Synlogic Reports Third Quarter 2024 Financial Results

12 November 2024 - 10:35PM

Synlogic, Inc. (Nasdaq: SYBX), a biopharmaceutical company

advancing novel therapeutics to transform the care of serious

diseases, today reported financial results for the third quarter

2024 and provided a corporate update.

As previously announced, the Company retained Lucid Capital

Markets, LLC to act as its financial advisor to explore and

evaluate strategic options for maximizing shareholder value.

Potential strategic alternatives that may be explored or evaluated

as part of this process include the potential for an acquisition,

merger, business combination or other strategic transaction

involving the Company. The Synlogic Board of Directors has not set

a timetable for the conclusion of this review, nor has it made any

decisions related to any further actions or potential strategic

options at this time. There can be no assurance, however, that this

process will result in any such transaction.

Third Quarter 2024 Financial Results

As of September 30, 2024 Synlogic had cash and cash equivalents

of $19.4 million.

There was no revenue for the three months ended September 30,

2024, compared to $0.4 million for the corresponding period in

2023. Revenue for the three months ended September 30, 2023 was

associated with the prior research collaboration with Roche.

There was a benefit of $0.7 million related to research and

development expenses for the three months ended September 30, 2024,

compared to expenses of $9.6 million for the corresponding period

in 2023. During the three months ended September 30, 2024, Synlogic

received a refund related to the closeout of one of its clinical

trials and estimates of manufacturing expenses that Synlogic

incurred were revised due to the decision to discontinue

Synpheny-3, resulting in a benefit upon reversal of the

accrual.

General and administrative expenses for the three months ended

September 30, 2024 were $1.2 million compared to $3.4 million for

the corresponding period in 2023.

There were restructuring charges of $0.3 million for the three

months ended September 30, 2024. The restructuring and other

charges were a result of the Company’s decision in February 2024 to

discontinue Synpheny-3, its pivotal study of labafenogene

marselecobac (SYNB1934) in phenylketonuria (PKU) and evaluate

strategic options for the Company. The restructuring charges were

primarily related to severance expense as a result of the reduction

in workforce.

For the three months ended September 30, 2024, Synlogic reported

a consolidated net loss of $(0.1) million, or ($0.01) per share,

compared to a consolidated net loss of $(12.1) million, or $(2.57)

per share, for the corresponding period in 2023.

About Synlogic

Synlogic is a biopharmaceutical company advancing novel

therapeutics to transform the care of serious diseases in need of

new treatment options. Synlogic designs, develops and manufactures

these drug candidates, which are produced by applying precision

genetic engineering to well-characterized probiotics.

Forward Looking Statements

This press release contains "forward-looking

statements" that involve substantial risks and uncertainties for

purposes of the safe harbor provided by the Private Securities

Litigation Reform Act of 1995. All statements, other than

statements of historical facts, included in this press release

regarding strategy, future operations, clinical development plans,

future financial position, future revenue, projected expenses,

prospects, plans and objectives of management are forward-looking

statements. In addition, when or if used in this press release, the

words "may," "could," "should," "anticipate," "believe," "look

forward," "estimate," "expect," “focused on,” "intend," "on track,"

"plan," "predict" and similar expressions and their variants, as

they relate to Synlogic, may identify forward-looking

statements. Actual results could differ materially from those

contained in any forward-looking statements as a result of various

factors, including: the Company may not execute on its planned

exploration and evaluation of strategic alternatives; and the

availability of suitable third parties with which to conduct

contemplated strategic transactions; as well as those risks

identified under the heading "Risk Factors"

in Synlogic's filings with the U.S. Securities and

Exchange Commission. The forward-looking statements contained in

this press release reflect Synlogic's current views with

respect to future events. Synlogic anticipates that

subsequent events and developments will cause its views to change.

However, while Synlogic may elect to update these

forward-looking statements in the

future, Synlogic specifically disclaims any obligation to

do so. These forward-looking statements should not be relied upon

as representing Synlogic's view as of any date subsequent

to the date hereof.

----

Contact: info@synlogictx.com

| |

|

|

|

|

|

|

|

|

| |

|

|

Synlogic, Inc.Condensed Consolidated

Statements of Operations(unaudited) |

| |

|

|

|

|

|

|

|

|

|

(in thousands, except share and per share data) |

For the Three Months Ended September 30 |

|

For the Nine Months Ended September 30 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

Revenue |

$ |

— |

|

|

$ |

393 |

|

|

$ |

8 |

|

|

$ |

602 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

| |

Research and development |

|

(713 |

) |

|

|

9,616 |

|

|

|

9,164 |

|

|

|

33,831 |

|

| |

General and administrative |

|

1,165 |

|

|

|

3,400 |

|

|

|

5,228 |

|

|

|

11,291 |

|

| |

Restructuring and other charges |

|

296 |

|

|

|

— |

|

|

|

24,790 |

|

|

|

— |

|

|

Total operating expenses |

|

748 |

|

|

|

13,016 |

|

|

|

39,182 |

|

|

|

45,122 |

|

|

Loss from operations |

|

(748 |

) |

|

|

(12,623 |

) |

|

|

(39,174 |

) |

|

|

(44,520 |

) |

|

Total other income, net |

|

631 |

|

|

|

548 |

|

|

|

16,534 |

|

|

|

1,784 |

|

|

Loss before income taxes |

|

(117 |

) |

|

|

(12,075 |

) |

|

|

(22,640 |

) |

|

|

(42,736 |

) |

|

Income tax expense |

|

— |

|

|

|

(3 |

) |

|

|

(5 |

) |

|

|

(12 |

) |

|

Net loss |

$ |

(117 |

) |

|

$ |

(12,078 |

) |

|

$ |

(22,645 |

) |

|

$ |

(42,748 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

$ |

(0.01 |

) |

|

$ |

(2.57 |

) |

|

$ |

(1.86 |

) |

|

$ |

(9.17 |

) |

|

Weighted-average common shares used in computing net loss per share

- basic and diluted |

|

12,223,922 |

|

|

|

4,699,847 |

|

|

|

12,186,830 |

|

|

|

4,662,444 |

|

| |

|

Synlogic, Inc.Condensed Consolidated Balance

Sheets(unaudited) |

| |

|

(in thousands, except share data) |

|

|

|

| |

|

September 30, 2024 |

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

Cash, cash equivalents & marketable securities |

$ |

19,389 |

|

|

$ |

47,746 |

|

|

|

Property and equipment, net |

|

— |

|

|

|

5,603 |

|

|

|

Other assets |

|

1,366 |

|

|

|

22,201 |

|

|

Total assets |

$ |

20,755 |

|

|

$ |

75,550 |

|

| |

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

Current liabilities |

$ |

7,647 |

|

|

$ |

30,288 |

|

|

|

Long-term liabilities |

|

— |

|

|

|

12,491 |

|

| |

Total liabilities |

|

7,647 |

|

|

|

42,779 |

|

| |

Total stockholders' equity |

|

13,108 |

|

|

|

32,771 |

|

| |

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

20,755 |

|

|

$ |

75,550 |

|

|

|

|

|

|

|

|

Common stock and common stock equivalents |

|

|

|

| |

Common stock |

|

11,696,109 |

|

|

|

9,186,157 |

|

| |

Common stock warrants (pre-funded) |

|

722,183 |

|

|

|

2,973,183 |

|

|

Total common stock |

|

12,418,292 |

|

|

|

12,159,340 |

|

Certain prior period amounts have been revised to

correct for an immaterial error impacting previously issued

financial statements, which are more fully described in our

Quarterly Report on Form 10-Q for the period ended September 30,

2024.

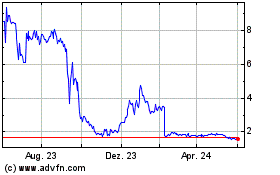

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024