false

0000814676

0000814676

2024-11-01

2024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2024

CPS TECHNOLOGIES CORP.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

0-16088

|

04-2832509

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

111 South Worcester Street, Norton, Massachusetts

|

02766

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code

|

508-222-0614

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4( c)) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

CPSH

|

Nasdaq Capital Market

|

Item 2.02 Results of Operations and Financial Condition

On October 30, 2024, the Company issued a press release announcing its financial results for the quarter and nine months ended September 28, 2024. A copy of the press release is attached hereto as Exhibit 99 and is incorporated herein in its entirety by reference.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (The “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements.

Except for historical information contained in the press release attached as an exhibit hereto, the press release contains forward-looking statements which involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. Please refer to the cautionary note in the press release regarding these forward-looking statements.

Item 8.01 Other Events

Exhibit 99.2 is incorporated herein in its entirety by reference.

Item 9.01 Financial Statements and Exhibits

|

EXHIBIT

NUMBER

|

DESCRIPTION

|

|

99.1

|

|

|

99.2

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

CPS Technologies Corp.

(Registrant)

|

|

Date: November 1, 2024

|

/s/ Charles K. Griffith, Jr.

Charles K. Griffith Jr.

Chief Financial Officer

|

Exhibit 99.1

FOR RELEASE: IMMEDIATE

CPS Technologies Corporation Announces Third Quarter 2024 Financial Results

Set for Improved Financial Performance in Fourth Quarter and Beyond

Norton, Massachusetts – October 30, 2024 – CPS Technologies Corporation (NASDAQ:CPSH) (“CPS” or the “Company”) today announced financial results for the fiscal third quarter ended September 28, 2024.

Third Quarter Summary

| |

●

|

Revenue of $4.2 million for the third quarter of 2024 versus $6.3 million in the prior-year period, reflecting lower overall shipments due to the previously-announced end of the Company’s HybridTech Armor® contract with Kinetic Protection for the U.S. Navy

|

| |

●

|

Gross margin of (12) percent versus 20 percent in the third quarter of 2023, largely reflecting lower manufacturing efficiencies as well as start-up costs tied to hiring and training of a third shift, the benefit of which will be seen in the fourth quarter and beyond.

|

| |

●

|

Operating loss of $1.5 million for the quarter ended September 28, 2024 compared to an operating profit of $0.1 million in the prior-year period

|

| |

●

|

Recently won a Phase II contract from the U.S. Department of Energy, worth $1.1 million over 24 months, to continue development of “Modular Radiation Shielding for Transportation and Use of Microreactors”

|

| |

●

|

Secured a new $200K development contract from the U.S. Naval Air Systems Command, or NAVAIR, under which CPS will continue development of metal matrix composite solutions for applications requiring high strength at reduced weight.

|

| |

●

|

The Company today announced that it has received an award, valued at approximately $12 million, from a longstanding global semiconductor customer to provide power module components and related solutions. See separate press release for further details.

|

“While this quarter was negatively impacted by the costs related to staffing and training a third operating shift, we are optimistic about significantly improved performance in the fourth quarter and beyond,” said Brian Mackey, President and CEO. “We recently won another Phase II award from the U.S. government – with the Department of Energy – and just today announced a $12.0 million power module component contract, with a well-known global semiconductor manufacturer. Our third shift began production in the third quarter, though the impact on revenue will not be felt until the fourth quarter. We anticipate higher deliveries going forward. Overall, our book to bill ratio – currently 1.22 – provides confidence that we are weathering the storm of headwinds caused by the end of our HybridTech Armor® contract, supply chain inefficiencies, and a challenging staffing environment. We are now confident that the Company’s long-term strategy of expanding its product portfolio, working with the government to fund innovative R&D initiatives, and growing our core product lines are starting to bear fruit. We appreciate our investors’ continued patience and interest, and we look forward to the quarters to come.”

Results of Operations

CPS reported revenue of $4.2 million in the third quarter of fiscal 2024 versus $6.3 million in the prior-year period, primarily reflecting the previously-announced completion of the Company’s HybridTech Armor® contract with Kinetic Protection, the prime contractor for the U.S. Navy; another major customer has also purchased less, year-over-year, as it works through excess inventory.

Gross loss was $0.5 million, or (12) percent of revenue, versus a gross profit of $1.2 million, or 20 percent of revenue, in the fiscal 2023 third quarter, with the negative variance year-over-year due to lower overall revenue and reduced manufacturing efficiencies, along with costs associated with staffing and training a third shift that began operating the last week of August. During the quarter, this new staff worked alongside other workers for training, impacting overall cost of goods sold without a corresponding top line revenue component in the quarter.

The Company reported an operating loss of $1.5 million in the fiscal 2024 third quarter compared with an operating profit of $0.1 million in the prior-year period. Reported net loss was $1.0 million, or $(0.07) per diluted share, versus net income of $0.2 million, or $0.01 per diluted share, in the quarter ended September 30, 2023.

Conference Call

The Company will be hosting its third quarter 2024 earnings call at 9:00 am tomorrow, October 31, 2024. Those interested in participating in the conference call should dial the following:

Call in Number: 1-844-943-2942

Participant Passcode: 475242

The Company encourages those who wish to participate to call in 10 minutes before the scheduled start time to ensure the operator can connect all participants.

About CPS

CPS is a technology and manufacturing leader in producing high-performance materials solutions for its customers. The company’s products and intellectual property address critical needs in a variety of applications, including electric trains and subway cars, wind turbines, hybrid vehicles, electric vehicles, Navy ships, the smart electric grid, 5G infrastructure and others. CPS hermetic packages can be found in many Aerospace and Satellite applications. CPS’ armor products provide exceptional ballistic protection and environmental durability at very light weight. CPS is committed to innovation and to supporting our customers in building solutions for the transition to clean energy.

Safe Harbor

Statements made in this document that are not historical facts or which apply prospectively, including those relating to 2024 financial results, are forward-looking statements that involve risks and uncertainties. These forward-looking statements are identified by the use of terms and phrases such as "will," "intends," "believes," "expects," "plans," "anticipates" and similar expressions. Investors should not rely on forward looking statements because they are subject to a variety of risks and uncertainties and other factors that could cause actual results to differ materially from the company's expectation. Additional information concerning risk factors is contained from time to time in the company's SEC filings, including its Annual Report on Form 10-K and other periodic reports filed with the SEC. Forward-looking statements contained in this press release speak only as of the date of this release. Subsequent events or circumstances occurring after such date may render these statements incomplete or out of date. The company expressly disclaims any obligation to update the information contained in this release.

CPS Technologies Corporation

111 South Worcester Street

Norton, MA 02766

www.cpstechnologysolutions.com

Investor Relations:

Chris Witty

646-438-9385

cwitty@darrowir.com

|

CPS TECHNOLOGIES CORPORATION

|

|

Statements of Operations (Unaudited)

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 28,

|

|

|

September 30,

|

|

|

September 28,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

$ |

4,247,116 |

|

|

$ |

6,285,041 |

|

|

$ |

15,190,063 |

|

|

$ |

20,803,447 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

4,247,116 |

|

|

|

6,285,041 |

|

|

|

15,190,063 |

|

|

|

20,803,447 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales

|

|

|

4,770,548 |

|

|

|

5,049,177 |

|

|

|

15,037,177 |

|

|

|

15,126,621 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss)

|

|

|

(523,432 |

) |

|

|

1,235,864 |

|

|

|

152,886 |

|

|

|

5,676,826 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expense

|

|

|

963,064 |

|

|

|

1,105,227 |

|

|

|

3,214,831 |

|

|

|

4,121,099 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

(1,486,496 |

) |

|

|

130,637 |

|

|

|

(3,061,945 |

) |

|

|

1,555,727 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net

|

|

|

71,650 |

|

|

|

78,181 |

|

|

|

241,686 |

|

|

|

176,325 |

|

|

Other income (expense), net

|

|

|

(676 |

) |

|

|

(1,228 |

) |

|

|

159 |

|

|

|

(4,130 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) before income tax

|

|

|

(1,415,522 |

) |

|

|

207,590 |

|

|

|

(2,820,100 |

) |

|

|

1,727,922 |

|

|

Income tax provision (benefit)

|

|

|

(372,683 |

) |

|

|

36,509 |

|

|

|

(679,803 |

) |

|

|

497,137 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(1,042,839 |

) |

|

$ |

171,081 |

|

|

$ |

(2,140,297 |

) |

|

$ |

1,230,785 |

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized gains on available for sale securities

|

|

|

8,745 |

|

|

|

-- |

|

|

|

17,446 |

|

|

|

-- |

|

|

Total other comprehensive income

|

|

|

8,745 |

|

|

|

-- |

|

|

|

17,446 |

|

|

|

-- |

|

|

Total comprehensive income (loss)

|

|

$ |

(1,034,094 |

) |

|

$ |

171,081 |

|

|

$ |

(2,122,851 |

) |

|

$ |

1,230,785 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per basic common share

|

|

$ |

(0.07 |

) |

|

$ |

0.01 |

|

|

$ |

(0.15 |

) |

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of basic common shares outstanding

|

|

|

14,525,664 |

|

|

|

14,517,364 |

|

|

|

14,520,827 |

|

|

|

14,487,873 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per diluted common share

|

|

$ |

(0.07 |

) |

|

$ |

0.01 |

|

|

$ |

(0.15 |

) |

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of diluted common shares outstanding

|

|

|

14,525,664 |

|

|

|

14,636,241 |

|

|

|

14,520,827 |

|

|

|

14,632,591 |

|

CPS TECHNOLOGIES CORP.

Balance Sheets (Unaudited)

| |

|

September 28,

|

|

|

December 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

4,689,004 |

|

|

$ |

8,813,626 |

|

|

Marketable securities, at fair value

|

|

|

1,020,952 |

|

|

|

– |

|

|

Accounts receivable-trade, net

|

|

|

3,654,549 |

|

|

|

4,389,155 |

|

|

Accounts receivable-other

|

|

|

362,312 |

|

|

|

83,191 |

|

|

Inventories, net

|

|

|

4,433,412 |

|

|

|

4,581,930 |

|

|

Prepaid expenses and other current assets

|

|

|

506,126 |

|

|

|

276,349 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

14,666,355 |

|

|

|

18,144,251 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment:

|

|

|

|

|

|

|

|

|

|

Production equipment

|

|

|

9,953,702 |

|

|

|

11,271,982 |

|

|

Furniture and office equipment

|

|

|

891,921 |

|

|

|

952,883 |

|

|

Leasehold improvements

|

|

|

988,804 |

|

|

|

985,649 |

|

| |

|

|

|

|

|

|

|

|

|

Total cost

|

|

|

11,834,427 |

|

|

|

13,210,514 |

|

| |

|

|

|

|

|

|

|

|

|

Accumulated depreciation and amortization

|

|

|

(10,200,302 |

) |

|

|

(11,936,004 |

) |

|

Construction in progress

|

|

|

448,184 |

|

|

|

281,629 |

|

| |

|

|

|

|

|

|

|

|

|

Net property and equipment

|

|

|

2,082,309 |

|

|

|

1,556,139 |

|

| |

|

|

|

|

|

|

|

|

|

Right-of-use lease asset

|

|

|

224,000 |

|

|

|

332,000 |

|

|

Deferred taxes, net

|

|

|

2,249,985 |

|

|

|

1,569,726 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

19,222,649 |

|

|

$ |

21,602,116 |

|

| |

|

September 28,

|

|

|

December 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

LIABILITIES AND STOCKHOLDERS` EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Note payable, current portion

|

|

$ |

20,103 |

|

|

$ |

46,797 |

|

|

Accounts payable

|

|

|

2,497,055 |

|

|

|

2,535,086 |

|

|

Accrued expenses

|

|

|

840,757 |

|

|

|

1,075,137 |

|

|

Deferred revenue

|

|

|

160,412 |

|

|

|

251,755 |

|

|

Lease liability, current portion

|

|

|

160,000 |

|

|

|

160,000 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

3,678,327 |

|

|

|

4,068,775 |

|

| |

|

|

|

|

|

|

|

|

|

Note payable less current portion

|

|

|

– |

|

|

|

8,090 |

|

|

Deferred revenue – long term

|

|

|

31,277 |

|

|

|

31,277 |

|

|

Long term lease liability

|

|

|

64,000 |

|

|

|

172,000 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

3,773,604 |

|

|

|

4,280,142 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (note 7)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders` equity:

|

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value, authorized 20,000,000 shares; issued 14,661,487 shares; outstanding 14,525,960 shares at September 28, 2024 and issued 14,601,487 shares; outstanding 14,519,215 shares at December 30, 2023

|

|

|

146,615 |

|

|

|

146,015 |

|

|

Preferred stock, no shares issued or outstanding

|

|

|

– |

|

|

|

– |

|

|

Additional paid-in capital

|

|

|

40,520,215 |

|

|

|

40,180,893 |

|

|

Accumulated other comprehensive income

|

|

|

17,446 |

|

|

|

– |

|

|

Accumulated deficit

|

|

|

(24,895,093 |

) |

|

|

(22,754,796 |

) |

|

Less cost of 135,527 common shares repurchased at September 28, 2024 and 82,272 common shares repurchased at December 30, 2023

|

|

|

(340,138 |

) |

|

|

(250,138 |

) |

| |

|

|

|

|

|

|

|

|

|

Total stockholders` equity

|

|

|

15,449,045 |

|

|

|

17,321,974 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders` equity

|

|

$ |

19,222,649 |

|

|

$ |

21,602,116 |

|

Exhibit 99.2

|

CPS TECHNOLOGIES CORPORATION

|

|

Statements of Operations (Unaudited)

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 28,

|

|

|

September 30,

|

|

|

September 28,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

$ |

4,247,116 |

|

|

$ |

6,285,041 |

|

|

$ |

15,190,063 |

|

|

$ |

20,803,447 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

4,247,116 |

|

|

|

6,285,041 |

|

|

|

15,190,063 |

|

|

|

20,803,447 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales

|

|

|

4,770,548 |

|

|

|

5,049,177 |

|

|

|

15,037,177 |

|

|

|

15,126,621 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss)

|

|

|

(523,432 |

) |

|

|

1,235,864 |

|

|

|

152,886 |

|

|

|

5,676,826 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expense

|

|

|

963,064 |

|

|

|

1,105,227 |

|

|

|

3,214,831 |

|

|

|

4,121,099 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

(1,486,496 |

) |

|

|

130,637 |

|

|

|

(3,061,945 |

) |

|

|

1,555,727 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net

|

|

|

71,650 |

|

|

|

78,181 |

|

|

|

241,686 |

|

|

|

176,325 |

|

|

Other income (expense), net

|

|

|

(676 |

) |

|

|

(1,228 |

) |

|

|

159 |

|

|

|

(4,130 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) before income tax

|

|

|

(1,415,522 |

) |

|

|

207,590 |

|

|

|

(2,820,100 |

) |

|

|

1,727,922 |

|

|

Income tax provision (benefit)

|

|

|

(372,683 |

) |

|

|

36,509 |

|

|

|

(679,803 |

) |

|

|

497,137 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(1,042,839 |

) |

|

$ |

171,081 |

|

|

$ |

(2,140,297 |

) |

|

$ |

1,230,785 |

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized gains on available for sale securities

|

|

|

8,745 |

|

|

|

-- |

|

|

|

17,446 |

|

|

|

-- |

|

|

Total other comprehensive income

|

|

|

8,745 |

|

|

|

-- |

|

|

|

17,446 |

|

|

|

-- |

|

|

Total comprehensive income (loss)

|

|

$ |

(1,034,094 |

) |

|

$ |

171,081 |

|

|

$ |

(2,122,851 |

) |

|

$ |

1,230,785 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per basic common share

|

|

$ |

(0.07 |

) |

|

$ |

0.01 |

|

|

$ |

(0.15 |

) |

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of basic common shares outstanding

|

|

|

14,525,664 |

|

|

|

14,517,364 |

|

|

|

14,520,827 |

|

|

|

14,487,873 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per diluted common share

|

|

$ |

(0.07 |

) |

|

$ |

0.01 |

|

|

$ |

(0.15 |

) |

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of diluted common shares outstanding

|

|

|

14,525,664 |

|

|

|

14,636,241 |

|

|

|

14,520,827 |

|

|

|

14,632,591 |

|

CPS TECHNOLOGIES CORP.

Balance Sheets (Unaudited)

| |

|

September 28,

|

|

|

December 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

4,689,004 |

|

|

$ |

8,813,626 |

|

|

Marketable securities, at fair value

|

|

|

1,020,952 |

|

|

|

– |

|

|

Accounts receivable-trade, net

|

|

|

3,654,549 |

|

|

|

4,389,155 |

|

|

Accounts receivable-other

|

|

|

362,312 |

|

|

|

83,191 |

|

|

Inventories, net

|

|

|

4,433,412 |

|

|

|

4,581,930 |

|

|

Prepaid expenses and other current assets

|

|

|

506,126 |

|

|

|

276,349 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

14,666,355 |

|

|

|

18,144,251 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment:

|

|

|

|

|

|

|

|

|

|

Production equipment

|

|

|

9,953,702 |

|

|

|

11,271,982 |

|

|

Furniture and office equipment

|

|

|

891,921 |

|

|

|

952,883 |

|

|

Leasehold improvements

|

|

|

988,804 |

|

|

|

985,649 |

|

| |

|

|

|

|

|

|

|

|

|

Total cost

|

|

|

11,834,427 |

|

|

|

13,210,514 |

|

| |

|

|

|

|

|

|

|

|

|

Accumulated depreciation and amortization

|

|

|

(10,200,302 |

) |

|

|

(11,936,004 |

) |

|

Construction in progress

|

|

|

448,184 |

|

|

|

281,629 |

|

| |

|

|

|

|

|

|

|

|

|

Net property and equipment

|

|

|

2,082,309 |

|

|

|

1,556,139 |

|

| |

|

|

|

|

|

|

|

|

|

Right-of-use lease asset

|

|

|

224,000 |

|

|

|

332,000 |

|

|

Deferred taxes, net

|

|

|

2,249,985 |

|

|

|

1,569,726 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

19,222,649 |

|

|

$ |

21,602,116 |

|

| |

|

September 28,

|

|

|

December 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

LIABILITIES AND STOCKHOLDERS` EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Note payable, current portion

|

|

$ |

20,103 |

|

|

$ |

46,797 |

|

|

Accounts payable

|

|

|

2,497,055 |

|

|

|

2,535,086 |

|

|

Accrued expenses

|

|

|

840,757 |

|

|

|

1,075,137 |

|

|

Deferred revenue

|

|

|

160,412 |

|

|

|

251,755 |

|

|

Lease liability, current portion

|

|

|

160,000 |

|

|

|

160,000 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

3,678,327 |

|

|

|

4,068,775 |

|

| |

|

|

|

|

|

|

|

|

|

Note payable less current portion

|

|

|

– |

|

|

|

8,090 |

|

|

Deferred revenue – long term

|

|

|

31,277 |

|

|

|

31,277 |

|

|

Long term lease liability

|

|

|

64,000 |

|

|

|

172,000 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

3,773,604 |

|

|

|

4,280,142 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (note 7)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders` equity:

|

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value, authorized 20,000,000 shares; issued 14,661,487 shares; outstanding 14,525,960 shares at September 28, 2024 and issued 14,601,487 shares; outstanding 14,519,215 shares at December 30, 2023

|

|

|

146,615 |

|

|

|

146,015 |

|

|

Preferred stock, no shares issued or outstanding

|

|

|

– |

|

|

|

– |

|

|

Additional paid-in capital

|

|

|

40,520,215 |

|

|

|

40,180,893 |

|

|

Accumulated other comprehensive income

|

|

|

17,446 |

|

|

|

– |

|

|

Accumulated deficit

|

|

|

(24,895,093 |

) |

|

|

(22,754,796 |

) |

|

Less cost of 135,527 common shares repurchased at September 28, 2024 and 82,272 common shares repurchased at December 30, 2023

|

|

|

(340,138 |

) |

|

|

(250,138 |

) |

| |

|

|

|

|

|

|

|

|

|

Total stockholders` equity

|

|

|

15,449,045 |

|

|

|

17,321,974 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders` equity

|

|

$ |

19,222,649 |

|

|

$ |

21,602,116 |

|

v3.24.3

Document And Entity Information

|

Nov. 01, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CPS TECHNOLOGIES CORP.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 01, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

0-16088

|

| Entity, Tax Identification Number |

04-2832509

|

| Entity, Address, Address Line One |

111 South Worcester Street

|

| Entity, Address, City or Town |

Norton

|

| Entity, Address, State or Province |

MA

|

| Entity, Address, Postal Zip Code |

02766

|

| City Area Code |

508

|

| Local Phone Number |

222-0614

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CPSH

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000814676

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

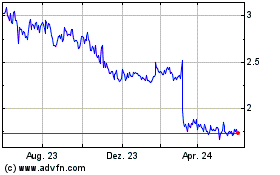

CPS Technologies (NASDAQ:CPSH)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

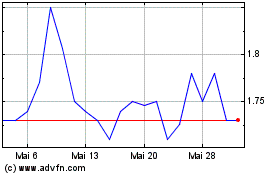

CPS Technologies (NASDAQ:CPSH)

Historical Stock Chart

Von Nov 2023 bis Nov 2024