Novo Integrated Sciences, Inc. (NASDAQ:NVOS) (the “Company” or

“Novo”), pioneering a holistic approach to patient-first health and

wellness through a multidisciplinary healthcare ecosystem of

multiple patient and consumer touchpoints for services and product

innovation, today reported its financial results for the third

fiscal quarter ended May 31, 2024.

Robert Mattacchione, Novo’s CEO and Board Chairman, stated, “The

Company’s fiscal year 2024 third quarter emphasized maximizing

operational efficiencies for all business units. The Company

continues to work with certain prospective financial partners to

close previously announced non-traditional financing opportunities

to raise foundational capital with repayment terms necessary to

support and accelerate the further growth of Novo’s three-pillar

business model. The Company remains committed to the

commercialization of its proprietary product offerings and the

expansion and delivery of its essential services and solutions for

how non-catastrophic healthcare is delivered both now and in the

future.”

Financial Highlights for the three-month period ended May 31,

2024:

- Cash and cash equivalents were $1,539,771, total assets were

$35,327,000, total liabilities were $25,663,779, and total

stockholders’ equity was $9,956,134.

- Revenues were $3,151,851, representing a decrease of $141,082,

or 4%, from $3,292,933 for the three months ended May 31, 2023. The

decrease in revenue is principally due to a decrease in product

sales. Acenzia’s and Terragenx’s revenue for the three months ended

May 31, 2024 were $884,396 and $103,399, respectively. Despite a

decrease in total revenue, revenue from our healthcare services

increased by 8.1% when comparing the revenue for the three months

ended May 31, 2024 to the three months ended May 31, 2023.

- Operating costs were $3,417,096, representing an increase of

$672,584, or 25%, from $2,744,512 for the three months ended May

31, 2023. The increase in operating costs was primarily due to the

inflationary impact on operating costs.

- Net loss attributed to Novo Integrated Sciences, Inc. for the

three months ended May 31, 2024, was $13,741,903, representing an

increase of $12,244,573, or 818%, from $1,497,330 for the three

months ended May 31, 2023. The increase in net loss of $12,244,573

is mainly attributed to the recognition of a $6,724,690 loss in the

fair value of the derivative liability, loss from operations of

$1,089,785, amortization of the debt discount of $2,748,793 and

foreign currency exchange loss of $1,455,248 arising as a result of

intercompany balance reconciliation.

- On April 5, 2024, the Company executed a $6.21 million

Securities Purchase Agreement and Promissory Note with

Streeterville Capital LLC (the “Streeterville Note”). The interest

rate on the Streeterville Note is 10.9% and it has a 12-month

maturity date. A portion of the proceeds from the Streeterville

Note paid the balance owed on two notes, as follows:

- $3,228,774 (principal) and $30,571.28 (interest) on the 2023

$3.5 million Mast Hill note; and

- $82,761 (principal) and $1,552 (interest) on the 2023 $277,777

First Fire note.

About Novo Integrated Sciences,

Inc.

Novo Integrated Sciences, Inc. is pioneering a holistic approach

to patient-first health and wellness through a multidisciplinary

healthcare ecosystem of services and product innovation. Novo

offers an essential and differentiated solution to deliver, or

intend to deliver, these services and products through the

integration of medical technology, advanced therapeutics, and

rehabilitative science.

We believe that “decentralizing” healthcare, through the

integration of medical technology and interconnectivity, is an

essential solution to the rapidly evolving fundamental

transformation of how non-catastrophic healthcare is delivered both

now and in the future. Specific to non-critical care, ongoing

advancements in both medical technology and inter-connectivity are

allowing for a shift of the patient/practitioner relationship to

the patient’s home and away from on-site visits to primary medical

centers with mass-services. This acceleration of “ease-of-access”

in the patient/practitioner interaction for non-critical care

diagnosis and subsequent treatment minimizes the degradation of

non-critical health conditions to critical conditions as well as

allowing for more cost-effective healthcare distribution.

The Company’s decentralized healthcare business model is

centered on three primary pillars to best support the

transformation of non-catastrophic healthcare delivery to patients

and consumers:

- First Pillar: Service Networks. Deliver multidisciplinary

primary care services through (i) an affiliate network of clinic

facilities, (ii) small and micro footprint sized clinic facilities

primarily located within the footprint of box-store commercial

enterprises, (iii) clinic facilities operated through a franchise

relationship with the Company, and (iv) corporate operated clinic

facilities.

- Second Pillar: Technology. Develop, deploy, and integrate

sophisticated interconnected technology, interfacing the patient to

the healthcare practitioner thus expanding the reach and

availability of the Company’s services, beyond the traditional

clinic location, to geographic areas not readily providing

advanced, peripheral based healthcare services, including the

patient’s home.

- Third Pillar: Products. Develop and distribute effective,

personalized health and wellness product solutions allowing for the

customization of patient preventative care remedies and ultimately

a healthier population. The Company’s science-first approach to

product innovation further emphasizes our mandate to create and

provide over-the-counter preventative and maintenance care

solutions.

Innovation through science combined with the integration of

sophisticated, secure technology assures Novo Integrated Sciences

of continued cutting-edge advancement in patient-first

platforms.

For more information concerning Novo Integrated Sciences, please

visit www.novointegrated.com.

Twitter, LinkedIn, Facebook, Instagram, YouTube

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical facts

included in this press release are forward-looking statements. In

some cases, forward-looking statements can be identified by words

such as "believe," “intend,” "expect," "anticipate," "plan,"

"potential," "continue" or similar expressions. Such

forward-looking statements include risks and uncertainties, and

there are important factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements. These factors, risks and uncertainties

are discussed in Novo’s filings with the Securities and Exchange

Commission. Investors should not place any undue reliance on

forward-looking statements since they involve known and unknown,

uncertainties and other factors which are, in some cases, beyond

Novo’s control which could, and likely will, materially affect

actual results, levels of activity, performance or achievements.

Any forward-looking statement reflects Novo’s current views with

respect to future events and is subject to these and other risks,

uncertainties and assumptions relating to operations, results of

operations, growth strategy and liquidity. Novo assumes no

obligation to publicly update or revise these forward-looking

statements for any reason, or to update the reasons actual results

could differ materially from those anticipated in these

forward-looking statements, even if new information becomes

available in the future. The contents of any website referenced in

this press release are not incorporated by reference herein.

NOVO INTEGRATED SCIENCES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

As of May 31, 2024 (unaudited)

and August 31, 2023

May 31,

August 31,

2024

2023

ASSETS

Current Assets:

Cash and cash equivalents

$

1,539,771

$

416,323

Accounts receivable, net

2,251,528

1,467,028

Inventory, net

1,112,068

1,106,983

Other receivables, current portion

1,043,473

1,051,584

Prepaid expenses and other current

assets

214,436

346,171

Total current assets

6,161,276

4,388,089

Property and equipment, net

5,157,781

5,390,038

Intangible assets, net

14,690,038

16,218,539

Right-of-use assets, net

1,793,907

1,983,898

Goodwill

7,523,998

7,582,483

TOTAL ASSETS

$

35,327,000

$

35,563,047

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current Liabilities:

Accounts payable

$

3,894,602

$

3,513,842

Accrued expenses

1,332,485

1,233,549

Accrued interest (including amounts to

related parties)

450,795

382,666

Government loans and notes payable,

current portion

93,488

277,405

Convertible notes payable, net of discount

of $4,985,381

1,224,619

558,668

Derivative liability

14,048,576

–

Contingent liability

45,968

61,767

Debentures, related parties

909,753

916,824

Due to related parties

262,295

533,001

Finance lease liability, net of current

portion

4,336

11,744

Operating lease liability, current

portion

409,516

415,392

Total current liabilities

22,676,433

7,904,858

Government loans and notes payable, net of

current portion

63,572

65,038

Operating lease liability, net of current

portion

1,534,078

1,693,577

Deferred tax liability

1,389,696

1,400,499

TOTAL LIABILITIES

25,663,779

11,063,972

Commitments and contingencies

–

–

STOCKHOLDERS’ EQUITY

Novo Integrated Sciences, Inc.

Convertible preferred stock; $0.001 par

value; 1,000,000 shares authorized; Nil shares issued and

outstanding at May 31, 2024 and August 31, 2023

–

–

Common stock; $0.001 par value;

499,000,000 shares authorized; 19,054,523 and 15,759,325 shares

issued and outstanding at May 31, 2024 and August 31, 2023,

respectively

19,055

15,760

Additional paid-in capital

96,660,608

90,973,316

Common stock to be issued (1,700 and

91,138 shares at May 31, 2024 and August 31, 2023)

25,500

1,217,293

Other comprehensive (loss) income

1,452,386

(357,383

)

Accumulated deficit

(88,201,415

)

(67,033,041

)

Total Novo Integrated Sciences, Inc.

stockholders’ equity

9,956,134

24,815,945

Noncontrolling interest

(292,913

)

(316,870

)

Total stockholders’ equity

9,663,221

24,499,075

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

35,327,000

$

35,563,047

* The condensed consolidated balance sheets’

common stock amounts have been retroactively adjusted to account

for the Company’s 1:10 reverse stock split, effective November 7,

2023.

NOVO INTEGRATED SCIENCES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

For the Three and Nine Months

Ended May 31, 2024 and 2023 (unaudited)

Three Months Ended

Nine Months Ended

May 31,

May 31,

May 31,

May 31,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Revenues

$

3,151,851

$

3,292,933

$

10,213,661

$

9,268,722

Cost of revenues

2,254,958

1,978,839

6,048,664

5,244,192

Gross profit

896,893

1,314,094

4,164,997

4,024,530

Operating expenses:

Selling expenses

2,635

1,877

14,811

9,916

General and administrative expenses

3,414,461

2,742,635

11,527,794

9,473,802

Total operating expenses

3,417,096

2,744,512

11,542,605

9,483,718

Loss from operations

(2,520,203

)

(1,430,418

)

(7,377,608

)

(5,459,188

)

Non operating income (expense)

Interest income

2,214

62,397

6,910

6,762

Interest expense

(178,445

)

(9,570

)

(460,503

)

(240,520

)

Other expense

(3,431

)

–

(964,368

)

–

Change in fair value of derivative

liability

(6,724,690

)

–

(5,765,822

)

–

Amortization of debt discount

(2,904,830

)

(156,037

)

(5,095,331

)

(4,386,899

)

Exchange currency (loss) gain

(1,406,915

)

48,333

(1,485,861

)

12,652

Total other expense

(11,216,097

)

(54,877

)

(13,764,975

)

(4,608,005

)

Loss before income taxes

(13,736,300

)

(1,485,295

)

(21,142,583

)

(10,067,193

)

Income tax expense

–

–

–

–

Net loss

$

(13,736,300

)

$

(1,485,295

)

$

(21,142,583

)

$

(10,067,193

)

Net income (loss) attributed to

noncontrolling interest

5,603

12,035

25,791

(13,095

)

Net loss attributed to Novo Integrated

Sciences, Inc.

$

(13,741,903

)

$

(1,497,330

)

$

(21,168,374

)

$

(10,054,098

)

Comprehensive loss:

Net loss

(13,736,300

)

(1,485,295

)

(21,142,583

)

(10,067,193

)

Foreign currency translation gain

(loss)

750,067

(120,357

)

1,809,769

(738,022

)

Comprehensive loss:

$

(12,986,233

)

$

(1,605,652

)

$

(19,332,814

)

$

(10,805,215

)

Weighted average common shares outstanding

- basic and diluted

18,685,979

14,360,058

17,688,692

8,583,229

Net loss per common share - basic and

diluted

$

(0.74

)

$

(0.10

)

$

(1.20

)

$

(1.17

)

* The condensed consolidated statements of

operations and comprehensive loss’s share and per share amounts

have been retroactively adjusted to account for the Company’s 1:10

reverse stock split, effective November 7, 2023.

NOVO INTEGRATED SCIENCES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF STOCKHOLDERS’ EQUITY

For the Three and Nine Months

Ended May 31, 2024 and 2023 (unaudited)

Additional

Common

Other

Total Novo

Common Stock

Paid-in

Stock To

Comprehensive

Accumulated

Stockholders’

Noncontrolling

Total

Shares

Amount

Capital

Be Issued

Income

Deficit

Equity

Interest

Equity

Balance, August 31, 2023

15,759,325

$

15,760

$

90,973,316

$

1,217,293

$

(357,383

)

$

(67,033,041

)

$

24,815,945

$

(316,870

)

$

24,499,075

Cashless exercise of warrants

245,802

246

1,323,152

–

–

–

1,323,398

–

1,323,398

Exercise of warrants for cash

240,400

240

240,160

–

–

–

240,400

–

240,400

Share issuance for convertible debt

settlement

519,845

520

577,002

–

–

–

577,522

–

577,522

Issuance of common stock to be issued

73,767

74

1,172,776

(1,172,850

)

–

–

–

–

–

Common stock issued for services

424,080

424

1,194,976

–

–

–

1,195,400

–

1,195,400

Reverse stock split share rounding

27,973

28

(28

)

–

–

–

–

–

–

Foreign currency translation gain

–

–

–

–

110,895

–

110,895

(1,919

)

108,976

Net loss

–

–

–

–

–

(4,680,343

)

(4,680,343

)

19,620

(4,660,723

)

Balance, November 30, 2023

17,291,192

$

17,292

$

95,481,354

$

44,443

$

(246,488

)

$

(71,713,384

)

$

23,583,217

$

(299,169

)

$

23,284,048

Share issuance for convertible debt

settlement

457,128

457

453,616

–

–

–

454,073

–

454,073

Foreign currency translation gain

–

–

–

–

749,869

–

749,869

198

750,067

Fair value of stock options

–

–

147,656

–

–

–

147,656

–

147,656

Net loss

–

–

–

–

–

(2,746,128

)

(2,746,128

)

568

(2,745,560

)

Balance, February 29, 2024

17,748,320

$

17,749

$

96,082,626

$

44,443

$

503,381

$

(74,459,512

)

$

22,188,687

$

(298,403

)

$

21,890,284

Share issuance for convertible debt

settlement

1,306,203

1,306

577,982

–

–

–

579,288

–

579,288

Cancellation of agreement

–

–

–

(18,943

)

–

–

(18,943

)

–

(18,943

)

Foreign currency translation gain

–

–

–

–

949,005

–

949,005

(113

)

948,892

Net loss

–

–

–

–

–

(13,741,903

)

(13,741,903

)

5,603

(13,736,300

)

Balance, May 31, 2024

19,054,523

$

19,055

$

96,660,608

$

25,500

$

1,452,386

$

(88,201,415

)

$

9,956,134

$

(292,913

)

$

9,663,221

Additional

Common

Other

Total Novo

Common Stock

Paid-in

Stock To

Comprehensive

Accumulated

Stockholders’

Noncontrolling

Total

Shares

Amount

Capital

Be Issued

Income

Deficit

Equity

Interest

Equity

Balance, August 31, 2022

3,118,063

$

3,118

$

66,084,887

$

9,474,807

$

560,836

$

(53,818,489

)

$

22,305,159

$

(257,588

)

$

22,047,571

Common stock issued for cash, net of

offering costs

400,000

400

1,794,600

–

–

–

1,795,000

–

1,795,000

Issuance of common stock to be issued

3,623

4

92,362

(92,366

)

–

–

–

–

–

Cashless exercise of warrants

467,399

467

1,138,583

–

–

–

1,139,050

–

1,139,050

Fair value of stock options

–

–

60,887

–

–

–

60,887

–

60,887

Foreign currency translation loss

–

–

–

–

(417,008

)

–

(417,008

)

(3,974

)

(420,982

)

Net loss

–

–

–

–

–

(3,935,413

)

(3,935,413

)

(1,323

)

(3,936,736

)

Balance, November 30, 2022

3,989,085

$

3,989

$

69,171,319

$

9,382,441

$

143,828

$

(57,753,902

)

$

20,947,675

$

(262,885

)

$

20,684,790

Share issuance for convertible debt

settlement

9,310,940

9,311

9,076,740

–

–

–

9,086,051

–

9,086,051

Exercise of warrants (Cashless

Exercise)

115,935

116

282,417

–

–

–

282,533

–

282,533

Exercise of warrants for cash

131,000

131

130,869

–

–

–

131,000

–

131,000

Issuance of common stock to be issued

320,202

320

8,164,828

(8,165,148

)

–

–

–

–

–

Shares issued with convertible notes

95,500

96

82,868

–

–

–

82,963

–

82,963

Value of warrants issued with convertible

notes

–

–

86,327

–

–

–

86,327

–

86,327

Fair value of stock options

–

–

60,887

–

–

–

60,887

–

60,887

Extinguishment of derivative liability due

to conversion

–

–

1,390,380

–

–

–

1,390,380

–

1,390,380

Foreign currency translation loss

–

–

–

–

(195,821

)

–

(195,821

)

(862

)

(196,683

)

Net loss

–

–

–

–

–

(4,621,355

)

(4,621,355

)

(23,807

)

(4,645,162

)

Balance, February 28, 2023

13,962,662

13,963

88,446,635

1,217,293

(51,993

)

(62,375,257

)

27,250,640

(287,554

)

26,963,086

Share issuance for convertible debt

settlement

107,594

108

100,170

–

–

–

100,278

–

100,278

Exercise of warrants for cash

320,000

320

319,680

–

–

–

320,000

–

320,000

Shares issued with convertible notes

95,500

96

90,037

–

–

–

90,132

–

90,132

Value of warrants issued with convertible

notes

–

–

93,811

–

–

–

93,811

–

93,811

Beneficial conversion feature upon

issuance of convertible debt

–

–

66,068

–

–

–

66,068

–

66,068

Stock option expense

–

–

263,561

–

–

–

263,561

–

263,561

Foreign currency translation loss

–

–

–

–

(120,533

)

–

(120,533

)

176

(120,357

)

Net loss

–

–

–

–

–

(1,497,330

)

(1,497,330

)

12,035

(1,485,295

)

Balance, May 31, 2023

14,485,756

$

14,486

$

89,379,961

$

1,217,293

$

(172,526

)

$

(63,872,587

)

$

26,566,627

$

(275,343

)

$

26,291,284

* The condensed consolidated statements of

stockholders’ equity share amounts have been retroactively adjusted

to account for the Company’s 1:10 reverse stock split, effective

November 7, 2023.

NOVO INTEGRATED SCIENCES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

For the Nine Months Ended May

31, 2024 and 2023 (unaudited)

Nine Months Ended

May 31,

May 31,

2024

2023

(unaudited)

(unaudited)

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net loss

$

(21,142,583

)

$

(10,067,193

)

Adjustments for non-cash items:

Depreciation and amortization

1,697,317

1,718,388

Fair value of vested stock options

147,656

385,335

Change in fair value of derivative

liability

5,765,822

–

Cashless exercise of warrants

1,323,398

1,421,583

Common stock issued for services

1,195,400

–

Operating lease expense

466,276

624,246

Amortization of debt discount

5,095,331

4,386,899

Foreign currency transaction losses

1,485,861

(12,652

)

Changes in operating assets and

liabilities:

Accounts receivable

(797,692

)

(308,907

)

Inventory

(12,548

)

(92,260

)

Prepaid expenses and other current

assets

130,015

333,724

Accounts payable

408,067

154,542

Accrued expenses

76,428

104,004

Accrued interest

103,605

(67,634

)

Operating lease liability

(466,276

)

(594,618

)

Net cash used in operating activities

(4,523,923

)

(2,014,543

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchase of property and equipment

(2,005

)

(18,870

)

Net cash used in investing activities

(2,005

)

(18,870

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

(Repayments to) proceeds from related

parties

(267,756

)

(56,649

)

Proceeds from notes payable

274

222,000

Repayments of notes payable

(184,125

)

–

Repayments of finance leases

(7,350

)

(6,435

)

Proceeds from issuance of convertible

notes, net

8,649,153

925,306

Repayment of convertible notes

(3,311,536

)

(3,033,888

)

Proceeds from the sale of common stock,

net of offering costs

–

1,795,000

Proceeds from exercise of warrants

240,400

451,000

Net cash provided by financing

activities

5,119,060

296,334

Effect of exchange rate changes on cash

and cash equivalents

530,316

22,403

NET INCREASE (DECREASE) IN CASH AND

CASH EQUIVALENTS

1,123,448

(1,714,676

)

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD

416,323

2,178,687

CASH AND CASH EQUIVALENTS, END OF

PERIOD

$

1,539,771

$

464,011

CASH PAID FOR:

Interest

$

190,491

$

343,878

Income taxes

$

–

$

–

SUPPLEMENTAL NON-CASH INVESTING AND

FINANCING ACTIVITIES:

Common stock issued for convertible debt

settlement

$

1,610,883

$

9,186,329

Beneficial conversion feature upon

issuance of convertible notes

–

66,068

Debt discount recognized on derivative

liability

–

1,390,380

Debt discount recognized on convertible

note

–

639,993

Extinguishment of derivative liability due

to conversion

–

1,390,380

Common stock issued with convertible

notes

–

173,095

Warrants issued with convertible notes

$

–

$

180,138

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240719320957/en/

Chris David, COO-President Novo Integrated Sciences, Inc.

chris.david@novointegrated.com (888) 512-1195

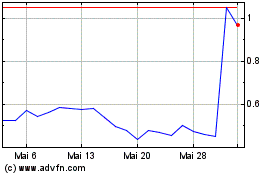

Novo Integrated Sciences (NASDAQ:NVOS)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Novo Integrated Sciences (NASDAQ:NVOS)

Historical Stock Chart

Von Nov 2023 bis Nov 2024