false

0001692415

0001692415

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): November 7, 2024

CO-DIAGNOSTICS,

INC.

(Exact

name of small business issuer as specified in its charter)

| Utah |

|

1-38148 |

|

46-2609363 |

| (State

or other jurisdiction of |

|

(Commission |

|

(IRS

Employer |

| incorporation

or organization) |

|

File

Number) |

|

Identification

Number) |

2401

S. Foothill Drive, Suite D, Salt Lake City, Utah 84109

(Address

of principal executive offices)

(801)

438-1036

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

CODX |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

November 7, 2024, Co-Diagnostics, Inc. (the “Company”) issued a press release announcing financial results for its quarter

ended September 30, 2024. The full text of the press release, which includes information regarding the Company’s use of a non-GAAP

financial measure, is furnished as Exhibit 99.1 to this Form 8-K.

The

information contained in this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Furthermore,

the information contained in this Item 2.02 or Exhibit 99.1 shall not be deemed to be incorporated by reference into any registration

statement or other document filed pursuant to the Securities Act of 1933, except as shall be expressly set forth by specific reference

in such filing.

Item

7.01. Regulation FD. Disclosure.

The

information set forth under Item 2.02 is incorporated by reference as if fully set forth herein.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

CO-DIAGNOSTICS,

INC. |

| |

|

|

| Date:

November 7, 2024 |

By: |

/s/

Brian Brown |

| |

Name:

|

Brian

Brown |

| |

Title: |

Chief

Financial Officer |

| |

|

(Principal

Financial and Accounting Officer) |

Exhibit 99.1

Co-Diagnostics,

Inc. Reports Third Quarter 2024 Financial Results

SALT

LAKE CITY, November 7, 2024— Co-Diagnostics, Inc. (NASDAQ: CODX), a molecular diagnostics company with a unique, patented platform

for the development of molecular diagnostic tests, today announced financial results for the quarter ended September 30, 2024.

Third

Quarter 2024 Financial Results:

| |

● |

Revenue

of $0.6 million, which declined from $2.5 million during the prior year primarily due to timing of grant revenue recognition.

Grant revenue totaled $0.4 million while product revenue totaled $0.2 million |

| |

● |

Operating

expenses of $10.6 million decreased by 5.0% from the prior year due to higher expenses in 2023 related to platform development and

regulatory submission preparation |

| |

● |

Operating

loss of $10.2 million compared to operating loss of $8.9 million in 2023 |

| |

● |

Net

loss of $9.7 million, compared to net loss of $6.0 million in the prior year, representing a loss of $0.32 per fully diluted share,

compared to a loss of $0.20 per fully diluted share in the prior year |

| |

● |

Adjusted

EBITDA loss of $8.8 million |

| |

● |

Cash,

cash equivalents, and marketable securities of $37.7 million as of September 30, 2024 |

Third

Quarter and Recent 2024 Business Highlights:

| |

● |

Completed

in silico analysis of the Co-Dx™ Logix Smart® Mpox 2-Gene RUO test to evaluate sensitivity for clade 1b mpox, which showed

that the test should retain full reactivity against newer strains |

| |

● |

Announced

expansion of vector control business line to customers across 15 states |

| |

● |

Attended

and participated in ADLM 2024 in Chicago to discuss the role of the Co-Dx PCR Pro™ Platform* in closing the global diagnostics

gap for many indications, including tuberculosis (TB) |

| |

● |

Presented

and hosted a booth at the 16th Next Generation Dx Summit in Washington, D.C., to discuss the future of accessible diagnostics

on the Co-Dx PCR Pro Platform* |

| |

● |

Oligonucleotide

(Co-Primers) manufacturing facility in India preparing for inauguration in early December 2024 |

“We

are excited by the progress that Co-Diagnostics has made on the development of our pipeline this year,” said Dwight Egan, Co-Diagnostics’

Chief Executive Officer. “We have maintained an active dialogue with the FDA throughout their substantive review of our 510(k)

application, and continue to advance all tests in our pipeline towards completion, regulatory submission and commercialization. At Co-Diagnostics,

we firmly believe that our COVID-19, tuberculosis, multiplex respiratory, and HPV multiplex tests on the Co-Dx PCR platform have the

potential to increase access to state-of-the-art PCR diagnostics and to improve the quality of health care around the world. Our team

has been working hard to make our mission a reality, and I am excited to continue to drive our test developments forward throughout the

remainder of the year and into next.”

“Co-Diagnostics

has made significant progress on our tests, and look forward to providing you with regulatory and commercialization updates as they develop,”

said Brian Brown, Co-Diagnostics’ Chief Financial Officer.

Conference

Call and Webcast

Co-Diagnostics

will host a conference call and webcast at 4:30 p.m. EDT today to discuss its financial results with analysts and institutional investors.

The conference call and webcast will be available via:

Webcast:

ir.codiagnostics.com on the Events & Webcasts page

Conference

Call: 844-481-2661 (domestic) or 412-317-0652 (international)

The

call will be recorded and later made available on the Company’s website: https://codiagnostics.com.

*The

Co-Dx PCR platform (including the PCR Home™, PCR Pro™, mobile app, and all associated tests) is subject to review by the

FDA and/or other regulatory bodies and is not yet available for sale. The Co-Dx PCR Pro instrument and Co-Dx COVID-19 Test are currently

under review by the FDA.

About

Co-Diagnostics, Inc.:

Co-Diagnostics,

Inc., a Utah corporation, is a molecular diagnostics company that develops, manufactures and markets state-of-the-art diagnostics technologies.

The Company’s technologies are utilized for tests that are designed using the detection and/or analysis of nucleic acid molecules

(DNA or RNA). The Company also uses its proprietary technology to design specific tests for its Co-Dx PCR at-home and point-of-care platform

and to locate genetic markers for use in applications other than infectious disease.

Non-GAAP

Financial Measures:

This

press release contains adjusted EBITDA, which is a non-GAAP measure defined as net income excluding depreciation, amortization, income

tax (benefit) expense, net interest (income) expense, realized gains on investments, stock-based compensation, change in fair

value of contingent consideration, gain or loss on disposition of assets, and one-time transaction related costs. The Company believes

that adjusted EBITDA provides useful information to management and investors relating to its results of operations. The Company’s

management uses this non-GAAP measure to compare the Company’s performance to that of prior periods for trend analyses, and for

budgeting and planning purposes. The Company believes that the use of adjusted EBITDA provides an additional tool for investors to use

in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with other companies, many

of which present similar non-GAAP financial measures to investors, and that it allows for greater transparency with respect to key metrics

used by management in its financial and operational decision-making.

Management

does not consider the non-GAAP measure in isolation or as an alternative to financial measures determined in accordance with GAAP. The

principal limitation of the non-GAAP financial measure is that it excludes significant expenses that are required by GAAP to be recorded

in the Company’s financial statements. In order to compensate for these limitations, management presents the non-GAAP financial

measure together with GAAP results. Non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but

should not be considered a substitute for, or superior to, GAAP results. A reconciliation table of the net income, the most comparable

GAAP financial measure to adjusted EBITDA, is included at the end of this release. The Company urges investors to review the reconciliation

and not to rely on any single financial measure to evaluate the Company’s business.

Forward-Looking

Statements:

This

press release contains forward-looking statements. Forward-looking statements can be identified by words such as “believes,”

“expects,” “estimates,” “intends,” “may,” “plans,” “will” and

similar expressions, or the negative of these words. Such forward-looking statements are based on facts and conditions as they exist

at the time such statements are made and predictions as to future facts and conditions. Forward-looking statements in this release include

statements regarding our advancement of all tests in our pipeline towards completion, regulatory submission and commercialization and

our belief that our COVID-19, tuberculosis, multiplex respiratory, and HPV multiplex tests on the Co-Dx PCR platform have the potential

to increase access to state-of-the-art PCR diagnostics and to improve the quality of health care around the world.

Forward-looking statements are subject to inherent uncertainties, risks and changes in circumstances. Actual results may differ materially

from those contemplated or anticipated by such forward-looking statements. Readers of this press release are cautioned not to place undue

reliance on any forward-looking statements. There can be no assurance that any of the anticipated results will occur on a timely basis

or at all due to certain risks and uncertainties, a discussion of which can be found in our Risk Factors disclosure in our Annual Report

on Form 10-K, filed with the Securities and Exchange Commission (SEC) on March 14, 2024, and in our other filings with the SEC. The Company

does not undertake any obligation to update any forward-looking statement relating to matters discussed in this press release, except

as may be required by applicable securities laws.

Investor

Relations Contact:

Andrew

Benson

Head

of Investor Relations

+1

801-438-1036

investors@codiagnostics.com

CO-DIAGNOSTICS,

INC. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

(Unaudited)

| | |

September 30, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 10,797,630 | | |

$ | 14,916,878 | |

| Marketable investment securities | |

| 26,864,571 | | |

| 43,631,510 | |

| Accounts receivable, net | |

| 178,243 | | |

| 303,926 | |

| Inventory, net | |

| 1,266,016 | | |

| 1,664,725 | |

| Income taxes receivable | |

| - | | |

| 26,955 | |

| Prepaid expenses and other current assets | |

| 996,698 | | |

| 1,597,114 | |

| Total current assets | |

| 40,103,158 | | |

| 62,141,108 | |

| Property and equipment, net | |

| 2,984,112 | | |

| 3,035,729 | |

| Operating lease right-of-use asset | |

| 2,332,877 | | |

| 2,966,774 | |

| Intangible assets, net | |

| 26,176,667 | | |

| 26,403,667 | |

| Investment in joint venture | |

| 784,357 | | |

| 773,382 | |

| Total assets | |

$ | 72,381,171 | | |

$ | 95,320,660 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 2,176,426 | | |

$ | 1,482,109 | |

| Accrued expenses | |

| 1,826,297 | | |

| 2,172,959 | |

| Operating lease liability, current | |

| 896,745 | | |

| 838,387 | |

| Contingent consideration liabilities, current | |

| 838,032 | | |

| 891,666 | |

| Deferred revenue | |

| 60,477 | | |

| 362,449 | |

| Total current liabilities | |

| 5,797,977 | | |

| 5,747,570 | |

| Long-term liabilities | |

| | | |

| | |

| Income taxes payable | |

| 719,628 | | |

| 659,186 | |

| Operating lease liability | |

| 1,472,100 | | |

| 2,152,180 | |

| Contingent consideration liabilities | |

| 607,526 | | |

| 748,109 | |

| Total long-term liabilities | |

| 2,799,254 | | |

| 3,559,475 | |

| Total liabilities | |

| 8,597,231 | | |

| 9,307,045 | |

| Commitments and contingencies (Note 10) | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Convertible preferred stock, $0.001 par value; 5,000,000 shares authorized; 0 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| - | | |

| - | |

| Common stock, $0.001 par value; 100,000,000 shares authorized; 36,778,430 shares issued and 31,929,752 shares outstanding as of September 30, 2024 and 36,108,346 shares issued and 31,259,668 shares outstanding as of December 31, 2023 | |

| 36,778 | | |

| 36,108 | |

| Treasury stock, at cost; 4,848,678 shares held as of September 30, 2024 and December 31, 2023, respectively | |

| (15,575,795 | ) | |

| (15,575,795 | ) |

| Additional paid-in capital | |

| 100,924,241 | | |

| 96,808,436 | |

| Accumulated other comprehensive income | |

| 408,366 | | |

| 146,700 | |

| Accumulated earnings (deficit) | |

| (22,009,650 | ) | |

| 4,598,166 | |

| Total stockholders’ equity | |

| 63,783,940 | | |

| 86,013,615 | |

| Total liabilities and stockholders’ equity | |

$ | 72,381,171 | | |

$ | 95,320,660 | |

CO-DIAGNOSTICS,

INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

| | |

Three Months Ended September 30, | |

| | |

2024 | | |

2023 | |

| Product revenue | |

$ | 206,876 | | |

$ | 136,533 | |

| Grant revenue | |

| 434,265 | | |

| 2,320,565 | |

| Total revenue | |

| 641,141 | | |

| 2,457,098 | |

| Cost of revenue | |

| 297,403 | | |

| 255,772 | |

| Gross profit | |

| 343,738 | | |

| 2,201,326 | |

| Operating expenses | |

| | | |

| | |

| Sales and marketing | |

| 1,059,745 | | |

| 1,904,395 | |

| General and administrative | |

| 4,287,380 | | |

| 3,147,753 | |

| Research and development | |

| 4,880,315 | | |

| 5,788,789 | |

| Depreciation and amortization | |

| 351,235 | | |

| 296,340 | |

| Total operating expenses | |

| 10,578,675 | | |

| 11,137,277 | |

| Loss from operations | |

| (10,234,937 | ) | |

| (8,935,951 | ) |

| Other income, net | |

| | | |

| | |

| Interest income | |

| 263,335 | | |

| 322,877 | |

| Realized gain on investments | |

| 293,067 | | |

| 425,446 | |

| Gain on disposition of assets | |

| 3,513 | | |

| (2,578 | ) |

| Gain (loss) on remeasurement of acquisition contingencies | |

| (11,927 | ) | |

| 140,296 | |

| Gain (loss) on equity method investment in joint venture | |

| 12,683 | | |

| (45,865 | ) |

| Total other income, net | |

| 560,671 | | |

| 840,176 | |

| Loss before income taxes | |

| (9,674,266 | ) | |

| (8,095,775 | ) |

| Income tax provision (benefit) | |

| 22,189 | | |

| (2,113,581 | ) |

| Net loss | |

$ | (9,696,455 | ) | |

$ | (5,982,194 | ) |

| Other comprehensive loss | |

| | | |

| | |

| Change in net unrealized gains on marketable securities, net of tax | |

| 37,158 | | |

| 33,522 | |

| Total other comprehensive income | |

$ | 37,158 | | |

$ | 33,522 | |

| Comprehensive loss | |

$ | (9,659,297 | ) | |

$ | (5,948,672 | ) |

| | |

| | | |

| | |

| Loss per common share: | |

| | | |

| | |

| Basic and Diluted | |

$ | (0.32 | ) | |

$ | (0.20 | ) |

| Weighted average shares outstanding: | |

| | | |

| | |

| Basic and Diluted | |

| 30,494,206 | | |

| 29,361,300 | |

CO-DIAGNOSTICS,

INC. AND SUBSIDIARIES

GAAP

AND NON-GAAP MEASURES

(Unaudited)

Reconciliation

of net loss to adjusted EBITDA:

| | |

Three Months Ended September 30, | |

| | |

2024 | | |

2023 | |

| Net loss | |

$ | (9,696,455 | ) | |

$ | (5,982,194 | ) |

| Interest income | |

| (263,335 | ) | |

| (322,877 | ) |

| Realized gain on investments | |

| (293,067 | ) | |

| (425,446 | ) |

| Depreciation and amortization | |

| 351,235 | | |

| 296,340 | |

| Gain on disposition of assets | |

| (3,513 | ) | |

| 2,578 | |

| Stock-based compensation expense | |

| 1,045,583 | | |

| 2,172,165 | |

| Income tax provision (benefit) | |

| 22,189 | | |

| (2,113,581 | ) |

| Change in fair value of contingent consideration | |

| 11,927 | | |

| (140,296 | ) |

| Adjusted EBITDA | |

$ | (8,825,436 | ) | |

$ | (6,513,311 | ) |

v3.24.3

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity File Number |

1-38148

|

| Entity Registrant Name |

CO-DIAGNOSTICS,

INC.

|

| Entity Central Index Key |

0001692415

|

| Entity Tax Identification Number |

46-2609363

|

| Entity Incorporation, State or Country Code |

UT

|

| Entity Address, Address Line One |

2401

S. Foothill Drive

|

| Entity Address, Address Line Two |

Suite D

|

| Entity Address, City or Town |

Salt Lake City

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84109

|

| City Area Code |

(801)

|

| Local Phone Number |

438-1036

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

CODX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

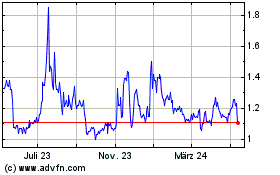

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

Von Nov 2023 bis Nov 2024