UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January

2025.

Commission File Number 0-26046

China Natural Resources, Inc.

(Translation of registrant's name into English)

Room 2205, 22/F, West Tower, Shun Tak Centre,

168-200 Connaught Road Central, Sheung Wan,

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F. Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This report on Form 6-K is hereby incorporated by reference into the Registration

Statement on Form F-3 (File No. 333-268454) of China Natural Resources, Inc. (the “Company”), and the related prospectuses,

as such registration statement and prospectuses may be amended or supplemented from time to time, and to be a part thereof from the date

on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

Nasdaq Minimum Bid Price Compliance Period Extension

On January 3, 2025, the Nasdaq Capital Market (“Nasdaq”) granted

the Company an additional 180 calendar days, or until June 30, 2025, to regain compliance with the $1.00 per share minimum requirement

for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”).

As previously reported, on July 5, 2024, the Company received a notification

letter (the “Notice”) from Nasdaq advising the Company that for 30 consecutive business days preceding the date of the Notice,

the bid price of the Company’s common shares had closed below the $1.00 per share minimum requirement for continued listing on Nasdaq

pursuant to the Bid Price Requirement. The Company was provided 180 calendar days, or until January 2, 2025, to regain compliance with

the Bid Price Requirement. The Company was unable to regain compliance with the Bid Price Requirement by January 2, 2025. Nasdaq’s

determination to grant the second compliance period was based on the Company meeting the continued listing requirement for market value

of publicly held shares and all other applicable requirements for initial listing on Nasdaq, with the exception of the Bid Price Requirement,

and the Company’s written notice of its intention to cure the deficiency during the second compliance period by effecting a reverse

stock split, if necessary.

To regain compliance, the bid price of the Company’s common shares

must close at or above $1.00 per share for a minimum of ten consecutive trading days at any time during the second 180-day compliance

period. The Company intends to monitor the closing bid price of its common shares and may, if appropriate, consider implementing available

options. There can be no assurance that the Company will be able to regain compliance with the Bid Price Requirement or maintain compliance

with the other listing requirements necessary for the Company to maintain the listing of its common shares on Nasdaq.

The Notice has no effect on the listing of the Company’s common shares

at this time and the Company’s common shares will continue to trade on Nasdaq under the symbol “CHNR”.

On January 6, 2025, the Company issued a press release

discussing the receipt of the extension notice, which is filed as Exhibit 15.1 to this Form 6-K.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CHINA NATURAL RESOURCES, INC.

|

| |

|

|

|

| Date: January 6, 2025 |

By: |

/s/ Wong Wah On Edward |

|

| |

|

Wong Wah On Edward |

|

| |

|

Chairman and Chief Executive Officer |

|

Exhibit 15.1

CHINA NATURAL RESOURCES GRANTED SECOND 180-DAY

PERIOD BY NASDAQ TO REGAIN COMPLIANCE WITH MINIMUM BID PRICE RULE

HONG KONG, January 6, 2025

– China Natural Resources Inc. (NASDAQ: CHNR) (the “Company”) today announced on January 3, 2025, that the

Company has been granted an additional 180-day period from Nasdaq’s Listing Qualifications Department, through June 30, 2025,

to regain compliance with the $1.00 minimum bid price requirement for continued listing on the Nasdaq Capital Market. The

Company’s common shares continue to trade on the Nasdaq Capital Market under the symbol “CHNR.”

If at any time until June 30, 2025, the closing bid price of

the Company’s common shares is at least $1.00 per share for a minimum of ten consecutive business days, Nasdaq will provide the

Company with written confirmation of compliance. If compliance cannot be demonstrated by June 30, 2025, Nasdaq will provide written notification

that the common shares will be subject to delisting. At such time, the Company may appeal the determination to a Nasdaq Hearings Panel.

The Company intends to monitor the closing bid price of its common shares between now and June 30, 2025, and intends to consider available

options to cure the deficiency and regain compliance with the minimum bid price requirement within the compliance period.

About China Natural Resources:

China Natural Resources, Inc. (NASDAQ: CHNR)

is currently a holding company that operates in exploration and mining business. Upon the completion of Precise Space-Time Technology

disposition on July 28, 2023, the Company is engaged in the acquisition and exploitation of mining rights in Inner Mongolia, including

exploring for lead, silver and other nonferrous metal, and is actively exploring business opportunities in the healthcare and other non-natural

resource sectors. In 2023, China Natural Resources agreed to acquire Williams Minerals, which operates a lithium mine in Zimbabwe, for

a maximum consideration of US$1.75 billion. Currently, we are actively working with all involved parties to close the deal as soon as

possible. Williams Minerals is owned by China Natural Resources’ controlling shareholder, Feishang Group Limited, and a non-affiliate,

Top Pacific (China) Limited.

Forward-Looking Statements:

This press release includes forward-looking statements

within the meaning of the U.S. federal securities laws. These statements include, without limitation, statements regarding the intent,

belief and current expectations of the Company, its directors or its officers with respect to: the potential presented by the exploration

and mining sector in the People’s Republic of China (the “PRC”) and other industry sectors in the PRC generally; the

impact on the Company’s financial position, growth potential and business of in the sale of Precise Space-Time Technology and Shanghai

Onway specifically; the experience, supply chain and customer relationships and market insights of the Precise Space-Time Technology team;

and the Company’s ability to locate and execute on strategic opportunities in non-natural resources sectors. Forward-looking statements

are not a guarantee of future performance and involve risks and uncertainties, and actual results may differ materially from those in

the forward-looking statement as a result of various factors. Among the risks and uncertainties that could cause the Company’s actual

results to differ from its forward-looking statements are uncertainties associated with metal price volatility; uncertainties concerning

the viability of mining and estimates of reserves at the Company’s Wulatehouqi Moruogu Tong Mine in Inner Mongolia; uncertainties

regarding our ability to acquire a mining permit and to extract mineral reserves located in the Moruogu Tong Mine in an economically feasible

manner; uncertainties related to our ability to fund operations and capital expenditures; uncertainties relating to the acquisition of

Williams Minerals that were not discovered by us through our due diligence investigation; uncertainties related to the completion of the

acquisition of Williams Minerals which is conditional upon satisfaction or waiver of various conditions; failure to complete the acquisition

of Williams Minerals may have a material adverse effect on the Company’s business, financial condition and results of operations;

uncertainties related to the realization of the anticipated benefits associated with it; the potential lack of appetite for the Company’s

current holdings as consideration for a transaction; uncertainties related to geopolitical events and conflicts, such as the conflict

between Russia and Ukraine; uncertainties regarding the impact of climate change on our operations and business; uncertainties related

to possible future increases in operating expenses; the fluctuations of interest rates and foreign exchange rates; the results of the

next assessment by the Staff of the Nasdaq Listing Qualifications department of the Company’s compliance with the Nasdaq Listing

Rules; uncertainties related to governmental, economic and political circumstances in the PRC; uncertainties related to the Company’s

ability to fund operations; uncertainties related to possible future increases in operating expenses, including costs of labor and materials;

uncertainties related to the political situation between the PRC and the United States, and potential negative impacts on companies with

operations in the PRC that are listed on exchanges in the United States; and other risks detailed from time to time in the Company’s

filings with the U.S. Securities and Exchange Commission. When, in any forward-looking statement, the Company, or its management, expresses

an expectation or belief as to future results, that expectation or belief is expressed in good faith and is believed to have a reasonable

basis, but there can be no assurance that the stated expectation or belief will result or be achieved or accomplished. Except as required

by law, the Company undertakes no obligation to update any forward-looking statements.

SOURCE China Natural Resources, Inc.

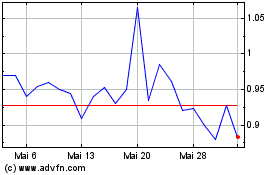

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025