Sify reports Consolidated Financial Results for Q3 FY 2022-23

25 Januar 2023 - 1:30PM

HIGHLIGHTS

- Revenue was INR 8,896

Million, an increase of 31% over the same quarter last

year.

- EBITDA was INR 1,619

Million, an increase of 3% over the same quarter last

year.

- Profit before tax was INR

227 Million, a decrease of 52% over the same

quarter last year.

- Profit after tax was INR 258

Million, a decrease of 25% over the same quarter last

year.

- CAPEX during the quarter was

INR 4,226 Million.

|

(IN INR MILLION) |

31.12.2022 |

31.03.2022 |

|

EQUITY |

15,110 |

14,476 |

|

BORROWINGS |

|

|

|

Long term |

13,111 |

7,769 |

|

Short term |

7,116 |

7,483 |

MANAGEMENT COMMENTARY

Mr. Raju Vegesna, Chairman,

said, “India’s resilience, demonstrated post covid, has firmly

established it as an economy that is not easily disturbed by

changes in the business environment. This, supported with an

aggressive adoption of digital tools, has worked well for the

economy.

The government’s larger agenda of ensuring that

social measures reach the intended beneficiaries is a work in

progress and will continue to drive domestic IT demand.

International demand is expected to continue due to the comparable

attractiveness of the Indian market, in spite of a tightening world

economy.

Viewed together, this works well for an economy

that is still at the early stages of realizing its potential.”

Mr. Kamal Nath, CEO, said,

“Indian Enterprises have fast-tracked their digital initiatives

based on their success navigating the pandemic and are now

operationalizing pandemic-era innovations. Enterprise priorities

are building businesses-aligned digital models, enhancing end-user

experience, deploying resilient business continuity models and

mitigating security risks.

Our Data Center and Cloud services, Digital and

Network services are all important building blocks to enable

customers’ business priorities, and we expect each of the

businesses to grow with the related investments.”

Mr. M P Vijay Kumar, ED & Group CFO,

said, “Our investment into the Data Center side of the

business continues, with incoming demand from both retail and

hyperscale customers. We have scaled up investments in our fibre

network in select metro cities and in people for our digital

services business.

Network connectivity, Cloud interconnects and

the resultant investment in tools, process and people will augment

this demand.

Fiscal discipline will be a constant,

particularly in our investment process.

Cash balance at the end of the quarter was INR 4,256

Million.”

BUSINESS HIGHLIGHTS

- The Revenue split between the

businesses for the quarter was Data Center colocation services 27%,

Digital services 35% and Network services 38%.

|

Business Revenue (INR Millions) |

Q3 FY 2022-23 |

Q3 FY 2021-22 |

FY 2021-22 |

% GrowthQ3 2022-23 vsQ3 2021-22 |

|

Data Center services |

2409 |

2024 |

7494 |

19 |

|

Digital Services |

3155 |

1664 |

7520 |

90 |

|

Network services |

3332 |

3095 |

12012 |

8 |

|

TOTAL |

8896 |

6783 |

27026 |

31 |

- Sify commissioned incremental Data

Center capacity of 4.1 MW in the quarter.

- As on December

31,2022, Sify provides services via 846 fiber nodes across the

country, a 11% increase over same quarter last year.

- The network connectivity service has

now deployed 5900 SDWAN service points across the country.

- During the quarter, Sify has

invested USD 482,500 in start-ups in the Silicon Valley area as

part of our Corporate Venture Capital initiative. To date, the

cumulative investment stands at USD 4.69 Million.

CUSTOMER ENGAGEMENTS

Among the most prominent new contracts during the quarter were

the following:

Data Center Services

- An International banking major and

its subsidiary signed up to migrate from their on-premise DC to

Sify Data Center.

- A Public sector bank, a government

agricultural governing body, a State division and a private power

player migrated from the competition to Sify Data Center.

- A private finance player contracted

with Sify to modernize their Data Center.

Digital services

- A health services major and a

co-operative bank contracted for a Greenfield Cloud

implementation.

- A large public sector bank signed up

for private cloud storage at their on-premise Data Center.

- A large automobile major and a

Financial services major signed a multi-year contract to have their

infrastructure and managed services refreshed.

- A State Data Center, multiple

manufacturing majors and a power subsidiary of another state

government contracted for services such as DRaaS, PaaS and

IaaS.

- A Public sector and another State

cooperative bank signed up for security infrastructure and managed

services.

- A large Public sector Oil major and

a Public Sector bank has contracted to have their collaboration

infrastructure revamped across all their offices.

- A Public Sector banking major signed

up to have their on-premise Network Operations Center

refreshed.

Network Services

- Three of India’s top private banks

contracted Sify to significantly expand their networks.

- A subsidiary of the Central bank

contracted Sify for managed and secure SDWAN service.

- A private bank contracted Sify for

DCI and Cloud Network.

- A spirits major and a leading

chemical manufacturer signed up to have their entire edge network

transformed.

- Sify commissioned a 800G circuit for

a global IT leader as phase 1 of its Long haul network.

- During the quarter, Sify commenced

SDN platform trails for cloud interconnects.

FINANCIAL HIGHLIGHTS

|

Unaudited Consolidated Income Statement as per

IFRS |

|

|

|

(In INR millions) |

|

|

|

|

|

Quarter

ended |

Quarter

ended |

Quarter ended |

|

Description |

December |

December |

September |

|

|

2022 |

2021 |

2022 |

|

|

|

|

|

| |

|

|

|

|

Revenue |

8,896 |

|

6,783 |

|

7,938 |

|

|

Cost of Revenues |

(5,767 |

) |

(3,931 |

) |

(4,988 |

) |

|

Selling, General and Administrative Expenses |

(1,510 |

) |

(1,277 |

) |

(1,441 |

) |

| |

|

|

|

|

EBITDA |

1,619 |

|

1,575 |

|

1,509 |

|

| |

|

|

|

|

Depreciation and Amortisation expense |

(996 |

) |

(836 |

) |

(956 |

) |

|

Impairment loss on goodwill |

- |

|

(15 |

) |

- |

|

|

Net Finance Expenses |

(420 |

) |

(278 |

) |

(362 |

) |

|

Other Income (including exchange gain) |

24 |

|

30 |

|

29 |

|

|

Other Expenses (including exchange loss) |

- |

|

- |

|

- |

|

|

|

|

|

|

|

Profit before tax |

227 |

|

476 |

|

220 |

|

|

Current Tax |

(92 |

) |

(129 |

) |

(167 |

) |

|

Deferred Tax |

123 |

|

(4 |

) |

59 |

|

|

Profit for the period |

258 |

|

343 |

|

112 |

|

|

|

|

|

|

|

Profit attributable to: |

|

|

|

|

Reconciliation with Non-GAAP measure |

|

|

|

|

Profit for the period |

258 |

|

343 |

|

112 |

|

|

Add: |

|

|

|

|

Depreciation and Amortisation expense |

996 |

|

836 |

|

956 |

|

|

Impairment loss on goodwill |

- |

|

15 |

|

- |

|

|

Net Finance Expenses |

420 |

|

278 |

|

362 |

|

|

Other Expenses (including exchange loss) |

- |

|

- |

|

- |

|

|

Income tax expense |

92 |

|

129 |

|

167 |

|

|

Less: |

|

|

|

|

Deferred Tax |

(123 |

) |

4 |

|

(59 |

) |

|

Other Income (including exchange gain) |

(24 |

) |

(30 |

) |

(29 |

) |

| |

|

|

|

|

EBITDA |

1,619 |

|

1,575 |

|

1,509 |

|

|

|

|

|

|

|

|

|

About Sify TechnologiesA Fortune

India 500 company, Sify Technologies is India’s most comprehensive

ICT service & solution provider. With Cloud at the core of our

solutions portfolio, Sify is focussed on the changing ICT

requirements of the emerging Digital economy and the resultant

demands from large, mid and small-sized businesses.

Sify’s infrastructure comprising the largest

MPLS network, top-of-the-line DCs, partnership with global

technology majors, vast expertise in business transformation

solutions modelled on the cloud make it the first choice of

start-ups, incoming Enterprises and even large Enterprises on the

verge of a revamp.

More than 10000 businesses across multiple

verticals have taken advantage of our unassailable trinity of Data

Centers, Networks and Security services and conduct their business

seamlessly from more than 1600 cities in India. Internationally,

Sify has presence across North America, the United Kingdom and

Singapore.

Sify, www.sify.com, Sify Technologies, Sify

Infinit Spaces limited, Sify Digital Services limited and

www.sifytechnologies.com are registered trademarks of Sify

Technologies Limited.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. The forward-looking statements

contained herein are subject to risks and uncertainties that could

cause actual results to differ materially from those reflected in

the forward-looking statements. Sify undertakes no duty to update

any forward-looking statements.

For a discussion of the risks associated with

Sify’s business, please see the discussion under the caption “Risk

Factors” in the company’s Annual Report on Form 20-F for the year

ended March 31, 2022, which has been filed with the United States

Securities and Exchange Commission and is available by accessing

the database maintained by the SEC at www.sec.gov, and Sify’s other

reports filed with the SEC.

For further information, please contact:

|

Sify Technologies LimitedMr. Praveen

KrishnaInvestor Relations & Public Relations+91 44 22540777

(ext.2055)praveen.krishna@sifycorp.com |

Grayling Investor RelationsLucia

Domville+1-646-824-2856Lucia.Domville@grayling.com |

20:20 Media Nikhila Kesavan+91

9840124036nikhila.kesavan@2020msl.com |

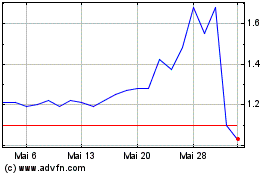

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

Von Jun 2023 bis Jun 2024