false

--12-31

Q3

0000890821

0000890821

2024-01-01

2024-09-30

0000890821

2024-11-12

0000890821

2024-09-30

0000890821

2023-12-31

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2024-09-30

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2023-12-31

0000890821

us-gaap:SeriesBPreferredStockMember

2024-09-30

0000890821

us-gaap:SeriesBPreferredStockMember

2023-12-31

0000890821

2024-07-01

2024-09-30

0000890821

2023-07-01

2023-09-30

0000890821

2023-01-01

2023-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-12-31

0000890821

ENVB:MezzanineEquityMember

2023-12-31

0000890821

us-gaap:CommonStockMember

2023-12-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0000890821

ENVB:SubscriptionReceivableMember

2023-12-31

0000890821

us-gaap:RetainedEarningsMember

2023-12-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2024-03-31

0000890821

ENVB:MezzanineEquityMember

2024-03-31

0000890821

us-gaap:CommonStockMember

2024-03-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0000890821

ENVB:SubscriptionReceivableMember

2024-03-31

0000890821

us-gaap:RetainedEarningsMember

2024-03-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0000890821

2024-03-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2024-06-30

0000890821

ENVB:MezzanineEquityMember

2024-06-30

0000890821

us-gaap:CommonStockMember

2024-06-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0000890821

ENVB:SubscriptionReceivableMember

2024-06-30

0000890821

us-gaap:RetainedEarningsMember

2024-06-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-06-30

0000890821

2024-06-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2022-12-31

0000890821

ENVB:MezzanineEquityMember

2022-12-31

0000890821

us-gaap:CommonStockMember

2022-12-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000890821

us-gaap:RetainedEarningsMember

2022-12-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0000890821

2022-12-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-03-31

0000890821

ENVB:MezzanineEquityMember

2023-03-31

0000890821

us-gaap:CommonStockMember

2023-03-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0000890821

us-gaap:RetainedEarningsMember

2023-03-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0000890821

2023-03-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-06-30

0000890821

ENVB:MezzanineEquityMember

2023-06-30

0000890821

us-gaap:CommonStockMember

2023-06-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0000890821

us-gaap:RetainedEarningsMember

2023-06-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0000890821

2023-06-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2024-01-01

2024-03-31

0000890821

ENVB:MezzanineEquityMember

2024-01-01

2024-03-31

0000890821

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0000890821

ENVB:SubscriptionReceivableMember

2024-01-01

2024-03-31

0000890821

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0000890821

2024-01-01

2024-03-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2024-04-01

2024-06-30

0000890821

ENVB:MezzanineEquityMember

2024-04-01

2024-06-30

0000890821

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0000890821

ENVB:SubscriptionReceivableMember

2024-04-01

2024-06-30

0000890821

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-04-01

2024-06-30

0000890821

2024-04-01

2024-06-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2024-07-01

2024-09-30

0000890821

ENVB:MezzanineEquityMember

2024-07-01

2024-09-30

0000890821

us-gaap:CommonStockMember

2024-07-01

2024-09-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2024-07-01

2024-09-30

0000890821

ENVB:SubscriptionReceivableMember

2024-07-01

2024-09-30

0000890821

us-gaap:RetainedEarningsMember

2024-07-01

2024-09-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-07-01

2024-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-01-01

2023-03-31

0000890821

ENVB:MezzanineEquityMember

2023-01-01

2023-03-31

0000890821

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0000890821

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0000890821

2023-01-01

2023-03-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-04-01

2023-06-30

0000890821

ENVB:MezzanineEquityMember

2023-04-01

2023-06-30

0000890821

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0000890821

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0000890821

2023-04-01

2023-06-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-07-01

2023-09-30

0000890821

ENVB:MezzanineEquityMember

2023-07-01

2023-09-30

0000890821

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0000890821

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2023-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2024-09-30

0000890821

ENVB:MezzanineEquityMember

2024-09-30

0000890821

us-gaap:CommonStockMember

2024-09-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2024-09-30

0000890821

ENVB:SubscriptionReceivableMember

2024-09-30

0000890821

us-gaap:RetainedEarningsMember

2024-09-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-09-30

0000890821

ENVB:MezzanineEquityMember

2023-09-30

0000890821

us-gaap:CommonStockMember

2023-09-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0000890821

us-gaap:RetainedEarningsMember

2023-09-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0000890821

2023-09-30

0000890821

2023-11-21

0000890821

2024-05-16

0000890821

2023-11-12

0000890821

country:US

2024-09-30

0000890821

country:CA

2024-09-30

0000890821

country:AU

2024-09-30

0000890821

ENVB:WarrantsToPurchaseSharesOfCommonStockMember

2024-07-01

2024-09-30

0000890821

ENVB:WarrantsToPurchaseSharesOfCommonStockMember

2023-07-01

2023-09-30

0000890821

ENVB:WarrantsToPurchaseSharesOfCommonStockMember

2024-01-01

2024-09-30

0000890821

ENVB:WarrantsToPurchaseSharesOfCommonStockMember

2023-01-01

2023-09-30

0000890821

ENVB:RestrictedStockUnitsVestedAndUnIssuedMember

2024-07-01

2024-09-30

0000890821

ENVB:RestrictedStockUnitsVestedAndUnIssuedMember

2023-07-01

2023-09-30

0000890821

ENVB:RestrictedStockUnitsVestedAndUnIssuedMember

2024-01-01

2024-09-30

0000890821

ENVB:RestrictedStockUnitsVestedAndUnIssuedMember

2023-01-01

2023-09-30

0000890821

ENVB:RestrictedStockUnitsUnvestedMember

2024-07-01

2024-09-30

0000890821

ENVB:RestrictedStockUnitsUnvestedMember

2023-07-01

2023-09-30

0000890821

ENVB:RestrictedStockUnitsUnvestedMember

2024-01-01

2024-09-30

0000890821

ENVB:RestrictedStockUnitsUnvestedMember

2023-01-01

2023-09-30

0000890821

ENVB:InvestmentOptionsToPurchaseSharesOfCommonStockMember

2024-07-01

2024-09-30

0000890821

ENVB:InvestmentOptionsToPurchaseSharesOfCommonStockMember

2023-07-01

2023-09-30

0000890821

ENVB:InvestmentOptionsToPurchaseSharesOfCommonStockMember

2024-01-01

2024-09-30

0000890821

ENVB:InvestmentOptionsToPurchaseSharesOfCommonStockMember

2023-01-01

2023-09-30

0000890821

ENVB:OptionsToPurchaseSharesOfCommonStockMember

2024-07-01

2024-09-30

0000890821

ENVB:OptionsToPurchaseSharesOfCommonStockMember

2023-07-01

2023-09-30

0000890821

ENVB:OptionsToPurchaseSharesOfCommonStockMember

2024-01-01

2024-09-30

0000890821

ENVB:OptionsToPurchaseSharesOfCommonStockMember

2023-01-01

2023-09-30

0000890821

ENVB:LabEquipmentMember

2024-09-30

0000890821

ENVB:LabEquipmentMember

2023-12-31

0000890821

ENVB:ComputerEquipmentAndLeaseholdImprovementsMember

2024-09-30

0000890821

ENVB:ComputerEquipmentAndLeaseholdImprovementsMember

2023-12-31

0000890821

ENVB:DistributionAgreementMember

ENVB:CanaccordGenuityLLCMember

2023-09-01

0000890821

ENVB:DistributionAgreementMember

ENVB:CanaccordGenuityLLCMember

2023-09-01

2023-09-01

0000890821

ENVB:DistributionAgreementMember

ENVB:CanaccordGenuityLLCMember

2024-01-01

2024-09-30

0000890821

ENVB:DistributionAgreementMember

ENVB:CanaccordGenuityLLCMember

2024-09-30

0000890821

ENVB:DistributionAgreementMember

ENVB:CanaccordGenuityLLCMember

2023-12-31

0000890821

ENVB:DistributionAgreementMember

2024-09-30

0000890821

ENVB:FebruaryWarrantsMember

2023-12-28

2023-12-28

0000890821

ENVB:FebruaryWarrantsMember

srt:MinimumMember

2023-12-28

2023-12-28

0000890821

ENVB:FebruaryWarrantsMember

srt:MaximumMember

2023-01-01

2023-12-31

0000890821

ENVB:FebruaryWarrantsMember

2023-12-28

0000890821

2024-01-01

2024-01-31

0000890821

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0000890821

ENVB:FebruaryWarrantsMember

2023-12-31

0000890821

ENVB:FebruaryWarrantsMember

2024-09-30

0000890821

ENVB:PurchaseAgreementMember

2024-03-08

2024-03-08

0000890821

ENVB:RegistrationRightsAgreementMember

2023-11-03

2023-11-03

0000890821

ENVB:PurchaseAgreementMember

2024-05-03

2024-05-03

0000890821

ENVB:PurchaseAgreementsMember

2024-05-03

2024-05-03

0000890821

ENVB:PurchaseAgreementsMember

2024-07-01

2024-09-30

0000890821

ENVB:PurchaseAgreementsMember

2024-01-01

2024-09-30

0000890821

ENVB:PurchaseAgreementsMember

2024-09-30

0000890821

ENVB:PurchaseAgreementsMember

2023-12-31

0000890821

ENVB:TwoThousandTwentyLongTermIncentivePlanMember

2023-11-02

0000890821

ENVB:TwoThousandTwentyLongTermIncentivePlanMember

ENVB:BoardMember

2024-03-31

0000890821

ENVB:TwoThousandTwentyLongTermIncentivePlanMember

ENVB:BoardMember

2024-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2024-07-01

2024-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2023-07-01

2023-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2024-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2024-07-01

2024-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2023-07-01

2023-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2024-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:CommonStockMember

2024-01-01

2024-09-30

0000890821

2023-01-01

2023-12-31

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2023-12-31

0000890821

us-gaap:GeneralAndAdministrativeExpenseMember

2024-07-01

2024-09-30

0000890821

us-gaap:GeneralAndAdministrativeExpenseMember

2023-07-01

2023-09-30

0000890821

us-gaap:GeneralAndAdministrativeExpenseMember

2024-01-01

2024-09-30

0000890821

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-09-30

0000890821

us-gaap:ResearchAndDevelopmentExpenseMember

2024-07-01

2024-09-30

0000890821

us-gaap:ResearchAndDevelopmentExpenseMember

2023-07-01

2023-09-30

0000890821

us-gaap:ResearchAndDevelopmentExpenseMember

2024-01-01

2024-09-30

0000890821

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-09-30

0000890821

us-gaap:WarrantMember

2023-12-31

0000890821

us-gaap:WarrantMember

2023-01-01

2023-12-31

0000890821

us-gaap:WarrantMember

2024-01-01

2024-09-30

0000890821

us-gaap:WarrantMember

2024-09-30

0000890821

ENVB:InvestmentOptionsMember

2023-12-31

0000890821

ENVB:InvestmentOptionsMember

2024-01-01

2024-09-30

0000890821

ENVB:InvestmentOptionsMember

2023-01-01

2023-12-31

0000890821

ENVB:InvestmentOptionsMember

2024-09-30

0000890821

ENVB:AvanceClinicalMember

2024-09-30

0000890821

ENVB:AvanceClinicalMember

2024-07-01

2024-09-30

0000890821

ENVB:AvanceClinicalMember

2024-01-01

2024-09-30

0000890821

ENVB:AvanceClinicalMember

2023-07-01

2023-09-30

0000890821

ENVB:AvanceClinicalMember

2023-01-01

2023-09-30

0000890821

ENVB:OtherConsultingAndVendorAgreementsMember

2024-09-30

0000890821

2023-05-31

2023-05-31

0000890821

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

ENVB:PurchaseAgreeentMember

2024-10-01

2024-11-14

0000890821

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

ENVB:PurchaseAgreeentMember

2024-11-12

0000890821

us-gaap:SubsequentEventMember

2024-10-09

2024-10-09

0000890821

us-gaap:SubsequentEventMember

ENVB:IncentivePlanMember

2024-10-09

0000890821

us-gaap:SubsequentEventMember

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:AUD

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the quarterly period ended: September 30, 2024

OR

☐

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the transition period from ___ to ___

Commission

File Number 001-38286

ENVERIC

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

95-4484725 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(IRS

Employer

Identification

No.) |

4851

Tamiami Trail N, Suite 200

Naples,

FL |

|

34103 |

| (Address

of principal executive offices) |

|

(Zip

code) |

(239) 302-1707

(Registrant’s telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value per share |

|

ENVB |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was

required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of November 12, 2024, there were 9,944,920 shares outstanding of Registrant’s Common Stock (par value $0.01 per share).

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

FORM

10-Q

TABLE

OF CONTENTS

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 3,111,683 | | |

$ | 2,287,977 | |

| Prepaid expenses and other current assets | |

| 1,226,576 | | |

| 1,293,554 | |

| Total current assets | |

| 4,338,259 | | |

| 3,581,531 | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Property and equipment, net | |

| 367,689 | | |

| 507,377 | |

| Intangible assets, net | |

| 84,368 | | |

| 210,932 | |

| Total other assets | |

| 452,057 | | |

| 718,309 | |

| Total assets | |

$ | 4,790,316 | | |

$ | 4,299,840 | |

| | |

| | | |

| | |

| LIABILITIES, MEZZANINE EQUITY, AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 576,324 | | |

$ | 1,218,783 | |

| Accrued liabilities | |

| 253,150 | | |

| 1,075,643 | |

| Investment option liability | |

| 4,944 | | |

| 23,608 | |

| Warrant liability | |

| 4,748 | | |

| 25,470 | |

| Total current liabilities | |

| 839,166 | | |

| 2,343,504 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 9) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Mezzanine equity | |

| | | |

| | |

| Series C redeemable preferred stock, $0.01 par value, 100,000 shares authorized, and 0 shares issued and outstanding as of September 30, 2024 and December 31, 2023 | |

| — | | |

| — | |

| Total mezzanine equity | |

| — | | |

| — | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Preferred stock, $0.01 par value, 20,000,000 shares authorized; Series B preferred stock, $0.01 par value, 3,600,000 shares authorized, 0 shares issued and outstanding as of September 30, 2024 and December 31, 2023 | |

| — | | |

| — | |

| Common stock, $0.01 par value, 100,000,000 shares authorized, 8,994,920 and 2,739,315 shares issued and outstanding as of September 30, 2024 and December 31, 2023 | |

| 89,949 | | |

| 27,392 | |

| Additional paid-in capital | |

| 107,316,058 | | |

| 100,815,851 | |

| Stock subscription receivable | |

| — | | |

| (1,817,640 | ) |

| Accumulated deficit | |

| (102,919,859 | ) | |

| (96,499,518 | ) |

| Accumulated other comprehensive loss | |

| (534,998 | ) | |

| (569,749 | ) |

| Total shareholders’ equity | |

| 3,951,150 | | |

| 1,956,336 | |

| Total liabilities, mezzanine equity, and shareholders’ equity | |

$ | 4,790,316 | | |

$ | 4,299,840 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

$ | 1,235,661 | | |

$ | 2,080,644 | | |

$ | 4,467,065 | | |

$ | 8,273,344 | |

| Research and development | |

| 762,717 | | |

| 1,281,455 | | |

| 1,736,373 | | |

| 5,531,436 | |

| Depreciation and amortization | |

| 84,814 | | |

| 86,296 | | |

| 255,002 | | |

| 259,300 | |

| Total operating expenses | |

| 2,083,192 | | |

| 3,448,395 | | |

| 6,458,440 | | |

| 14,064,080 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (2,083,192 | ) | |

| (3,448,395 | ) | |

| (6,458,440 | ) | |

| (14,064,080 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of warrant liabilities | |

| (122 | ) | |

| 67,822 | | |

| 20,722 | | |

| (115,342 | ) |

| Change in fair value of investment option liability | |

| (501 | ) | |

| 562,715 | | |

| 18,664 | | |

| (399,921 | ) |

| Change in fair value of derivative liability | |

| — | | |

| — | | |

| — | | |

| 727,000 | |

| Interest income (expense), net | |

| (217 | ) | |

| 2,237 | | |

| 444 | | |

| 3,142 | |

| Total other income (expense) | |

| (840 | ) | |

| 632,774 | | |

| 39,830 | | |

| 214,879 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| — | | |

| (6,595 | ) | |

| (1,731 | ) | |

| (6,595 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (2,084,032 | ) | |

| (2,822,216 | ) | |

| (6,420,341 | ) | |

| (13,855,796 | ) |

| Less preferred dividends attributable to non-controlling interest | |

| — | | |

| — | | |

| — | | |

| 19,041 | |

| Less deemed dividends attributable to accretion of embedded derivative at redemption value | |

| — | | |

| — | | |

| — | | |

| 147,988 | |

| Net loss attributable to shareholders | |

| (2,084,032 | ) | |

| (2,822,216 | ) | |

| (6,420,341 | ) | |

| (14,022,825 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation | |

| 31,497 | | |

| 10,433 | | |

| 34,751 | | |

| 1,115 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

$ | (2,052,535 | ) | |

$ | (2,811,783 | ) | |

$ | (6,385,590 | ) | |

$ | (14,021,710 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and diluted | |

$ | (0.24 | ) | |

$ | (1.30 | ) | |

$ | (0.95 | ) | |

$ | (6.62 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding, basic and diluted | |

| 8,702,951 | | |

| 2,164,656 | | |

| 6,771,162 | | |

| 2,117,153 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY

FOR

THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

| |

- | - |

Shares | | |

Amount | | |

Additional

Paid-In

Capital | | |

Subscription

Receivable | | |

Accumulated

Deficit | | |

Accumulated

Other

Comprehensive

Loss | | |

Total

Shareholders’

Equity | |

| |

| |

Common Stock | | |

| | |

| | |

| | |

| | |

| |

| |

| |

Shares | | |

Amount | | |

Additional

Paid-In

Capital | | |

Subscription

Receivable | | |

Accumulated

Deficit | | |

Accumulated

Other

Comprehensive

Loss | | |

Total

Shareholders’

Equity | |

| Balance at January 1, 2024 |

- | - |

| 2,739,315 | | |

| 27,392 | | |

| 100,815,851 | | |

| (1,817,640 | ) | |

| (96,499,518 | ) | |

| (569,749 | ) | |

| 1,956,336 | |

| Stock-based compensation |

- | - |

| — | | |

| — | | |

| 351,488 | | |

| — | | |

| — | | |

| — | | |

| 351,488 | |

| Common stock sold under the Equity Distribution Agreement, net of offering costs of $583,713 |

| |

| 1,668,000 | | |

| 16,680 | | |

| 1,792,109 | | |

| — | | |

| — | | |

| — | | |

| 1,808,789 | |

| Issuance of direct offering shares (see Note 7) |

| |

| 228,690 | | |

| 2,287 | | |

| 320,166 | | |

| — | | |

| — | | |

| — | | |

| 322,453 | |

| Exercise of Inducement Warrants for common stock |

| |

| 1,954,000 | | |

| 19,540 | | |

| 2,657,440 | | |

| — | | |

| — | | |

| — | | |

| 2,676,980 | |

| Proceeds from the subscription receivable related to the issuance of Inducement Warrants, net of offering costs of $12,821 |

| |

| — | | |

| — | | |

| (12,821 | ) | |

| 280,500 | | |

| — | | |

| — | | |

| 267,679 | |

| Proceeds from the subscription receivable related to the exercise of warrants and preferred investment options and issuance of common stock in abeyance |

| |

| 704,000 | | |

| 7,040 | | |

| (7,040 | ) | |

| 1,537,140 | | |

| — | | |

| — | | |

| 1,537,140 | |

| Foreign exchange translation gain |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 17,906 | | |

| 17,906 | |

| Net loss |

- | - |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,456,915 | ) | |

| — | | |

| (2,456,915 | ) |

| Balance at March 31, 2024 |

- | - |

| 7,294,005 | | |

$ | 72,939 | | |

$ | 105,917,193 | | |

$ | — | | |

$ | (98,956,433 | ) | |

$ | (551,843 | ) | |

$ | 6,481,856 | |

| Stock-based compensation |

| |

| — | | |

| — | | |

| 369,614 | | |

| — | | |

| — | | |

| — | | |

| 369,614 | |

| Common stock sold under the Purchase Agreement, net of offering costs of $82,850 |

| |

| 125,000 | | |

| 1,250 | | |

| (1,250 | ) | |

| — | | |

| — | | |

| — | | |

| — | |

| Issuance of direct offering shares (see Note 7) |

| |

| 458,000 | | |

| 4,580 | | |

| 444,260 | | |

| — | | |

| — | | |

| — | | |

| 448,840 | |

| Issuance of common shares for vested RSU |

| |

| 1,563 | | |

| 16 | | |

| (16 | ) | |

| — | | |

| — | | |

| — | | |

| — | |

| Foreign exchange translation loss |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (14,652 | ) | |

| (14,652 | ) |

| Net loss |

- | - |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,879,394 | ) | |

| — | | |

| (1,879,394 | ) |

| Balance at June 30, 2024 |

- | - |

| 7,878,568 | | |

$ | 78,785 | | |

$ | 106,729,801 | | |

$ | — | | |

$ | (100,835,827 | ) | |

$ | (566,495 | ) | |

$ | 5,406,264 | |

| Stock-based compensation |

| |

| — | | |

| — | | |

| 369,614 | | |

| — | | |

| — | | |

| — | | |

| 369,614 | |

| Common stock sold under the Purchase Agreement, net of offering costs of $290,029 |

| |

| 1,090,477 | | |

| 10,905 | | |

| 216,902 | | |

| — | | |

| — | | |

| — | | |

| 227,807 | |

| Issuance of common shares for vested RSU |

| |

| 25,875 | | |

| 259 | | |

| (259 | ) | |

| — | | |

| — | | |

| — | | |

| — | |

| Foreign exchange translation gain |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 31,497 | | |

| 31,497 | |

| Net loss |

- | - |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,084,032 | ) | |

| — | | |

| (2,084,032 | ) |

| Balance at September 30, 2024 |

- | - |

| 8,994,920 | | |

$ | 89,949 | | |

$ | 107,316,058 | | |

$ | — | | |

$ | (102,919,859 | ) | |

$ | (534,998 | ) | |

$ | 3,951,150 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY

FOR

THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

| | |

Shares | | |

Amount | | |

Total

Mezzanine

Equity | |

| |

Shares | | |

Amount | | |

Additional Paid-In Capital | | |

Accumulated Deficit | | |

Accumulated

Other

Comprehensive

Loss | | |

Total

Shareholders’

Equity | |

| | |

Redeemable Non-controlling Interest | | |

| |

| |

Common Stock | | |

| | |

| | |

| | |

| |

| | |

Shares | | |

Amount | | |

Total

Mezzanine

Equity | |

| |

Shares | | |

Amount | | |

Additional Paid-In Capital | | |

Accumulated Deficit | | |

Accumulated

Other

Comprehensive

Loss | | |

Total

Shareholders’

Equity | |

| Balance at January 1, 2023 | |

| 1,000 | | |

$ | 885,028 | | |

$ | 885,028 | |

| |

| 2,078,271 | | |

$ | 20,782 | | |

$ | 94,395,662 | | |

$ | (79,207,786 | ) | |

$ | (536,734 | ) | |

$ | 14,671,924 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| 532,835 | | |

| — | | |

| — | | |

| 532,835 | |

| Preferred dividends attributable to redeemable non-controlling interest | |

| — | | |

| 12,329 | | |

| 12,329 | |

| |

| — | | |

| — | | |

| (12,329 | ) | |

| — | | |

| — | | |

| (12,329 | ) |

| Accretion of embedded derivative to redemption value | |

| — | | |

| 110,991 | | |

| 110,991 | |

| |

| — | | |

| — | | |

| (110,991 | ) | |

| — | | |

| — | | |

| (110,991 | ) |

| Foreign exchange translation gain | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,968 | | |

| 1,968 | |

| Net loss | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| — | | |

| (4,677,527 | ) | |

| — | | |

| (4,677,527 | ) |

| Balance at March 31, 2023 | |

| 1,000 | | |

$ | 1,008,348 | | |

$ | 1,008,348 | |

| |

| 2,078,271 | | |

$ | 20,782 | | |

$ | 94,805,177 | | |

$ | (83,885,313 | ) | |

$ | (534,766 | ) | |

$ | 10,405,880 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| 879,738 | | |

| — | | |

| — | | |

| 879,738 | |

| Preferred dividends attributable to redeemable | |

| — | | |

| 6,712 | | |

| 6,712 | |

| |

| — | | |

| — | | |

| (6,712 | ) | |

| — | | |

| — | | |

| (6,712 | ) |

| Accretion of embedded derivative to redemption value | |

| — | | |

| 36,997 | | |

| 36,997 | |

| |

| — | | |

| — | | |

| (36,997 | ) | |

| — | | |

| — | | |

| (36,997 | ) |

| Redemption of Series A preferred stock | |

| (1,000 | ) | |

| (1,052,057 | ) | |

| (1,052,057 | ) |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Issuance of common shares in exchange for RSU conversions from the reduction in force | |

| — | | |

| — | | |

| — | |

| |

| 63,511 | | |

| 635 | | |

| (635 | ) | |

| — | | |

| — | | |

| — | |

| Foreign exchange translation loss | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| (11,286 | ) | |

| (11,286 | ) |

| Net loss | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| — | | |

| (6,356,053 | ) | |

| — | | |

| (6,356,053 | ) |

| Balance at June 30, 2023 | |

| — | | |

$ | — | | |

$ | — | |

| |

| 2,141,782 | | |

$ | 21,417 | | |

$ | 95,640,571 | | |

$ | (90,241,366 | ) | |

$ | (546,052 | ) | |

$ | 4,874,570 | |

| Balance | |

| — | | |

$ | — | | |

$ | — | |

| |

| 2,141,782 | | |

$ | 21,417 | | |

$ | 95,640,571 | | |

$ | (90,241,366 | ) | |

$ | (546,052 | ) | |

$ | 4,874,570 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| 372,859 | | |

| — | | |

| — | | |

| 372,859 | |

| Issuance of common shares for vested RSU | |

| — | | |

| — | | |

| — | |

| |

| 40,130 | | |

| 401 | | |

| (401 | ) | |

| — | | |

| — | | |

| — | |

| Foreign exchange translation gain | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| 10,433 | | |

| 10,433 | |

| Foreign exchange translation gain (loss) | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| — | | |

| — | | |

| 10,433 | | |

| 10,433 | |

| Net loss | |

| — | | |

| — | | |

| — | |

| |

| — | | |

| — | | |

| — | | |

| (2,822,216 | ) | |

| — | | |

| (2,822,216 | ) |

| Balance at September 30, 2023 | |

| — | | |

$ | — | | |

$ | — | |

| |

| 2,181,912 | | |

$ | 21,818 | | |

$ | 96,013,029 | | |

$ | (93,063,582 | ) | |

$ | (535,619 | ) | |

$ | 2,435,646 | |

| Balance | |

| — | | |

$ | — | | |

$ | — | |

| |

| 2,181,912 | | |

$ | 21,818 | | |

$ | 96,013,029 | | |

$ | (93,063,582 | ) | |

$ | (535,619 | ) | |

$ | 2,435,646 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

2024 | | |

2023 | |

| | |

For the Nine Months Ended September 30, | |

| | |

2024 | | |

2023 | |

| Cash Flows From Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (6,420,341 | ) | |

$ | (13,855,796 | ) |

| Adjustments to reconcile net loss to cash used in operating activities | |

| | | |

| | |

| Change in fair value of warrant liability | |

| (20,722 | ) | |

| 115,342 | |

| Change in fair value of investment option liability | |

| (18,664 | ) | |

| 399,921 | |

| Change in fair value of derivative liability | |

| — | | |

| (727,000 | ) |

| Stock-based compensation | |

| 1,090,716 | | |

| 1,785,432 | |

| Amortization of right of use asset | |

| — | | |

| 64,246 | |

| Amortization of intangibles | |

| 126,564 | | |

| 126,566 | |

| Depreciation expense | |

| 128,438 | | |

| 132,734 | |

| Gain on disposal of property and equipment | |

| — | | |

| (4,219 | ) |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| (3,674 | ) | |

| (746,033 | ) |

| Accounts payable and accrued liabilities | |

| (1,296,907 | ) | |

| 429,688 | |

| Right-of-use operating lease asset and obligation | |

| — | | |

| (64,244 | ) |

| Net cash used in operating activities | |

| (6,414,590 | ) | |

| (12,343,363 | ) |

| | |

| | | |

| | |

| Cash Flows From Investing Activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| — | | |

| (5,195 | ) |

| Proceeds from disposal of property and equipment | |

| — | | |

| 16,900 | |

| Net cash provided by investing activities | |

| — | | |

| 11,705 | |

| | |

| | | |

| | |

| Cash Flows From Financing Activities: | |

| | | |

| | |

| Proceeds from the subscription receivable related to the issuance of Inducement Warrants and the exercise of warrants and preferred investment options | |

| 1,804,819 | | |

| — | |

| Proceeds from exercise of Inducement Warrants | |

| 2,676,980 | | |

| — | |

| Proceeds from common stock sold under the Equity Distribution Agreement, net of offering costs | |

| 2,290,186 | | |

| — | |

| Proceeds from common stock sold under the Purchase Agreement, net of offering costs | |

| 599,862 | | |

| — | |

| Payment for offering costs previously accrued | |

| (161,461 | ) | |

| (105,000 | ) |

| Redemption of Series A Preferred Stock | |

| — | | |

| (1,052,057 | ) |

| Net cash provided by (used in) financing activities | |

| 7,210,386 | | |

| (1,157,057 | ) |

| | |

| | | |

| | |

| Effect of Foreign Exchange Rate on Changes on Cash | |

| 27,910 | | |

| 31,399 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| 823,706 | | |

| (13,457,316 | ) |

| Cash at beginning of period | |

| 2,287,977 | | |

| 17,723,884 | |

| Cash at end of period | |

$ | 3,111,683 | | |

$ | 4,266,568 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash and non-cash transactions: | |

| | | |

| | |

| Cash paid for interest | |

$ | — | | |

$ | — | |

| Income taxes paid | |

$ | 24,001 | | |

$ | 6,595 | |

| Offering costs accrued not paid | |

$ | 35,455 | | |

$ | 20,800 | |

| Deferred offering costs charged to offering costs | |

$ | 495,544 | | |

| — | |

| Issuance of common shares for offering costs | |

$ | 771,293 | | |

$ | — | |

| Preferred dividends attributable to redeemable non-controlling interest | |

$ | — | | |

$ | 19,041 | |

| Accretion of embedded derivative to redemption value | |

$ | — | | |

$ | 147,988 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1. BUSINESS AND LIQUIDITY AND OTHER UNCERTAINTIES

Nature

of Operations

Enveric

Biosciences, Inc. (“Enveric” or the “Company”) is a biotechnology company developing novel neuroplastogenic small-molecule

therapeutics for the treatment of depression, anxiety, and addiction disorders. The head office of the Company is located in Naples,

Florida. The Company has the following wholly-owned subsidiaries: Jay Pharma Inc. (“Jay Pharma”), 1306432 B.C. Ltd., MagicMed

Industries, Inc. (“MagicMed”), Enveric Biosciences Canada Inc., Akos Biosciences, Inc. (“Akos”), and Enveric

Therapeutics, Pty. Ltd. (“Enveric Therapeutics”).

Leveraging

its unique discovery and development platform, The Psybrary™, Enveric has created a robust intellectual property portfolio of new

chemical entities for specific mental health indications. Enveric’s lead program, the EVM201 Series, comprises next generation

synthetic prodrugs of the active metabolite, psilocin. Enveric is developing the first product from the EVM201 Series – EB-002

(formerly EB-373) – for the treatment of psychiatric disorders. Enveric is also advancing its product EB-003, a non-hallucinogenic

neuroplastogen from the EVM301 Series, which is expected to offer a first-in-class, new approach to the treatment of difficult-to-address

mental health disorders, mediated by the promotion of neuroplasticity without also inducing hallucinations in the patient.

The

Company has continued to pursue the development of MagicMed’s proprietary library, the Psybrary™ which the Company believes

will help to identify and develop the right drug candidates needed to address mental health challenges. The Company synthesizes novel

analogues of serotonin, using a mixture of chemistry and synthetic biology, resulting in the expansion of the Psybrary™, which

includes 15 patent families with over a million potential variations and hundreds of synthesized molecules. The Company has created over

1,200 novel molecular compounds and derivatives that are housed in the Psybrary™. The Company’s current focus is to develop

its lead molecules, EB-002 and EB-003, and to out license other molecules from the Psybrary™.

The

Company screens newly synthesized molecules in the Psybrary™ through PsyAI™, a proprietary artificial intelligence (“AI”)

tool. Leveraging AI systems is expected to reduce the time and cost of pre-clinical, clinical, and commercial development. The Company

believes it streamlines pharmaceutical design by predicting ideal binding structures of molecules, manufacturing capabilities, and pharmacological

effects to help determine ideal drug candidates, tailored to each indication. Each of these molecules that the Company believes are patentable

can then be further screened to see how changes to its makeup alter its effects in order to synthesize additional new molecules. New

compounds of sufficient purity are undergoing pharmacological screening, including non-clinical (receptors/cell lines), preclinical (animal),

and ultimately clinical (human) evaluations. The Company intends to utilize the Psybrary™ and the AI tool to categorize and characterize

the Psybrary™ substituents to focus on bringing more non-hallucinogenic neuroplastogen molecules from discovery to the clinical

phase.

Going

Concern, Liquidity and Other Uncertainties

The

Company has incurred a loss since inception resulting in an accumulated deficit of $102,919,859 as of September 30, 2024, and further

losses are anticipated in the development of its business. For the nine months ended September 30, 2024, the Company has operating cash

outflows of $6,414,590 and had a loss from operations of $6,458,440. Being a research and development company, since inception, the Company

has not yet generated revenue and the Company has incurred continuing losses from its operations. The Company’s operations have

been funded principally through the issuance of equity. These factors raise substantial doubt about the Company’s ability to continue

as a going concern for a period of one year from the issuance of these unaudited condensed consolidated financial statements.

In

assessing the Company’s ability to continue as a going concern, the Company monitors and analyzes its cash and its ability to generate

sufficient cash flow in the future to support its operating and capital expenditure commitments. At September 30, 2024, the Company had

cash of $3,111,683 and working capital of $3,499,093. The Company’s current cash on hand is not sufficient to satisfy its operating

cash needs for the 12 months from the filing of this Quarterly Report on Form 10-Q. These conditions raise substantial doubt regarding

the Company’s ability to continue as a going concern for a period of one year after the date the financial statements are issued.

Management’s plan to alleviate the conditions that raise substantial doubt include raising additional working capital through public

or private equity or debt financings or other sources, the Purchase Agreement with Lincoln Park (see Note 7), subject to registration,

and may include additional collaborations with third parties as well as disciplined cash spending. Adequate additional financing may

not be available to us on acceptable terms, or at all. Should the Company be unable to raise sufficient additional capital, the Company

may be required to undertake further cost-cutting measures including delaying or discontinuing certain operating activities.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

As

a result of these factors, management has concluded that there is substantial doubt about the Company’s ability to continue as

a going concern for a period of one year after the date of the unaudited condensed consolidated financial statements are issued. The

Company’s unaudited condensed consolidated financial statements do not include any adjustments that might result from the outcome

of this uncertainty.

Inflation

Risks

The

Company considers the current inflationary trend existing in the North American economic environment reasonably likely to have a material

unfavorable impact on results of continuing operations. Higher rates of price inflation, as compared to recent prior levels of price

inflation, have caused a general increase in the cost of labor and materials. In addition, there is an increased risk of the Company

experiencing labor shortages due to a potential inability to attract and retain human resources due to increased labor costs resulting

from the current inflationary environment.

Nasdaq

Notice

On

November 21, 2023, the Company received a letter from the Listing Qualifications Department of the Nasdaq Stock Market (“Nasdaq”)

stating that as of September 30, 2023, the Company did not meet the minimum of $2,500,000 in stockholders’ equity required for

continued listing pursuant to Nasdaq Listing Rule 5550(b)(1). On February 6, 2024, the Company received a letter from Nasdaq, granting

the Company an extension to regain compliance with the minimum stockholders’ equity requirement by May 20, 2024. On May 21, 2024,

the Company received a letter from Nasdaq notifying the Company that it regained compliance with the minimum stockholders’ equity

requirement for continued listing on the Nasdaq.

On

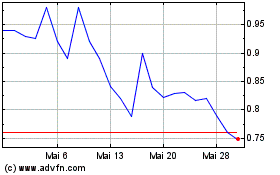

May 16, 2024, the Company received a letter from Nasdaq’s Listing Qualifications Department stating that because the closing bid

price for the Company’s common stock listed on Nasdaq was below $1.00 for 30 consecutive business days, the Company no longer meets

the minimum bid price requirement for continued listing on the Nasdaq Capital Market (the “Minimum Bid Price Requirement”).

The Company received an initial period of 180 calendar days from May 16, 2024, or until November 12, 2024, to regain compliance with

the Minimum Bid Price Requirement and was unable to regain compliance during that time. The Company has applied for a second 180-day

compliance period. As of the date hereof, the Company has not heard whether it will be granted the second compliance period. The Company

anticipates conducting a reverse split during the first or second quarter of 2025 in order to regain compliance with the Minimum Bid

Price Requirement if the bid price of the Company’s common stock fails to close at or above $1.00 per share for a minimum of 10

consecutive business days prior the end of the second compliance period.

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of Presentation and Principal of Consolidation

The

accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally

accepted in the United States (“U.S. GAAP”) for interim financial information and Article 8 of Regulation S-X. Accordingly,

they do not include all the information and footnotes required by U.S. GAAP for complete financial statements. Management’s opinion

is that all adjustments (consisting of normal accruals) considered necessary for a fair presentation have been included. Operating results

for the three and nine months ended September 30, 2024 are not necessarily indicative of the results that may be expected for the year

ending December 31, 2024. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated

financial statements for the year ended December 31, 2023, and related notes thereto included in the Company’s Annual Report on

Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 26, 2024.

The

Company’s significant accounting policies and recent accounting standards are summarized in Note 2 of the Company’s consolidated

financial statements for the year ended December 31, 2023. There were no significant changes to these accounting policies during the

three and nine months ended September 30, 2024.

Use

of Estimates

The

preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates

and assumptions that affect the reported amount of assets and liabilities at the date of the financial statements and expenses during

the periods reported. By their nature, these estimates are subject to measurement uncertainty and the effects on the financial statements

of changes in such estimates in future periods could be significant. Significant areas requiring management’s estimates and assumptions

include determining the fair value of transactions involving common stock, the valuation of warrants and preferred investment options,

and the valuation of stock-based compensation and accruals associated with third party providers supporting research and development

efforts. Actual results could differ from those estimates.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Reclassification

Certain

reclassifications have been made to the prior period’s unaudited condensed consolidated financial statements in order to conform

to the current year presentation. In the prior year, the Company included certain investor related expenses within research and development

on the unaudited condensed consolidated statements of operations. These expenses were reclassified to general and administrative expenses

in the current year. This reclassification had no effect on the Company’s previously reported results of operations, changes in

equity, or cash flows.

Foreign

Currency Translation

From

inception through September 30, 2024, the reporting currency of the Company was the United States dollar while the functional currency

of certain of the Company’s subsidiaries was the Canadian dollar and Australian dollar. For the reporting periods ended September

30, 2024 and 2023, the Company engaged in a number of transactions denominated in Canadian dollars and Australian dollars. As a result,

the Company is subject to exposure from changes in the exchange rates of the Canadian dollar and Australian dollar against the United

States dollar.

The

Company translates the assets and liabilities of its Canadian subsidiaries and Australian subsidiary into the United States dollar at

the exchange rate in effect on the balance sheet date. Revenues and expenses are translated at the average exchange rate in effect during

each monthly period. Unrealized translation gains and losses are recorded as foreign currency translation gain (loss), which is included

in the unaudited condensed consolidated statements of shareholders’ equity as a component of accumulated other comprehensive loss.

The

Company has not entered into any financial derivative instruments that expose it to material market risk, including any instruments designed

to hedge the impact of foreign currency exposures. The Company may, however, hedge such exposure to foreign currency exchange fluctuations

in the future.

Adjustments

that arise from exchange rate changes on transactions denominated in a currency other than the local currency are included in other comprehensive

loss in the unaudited condensed consolidated statements of operations and comprehensive loss as incurred.

Concentration

of Credit Risk

Financial

instruments that potentially subject the Company to concentrations of credit risk consist of cash accounts in a financial institution,

which at times, may exceed the federal depository insurance coverage of $250,000 in the United States and Australia and $100,000 in Canada.

The Company has not experienced losses on these accounts, and management believes the Company is not exposed to significant risks on

such accounts. As of September 30, 2024, the Company had greater than $250,000 at United States financial institutions, greater than

$250,000 at Australian financial institutions, and less than $100,000 at Canadian financial institutions.

Research

and Development

Research

and development expenses are charged to operations as incurred. Research and development expenses include, among other things, internal

and external costs associated with preclinical development, pre-commercialization manufacturing expenses, and clinical trials. The Company

accrues for costs incurred as the services are being provided by monitoring the status of the trial or services provided and the invoices

received from its external service providers. In the case of clinical trials, a portion of the estimated cost normally relates to the

projected cost to treat a patient in the trials, and this cost is recognized based on the number of patients enrolled in the trial. As

actual costs become known, the Company adjusts its accruals accordingly.

Income

Taxes

The

Company files U.S. federal and state returns. The Company’s foreign subsidiary also files a local tax return in their local jurisdiction.

From a U.S. federal, state, and Canadian perspective, the years that remain open to examination are consistent with each jurisdiction’s

statute of limitations. The Company receives no tax benefit from operating losses due to a full valuation allowance.

Research

and Development Tax Incentive Receivable

The

Company, through its wholly-owned subsidiary in Australia, participates in the Australian research and development tax incentive program,

such that a percentage of the Company’s qualifying research and development expenditures are reimbursed by the Australian government,

and such incentives are reflected as a reduction of research and development expense. The Australian research and development tax incentive

is recognized when there is reasonable assurance that the incentive will be received, the relevant expenditure has been incurred and

the amount of the consideration can be reliably measured. At each period end, management estimates the reimbursement available to the

Company based on available information at the time.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Net

Loss per Share

Basic

net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period.

Diluted loss per share is computed using the weighted average number of common shares and, if dilutive, potential common shares outstanding

during the period. Potential common shares consist of the incremental common shares issuable upon the exercise of stock options and warrants

(using the treasury stock method). The computation of basic net loss per share for the three and nine months ended September 30, 2024

and 2023 excludes potentially dilutive securities. The computations of net loss per share for each period presented is the same for both

basic and fully diluted. In accordance with ASC 260 “Earnings per Share” (“ASC 260”), penny warrants were included

in the calculation of weighted average shares outstanding for the purposes of calculating basic and diluted earnings per share.

Potentially

dilutive securities outlined in the table below have been excluded from the computation of diluted net loss per share for the three and

nine months ended September 30, 2024 and 2023 because the effect of their inclusion would have been anti-dilutive.

SCHEDULE OF POTENTIALLY DILUTIVE SECURITIES

| | |

For the three and nine months ended

September 30, 2024 | | |

For the three and nine months ended

September 30, 2023 | |

| Warrants to purchase shares of common stock | |

| 844,628 | | |

| 609,893 | |

| Restricted stock units - vested and unissued | |

| 20,526 | | |

| 20,847 | |

| Restricted stock units - unvested | |

| 351,616 | | |

| 148,251 | |

| Investment options to purchase shares of common stock | |

| 70,000 | | |

| 1,070,000 | |

| Options to purchase shares of common stock | |

| 23,082 | | |

| 31,852 | |

| Total potentially dilutive securities | |

| 1,309,852 | | |

| 1,880,843 | |

Recent

Accounting Pronouncements

In

November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. ASU

2023-07 updates reportable segment disclosure requirements primarily through enhanced disclosures about significant segment expenses.

ASU 2023-07 is effective for all entities for fiscal years beginning after December 15, 2023, and for interim periods within fiscal years

beginning after December 15, 2024. Early adoption is permitted. The amendments should be applied retrospectively to all prior periods

presented in the financial statements. The Company is currently assessing the potential impacts of ASU 2023-07, however as the Company

currently has one reportable segment, does not expect this guidance will not have a material impact on its unaudited condensed consolidated

financial statements.

In

December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which amends the

disclosure to address investor requests for more transparency about income tax information through improvements to income tax disclosures

primarily related to the rate reconciliation and income taxes paid information and includes certain other amendments to improve the effectiveness

of income tax disclosures. The ASU is effective on a prospective basis for annual periods beginning after December 15, 2024, and early

adoption and retrospective application are permitted. Early adoption is permitted. The Company is currently assessing potential impacts

of ASU 2023-09 and does not expect the adoption of this guidance will have a material impact on its unaudited condensed consolidated

financial statements and disclosures.

In

November 2024, the FASB issued ASU 2024-03, Income Statement (Topic 220): Reporting Comprehensive Income - Expense Disaggregation

Disclosures, Disaggregation of Income Statement Expenses, that requires public companies to disclose, in interim and reporting periods,

additional information about certain expenses in the financial statements. The ASU is effective for annual periods beginning after December

15, 2026, and interim reporting periods beginning after December 15, 2027. Early adoption is permitted and is effective on either a prospective

basis or retrospective basis. The Company is currently assessing the potential impacts of ASU 2024-03.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

3. PREPAID EXPENSES AND OTHER CURRENT ASSETS

As

of September 30, 2024 and December 31, 2023, the prepaid expenses and other current assets of the Company consisted of the following:

SCHEDULE OF PREPAID EXPENSES AND OTHER CURRENT ASSETS

| | |

September 30, 2024 | | |

December 31, 2023 | |

| Prepaid research and development | |

$ | 106,138 | | |

$ | 46,320 | |

| Prepaid value-added taxes | |

| 245,972 | | |

| 243,429 | |

| Prepaid insurance | |

| 249,048 | | |

| 149,559 | |

| Prepaid other | |

| 99,061 | | |

| 62,036 | |

| Deferred offering costs (see Note 7) | |

| 508,599 | | |

| 567,603 | |

| Franchise tax receivable | |

| 17,758 | | |

| 79,258 | |

| R&D tax incentive receivable | |

| — | | |

| 145,349 | |

| Total prepaid expenses and other current assets | |

$ | 1,226,576 | | |

$ | 1,293,554 | |

NOTE

4. INTANGIBLE ASSETS

As

of September 30, 2024, the Company’s intangible assets consisted of:

SCHEDULE OF INTANGIBLE ASSETS

| Definite lived intangible assets | |

| | |

| Balance at January 1, 2024 | |

$ | 210,932 | |

| Amortization | |

| (126,564 | ) |

| Balance at September 30, 2024 | |

$ | 84,368 | |

For

identified definite lived intangible assets, there was no impairment expense during the three and nine months ended September 30, 2024

and 2023. For identified definite lived intangible assets, amortization expense amounted to $42,188 and $42,191 during the three months

ended September 30, 2024 and 2023, respectively and $126,564 and $126,566 during each of the nine months ended September 30, 2024 and

2023, respectively.

NOTE

5. PROPERTY AND EQUIPMENT

Property

and equipment consists of the following assets which are located in Calgary, Canada, with all amounts converted into U.S. dollars:

SCHEDULE OF PROPERTY PLANT AND EQUIPMENT NET OF ACCUMULATED DEPRECIATION

| | |

September 30, 2024 | | |

December 31, 2023 | |

| Lab equipment | |

$ | 819,784 | | |

$ | 836,709 | |

| Computer equipment and leasehold improvements | |

| 27,804 | | |

| 28,379 | |

| Property and equipment, gross | |

| 27,804 | | |

| 28,379 | |

| Less: Accumulated depreciation | |

| (479,899 | ) | |

| (357,711 | ) |

| Property and equipment, net of accumulated depreciation | |

$ | 367,689 | | |

$ | 507,377 | |

Depreciation

expense was $42,626 and $44,105 for the three months ended September 30, 2024 and 2023, respectively and $128,438 and $132,734 for the

nine months ended September 30, 2024 and 2023, respectively.

NOTE

6. ACCRUED LIABILITIES

As

of September 30, 2024 and December 31, 2023, the accrued liabilities of the Company consisted of the following:

SCHEDULE OF ACCRUED LIABILITIES

| | |

September 30, 2024 | | |

December 31, 2023 | |

| Product development | |

$ | 112,346 | | |

$ | 139,981 | |

| Accrued salaries, wages, and bonuses | |

| 8,736 | | |

| 8,889 | |

| Professional fees | |

| 114,068 | | |

| 584,810 | |

| Accrued restructuring costs (see Note 9) | |

| — | | |

| 301,645 | |

| Accrued franchise taxes | |

| — | | |

| 22,318 | |

| Patent costs | |

| 18,000 | | |

| 18,000 | |

| Total accrued expenses | |

$ | 253,150 | | |

$ | 1,075,643 | |

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

7. SHARE CAPITAL AND OTHER EQUITY INSTRUMENTS

Equity

Distribution Agreement

On

September 1, 2023, the Company entered into the Equity Distribution Agreement (the “Distribution Agreement”), with Canaccord

Genuity LLC (“Canaccord”), pursuant to which the Company may offer and sell from time to time, through Canaccord as sales

agent and/or principal, shares of common stock of the Company, par value $0.01 per share having an aggregate offering price of up to

$10.0 million. Due to the offering limitations applicable to the Company and in accordance with the terms of the Distribution Agreement,

the Company may offer Common Stock having an aggregate gross sales price of up to $2,392,514 pursuant to the prospectus supplement dated

September 1, 2023 (the “Prospectus Supplement”). Subject to the terms and conditions of the Distribution Agreement, Canaccord

may sell the Common Stock by any method permitted by law deemed to be an “at-the-market offering”. The Company will pay Canaccord

a commission equal to 3.0% of the gross sales price of the Common Stock sold through Canaccord under the Distribution Agreement and has

also agreed to reimburse Canaccord for certain expenses. The Company may also sell Common Stock to Canaccord as principal for Canaccord’s

own account at a price agreed upon at the time of sale. Any sale of Common Stock to Canaccord as principal would be pursuant to the terms

of a separate terms agreement between the Company and Canaccord.

During

the nine months ended September 30, 2024, the Company issued 1,668,000 shares of common stock for gross proceeds of $2,392,502 under

the Distribution Agreement, and charged offering costs of $583,713 to additional paid in capital on the unaudited condensed consolidated

balance sheet. As of September 30, 2024 and December 31, 2023, there were deferred offering costs related to the Distribution Agreement

of $0 and $171,944, respectively. As of September 30, 2024, there is $0 available under the Distribution Agreement.

On

December 28, 2023, the Company entered into warrant exercise inducement offer letters (the “Inducement Letters”) with certain

holders (the “Holders”) of the February 2022 Post-Modification Warrants and RD and PIPE preferred investment options to purchase

shares of the Company’s common stock (the “Existing Warrants and Investment Options”) pursuant to which the Holders

agreed to exercise for cash their Existing Warrants and Investment Options to purchase 1,122,000 shares of the Company’s common

stock, in the aggregate, at a reduced exercised price of $1.37 per share (from an original exercise price of $7.78 per share), in exchange

for the Company’s agreement to issue new warrants (the “Inducement Warrants”) to purchase up to 2,244,000 shares of

the Company’s common stock (the “Inducement Warrant Shares”), and the Holders to make a cash payment of $0.125 per

Inducement Warrant share for total proceeds of $280,500. In January 2024, the Company received aggregate gross proceeds of $1,817,640

from the exercise of the Existing Warrants and Investment Options by the Holders and the sale of the Inducement Warrants. Because the

Existing Warrants and Investment Options by the Holders and the sale of the Inducement Warrants that exercised on December 28, 2023 and

unsettled until January 2024, the proceeds are included in the condensed consolidated balance sheet as a subscription receivable as of

December 31, 2023. As of December 31, 2023, 418,000 shares of the Existing Warrants and Investment Options exercised were considered

issued as the Company had the enforceable right to the obtain the cash proceeds, which were in-transit, and the Holders were no longer

able to rescind the exercise election. Due to the beneficial ownership limitation provisions, 704,000 shares of the Existing Warrants

and Investment Options exercised were initially unissued and held in abeyance for the benefit of the Holder until notice is received

from the Holder that the shares may be issued in compliance with such limitation. During the nine months ended September 30, 2024, the

Company issued all 704,000 shares of common stock of the 704,000 shares of Existing Warrants and Investment Options exercised that were

held in abeyance due to the beneficial ownership limitation provisions.

On

December 28, 2023, the Company entered into warrant exercise inducement offer letters (the “Inducement Letters”) with certain

holders of warrants and preferred investment options. The Inducement Letters prohibit the Company from entering into any variable rate

transaction as defined in the Inducement Letters, including the issuance of (1) any variable priced debt or equity securities or (2)

transactions whereby the Company may issue securities at a future determined price, such as through an at-the-market offering or an equity

line of credit. The variable rate transaction restriction would have expired after six-months from the closing date of December 28, 2023

for the Inducement Letters for an issuance through an at-the-market offering, and one-year for the remaining variable rate transactions,

however the restriction was waived for the at-the-market offering on March 8, 2024 and the equity line on May 3, 2024.

On

March 8, 2024, the Company entered into a series of common stock purchase agreements for the issuance in a registered direct offering

of 228,690 shares of the Company’s common stock to the Holders of the Inducement Warrants. The issuance was made in exchange for

the permanent and irrevocable waiver of the variable rate transaction limitation solely with respect to the entry into and/or issuance

of shares of common stock in an at the market offering contained in the Inducement Letters. The fair value of the shares issued for consideration

of waiving the variable rate transaction limitation was $322,453 and was charged to additional paid in capital, as it is direct and incremental

to the Distribution Agreement, on the unaudited condensed consolidated balance sheet as an offering cost related to the Distribution

Agreement.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Lincoln

Park Equity Line

On

November 3, 2023, the Company entered into a Purchase Agreement (the “Purchase Agreement”) and a registration rights agreement

(the “Registration Rights Agreement”), with Lincoln Park Capital Fund, LLC (“Lincoln Park”), pursuant to which

Lincoln Park has committed to purchase up to $10.0 million of the Company’s common stock subject to certain limitations and satisfaction

of the conditions set forth in the Purchase Agreement.

Under

the terms and subject to the conditions of the Purchase Agreement, the Company has the right, but not the obligation, to sell to Lincoln

Park, and Lincoln Park is obligated to purchase up to $10.0 million of the Company’s Common Stock (the “Purchase Shares”).

However, such sales of Common Stock by the Company, if any, will be subject to important limitations set forth in the Purchase Agreement,

including limitations on number of shares that may be sold. Sales may occur from time to time, at the Company’s sole discretion,

over the 24-month period commencing on the date that the conditions to Lincoln Park’s purchase obligation set forth in the Purchase

Agreement are satisfied, including that a registration statement on Form S-1 covering the resale of the shares of the Company’s

Common Stock that have been and may be issued to Lincoln Park under the Purchase Agreement, which the Company has filed with the SEC

pursuant to the Registration Rights Agreement, is declared effective by the SEC and a final prospectus relating thereto is filed with

the SEC. As required under the Purchase Agreement, the Company registered a resale of 1,140,477 shares of our common stock, plus the