- On August 11, 2024, Revance and Crown Laboratories, Inc.

entered into a merger agreement. As a result of discussions between

the Revance and Teoxane, Crown and Revance agreed to extend the

deadline upon which the tender offer must commence to November 12,

2024. The tender offer has not yet commenced.

- Revance entered into an amendment to the Exclusive

Distribution Agreement with Teoxane for the distribution of the

RHA® Collection of dermal fillers in the U.S. and an Exclusive

Distribution Agreement with Teoxane for DAXXIFY® in Australia and

New Zealand.

- Shanghai Fosun Pharmaceutical Industrial Development Co., Ltd.

announced China’s National Medical Products Association’s approval

of DAXXIFY in Mainland China for the temporary improvement of the

appearance of moderate to severe glabellar lines.

- Revance is withdrawing the Company’s 2024 financial guidance

and will not be holding a conference call to accompany its 3Q’24

financial results.

Revance Therapeutics, Inc. (NASDAQ: RVNC) (“Revance,” the

“Company” or “our”), today reported financial results for the third

quarter ended September 30, 2024 and provided a corporate

update.

Third Quarter Highlights and Subsequent Updates

- Crown Laboratories and Revance Announce Entry Into Merger

Agreement and Delay of Tender Offer Commencement. During the

quarter, Revance and Crown Laboratories, Inc (“Crown”) announced

that they had entered into a merger agreement pursuant to which the

companies would seek to merge the two complementary organizations.

Under the terms of the agreement, which was unanimously approved by

Revance's Board of Directors, Crown will commence a tender offer to

purchase all of Revance’s outstanding shares of common stock, at a

price of $6.66 per share, in cash. As a result of discussions

between the Company and Teoxane SA (“Teoxane”) regarding an alleged

breach of the Exclusive Distribution Agreement for the distribution

of the RHA® Collection of dermal fillers in the U.S. (the “U.S.

Distribution Agreement”), the parties extended the date by which

the tender offer must be commenced. Revance and Crown agreed to

extend the tender offer commencement date to November 12, 2024 or

another date mutually agreed to between the parties.

- Revance and Teoxane Enter into Agreements to Further their

Partnership. Following a notice from Teoxane to remedy alleged

material breaches of the U.S. Distribution Agreement and

discussions between the parties, on October 24, 2024, Revance and

Teoxane entered into a sixth amendment to the U.S. Distribution

Agreement and an exclusive distribution agreement (the “ANZ

Distribution Agreement”) pursuant to which Teoxane will act as

Revance’s and Revance Australia's exclusive distributor and

licensee in Australia and New Zealand of certain products

containing DaxibotulinumtoxinA-lanm, including DAXXIFY®, for the

treatment of (a) temporary improvements in the appearance of

glabellar lines and other indications related to altering cosmetic

appearance and (b) cervical dystonia. The ANZ Distribution

Agreement expires December 31, 2040.

- DAXXIFY Approved in Mainland China for Glabellar Lines.

On September 9, Shanghai Fosun Pharmaceutical Industrial

Development Co., Ltd. (“Fosun”) announced that the Biologics

License Application for DAXXIFY had been recently approved by

China’s National Medical Products Administration for the temporary

improvement in the appearance of moderate to severe glabellar

lines.

Financial Highlights

- Total net revenue for the third quarter ended September

30, 2024 was $59.9 million compared to $54.1 million for the same

period in 2023, representing an increase of 11%, due primarily to

an overall increase in the sales volume of DAXXIFY and the RHA®

Collection, partially offset by an overall reduction in the average

selling prices for both product lines. Net revenue for the third

quarter ended September 30, 2024 included $30.5 million of RHA®

Collection revenue, $28.3 million of DAXXIFY revenue, and $1.1

million of collaboration revenue. Total net revenue for the nine

months ended September 30, 2024 was $177.2 million compared to

$154.3 million for the same period in 2023.

- Selling, general and administrative (SG&A) expenses

for the three and nine months ended September 30, 2024 were $62.6

million and $197.3 million compared to $65.8 million and $202.5

million, respectively, for the same periods in 2023. The decrease

was primarily due to lower stock-based compensation charges and

sales and marketing expenses related to DAXXIFY and the RHA®

Collection, offset primarily by expenses related to the launch of

DAXXIFY for cervical dystonia and $7.3 million of transaction costs

related to the pending merger.

- Research and development (R&D) expenses for the

three and nine months ended September 30, 2024 were $11.4 million

and $41.7 million compared to $8.7 million and $43.8 million,

respectively, for the same periods in 2023. The decrease was

primarily due to the U.S. Food and Drug Administration’s approval

of our manufacturing partner’s, Ajinomoto Bio-Pharma Services, site

in late Q1 2023 which allowed the subsequent DAXXIFY manufacturing

expenses to be capitalized as inventory.

- Total operating expenses for the three and nine months

ended September 30, 2024 were $92.1 million and $290.8 million

compared to $91.7 million and $294.9 million, respectively, for the

same periods in 2023.

- Net loss from continuing operations for the three and

nine months ended September 30, 2024 were $38.1 million and $125.1

million, respectively, compared to $39.4 million and $146.1 million

for the same periods in 2023.

- Cash, cash equivalents and short-term investments as of

September 30, 2024 were $184.1 million.

Note: In connection with the exit of the Fintech Platform

business (HintMD and OPUL®), the results of the Fintech Platform

business are reflected as discontinued operations in our financial

statements as of September 30, 2024 and December 31, 2023 and for

the periods ended September 30, 2024 and 2023. Therefore, the

results discussed reflect our continuing operations and exclude

results of the Fintech Platform, which was presented in our

financial statements as the service segment.

2024 Financial Outlook

In light of the proposed merger with Crown and other recent

developments, Revance will not be providing any forward-looking

guidance and is withdrawing any previously provided guidance and

outlook. In addition, Revance will not hold a conference call to

discuss its third quarter 2024 earnings.

About Revance

Revance is a biotechnology company setting the new standard in

healthcare with innovative aesthetic and therapeutic offerings that

enhance patient outcomes and physician experiences. Revance’s

portfolio includes DAXXIFY (DaxibotulinumtoxinA-lanm) for injection

and the RHA® Collection of dermal fillers, which RHA® technology is

proprietary to and manufactured by Teoxane SA in Switzerland.

Revance has partnered with Teoxane, SA to supply HA fillers for

U.S. distribution. Revance has also partnered with Viatris Inc. to

develop a biosimilar to onabotulinumtoxinA for injection and

Shanghai Fosun Pharmaceutical to commercialize DAXXIFY in

China.

Revance’s global headquarters and experience center is located

in Nashville, Tennessee. Learn more at Revance.com,

RevanceAesthetics.com, DAXXIFY.com,

HCP.DAXXIFYCervicalDystonia.com, or connect with us on

LinkedIn.

“Revance”, the Revance logo, and DAXXIFY® are registered

trademarks of Revance Therapeutics, Inc. Resilient Hyaluronic Acid®

and RHA® are trademarks of TEOXANE SA.

Forward-Looking Statements

Any statements in this press release that are not statements of

historical fact, including statements related to expectations with

respect to the tender offer and the merger, including the timing

thereof and the likelihood of the tender offer being commenced on

the same terms as previously announced, or at all; our and Crown's

ability to successfully complete the merger; the impact to the

Company if the merger is not completed; plans regarding 2024

guidance; the potential to set a new standard in healthcare;

patient outcomes and physician experiences; commercialization of

DAXXIFY in Australia and New Zealand with our partner, Teoxane;

development of an onobotulinumtoxinA biosimilar with our partner,

Viatris; and commercialization of DAXXIFY in China with our

partner, Shanghai Fosun Pharmaceutical; constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. You should not rely upon forward-looking statements as

predictions of future events. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee that the future results, levels of

activity, performance, events, circumstances or achievements

reflected in the forward-looking statements will ever be achieved

or occur.

Forward-looking statements are subject to risks and

uncertainties that could cause actual results and the timing of

events to differ materially from our expectations. These risks and

uncertainties relate to, but are not limited to: the risks and

uncertainties inherent in the tender offer and the merger,

including, among other things, regarding how many of the Company

stockholders will tender their shares in the offer, the possibility

that competing offers will be made, the ability to satisfy the

conditions to the closing of the tender offer and the merger, the

expected timing of the tender offer and the merger, the possibility

that the merger will not be completed, difficulties or

unanticipated expenses in connection with integrating the parties’

operations, products and employees and the possibility that

anticipated synergies and other anticipated benefits of the

transaction will not be realized in the amounts expected, within

the expected timeframe or at all, the effect of the announcement of

the tender offer and the merger on the Company’s and Crown’s

business relationships (including, without limitations, partners

and customers), the occurrence of any event, change or other

circumstances that could give rise to the termination of the Merger

Agreement, the expected tax treatment of the transaction, and the

impact of the transaction on the businesses of the Company and

Crown, and other circumstances beyond the Company’s and Crown’s

control; our ability to obtain funding for our operations; the

timing of capital expenditures; the accuracy of our estimates

regarding expenses, revenues, capital requirements, supply chain

and operational efficiencies; our financial performance and the

economics of DAXXIFY and the RHA® Collection of dermal fillers; our

ability to comply with our debt obligations; the impact of

macroeconomic factors on our manufacturing operations, supply

chain, end user demand for our products, commercialization efforts,

business operations, regulatory meetings, inspections and

approvals, clinical trials and other aspects of our business and on

the market; our ability to maintain approval of our products; our

ability and the ability of our partners to manufacture supplies for

DAXXIFY and our drug product candidates; our ability to acquire

supplies of the RHA® Collection of dermal fillers; the uncertain

clinical development process; our ability to obtain, and the timing

relating to, regulatory submissions and approvals with respect to

our drug product candidates and third-party manufacturers; the risk

that clinical trials may not have an effective design or generate

positive results or that positive results would assure regulatory

approval or commercial success; the applicability of clinical study

results to actual outcomes; the rate and degree of economic

benefit, safety, efficacy, duration, commercial acceptance, market,

competition and/or size and growth potential of DAXXIFY, the RHA®

Collection of dermal fillers, and our drug product candidates, if

approved; our ability to successfully commercialize DAXXIFY and to

continue to successfully commercialize the RHA® Collection of

dermal fillers; the timing and cost of commercialization

activities; securing or maintaining adequate coverage or

reimbursement by third-party payers for DAXXIFY; the proper

training and administration of our products by physicians and

medical staff; our ability to maintain and gain acceptance from

injectors and physicians in the use of DAXXIFY for aesthetic and

therapeutic indications; our ability to strengthen professional

partnerships; our ability to expand sales and marketing

capabilities; the status of commercial collaborations; changes in

and failures to comply with laws and regulations; our ability to

continue obtaining and maintaining intellectual property protection

for our products; the cost and our ability to defend ourselves in

product liability, intellectual property, class action or other

lawsuits; our ability to limit or mitigate cybersecurity incidents;

the volatility of our stock price; and other risks. Detailed

information regarding factors that may cause actual results to

differ materially from the results expressed or implied by

statements in this press release may be found in our periodic

filings with the Securities and Exchange Commission (SEC),

including factors described in the section entitled "Risk Factors"

in our Form 10-K filed with the SEC on February 28, 2024, and

including, without limitation, our Form 10-Q for the quarter ended

September 30, 2024 expected to be filed with the SEC on November 7,

2024. The forward-looking statements in this press release speak

only as of the date hereof. We disclaim any obligation to update

these forward-looking statements.

REVANCE THERAPEUTICS,

INC.

Condensed Consolidated Balance

Sheets

(In thousands, except share

and per share amounts)

(Unaudited)

September 30,

December 31,

2024

2023

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

58,585

$

137,329

Restricted cash, current

465

550

Short-term investments

125,491

116,586

Accounts receivable, net

48,263

27,660

Inventories

85,213

45,579

Prepaid expenses and other current

assets

9,935

9,308

Current assets of discontinued

operations

1,735

1,853

Total current assets

329,687

338,865

Property and equipment, net

15,897

17,225

Intangible assets, net

7,634

9,270

Operating lease right-of-use assets

47,996

53,167

Finance lease right-of-use asset

13,100

19,815

Restricted cash, non-current

5,564

5,995

Finance lease prepaid expense

41,514

32,383

Other non-current assets

172

321

Non-current assets of discontinued

operations

—

1,413

TOTAL ASSETS

$

461,564

$

478,454

LIABILITIES AND STOCKHOLDERS’

DEFICIT

CURRENT LIABILITIES

Accounts payable

$

12,335

$

13,554

Accruals and other current liabilities

34,022

52,863

Deferred revenue, current

6,329

10,737

Operating lease liabilities, current

6,372

5,703

Finance lease liability, current

10,841

2,651

Debt, current

10,150

2,500

Current liabilities of discontinued

operations

—

1,216

Total current liabilities

80,049

89,224

Debt, non-current

421,041

426,595

Deferred revenue, non-current

85,550

70,419

Operating lease liabilities,

non-current

35,043

40,985

Other non-current liabilities

2,911

2,835

TOTAL LIABILITIES

624,594

630,058

STOCKHOLDERS’ DEFICIT

Preferred stock, par value $0.001 per

share — 5,000,000 shares authorized, and no shares issued and

outstanding as of September 30, 2024 and December 31, 2023

—

—

Common stock, par value $0.001 per share —

190,000,000 shares authorized as of September 30, 2024 and December

31, 2023; 104,895,611 and 87,962,765 shares issued and outstanding

as of September 30, 2024 and December 31, 2023, respectively

105

88

Additional paid-in capital

2,043,893

1,926,654

Accumulated other comprehensive gain

72

14

Accumulated deficit

(2,207,100

)

(2,078,360

)

TOTAL STOCKHOLDERS’ DEFICIT

(163,030

)

(151,604

)

TOTAL LIABILITIES AND STOCKHOLDERS’

DEFICIT

$

461,564

$

478,454

REVANCE THERAPEUTICS,

INC.

Condensed Consolidated

Statements of Operations and Comprehensive Loss

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue:

Product revenue, net

$

58,827

$

54,109

$

175,874

$

154,160

Collaboration revenue

1,052

3

1,330

139

Total revenue, net

59,879

54,112

177,204

154,299

Operating expenses:

Cost of product revenue (exclusive of

amortization)

17,633

16,821

50,179

46,915

Selling, general and administrative

62,578

65,791

197,314

202,523

Research and development

11,379

8,688

41,674

43,844

Amortization

545

374

1,636

1,636

Total operating expenses

92,135

91,674

290,803

294,918

Loss from continuing operations

(32,256

)

(37,562

)

(113,599

)

(140,619

)

Interest income

2,631

3,733

8,806

9,851

Interest expense

(6,732

)

(5,093

)

(17,667

)

(13,958

)

Other expense, net

(258

)

(223

)

(1,149

)

(1,056

)

Loss from continuing operations before

income taxes

(36,615

)

(39,145

)

(37,469

)

(58,166

)

Income tax provision

(1,500

)

(300

)

(1,500

)

(300

)

Net loss from continuing operations

(38,115

)

(39,445

)

(125,109

)

(146,082

)

Net loss from discontinued operations

—

(101,731

)

(3,631

)

(122,205

)

Total net loss

(38,115

)

(141,176

)

(128,740

)

(268,287

)

Unrealized gain

98

48

58

361

Comprehensive loss

$

(38,017

)

$

(141,128

)

$

(128,682

)

$

(267,926

)

Basic and diluted net loss per share:

Continuing operations

$

(0.37

)

$

(0.46

)

$

(1.25

)

$

(1.74

)

Discontinued operations

—

(1.17

)

(0.04

)

(1.46

)

Total net loss per basic and diluted

share

$

(0.37

)

$

(1.63

)

$

(1.29

)

$

(3.20

)

Basic and diluted weighted-average number

of shares used in computing net loss per share

104,212,891

86,613,425

100,016,088

83,816,577

REVANCE THERAPEUTICS,

INC.

Product Revenue Breakdown

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

(in thousands)

2024

2023

2024

2023

Product:

RHA® Collection of dermal fillers

$

30,503

$

32,133

$

96,704

$

94,180

DAXXIFY®

28,324

21,976

79,170

59,980

Total product revenue, net

$

58,827

$

54,109

$

175,874

$

154,160

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107685733/en/

Investors Laurence Watts, New Street Investor Relations

laurence@newstreetir.com

Media Revance@evolvemkd.com

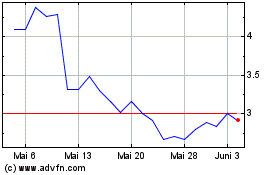

Revance Therapeutics (NASDAQ:RVNC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Revance Therapeutics (NASDAQ:RVNC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024