Ontrak, Inc. Announces Pricing of $6.3 Million Public Offering, $11 Million Concurrent Private Placement and $16.3 Million Conversion of Secured Notes

10 November 2023 - 2:19PM

Business Wire

Ontrak, Inc. (NASDAQ: OTRK) (“Ontrak” or the “Company”), a

leading AI-powered and telehealth-enabled healthcare company, today

announced the pricing of a public offering of:

- 4,592,068 shares of its common stock and 9,184,136 warrants to

purchase up to 9,184,136 shares of its common stock at a combined

public offering price of $0.60 per share of common stock and

accompanying warrants, and

- 5,907,932 pre-funded warrants to purchase up to 5,907,932

shares of its common stock and 11,815,864 warrants to purchase up

to 11,815,864 shares of its common stock at a combined public

offering price of $0.5999 per pre-funded warrant and accompanying

warrants, which represents the per share public offering price for

the common stock and accompanying warrants less the $0.0001 per

share exercise price for each pre-funded warrant.

Each share of common stock and pre-funded warrant is being sold

together with two warrants, each to purchase one share of common

stock. The warrants accompanying the common stock and pre-funded

warrants will have an exercise price of $0.85 per share. The

exercisability of the pre-funded warrants and accompanying warrants

will be subject to stockholder approval and, if such approval is

obtained, will expire on the fifth anniversary of the date of such

approval. The offering is expected to close on November 14, 2023,

subject to customary closing conditions. Pursuant to a support

agreement from Acuitas Group Holdings, LLC and Acuitas Capital LLC

(collectively, “Acuitas”), Acuitas agreed to vote for, or consent

to, among other things, the exercisability of the warrants offered

in the public offering and in the private placement described

below. Acuitas will hold a majority of the outstanding common stock

immediately before the closing of the offering.

In addition, Ontrak today announced the pricing of a concurrent

private placement to Acuitas of 18,333,333 pre-funded warrants to

purchase up to 18,333,333 shares of its common stock and 36,666,666

warrants to purchase up to 36,666,666 shares of its common stock at

a combined offering price of $0.5999 per pre-funded warrant and

accompanying warrants, which represents the per share public

offering price for the common stock and accompanying warrants less

the $0.0001 per share exercise price for each pre-funded warrant.

The warrants accompanying the pre-funded warrants will have an

exercise price of $0.85 per share. The exercisability of such

warrants will be subject to stockholder approval and, if such

approval is obtained, will expire on the fifth anniversary of the

date of such approval. Prior to the closing of the public offering

and private placement, Acuitas will convert approximately $16.3

million of outstanding senior secured convertible notes, leaving

$2.0 million of senior secured convertible notes outstanding.

The gross proceeds to the Company from the public offering are

expected to be approximately $6.3 million before deducting

placement agent fees and other offering expenses payable by the

Company. The Company intends to use the net proceeds of the

offering for working capital and other general corporate purposes.

In addition, the Company estimates that the private placement will

result in the cancellation of $5.0 million of debt owed by the

Company to Acuitas under outstanding senior secured convertible

notes and the reclassification of $6.0 million of restricted cash

held under the terms of the Master Note Purchase Agreement

previously entered into with Acuitas to unrestricted cash.

Roth Capital Partners is acting as the exclusive placement agent

for the offering and the private placement.

The public offering described above is being made pursuant to a

registration statement on Form S-1 (File No. 333-273029), as

amended, that was originally filed with the U.S. Securities and

Exchange Commission (the “SEC”) on June 29, 2023, and was declared

effective on November 9, 2023. A final prospectus related to the

offering will be filed and made available on the SEC’s website at

https://www.sec.gov/. The public offering is being made only by

means of a prospectus, which forms a part of the registration

statement. Electronic copies of the final prospectus may be

obtained, when available, by contacting Roth Capital Partners at

888 San Clemente Drive, Newport Beach CA 92660, or by phone at

(800) 678-9147 or e-mail at rothecm@roth.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of any

of the securities described herein in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Ontrak, Inc.

Ontrak, Inc. is a leading AI and telehealth-enabled healthcare

company, whose mission is to help improve the health and save the

lives of as many people as possible. Ontrak identifies, engages,

activates, and provides care pathways to treatment for the most

vulnerable members of the behavioral health population who would

otherwise fall through the cracks of the healthcare system. We

engage individuals with anxiety, depression, substance use disorder

and chronic disease through personalized care coaching and

customized care pathways that help them receive the treatment and

advocacy they need, despite the socio-economic, medical and health

system barriers that exacerbate the severity of their comorbid

illnesses. The company’s integrated intervention platform uses AI,

predictive analytics and digital interfaces combined with dozens of

care coach engagements to deliver improved member health, better

healthcare system utilization, and durable outcomes and savings to

healthcare payors.

Forward Looking Statements

Statements in this press release about future expectations,

plans and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of The Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements relating to the completion of

the public offering and private placement, the amount of gross

proceeds expected from the offering and the intended use of

proceeds from the offering. Actual results may differ materially

from those indicated by forward-looking statements as a result of

various factors, including, the uncertainties related to market

conditions, the satisfaction of the closing conditions for the

offering and other factors described more fully in the section

entitled the Company’s Annual Report on Form 10-K for the year

ended December 31, 2022, and other reports filed with the

Securities and Exchange Commission thereafter. Any forward-looking

statements contained in this press release speak only as of the

date hereof, and the Company disclaims any obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231110265838/en/

Investors: Ryan Halsted Gilmartin Group

investors@ontrakhealth.com

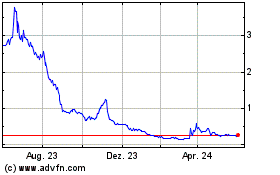

Ontrak (NASDAQ:OTRK)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

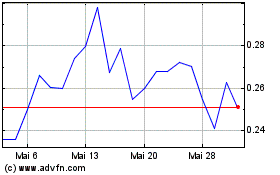

Ontrak (NASDAQ:OTRK)

Historical Stock Chart

Von Jan 2024 bis Jan 2025