Fifth Third Launches Small Business Catalyst Fund in Partnership with Community Reinvestment Fund, USA

30 Oktober 2024 - 7:41PM

Business Wire

$7.85M in investments will help build a more

equitable small business ecosystem

Fifth Third Bank has partnered with Community Reinvestment Fund,

USA (CRF) to launch the Small Business Catalyst Fund, a $7.85M

investment that will empower small businesses across Fifth Third’s

11-state footprint to grow and create jobs in their communities and

build a more equitable small business ecosystem.

"Small businesses form the foundation of our communities – and

when they succeed, we all succeed,” said Kala Gibson, chief

corporate responsibility officer for Fifth Third. “We are proud to

launch this new fund to help expand access to capital for more

small businesses across the communities we serve.”

A partnership between CRF and Fifth Third Bank, the Small

Business Catalyst Fund connects small business owners to potential

capital options offered by trusted Community Development Financial

Institutions (CDFIs). The program will utilize an innovative

funding model that combines grants, micro loans and small business

loans.

Guided by the local communities they serve, CDFIs are

mission-driven community lenders and resource providers that often

work with entrepreneurs who have historically faced roadblocks

along their journey to secure capital and other resources.

“Despite the access to capital barriers faced by small

businesses, they contribute to the success and vibrancy of

communities across the country,” said Alexis Dishman, SVP &

Small Business Lending Officer for CRF. “In collaboration with

Fifth Third Bank and our CDFI partners, CRF aims to improve access

to capital and accelerate small business momentum through the

creation of this innovative fund.”

The Small Business Catalyst Fund will provide an alternative to

help small and micro business owners obtain working capital when

traditional lending is not an option. The fund will provide grants,

micro loans and small business loans ranging from $5,000 to

$750,000 to small businesses at various stages of maturity.

Funders include the Fifth Third Foundation, the Fifth Third Bank

Community Development Corporation, and Rockefeller Philanthropy

Advisors. CRF will administer grants and small business loans and

work alongside two local CDFI partners who focus on microloans and

technical assistance: Ohio-based Economic & Community

Development Institute (ECDI), and New York-based Ascendus.

Fifth Third has a proven track record of success in community

development through its neighborhood program, which creates and

implements innovative place-based strategies to effect positive

change in nine historically disinvested neighborhoods across the

Bank’s 11-state footprint.

The program is pioneering a new way to do community development

by partnering with local organizations to build ecosystems that

drive real change through both financial and social investments.

This collective ecosystem approach is focused on identifying

solutions to key challenges in partnership with the community, with

the goal of creating lasting, transformative change. More than

$13.5 million in small business lending has been delivered by Fifth

Third through the neighborhood program since 2021.

For more information about the Small Business Catalyst Fund or

to apply, please visit www.SmallBusinessCatalystFund.com.

About the Fifth Third Foundation

Established in 1948, the Fifth Third Foundation was one of the

first charitable foundations created by a financial institution.

The Fifth Third Foundation supports worthy causes in the areas of

health and human services, education, community development and the

arts in the states where Fifth Third Bank operates.

About Fifth Third

Fifth Third is a bank that’s as long on innovation as it is on

history. Since 1858, we’ve been helping individuals, families,

businesses and communities grow through smart financial services

that improve lives. Our list of firsts is extensive, and it’s one

that continues to expand as we explore the intersection of

tech-driven innovation, dedicated people and focused community

impact. Fifth Third is one of the few U.S.-based banks to have been

named among Ethisphere’s World’s Most Ethical Companies® for

several years. With a commitment to taking care of our customers,

employees, communities and shareholders, our goal is not only to be

the nation’s highest performing regional bank, but to be the bank

people most value and trust.

Fifth Third Bank, National Association is a federally chartered

institution. Fifth Third Bancorp is the indirect parent company of

Fifth Third Bank and its common stock is traded on the NASDAQ®

Global Select Market under the symbol "FITB." Investor information

and press releases can be viewed at www.53.com. Deposit and credit

products provided by Fifth Third Bank, National Association. Member

FDIC.

About Community Reinvestment Fund, USA

Founded in 1988, Community Reinvestment Fund, USA (CRF) is a

national non-profit organization with a mission to improve lives

and strengthen communities through innovative financial solutions.

A leading Community Development Financial Institution (CDFI), CRF

supports mission-driven organizations, increases economic mobility,

and builds strong local economies through the development of

solutions aimed at creating an equitable financial system. CRF has

injected more than $3.6 billion to stimulate job creation and

economic development and support community facilities. To learn

more about CRF, visit www.crfusa.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030245753/en/

Amanda Nageleisen (Media Relations) amanda.nageleisen@53.com

Matt Curoe (Investor Relations) matt.curoe@53.com |

513-534-2345

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

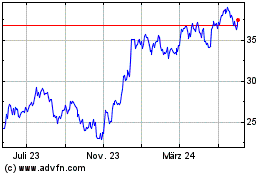

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025