UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of November 2023

Commission

File Number: 001-41333

LOCAFY

LIMITED

(Registrant’s

name)

246A

Churchill Avenue, Subiaco Western Australia 6008, Australia

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On November 27, 2023, Locafy Limited issued a press release, “Locafy Reports Fiscal First Quarter 2024 Results,” which is attached hereto as Exhibit 99.1.

Incorporation

by Reference

This

Report on Form 6-K, including all exhibits attached hereto, is hereby incorporated by reference into the Locafy Limited’s Registration

Statement on Form F-3, as amended, originally filed with the Securities and Exchange Commission on May 19, 2023 (File No. 333-272066),

to be a part thereof from the date on which this Report on Form 6-K is submitted, to the extent not superseded by documents or reports

subsequently filed or furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

LOCAFY

LIMITED |

| |

|

|

| Date:

November 27, 2023 |

By: |

/s/

Gavin Burnett |

| |

Name:

|

Gavin

Burnett |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Locafy

Reports Fiscal First Quarter 2024 Results

Fiscal

First Quarter 2024 Highlighted by Strategic Partnerships, Maintained Gross Margin of 81%, and 53% Year-Over-Year Cost of Sales Decrease

Continued

Cost-Efficiency Initiatives Help Drive Locafy Closer to Profitability; Milestone Expected Early in Calendar-Year 2024

PERTH,

Australia – November 27, 2023 – Locafy Limited (Nasdaq: LCFY, LCFYW) (“Locafy” or the “Company”),

a globally recognized software-as-a-service technology company specializing in local search engine marketing, today reported financial

results for the 2024 fiscal first quarter ended September 30, 2023. All financial results are reported in Australian Dollars (AUD).

Recent

Operational Highlights

| |

● |

Announced

an enterprise partnership with Method, an Australian digital marketing agency with local-scale expertise. Method has been using

Locafy’s products over several years and has grown to enterprise partner scale through an expanded client network and significant

growth. Through this continued partnership, Method will ramp-up its deployment of Locafy’s Entity-Based SEO product suite to

further supplement its growth and increase its market share. |

| |

● |

Announced

a strategic partnership with TransUnion to expand Locafy’s publishing network. This partnership will allow for the publication

of 17 million business listings in Hotfrog.com, a top-20 free online directory which Locafy acquired in 2016. The collaboration will

assist in increasing Locafy’s existing publishing network by 34% to approximately 66 million pages. |

Management

Commentary

“Our

fiscal first quarter included several achievements that we believe position our business for strong growth over the rest of fiscal 2024,”

said Locafy CEO Gavin Burnett. “Despite a series of billing relief extensions granted to customers impacted by our recent platform

upgrades and transitions, we believe we made progress across our growth strategy pillars. We confirmed an enterprise partnership, expanded

our publishing network, significantly advanced our cost-efficiency initiatives, and continued driving successful software trials to further

validate our technology.

“Since

the end of the quarter, we’ve transitioned our focus to accelerating growth and achieving profitability in the upcoming calendar

year. We are confident that our recent enterprise partnerships have helped us develop a strong business development pipeline and believe

in the significant tailwinds for our technology throughout our industry. We’re encouraged by our demand outlook and look forward

to driving continued adoption of our solutions in calendar-year 2024.”

Fiscal

First Quarter 2024 Financial Results

Results

compare the 2024 fiscal first quarter end (September 30, 2023) to the 2023 fiscal first quarter end (September 30, 2022) unless otherwise

indicated.

| ● | Total

operating revenue decreased 24.3% to $1.1 million from $1.4 million in the comparable

year-ago period. |

| ○ | Subscription

revenue decreased 28.2% to $768,000 from $1.1 million in the comparable year-ago period.

Compared to the 2023 fiscal fourth quarter, subscription revenue decreased 15.4%. The decrease

in subscription revenue was primarily attributable to the Company’s extended billing

relief to customers whose campaigns were affected by the transition onto Locafy’s upgraded

technology platform (the “Platform”), together with the tapering of the Company’s

labor-intensive educational program and Brand Boost products in the near term. |

| ○ | Advertising

revenue increased 12.2% to $97,000 from $87,000 in the comparable year-ago period. Compared

to the 2023 fiscal fourth quarter, advertising revenue increased 27.0%. |

| ○ | Data

revenue decreased 11.0% to $214,000 from $240,000 in the comparable year-ago period.

Compared to the 2023 fiscal fourth quarter, data revenue increased 2.1%. |

| ○ | Services

revenue decreased 78% to $9,000 from $40,000 in the comparable year-ago period. Compared

to the 2023 fiscal fourth quarter, services revenue decreased 87.2%. These decreases are

primarily due to comparatively lower custom website builds undertaken by the Company as it

completed the transition of its customer base to the Platform. |

| ● | Cost

of sales decreased 53.2% to $205,000 from $438,000 in the comparable year-ago period.

Compared to the 2023 fiscal fourth quarter, cost of sales decreased 10.8%. |

| ● | Gross

margin increased to 81.1% from 69.5% for the comparable year-ago period. Compared to

the 2023 fiscal fourth quarter, gross margin remained steady. |

| ● | Net

loss was $808,000, or $0.63 per diluted share, compared to a net loss of $1.2 million,

or $1.13 per diluted share, in the comparable year-ago period. |

Key

Performance Indicators (KPIs)

Unless

otherwise specified, KPI data has been recorded as of the 2024 fiscal first quarter end (September 30, 2023).

| ● | Monthly

recurring revenue (MRR) for the 2024 fiscal first quarter was $360,000, a 21.2% decrease

compared to $456,000 for the comparable year-ago period, and a 9.6% decrease compared to

$398,000 for the 2023 fiscal fourth quarter. |

| ● | Total

active reseller count for the 2024 fiscal first quarter was 99 resellers, a 43.5% increase

compared to 69 resellers for the comparable year-ago period, and a 7.5% decrease compared

to 107 resellers as of the 2023 fiscal fourth quarter. |

| ● | Total

end user count for the 2024 fiscal first quarter was 1,048 end users, a 27.2% decrease

compared to 1,440 end users for the comparable year-ago period, and a 7.2% decrease compared

to 1,129 end users as of the 2023 fiscal fourth quarter. |

For

more information, please see Locafy’s investor relations website at investors.locafy.com.

About

Locafy

Founded

in 2009, Locafy’s (Nasdaq: LCFY, LCFYW) mission is to revolutionize the US$700 billion SEO sector. We help businesses and brands

increase search engine relevance and prominence in a specific proximity using a fast, easy, and automated approach. For more information,

please visit www.locafy.com.

About

Key Performance Indicators

Locafy

defines MRR as the value of all recurring subscription contracts with active entitlements as at the end of each month. MRR across a period

is the average of each month’s MRR within that period.

Locafy’s

recent Platform upgrade caused a significant change to the calculation of average page metrics, and Locafy management no longer views

these metrics as relevant indicators of the performance of Locafy technology. The Company may introduce additional KPIs in future quarters

if deemed relevant long-term indicators of performance.

Forward-Looking

Statements

This

press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements,

other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements

contained in this press release may be identified by the use of words such as “subject to”, “believe,” “anticipate,”

“plan,” “expect,” “intend,” “estimate,” “project,” “may,” “will,”

“should,” “would,” “could,” “can,” the negatives thereof, variations thereon and similar

expressions, or by discussions of strategy, although not all forward-looking statements contain these words. Although the Company believes

that the expectations reflected in such forward-looking statements are reasonable, they do involve assumptions, risks, and uncertainties,

and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company’s actual results could differ materially from those anticipated in these

forward-looking statements as a result of a variety of factors and risk factors, including those discussed in the Company’s filings

with the Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 20-F filed with

the SEC on October 11, 2023, and available on its website (http://www.sec.gov). All forward-looking statements attributable to

the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under

the securities laws, the Company does not assume a duty to update these forward-looking statements.

Investor

Relations Contact

Tom

Colton or Chris Adusei-Poku

Gateway

Investor Relations

(949)

574-3860

LCFY@gateway-grp.com

-Financial

Tables to Follow-

Locafy

Limited

Consolidated

Statement of Profit or Loss and Other Comprehensive Income

| | |

3

months to

30 Sep 2023

AUD $

(unaudited) | | |

3

months to

30 Sep 2022

AUD $

(unaudited) | |

| Revenue | |

| 1,087,642 | | |

| 1,436,807 | |

| Other income | |

| 43,860 | | |

| 169,952 | |

| Technology expense | |

| (314,550 | ) | |

| (514,533 | ) |

| Employee benefits expense | |

| (927,342 | ) | |

| (1,788,103 | ) |

| Occupancy expense | |

| (17,461 | ) | |

| (16,187 | ) |

| Advertising expense | |

| (61,134 | ) | |

| (39,196 | ) |

| Consultancy expense | |

| (234,951 | ) | |

| (146,058 | ) |

| Depreciation and amortization expense | |

| (359,639 | ) | |

| (167,065 | ) |

| Other expenses | |

| (3,144 | ) | |

| (46,299 | ) |

| Impairment of financial assets | |

| - | | |

| (32,602 | ) |

| Operating profit/(loss) | |

| (786,719 | ) | |

| (1,143,284 | ) |

| Financial cost | |

| (21,373 | ) | |

| (19,948 | ) |

| Profit/(Loss) before income tax | |

| (808,092 | ) | |

| (1,163,232 | ) |

| Income tax expense | |

| - | | |

| - | |

| Profit/(Loss) for the period | |

| (808,092 | ) | |

| (1,163,232 | ) |

| | |

| | | |

| | |

| Other comprehensive income | |

| | | |

| | |

| Items that will be reclassified subsequently to profit and loss | |

| | | |

| | |

| Exchange differences on translating foreign operations | |

| 15,749 | | |

| 34,530 | |

| Total comprehensive profit/(loss) for the period | |

| (792,343 | ) | |

| (1,128,702 | ) |

| | |

| | | |

| | |

| Earnings per share | |

| | | |

| | |

| Basic profit/(loss) per share | |

| (0.63 | ) | |

| (1.13 | ) |

| Diluted profit/(loss) per share | |

| (0.63 | ) | |

| (1.13 | ) |

Locafy

Limited

Consolidated

Statement of Financial Position

| | |

As

at

30 Sep 2023

AUD $

(unaudited) | | |

As

at

30 Jun 2023

AUD $

(audited) | | |

As

at

30 Jun 2022

AUD $

(audited) | |

| Assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 1,773,145 | | |

| 3,174,700 | | |

| 4,083,735 | |

| Trade and other receivables | |

| 1,326,451 | | |

| 1,288,513 | | |

| 1,203,249 | |

| Other assets | |

| 301,836 | | |

| 356,782 | | |

| 230,094 | |

| Current assets | |

| 3,401,432 | | |

| 4,819,995 | | |

| 5,517,078 | |

| Property, plant and equipment | |

| 348,818 | | |

| 380,018 | | |

| 395,999 | |

| Right of use assets | |

| 291,577 | | |

| 314,596 | | |

| 406,673 | |

| Intangible assets | |

| 3,764,232 | | |

| 3,720,272 | | |

| 2,235,180 | |

| Non-current assets | |

| 4,404,627 | | |

| 4,414,886 | | |

| 3,037,852 | |

| Total assets | |

| 7,806,059 | | |

| 9,234,881 | | |

| 8,554,930 | |

| | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | |

| Trade and other payables | |

| 2,177,510 | | |

| 2,507,573 | | |

| 1,454,241 | |

| Borrowings | |

| 271,600 | | |

| 301,600 | | |

| 308,100 | |

| Provisions | |

| 215,450 | | |

| 214,465 | | |

| 473,006 | |

| Accrued expenses | |

| 259,830 | | |

| 512,611 | | |

| 511,848 | |

| Lease liabilities | |

| 105,222 | | |

| 85,165 | | |

| 32,672 | |

| Contract and other liabilities | |

| 153,143 | | |

| 152,211 | | |

| 137,342 | |

| Current liabilities | |

| 3,182,755 | | |

| 3,773,625 | | |

| 2,917,209 | |

| Lease liabilities | |

| 301,345 | | |

| 332,578 | | |

| 417,744 | |

| Provisions | |

| 52,291 | | |

| 48,271 | | |

| 25,988 | |

| Accrued expenses | |

| 90,450 | | |

| 90,450 | | |

| 76,504 | |

| Non-current liabilities | |

| 444,086 | | |

| 471,299 | | |

| 520,236 | |

| Total liabilities | |

| 3,626,841 | | |

| 4,244,924 | | |

| 3,437,445 | |

| Net assets/(liabilities) | |

| 4,179,218 | | |

| 4,989,957 | | |

| 5,117,485 | |

| | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Issued capital | |

| 47,835,074 | | |

| 47,930,486 | | |

| 45,038,037 | |

| Reserves | |

| 2,375,089 | | |

| 2,404,933 | | |

| 5,306,475 | |

| Accumulated losses | |

| (46,030,945 | ) | |

| (45,345,462 | ) | |

| (45,227,027 | ) |

| Total equity/(deficiency) | |

| 4,179,218 | | |

| 4,989,957 | | |

| 5,117,485 | |

Locafy

Limited

Consolidated

Statement of Cash Flows

(Unaudited)

| | |

3 months to 30 Sep 2023 AUD $ (unaudited) | | |

FY2023

AUD $ (audited) | | |

FY2022

AUD $ (audited) | |

| Cash flows from operating activities | |

| | | |

| | | |

| | |

| Receipts from customers (inclusive of GST) | |

| 939,249 | | |

| 4,463,725 | | |

| 3,038,044 | |

| Payments to suppliers and employees (inclusive of GST) | |

| (1,624,006 | ) | |

| (7,005,510 | ) | |

| (7,999,866 | ) |

| R&D Tax Incentive and government grants | |

| - | | |

| 386,181 | | |

| 803,042 | |

| Financial cost | |

| (21,373 | ) | |

| (105,367 | ) | |

| (81,656 | ) |

| Net cash used by operating activities | |

| (706,130 | ) | |

| (2,260,971 | ) | |

| (4,240,436 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | | |

| | |

| Purchase of intellectual property | |

| (486,955 | ) | |

| (1,617,446 | ) | |

| (1,615,192 | ) |

| Purchase of property, plant and equipment | |

| - | | |

| (2,170 | ) | |

| (390,339 | ) |

| Net cash used by investing activities | |

| (486,955 | ) | |

| (1,619,616 | ) | |

| (2,005,531 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | | |

| | |

| Proceeds from issue of shares | |

| - | | |

| 3,295,822 | | |

| 9,979,861 | |

| Payment for share issue costs | |

| (199,668 | ) | |

| (403,373 | ) | |

| (639,429 | ) |

| Repayment of borrowings | |

| (30,000 | ) | |

| (6,500 | ) | |

| (97,500 | ) |

| Leasing liabilities | |

| (11,176 | ) | |

| (32,673 | ) | |

| (59,419 | ) |

| Net cash from financing activities | |

| (240,844 | ) | |

| 2,853,276 | | |

| 9,183,513 | |

| | |

| | | |

| | | |

| | |

| Net increase/(decrease) in cash and cash equivalents | |

| (1,433,929 | ) | |

| (1,027,311 | ) | |

| 2,937,546 | |

| Net foreign exchange difference | |

| 32,374 | | |

| 118,276 | | |

| 495,458 | |

| Cash and cash equivalents at the beginning of the period | |

| 3,174,700 | | |

| 4,083,735 | | |

| 650,731 | |

| Cash and cash equivalents at the end of the period | |

| 1,773,145 | | |

| 3,174,700 | | |

| 4,083,735 | |

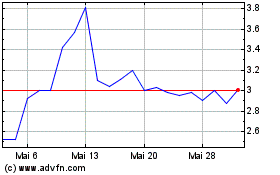

Locafy (NASDAQ:LCFY)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Locafy (NASDAQ:LCFY)

Historical Stock Chart

Von Nov 2023 bis Nov 2024