UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2023

Commission

File Number: 001-40301

Infobird

Co., Ltd

(Registrant’s

Name)

Unit

532A, 5/F, Core Building 2, No. 1 Science Park West Avenue

Hong

Kong Science Park, Tai Po, N.T., Hong Kong

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Infobird

Co., Ltd. (the “Company”), today announced to hold the Annual Shareholders’ Meeting on October 6, 2023.

The

Company’s Annual Shareholders’ Meeting will be held on November 15, 2023, at 9:30 p.m. ET. The meeting will take place

at Unit 532A, 5/F, Core Building 2, No.

1 Science Park West Avenue, Hong Kong Science Park, Tai Po, N.T., Hong Kong.

The matters to be voted on at the meeting are set forth in the Company’s Form 6-K filed with the U.S. Securities and Exchange

Commission on October 30, 2023. Shareholders of record on October

26, 2023 will be eligible to vote at this meeting.

Exhibits

Exhibit

99.1

INFOBIRD

CO., LTD

Notice

of 2023 Annual General Meeting of Shareholders

To

Be Held on November 15, 2023, at 9:30 p.m. ET

NOTICE

IS HEREBY GIVEN THAT the annual general meeting (the “Meeting”) of holders of ordinary shares (the “Ordinary

Shares”) (the “shareholders”) of Infobird Co., Ltd (the “Company”) will be held at Unit

532A, 5/F, Core Building 2, No. 1 Science Park West Avenue, Hong Kong Science Park, Tai Po, N.T., Hong Kong (“Principal

Executive Office”), on November 15, 2023, at 9:30 p.m. ET.

The

purpose of the Meeting is to consider, if thought fit, to approve the following resolutions:

| |

1. |

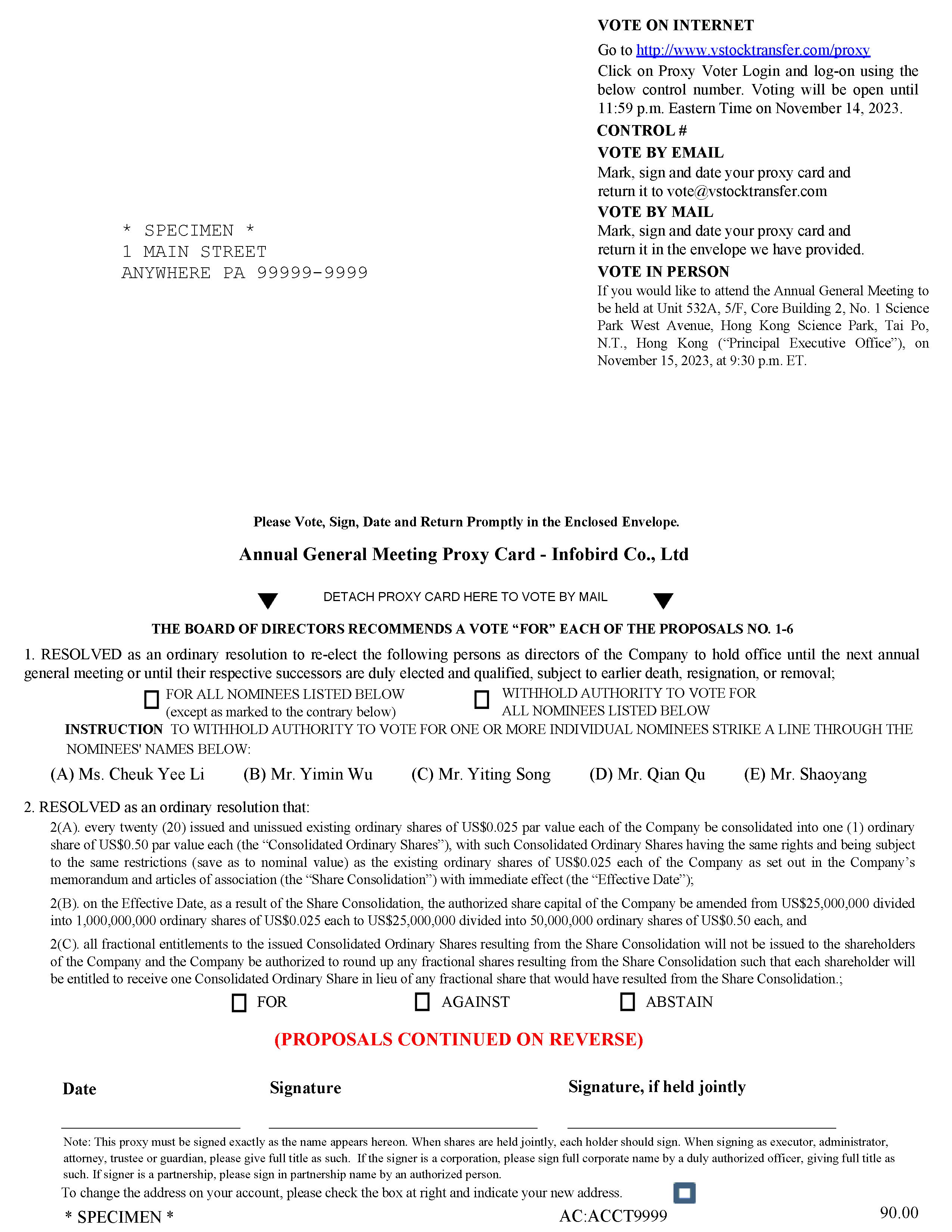

RESOLVED as an ordinary resolution to re-elect

the following persons as directors of the Company to hold office until the next annual general meeting or until their respective

successors are duly elected and qualified, subject to earlier death, resignation, or removal (the “Directors Proposal”);

(A) Ms. Cheuk Yee Li be re-elected as a director of the Company; (B) Mr. Yimin Wu be re-elected as a director of

the Company; (C) Mr. Yiting Song be re-elected as a director of the Company; (D) Mr. Qian Qu be re-elected as a

director of the Company; and (E) Mr. Shaoyang E be re-elected as a director of the Company. |

| |

(A) |

Ms. Cheuk Yee Li be re-elected as a

director of the Company; |

| |

|

|

| |

(B) |

Mr. Yimin Wu be re-elected as a director of the Company; |

| |

|

|

| |

(C) |

Mr. Yiting Song be re-elected as a director of the Company; |

| |

|

|

| |

(D) |

Mr. Qian Qu be re-elected as a director of the Company;

and |

| |

|

|

| |

(E) |

Mr. Shaoyang E be re-elected as a director of the Company. |

| |

2. |

RESOLVED as an ordinary resolution that: |

| |

(A) |

every twenty (20) issued and unissued existing ordinary shares of US$0.025 par

value each of the Company be consolidated into one (1) ordinary share of US$0.50 par value each (the “Consolidated Ordinary Shares”),

with such Consolidated Ordinary Shares having the same rights and being subject to the same restrictions (save as to nominal value) as

the existing ordinary shares of US$0.025 each of the Company as set out in the Company’s memorandum and articles of association

(the “Share Consolidation”) with immediate effect (the “Effective Date”); |

| |

|

|

| |

(B) |

on the Effective Date, as a result of the Share Consolidation, the authorized

share capital of the Company be amended from US$25,000,000 divided into 1,000,000,000 ordinary shares of US$0.025 each to US$25,000,000

divided into 50,000,000 ordinary shares of US$0.50 each, and |

| |

|

|

| |

(C) |

all fractional entitlements to the issued Consolidated

Ordinary Shares resulting from the Share Consolidation will not be issued to the shareholders of the Company and the Company be authorized

to round up any fractional shares resulting from the Share Consolidation such that each shareholder will be entitled to receive one Consolidated

Ordinary Share in lieu of any fractional share that would have resulted from the Share Consolidation.; |

| |

3. |

RESOLVED as an ordinary resolution that immediately after the Share Consolidation takes

effect, the Company’s authorized share capital be increased from US$25,000,000 divided into 50,000,000 ordinary shares of a par

value of US$0.50 each to US$25,000,000,000 divided into 50,000,000,000 shares of a par value of US$0.50 each, by the creation of an additional

49,950,000,000 ordinary shares, of a par value of US$0.50 each (the “Increase of Authorized Shares”). |

| |

|

|

| |

4. |

RESOLVED as a special resolution that the amendments of

the Company’s Memorandum and Articles of Association in the form of Fifth Amended and Restated Memorandum and Articles of Association

attached as Annex A hereto to reflect the above Share Consolidation and Increased of Authorized Shares be approved; and that the Fifth

Amended and Restated Memorandum and Articles of Association be adopted as the Memorandum and Articles of Association of the Company in its entirety,

to the exclusion of the existing Fourth Amended and Restated Memorandum and Articles of Association with effect from the effective date

of the Share Consolidation and Increased of Authorized Shares. The registered office provider of the Company shall be instructed to file

the Fifth Amended and Restated Memorandum and Articles of Association with the Registrar of Companies in the Cayman Islands and to do

and complete all other matters ancillary to such filing as may be necessary or desirable in order to give effect to amendment of the Memorandum

and Articles of Association in the Cayman Islands. |

| |

5. |

RESOLVED as an ordinary resolution

to ratify the appointment of WWC, P.C. Certified Public Accountants as our independent registered public accounting firm for the fiscal

year ended December 31, 2023 (the “Auditors Proposal”). |

| |

|

|

| |

6. |

to consider and approve to

direct the chairman of the annual general meeting to adjourn the annual general meeting to a later date or dates, if necessary, to permit

further solicitation and vote of proxies if, based upon the tabulated vote at the time of the meeting, there are not sufficient votes

to approve the proposals 1 – 5 (the “Adjournment Proposal”). |

The

foregoing items of business are described in the proxy statement accompanying this notice. The board of directors of the Company

(the “Board of Directors”) unanimously recommends that the shareholders vote “FOR” for all the

items.

The

Board of Directors has fixed the close of business on October 26, 2023 as the record date (the “Record Date”) for

determining the shareholders entitled to receive notice of and to vote at the Meeting or any adjournment thereof. Only holders

of Ordinary Shares of the Company on the Record Date are entitled to receive notice

of and to vote at the Meeting or any adjournment thereof.

We

cordially invite all holders of Ordinary Shares to attend the Annual General Meeting in person. However, holders of Ordinary Shares

entitled to attend and vote are entitled to appoint a proxy to attend and vote instead of such holders. A proxy needs not be a

shareholder of the Company. If you are a holder of Ordinary Shares and whether or not you expect to attend the Annual General

Meeting in person, please mark, date, sign and return the enclosed form of proxy as promptly as possible to ensure your representation

and the presence of a quorum at the Annual General Meeting. If you send in your form of proxy and then decide to attend the Annual

General Meeting to vote your Ordinary Shares in person, you may still do so. Your proxy is revocable in accordance with the procedures

set forth in the proxy statement. The enclosed form of proxy is to be delivered to the attention of Cheuk Yee Li, Chairman of

the Board of Directors, Infobird Co., Ltd, Unit 532A, 5/F, Core Building 2, No. 1 Science

Park West Avenue, Hong Kong Science Park, Tai Po, N.T., Hong Kong, and must arrive no later than the time for holding the

Annual General Meeting or any adjournment thereof. This notice of the Annual General Meeting of Shareholders and the attached

proxy statement are also available through our website at http://www.infobird.com/EN/investorRelations.

A

proxy statement providing information, and a form of proxy to vote, with respect to the foregoing matters accompany this notice.

The Board of Directors of the Company fixed the close of business on October 26, 2023 as the record date (the “Record Date”)

for determining the shareholders entitled to receive notice of and to vote at the Meeting or any adjourned or postponement thereof.

Only holders of Ordinary Shares of the Company on the Record Date are entitled to

receive notice of and to vote at the Meeting or any adjournment thereof.

Holders

of record of the Company’s Ordinary Shares as of the Record Date are cordially

invited to attend the Meeting in person. Your vote is important. Whether or not you expect to attend the Meeting in person, you

are urged to complete, sign, date and return the accompanying proxy form as promptly as possible. We must receive the proxy form

no later than noon (Hong Kong time) on the day of the Meeting to ensure your representation at such meeting. Shareholders who

execute proxies retain the right to revoke them at any time prior to the voting thereof, and may nevertheless vote in person at

the Meeting. You may obtain directions to the meeting by calling our offices at +852 3690 9227. Shareholders may obtain a copy

of these materials, free of charge, by contacting the Chief Executive Officer of the Company at the Principal Executive Office.

| By Order of the

Board of Directors, |

|

| |

|

| /s/

Cheuk Yee Li |

|

| Cheuk Yee Li |

|

| Chief Executive Officer |

|

Hong

Kong

October

30, 2023

Exhibit

99.2

INFOBIRD

CO., LTD

Annual

General Meeting of Shareholders

November

15, 2023

9:30

p.m. ET

PROXY

STATEMENT

The

board of directors (the “Board of Directors”) of Infobird Co., Ltd (the “Company”) is soliciting proxies

for the annual general meeting of shareholders (the “Meeting”) of the Company to be held on November 15, 2023 at 9:30

p.m. EST. The Company will hold the Meeting at Unit 532A, 5/F, Core Building 2, No. 1 Science

Park West Avenue, Hong Kong Science Park, Tai Po, N.T., Hong Kong, which shareholders will be able to attend in person.

Shareholders will have an equal opportunity to participate at the Meeting and engage with the directors, management, and other

shareholders of the Company.

Registered

shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting in real time. Beneficial

shareholders who hold their ordinary shares of the Company (the “Ordinary Shares”) through a broker, investment dealer,

bank, trust corporation, custodian, nominee, or other intermediary who have not duly appointed themselves as proxyholder will

be able to attend as guest, but will not be able to participate in or vote at the Meeting. If the enclosed proxy is properly executed

and returned, the shares represented thereby will be voted in accordance with the directions thereon and otherwise in accordance

with the judgment of the persons designated as proxies. Any proxy on which no direction is specified will be voted in favor of

the actions described in this Proxy Statement.

Only

holders of the Ordinary Shares of the Company of record at the close of business on October 26, 2023 (the “Record Date”)

are entitled to attend and vote at the Meeting or at any adjournment thereof. Members holding Ordinary Shares that represent not

less than one-third (1/3) in nominal value of the total issued voting shares in the Company carrying the right to vote at the

Meeting shall form a quorum.

Any

shareholder entitled to attend and vote at the Meeting is entitled to appoint a proxy to attend and vote on such shareholder’s

behalf. A proxy need not be a shareholder of the Company. Each holder of the Company’s Ordinary Shares shall be entitled

to one vote in respect of each Ordinary Share held by such holder on the Record Date. Any shareholder giving such a proxy has

the power to revoke it at any time before it is voted. Written notice of such revocation should be forwarded directly to the Chief

Executive Officer of the Company, at the above stated address. Proxies may be solicited through the mails or direct communication

with certain shareholders or their representatives by Company officers, directors, or employees, who will receive no additional

compensation therefor. You may obtain directions to the meeting by calling our offices at +852 3690 9227.

After

carefully reading and considering the information contained in this proxy statement, including the annexes, please vote your shares

as soon as possible so that your shares will be represented at the Meeting. Please follow the instructions set forth on the proxy

card or on the voting instruction form provided by the record holder if your shares are held in the name of your broker or other

nominee.

PROPOSALS

TO BE VOTED ON

The

purpose of the Meeting is to consider, if thought fit, to approve the following resolutions:

| |

1. |

RESOLVED as an ordinary resolution

to re-elect the following persons as directors of the Company hold office until the next annual general meeting or until their

respective successors are duly elected and qualified, subject to earlier death, resignation, or removal (the “Directors

Proposal”); (A) Ms. Cheuk Yee Li be re-elected as a director of the Company; (B) Mr. Yimin Wu be re-elected

as a director of the Company; (C) Mr. Yiting Song be re-elected as a director of the Company; (D) Mr. Qian Qu

be re-elected as a director of the Company; and (E) Mr. Shaoyang E be re-elected as a director of the Company. |

| |

(A) |

Ms. Cheuk Yee Li be re-elected as a

director of the Company; |

| |

|

|

| |

(B) |

Mr. Yimin Wu be re-elected as a director of the Company; |

| |

|

|

| |

(C) |

Mr. Yiting Song be re-elected as a director

of the Company; |

| |

|

|

| |

(D) |

Mr. Qian Qu be re-elected as a director of the Company;

and |

| |

|

|

| |

(E) |

Mr. Shaoyang E be re-elected as a director of the Company. |

| |

2. |

RESOLVED

as an ordinary resolution that: |

| |

(A) |

every twenty (20) issued and unissued existing ordinary shares of US$0.025 par

value each of the Company be consolidated into one (1) ordinary share of US$0.50 par value each (the “Consolidated Ordinary Shares”),

with such Consolidated Ordinary Shares having the same rights and being subject to the same restrictions (save as to nominal value) as

the existing ordinary shares of US$0.025 each of the Company as set out in the Company’s memorandum and articles of association

(the “Share Consolidation”) with immediate effect(the “Effective Date”); |

| |

|

|

| |

(B) |

on the Effective Date, as a result of the Share Consolidation, the authorized

share capital of the Company be amended from US$25,000,000 divided into 1,000,000,000 ordinary shares of US$0.025 each to US$25,000,000

divided into 50,000,000 ordinary shares of US$0.50 each, and |

| |

|

|

| |

(C) |

all fractional entitlements to the issued Consolidated

Ordinary Shares resulting from the Share Consolidation will not be issued to the shareholders of the Company and the Company be authorized

to round up any fractional shares resulting from the Share Consolidation such that each shareholder will be entitled to receive one Consolidated

Ordinary Share in lieu of any fractional share that would have resulted from the Share Consolidation. |

| |

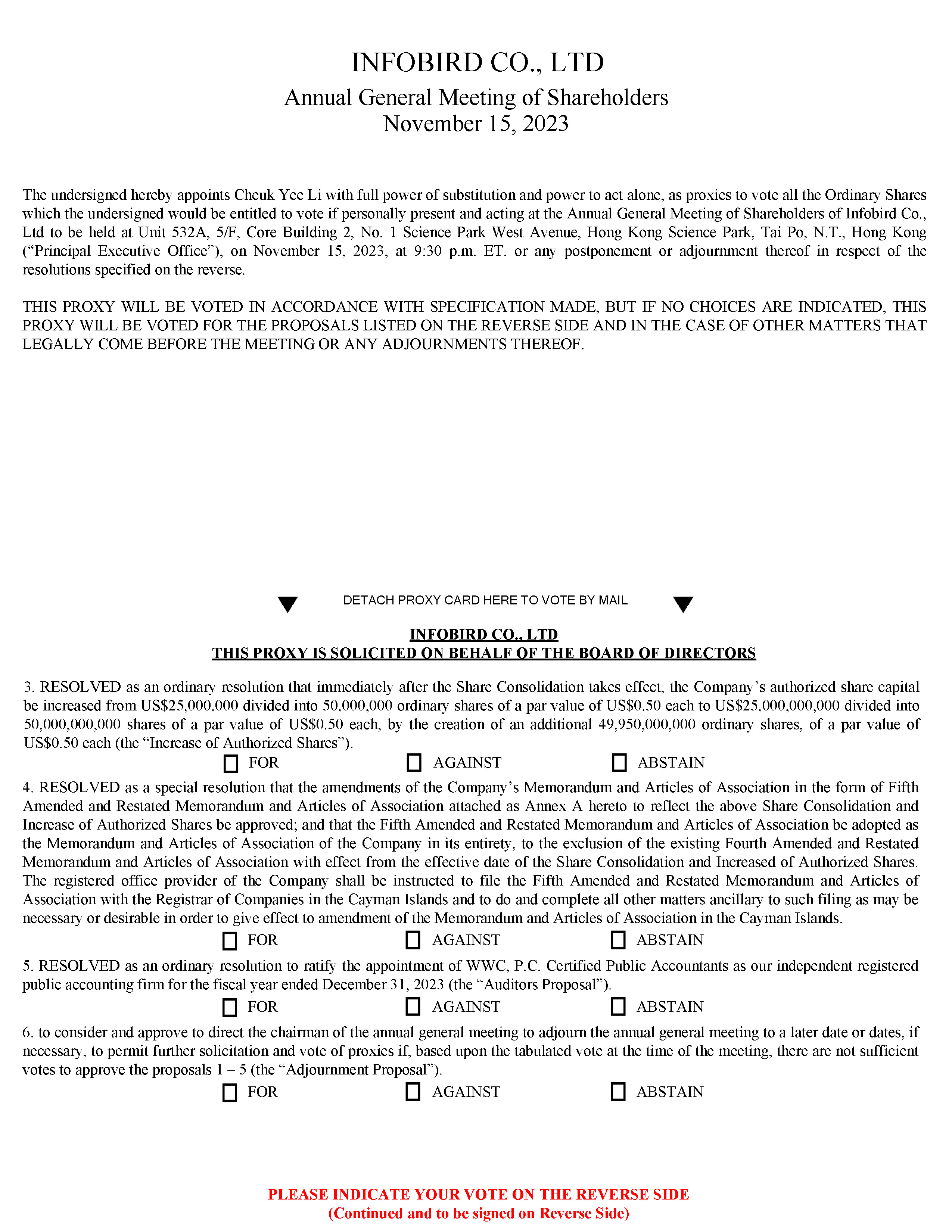

3. |

RESOLVED as an ordinary resolution that immediately after the Share Consolidation takes

effect, the Company’s authorized share capital be increased from US$25,000,000 divided into 50,000,000 ordinary shares of a par

value of US$0.50 each to US$25,000,000,000 divided into 50,000,000,000 shares of a par value of US$0.50 each, by the creation of an additional

49,950,000,000 ordinary shares, of a par value of US$0.50 each (the “Increase of Authorized Shares”). |

| |

|

|

| |

4. |

RESOLVED as a special resolution that

the amendments of the Company’s Memorandum and Articles of Association in the form of Fifth Amended and Restated Memorandum

and Articles of Association attached as Annex A hereto to reflect the above Share Consolidation and Increase of Authorized

Shares be approved; and that the Fifth Amended and Restated Memorandum and Articles of Association be adopted as the Memorandum

and Articles of Association of the Company in its entirety, to the exclusion of the existing Fourth Amended and Restated Memorandum

and Articles of Association with effect from the effective date of the Share Consolidation and Increased of Authorized Shares.

The registered office provider of the Company shall be instructed to file the Fifth Amended and Restated Memorandum and Articles

of Association with the Registrar of Companies in the Cayman Islands and to do and complete all other matters ancillary to

such filing as may be necessary or desirable in order to give effect to amendment of the Memorandum and Articles of Association

in the Cayman Islands. |

| |

5. |

RESOLVED as an ordinary resolution

to ratify the appointment of WWC, P.C. Certified Public Accountants as our independent registered public accounting firm for

the fiscal year ended December 31, 2023 (the “Auditors Proposal”). |

| |

|

|

| |

6. |

to consider and approve to direct the

chairman of the annual general meeting to adjourn the annual general meeting to a later date or dates, if necessary, to permit

further solicitation and vote of proxies if, based upon the tabulated vote at the time of the meeting, there are not sufficient

votes to approve the proposals 1 – 5 (the “Adjournment Proposal”). |

The

Board of Directors recommends a vote “FOR” each of the Proposals No. 1–6.

VOTING

PROCEDURE FOR HOLDERS OF ORDINARY SHARES

Holders

of Ordinary Shares whose shares are registered in their own names as at the Record Date may vote by attending the Annual General

Meeting in person or by completing, dating, signing and returning the enclosed form of proxy to the attention of Cheuk Yee Li,

Chairman of the Board of Directors, Infobird Co., Ltd, Unit 532A, 5/F, Core Building 2,

No. 1 Science Park West Avenue, Hong Kong Science Park, Tai Po, N.T., Hong Kong. The form of proxy must arrive no later

than the time for holding the Annual General Meeting or any adjournment thereof.

When

proxies are properly completed, dated, signed and returned by holders of Ordinary Shares, the Ordinary Shares they represent,

unless the proxies are revoked, will be voted at the Annual General Meeting in accordance with the instructions of the shareholder.

If no specific instructions are given by such holders, the Ordinary Shares will be voted “FOR” each proposal and in

the proxy holder’s discretion as to other matters that may properly come before the Annual General Meeting. Abstentions

and broker non-votes will not count as a vote cast at the Annual General Meeting and will have no effect on the outcome of the

vote on any proposal.

Please

refer to this proxy statement for information related to the proposed resolutions.

Any

proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering a written

notice of revocation or a duly executed proxy bearing a later date or, if you hold Ordinary Shares, by attending the meeting and

voting in person. A written notice of revocation must be delivered to the attention of Infobird Co., Ltd., if you hold our Ordinary

Shares.

ANNUAL

REPORT TO SHAREHOLDERS

Pursuant

to Nasdaq’s Marketplace Rules which permit companies to make available their annual report to shareholders on or through

the company’s website, the Company posts its annual reports on the Company’s website. The Company adopted this practice

to avoid the considerable expense associated with mailing physical copies of such report to record holders. You may obtain a copy

of our annual report to shareholders by visiting the “SEC Filings” heading under the “Financials” section

of the Company’s website at http://www.infobird.com/EN/investorRelations. If you want to receive a paper or email copy of

the Company’s annual report to shareholders, you must request one. There is no charge to you for requesting a copy. Please

make your request for a copy to the Investor Relations Contact of the Company, at changjx@infobird.com .

PROPOSAL

NO. 1

RE-ELECTION

OF CURRENT DIRECTORS

The

Board of Directors currently consists of five members. All five current directors named below will seek re-election at the Meeting.

The

Company’s corporate governance and nominating committee recommends, and the Board of Directors concurs, that the five current

directors be re-elected.

Each

director to be re-elected will hold office until the next annual general meeting of shareholders or until his or her appointment

is otherwise terminated in accordance with the articles of association of the Company.

DIRECTORS

FOR RE-ELECTION

Cheuk

Yee Li has served as a member of our board of directors since October 2022, our chief executive officer since November

2022, and the chairman of our board of directors since March 2023. Ms. Li has served as senior unit manager of Prudential Hong

Kong Limited, an insurance company, since September 2012. From November 2011 to September 2012, Ms. Li served as sales executive

of Hellmann Worldwide Logistics, a logistics services company. From April 2008 to November 2011, Ms. Li served as customer services

executive of Panalpina China Limited, a transportation services company. Ms. Li received a Bachelor’s Degree in Social Sciences

from Open Universities of Hong Kong.

Yimin

Wu has served as a member of our board of directors since March 2020, the chairman of our board of directors from

June 2020 to March 2023, and our chief executive officer from May 2020 to November 2022. Mr. Wu founded Beijing Infobird Software

Co., Ltd. (“Infobird Beijing”), in October 2001 and has served as the chairman of the board of directors and chief

executive officer of Infobird Beijing since such time. Mr. Wu is also a shareholder of Infobird Beijing. From August 1990 to March

1993, Mr. Wu served as software engineer of the Software Center of Tsinghua University and was sent to the United States to co-develop

HP_UX operating system at HP, Inc., an American multinational information technology company. From April 1993 to May 2000, Mr.

Wu served as general manager of Beijing Jing Zhou Computers, Co., Ltd., a company responsible for marketing and developing interactive

voice response systems. From July 2000 to October 2001, Mr. Wu served as general manager of Beijing Jing Zhou Rong Hua Internet

Technology, Co., Ltd., a company responsible for developing middleware for call centers. Mr. Wu received a Bachelor’s Degree

and a Master’s Degree in Computer Sciences from Tsinghua University.

Yiting

Song has served as a member of our board of directors since October 2022, and our chief financial officer since November

2022. Ms. Song has served as vice president of the investment management department of Gujia (Beijing) Technology Co., Ltd., a

technology company that focuses on investment banking and asset management, since July 2019. From November 2018 to March 2019,

Ms. Song served as financial manager of Beijing Zhenyanlishe Trading Ltd, an internet e-commerce company. From April 2016 to October

2018, Ms. Song served as financial director of Beijing Weige investment Ltd, a company that provides investment management and

consulting services. Ms. Song received a Bachelor’s Degree in Accounting from Tianjin University of Finance & Economics.

Qian

Qu has served as a member of our board of directors since October 2022. Ms. Qu has served as financial director of

Beijing Yunyingbao Technology Ltd, an internet e-commerce company, since March 2020. From April 2016 to March 2020, Ms. Qu served

as financial director of Jiangsu Seif Green Food Development Ltd, a trading company. From May 2015 to April 2016, Ms. Qu served

as senior audit manager of KCCW Accountancy Corp, a public accounting and consulting firm. Ms. Qu received a Bachelor’s

Degree in Accounting from Tsinghua University.

Shaoyang

E has served as a member of our board of directors since March 2023. Mr. E is the general manager of Shanghai Junmeng

Network Technology Co., Ltd. (“Junmeng”). Prior to joining Junmeng, he was the founder and chief executive officer

of Beijing DaoYi Network Technology Co., Ltd. from April 2017 to January 2022. Prior to that, he was the vice president at Baidu

Game from February 2015 to January 2017. Mr. E received his bachelor degree in Computational Science and Technology from North

East University and his EMBA from the Guanghua School of Management of Peking University.

Vote

Required and Board Recommendation

If

a quorum is present, the affirmative vote of a simple majority of the votes of the holders of Ordinary Shares present in person

or represented by proxy and entitled to vote at the Meeting will be required to elect all of the Director Nominees.

| |

1. |

“IT IS HEREBY RESOLVED,

as an ordinary resolution to re-elect the following persons as directors of the Company to hold office until the next annual general

meeting or until their respective successors are duly elected and qualified, subject to earlier death, resignation, or removal: |

| |

(A) |

Ms. Cheuk Yee Li be re-elected

as a director of the Company; |

| |

|

|

| |

(B) |

Mr. Yimin Wu be re-elected

as a director of the Company; |

| |

|

|

| |

(C) |

Mr. Yiting Song be re-elected

as a director of the Company; |

| |

|

|

| |

(D) |

Mr. Qian Qu be re-elected

as a director of the Company; and |

| |

|

|

| |

(E) |

Mr. Shaoyang E be re-elected

as a director of the Company.” |

THE

BOARD OF DIRECTORS RECOMMENDS

A

VOTE FOR

THE

RE-ELECTION OF EACH OF THE CURRENT DIRECTORS NAMED ABOVE

PROPOSAL

NO. 2

APPROVAL

OF THE SHARE CONSOLIDATION OF THE COMPANY’S ORDINARY SHARES

General

The

Board of Directors believes that it is in the best interest of the Company

and the shareholders, and is hereby soliciting shareholder approval, to effect a share consolidation of the Company’s Ordinary Shares

at a ratio of twenty shares into one such that the authorized share capital of the Company

be amended from US$25,000,000 divided into 1,000,000,000 ordinary shares of US$0.025 each to US$25,000,000 divided into 50,000,000 ordinary

shares of US$0.50 each, so that every shareholder holding 20 ordinary shares of US$0.025 each will hold one (1) ordinary share of US$0.50

upon the consolidation taking effect, such consolidated shares having the same rights and being subject to the same restrictions (save

as to nominal value) as the existing ordinary shares of US$0.025 each in the capital of the Company as set out in the Company’s

memorandum and articles of association (the “Share Consolidation”)with effect from the date of the passing of the resolutions

(the “Effective Date”).

The

Share Consolidation must be passed by ordinary resolution which requires the affirmative vote of a simple majority of the votes

cast at the Meeting by the shareholders present in person or represented by proxy and entitled to vote at the Meeting. If our

shareholders approve this proposal, our Board of Directors will have the authority to effect the Share Consolidation on the Effective

Date and arrange filing of the relevant Share Consolidation resolution with the Cayman Islands Registrar of Companies on the Effective

Date.

The

Share Consolidation will be implemented simultaneously for all Ordinary Shares. The Share Consolidation will affect all shareholders

uniformly and will have no effect on the proportionate holdings of any individual shareholder, with the exception of adjustments

related to the treatment of fractional shares (see below).

Purpose

of the Share Consolidation

The

Company’s Ordinary Shares are currently listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “IFBD.”

Among other requirements, the listing maintenance standards established by Nasdaq require the Ordinary Shares to have a minimum

closing bid price of at least $1.00 per share. Pursuant to the Nasdaq Marketplace Rule 5550(a)(2) (the ”Minimum Bid

Price Rule”), if the closing bid price of the Ordinary Shares is not equal to or greater than $1.00 for 30 consecutive business

days, Nasdaq will send a deficiency notice to the Company. Thereafter, if the Ordinary Shares do not close at a minimum bid price

of $1.00 or more for 10 consecutive business days within 180 calendar days of the deficiency notice, Nasdaq may determine to delist

the Ordinary Shares.

On

September 12, 2023, the Company received a written notification from the Nasdaq Stock Market LLC notifying the Company that it

was not in compliance with the Minimum Bid Price Rule, and the Company was provided 180 calendar days, or until March 11, 2024,

to regain compliance.

To

regain compliance with the Minimum Bid Price Rule by March 11, 2024, the Board of Directors determined that it was in the best

interest of the Company to solicit the approval of the shareholders to effect a share consolidation of the Company’s Ordinary

Shares. The Board of Directors believes that without receiving the shareholders’ approval and without the closing price

of the Ordinary Shares otherwise meeting the $1.00 minimum closing bid price requirement, the Company’s Ordinary Shares

will be delisted from Nasdaq. In the event the Company does not regain compliance by March 11, 2024, the Company may be eligible

for an additional 180 calendar day grace period. To qualify, the Company will be required to meet the continued listing requirement

for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception

of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second

compliance period, including by effecting a reverse stock split, if necessary. If the Company chooses to implement a reverse stock

split, it must complete the split no later than ten (10) business days prior to March 11, 2024, or the expiration of the second

compliance period if granted.

In

the event the Ordinary Shares were no longer eligible for continued listing on Nasdaq, the Company could be forced to seek to

be traded on the OTC Bulletin Board or in the “pink sheets.” These alternative markets are generally considered to

be less efficient than, and not as broad as, Nasdaq, and therefore less desirable. Accordingly, the Board of Directors believes

delisting of the Ordinary Shares would likely have a negative impact on the liquidity and market price of the Ordinary Shares

and may increase the spread between the “bid” and “ask” prices quoted by market makers.

The

Board of Directors has considered the potential harm to the Company of a delisting from Nasdaq and believes that delisting could,

among other things, adversely affect (i) the trading price of the Ordinary Shares, and (ii) the liquidity and marketability of

the Ordinary Shares. This could reduce the ability of holders of the Ordinary Shares to purchase or sell Ordinary Shares as quickly

and as inexpensively as they have done historically. Delisting could also adversely affect the Company’s relationships

with customers who may perceive the Company’s business less favorably, which would have a detrimental effect on the Company’s

relationships with these entities.

Furthermore,

if the Ordinary Shares were no longer listed on Nasdaq, it may reduce the Company’s access to capital and cause the Company

to have less flexibility in responding to its capital requirements. Certain institutional investors may also be less interested

or prohibited from investing in the Ordinary Shares, which may cause the market price of the Ordinary Shares to decline.

Registration

and Trading of our Ordinary Shares

The

Share Consolidation will not affect the registration of our Ordinary Shares or our obligation to publicly file financial and other

information with the U.S. Securities and Exchange Commission. When the Share Consolidation is implemented, our Ordinary Shares

will begin trading on a post-split basis on the Effective Date that we announce by press release. In connection with the Share

Consolidation, the CUSIP number of our Ordinary Shares (which is an identifier used by participants in the securities industry

to identify our Ordinary Shares) will change.

Fractional

Shares

No

fractional Ordinary Shares will be issued to any shareholders in connection with the Share Consolidation. Any fractional shares

resulting from the Share Consolidation shall be rounded up such that each shareholder will be entitled to receive one Ordinary

Share in lieu of the fractional share that would have resulted from the Share Consolidation.

Authorized

Shares

Upon

the Share Consolidation becoming effective, our authorized share capital

of the Company shall be decreased from 1,000,000,000 ordinary shares of US$0.025 each to 50,000,000 ordinary shares of US$0.50 each.

Street

Name Holders of Ordinary Shares

The

Company intends for the Share Consolidation to treat shareholders holding Ordinary Shares in street name through a nominee (such

as a bank or broker) in the same manner as shareholders whose shares are registered in their names. Nominees will be instructed

to effect the Share Consolidation for their beneficial holders. However, nominees may have different procedures. Accordingly,

shareholders holding Ordinary Shares in street name should contact their nominees.

Share

Certificates

Mandatory

surrender of certificates by our shareholders is not required. The Company’s transfer agent will adjust the record books

of the Company to reflect the Share Consolidation as of the Effective Date. New certificates will not be mailed to shareholders.

Resolutions

The

Board of Directors proposes to solicit shareholder approval to effect Share

Consolidation of the Company’s Ordinary Shares at a ratio of twenty shares into one share in the form of shareholder resolutions.

The resolutions be put to the shareholders to consider and to vote upon at the Meeting in relation to amending the authorized share capital

of the Company are:

Vote

Required and Board Recommendation

If

a quorum is present, the affirmative vote of a majority of the votes of the holders of Ordinary Shares present in person or represented

by proxy and entitled to vote at the Meeting will be required to approve the Share Consolidation.

| |

1. |

“IT IS HEREBY RESOLVED,

as an ordinary resolution, that: |

| |

(A) |

every twenty (20) issued and unissued existing ordinary shares of US$0.025 par value each of the Company be consolidated into one (1) ordinary share of US$0.50 par value each (the “Consolidated Ordinary Shares”), with such Consolidated Ordinary Shares having the same rights and being subject to the same restrictions (save as to nominal value) as the existing ordinary shares of US$0.025 each of the Company as set out in the Company’s memorandum and articles of association (the “Share Consolidation”) with immediate effect(the “Effective Date”); |

| |

|

|

| |

(B) |

on the Effective Date, as a result of the Share Consolidation, the authorized share capital of the Company be amended from US$25,000,000 divided into 1,000,000,000 ordinary shares of US$0.025 each to US$25,000,000 divided into 50,000,000 ordinary shares of US$0.50 each; and |

| |

|

|

| |

(C) |

all fractional entitlements to the issued Consolidated Ordinary Shares resulting from the Share Consolidation will not be issued to the shareholders of the Company and the Company be authorized to round up any fractional shares resulting from the Share Consolidation such that each shareholder will be entitled to receive one Consolidated Ordinary Share in lieu of any fractional share that would have resulted from the Share Consolidation. |

THE

BOARD OF DIRECTORS RECOMMEND

A

VOTE FOR

APPROVAL

OF

THE

SHARE CONSOLIDATION OF THE COMPANY’S ORDINARY SHARES

PROPOSAL

NO. 3

THE

INCREASE OF THE COMPANY’S AUTHORIZED SHARES

General

The

Board of Directors believes that it is in the best interest of the Company

and the shareholders, and is hereby soliciting shareholder approval, to increase of the Company’s authorized share capital from

US$25,000,000 divided into 50,000,000 shares of a par value of US$0.50 each to US$25,000,000,000 divided into 50,000,000,000 shares of

a par value of US$0.50 each, by the creation of an additional 49,950,000,000 Ordinary Shares of a par value of US$0.50 each (the “Increase

of Authorized Shares”).

The

Increase of Authorized Shares must be passed by an ordinary resolution which requires the affirmative vote of a simple majority

of the votes cast at the Annual General Meeting by the shareholders present in person or represented by proxy and entitled to

vote on such proposals, either in person, by proxy or by authorized representative.

PROPOSAL

NO. 4

APPROVAL

OF THE FIFTH AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION

To

consider and approve by a special resolution the amendments of the Company’s Memorandum and Articles of Association in the

form of Fifth Amended and Restated Memorandum and Articles of Association attached as Annex A hereto to reflect the above Share

Consolidation; and that the Fifth Amended and Restated Memorandum and Articles of Association be adopted as the Memorandum and

Articles of Association of the Company, to the exclusion of the existing Memorandum and Articles of Association with effect from

the effective date of the Share Consolidation and the Increase of Authorised Shares. The registered office provider of the Company

shall be instructed to file the Fifth Amended and Restated Memorandum and Articles of Association with the Registrar of Companies

in the Cayman Islands and to do and complete all other matters ancillary to such filing as may be necessary or desirable in order

to give effect to amendment of the Memorandum and Articles of Association in the Cayman Islands. The resolutions put to the shareholders

to consider and to vote upon at the Annual General Meeting in relation to amending the Company’s fourth amended and restated

memorandum of association are:

IT

IS HEREBY RESOLVED, as a special resolution, that:

the

amendments of the Company’s Memorandum and Articles of Association in the form of Fifth Amended and Restated Memorandum

and Articles of Association attached as Annex A hereto to reflect the above Share Consolidation and Increase of Authorized Shares

be approved; and that the Fifth Amended and Restated Memorandum and Articles of Association be adopted as the Memorandum and Articles

of Association of the Company in its entirety, to the exclusion of the existing Fourth Amended and Restated Memorandum and Articles

of Association, with effect from the effective date of the Share Consolidation and Increase of Authorized Shares. The registered

office provider of the Company shall be instructed to file the Fifth Amended and Restated Memorandum and Articles of Association

with the Registrar of Companies in the Cayman Islands and to do and complete all other matters ancillary to such filing as may

be necessary or desirable in order to give effect to amendment of the Memorandum and Articles of Association in the Cayman Islands.

Vote

Required and Board Recommendation

If

a quorum is present, the affirmative vote of a majority of not less than two-thirds the votes of the holders of Ordinary Shares

present in person or represented by proxy and entitled to vote at the Meeting will be required to approve the amendment to the

fourth amended and restated memorandum of association.

THE

BOARD OF DIRECTORS RECOMMEND

A

VOTE FOR

APPROVAL

OF

THE

FIFTH AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION

PROPOSAL

5

RATIFICATION

OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our

Audit Committee has selected WWC, P.C. Certified Public Accountants (“WWC”) as our independent registered public

accounting firm for the fiscal year ended December 31, 2023, and has further directed that we submit the selection of the independent

registered accounting firm for ratification by our shareholders at the 2023 Annual Meeting. WWC has audited the Company’s

financial statements since 2022. Representatives of WWC will not be presented at the 2023 Annual Meeting.

The

selection of our independent registered public accounting firm is not required to be submitted for shareholder approval. Nonetheless,

the Board is seeking ratification of its selection of WWC as a matter of further involving our shareholders in our corporate affairs.

If our shareholders do not ratify this selection, the Board will reconsider its selection of WWC and will either continue to retain

the firm or appoint a new independent registered public accounting firm. Even if the selection is ratified, the Board may, in

its sole discretion, determine to appoint a different independent registered public accounting firm at any time during the year

if it determines that such a change would be in our and our shareholders’ best interests.

The

Audit Committee reviews and must pre-approve all audit and non-audit services performed by our independent registered public accounting

firm, as well as the fees charged by it for such services. In its review of non-audit service fees, the Audit Committee considers,

among other things, the possible impact of the performance of such services on the accounting firm’s independence.

Independent

Registered Public Accounting Firm’s Fees

The

following table sets forth the aggregate fees billed or expected to be billed for audit and other services provided by WWC for

the fiscal years ended December 31, 2022. WWC has served as our principal accounting firm since 2023.

| | |

Fiscal year Ended

December 31, 2022 |

| Audit fees | |

$ | 12,000 | |

| Audit-Related Fees | |

| — | |

| Tax fees | |

| — | |

| All other fees | |

| — | |

| Total | |

$ | 12,000 | |

Audit

Fees include primarily professional services rendered for the audits of the consolidated financial statements and internal controls

over financial reporting, the review of documents filed with the SEC, consents, and financial accounting and reporting consultations.

Audit-Related

Fees include reviews of the interim financial statements contained in the Company’s Form 6-K.

Tax

Fees include professional service fees for tax compliance, tax planning, and tax advice. Tax compliance involves preparation of

original and amended tax returns and claims for refund. Tax planning and tax advice encompass a diverse range of services, including

assistance with tax audits and appeals, tax advice related to employee benefit plans, and requests for rulings or technical advice

from taxing authorities.

All

Other Fees include professional fees associated with the review and consent of SEC filings related to equity issuance for certain

officers and former employees.

Pre-Approval

Policies and Procedures

Our

Audit Committee has adopted a procedure for pre-approval of all fees charged by our independent auditors. Under the procedure,

the Audit Committee pre-approves all auditing services and the terms of non-audit services provided by our independent registered

public accounting firm, but only to the extent that the non-audit services are not prohibited under applicable law and the Audit

Committee determines that the non-audit services do not impair the independence of the independent registered public accounting

firm. Other fees are subject to pre-approval by the Audit Committee, or, in the period between meetings, by a designated member

of the Board or Audit Committee. Any such approval by the designated member is disclosed to the entire Board at the next meeting.

All fees that were incurred in fiscal year 2022 were pre-approved by the Audit Committee.

Vote

Required and Board of Directors’ Recommendation

If

a quorum is present, the affirmative vote of a simple majority of the votes of the holders of Ordinary Shares present in person

or represented by proxy and entitled to vote at the Meeting will be required to ratify

the appointment of WWC.

THE

BOARD OF DIRECTORS RECOMMENDS

A

VOTE FOR

THE

RATIFICATION OF SELECTION OF WWC, P.C. CERTIFIED PUBLIC ACCOUNTANTS AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE YEAR ENDED DECEMBER 31, 2023

PROPOSAL

6

THE

ADJOURNMENT PROPOSAL

The

adjournment proposal, if approved, will request the chairman of the Annual General Meeting (who has agreed to act accordingly)

to adjourn the Annual General Meeting to a later date or dates to permit further solicitation of proxies. The adjournment proposal

will only be presented to our shareholders in the event, based on the tabulated votes, there are not sufficient votes at the time

of the Annual General Meeting to approve the proposals in this proxy statement. If the adjournment proposal is not approved by

our shareholders, the chairman of the meeting has the power to adjourn the Annual General Meeting to a later date in the event,

based on the tabulated votes, there are not sufficient votes at the time of the Annual General Meeting to approve the proposals.

Vote

Required and Board of Directors’ Recommendation

If

a majority of the votes of the shares which were present in person or by proxy and voting on the matter at the Annual General

Meeting vote for the adjournment proposal, the chairman of the Annual General Meeting will exercise his or her power to adjourn

the meeting as set out above.

THE

BOARD OF DIRECTORS RECOMMENDS

A

VOTE FOR

THE

ADJOURNMENT PROPOSAL

OTHER

MATTERS

The

Board of Directors is not aware of any other matters to be submitted to the Meeting. If any other matters properly come before

the Meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as the Board

of Directors may recommend.

| |

By order of the Board of Directors |

| |

|

| October

30, 2023 |

/s/ Cheuk Yee Li |

| |

Cheuk Yee Li |

| |

Chief Executive Officer |

EXHIBIT 99.3

Infobird (NASDAQ:IFBD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Infobird (NASDAQ:IFBD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024