First Busey Corporation (“Busey”) (Nasdaq: BUSE), the holding

company for Busey Bank, and CrossFirst Bankshares, Inc.

(“CrossFirst”) (Nasdaq: CFB), the holding company for CrossFirst

Bank, jointly announced today the signing of a definitive agreement

and plan of merger, pursuant to which CrossFirst will merge with

and into Busey (the “Merger”) in an all-common stock transaction

valued at approximately $916.8 million, based on Busey’s closing

stock price of $27.39 as of August 26, 2024. The combined company,

which will operate under the Busey brand, will have approximately

$20 billion in total assets, approximately $17 billion in total

deposits and approximately $13 billion in wealth management assets

under care.

“The partnership between our high-quality franchises is a great

fit from a strategic, financial and cultural perspective, and we

look forward to capitalizing on the many opportunities we see as a

combined company in 2025 and beyond,” said Busey Chairman and CEO

Van Dukeman. “CrossFirst is a natural fit alongside Busey’s

established commercial and wealth management offerings and our

payment technology solutions business, FirsTech, Inc. By leveraging

CrossFirst’s established presence in attractive markets with

compelling growth potential, this partnership is expected to serve

as a catalyst for additional commercial banking growth as well as

expanded opportunities to grow our existing wealth management and

payments businesses. We are excited for our associates, customers

and shareholders to experience our next chapter as Busey and

CrossFirst combine to form a premier commercial bank that maintains

the community bank values our customers and communities expect and

deserve.”

Mike Maddox, CrossFirst CEO, President and Director, stated,

“Founded on the ideals of extraordinary, personal service provided

by outstanding, local bankers, our dedicated associates at

CrossFirst have built strong, trusting relationships with our

clients and the markets we serve. We believe Busey is the right

partner to continue CrossFirst’s customer- and community-focus.

Because of our like-minded cultures, our complementary business

models and manner in which we operate, we are confident this

partnership will create significant benefits for our teams,

customers, communities and shareholders.”

Strategic Benefits of the PartnershipThe

partnership will extend Busey’s regional operating model in the

high-growth metro markets of Kansas City, Wichita, Dallas/Fort

Worth, Denver and Phoenix while bolstering its commercial banking

relationships and offering additional opportunities to grow its

wealth management business and FirsTech, Inc., Busey’s payment

technology solutions subsidiary. The combined company will further

strengthen its deep commitment to and extensive skill set in

commercial banking.

The combination is expected to create a premier full-service

commercial bank serving clients from 77 full-service locations

across 10 states with combined total assets of approximately $20

billion, $17 billion in total deposits, $15 billion in total loans

and $13 billion in wealth assets under care. With a diversified

client, loan and deposit base, this scale provides opportunities to

augment business models through new customer and product

channels.

Through compatible banking philosophies and cultures,

complementary business models, combined capital strength and

increased economies of scale, the combination is expected to

significantly enhance key performance metrics with meaningful

improvements in net interest margin and efficiency, driving

increased profitability and returns to our shareholders. Pro forma

calculations estimate Busey earnings per share accretion of

approximately 20% in 2026, the first full year of combined

operations, excluding one-time merger-related charges and assuming

fully phased-in cost savings. Tangible book value per share

dilution is projected to be modest at -0.6% with a forecasted

earnback period of approximately six months. Capital ratios are

expected to be significantly above “well-capitalized” thresholds

with 9.6% leverage, 11.0% CET1 and 14.1% total risk-based capital.

The transaction is expected to result in an internal rate of return

of over 19%. With a combined loan-to-deposit ratio of 86%, C&D

concentration of 60% and CRE concentration of 250%, the pro forma

company will be well-positioned for future growth.

Both Busey and CrossFirst have extensive experience in

successfully integrating with merger partners and are acutely

focused on ensuring a smooth transition. Between the two management

teams, Busey and CrossFirst have successfully navigated 11 mergers

and integrations since 2013.

Transaction DetailsThe merger has been

unanimously approved by each company’s board of directors.

In the merger, CrossFirst shareholders will receive 0.6675

shares of Busey common stock for each share held of CrossFirst

common stock. CrossFirst’s common shareholders, which currently do

not receive a dividend, will be eligible to receive Busey’s ongoing

dividends as declared following the closing of the merger.

Upon completion of the transaction, Busey’s shareholders will

own approximately 63.5% of the combined company and CrossFirst’s

shareholders will own approximately 36.5% of the combined company,

on a fully-diluted basis, which will continue to trade on the

Nasdaq under the “BUSE” stock ticker symbol.

Completion of the merger is subject to customary closing

conditions, including the approval of both Busey and CrossFirst

shareholders and the regulatory approvals for the holding company

merger and the bank merger. With approvals, the parties expect to

close the holding company merger in the first or second quarter of

2025.

Name and HeadquartersThe combined holding

company will continue to operate under the First Busey Corporation

name and the combined bank will operate under the Busey Bank name.

It is anticipated that CrossFirst Bank will merge with and into

Busey Bank in mid-2025. At the time of the bank merger, CrossFirst

Bank locations will become service centers of Busey Bank.

Busey Bank’s headquarters will remain in Champaign,

Illinois—near where Busey was founded more than 155 years ago. The

majority of Busey’s stable deposit base and wealth management

assets under care are within its legacy footprint.

The headquarters of the holding company will move to Leawood,

Kansas—at the site of the current CrossFirst headquarters in the

Kansas City area, which will be central to the combined company’s

new footprint, providing benefits for ease of travel, accessibility

and visibility.

Governance, Leadership and CultureThe Board of

Directors of the combined company will be comprised of thirteen

(13) members, eight (8) from Busey or Busey Bank and five (5) from

CrossFirst, with Van Dukeman serving as Executive Chairman and CEO,

Mike Maddox as President and Executive Vice Chairman, and Rod

Brenneman—current independent Chairman of the Board of

CrossFirst—as Lead Independent Director.

Management of the combined company will be a combination of both

Busey and CrossFirst executives. Van Dukeman will continue to serve

as Executive Chairman and CEO of Busey and Executive Chairman of

Busey Bank. Mike Maddox will become President and Executive Vice

Chairman of Busey and CEO of Busey Bank. Mr. Maddox will succeed

Mr. Dukeman as CEO of Busey on the earlier of the one-year

anniversary of the bank merger or the 18-month anniversary of the

holding company merger, with Dukeman remaining the Executive

Chairman of both Busey and Busey Bank.

The remainder of the management team of the combined company

will be led by a well-respected group of individuals with

significant financial services and M&A integration experience.

This group will provide continuity of leadership both during and

beyond integration. Current Busey executives—Chief Financial

Officer Jeff Jones, Chief Operating Officer Amy Randolph, Chief

Risk Officer Monica Bowe and General Counsel John Powers—will

remain in their current roles with the combined company. Randy

Rapp, current President of CrossFirst Bank, will assume the role of

President of Busey Bank while Chip Jorstad, Busey’s current

President of Credit and Bank Administration, and Amy Fauss,

CrossFirst’s current Chief Operating Officer, will assume the roles

of Chief Credit Officer and Chief Information and Technology

Officer, respectively.

Both companies support and value an engaged and empowered

workforce and are committed to building an extraordinary,

service-oriented banking experience. Busey has been named among

American Banker’s Best Banks to Work For since 2016; listed among

2023 and 2024’s America’s Best Banks by Forbes; and recognized in

all states where it operates as a Best Place to Work, in addition

to earning various wellness, training and development,

philanthropic and other workplace awards. Similarly, CrossFirst

continues to be honored with prestigious workplace awards including

being recognized as a back-to-back winner of the Don Clifton

Strengths-Based Culture award from Gallup® in 2023 and 2024 and a

Best Place to Work by the Kansas City Business Journal for the past

two years.

AdvisorsRaymond James & Associates, Inc.

served as financial advisor and provided a fairness opinion to the

Board of Directors of Busey, and Sullivan & Cromwell LLP served

as legal counsel to Busey. Keefe, Bruyette & Woods, Inc. A

Stifel Company, served as financial advisor and provided a fairness

opinion to the Board of Directors of CrossFirst, and Squire Patton

Boggs (US) LLP served as legal counsel to CrossFirst.

Investor PresentationFor additional information

on Busey’s planned acquisition of CrossFirst, please refer to the

Investor Presentation filed with the Current Report on Form 8-K

filed on August 27, 2024.

Information to Access Joint Conference Call About the

MergerA special webcast will be held today, Tuesday,

August 27, at 9:30 am Central Time with Busey and CrossFirst

discussing our partnership. This call may also include discussion

of company developments, forward-looking statements and other

material information about business and financial matters.

To listen, the full webcast with audio, slides and available

resources will be available at

https://edge.media-server.com/mmc/p/74nwf87p. If you need to join

by phone, please register to receive the dial in numbers and unique

pin at

https://register.vevent.com/register/BI83613fe5b66647e3b5d664c90884bfb9.

If you are unable to attend, the webcast will be archived on

busey.com/IR and investors.crossfirstbankshares.com after the

call.

About First Busey CorporationAs of June 30,

2024, First Busey Corporation (Nasdaq: BUSE) was an $11.97 billion

financial holding company headquartered in Champaign, Illinois.

Busey Bank, a wholly-owned bank subsidiary of First Busey

Corporation, had total assets of $11.94 billion as of June 30,

2024, and is headquartered in Champaign, Illinois. Busey Bank

currently has 62 banking centers, with 24 in Central Illinois

markets, 14 in suburban Chicago markets, 20 in the St. Louis

Metropolitan Statistical Area, three in Southwest Florida, and one

in Indianapolis. More information about Busey Bank can be found at

busey.com.

Through Busey’s Wealth Management division, the company provides

a full range of asset management, investment, brokerage, fiduciary,

philanthropic advisory, tax preparation, and farm management

services to individuals, businesses, and foundations. Assets under

care totaled $13.02 billion as of June 30, 2024. More information

about Busey’s Wealth Management services can be found at

busey.com/wealthmanagement.

Busey Bank’s wholly-owned subsidiary, FirsTech, Inc.,

specializes in the evolving financial technology needs of small and

medium-sized businesses, highly regulated enterprise industries,

and financial institutions. FirsTech provides comprehensive and

innovative payment technology solutions, including online, mobile,

and voice-recognition bill payments; money and data movement;

merchant services; direct debit services; lockbox remittance

processing for payments made by mail; and walk-in payments at

retail agents. Additionally, FirsTech simplifies client workflows

through integrations enabling support with billing, reconciliation,

bill reminders, and treasury services. More information about

FirsTech can be found at firstechpayments.com.

For the first time, Busey was named among the World’s Best Banks

for 2024 by Forbes, earning a spot on the list among 68 U.S. banks

and 403 banks worldwide. Additionally, Busey Bank was honored to be

named among America’s Best Banks by Forbes magazine for the third

consecutive year. Ranked 40th overall in 2024, Busey was the

second-ranked bank headquartered in Illinois of the six that made

this year’s list and the highest-ranked of those with more than $10

billion in assets. Busey is humbled to be named among the 2023 Best

Banks to Work For by American Banker, the 2023 Best Places to Work

in Money Management by Pensions and Investments, the 2024 Best

Places to Work in Illinois by Daily Herald Business Ledger, and the

2024 Best Companies to Work For in Florida by Florida Trend

magazine. We are honored to be consistently recognized globally,

nationally and locally for our engaged culture of integrity and

commitment to community development.

For more information, visit busey.com.

About CrossFirst Bankshares, Inc.CrossFirst

Bankshares, Inc. (Nasdaq: CFB) is a Kansas corporation and a

registered bank holding company for its wholly owned subsidiary,

CrossFirst Bank. CrossFirst Bank is a full-service financial

institution that offers products and services to businesses,

professionals, individuals, and families. CrossFirst Bank,

headquartered in Leawood, Kansas, has locations in Kansas,

Missouri, Oklahoma, Texas, Arizona, Colorado, and New Mexico.

CrossFirst Bank was organized by a group of financial executives

and prominent business leaders with a shared vision to couple

highly experienced people with technology to offer unprecedented

levels of personal service to clients. CrossFirst Bank strives to

be the most trusted bank serving its markets, which we believe has

driven value for our stockholders. We are committed to a culture of

serving our clients and communities in extraordinary ways by

providing personalized, relationship-based banking. We believe that

success is achieved through establishing and growing the trust of

our clients, employees, stakeholders, and communities. For more

information, visit investors.crossfirstbankshares.com.

|

First Busey Corporation

Contacts |

|

For Financials:Jeffrey D. Jones, EVP & CFOFirst Busey

Corporation(217) 365-4130jeff.jones@busey.com |

For Media:Amy L. Randolph, EVP & COOFirst Busey

Corporation(217) 365-4049amy.randolph@busey.com |

|

|

|

Forward-Looking StatementsThis press release

includes "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, with respect to

Busey's and CrossFirst's beliefs, goals, intentions, and

expectations regarding the proposed transaction, revenues,

earnings, loan production, asset quality, and capital levels, among

other matters; our estimates of future costs and benefits of the

actions we may take; our assessments of probable losses on loans;

our assessments of interest rate and other market risks; our

ability to achieve our financial and other strategic goals; the

expected timing of completion of the proposed transaction; the

expected cost savings, synergies and other anticipated benefits

from the proposed transaction; and other statements that are not

historical facts.

Forward-looking statements are typically identified by such

words as "believe," "expect," "anticipate," "plan," "intend,"

"outlook," "estimate," "forecast," "project," "should," "may,"

"will," “position,” and other similar words and expressions, and

are subject to numerous assumptions, risks, and uncertainties,

which change over time. These forward-looking statements include,

without limitation, those relating to the terms, timing and closing

of the proposed transaction.

Additionally, forward-looking statements speak only as of the

date they are made; Busey and CrossFirst do not assume any duty,

and do not undertake, to update such forward-looking statements,

whether written or oral, that may be made from time to time,

whether as a result of new information, future events, or

otherwise. Furthermore, because forward-looking statements are

subject to assumptions and uncertainties, actual results or future

events could differ, possibly materially, from those indicated in

such forward-looking statements as a result of a variety of

factors, many of which are beyond the control of Busey and

CrossFirst. Such statements are based upon the current beliefs and

expectations of the management of Busey and CrossFirst and are

subject to significant risks and uncertainties outside of the

control of the parties. Caution should be exercised against placing

undue reliance on forward-looking statements. The factors that

could cause actual results to differ materially include the

following: the occurrence of any event, change or other

circumstances that could give rise to the right of one or both of

the parties to terminate the merger agreement; the outcome of any

legal proceedings that may be instituted against Busey or

CrossFirst; the possibility that the proposed transaction will not

close when expected or at all because required regulatory,

stockholder or other approvals are not received or other conditions

to the closing are not satisfied on a timely basis or at all, or

are obtained subject to conditions that are not anticipated (and

the risk that required regulatory approvals may result in the

imposition of conditions that could adversely affect the combined

company or the expected benefits of the proposed transaction); the

ability of Busey and CrossFirst to meet expectations regarding the

timing, completion and accounting and tax treatments of the

proposed transaction; the risk that any announcements relating to

the proposed transaction could have adverse effects on the market

price of the common stock of either or both parties to the proposed

transaction; the possibility that the anticipated benefits of the

proposed transaction will not be realized when expected or at all,

including as a result of the impact of, or problems arising from,

the integration of the two companies or as a result of the strength

of the economy and competitive factors in the areas where Busey and

CrossFirst do business; certain restrictions during the pendency of

the proposed transaction that may impact the parties' ability to

pursue certain business opportunities or strategic transactions;

the possibility that the transaction may be more expensive to

complete than anticipated, including as a result of unexpected

factors or events; diversion of management's attention from ongoing

business operations and opportunities; the possibility that the

parties may be unable to achieve expected synergies and operating

efficiencies in the merger within the expected timeframes or at all

and to successfully integrate CrossFirst's operations and those of

Busey; such integration may be more difficult, time consuming or

costly than expected; revenues following the proposed transaction

may be lower than expected; Busey's and CrossFirst's success in

executing their respective business plans and strategies and

managing the risks involved in the foregoing; the dilution caused

by Busey's issuance of additional shares of its capital stock in

connection with the proposed transaction; effects of the

announcement, pendency or completion of the proposed transaction on

the ability of Busey and CrossFirst to retain customers and retain

and hire key personnel and maintain relationships with their

suppliers, and on their operating results and businesses generally;

changes in interest rates and prepayment rates of Busey's or

CrossFirst's assets fluctuations in the value of securities held in

Busey's or CrossFirst's securities portfolio; concentrations within

Busey's or CrossFirst's loan portfolio (including commercial real

estate loans), large loans to certain borrowers, and large deposits

from certain clients; the concentration of large deposits from

certain clients who have balances above current FDIC insurance

limits and may withdraw deposits to diversify their exposure; the

level of non-performing assets on Busey's or CrossFirst's balance

sheets; the strength of the local, state, national, and

international economy; risks related to the potential impact of

general economic, political and market factors or of exceptional

weather occurrences such as tornadoes, hurricanes, floods,

blizzards, droughts on the companies or the proposed transaction;

the economic impact of any future terrorist threats or attacks,

widespread disease or pandemics or other adverse external events

that could cause economic deterioration or instability in credit

markets; changes in state and federal laws, regulations, and

governmental policies concerning Busey's or CrossFirst's general

business; changes in accounting policies and practices; increased

competition in the financial services sector (including from

non-bank competitors such as credit unions and fintech companies)

and the inability to attract new customers; breaches or failures of

information security controls or cybersecurity-related incidents;

changes in technology and the ability to develop and maintain

secure and reliable electronic systems; the loss of key executives

or associates; changes in consumer spending; unexpected outcomes of

existing or new litigation, investigations, or inquiries involving

Busey (including with respect to Busey's Illinois franchise taxes)

or CrossFirst; other factors that may affect future results of

Busey and CrossFirst and the other factors discussed in the "Risk

Factors" section of each of Busey's and CrossFirst's Annual Report

on Form 10-K for the year ended December 31, 2023, in the "Risk

Factors" and "Management's Discussion and Analysis of Financial

Condition and Results of Operations" sections of each of Busey's

and CrossFirst's Quarterly Report on Form 10-Q for the quarter

ended June 30, 2024, and other reports Busey and CrossFirst file

with the U.S. Securities and Exchange Commission (the "SEC").

Additional Information and Where to Find ItIn

connection with the proposed transaction, Busey will file a

registration statement on Form S-4 with the SEC. The registration

statement will include a joint proxy statement of Busey and

CrossFirst, which also constitutes a prospectus of Busey, that will

be sent to stockholders of Busey and CrossFirst seeking certain

approvals related to the proposed transaction.

The information contained herein does not constitute an offer to

sell or a solicitation of an offer to buy any securities or a

solicitation of any vote or approval, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. INVESTORS AND

SECURITY HOLDERS OF BUSEY AND CROSSFIRST AND THEIR RESPECTIVE

AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION

STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE

INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY

OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN

CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT BUSEY, CROSSFIRST AND THE PROPOSED

TRANSACTION. Investors and security holders will be able to obtain

a free copy of the registration statement, including the joint

proxy statement/prospectus, as well as other relevant documents

filed with the SEC containing information about Busey and

CrossFirst, without charge, at the SEC's website

(http://www.sec.gov). Copies of documents filed with the SEC by

Busey will be made available free of charge in the "SEC Filings"

section of Busey's website, https://ir.busey.com. Copies of

documents filed with the SEC by CrossFirst will be made available

free of charge in the "Investor Relations" section of CrossFirst's

website, https://investors.crossfirstbankshares.com.

Participants in SolicitationBusey, CrossFirst,

and certain of their respective directors and executive officers

may be deemed to be participants in the solicitation of proxies in

respect of the proposed transaction under the rules of the SEC.

Information regarding Busey's directors and executive officers is

available in its definitive proxy statement, which was filed with

the SEC on April 12, 2024, and certain other documents filed by

Busey with the SEC. Information regarding CrossFirst's directors

and executive officers is available in its definitive proxy

statement, which was filed with the SEC on March 26, 2024, and

certain other documents filed by CrossFirst with the SEC. Other

information regarding the participants in the solicitation of

proxies in respect of the proposed transaction and a description of

their direct and indirect interests, by security holdings or

otherwise, will be contained in the joint proxy

statement/prospectus and other relevant materials to be filed with

the SEC. Free copies of these documents, when available, may be

obtained as described in the preceding paragraph.

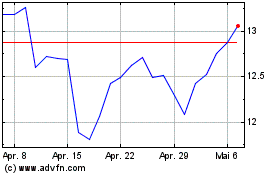

CrossFirst Bankshares (NASDAQ:CFB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

CrossFirst Bankshares (NASDAQ:CFB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024