the Shares,

when authorized and sold as contemplated in the Registration Statement and upon receipt by the Company of the consideration (which is

not less than the par value of such Shares) to be paid therefor in accordance with such authorization, will be validly issued by the Company

and will be fully paid and non-assessable.

We are attorneys licensed to practice law in the State of Ohio.

The opinion expressed herein is limited solely to the federal laws of the United States of America and the laws of the State of Ohio.

We express no opinion as to the effect or applicability of the laws of any other jurisdiction.

|

|

|

CALFEE.COM | 888.CALFEE1 |

Transcat, Inc.

September 20, 2023

Page 2

We consent to the filing of this opinion with the Additional

Registration Statement and to the use of our name under the caption “Legal Matters” in the Registration Statement. Such consent,

however, is not an admission that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

| |

Very truly yours, |

| |

|

| |

/s/ CALFEE, HALTER & GRISWOLD LLP |

| |

|

| |

CALFEE, HALTER & GRISWOLD LLP |

|

|

|

CALFEE.COM | 888.CALFEE1 |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in this

Registration Statement on Form S-3 and related Prospectus of Transcat, Inc. of our report dated June 6, 2023, relating

to the consolidated financial statements and the effectiveness of internal controls over financial reporting of Transcat, Inc. appearing

in the Annual Report on Form 10-K of Transcat, Inc. for the year ended March 25, 2023.

We also consent to the reference to our firm under

the caption “Experts”.

/s/ Freed Maxick CPAs, P.C.

Rochester, New York

September 20, 2023

Exhibit 107

Calculation of Filing Fee Tables

Form S-3

(Form Type)

Transcat, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

Security

Type |

Security Class Title |

Maximum Aggregate

Offering Price(1) |

Fee Rate |

Amount of

Registration Fee(2) |

| Equity |

Common Stock, $0.50 par value per share |

$15,000,000.00 |

$110.20 per $1,000,000 |

$1,653.00 |

| Total Offering Amounts |

$15,000,000.00 |

|

$1,653.00 |

| Total Feed Previously Paid |

|

|

— |

| Total Fee Offsets |

|

|

— |

| Net Fee Due |

|

|

$1,653.00 |

| (1) |

The Registrant previously registered such indeterminate number of securities as would have an aggregate offering price not to exceed $75,000,000 on a Registration Statement on Form S-3 (File No. 333-250135) filed on November 17, 2020, and declared effective on November 27, 2020 (the "Prior Registration Statement"). Of such securities, none have been sold under such Prior Registration Statement, leaving a remaining balance of $75,000,000 as of the date of this filing. The Registrant is filing this registration statement solely for the purpose of increasing the aggregate principal amount of securities being offered by $15,000,000 pursuant to Rule 462(b) of the Securities Act of 1933, as amended. |

| (2) |

Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

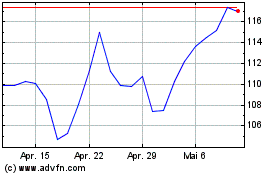

Transcat (NASDAQ:TRNS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

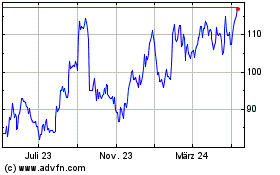

Transcat (NASDAQ:TRNS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024