$32.3 million cash balance at the end of Q1

2024 expected to provide cash runway into 2H 2025

Announced positive topline data from Phase 1b

EQUALISE study of itolizumab in lupus nephritis patients,

representing the first of two data sets that will trigger Ono

Pharmaceutical’s option exercise decision for itolizumab, expected

in 2H 2024

Equillium Inc. (Nasdaq: EQ), a clinical-stage biotechnology

company leveraging a deep understanding of immunobiology to develop

novel therapeutics to treat severe autoimmune and inflammatory

disorders, today announced financial results for the first quarter

2024 and highlights in clinical development.

“With multiple milestones expected in 2024, we are happy to have

reported our first milestone of positive topline data from the

Phase 1b EQUALISE study in lupus nephritis in early April,

representing the first of two data sets that will trigger our

partner Ono’s option exercise decision for itolizumab expected in

the second half of the year,” said Bruce Steel, chief executive

officer at Equillium. “We have also completed enrollment in our

Phase 2 study of our multi-cytokine inhibitor EQ101 for the

treatment of moderate to severe alopecia areata. This is the first

study in which EQ101 has been tested in alopecia areata patients,

where we are looking for signs of clinical activity above

historically low placebo response rates and anticipate announcing

topline data in the second quarter this year. We also expect to

announce the results of the interim review of our Phase 3 EQUATOR

study of itolizumab in patients with acute graft-versus-host

disease in the third quarter this year, representing the final data

deliverable to trigger Ono’s option exercise period, which will

expire three months following this interim review. If Ono exercises

their option to acquire our rights to itolizumab we would receive

an exercise payment of approximately $321 million, which would

significantly extend our cash runway beyond the second half of 2025

- our current guidance - and we would remain eligible to receive

approximately $101 million in additional milestone payments.”

Highlights Since the Beginning of 2024:

- Announced positive topline data from the Phase 1b EQUALISE

study of itolizumab in lupus nephritis patients.

Anticipated Upcoming Milestones:

- EQ101: Phase 2 clinical study in subjects with moderate to

severe alopecia areata – topline data anticipated in Q2 2024

- Itolizumab: EQUATOR acute graft-versus-host disease interim

review anticipated in Q3 2024

- Ono option exercise decision anticipated in 2H 2024

First Quarter 2024 Financial Results

Revenue for the first quarter of 2024 was $10.7 million,

compared to $8.9 million during the same period in 2023. Revenue in

the first quarters of 2024 and 2023 consisted entirely of

itolizumab development funding and amortization of the upfront

payment resulting from the Asset Purchase Agreement with Ono. In

the first quarter of 2024, development funding represented $8.0

million and amortization of the upfront payment represented $2.7

million, whereas those two components represented $6.7 million and

$2.2 million, respectively, in the first quarter of 2023.

Research and development (R&D) expenses for the first

quarter of 2024 were $9.7 million, compared to $9.3 million for the

same period in 2023. The increase was primarily due to an increase

in chemistry, manufacturing and controls (CMC) activities related

to itolizumab and EQ101, and greater employee compensation

expenses, which were partially offset by decreases in certain

clinical study expenses and greater estimated Australian research

and development tax incentive credits.

General and administrative (G&A) expenses were $3.7

million for each of the three-month periods ended March 31, 2024,

and 2023. General and administrative expenses for the first quarter

of 2024 remained relatively constant compared to the same period in

2023.

Net loss for the first quarter of 2024 was $2.7 million,

or $(0.08) per basic and diluted share, compared with a net loss of

$3.9 million, or $(0.11) per basic and diluted share, for the same

period in 2023. The decrease in net loss was primarily attributable

to increased revenue related to the Ono partnership, partially

offset by greater R&D operating expenses.

Cash, cash equivalents and short-term investments totaled

$32.3 million as of March 31, 2024, compared to $40.9 million as of

December 31, 2023. Cash used in operating activities in the first

quarter of 2024 was $8.8 million, which included payment of $2.6

million for annual bonuses to employees. Equillium believes that

its cash, cash equivalents and short-term investments will be

sufficient to fund its currently planned operations into the second

half of 2025, assuming no further repurchases under our stock

repurchase program.

About Multi-Cytokine Platform and Multi-Cytokine Inhibitors

EQ101 & EQ302

Our proprietary multi-cytokine platform generates rationally

designed composite peptides that selectively block key cytokines at

the shared receptor level targeting pathogenic cytokine

redundancies and synergies while preserving non-pathogenic

signaling. This approach is expected to avoid the broad

immuno-suppression and off-target safety liabilities that may be

associated with other therapeutic classes, such as Janus kinase

inhibitors. Many immune-mediated diseases are driven by the same

combination of dysregulated cytokines, and we believe identifying

the key cytokines for these diseases will allow us to target and

develop customized treatment strategies for multiple autoimmune and

inflammatory diseases.

Current platform assets include EQ101, a clinical stage,

first-in-class, selective, tri-specific inhibitor of IL-2, IL-9,

and IL-15 for intravenous and subcutaneous delivery and EQ302, a

preclinical stage, first-in-class, selective, bi-specific inhibitor

of IL-15 and IL-21 for oral delivery.

About Itolizumab

Itolizumab is a clinical-stage, first-in-class anti-CD6

monoclonal antibody that selectively targets the CD6-ALCAM

signaling pathway to downregulate pathogenic T effector cells while

preserving T regulatory cells critical for maintaining a balanced

immune response. This pathway plays a central role in modulating

the activity and trafficking of T cells that drive a number of

immuno-inflammatory diseases.

About Equillium

Equillium is a clinical-stage biotechnology company leveraging a

deep understanding of immunobiology to develop novel therapeutics

to treat severe autoimmune and inflammatory disorders with high

unmet medical need. The company’s pipeline consists of the

following novel first-in-class immunomodulatory assets and product

platform targeting immuno-inflammatory pathways. EQ101: a selective

tri-specific cytokine inhibitor targeting IL-2, IL-9, and IL-15;

currently under evaluation in a Phase 2 proof-of-concept clinical

study of patients with alopecia areata being conducted in Australia

and New Zealand by Equillium’s Australian subsidiary as the trial

sponsor. EQ302: an orally delivered, selective bi-specific cytokine

inhibitor targeting IL-15 and IL-21; currently in pre-clinical

development. The multi-cytokine platform: generates rationally

designed composite peptides that selectively block key cytokines at

the shared receptor level targeting pathogenic cytokine

redundancies and synergies while preserving non-pathogenic

signaling. Itolizumab: a monoclonal antibody that targets the

CD6-ALCAM signaling pathway which plays a central role in the

modulation of effector T cells; currently under evaluation in a

Phase 3 clinical study of patients with acute graft-versus-host

disease (aGVHD) and recently completed a Phase 1b clinical study of

patients with lupus/lupus nephritis. Equillium acquired rights to

itolizumab through an exclusive partnership with Biocon Limited and

has entered a strategic partnership with Ono Pharmaceutical Co.,

Ltd., for the development and commercialization of itolizumab under

an option and asset purchase agreement.

For more information, visit www.equilliumbio.com.

____________________________

1 Option exercise payment is denominated in Japanese yen (5

billion) and subject to currency exchange rates at the time of

payment.

Forward Looking Statements

Statements contained in this press release regarding matters

that are not historical facts are “forward-looking Statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements may be identified by the use of

words such as “anticipate”, “believe”, “could”, “continue”,

“expect”, “estimate”, “may”, “plan”, “outlook”, “future” and

“project” and other similar expressions that predict or indicate

future events or trends or that are not statements of historical

matters. These statements include, but are not limited to,

statements regarding Equillium’s plans for developing EQ101, EQ302

and itolizumab and the expected timeline for results from clinical

studies, anticipated upcoming milestones, the timing for triggering

Ono’s option period and for receiving Ono’s option decision, the

potential benefits and extended cash runway if Ono exercises their

option, the fluctuation of the foreign exchange rate, Equillium’s

cash runway, and the potential benefits of Equillium’s product

candidates. Because such statements are subject to risks and

uncertainties, many of which are outside of Equillium’s control,

actual results may differ materially from those expressed or

implied by such forward-looking statements. Risks that contribute

to the uncertain nature of the forward-looking statements include:

Equillium’s ability to execute its plans and strategies; risks

related to performing clinical and pre-clinical studies; whether

the results from clinical and pre-clinical studies will validate

and support the safety and efficacy of Equillium’s product

candidates; changes in the competitive landscape; risks related to

Ono’s financial condition and decision to exercise its option, if

ever to purchase itolizumab or terminate the asset purchase

agreement; uncertainties related to Equillium’s capital

requirements; and having to use cash in ways or on timing other

than expected and the impact of market volatility on cash reserves.

These and other risks and uncertainties are described more fully

under the caption "Risk Factors" and elsewhere in Equillium's

filings and reports, which may be accessed for free by visiting the

Securities and Exchange Commission’s website and on Equillium’s

website under the heading “Investors.” Investors should take such

risks into account and should not rely on forward-looking

statements when making investment decisions. All forward-looking

statements contained in this press release speak only as of the

date on which they were made. Equillium undertakes no obligation to

update such statements to reflect events that occur or

circumstances that exist after the date on which they were made,

except as required by law.

Equillium, Inc.

Condensed Consolidated Balance

Sheets

(In thousands)

(unaudited)

March 31,

December 31,

2024

2023

Assets

Cash, cash equivalents and short-term

investments

$

32,285

$

40,866

Accounts receivable

5,048

3,735

Prepaid expenses and other assets

5,570

5,133

Operating lease right-of-use assets

694

796

Total assets

$

43,597

$

50,530

Current liabilities

Accounts payable and other current

liabilities

$

8,848

$

11,844

Current portion of deferred revenue

13,360

15,729

Total current liabilities

22,208

27,573

Other long-term liabilities

295

384

Total liabilities

22,503

27,957

Total stockholders' equity

21,094

22,573

Total liabilities and stockholders'

equity

$

43,597

$

50,530

Equillium, Inc.

Condensed Consolidated

Statements of Operations

(In thousands, except share

and per share data)

(unaudited)

Three Months Ended March

31,

2024

2023

Revenue

$

10,689

$

8,879

Operating expenses:

Research and development

9,743

9,272

General and administrative

3,737

3,715

Total operating expenses

13,480

12,987

Loss from operations

(2,791

)

(4,108

)

Other income, net

57

228

Net loss before income tax expense

(2,734

)

(3,880

)

Income tax expense

-

60

Net loss

$

(2,734

)

$

(3,940

)

Net loss per common share, basic and

diluted

$

(0.08

)

$

(0.11

)

Weighted-average number of common shares

outstanding, basic and diluted

35,254,752

34,414,149

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509222492/en/

Investor Contact Michael Moore Vice President, Investor

Relations & Corporate Communications 619-302-4431

ir@equilliumbio.com

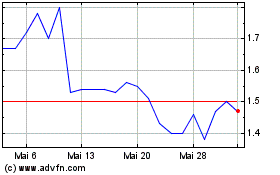

Equillium (NASDAQ:EQ)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Equillium (NASDAQ:EQ)

Historical Stock Chart

Von Mai 2023 bis Mai 2024