FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 under

the Securities Exchange Act of 1934

For the month of May 2024

ICON plc

(Translation of registrant's name into English)

333-08704

(Commission file number)

South County Business Park, Leopardstown, Dublin 18, Ireland

(Address of principal executive offices)

| | | | | | | | |

| Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. |

| | Form 20-F __X___ | Form 40-F ______ |

| |

| Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): |

| | Yes______ | No___X___ |

| |

| Indicate by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): |

| | Yes______ | No___X___ |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | | ICON plc |

| | | |

| | | |

| | | |

| | | /s/ Brendan Brennan |

| Date: May 30, 2024 | | Brendan Brennan Chief Financial Officer |

ICON Hosts Investor Day and Updates Full Year 2024 Financial Guidance

Highlights

•Accelerating mid-term financial outlook supported by positive market environment and strengthened, scaled offering.

•Continued focus on innovation to drive improved outcomes and efficiency in trial delivery.

•Updated 2024 financial outlook to incorporate positive impact of debt refinancing.

•2024 adjusted earnings per share* guidance is now expected to be in the range of $14.75 - $15.25, an increase of 15.3% to 19.2% over 2023.

Dublin, Ireland, May 30, 2024 – ICON plc, (NASDAQ: ICLR), a world-leading healthcare intelligence and clinical research organization, will host its 2024 Investor Day today in New York City. The event will feature presentations from ICON’s executive team and provide further details on the strategic initiatives that will drive the near and long-term outlook for the company. The event will begin at 10 am EST and can be joined via webcast here.

Dr. Steve Cutler, ICON’s CEO, commented, “We are excited to provide an update on ICON’s strategy and mid-term financial outlook, as our market leading offering continues to evolve to best meet the needs of our customers in a positive demand environment. As the need for innovation, efficiency and delivery continues to drive success in our industry, ICON is well positioned to outperform the market in the mid and long-term.”

Financial Outlook

ICON is updating its full-year 2024 guidance to incorporate its recent debt refinancing, including the impact of the successful $2 billion investment grade bond offering closed in early May, as well as the repricing in March of the existing Term Loan B facility. This is expected to result in a net interest expense of $200 - $210 million for the full year 2024, a reduction from the previous range of $200 - $230 million for the full year.

Full-year 2024 revenue guidance is reaffirmed in the range of $8,480 - $8,720 million, representing a year over year increase of 4.4% to 7.4%. Full-year 2024 adjusted earnings per share* guidance is now expected to be in the range of $14.75 - $15.25, an increase from the previous range of $14.65 - $15.15. The updated adjusted earnings per share* range represents a year over year increase of 15.3% to 19.2% over full year 2023.

About ICON plc

ICON plc is a world-leading healthcare intelligence and clinical research organization. From molecule to medicine, we advance clinical research providing outsourced services to pharmaceutical, biotechnology, medical device and government and public health organizations. We develop new innovations, drive emerging therapies forward and improve patient lives. With headquarters in Dublin, Ireland, ICON employed approximately 41,150 employees in 102 locations in 54 countries as at March 31, 2024. For further information about ICON, visit: www.iconplc.com.

Other information

This press release contains forward-looking statements, including statements about our financial guidance. These statements are based on management's current expectations and information currently available, including current economic and industry conditions. These statements are not guarantees of future performance or actual results, and actual results, developments and business decisions may differ from those stated in this press release. The forward-looking statements are subject to future events, risks, uncertainties and other factors that could cause actual results to differ materially from those projected in the statements, including, but not limited

to, the ability to enter into new contracts, maintain client relationships, manage the opening of new offices and offering of new services, the integration of new business mergers and acquisitions, as well as other economic and global market conditions and other risks and uncertainties detailed from time to time in SEC reports filed by ICON, all of which are difficult to predict and some of which are beyond our control. For these reasons, you should not place undue reliance on these forward-looking statements when making investment decisions. The word "expected" and variations of such words and similar expressions are intended to identify forward-looking statements. Forward-looking statements are only as of the date they are made and we do not undertake any obligation to update publicly any forward-looking statement, either as a result of new information, future events or otherwise. More information about the risks and uncertainties relating to these forward-looking statements may be found in SEC reports filed by ICON, including its Form 20-F, F-1, F-4, S-8, F-3 and certain other reports, which are available on the SEC's website at http://www.sec.gov.

In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), this press release contains certain non-GAAP financial measures, including adjusted earnings per share*.

*Adjusted earnings per share excludes amortization, stock compensation, foreign exchange gains and losses, and restructuring and transaction-related / integration-related adjustments (including transaction related financing costs). While non-GAAP financial measures are not superior to or a substitute for the comparable GAAP measures, ICON believes certain non-GAAP information is useful to investors for historical comparison purposes.

The full-year 2024 guidance adjusted earnings per share* measures are provided on a non-GAAP basis because the company is unable to predict with a reasonable degree of certainty certain items contained in the GAAP measures without unreasonable efforts. For the same reasons, the company is unable to address the probable significance of the unavailable information.

Source: ICON plc

Contact: Investor Relations +1 888 381 7923 or

Brendan Brennan Chief Financial Officer +353 1 291 2000

Kate Haven Vice President Investor Relations +1 888 381 7923

All at ICON

ICON/ICLR-F

ICON (NASDAQ:ICLR)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

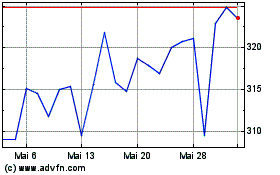

ICON (NASDAQ:ICLR)

Historical Stock Chart

Von Feb 2024 bis Feb 2025