UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June 30, 2024

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________

to ______________

Commission File Number 001-38174

Citius Pharmaceuticals, Inc.

(Exact name of registrant as specified in its

charter)

| Nevada | | 27-3425913 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

| 11 Commerce Drive, First Floor, Cranford, NJ | | 07016 |

| (Address of principal executive offices) | | (Zip Code) |

(908) 967-6677

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common stock, $0.001 par value | | CTXR | | Nasdaq Capital Market |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

☒

As of August 12, 2024, there were

180,725,407 shares of common stock, $0.001 par value, of the registrant issued and outstanding.

Citius Pharmaceuticals, Inc.

FORM 10-Q

TABLE OF CONTENTS

June 30, 2024

EXPLANATORY NOTE

In this Quarterly Report on Form 10-Q, and unless

the context otherwise requires, the “Company,” “we,” “us,” and “our” refer to Citius

Pharmaceuticals, Inc. (“Citius Pharma”) and its wholly-owned subsidiaries Leonard-Meron Biosciences, Inc., and Citius Oncology,

Inc. (“Citius Oncology”), and its majority-owned subsidiary, NoveCite, Inc., taken as a whole.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking

statements.” Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations,

strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements

are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These

statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore,

actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements

due to numerous factors discussed from time to time in this Report and in other documents which we file with the Securities and Exchange

Commission. In addition, such statements could be affected by risks and uncertainties related to:

| |

● |

our ability to apply for, obtain and maintain required regulatory approvals

for our product candidates; |

| |

|

|

| |

● |

the cost, timing and results of our pre-clinical and clinical trials; |

| |

|

|

| |

● |

our ability to raise funds for general corporate purposes and operations,

including our pre-clinical and clinical trials; |

| |

● |

the commercial feasibility and success of our technology and product

candidates; |

| |

● |

our ability to recruit and retain qualified management and technical

personnel to carry out our operations; |

| |

|

|

| |

● |

our ability to realize some or all of the benefits expected to result

from the spinoff of Citius Oncology, or the delay of such benefits; |

| |

|

|

| |

● |

our ongoing businesses may be adversely affected and subject to certain

risks and consequences as a result of the spinoff of Citius Oncology; and |

| |

● |

the other factors discussed in the “Risk Factors” section

of our most recent Annual Report on Form 10-K for the fiscal year ended September 30, 2023, filed with the Securities and Exchange

Commission on December 29, 2023, and elsewhere in this Report. |

Any forward-looking statements speak only as

of the date on which they are made, and except as may be required under applicable securities laws, we do not undertake any obligation

to update any forward-looking statement to reflect events or circumstances after the filing date of this Report.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

CITIUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | |

June 30, | | |

September 30, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| Current Assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 17,911,192 | | |

$ | 26,480,928 | |

| Prepaid expenses | |

| 10,094,597 | | |

| 7,889,506 | |

| Total Current Assets | |

| 28,005,789 | | |

| 34,370,434 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| — | | |

| 1,432 | |

| Operating lease right-of-use asset, net | |

| 299,932 | | |

| 454,426 | |

| Deposits | |

| 38,062 | | |

| 38,062 | |

| In-process research and development | |

| 59,400,000 | | |

| 59,400,000 | |

| Goodwill | |

| 9,346,796 | | |

| 9,346,796 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 97,090,579 | | |

$ | 103,611,150 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,663,336 | | |

$ | 2,927,334 | |

| Accrued expenses | |

| 550,485 | | |

| 476,300 | |

| Accrued compensation | |

| 1,702,668 | | |

| 2,156,983 | |

| Operating lease liability | |

| 235,581 | | |

| 218,380 | |

| Total Current Liabilities | |

| 4,152,070 | | |

| 5,778,997 | |

| | |

| | | |

| | |

| Deferred tax liability | |

| 6,569,800 | | |

| 6,137,800 | |

| Operating lease liability – noncurrent | |

| 84,430 | | |

| 262,865 | |

| Total Liabilities | |

| 10,806,300 | | |

| 12,179,662 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock – $0.001 par value; 10,000,000 shares authorized; no shares issued and outstanding | |

| — | | |

| — | |

| Common stock – $0.001 par value; 400,000,000 shares authorized; 180,725,407 and 158,857,798 shares issued and outstanding at June 30, 2024 and September 30, 2023, respectively | |

| 180,725 | | |

| 158,858 | |

| Additional paid-in capital | |

| 276,083,228 | | |

| 252,903,629 | |

| Accumulated deficit | |

| (190,580,054 | ) | |

| (162,231,379 | ) |

| Total Citius Pharmaceuticals, Inc. Stockholders’ Equity | |

| 85,683,899 | | |

| 90,831,108 | |

| Non-controlling interest | |

| 600,380 | | |

| 600,380 | |

| Total Equity | |

| 86,284,279 | | |

| 91,431,488 | |

| | |

| | | |

| | |

| Total Liabilities and Equity | |

$ | 97,090,579 | | |

$ | 103,611,150 | |

See notes to unaudited condensed consolidated

financial statements.

CITIUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE AND NINE MONTHS ENDED JUNE 30,

2024 AND 2023

(Unaudited)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

June 30, | | |

June 30, | | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,763,865 | | |

| 3,764,675 | | |

| 8,991,673 | | |

| 11,937,045 | |

| General and administrative | |

| 4,808,551 | | |

| 3,733,326 | | |

| 12,755,190 | | |

| 11,129,463 | |

| Stock-based compensation – general and administrative | |

| 3,061,763 | | |

| 1,174,111 | | |

| 9,198,340 | | |

| 3,540,787 | |

| Total Operating Expenses | |

| 10,634,179 | | |

| 8,672,112 | | |

| 30,945,203 | | |

| 26,607,295 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Loss | |

| (10,634,179 | ) | |

| (8,672,112 | ) | |

| (30,945,203 | ) | |

| (26,607,295 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 204,843 | | |

| 336,780 | | |

| 640,686 | | |

| 854,604 | |

| Gain on sale of New Jersey net operating losses | |

| — | | |

| — | | |

| 2,387,842 | | |

| 3,585,689 | |

| Total Other Income | |

| 204,843 | | |

| 336,780 | | |

| 3,028,528 | | |

| 4,440,293 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before Income Taxes | |

| (10,429,336 | ) | |

| (8,335,332 | ) | |

| (27,916,675 | ) | |

| (22,167,002 | ) |

| Income tax expense | |

| 144,000 | | |

| 144,000 | | |

| 432,000 | | |

| 432,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (10,573,336 | ) | |

| (8,479,332 | ) | |

| (28,348,675 | ) | |

| (22,599,002 | ) |

| Deemed dividend on warrant extension | |

| 321,559 | | |

| — | | |

| 321,559 | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Applicable to Common Stockholders | |

$ | (10,894,895 | ) | |

$ | (8,479,332 | ) | |

$ | (28,670,234 | ) | |

$ | (22,599,002 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Net Loss Per Share - Basic and Diluted | |

$ | (0.06 | ) | |

$ | (0.06 | ) | |

$ | (0.17 | ) | |

$ | (0.15 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Common Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

Basic and diluted | |

| 173,856,960 | | |

| 153,775,380 | | |

| 163,947,311 | | |

| 148,746,002 | |

See notes to unaudited condensed consolidated

financial statements.

CITIUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES

IN STOCKHOLDERS’ EQUITY

FOR THE THREE AND NINE MONTHS ENDED JUNE 30,

2024 AND 2023

(Unaudited)

| | |

Preferred | | |

Common Stock | | |

Additional

Paid-In | | |

Accumulated | | |

Total Citius

Pharmaceuticals,

Inc. Stockholders’ | | |

Non-Controlling | | |

Total | |

| | |

Stock | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | | |

Interest | | |

Equity | |

| Balance, September 30, 2023 | |

$ | — | | |

| 158,857,798 | | |

$ | 158,858 | | |

$ | 252,903,629 | | |

$ | (162,231,379 | ) | |

$ | 90,831,108 | | |

$ | 600,380 | | |

$ | 91,431,488 | |

| Issuance of common stock for services | |

| — | | |

| 108,778 | | |

| 109 | | |

| 76,037 | | |

| — | | |

| 76,146 | | |

| — | | |

| 76,146 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| 3,058,185 | | |

| — | | |

| 3,058,185 | | |

| — | | |

| 3,058,185 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (9,231,185 | ) | |

| (9,231,185 | ) | |

| — | | |

| (9,231,185 | ) |

| Balance, December 31, 2023 | |

| — | | |

| 158,966,576 | | |

| 158,967 | | |

| 256,037,851 | | |

| (171,462,564 | ) | |

| 84,734,254 | | |

| 600,380 | | |

| 85,334,634 | |

| Issuance of common stock for services | |

| — | | |

| 128,205 | | |

| 128 | | |

| 97,951 | | |

| — | | |

| 98,079 | | |

| — | | |

| 98,079 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| 3,078,392 | | |

| — | | |

| 3,078,392 | | |

| — | | |

| 3,078,392 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (8,544,154 | ) | |

| (8,544,154 | ) | |

| — | | |

| (8,544,154 | ) |

| Balance, March 31, 2024 | |

| — | | |

| 159,094,781 | | |

| 159,095 | | |

| 259,214,194 | | |

| (180,006,718 | ) | |

| 79,366,571 | | |

| 600,380 | | |

| 79,966,951 | |

| Issuance of common stock for services | |

| — | | |

| 150,000 | | |

| 150 | | |

| 109,800 | | |

| — | | |

| 109,950 | | |

| — | | |

| 109,950 | |

| Issuance of common stock in registered direct offering, net of costs of $1,281,051 | |

| — | | |

| 21,428,574 | | |

| 21,428 | | |

| 13,697,523 | | |

| — | | |

| 13,718,951 | | |

| — | | |

| 13,718,951 | |

| Issuance of common stock upon cashless exercise of stock options | |

| — | | |

| 52,052 | | |

| 52 | | |

| (52 | ) | |

| — | | |

| — | | |

| — | | |

| — | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| 3,061,763 | | |

| — | | |

| 3,061,763 | | |

| — | | |

| 3,061,763 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (10,573,336 | ) | |

| (10,573,336 | ) | |

| — | | |

| (10,573,336 | ) |

| Balance, June 30, 2024 | |

$ | — | | |

| 180,725,407 | | |

$ | 180,725 | | |

$ | 276,083,228 | | |

$ | (190,580,054 | ) | |

$ | 85,683,899 | | |

$ | 600,380 | | |

$ | 86,284,279 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September 30, 2022 | |

$ | — | | |

| 146,211,130 | | |

$ | 146,211 | | |

$ | 232,368,121 | | |

$ | (129,688,467 | ) | |

$ | 102,825,865 | | |

$ | 600,380 | | |

$ | 103,426,245 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| 1,201,081 | | |

| — | | |

| 1,201,081 | | |

| — | | |

| 1,201,081 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (3,593,645 | ) | |

| (3,593,645 | ) | |

| — | | |

| (3,593,645 | ) |

| Balance, December 31, 2022 | |

| — | | |

| 146,211,130 | | |

| 146,211 | | |

| 233,569,202 | | |

| (133,282,112 | ) | |

| 100,433,301 | | |

| 600,380 | | |

| 101,033,681 | |

| Issuance of common stock for services | |

| — | | |

| 100,000 | | |

| 100 | | |

| 101,900 | | |

| — | | |

| 102,000 | | |

| — | | |

| 102,000 | |

| Issuance of common stock upon exercise of stock options | |

| — | | |

| 46,667 | | |

| 47 | | |

| 31,220 | | |

| — | | |

| 31,267 | | |

| — | | |

| 31,267 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| 1,165,595 | | |

| — | | |

| 1,165,595 | | |

| — | | |

| 1,165,595 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (10,526,025 | ) | |

| (10,526,025 | ) | |

| — | | |

| (10,526,025 | ) |

| Balance, March 31, 2023 | |

| — | | |

| 146,357,797 | | |

| 146,358 | | |

| 234,867,917 | | |

| (143,808,137 | ) | |

| 91,206,138 | | |

| 600,380 | | |

| 91,806,518 | |

| Issuance of common stock in registered direct offering, net of costs of $1,201,131 | |

| — | | |

| 12,500,001 | | |

| 12,500 | | |

| 13,786,370 | | |

| — | | |

| 13,798,870 | | |

| — | | |

| 13,798,870 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| 1,174,111 | | |

| — | | |

| 1,174,111 | | |

| — | | |

| 1,174,111 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (8,479,332 | ) | |

| (8,479,332 | ) | |

| — | | |

| (8,479,332 | ) |

| Balance, June 30, 2023 | |

$ | — | | |

| 158,857,798 | | |

$ | 158,858 | | |

$ | 249,828,398 | | |

$ | (152,287,469 | ) | |

$ | 97,699,787 | | |

$ | 600,380 | | |

$ | 98,300.167 | |

See notes to unaudited condensed consolidated

financial statements.

CITIUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED JUNE 30, 2024 AND

2023

(Unaudited)

| | |

2024 | | |

2023 | |

| Cash Flows From Operating Activities: | |

| | |

| |

| Net loss | |

$ | (28,348,675 | ) | |

$ | (22,599,002 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation expense | |

| 9,198,340 | | |

| 3,540,787 | |

| Issuance of common stock for services | |

| 284,175 | | |

| 102,000 | |

| Amortization of operating lease right-of-use asset | |

| 154,494 | | |

| 142,257 | |

| Depreciation | |

| 1,432 | | |

| 2,090 | |

| Deferred income tax expense | |

| 432,000 | | |

| 432,000 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses | |

| (2,205,091 | ) | |

| (4,979,740 | ) |

| Accounts payable | |

| (1,263,998 | ) | |

| 1,914,289 | |

| Accrued expenses | |

| 74,185 | | |

| (512,520 | ) |

| Accrued compensation | |

| (454,315 | ) | |

| (156,806 | ) |

| Operating lease liability | |

| (161,234 | ) | |

| (145,352 | ) |

| Net Cash Used In Operating Activities | |

| (22,288,687 | ) | |

| (22,259,997 | ) |

| | |

| | | |

| | |

| Cash Flows From Financing Activities: | |

| | | |

| | |

| Net proceeds from registered direct offering | |

| 13,718,951 | | |

| 13,798,870 | |

| Proceeds from common stock option exercise | |

| — | | |

| 31,267 | |

| Net Cash Provided By Financing Activities | |

| 13,718,951 | | |

| 13,830,137 | |

| | |

| | | |

| | |

| Net Change in Cash and Cash Equivalents | |

| (8,569,736 | ) | |

| (8,429,860 | ) |

| Cash and Cash Equivalents - Beginning of Period | |

| 26,480,928 | | |

| 41,711,690 | |

| Cash and Cash Equivalents - End of Period | |

$ | 17,911,192 | | |

$ | 33,281,830 | |

See notes to unaudited condensed consolidated

financial statements.

CITIUS PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE NINE MONTHS ENDED JUNE 30, 2024 AND

2023

(Unaudited)

1. NATURE OF OPERATIONS, BASIS OF PRESENTATION

AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business

Citius Pharmaceuticals, Inc. (“Citius Pharma,”

and together with its subsidiaries, the “Company,” “we” or “us”) is a late-stage biopharmaceutical

company dedicated to the development and commercialization of first-in-class critical care products with a focus on oncology, anti-infectives

in adjunct cancer care, unique prescription products and stem cell therapies.

On March 30, 2016, Citius Pharma acquired Leonard-Meron

Biosciences, Inc. (“LMB”) as a wholly-owned subsidiary by issuing shares of its common stock.

On September 11, 2020, we formed NoveCite, Inc.

(“NoveCite”), a Delaware corporation, of which we own 75% (7,500,000 shares) of the issued and outstanding capital stock

(see Note 3).

On August 23, 2021, we formed Citius Oncology,

Inc. (formerly named Citius Acquisition Corp.) (“Citius Oncology”), as a wholly-owned subsidiary in conjunction with the

acquisition of LYMPHIR, which began operations in April 2022. On October 23, 2023, Citius Pharma and Citius Oncology entered into an

agreement and plan of merger and reorganization with TenX Keane Acquisition, and its wholly owned subsidiary, TenX Merger Sub Inc., whereby

TenX Merger Sub Inc. will merge with and into Citius Oncology, with Citius Oncology surviving as a wholly owned subsidiary of TenX Keane

Acquisition. The newly combined publicly traded company is to be named “Citius Oncology, Inc.” (see Note 9).

An inactive subsidiary, Citius Pharmaceuticals,

LLC, was dissolved on December 29, 2023.

In-process research and development (“IPR&D”)

consists of (i) the $19,400,000 acquisition value of LMB’s drug candidate Mino-Lok®, which is an antibiotic solution used to

treat catheter-related bloodstream infections and is expected to be amortized on a straight-line basis over a period of eight years commencing

upon revenue generation, and (ii) the $40,000,000 acquisition value of the exclusive license for LYMPHIR (denileukin diftitox), which

is a late-stage oncology immunotherapy for the treatment of cutaneous T-cell lymphoma (CTCL), a rare form of non-Hodgkin lymphoma, and

is expected to be amortized on a straight-line basis over a period of twelve years commencing upon revenue generation.

Goodwill of $9,346,796 represents the value of

LMB’s industry relationships and its assembled workforce. Goodwill will not be amortized but will be tested at least annually for

impairment.

Since our inception, we have devoted substantially

all our efforts to business planning, research and development, recruiting management and technical staff, and raising capital. We are subject

to a number of risks common to companies in the pharmaceutical industry including, but not limited to, risks related to the development

by Citius Pharma or its competitors of research and development stage products, regulatory approval and market acceptance of its products,

competition from larger companies, dependence on key personnel, dependence on key suppliers and strategic partners, the Company’s

ability to obtain additional financing and the Company’s compliance with governmental and other regulations.

Basis of Presentation and Summary

of Significant Accounting Policies

Basis of Preparation — The

accompanying unaudited condensed consolidated financial statements include the operations of Citius Pharmaceuticals, Inc., and its wholly-owned

subsidiaries, LMB and Citius Oncology, and its majority-owned subsidiary NoveCite. NoveCite began operations in October 2020 and Citius

Oncology began operations in April 2022. All significant inter-company balances and transactions have been eliminated in consolidation.

The accompanying unaudited condensed consolidated

financial statements of the Company have been prepared on the same basis as the annual consolidated financial statements and, in the

opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to fairly state the condensed

consolidated financial position of the Company as of June 30, 2024, and the results of its operations and cash flows for the three- and

nine-month periods ended June 30, 2024 and 2023. The operating results for the three- and nine-month periods ended June 30, 2024 are

not necessarily indicative of the results that may be expected for the year ending September 30, 2024. These unaudited condensed consolidated

financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the

Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2023 filed with the Securities and Exchange Commission

(“SEC”) on December 29, 2023.

Use of Estimates — Our accounting

principles require our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the

disclosure of assets and liabilities at the date of the financial statements, and reported amounts of revenues and expenses during the

reporting period. Estimates having relatively higher significance include the accounting for in-process research and development and

goodwill impairment, stock-based compensation, valuation of warrants, and income taxes. Actual results could differ from those estimates

and changes in estimates may occur.

Basic and Diluted Net Loss per Common Share —

Basic and diluted net loss per common share applicable to common stockholders is computed by dividing net loss applicable to common stockholders

in each period by the weighted average number of shares of common stock outstanding during such period. For the periods presented, common

stock equivalents, consisting of stock options and warrants, were not included in the calculation of the diluted loss per share because

they were anti-dilutive.

Recently Issued Accounting Standards

Other than as disclosed in our Form 10-K, we

are not aware of any other recently issued accounting standards not yet adopted that may have a material impact on our financial statements.

2. GOING CONCERN UNCERTAINTY AND MANAGEMENT’S

PLAN

The accompanying unaudited condensed consolidated

financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of

liabilities in the normal course of business. The Company experienced negative cash flows from operations of $22,288,687 for the nine

months ended June 30, 2024. The Company had working capital of approximately $23,850,000 at June 30, 2024. The Company estimates that

its available cash resources will be sufficient to fund its operations through December 2024, which raises substantial doubt

about the Company’s ability to continue as a going concern within one year after the date that the accompanying condensed consolidated

financial statements are issued.

The Company has generated no operating revenue to date and has principally

raised capital through the issuance of equity instruments to finance its operations. However, the Company’s continued operations

beyond December 2024, including its development plans for LYMPHIR (including after the proposed spin-off of Citius Oncology), Mino-Lok,

Halo-Lido and NoveCite, will depend on its ability to obtain regulatory approval to market Mino-Lok, successfully commercialize LYMPHIR,

Mino-Lok and any other approved products and generate substantial revenue from the sale of LYMPHIR and/or Mino-Lok and on its ability

to raise additional capital through various potential sources, such as equity and/or debt financings, strategic relationships, or out-licensing

of its product candidates. However, the Company can provide no assurances on regulatory approval, commercialization, or future sales of

LYMPHIR and/or Mino-Lok or that financing or strategic relationships will be available on acceptable terms, or at all. If the Company

is unable to raise sufficient capital, find strategic partners or generate substantial revenue from the sale of LYMPHIR and/or Mino-Lok,

there would be a material adverse effect on its business. Further, the Company expects in the future to incur additional expenses as it

continues to develop its product candidates, including seeking regulatory approval, and protecting its intellectual property.

3. PATENT AND TECHNOLOGY LICENSE AGREEMENTS

Patent and Technology License Agreement

– Mino-Lok

LMB has a patent and technology license agreement

with Novel Anti-Infective Therapeutics, Inc. (“NAT”) to develop and commercialize Mino-Lok on an exclusive, worldwide sub-licensable

basis, as amended. LMB pays an annual maintenance fee each June until commercial sales of a product subject to the license commence.

The Company recorded an annual maintenance fee expense of $90,000 in both 2024 and 2023 respectively.

LMB will also pay annual royalties on net sales

of licensed products, with a low double digit royalty rate (within a range of 10% to 15%). In limited circumstances in which the licensed

product is not subject to a valid patent claim and a competitor is selling a competing product, the royalty rate is in the low- to mid-single

digits (within a range of 2% to 7%). After a commercial sale is obtained, LMB must pay minimum aggregate annual royalties of $100,000

in the first commercial year which is prorated for a less than 12-month period, increasing $25,000 per year to a maximum of $150,000

annually. LMB must also pay NAT up to $1,100,000 upon achieving specified regulatory and sales milestones. Finally, LMB must pay NAT

a specified percentage of payments received from any sub-licensees.

Unless earlier terminated by NAT, based on the

failure to achieve certain development and commercial milestones, the license agreement remains in effect until the date that all patents

licensed under the agreement have expired and all patent applications within the licensed patent rights have been cancelled, withdrawn,

or expressly abandoned.

Patent and Technology License Agreement

– Mino-Wrap

On January 2, 2019, we entered into a patent

and technology license agreement with the Board of Regents of the University of Texas System on behalf of the University of Texas M.

D. Anderson Cancer Center (“Licensor”), whereby we in-licensed exclusive worldwide rights to the patented technology for

any and all uses relating to breast implants. We terminated the Mino-Wrap license agreement on December 11, 2023.

License Agreement with Eterna

On October 6, 2020, our subsidiary, NoveCite,

signed an exclusive license agreement for a novel cellular therapy for acute respiratory distress syndrome (ARDS) with a subsidiary of

Novellus, Inc. (“Novellus”). Upon execution of the agreement, we paid $5,000,000 to Novellus, which was charged to research

and development expense during the year ended September 30, 2021, and issued Novellus shares of NoveCite’s common stock representing

25% of the outstanding equity. We own the other 75% of NoveCite’s outstanding equity. Pursuant to the terms of the original stock

subscription agreement, if NoveCite issued additional equity, subject to certain exceptions, NoveCite had to maintain Novellus’s

ownership at 25% by issuing additional shares to Novellus.

In July 2021, Novellus was acquired by Brooklyn

ImmunoTherapeutics, Inc. (“Brooklyn”). In connection with that transaction, the stock subscription agreement was amended

to assign to Brooklyn all of Novellus’s right, title, and interest in the stock subscription agreement and delete the anti-dilution

protection and replace it with a right of first refusal whereby Brooklyn will have the right to purchase all or a portion of the securities

that NoveCite intends to sell or in the alternative, at the option of NoveCite, Brooklyn may purchase that amount of the securities proposed

to be sold by NoveCite to allow Brooklyn to maintain its then percentage ownership. In October 2022, Brooklyn changed its name to Eterna

Therapeutics Inc. (“Eterna”).

Citius Pharma is responsible for the operational

activities of NoveCite and bears all costs necessary to operate NoveCite. Citius Pharma’s officers are also the officers of NoveCite

and oversee the business strategy and operations of NoveCite. As such, NoveCite is accounted for as a consolidated subsidiary with a

noncontrolling interest.

Eterna has no contractual rights in the profits

or obligations to share in the losses of NoveCite, and the Company has not allocated any losses to the noncontrolling interest.

NoveCite is obligated to pay Eterna up to $51,000,000

upon the achievement of various regulatory and developmental milestones. NoveCite also must pay a royalty equal to a mid-teens percentage

of net sales, commencing upon the sale of a licensed product. This royalty is subject to downward adjustment to a mid-single digit percentage

(within a range of 4% to 8%) of net sales in any country in the event of the expiration of the last valid patent claim or if no valid

patent claim exists in that country. The royalty will end on the earlier of (i) date on which a biosimilar product is first marketed,

sold, or distributed in the applicable country or (ii) the 10-year anniversary of the date of expiration of the last-to-expire valid

patent claim in that country. In the case of a country where no licensed patent ever exists, the royalty will end on the later of (i)

the date of expiry of such licensed product’s regulatory exclusivity and (ii) the 10-year anniversary of the date of the first

commercial sale of the licensed product in the applicable country. In addition, NoveCite will pay to Eterna an amount equal to a mid-twenties

percentage of any sublicensee fees it receives.

Under the terms of the license agreement, if

Eterna receives any revenue involving the original cell line included in the licensed technology, then Eterna shall remit to NoveCite

50% of such revenue.

The term of the license agreement continues on

a country-by-country and licensed product-by-licensed product basis until the expiration of the last-to-expire royalty term. Either party

may terminate the license agreement upon written notice if the other party is in material default. NoveCite may terminate the license

agreement at any time without cause upon 90 days prior written notice.

Eterna will be responsible for preparing, filing,

prosecuting, and maintaining all patent applications and patents included in the licensed patents in the territory, provided however,

that if Eterna decides that it is not interested in maintaining a particular licensed patent or in preparing, filing, or prosecuting

a licensed patent, NoveCite will have the right, but not the obligation, to assume such responsibilities in the territory at NoveCite’s

sole cost and expense.

License Agreement with Eisai

In September 2021, Citius Pharma entered into

an asset purchase agreement with Dr. Reddy’s Laboratories SA, a subsidiary of Dr. Reddy’s Laboratories, Ltd. (collectively,

“Dr. Reddy’s”) and a license agreement with Eisai Co., Ltd. (“Eisai”) to acquire an exclusive license for

E7777 (denileukin diftitox), a late-stage oncology immunotherapy for the treatment of CTCL, a rare form of non-Hodgkin lymphoma. We renamed

E7777 as I/ONTAK and also obtained the trade name LYMPHIR for the product. Citius Pharma assigned these agreements to Citius Oncology

effective April 1, 2022.

Under the terms of the

agreements, Citius Pharma acquired Dr. Reddy’s exclusive license for E7777 from Eisai and other related assets owned by Dr. Reddy’s.

The exclusive license includes rights to develop and commercialize E7777 in all markets except for Japan and certain parts of Asia. Additionally,

we retain an option on the right to develop and market the product in India. Eisai retains exclusive development and marketing rights

for the agent in Japan, China, Korea, Taiwan, Hong Kong, Macau, Indonesia, Thailand, Malaysia, Brunei, Singapore, India (subject to the

India option), Pakistan, Sri Lanka, Philippines, Vietnam, Myanmar, Cambodia, Laos, Afghanistan, Bangladesh, Bhutan, Nepal, Mongolia,

and Papua New Guinea. Citius Pharma paid a $40 million upfront payment which represents the acquisition date fair value of the in-process

research and development acquired from Dr. Reddy’s. Dr. Reddy’s is entitled to up to $40 million in development milestone

payments related to CTCL approvals in the U.S. and other markets, up to $70 million in development milestones for additional indications,

as well as commercial milestone payments and low double-digit tiered royalties on net product sales (within a range of 10% to 15%), and

up to $300 million for commercial sales milestones. We also must pay on a fiscal quarter basis tiered royalties equal to low double-digit

percentages of net product sales (within a range of 10% to 15%). The royalties will end on the earlier of (i) the 15-year anniversary

of the first commercial sale of the latest indication that received regulatory approval in the applicable country and (ii) the date on

which a biosimilar product results in the reduction of net sales in the applicable product by 50% in two consecutive quarters, as compared

to the four quarters prior to the first commercial sale of the biosimilar product. We will also pay to Dr. Reddy’s an amount equal

to a low-thirties percentage of any sublicense upfront consideration or milestone payments (or the like) received by us and the greater

of (i) a low-thirties percentage of any sublicensee sales-based royalties or (ii) a mid-single digit percentage of such licensee’s

net sales.

Under the license agreement, Eisai is to receive

a $6.0 million development milestone payment upon initial approval and additional commercial milestone payments related to the achievement

of net product sales thresholds (which increases to $7 million in the event we have exercised our option to add India to the licensed

territory prior to FDA approval) and an aggregate of up to $22 million related to the achievement of net product sales thresholds. Citius

Oncology was required to reimburse Eisai for up to $2.65 million of its costs to complete the Phase 3 pivotal clinical trial for LYMPHIR

for the CTCL indication and reimburse Eisai for all reasonable costs associated with the preparation of a Biologics License Application

(“BLA”) for LYMPHIR. Eisai was responsible for completing the CTCL clinical trial, and chemistry, manufacturing, and controls

(“CMC”) activities through the filing of the BLA for LYMPHIR with the FDA. The BLA was filed with the FDA on September 27,

2022, refiled on February 13, 2024, and accepted by the FDA on March 18, 2024, which assigned a Prescription Drug User Fee Act (“PDUFA”)

goal date of August 13, 2024. Citius Oncology will also be responsible for development costs associated with potential additional

indications.

The term of the license

agreement will continue until (i) if there has not been a commercial sale of a licensed product in the territory, the 10-year anniversary

of the original license effective date, March 30, 2016, or (ii) if there has been a first commercial sale of a licensed product in the

territory within the 10-year anniversary of the original license effective date, the 10-year anniversary of the first commercial sale

on a country-by-country basis. The term of the license may be extended for additional 10-year periods for all countries in the territory

by notifying Eisai and paying an extension fee equal to $10 million. Either party may terminate the license agreement upon written notice

if the other party is in material breach of the agreement, subject to cure within the designated time periods. Either party also may

terminate the license agreement immediately upon written notice if the other party files for bankruptcy or takes related actions or is

unable to pay its debts as they become due. Additionally, either party will have the right to terminate the agreement if the other party

directly or indirectly challenges the patentability, enforceability or validity of any licensed patent.

Also under the purchase

agreement with Dr. Reddy’s, we are required to (i) use commercially reasonable efforts to make commercially available products

in the CTCL indication, peripheral T-cell lymphoma indication and immuno-oncology indication, (ii) initiate two investigator initiated

immuno-oncology trials (both of which have been initiated), (iii) use commercially reasonable efforts to achieve each of the approval

milestones, and (iv) complete each specified immuno-oncology investigator trial on or before the four-year anniversary of the effective

date of the definitive agreement. Additionally, we are required to commercially launch a product in a territory within six months of

receiving regulatory approval for such product in each such jurisdiction.

4. PREPAID EXPENSES

Prepaid expenses at June 30, 2024 and September

30, 2023 consist of $87,782 and $154,611 of prepaid insurance, respectively, and $10,006,815 and $7,734,895 of advance

payments, respectively, made for the preparation of long-lead time drug substance and product costs, which will be utilized in the manufacturing

of LYMPHIR for sales upon approval.

5. COMMON STOCK, STOCK OPTIONS AND WARRANTS

Common Stock Issued for Services

On October 10, 2023, the Company issued 108,778

shares of common stock for media, and public and investor relations services and expensed the $76,146 fair value of the common stock

issued.

On January 17, 2024, the Company issued 128,205

shares of common stock for general and business development advisory services and expensed the $98,079 fair value of the common stock

issued.

On April 25, 2024, the Company issued 150,000

shares of common stock for financial, general and business development advisory services and expensed the $109,950 fair value of the

common stock issued.

Common Stock Offerings

On May 8, 2023, the Company closed a registered

direct offering of 12,500,001 common shares and warrants to purchase up to 12,500,001 common shares, at a purchase price of $1.20 per

share and accompanying warrant for gross proceeds of $15,000,001. The warrants have an exercise price of $1.50 per share, are exercisable

six months from the date of issuance, and expire five years from the date of issuance. The estimated fair value of the warrants issued

to the investors was approximately $11,000,000.

Net proceeds were $13,798,870 after deducting

the placement agent fee of $1,050,000, placement agent expenses of $85,000, legal fees of $50,181, and other offering expenses of $15,950.

The Company also issued 875,000 warrants to the placement agent at an exercise price of $1.50 per share, that are exercisable six months

from the date of issuance, and expire five years from the date of issuance. The estimated fair value of the warrants issued to the placement

agent was approximately $771,000.

On April 30, 2024, the Company closed a registered

direct offering of 21,428,574 common shares and warrants to purchase up to 21,428,574 common shares, at a purchase price of $0.70 per

share and accompanying warrant for gross proceeds of $15,000,002. The warrants have an exercise price of $0.75 per share, are exercisable

six months from the date of issuance, and expire on October 30, 2029. The estimated fair value of the warrants issued to the investors

was approximately $11,206,000.

Net proceeds were $13,718,951 after deducting

the placement agent fee of $1,050,000, placement agent expenses of $135,000, legal fees of $80,101, and other offering expenses of $15,950.

The Company also issued 1,500,000 warrants to the placement agent at an exercise price of $0.875 per share, that are exercisable six

months from the date of issuance, and expire on April 25, 2029. The estimated fair value of the warrants issued to the placement agent

was approximately $756,000.

Stock Option Plans

Pursuant to our 2014 Stock Incentive Plan, we

reserved 866,667 shares of common stock. As of June 30, 2024, there were options to purchase 705,441 shares outstanding, options to purchase

57,943 shares were exercised, options to purchase 103,283 shares expired or were forfeited, and no shares were available for future grants.

Pursuant to our 2018 Omnibus Stock Incentive

Plan, we reserved 2,000,000 shares of common stock. As of June 30, 2024, there were options to purchase 1,720,000 shares outstanding,

options to purchase 116,667 shares were exercised, options to purchase 53,333 shares expired or were forfeited, and the remaining 110,000

shares were transferred to the 2020 Omnibus Stock Incentive Plan (“2020 Plan”).

Pursuant to our 2020 Plan, we reserved 3,110,000

shares of common stock. As of June 30, 2024, there were options to purchase 1,735,000 shares outstanding, options to purchase 135,000

shares expired or were forfeited and the remaining 1,240,000 shares were transferred to the 2021 Omnibus Stock Incentive Plan (“2021

Stock Plan”).

Pursuant to our 2021 Stock Plan, we reserved

8,740,000 shares of common stock. As of June 30, 2024, options to purchase 8,398,333 shares were outstanding, options to purchase 306,667

shares expired or were forfeited and the remaining 35,000 shares were transferred to the 2023 Omnibus Stock Incentive Plan (“2023

Stock Plan”).

In November 2022, our Board approved the 2023

Stock Plan, subject to stockholder approval, which was received on February 7, 2023. The 2023 Stock Plan reserved 12,035,000 shares of

common stock for issuance. As of June 30, 2024, options to purchase 4,360,000 shares were outstanding, options to purchase 100,000 shares

expired or were forfeited and 7,575,000 shares remain available for future grants.

The fair value of each stock option award is

estimated on the date of grant using the Black-Scholes option pricing model. The risk-free interest rate is based on the U.S. Treasury

yield curve in effect at the time of grant commensurate with the expected term assumption. The expected term of stock options granted,

all of which qualify as “plain vanilla,” is based on the average of the contractual term (generally 10 years) and the

vesting period. For non-employee options, the expected term is the contractual term.

A summary of option activity under our stock

option plans (excluding the NoveCite and Citius Oncology Stock Plans) is presented below:

| | | Option

Shares | | | Weighted-

Average

Exercise

Price | | | Weighted-

Average

Remaining

Contractual

Term | | Aggregate

Intrinsic

Value | |

| Outstanding at September 30, 2023 | | | 13,305,171 | | | $ | 1.79 | | | 7.41 years | | $ | 56,203 | |

| Granted | | | 4,160,000 | | | | 0.70 | | | | | | | |

| Exercised | | | (53,114 | ) | | | 0.02 | | | | | | | |

| Forfeited or expired | | | (493,283 | ) | | | 1.59 | | | | | | | |

| Outstanding at June 30, 2024 | | | 16,918,774 | | | $ | 1.54 | | | 7.32 years | | $ | 750 | |

| | | | | | | | | | | | | | | |

| Exercisable at June 30, 2024 | | | 9,192,107 | | | $ | 1.91 | | | 6.21 years | | $ | 750 | |

On October 10, 2023, the Board of Directors granted

options to purchase 3,725,000 shares to employees, 300,000 shares to directors and 60,000 shares to consultants at $0.70 per share. On

March 14, 2024, the Board of Directors granted options to purchase 75,000 shares to a director at $0.69 per share. The weighted average

grant date fair value of the options granted during the nine months ended June 30, 2024 was estimated at $0.53 per share. These options

vest over terms of 12 to 36 months and have a term of 10 years.

On October 4, 2022, the Board of Directors granted

options to purchase 3,375,000 shares to employees, 375,000 shares to directors and 50,000 shares to a consultant at $1.25 per share.

On November 8, 2022, the Board of Directors granted options to purchase 50,000 shares to a consultant at $1.04 per share. On February

7, 2023, the Board of Directors granted options to purchase 150,000 shares to an employee and 75,000 shares to a director at $1.42 per

share. On April 10, 2023, the Board of Directors granted options to purchase 75,000 shares to an employee at $1.46 per share. The weighted

average grant date fair value of the options granted during the nine months ended June 30, 2023 was estimated at $0.98 per share. These

options vest over terms of 12 to 36 months and have a term of 10 years.

Stock-based compensation expense for the three

months ended June 30, 2024 and 2023 was $3,061,763 (including $13,858 for the NoveCite plan and $1,957,000 for the Citius Oncology Plan)

and $1,174,111 (including $31,858 for the NoveCite Stock Plan), respectively. Stock-based compensation expense for the nine months ended

June 30, 2024 and 2023 was $9,198,340 (including $47,574 for the NoveCite plan and $5,831,000 for the Citius Oncology Plan) and $3,540,787

(including $98,524 for the NoveCite Stock Plan), respectively.

At June 30, 2024, unrecognized total compensation

cost related to unvested awards under the Citius Pharma stock plans of $3,651,795 is expected to be recognized over a weighted average

period of 1.49 years.

NoveCite Stock Plan - Under the

NoveCite Stock Plan, adopted November 5, 2020, we reserved 2,000,000 common shares of NoveCite for issuance. The NoveCite Stock Plan

provides incentives to employees, directors, and consultants through grants of options, SARs, dividend equivalent rights, restricted

stock, restricted stock units, or other rights.

As of June 30, 2024, NoveCite has options outstanding

to purchase 1,911,500 common shares of NoveCite, all of which are exercisable, and 88,500 shares available for future grants. All of

the options were issued during the year ended September 30, 2021. These options vested over 36 months and have a term of 10 years. The

weighted average remaining contractual term of options outstanding under the NoveCite Stock Plan is 6.64 years and the weighted average

exercise price is $0.24 per share. At June 30, 2024, there is no unrecognized compensation cost related to these awards.

Citius Oncology Stock Plan - Under

the Citius Oncology Stock Plan, adopted on April 29, 2023, we reserved 15,000,000 common shares of Citius Oncology for issuance. The

Citius Oncology Stock Plan provides incentives to employees, directors, and consultants through grants of options, SARs, dividend equivalent

rights, restricted stock, restricted stock units, or other rights.

During the year ended September 30, 2023, Citius

Oncology granted options to purchase 12,750,000 common shares at a weighted average exercise price of $2.15 per share, of which options

to purchase 150,000 common shares were forfeited. The weighted average grant date fair value of the options granted during the year ended

September 30, 2023 was estimated at $1.65 per share. These options vest over periods from 12 to 36 months and have a term of 10 years.

At June 30, 2024, Citius Oncology has options

outstanding to purchase 12,600,000 shares, of which 3,605,556 common shares are exercisable, and 2,400,000 shares available for future

grants. The weighted average remaining contractual term of options outstanding under the Citius Oncology Stock Plan is 9.02 years. At

June 30, 2024, unrecognized total compensation cost related to unvested awards under the Citius Oncology Stock Plan of $13,011,500 is

expected to be recognized over a weighted average period of 2.0 years.

Warrants

As of June 30, 2024, we have reserved shares

of common stock for the exercise of outstanding warrants as follows:

| | | Exercise

price | | | Number | | | Expiration Date |

| August 2018 Offering Investors | | $ | 1.15 | | | | 3,921,569 | | | August 14, 2024 |

| August 2018 Offering Agent | | | 1.59 | | | | 189,412 | | | August 8, 2024 |

| April 2019 Registered Direct/Private Placement Investors | | | 1.42 | | | | 1,294,498 | | | April 5, 2025 |

| April 2019 Registered Direct/Private Placement Agent | | | 1.93 | | | | 240,130 | | | April 5, 2025 |

| September 2019 Offering Investors | | | 0.77 | | | | 2,793,297 | | | September 27, 2024 |

| September 2019 Offering Underwriter | | | 1.12 | | | | 194,358 | | | September 27, 2024 |

| February 2020 Exercise Agreement Agent | | | 1.28 | | | | 138,886 | | | August 19, 2025 |

| May 2020 Registered Direct Offering Investors | | | 1.00 | | | | 1,670,588 | | | November 18, 2025 |

| May 2020 Registered Direct Offering Agent | | | 1.33 | | | | 155,647 | | | May 14, 2025 |

| August 2020 Underwriter | | | 1.31 | | | | 201,967 | | | August 10, 2025 |

| January 2021 Private Placement Investors | | | 1.23 | | | | 3,091,192 | | | July 27, 2026 |

| January 2021 Private Placement Agent | | | 1.62 | | | | 351,623 | | | July 27, 2026 |

| February 2021 Offering Investors | | | 1.70 | | | | 20,580,283 | | | February 19, 2026 |

| February 2021 Offering Agent | | | 1.88 | | | | 2,506,396 | | | February 19, 2026 |

| May 2023 Registered Direct Offering Investors | | | 1.50 | | | | 12,500,001 | | | May 8, 2028 |

| May 2023 Registered Direct Offering Agent | | | 1.50 | | | | 875,000 | | | May 3, 2028 |

| April 2024 Registered Direct Offering Investors | | | 0.75 | | | | 21,428,574 | | | October 30, 2029 |

| April 2024 Registered Direct Offering Agent | | | 0.88 | | | | 1,500,000 | | | April 25, 2029 |

| | | | | | | | 73,633,421 | | | |

On April 3, 2024, the Board of Directors approved

a one-year extension to April 5, 2025 for warrants to purchase 1,294,498 shares of common stock with an exercise price of $1.42 per share.

The warrants are held by Leonard Mazur, the Company’s Chief Executive Officer and Chairman of the Board of Directors, and Myron

Holubiak, the Company’s Executive Vice President and member of the Board of Directors, and were originally issued in April 2019

in a registered direct offering of common stock. Additionally, 240,130 warrants with an exercise price of $1.9313 per share issued in

connection with the registered direct offering were extended by one-year to April 5, 2025. These warrants are held by certain representatives

of the registered direct offering placement agent. The terms of the warrants were previously extended in April 2021 to April 5, 2024.

If these warrants are fully exercised, the Company would receive approximately $2.3 million in cash proceeds. We recorded a deemed

dividend of $321,559 based on the excess of the fair value of the modified warrants over the fair value of the warrants before the modification,

the effect of which was an increase in the net loss attributable to common shareholders in the statement of operations for the three

and nine months ended June 30, 2024.

At June 30, 2024, the weighted average remaining

life of the outstanding warrants is 3.0 years, all warrants are exercisable except for the April 2024 registered direct offering warrants

for 22,928,574 shares which are exercisable commencing October 30, 2024, and there was no aggregate intrinsic value of the warrants outstanding.

Common Stock Reserved

A summary of common stock reserved for future

issuances as of June 30, 2024 is as follows:

| Stock plan options outstanding | |

| 16,918,774 | |

| Stock plan shares available for future grants | |

| 7,575,000 | |

| Warrants outstanding | |

| 73,633,421 | |

| Total | |

| 98,127,195 | |

6. OPERATING LEASE

Effective July 1, 2019, Citius Pharma entered

into a 76-month lease for office space in Cranford, NJ. Citius Pharma pays its proportionate share of real estate taxes and operating

expenses in excess of the base year expenses. These costs are variable lease payments and are not included in the determination of the

lease’s right-of-use asset or lease liability.

The Company identified and assessed the following

significant assumptions in recognizing its right-of-use assets and corresponding lease liabilities:

| |

● |

As the Company’s lease does not provide an implicit rate, the

Company estimated the incremental borrowing rate in calculating the present value of the lease payments based on the remaining lease

term as of the adoption date. |

| |

● |

Since the Company elected to account for each lease component and its

associated non-lease components as a single combined component, all contract consideration was allocated to the combined lease component. |

| |

● |

The expected lease terms include noncancelable lease periods. |

The elements of lease expense are as follows:

| Lease cost | | | Nine Months Ended

June 30,

2024 | | | Nine Months Ended

June 30,

2023 | |

| Operating lease cost | | | $ | 179,117 | | | $ | 179,118 | |

| Variable lease cost | | | | 3,732 | | | | 3,567 | |

| Total lease cost | | | $ | 182,849 | | | $ | 182,685 | |

| | | | | | | | | | |

| Other information | | | | | | | | | |

| Weighted-average remaining lease term - operating leases | | | | 1.3 Years | | | | 2.3 Years | |

| Weighted-average discount rate - operating leases | | | | 8.0 | % | | | 8.0 | % |

Maturities of lease liabilities due under the

Company’s non-cancellable leases are as follows:

| Year Ending September 30, | |

June 30,

2024 | |

| 2024 (excluding the 9 months ended June 30, 2024) | |

$ | 63,167 | |

| 2025 | |

| 253,883 | |

| 2026 | |

| 21,460 | |

| Total lease payments | |

| 338,510 | |

| Less: interest | |

| (18,499 | ) |

| Present value of lease liabilities | |

$ | 320,011 | |

| Leases | |

Classification | |

June 30,

2024 | | |

September 30,

2023 | |

| Assets | |

| |

| | |

| |

| Lease asset | |

Operating | |

$ | 299,932 | | |

$ | 454,426 | |

| Total lease assets | |

| |

$ | 299,932 | | |

$ | 454,426 | |

| | |

| |

| | | |

| | |

| Liabilities | |

| |

| | | |

| | |

| Current | |

Operating | |

$ | 235,581 | | |

$ | 218,380 | |

| Non-current | |

Operating | |

| 84,430 | | |

| 262,865 | |

| Total lease liabilities | |

| |

$ | 320,011 | | |

$ | 481,245 | |

Interest expense on the lease liability was $24,623

and $36,861 for the nine months ended June 30, 2024 and 2023, respectively.

7. GAIN ON SALE OF NEW JERSEY NET OPERATING

LOSSES

The Company recognized a gain of $2,387,842 and

$3,585,689 for the nine months ended June 30, 2024 and 2023, respectively, in connection with sales of certain New Jersey income tax

net operating losses to third parties under the New Jersey Technology Business Tax Certificate Transfer Program.

8. NASDAQ LISTING

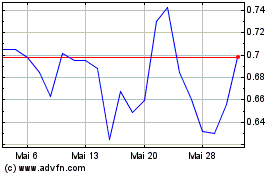

On September 12, 2023, we received a notification

letter from the Nasdaq Stock Market LLC (“Nasdaq”) indicating that we were not in compliance with Nasdaq Listing Rule 5550(a)(2)

because the minimum bid price of our common stock on the Nasdaq Capital Market closed below $1.00 per share for 30 consecutive business

days. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company had a compliance period of 180 calendar days, or until March

11, 2024, to regain compliance with the Bid Price Rule.

On March 12, 2024, Nasdaq granted our request

for an extension through September 9, 2024 to evidence compliance with the $1.00 per share requirement for continued inclusion on the

Nasdaq Capital Market. If at any time before September 9, 2024, the bid price of our common stock closes at $1.00 per share or more for

a minimum of ten consecutive business days, Nasdaq will provide us with written confirmation of compliance with the Bid Price Rule. If

we do not regain compliance with the Bid Price Rule by September 9, 2024, Nasdaq will provide notice to us that our common stock is subject

to delisting. At that time, we may appeal the determination to a Nasdaq hearings panel. The request for a hearing will stay any suspension

or delisting action pending the issuance of the hearing panel’s decision. The Extension Notice has no effect at this time on the

listing of our common stock, which will continue to trade on The Nasdaq Capital Market. We are currently evaluating our options for regaining

compliance. There can be no assurance that we will be able to regain compliance with the Bid Price Rule, even if we maintain compliance

with the other listing requirements.

9. MERGER AGREEMENT

On October 23, 2023, Citius Pharma and Citius

Oncology entered into an agreement and plan of merger and reorganization (the “Merger Agreement”) with TenX Keane Acquisition,

a Cayman Islands exempted company (“TenX”), and its wholly owned subsidiary, TenX Merger Sub Inc. (“Merger Sub”),

a Delaware corporation. The Merger Agreement provides, among other things, (i) on the terms and subject to the conditions set forth therein,

that Merger Sub will merge with and into Citius Oncology, with Citius Oncology surviving as a wholly owned subsidiary of TenX (the “Merger”),

and (ii) that prior to the effective time of the Merger (the “Effective Time”), TenX will migrate to and domesticate as a

Delaware corporation in accordance with Section 388 of the General Corporation Law of the State of Delaware and the Cayman Islands Companies

Act (As Revised) (the “Domestication”). The newly combined publicly traded company is to be named “Citius Oncology,

Inc.” (the “Combined Company”). The Domestication, Merger and the other transactions contemplated by the Merger Agreement

are referred to as the “Business Combination.”

In the Merger, all shares of Citius Oncology would be converted into

the right to receive common stock of the Combined Company. As a result, upon closing, Citius Pharma would receive 67.5 million shares

of common stock of the Combined Company. As part of the transaction, Citius Pharma will contribute $10 million in cash to the Combined

Company for transaction expenses and general operating expenses. The 12.6 million existing Citius Oncology common stock options will be

assumed by the Combined Company. Citius Pharma and the Combined Company will also enter into an amended and restated shared services agreement,

which, among other things, will govern certain management and scientific services that Citius Pharma will continue to provide to the Combined

Company following the Effective Time.

The Merger Agreement, Business Combination and

the transactions contemplated thereby were unanimously approved by the boards of directors of each of Citius Pharma, Citius Oncology

and TenX. The transaction is expected to be completed in August 2024, subject to and the provisions of the Merger Agreement and other

customary closing conditions, including final regulatory approvals and SEC filings. There can be no assurance regarding the ultimate

timing of the proposed transaction or that the transaction will be completed at all.

10. SUBSEQUENT EVENTS

On August 8, 2024, the Company announced

that the FDA had approved LYMPHIR.

On August 12, 2024, the Company completed the Merger, whereby its wholly owned subsidiary Citius

Oncology, Inc. (now known as Citius Oncology Sub, Inc.), became a wholly owned subsidiary of TenX Keane Acquisition (now Citius

Oncology, Inc.). In connection with Closing, Citius Pharma and Citius Oncology entered into an amended and restated shared services

agreement, which, among other things, governs certain management and scientific services that Citius Pharma will continue to provide

to Citius Oncology. After the closing of the Merger, Citius Pharma continues to control a majority of the voting power of Citius

Oncology, owning approximately 92.6% of the outstanding shares of Citius Oncology.

Item 2. Management’s Discussion and

Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our

financial condition and results of operations for the three and nine months ended June 30, 2024 and 2023 should be read together with

our unaudited condensed consolidated financial statements and related notes included elsewhere in this Report and in conjunction with

the audited financial statements of Citius Pharmaceuticals, Inc. included in our Annual Report on Form 10-K for the year ended September

30, 2023, filed with the Securities and Exchange Commission (“SEC”) on December 29, 2023. The following discussion contains

“forward-looking statements” that reflect our future plans, estimates, beliefs and expected performance. Our actual results

may differ materially from those currently anticipated and expressed in such forward-looking statements as a result of a number of factors.

We caution that assumptions, expectations, projections, intentions, or beliefs about future events may, and often do, vary from actual

results and the differences can be material. Please see “Cautionary Note Regarding Forward-Looking Statements” on page iii

of this Report.

Historical Background

Citius Pharmaceuticals, Inc. (“Citius Pharma,”

and together with its subsidiaries, the “Company,” “we” or “us”) is a late-stage biopharmaceutical

company dedicated to the development and commercialization of first-in-class critical care products with a focus on oncology, anti-infectives

in adjunct cancer care, unique prescription products and stem cell therapies. On September 12, 2014, we acquired Citius Pharmaceuticals,

LLC as a wholly-owned subsidiary. Citius Pharmaceuticals, LLC, was dissolved on December 29, 2023.

On March 30, 2016, we acquired all of the outstanding

stock of Leonard-Meron Biosciences, Inc. (“LMB”) by issuing shares of our common stock. We acquired identifiable intangible

assets of $19,400,000 related to in-process research and development and recorded goodwill of $9,346,796 for the excess of the purchase

consideration over the net assets acquired.

On September 11, 2020, we formed NoveCite, Inc.

(“NoveCite”), a Delaware corporation, of which we own 75% of the issued and outstanding capital stock.

On August 23, 2021, we formed Citius Oncology, Inc. (formerly named

Citius Acquisition Corp.) (“Citius Oncology”) (now named “Citius Oncology Sub, Inc.), as a wholly-owned subsidiary in

conjunction with the acquisition of LYMPHIR, which began operations in April 2022. On August 12, 2024, Citius Pharma completed the Spinoff

of Citius Oncology as a separate publicly traded entity (Nasdaq: CTOR) focused on commercializing LYMPHIR.

In-process research and development (“IPR&D”)

consists of (i) the $19,400,000 acquisition value of LMB’s drug candidate Mino-Lok®, which is an antibiotic solution used to

treat catheter-related bloodstream infections and is expected to be amortized on a straight-line basis over a period of eight years commencing

upon revenue generation, and (ii) the $40,000,000 acquisition value of the exclusive license for LYMPHIR (denileukin diftitox), which

is a late-stage oncology immunotherapy for the treatment of cutaneous T-cell lymphoma (“CTCL”), a rare form of non-Hodgkin

lymphoma, and is expected to be amortized on a straight-line basis over a period of twelve years commencing upon revenue generation.

Goodwill of $9,346,796 represents the value of

LMB’s industry relationships and its assembled workforce. Goodwill will not be amortized but will be tested at least annually for

impairment.

Through June 30, 2024, we have devoted substantially

all our efforts to business planning, research and development, recruiting management and technical staff, and raising capital. We have

not yet realized any revenues from our operations.

Recent Developments

On October 23, 2023, Citius Pharma and Citius Oncology entered into

an agreement and plan of merger and reorganization with TenX Keane Acquisition, and its wholly owned subsidiary, TenX Merger Sub Inc.,

whereby TenX Merger Sub Inc. will merge with and into Citius Oncology, with Citius Oncology surviving as a wholly owned subsidiary of

TenX Keane Acquisition. The newly combined publicly traded company is to be named “Citius Oncology, Inc.” On August 2, 2024,

the shareholders of TenX Keane Acquisition approved the transaction. The transaction closed on August 12, 2024.

Patent and Technology License Agreements

Mino-Lok® – LMB has a patent

and technology license agreement with Novel Anti-Infective Therapeutics, Inc. (“NAT”) to develop and commercialize Mino-Lok

on an exclusive, worldwide sub-licensable basis, as amended. Since May 2014, LMB has paid an annual maintenance fee, which began at $30,000

and increased over five years to $90,000, where it will remain until the commencement of commercial sales of a product subject to the

license. LMB will also pay annual royalties on net sales of licensed products, with a low double digit royalty rate (with a range of

10% to 15%). In limited circumstances in which the licensed product is not subject to a valid patent claim and a competitor is selling

a competing product, the royalty rate is in the low- to mid-single digits (within a range of 2% to 7%). After a commercial sale is obtained,

LMB must pay minimum aggregate annual royalties that increase in subsequent years. LMB must also pay NAT up to $1,100,000 upon achieving

specified regulatory and sales milestones. Finally, LMB must pay NAT a specified percentage of payments received from any sub licensees.

Mino-Wrap – On January 2, 2019,

we entered into a patent and technology license agreement with the Board of Regents of the University of Texas System on behalf of the

University of Texas M. D. Anderson Cancer Center (“Licensor”), whereby we in-licensed exclusive worldwide rights to the patented

technology for any and all uses relating to breast implants. We terminated the Mino-Wrap license agreement on December 11, 2023.

NoveCite – On October 6, 2020, our

subsidiary NoveCite entered into a license agreement with Novellus Therapeutics Limited (“Licensor”), whereby NoveCite acquired

an exclusive, worldwide license, with the right to sublicense, develop and commercialize a stem cell therapy based on the Licensor’s

patented technology for the treatment of acute pneumonitis of any etiology in which inflammation is a major agent in humans. Upon execution

of the license agreement, NoveCite paid an upfront payment of $5,000,000 to Licensor and issued to Licensor shares of Novecite’s

common stock representing 25% of NoveCite’s currently outstanding equity. We own the other 75% of NoveCite’s currently outstanding

equity.

Citius Pharma is responsible for the operational

activities of NoveCite and bears all costs necessary to operate NoveCite. Citius Pharma’s officers are also the officers of NoveCite

and oversee the business strategy and operations of NoveCite. As such, NoveCite is accounted for as a consolidated subsidiary with a

noncontrolling interest.

In July 2021, Novellus was acquired by Brooklyn

ImmunoTherapeutics (“Brooklyn”). Pursuant to this transaction, the NoveCite license was assumed by Brooklyn with all original

terms and conditions. As part of the Novellus and Brooklyn merger transaction, the 25% non-dilutive position per the subscription agreement

between Novellus and NoveCite was removed. In October 2021, Brooklyn changed its name to Eterna Therapeutics Inc. (“Eterna”).

Under the license agreement, NoveCite is obligated

to pay Licensor up to an aggregate of $51,000,000 in regulatory and developmental milestone payments. NoveCite also must pay a royalty

equal to a mid-teens percentage of net sales, commencing upon the first commercial sale of a licensed product. This royalty is subject

to downward adjustment on a product-by-product and country-by-country basis to a mid-single digit percentage (within a range of 4% to

8%) of net sales in any country in the event of the expiration of the last valid patent claim or if no valid patent claim exists in that

country. The royalty will end on the earlier of (i) date on which a biosimilar product is first marketed, sold, or distributed by Licensor

or any third party in the applicable country or (ii) the 10-year anniversary of the date of expiration of the last-to-expire valid patent

claim in that country. In the case of a country where no licensed patent ever exists, the royalty will end on the later of (i) the date

of expiry of such licensed product’s regulatory exclusivity and (ii) the 10-year anniversary of the date of the first commercial

sale of the licensed product in the applicable country. In addition, NoveCite will pay to Licensor an amount equal to a mid-twenties

percentage of any sublicensee fees it receives.

Under the terms of the license agreement, in

the event that Licensor receives any revenue involving the original cell line included in the licensed technology, then Licensor shall

remit to NoveCite 50% of such revenue.

LYMPHIR – In September 2021, Citius Pharma

entered into an asset purchase agreement with Dr. Reddy’s and a license agreement with Eisai to acquire an exclusive license for

E7777 (denileukin diftitox), a late-stage oncology immunotherapy for the treatment of CTCL, a rare form of non-Hodgkin lymphoma. Citius

Pharma renamed E7777 as I/ONTAK and also obtained the trade name LYMPHIR for the product. Citius Pharma assigned these agreements to

Citius Oncology effective April 1, 2022.

Under the terms of the agreements, Citius Pharma

acquired Dr. Reddy’s exclusive license for E7777 from Eisai and other related assets owned by Dr. Reddy’s (now owned by Citius

Oncology). The exclusive license rights, through Citius Oncology, include rights to develop and commercialize E7777 in all markets except

for Japan and certain parts of Asia. Additionally, we, through Citius Oncology, retain an option on the right to develop and market the

product in India. Eisai retains exclusive development and marketing rights for the agent in Japan, China, Korea, Taiwan, Hong Kong, Macau,

Indonesia, Thailand, Malaysia, Brunei, Singapore, India (subject to the India option), Pakistan, Sri Lanka, Philippines, Vietnam, Myanmar,

Cambodia, Laos, Afghanistan, Bangladesh, Bhutan, Nepal, Mongolia, and Papua New Guinea. Citius Pharma paid a $40 million upfront payment,

which represents the acquisition date fair value of the in-process research and development acquired from Dr. Reddy’s. Dr. Reddy’s

is entitled to up to $40 million in development milestone payments related to CTCL approvals in the U.S. and other markets, up to $70

million in development milestones for additional indications, as well as commercial milestone payments and low double-digit tiered royalties