Follow - on Offering Investor Presentation December 2024

Forward - Looking Statements 2 This presentation contains a number of forward - looking statements within the meaning of the federal securities laws . These statements may be identified by use of words such as “annualized,” “anticipate,” “anticipated,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “seek,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” “opportunity,” “opportunities,” “targeted,” “goal,” “path,” and similar terms and phrases, including references to assumptions . Examples of forward - looking statements include, but are not limited to, the proposed offering of our common stock, which is opportunistic and subject to market conditions, the expected use of proceeds from this offering (including any repositioning of the Company’s securities portfolio, growth initiatives, and other actions described herein), possible or assumed estimates and expectations with respect to the Company’s financial condition and market position, expected or anticipated revenue, profitability, and results of operations . In addition, although this presentation describes the current estimated impact of our potential use of a portion of the proceeds from this offering (including in connection with our future balance sheet optimization efforts, potential securities portfolio repositioning, and other actions described herein), any such actions will depend on a number of factors, including market conditions and business developments . We are not required to apply any portion of the net proceeds of this offering for any particular purpose, and our management will have broad discretion in allocating the net proceeds of the offering . Accordingly, our management may not apply the net proceeds of this offering as described herein, and our future financial condition and results of operations may differ significantly from the prospective estimates presented herein . Forward - looking statements are based upon various assumptions and analyses made by Flushing Financial Corporation (together with its direct and indirect subsidiaries, the “Company”), in light of management’s experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes appropriate under the circumstances . These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors (many of which are beyond the Company’s control) that could cause actual conditions or results to differ materially from those expressed or implied by such forward - looking statements . Accordingly, you should not place undue reliance on such statements . These factors include, without limitation, the following : ▪ changes in market interest rates may significantly impact our financial condition and results of operations ; ▪ our lending activities involve risks that may be exacerbated depending on the mix of loan types ; ▪ failure to effectively manage our liquidity could significantly impact our financial condition and results of operations ; ▪ our ability to obtain brokered deposits as an additional funding source could be limited ; ▪ the markets in which we operate are highly competitive ; ▪ our results of operations may be adversely affected by changes in national and/or local economic conditions ; ▪ changes in laws and regulations could adversely affect our business ; ▪ current conditions in, and regulation of, the banking industry may have a material adverse effect on our financial condition and results of operations ; ▪ a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyber - attacks, could disrupt our business, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses ; ▪ changes in cybersecurity or privacy regulations may increase our compliance costs, limit our ability to gain insight from data and lead to increased regulatory scrutiny ; ▪ we may experience increased delays in foreclosure proceedings ; ▪ our inability to hire or retain key personnel could adversely affect our business ; ▪ we are not required to pay dividends on our common stock ; ▪ our financial results may be adversely impacted by global climate changes ; ▪ our financial results may be adversely impacted by environmental, social and governance requirements ; and ▪ the risks referred to in the section entitled “Risk Factors” in our Annual Report on Form 10 - K for the year ended December 31 , 2023 , as updated by our Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K . Forward - looking statements speak only as of the date on which such statements are made . There is no assurance that future results, levels of activity, performance or goals will be achieved . Except as required by law, the Company has no obligation to update any forward - looking statements to reflect events or circumstances after the date of this document .

Additional Information 3 No Offer or Solicitation This presentation is neither an offer to sell nor a solicitation of an offer to purchase any securities of the Company . There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities of any such jurisdiction . Any offer to sell or solicitation of an offer to purchase securities of the Company will be made only pursuant to a prospectus supplement and prospectus filed with the U . S . Securities and Exchange Commission (“SEC”) . The Company has filed a registration statement (including a prospectus) (File No . 333 - 283312 ) and a preliminary prospectus supplement with the SEC for the offering to which this presentation relates . Before making an investment decision, you should read the prospectus in that registration statement and the preliminary prospectus supplement and the other documents that the Company has filed with the SEC for additional information about the Company and the offering . You may obtain these documents for free by visiting the SEC's website at www . sec . gov . Alternatively, the Company or any underwriter or dealer participating in the offering can arrange to send you copies of the prospectus and preliminary prospectus supplement if you request by contacting Keefe, Bruyette & Woods, Inc . at kbwsyndicatedesk@kbw . com (toll - free at ( 800 ) 966 - 1559 ), Piper Sandler & Co . at prospectus@psc . com (toll - free at ( 800 ) 747 - 3924 ), or Raymond James & Associates, Inc . at prospectus@raymondjames . com (toll free at ( 800 ) 248 - 8863 ) . These securities are not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other governmental agency or public or private insurer . Neither the SEC nor any other regulator has approved or disproved of the securities of the Company or passed on the adequacy or accuracy of this presentation . Any representation to the contrary is a criminal offense . Use of Non - GAAP Financial Measures This presentation contains non - GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles (“GAAP”) . The Company uses such non - GAAP financial measures to provide meaningful supplemental information regarding its performance . The Company believes these non - GAAP measures and ratios are beneficial in assessing our operating results and related trends, and when planning and forecasting future periods . These non - GAAP measures should be considered in addition to, and not as a substitute for or preferable to, financial results determined in accordance with GAAP . The non - GAAP financial measures the Company uses may differ from the non - GAAP financial measures other financial institutions use . Reconciliations of non - GAAP financial measures used in this presentation to the most directly comparable GAAP financial measure are included in the Appendix to this presentation Third Party Sources Certain information contained in this presentation and oral statements made during this presentation relate to or are based on publications and data obtained from third party sources . While the Company believes these sources to be reliable as of the date of this presentation, the Company has not independently verified such information, any statements based on such third party sources involve risks and uncertainties and are subject to change based on various factors, including those set forth in the section entitled "Risk Factors" in our Annual Report on Form 10 - K for the year ended December 31 , 2023 , as updated by our Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K as filed with the SEC .

4 Offering Summary Issuer Flushing Financial Corporation Exchange / Ticker NASDAQ / FFIC Base Offering Size Approximately $70 million (100% Primary) Over - allotment Option 15% of base deal (100% Primary) Use of Proceeds We intend to use the net proceeds of this offering for general corporate purposes, including investing a portion of the net proceeds into the Bank to support the Bank’s capital ratios in connection with the potential repositioning of a substantial portion of our available - for - sale securities portfolio as well as a potential sale of certain of our commercial real estate loans Lock - up Period 90 days for the Company, Directors & Officers Bookrunning Managers Keefe, Bruyette & Woods, Inc., a Stifel Company Piper Sandler & Co. Raymond James & Associates, Inc. Expected Pricing Date Week of December 9 th

5 Branch Footprint $9.3B Assets $6.8B Net Loans $7.6B Deposits 1 $667M Total Equity Company Overview Flushing Financial Corporation (NASDAQ: FFIC) Uniondale, NY Headquarters: 1929 Founded: 1995 IPO: 28 Total Branches: $17.19 Stock Price 2 $ 500 M Market Cap 2 0.77x Price / TBV 2 5 .1% Dividend Yield 2 Note: Financial data for the quarter ended 9/30/2024 1 Includes mortgagors’ escrow deposits 2 Calculated using 12/6/2024 closing price of $17.19

6 Today’s Presenters ▪ Joined the Company in 2001 as Executive Vice President and Chief Operating Officer of the Company and currently serves as President and Chief Executive Officer of the Company and the Bank since July 2005 ▪ Prior to joining the Company, held a variety of positions within the Banking industry, including Executive Vice President of the New York Metro Division of Fleet Bank and Vice President New York Investment Sales at Citibank ▪ Former Chairman of the Board and current director of the New York Bankers Association ▪ Former Chairman of the Board of the Federal Home Loan Bank of New York John R. Buran President, Chief Executive Officer and Director ▪ Joined the Company in August 2015 as Executive Vice President/Chief Accounting Officer and currently serves as Senior Executive Vice President, Treasurer and Chief Financial Officer of the Company since February 2016 ▪ Former Executive Vice President/Chief Risk Officer, from June 2012 to January 2014, at Hudson Valley Bank ▪ Previously served as Audit Partner with Grant Thornton, LLP in the Financial Service Practice Susan K. Cullen Senior Executive Vice President, Treasurer and Chief Financial Officer

7 Highly Seasoned and Experienced Management Team All Senior Executives Have Over 25 Years of Experience in Banking Aligned Investor Interest with Insider Ownership of Approximately 6.25% ² John Buran President and CEO FFIC: 2 4 years Industry: 4 7 years Allen Brewer SEVP, Chief Information Officer 1 6 years 50 years 1 Previously President and COO of Empire Bancorp and Empire National Bank from its inception in February 2008 until the sale to Flushing in October 2020 2 Directors and executive officers as of 9/30/2024 Maria Grasso SEVP, COO, Corporate Secretary 1 8 years 3 8 years Susan Cullen SEVP, CFO, Treasurer 9 years 3 4 years Francis Korzekwinski SEVP, Chief of Real Estate 31 years 3 5 years Michael Bingold SEVP, Chief Retail and Client Dev elopment Officer 11 years 41 years Tom Buonaiuto SEVP, Chief of Staff, Deposit Channel Executiv e 1 7 years 1 32 years Vincent Giovinco EVP, Commercial Real Estate Lending 4 years 2 6 years Jeoung Jin EVP, Residential and Mix ed Use 2 6 years 31 years Theresa Kelly EVP, Business Banking 1 8 years 40 years Patricia Mezeul EVP, Director of Gov ernment Banking 1 7 years 4 4 years

8 Investment Highlights Long history of exceptional asset quality Established and growing Asian Banking niche Compelling valuation Leading community bank in the greater New York City markets Opportunity to accelerate performance improvement through a potential balance sheet restructuring Improving profitability metrics as a result of balance sheet repricing dynamics

9 Highly Attractive Market Source: S&P Capital IQ Pro; Data as of 6/30/2024 1 Greater Long Island defined as Nassau, Queens, Suffolk, and Kings counties 2 Median owner occupied home value is weighted by population 3 Median household income is weighted by FFIC’s deposits in each county in Greater Long Island 4 Includes community banks with less than $10B in assets in the Nassau, Queens, Suffolk, and Kings counties RankInstitution Number of Branches Deposits in Market ($M) 1 Flushing Financial Corp. 25 $6,527 2 Ridgewood Savings Bank 27 4,787 3 Hanover Bancorp Inc. 6 1,743 4 Esquire Financial Holdings Inc 2 1,498 5 Maspeth Federal Savings & Loan Association 8 1,412 6 Alma Bank 8 903 7 First Central Savings Bank 10 874 8 Preferred Bank 1 719 9 Community Federal Savings Bank 1 695 10 RBB Bancorp 6 530 93% of FFIC’s deposits are in the Greater Long Island 1 Market Greater Long Island 1 Community Bank Rank 4 RankInstitution Number of Branches Deposits in Market ($M) Deposit Market Share (%) 1 JPMorgan Chase & Co. 257 $91,161 29.5 2 Citigroup Inc. 106 35,597 11.5 3 The Toronto-Dominion Bank 123 27,981 9.1 4 Bank of America Corporation 113 21,310 6.9 5 Webster Financial Corp. 51 20,768 6.7 6 Capital One Financial Corp. 58 16,526 5.4 7 Flagstar Financial Inc. 107 16,049 5.2 8 Dime Community Bancshares Inc. 57 10,532 3.4 9 Apple Financial Holdings Inc. 46 6,981 2.3 10 Flushing Financial Corp. 25 6,527 2.1 Total (Top 10) 943 253,431 82.1 Total 1,345 308,811 100.0 Greater Long Island 1 Market Share Top 4 banks control 57% of deposits in Greater Long Island 1 Attractive Footprint Across Greater Long Island 1 $791k Median Owner Occupied Home Value 2 vs. $439k Nationwide 7.6MM Total Population Would be within the top 15 largest states in the country $118k 2025 Median Household Income 3 vs. $79k Nationwide

Buyer Name Target Name Completion Date Greater Long Island 2 Total Deposits ($B) Pending $3.3 Private Equity Mar-24 $32.1 Mar-23 $18.8 Jan-22 $8.1 10 Market Disruption Provides Opportunity for Growth Source: S&P Capital IQ Pro and FDIC; Data as of 9/30/2024 1 Includes select bank transactions since January 1, 2021 with the target headquartered in the New York - Newark - Jersey City, NY - NJ MSA and a deal value greater than $100 million 2 Greater Long Island defined as Nassau, Queens, Suffolk, and Kings counties; FDIC deposit data for the most recent period ende d June 30 th at the time of announcement 4 bank mergers have been announced or closed involving Long Island area Banks 1 Select Transactions Involving New York Banks in Last 3 years 1

11 Corporate Focus and Strategy Financial data as of 9/30/2024 1 Peers include major exchange - traded banks in NJ, NY, and PA with total assets between $5B and $15B; NBT Bancorp Inc. excluded du e to pending transaction expecting to result in assets above $15B; Excludes merger targets and mutual holding companies; Data presented on a median basis Areas of Focus to Enhance Financial Results Increase NIM and Reduce Volatility ▪ Capitalize on near - term loan repricing and CD maturity roll - overs to expand net interest margin ▪ Interest rate swaps are used to mitigate volatility in earnings Maintain Credit Discipline ▪ Highly diversified, community focused loan portfolio across Multifamily, Investor CRE and Commercial Business Banking portfolios − Minimal exposure to Manhattan office buildings, which represent 0.5% of gross loans with one nonperforming loan ▪ Robust loan underwriting standards have led to above industry credit performance (0.50% NPLs / gross loans vs. 0.63% peers 1 ) Preserve Strong Liquidity & Capital ▪ Balance sheet strength supported by sound capital levels and core deposit funded model ▪ $3.9 billion in combined available liquidity through cash lines with the FHLB - NY, Federal Reserve and other commercial banks as well as unencumbered securities Bend the Expense Curve ▪ Improve core earnings power by improving scalability and efficiency ▪ Invest in the business by adding new branches and capitalizing on market disruption to obtain experienced revenue - enhancing personnel Continued Expansion of Asian Banking Market ▪ Continue to expand our footprint in strategically aligned markets to grow noninterest - bearing deposits and leverage the success of our Asian and South Asian market initiatives ▪ Increase our commitment to the multi - cultural marketplace by leveraging our staff and Asian advisory board to broaden our links to the communities we serve

Strong Asian Banking Market Focus 1 As of 6/30/2024; Latest FDIC Data 1 Asian Communities – Total Loans $744 million and Deposits $1.3 billion 2 Multilingual Branch Staff Serves Diverse Customer Base in NYC Metro Area 3 Growth Aided by the Asian Advisory Board 4 Sponsorships of Cultural Activities Support New and Existing Opportunities 5 About One Third of Branches are in Asian markets 12 $40B Deposit Market Potential (~3% Market Share 1 ) 17% of Total Deposits 5.8% 1 - Year Growth in 2024

$1,438 $1,138 $946 $1,526 $2,311 $2,876 $191 $168 $156 $144 $109 $100 $1,592 $1,682 $2,342 $2,100 $1,726 $1,659 $1,366 $2,323 $1,921 $1,746 $1,771 $2,003 $435 $779 $968 $921 $848 $861 $44 $46 $52 $48 $50 $73 $5,066 $6,136 $6,385 $6,485 $6,815 $7,572 2019 2020 2021 2022 2023 3Q24 Certificate of Deposit Accounts 38.0% Savings Accounts 1.3% Money Market Accounts 21.9% NOW Accounts 26.5% NIB Demand 11.4% Mortgage Escrow 1.0% Deposit Portfolio Overview 13 Deposit Portfolio Composition Historical EoP Total Deposits (Shown in $ Millions) CAGR: 9% Financial data as of 9/30/2024 CDs Savings Accounts Money Market NOW NIB D emand Mortgage E scrow $7.6B Total Portfolio 3.55% Cost of Total Deposits (%): 15.0% Uninsured (Excl. Collateralized Deposits) (%):

4.17% 4.06% 4.96% ▪ CDs have a weighted average rate of 4.64% 1 as of September 30, 2024 ▪ Current CD APYs are approximately 3.50 - 4.50% for new accounts ▪ Approximately 72% 1 of the CD portfolio will mature within one year − $647.2 million in 4Q24 at 4.96% 1 − $420.8 million in 1Q25 at 4.70% − $164.6 million in 2Q25 at 4.06% − $251.0 million in 3Q25 at 4.17% ▪ Historically, we have retained a high percentage of maturing CDs 14 CDs Expected to Reprice Favorably CDs Maturing Within 12 Months (Shown in $ Millions) 1 Excludes $801MM of CDs with interest rate hedges $647.2 $420.8 $164.6 $251.0 4Q24 1Q25 2Q25 3Q25 Total CDs of $2.9B Weighted Avg. Rate: 4.70%

39% 11% 10% 7% 6% 5% 4% 4% 4% $6.8B Total Portfolio Loan Portfolio Overview 15 Data as of 9/30/2024 1 Includes $1.6M of prepayment penalty along with net reversals and recoveries from nonaccrual and delinquent loans for the qua rt er ended 9/30/2024 2 LTV is based on the outstanding principal balance divided by the appraised value of the property at the time of origination ( or more recent valuation updates, where available) Manhattan Office Buildings are Approximately 0.5% of Gross Loans ~90% of Loan Portfolio is Real Estate Based Loans Secured by Real Estate Have an Average LTV of ~36% 2 5.69% 1 Yield on Loans (%): Multifamiy: 39% Owner Occupied CRE: 11% Non Real Estate: 10% One-to-four Family - Mixed Use: 7% General Commercial: 6% CRE - Shopping Center: 5% CRE - Strip Mall: 4% One-to-four Family - Residential: 4% Commercial Mixed Use: 4% CRE - Single Tenant: 2% Industrial: 2% Office - Multi & Single Tenant: 2% Health Care / Medical Use: 1% Commercial Special Use: 1% Construction: 1% Office Condo & Co-Op: 1% Total Commercial Real Estate (%): 67%

$1.2M Average Loan Size 5.03% Current Weighted Average Coupon $96M Loans repricing in 4Q24 3 $358M Loans repricing in 2025 3 44% Weighted Average LTV 0.10% Loans with LTV above 75% 1.9x Weighted Average DCR 0.33% NPLs / Loans 0.52% 30 - 89 Days Past Due / Loans 55 bps Criticized and Classified Loans / Loans 29% 21% 17% 17% 16% Kings Manhattan Queens Other Bronx Borrowers have over 50% equity in these properties Average seasoning over 7 years Credit performance is solid with low levels of delinquencies, criticized, and classified loans Multifamily Geography 1 Overview of Multifamily and Rent Regulated Portfolio 16 $2.6B Portfolio 1 Data as of 9/30/2024 2 Data as of 6/30/2024 3 Forecasted to reprice to a weighted average rate of 6.14% based on underlying index value on 9/30/2024 49% 33% 18% 100% Rent Regulated Buildings 50-99% Rent Regulated Buildings <50% Rent Regulated Buildings $1.6B Portfolio Multifamily Rent Regulated 2

Significant Short - Term Loan Repricing 17 1 Loans repricing include floating rate loans, adjustable loans repricing, and maturing fixed rate loans 2 Currently floating loans excludes $500M of interest rate hedges 3 Incremental repricing spread assumes index values as of 9/30/2024 ▪ Floating rate loans include any loans (including back - to - back swaps) tied to an index that reprices within 90 days – Including interest rate hedges of $500 million, $1.8 billion or ~26% of the loan portfolio is effectively floating rate ▪ Through 2026, $1.7B of loans to reprice ~159 - 199 bps higher assuming index values as of September 30, 2024 ▪ Including loan portfolio hedges, ~26% of loans reprice with every Fed move and an additional 11 - 15% reprice annually Loan Repricing Through 2026 1 ( Shown in $ Millions ) $1,264 $226 $777 $730 Currently Floating Remainder of 2024 2025 2026 NIM outlook to benefit as loans reprice $3.0B Aggregate loans re - pricing through 2026 + 185bps Remainder of 2024 Incremental Repricing Spread 3 : + 159bps 2025 Incremental Repricing Spread 3 : + 199bps 2026 Incremental Repricing Spread 3 : 2

Asset Quality Overview Peers include major exchange - traded banks in NJ, NY, and PA with total assets between $5B and $15B; NBT Bancorp Inc. excluded du e to pending transaction expecting to result in assets above $15B; Excludes merger targets and mutual holding companies; Data presented on a median basis 1 “Industry” includes FDIC insured institutions from “FDIC Statistics At A Glance” through 12/31/2023; Q3 2024 year - to - date data includes all U.S. Commercial Banks per S&P Capital IQ Pro 2 For comparison purposes, NPLs include nonaccrual loans and loans 90 days or more past due and still accruing 18 0.66% 1.07% 0.87% 0.98% 1.11% 1.00% 1.68% 3.38% 2.86% 1.93% 2.20% 2.23% 2019 2020 2021 2022 2023 3Q24 FFIC Peer Median Criticized and Classified Loans / Gross Loans (%) 0.23% 0.31% 0.23% 0.47% 0.36% 0.50% 0.50% 0.58% 0.45% 0.34% 0.56% 0.63% 2019 2020 2021 2022 2023 3Q24 FFIC Peer Median NPLs / Gross Loans (%) 2 NCOs / Gross Loans (%) 1 0.04% 0.06% 0.05% 0.02% 0.16% 0.06% 0.52% 0.50% 0.25% 0.27% 0.52% 0.64% 2019 2020 2021 2022 2023 3Q24 YTD FFIC Industry

19 Securities Portfolio Overview Financial data as of 9/30/2024 1 Excludes FHLB stock; HTM securities balance shown net of allowance for credit losses 2 Excludes portfolio layer method basis adjustments related to available for sale securities hedged in a closed portfolio 3 Shown before allowance for credit losses adjustment 4 Consists of 95% AAA and 5% AA Available for Sale Portfolio Mix 2 (9/30/2024) Held to Maturity Portfolio Mix 3 (9/30/2024) $64M Pre - Tax Loss $9M Pre - Tax Loss U.S. gov. agencies 1.8% Corporate 10.9% Mutual funds 0.7% CLOs 28.2% Other non - MBS 0.1% REMIC and CMO 43.1% GNMA 1.4% FNMA 8.7% FHLMC 5.0% $1.7B Amortized Cost Municipals 89.2% FNMA 10.8% $73MM Amortized Cost Yield on Securities 1 (%) 2.98% 2.16% 1.72% 2.22% 3.84% 5.52% 2019 2020 2021 2022 2024 3Q24 Total Securities Portfolio 1 ($ M ) $831 $706 $835 $809 $948 $1,686 2019 2020 2021 2022 2023 3Q24 AFS Securities HTM Securities 4

1 Actual amounts and terms may vary depending on market conditions and execution 2 Based on current market rates, we estimate the new securities would have an estimated aggregate yield of approximately 5.50%, b ut the actual yield will depend on market conditions at the time of purchase 20 Illustrative Transaction Assumptions Potential Transaction Assumptions 1 1 2 3 4 We are evaluating a potential repositioning of low - yielding available - for - sale securities as well as a sale of certain CRE loans Potential AFS Securities Sold: (Amortized Cost) Estimated Total Pre - Tax Loss: ~$85 Million May be recorded in Fourth Quarter 2024 ~$405 Million Yield of ~5.50% 2 Reinvestment of Net Proceeds : The goal of the potential transactions is to improve profitability and liquidity, increase capital, manage CRE concentration and support continued growth Any security or loan sales would NOT be undertaken until FFIC has received the proceeds from the planned common equity offering and recognized capital increase Illustrative repositioning expected to result in: x Improvement in profitability and shareholder returns x Accretion to EPS x Enhanced liquidity x Shorter duration balance sheet x Stronger capital generation Potential CRE Loans Sold : ~$100 Million Risk - Weighting of ~50% - 100% Yield of ~3.60% Reduction in Government Banking Deposits : ~$150 Million Cost of ~4.45% ~$400 Million – $500 Million Yield of ~2.05% WAL of ~7 Yrs

Note: Stand - alone and pro forma metrics reflect annualized data for 3Q24; pro forma metrics reflect common equity raise price of $17.19 per share which reflects closing price as of December 6 2024, gross spread of 5.25% and additional one - time costs of $150 thousand 1 Pro forma net income reflects tax rate of 26% 2 Adjusted tangible book value per share of $21.95 reflects estimated incremental fair value adjustment on identified securitie s that could be sold, tax effected at 31%; Refer to Non - GAAP Reconciliation 21 Potential Repositioning Accelerates Profitability Return on Average Assets 1 6WDQG $ORQH 4 3UR)RUPD Net Interest Margin (FTE)6WDQG $ORQH 3UR)RUPD Net Interest Income (FTE) ($M) 6WDQG $ORQH 4 3UR RUPD Earnings Per Share 1 Adjusted Tangible Book Value Per Share 2 4 6WDQG $ORQH 4 3UR )RUPD 4 6WDQG $ORQH 4 6WDQG $ORQ $GMXVWHG 4 3UR)RUPD $0.21 per share EPS accretion $0.86 per share TBV dilution 13 bps improvement 20 bps improvement $16 million increase

1 Refer to Non - GAAP Reconciliation 2 Pro forma bank - level CRE Concentration excludes approximately $20 million of net proceeds from the common equity raise that are retained at the holding company for general corporate purposes Note: Reflects consolidated regulatory capital ratios unless otherwise noted; 3Q24 pro forma metrics reflect net proceeds of approximately $66 million from common equity raise , which include gross spread of 5.25% and additional one - time costs of $150 thousand 4 6WDQG $ORQH 4 3UR)RUPD 4 6WDQG $ORQH 4 3UR)RUPD4 6WDQG $ORQH 4 3UR)RUPD 22 And Strengthens The Balance Sheet TCE / TA 1 Tier 1 Leverage Ratio CET1 Ratio Tier 1 RBC Ratio 4 6WDQG $ORQH 4 3UR)RUPD Total RBC Ratio 4 6WDQG $ORQH 4 3UR)RUPD CRE Concentration (Bank - Level) 2 4 6WDQG $ORQH 4 3UR)RUPD 21 bps improvement 25 bps improvement 389 bps improvement 63 bps improvement 16 bps improvement 21 bps improvement

0.77x 0.81x 0.85x 0.98x 1.03x 1.04x 1.05x 1.13x 1.14x 1.14x 1.18x 1.33x 1.42x 1.51x 1.61x 1.64x 1.77x 1.86x 1.91x Peer Median: 1.16x FFIC KRNY NFBK FISI TRST MCB OCFC CNOB PGC CCNE MPB UVSP DCOM PFIS AMAL STBA TMP FCF ORRF Compelling Valuation Relative to Peers Market data as of 12/6/2024; Financial data for the quarter ended 9/30/2024 Peers include major exchange - traded banks in NJ, NY, and PA with total assets between $5B and $15B; NBT Bancorp Inc. excluded du e to pending transaction expecting to result in assets above $15B; Excludes merger targets and mutual holding companies; Median value excludes FFIC 1 Refer to Non - GAAP Reconciliation 23 Price / Tangible Book Value Per Share 1 ▪ Peers include major exchange - traded banks in NJ, NY, and PA with total assets between $5B and $15B

Appendix 24

25 Ample Liquidity x Significant liquidity is available to meet immediate operating needs of the business x $3.9B of available liquidity provides additional support to granular deposit base x Approximately 340% coverage of $1.1B uninsured and uncollateralized deposit balances with total liquidity sources Net Avail. Used Total Avail. $MM $MM $MM Type $896 -- $896 Unencumbered Securities $186 -- $186 Interest Earnings Deposits $1,082 -- $1,082 Internal Resources $754 $1,901 $2,655 Federal Home Loan Bank $1,578 $100 $1,678 Federal Reserve Bank $474 -- $474 Other Banks $2,806 $2,001 $4,807 External Resources $3,888 $2,001 $5,888 Total Liquidity Data as of 9/30/2024

1 Assumes approximately $400 million - $500 million of AFS securities at amortized cost are sold with a weighted average yield of approximately 2.05% with the approximate mid - point used in calculations 2 Assumes approximately $100 million of CRE loans are sold with a weighted average yield of approximately 3.60% and risk - weighting of approximately 50% - 100% 3 Assumes approximately $150 million reduction of Government Banking deposits with a weighted average cost of approximately 4.4 5% 4 Assumes approximately $405 million of net offering proceeds are reinvested at a pre - tax weighted average yield of approximately 5.50%, which is based on current market rates; actual yield will depend on current market conditions at the time of purchase 26 Pro Forma Adjustments Illustrative for Securities Sale, Return on Average Assets CRE Loan Sale, Deposits Reduction Dollars in millions & Common Raise Net Income Stand-Alone Net Income (3Q24 Annualized) $35.6 Net of Tax Adjustments @ 26% Marginal Tax Rate: Less: Yield from Securities Sold¹ 6.8 Less: Yield from CRE Loans Sold² 2.6 Less: Amortization of Securities Swap Carry Reduction 0.2 Plus: Cost from Deposits Reduction³ 4.9 Plus: Income from Net Offering Proceeds @ 5.50% Yield⁴ 16.5 Plus: Retained Servicing Income from CRE Loans Sold (25 bps) 0.2 Total Adjustments $12.0 Pro Forma Net Income (3Q24 Annualized) $47.6 A Average Assets Stand-Alone Average Assets $9,203.9 Pro Forma Adjustments Less: Securities Sold 8.4 Less: CRE Loans Sold 6.9 Less: Deposits Reduction 150.0 Plus: Net Offering Proceeds Received 66.2 Total Adjustments ($99.1) Pro Forma Average Assets $9,104.8 B Pro Forma Return on Average Assets 0.52% A / B

27 Pro Forma Adjustments (Cont.) 1 Assumes approximately $400 million - $500 million of AFS securities at amortized cost are sold with a weighted average yield of approximately 2.05% with the approximate mid - point used in calculations 2 Assumes approximately $100 million of CRE loans are sold with a weighted average yield of approximately 3.60% and risk - weighting of approximately 50% - 100% 3 Assumes approximately $150 million reduction of Government Banking deposits with a weighted average cost of approximately 4.4 5% 4 Assumes approximately $405 million of net offering proceeds are reinvested at a pre - tax weighted average yield of approximately 5.50%, which is based on current market rates; actual yield will depend on current market conditions at the time of purchase Illustrative for Securities Sale, Net Interest Income and Net Interest Margin CRE Loan Sale, Deposits Reduction Dollars in millions & Common Raise Net Interest Income Stand-Alone Net Interest Income (FTE) (3Q24 Annualized) $182.8 Pro Forma Adjustments: Less: Yield from Securities Sold¹ 9.1 Less: Yield from CRE Loans Sold² 3.6 Less: Amortization of Securities Swap Carry Reduction 0.3 Plus: Cost from Deposits Reduction³ 6.7 Plus: Income from Net Offering Proceeds @ 5.50% Yield⁴ 22.3 Total Adjustments $16.0 Pro Forma Net Interest Income (FTE) (3Q24 Annualized) $198.8 A Average Interest Earning Assets Stand-Alone Average Interest Earning Assets $8,709.7 Pro Forma Adjustments Plus: Securities Sold 8.8 Less: CRE Loans Sold 6.9 Less: Deposits Reduction 150.0 Plus: Net Offering Proceeds Received 66.2 Total Adjustments ($81.9) Pro Forma Average Interest Earning Assets $8,627.8 B Pro Forma Net Interest Margin (FTE) (3Q24 Annualized) 2.30% A / B

Note: Pro forma tangible book value per share at September 30, 2024 reflects common equity raise price of $17.19 per share which reflects closing price as of December 6 2024, gross spread of 5.25% and additional one - time costs of $150 thousand 1 Represents estimated incremental fair value adjustment on identified securities that could be sold, tax effected at 31% 28 Non - GAAP Reconciliation Tangible Book Value Per Share Reconciliation Reported Incremental Adjusted Pro Forma Values in millions 9/30/24 AOCI Mark (1) 9/30/24 9/30/24 Common Shareholders' Equity (GAAP) $707.7 $707.7 $715.0 Plus: AOCI (GAAP) ($40.8) + ($10.0) = ($50.8) $2.8 Less: Goodwill and Other Intangibles (GAAP) $18.9 $18.9 $18.9 Tangible Common Shareholders' Equity (Non-GAAP) $648.0 $638.0 $698.9 Common Shares Outstanding 29.1 29.1 29.1 33.1 Tangible Book Value Per Share (Non-GAAP) $22.29 + ($0.34) = $21.95 $21.09

Tangible Common Equity Ratio Reconciliation Reported Pro Forma $ in millions 9/30/2024 9/30/2024 Total Equity (GAAP) $666.9 $717.8 Less: Goodwill and Other Intangibles (GAAP) $18.9 $18.9 Tangible Stockholders' Common Equity (Non-GAAP) $648.0 $698.9 Total Assets (GAAP) $9,280.9 $9,181.8 Less: Goodwill and Other Intangibles (GAAP) $18.9 $18.9 Tangible Assets (Non-GAAP) $9,262.0 $9,162.9 Tangible Stockholders' Common Equity to Tangible Assets 7.00 % 7.63 % 29 Non - GAAP Reconciliation

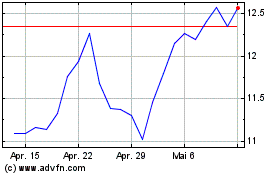

Flushing Financial (NASDAQ:FFIC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

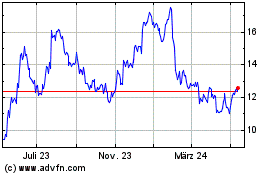

Flushing Financial (NASDAQ:FFIC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024