As filed with the Securities and Exchange Commission on June 5, 2024

Registration No. 333-

_____________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

CADENCE DESIGN SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

____________________

| | | | | |

Delaware | 00-0000000 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

2655 Seely Avenue, Building 5

San Jose, California 95134

(408) 943-1234

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Karna Nisewaner

Cadence Design Systems, Inc.

2655 Seely Avenue, Building 5

San Jose, California 95134

Telephone: (408) 943-1234

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Mark M. Bekheit

Kathleen M. Wells

Latham & Watkins LLP

140 Scott Drive

Menlo Park, California 94025

Telephone: (650) 328-4600

| | |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement. |

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act.

| | | | | | | | | | | | | | | | | |

Large accelerated filer | ☒ | | Accelerated filer | ☐ | |

| | | | | |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | |

| | | | | |

| | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

CADENCE DESIGN SYSTEMS, INC.

1,740,931 Shares

Common Stock

Offered by the Selling Stockholders

This prospectus relates to the proposed resale or other disposition of up to an aggregate of 1,740,931 shares of common stock, par value $0.01 per share (the “common stock”), by the selling stockholders identified in this prospectus. We are registering the offer and sale of the shares of the common stock owned by the selling stockholders to satisfy registration rights we granted to them pursuant to a share purchase agreement with the parties affiliated with the selling stockholders in connection with our acquisition of BETA CAE Systems International AG (the “Purchase Agreement”). We are not selling any shares of our common stock under this prospectus and will not receive any proceeds from the sale of our common stock by the selling stockholders.

Each time any of the selling stockholders offers and sells securities, such selling stockholders may provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained or incorporated by reference in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

The selling stockholders, together or separately, may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus titled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 6 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Our common stock is listed on the Nasdaq Global Select Market under the symbol “CDNS.” On June 4, 2024, the last reported sale price of our common stock on the Nasdaq Global Select Market was $287.13 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 5, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. By using a shelf registration statement, the selling stockholders may, from time to time, sell up to 1,740,931 shares of common stock in one or more offerings as described in this prospectus. In connection with the offer and sale of securities by the selling stockholders, the selling stockholders may provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. Any such prospectus supplement or free writing prospectus may also add, update or change information contained or incorporated by reference in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and any applicable prospectus supplement or free writing prospectus, together with the additional information described under the section titled “Where You Can Find More Information; Incorporation by Reference.”

Neither we, nor the selling stockholders, have authorized anyone to provide you with any information or to make any representations other than those contained or incorporated by reference in this prospectus, any applicable prospectus supplement or any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the selling stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the selling stockholders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the section titled “Risk Factors” contained in this prospectus, any applicable prospectus supplement and any applicable free writing prospectus, and under similar sections in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

When we refer to “Cadence,” “we,” “our,” “us” and the “Company” in this prospectus, we mean Cadence Design Systems, Inc. and its consolidated subsidiaries, unless otherwise specified. When we refer to “you,” we mean the potential holders of shares of our common stock.

We have proprietary rights to trademarks, trade names and service marks appearing in this prospectus that are important to our business. Solely for convenience, the trademarks, trade names and service marks may appear in this prospectus without the ®, TM and SM symbols, but any such references are not intended to indicate, in any way, that we forgo or will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains, and the information incorporated by reference herein and any applicable prospectus supplement may contain, statements that are not historical in nature, are predictive or that depend upon or refer to future events or conditions or contain other forward-looking statements. Statements including, but not limited to, statements regarding the extent, timing and mix of future revenues and customer demand; the deployment of our products and services; the impact of the macroeconomic and geopolitical environment, including but not limited to, expanded trade control laws and regulations, the conflicts in and around Ukraine, the Middle East and other areas of the world, volatility in foreign currency exchange rates, inflation and the rise in interest rates; the impact of government actions; future costs, expenses, tax rates and uses of cash; pending legal, administrative and tax proceedings; restructuring actions and associated benefits; pending acquisitions, the accounting for acquisitions and the integration of acquired businesses; and other statements using words such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “intends,” “may,” “plans,” “projects,” “should,” “targets,” “will” and “would,” and words of similar import and the negatives thereof, constitute forward-looking statements. These statements are predictions based upon our current expectations about future events. Actual results could vary materially as a result of certain factors, including but not limited to those expressed in these statements. Important risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements include, but are not limited to, those identified in the sections entitled “The Company,” “Plan of Distribution” and “Risk Factors” in this prospectus and the risks discussed in our other SEC filings.

We urge you to consider these factors carefully in evaluating the forward-looking statements contained in this prospectus. All subsequent written or oral forward-looking statements attributable to our company or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The forward-looking statements included in this prospectus are made only as of the date of this prospectus. We do not intend, and undertake no obligation, to update these forward-looking statements.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address is www.cadence.com. The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement or documents incorporated by reference in the registration statement. Statements in this prospectus or any prospectus supplement or any related free writing prospectus that we may provide about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

•Our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 14, 2024. •The information specifically incorporated by reference into our Annual Report on Form 10-K from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on March 21, 2024. •Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on April 24, 2024. •The description of our common stock contained in the Registration Statement on Form 8-A, filed with the SEC on August 29, 1990, as updated by Exhibit 4.04 to our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 14, 2024, and any amendment or report filed with the SEC for the purpose of updating the description. All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), prior to the termination of this offering but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

Cadence Design Systems, Inc.

2655 Seely Avenue, Building 5

San Jose, California 95134

Telephone: (408) 943-1234

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying prospectus supplement.

THE COMPANY

Cadence® is a leading pioneer in electronic system design software and intellectual property (“IP”), building upon more than 35 years of computational software expertise. Since our inception, we have been at the forefront of technology innovation, solving highly complex challenges in the semiconductor and electronic systems industries. We are a global company that provides computational software, special-purpose computational hardware, IP and services to multiple vertical sectors including automotive, artificial intelligence (“AI”), aerospace and defense, high-performance and mobile computing, hyperscalers, wireless communications, industrial internet of things and life sciences.

Our Intelligent System DesignTM strategy allows us to deliver essential computational software, hardware and IP that our customers use to turn their design concepts into reality. Our customers include many of the world’s most innovative companies that design and build highly sophisticated semiconductor and electronic systems found in products used in everyday life. Our Intelligent System Design strategy allows us to quickly adapt to our customers’ dynamic design requirements. Our products and services enable our customers to develop complex and innovative semiconductor and electronic systems, so demand for our technology and expertise is driven by increasing complexity and our customers’ need to invest in new designs and products that are highly differentiated. Historically, the industry that provided the tools used by integrated circuit (“IC”) engineers was referred to as Electronic Design Automation (“EDA”). Today, our offerings include and extend beyond EDA.

We group our products into categories related to major design activities:

•Custom IC Design and Simulation;

•Digital IC Design and Signoff;

•Functional Verification;

•IP; and

•System Design and Analysis.

For additional information about our products, see the discussion in the section entitled “Business” in our most recent Annual Report on Form 10-K.

We filed our restated certificate of incorporation with the Secretary of State of Delaware on May 3, 2024. Our principal executive offices are located at 2655 Seely Avenue, Building 5, San Jose, California 95134, and our telephone number is (408) 943-1234.

RISK FACTORS

Investment in the common stock offered pursuant to this prospectus and any applicable prospectus supplement involves risks. Before deciding whether to invest in our securities, you should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement and any applicable free writing prospectus. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment. Please also carefully read the discussion of forward-looking statements included in the sections entitled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q and any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of common stock being offered by any of the selling stockholders. A selling stockholder will pay any underwriting discounts, selling commissions and stock transfer taxes or any other expenses incurred by such selling stockholder in connection with the sale of the shares of common stock. We will bear all other fees and expenses incurred in effecting the registration of the shares covered by this prospectus, including, without limitation, all registration, filing and printing fees and expenses, fees and expenses of our counsel and our independent registered public accountants.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is not complete and may not contain all the information you should consider before investing in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our restated certificate of incorporation, or Restated Certificate of Incorporation, and amended and restated bylaws, or Amended and Restated Bylaws, each of which has been publicly filed with the SEC. See “Where You Can Find More Information; Incorporation by Reference.”

Our authorized capital stock consists of:

•600,000,000 shares of common stock, $0.01 par value; and

•400,000 shares of preferred stock, $0.01 par value.

All of the shares of preferred stock have been designated as Series A junior participating preferred stock, or Series A Preferred, but there are no shares of Series A Preferred outstanding.

Common Stock

Dividends

Holders of common stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by the board of directors out of funds legally available for dividend payments.

Voting

Holders of common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders, including the election of directors. Cadence stockholders are not authorized by our Restated Certificate of Incorporation or our Amended and Restated Bylaws to cumulate votes for the election of directors. Directors are elected by the affirmative vote of a majority of the votes cast (except that in a contested election, directors are elected by a plurality of the shares represented in person or by proxy at the relevant meeting of stockholders and entitled to vote on the election of directors). The affirmative vote of the holders of a majority of the voting power of the stock entitled to vote thereon present in person or represented by proxy at the relevant meeting of stockholders is generally required for Cadence stockholders to take action on all other matters, except as otherwise provided in our Restated Certificate of Incorporation or Amended and Restated Bylaws or as otherwise required by law.

Preemptive Rights, Conversion and Redemption

The common stock is not entitled to preemptive or conversion rights and is not subject to redemption or sinking fund provisions.

Liquidation, Dissolution and Winding-Up

Upon our liquidation, dissolution or winding-up, the holders of common stock are entitled to share ratably in all assets remaining after payment of liabilities and any preferences on preferred stock we may issue in the future.

Our common stock is subject and subordinate to the rights and preferences of any shares of Series A Preferred or other preferred stock that the board of directors may issue from time to time.

Preferred Stock

Our board of directors is authorized, without action by the stockholders, to designate and issue up to 400,000 shares of preferred stock in one or more series. Subject to the Delaware General Corporation Law, our board of directors may:

•fix the rights, preferences, privileges and restrictions on these shares,

•fix the number of shares and designation of any series, and

•increase or decrease the number of shares of any series if not below the number of outstanding shares plus the number of shares reserved for issuance.

As of June 4, 2024, all of the 400,000 authorized shares of preferred stock were designated as Series A Preferred and no shares of preferred stock were outstanding. The Series A Preferred was authorized in connection with our stockholder rights plan. The rights plan and related rights expired on February 9, 2006. Although we currently do not intend to do so, our board of directors may issue preferred stock in connection with a new stockholder rights plan or otherwise with voting and conversion rights that could negatively affect the voting power or other rights of the common stockholders without stockholder approval. The issuance of preferred stock may delay or prevent a change in control of Cadence.

Anti-Takeover Provisions

Delaware Takeover Statute

We are governed by Section 203 of the Delaware General Corporation Law, or Section 203, which prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years after the time that the stockholder became an interested stockholder, unless:

•before that time, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

•upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the number of shares outstanding those shares owned by persons who are directors and also officers and shares issued under employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

•on or after that time, the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least sixty-six and two-thirds percent (66 2/3%) of the outstanding voting stock that is not owned by the interested stockholder.

In general, Section 203 defines an interested stockholder as any entity or person who, with affiliates and associates, owns, or within the three-year period immediately prior to the business combination, beneficially owned 15% or more of the outstanding voting stock of the corporation. Section 203 defines business combination to include:

•any merger or consolidation involving the corporation and the interested stockholder;

•any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

•subject to specified exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

•any transaction involving the corporation that increases the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

•the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

Preferred Stock

Under our Restated Certificate of Incorporation, the board of directors has the power, without action by the stockholders, to designate and issue up to 400,000 shares of preferred stock in one or more series. As of June 4, 2024, all 400,000 shares of preferred stock are designated as Series A Preferred, but because no such shares are outstanding or reserved for issuance, the board of directors may reduce the number of shares of preferred stock designated as Series A Preferred to zero. Subject to the Delaware General Corporation Law, the board of directors may, as to any shares of preferred stock the terms of which have not then been designated:

•fix the rights, preferences, privileges and restrictions on these shares;

•fix the number of shares and designation of any series; and

•increase or decrease the number of shares of any series if not below the number of outstanding shares plus the number of shares reserved for issuance.

The board of directors has the power to issue shares of Series A Preferred with dividend, voting and liquidation rights superior to our common stock at a rate of 1,000-to-1 without further vote or action by the common stockholders. As a result, the issuance of Series A Preferred (or other preferred stock that the board of directors may designate and issue from time to time) may:

•delay, defer or prevent a change in control;

•adversely affect the voting and other rights of the holders of our common stock; and

•discourage acquisition proposals or tender offers for our shares and, as a consequence, inhibit increases in the market price of our shares that could result from actual or rumored takeover attempts.

Advance Notice Provisions

Our Amended and Restated Bylaws establish advance notice procedures for stockholder proposals and nominations of candidates for election as directors other than nominations made by or at the direction of the board of directors.

Special Meeting Requirements

Our Amended and Restated Bylaws provide that special meetings of stockholders may be called at the request of (a) the board of directors, (b) the chair of the board of directors, (c) the chief executive officer, or (d) the secretary upon the written request of stockholders who have “owned” (as defined in our Amended and Restated Bylaws) at least 15% of Cadence’s outstanding common stock for at least one year and satisfy the other requirements specified in our Amended and Restated Bylaws.

Cumulative Voting

Neither our Restated Certificate of Incorporation nor our Amended and Restated Bylaws provides for cumulative voting in the election of directors.

These provisions may deter a hostile takeover or delay a change in control or management of Cadence.

Proxy Access

Our Amended and Restated Bylaws provide that a stockholder or a group of up to 20 stockholders who have continuously “owned” (as defined in our Amended and Restated Bylaws) at least 3% of our common stock for three years or more may nominate a director and have that nominee included in our proxy materials for our annual meeting of stockholders, provided that the stockholder or stockholders and nominee satisfy the requirements specified in our Amended and Restated Bylaws.

Action by Written Consent

Our Restated Certificate of Incorporation provides that stockholder action by written consent in lieu of a meeting is permitted, provided, among other things, that (a) stockholders of record must request that the board of directors fix a record date to determine the stockholders entitled to act by consent and the record date must be requested by stockholders who “own” (as determined under our Restated Certificate of Incorporation and our Amended and Restated Bylaws) in the aggregate not less than 25% of all outstanding shares of common stock entitled to vote on the matter, (b) written consents must be solicited from all stockholders in accordance with Regulation 14A of the Exchange Act, and (c) any holder of common stock seeking to act by written consent must provide approximately the same information as required to propose a matter to be acted upon at a stockholder meeting or to nominate a director. The written consent process is not available in certain circumstances, as set forth in our Restated Certificate of Incorporation.

Choice of Forum

Our Amended and Restated Bylaws provide that unless a majority of the board of directors consents in writing to the selection of an alternative forum, the sole and exclusive forum for (i) (a) any derivative action or proceeding brought on behalf of Cadence, (b) any action that is based upon a breach of a fiduciary duty owed by any current or former director, officer, other employee or stockholder of Cadence to Cadence or our stockholders, (c) any action asserting a claim against Cadence or any of its current or former directors, officers or other employees arising pursuant to any provision of the Delaware General Corporation Law, our Restated Certificate of Incorporation or our Amended and Restated Bylaws, (d) any action asserting a claim against Cadence or any of its current or former directors, officers or other employees governed by the internal affairs doctrine of the State of Delaware, or (e) any other action asserting an internal corporate claim, as defined in Section 115 of the Delaware General Corporation Law shall be the Court of Chancery of the State of Delaware (or, if the Court of Chancery does not have jurisdiction, another state court located within the State of Delaware or, if no court located within the State of Delaware has jurisdiction, the federal district court for the District of Delaware), and (ii) for any complaint asserting a cause of action under the Securities Act of 1933, as amended, shall be the federal district courts of the United States of America, in all cases subject to such court’s having personal jurisdiction over all indispensable parties named as defendants.

Transfer Agent

The transfer agent and registrar for our common stock is Computershare Inc. The transfer agent and registrar’s address is 150 Royall Street, Suite 101, Canton, Massachusetts 02021.

Nasdaq Global Select Market Listing

Our common stock is listed on the Nasdaq Global Select Market under the symbol “CDNS.”

SELLING STOCKHOLDERS

This prospectus relates to the possible resale by certain of the selling stockholders from time to time of up to an aggregate of 1,740,931 shares of common stock. The term “selling stockholders” includes donees, pledgees, transferees, assignees or other successors in interest selling securities received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer.

On March 2, 2024, we entered into the Purchase Agreement, pursuant to which we issued 1,740,931 shares of common stock as partial consideration in connection with the acquisition of BETA CAE Systems International AG. We issued the shares of common stock in reliance upon the exemptions from registration afforded by Section 4(a)(2), Rule 506 of Regulation D promulgated under the Securities Act and/or Regulation S promulgated under the Securities Act. In accordance with our obligations under the Purchase Agreement, we agreed to register the resale of the shares of common stock offered by the selling stockholders hereby.

The following table sets forth information concerning the shares of common stock that may be offered from time to time by each selling stockholders. The number of shares beneficially owned by each selling stockholders is determined under rules issued by the SEC. Under these rules, beneficial ownership includes any shares as to which the selling stockholders has sole or shared voting power or investment power. Percentage ownership is based on 272,422,991 shares of common stock outstanding as of May 29, 2024. For purposes of this table, we have assumed that the selling stockholders will have sold all of the shares of common stock covered by this prospectus upon the completion of the offering. Each of the selling stockholders listed has sole voting and investment power with respect to the shares beneficially owned by the selling stockholders unless noted otherwise.

The information in the following table has been provided to us by or on behalf of the selling stockholders and the selling stockholders may have sold, transferred or otherwise disposed of all or a portion of the shares of common stock after the date on which they provided us with information regarding their securities. A selling stockholder may sell all, some or none of his, her or its shares of common stock in this offering. See the section titled “Plan of Distribution.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Common Stock

Beneficially Owned

Before this Offering | | | Maximum

Number of

Shares of Common Stock

to be Sold

Pursuant to this

Prospectus | | | Common Stock

Beneficially Owned

Upon Completion of this

Offering | |

| Selling Stockholder | | Number | | | Percentage | | | Number | | | Number | | | Percentage | |

Acronym International Limited, UK(1) | | 435,233 | | | | * | | | | 435,233 | | | | | — | | | | — | |

Eluco Holding AG(2) | | 87,046 | | | | * | | | | 87,046 | | | | | — | | | | — | |

Kiupi Limited(3) | | 435,233 | | | | * | | | | 435,233 | | | | | — | | | | — | |

NAMID Ltd.(4) | | 435,233 | | | | * | | | | 435,233 | | | | | — | | | | — | |

Ellandron Investments Ltd.(5) | | 348,186 | | | | * | | | | 348,186 | | | | | — | | | | — | |

| | | | | |

| * | Less than 1%. |

| (1) | Ermioni Valasidou, directly or indirectly, beneficially owns the shares held by Acronym International Limited, UK (“Acronym”) and controls the election of the board of directors of Acronym. In addition to Ms. Valasidou, Valasides Dimitrios and Gatsoris Lambros are directors of Acronym and may be deemed to beneficially own the shares held by Acronym. |

| (2) | Eluco Holding AG (“Eluco”) is solely owned by Thomas Chasiotis. Thomas Chasiotis and Stefan Widmer are directors of Eluco and may be deemed to beneficially own the shares held by Eluco. |

| (3) | Kiupi Limited (“Kiupi”) is solely owned by Panagiotis Kouvrakis. Panagiotis Kouvrakis and Ioanna Erkekidou are directors of Kiupi and may be deemed to beneficially own the shares held by Kiupi. |

| (4) | Dimitrios Angelis and Eirini Kaskanea are directors of NAMID Ltd. (“NAMID”) and may be deemed to beneficially own the shares held by NAMID. |

| (5) | Jennifer Ellington is the sole director of Ellandron Investments Ltd. (“Ellandron”). In her capacity as sole director of Ellandron, Jennifer Ellington may be deemed to beneficially own the shares held by Ellandron. The Goldman Sachs Trust Company of Delaware is the trustee of The Sandalen Trust. The Sandalen Trust is the sole owner of Ellandron and may be deemed to beneficially own the shares held by Ellandron. Jennifer Ellington is the sole beneficiary of The Sandalen Trust and may be deemed to beneficially own shares held by Ellandron. |

PLAN OF DISTRIBUTION

We are registering the shares of common stock issued to the selling stockholders to permit the resale of such shares of common stock by the holder of such shares of common stock from time to time after the date of this prospectus. The selling stockholders may from time to time offer some or all of the shares of common stock covered by this prospectus. To the extent required, this prospectus may be amended and supplemented from time to time to describe a specific plan of distribution. The selling stockholders will not pay any of the costs, expenses and fees in connection with the registration of the shares covered by this prospectus, but they will pay any and all underwriting discounts, selling commissions and similar charges attributable to sales of the shares. We will not receive any proceeds from the sale of the shares of our common stock covered hereby. The selling stockholders may sell some or all of the shares of common stock covered by this prospectus from time to time or may decide not to sell any of the shares of common stock covered by this prospectus. As used in this prospectus, “selling stockholders” includes donees, pledgees, transferees, assignees or other successors in interest selling securities received from a selling stockholder as a gift, pledge, partnership distribution, assignment or other transfer. The selling stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made on one or more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing or at prices related to the then-current market price or in negotiated transactions. The selling stockholders may dispose of their shares by one or more of, or a combination of, the following methods:

•distributions to members, partners, stockholders or other equityholders of the selling stockholders;

•purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus;

•ordinary brokerage transactions and transactions in which the broker solicits purchasers;

•block trades in which the broker-dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•an over-the-counter distribution in accordance with the rules of the Nasdaq Global Select Market;

•through trading plans entered into by a selling stockholders pursuant to Rule 10b5-1 under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans;

•to or through underwriters or broker-dealers;

•in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents;

•in privately negotiated transactions;

•in options transactions;

•through a combination of any of the above methods of sale; or

•any other method permitted pursuant to applicable law.

In addition, any shares that qualify for sale pursuant to Rule 144 under the Securities Act (“Rule 144”) may be sold under Rule 144 rather than pursuant to this prospectus. A selling stockholders that is an entity may elect to make an in-kind distribution of common stock to its members, partners, stockholders or other equityholders pursuant to the registration statement of which this prospectus forms a part by delivering a prospectus. To the extent that such members, partners, stockholders or other equityholders are not affiliates of ours, such members, partners, stockholders or other equityholders would thereby receive freely tradable shares of common stock pursuant to a distribution pursuant to the registration statement of which this prospectus forms a part.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. In connection with distributions of the shares or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of shares of common stock in the course of hedging the positions they assume with selling stockholders. The selling stockholders may also sell shares of common stock short and redeliver the shares to close out such short positions. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions that require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The selling stockholders may also pledge shares to a broker-dealer or other financial institution, and, upon a default, such broker-dealer or other financial institution, may effect sales of the pledged shares pursuant to this prospectus (as supplemented or amended to reflect such transaction).

A selling stockholders may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by any selling stockholders or borrowed from any selling stockholders or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from any selling stockholders in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition, any selling stockholders may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

In effecting sales, broker-dealers or agents engaged by the selling stockholders may arrange for other broker-dealers to participate. Broker-dealers or agents may receive commissions, discounts or concessions from the selling stockholders in amounts to be negotiated immediately prior to the sale.

In offering the shares covered by this prospectus, the selling stockholders and any broker-dealers who execute sales for the selling stockholders may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. Any profits realized by the selling stockholders and the compensation of any broker-dealer may be deemed to be underwriting discounts and commissions.

In order to comply with the securities laws of certain states, if applicable, the shares must be sold in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates. In addition, we will make copies of this prospectus available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities under the Securities Act.

At the time a particular offer of shares is made, if required, a prospectus supplement will be distributed that will set forth the number of shares being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

LEGAL MATTERS

The validity of the common stock being offered by this prospectus will be passed upon for us by Latham & Watkins LLP, Menlo Park, California.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2023 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following is an estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities being registered hereby.

| | | | | | | | | | | | | | |

SEC registration fee | | $ | 73,054.13 | |

Printing expenses | | $ | — | |

Legal fees and expenses | | $ | 50,000 | |

Accounting fees and expenses | | $ | 25,000 | |

Miscellaneous | | $ | 1,000 | |

Total | | $ | 149,054.13 | |

Item 15. Indemnification of Directors and Officers

Subsection (a) of Section 145 of the General Corporation Law of the State of Delaware, or the DGCL, empowers a corporation to indemnify any person who was or is a party or who is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

Subsection (b) of Section 145 empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person acted in any of the capacities set forth above, against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 145 further provides that to the extent a director or officer of a corporation has been successful on the merits or otherwise in the defense of any action, suit or proceeding referred to in subsections (a) and (b) of Section 145, or in defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith; that indemnification provided for by Section 145 shall not be deemed exclusive of any other rights to which the indemnified party may be entitled; and the indemnification provided for by Section 145 shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of such person’s heirs, executors and administrators. Section 145 also empowers the corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify such person against such liabilities under Section 145.

Section 102(b)(7) of the DGCL provides that a corporation’s certificate of incorporation may contain a provision eliminating or limiting the personal liability of a director or an officer to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or an officer, provided that such provision shall not eliminate or limit the liability of a director or an officer (i) for any breach of the director’s or officer’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit. The DGCL also does not permit the limitation of monetary liability of officers in any action by or in the right of the corporation, such as a derivative claim.

Article VII of the registrant’s currently effective Restated Certificate of Incorporation eliminates the personal liability of its directors and officers for monetary damages for breach of fiduciary duty as a director or an officer, except for liability (i) for any breach of the director’s or officer’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL in the case of directors or (iv) for any transaction from which the director or officer derived an improper personal benefit. Any repeal or modification of Article VII shall be prospective only, and shall not adversely affect any limitation on the personal liability of a director or an officer existing at the time of such repeal or modification. In addition, as permitted by Section 145 of the DGCL, Article V of the Amended and Restated Bylaws of the registrant provides that: (a) the registrant is required to indemnify its current or former directors and officers and persons serving in such capacities in other business entities (including, for example, subsidiaries of the registrant) at the registrant’s request (such current or former directors, officers and other persons are hereinafter referred to collectively as “Covered Persons”), to the fullest extent permitted by Delaware law; (b) the registrant is required to advance expenses as incurred to such Covered Persons in connection with defending a proceeding; (c) the indemnitee(s) of the registrant have the right to bring suit, and to be paid the expenses of prosecuting such suit, if successful, to enforce the rights to indemnification under the Amended and Restated Bylaws or to advancement of expenses under the Amended and Restated Bylaws; (d) the rights conferred in the Amended and Restated Bylaws are not exclusive and the registrant is authorized to enter into indemnification agreements with such directors, officers and employees; (e) the registrant is required to maintain director and officer liability insurance to the extent reasonably available; and (f) the registrant may not retroactively amend Article V of the Amended and Restated Bylaws in a way that would adversely affect any right or protection conferred on such Covered Persons.

The registrant has entered into indemnity agreements with each of its executive officers and directors that provide the maximum indemnity allowed to officers and directors by Section 145 of the DGCL and the Amended and Restated Bylaws, as well as certain additional procedural protections. The registrant also maintains a limited amount of director and officer insurance. The indemnification provision in the Amended and Restated Bylaws, and the indemnity agreements entered into between the registrant and its officers or directors, may be sufficiently broad to permit indemnification of the registrant’s officers and directors for liability arising under the Securities Act of 1933, as amended. Any underwriting agreement or distribution agreement that the registrant enters into with any underwriters or agents involved in the offering or sale of any securities registered hereby may require such underwriters or dealers to indemnify the registrant, some or all of its directors and officers and its controlling persons, if any, for specified liabilities, which may include liabilities under the Securities Act of 1933, as amended.

Item 16. Exhibits

| | | | | | | | |

| |

| | |

| |

| | |

| | |

| 4.3 | | Form of Specimen Certificate Representing Common Stock (incorporated by reference to the Registrant’s Registration Statement on Form S-4 filed with the SEC on October 17, 1991). |

| |

| | |

| |

| 23.1 | | Consent of Latham & Watkins LLP (included in Exhibit 5.1). |

| |

| | |

| |

| 24.1 | | Powers of Attorney (incorporated by reference to the signature page hereto). |

| |

| | |

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii), and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(5) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(6) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Jose, California, on June 5, 2024.

| | | | | | | | |

| | |

| CADENCE DESIGN SYSTEMS, INC. |

| |

| By: | | /s/ Anirudh Devgan |

| | Anirudh Devgan |

| | President and Chief Executive Officer |

POWER OF ATTORNEY

Each of the undersigned officers and directors of the registrant hereby severally constitutes and appoints Anirudh Devgan, John M. Wall and Karna Nisewaner, and each of them singly (with full power to each of them to act alone), as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution in each of them, for him or her and in his or her name, place and stead, and in any and all capacities, to file and sign any and all amendments, including post-effective amendments, to this registration statement and any other registration statement for the same offering that is to be effective under Rule 462(b) of the Securities Act of 1933, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith and about the premises as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof. This power of attorney shall be governed by and construed with the laws of the State of Delaware and applicable federal securities laws.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed below by the following persons on behalf of the registrant in the capacities and on the dates indicated.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| SIGNATURE | | TITLE | | DATE |

| | |

/s/ Anirudh Devgan | | President, Chief Executive Officer and Director (Principal Executive Officer) | | June 5, 2024 |

Anirudh Devgan | | | |

| | |

/s/ John M. Wall | | Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) | | June 5, 2024 |

John M. Wall | | | |

| | |

/s/ Mary Louise Krakauer | | Chair of the Board of Directors | | June 5, 2024 |

| Mary Louise Krakauer | | | | | |

| | |

/s/ Mark W. Adams | | Director | | June 5, 2024 |

| Mark W. Adams | | | | | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | |

/s/ Ita Brennan | | Director | | June 5, 2024 |

Ita Brennan | | | | | |

| |

| | |

/s/ Lewis Chew | | Director | | June 5, 2024 |

| Lewis Chew | | | | | |

| | | | | | | |

| /s/ Julia Liuson | | Director | | June 5, 2024 |

| Julia Liuson | | | | | |

| | | | | | | |

/s/ James D. Plummer | | Director | | June 5, 2024 |

| James D. Plummer | | | | | |

| | | | | | | |

/s/ Alberto Sangiovanni-Vincentelli | | Director | | June 5, 2024 |

Alberto Sangiovanni-Vincentelli | | | | | |

| | | | | | | |

/s/ Young K. Sohn | | Director | | June 5, 2024 |

Young K. Sohn | | | | | |

| | | | | | | |

Calculation of Filing Fee Tables

Form S-3

(Form Type)

Cadence Design Systems, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Security

Type | | Security

Class Title | | Fee

Calculation

or Carry

Forward

Rule | | Amount Registered | | Proposed

Maximum

Offering

Price Per

Unit(2) | | Maximum

Aggregate

Offering Price(2) | | Fee Rate | | Amount of Registration

Fee |

| Fees to Be Paid | | Equity | | Common Stock, par value $0.01 per share | | 457(c) | | 1,740,931(1) | | $284.30 | | $494,946,683.30 | | 0.0001476 | | $73,054.13 |

| Total Offering Amounts | | $494,946,683.30 | | | | $73,054.13 |

| Total Fees Previously Paid | | | | | | — |

Total Fee Offsets(3) | | | | | | — |

| Net Fee Due | | | | | | $73,054.13 |

| | | | | | | | |

| (1) | Consists of 1,740,931 shares of the registrant’s common stock issued to the selling stockholders. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares of common stock being registered hereunder include such indeterminate number of shares of common stock as may be issuable with respect to the shares of common stock being registered hereunder as a result of any stock dividend, stock split, recapitalization or similar transaction. |

| | | | | | | | |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) of the Securities Act, on the basis of the average of the high and low prices for a share of the registrant’s common stock as reported on the Nasdaq Global Select Market on May 31, 2024, which date is within five business days prior to the filing of this Registration Statement. |

| (3) | The Registrant does not have any fee offsets. |

| | |

Exhibit 5.1

| | | | | | | | | | | | | | | | | |

| 140 Scott Drive | |

| Menlo Park, California 94025 | |

| Tel: +1.650.328.4600 Fax: +1.650.463.2600 | |

| www.lw.com | |

| |

| FIRM / AFFILIATE OFFICES | |

| Austin | Milan | |

| Beijing | Munich | |

| Boston | New York | |

| Brussels | Orange County | |

| Century City | Paris | |

| Chicago | Riyadh | |

| Dubai | San Diego | |

| Düsseldorf | San Francisco | |

| Frankfurt | Seoul | |

| Hamburg | Silicon Valley | |

| | | Hong Kong | Singapore | |

| | | Houston | Tel Aviv | |

| | | London | Tokyo | |

| | | Los Angeles | Washington, D.C. | |

| | | Madrid | | |

| | | | | |

| | | | | |

| | | | | |

June 5, 2024

Cadence Design Systems, Inc.

2655 Seely Avenue, Building 5

San Jose, California 95134

Re: Registration Statement on Form S-3; 1,740,931 Shares of Common Stock

To the addressee set forth above:

We have acted as special counsel to Cadence Design Systems, Inc., a Delaware corporation (the “Company”), in connection with the resale from time to time by the selling securityholders named in the Registration Statement (as defined below) of up to 1,740,931 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share. The Shares are included in a registration statement on Form S-3 under the Securities Act of 1933, as amended (the “Securities Act”), filed with the U.S. Securities and Exchange Commission (the “Commission”) on June 5, 2024 (the “Registration Statement”). This opinion is being furnished in connection with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act, and no opinion is expressed herein as to any matter pertaining to the contents of the Registration Statement or the prospectus contained therein, other than as expressly stated herein with respect to the issuance of the Shares.

As such counsel, we have examined such matters of fact and questions of law as we have considered appropriate for purposes of this letter. With your consent, we have relied upon certificates and other assurances of officers of the Company and others as to factual matters without having independently verified such factual matters. We are opining herein as to the General Corporation Law of the State of Delaware, and we express no opinion with respect to any other laws.

Subject to the foregoing and the other matters set forth herein, it is our opinion that, as of the date hereof, the issuance of the Shares has been duly authorized by all necessary corporate action of the Company, and the Shares are validly issued, fully paid and non-assessable.

This opinion is for your benefit in connection with the Registration Statement and may be relied upon by you and by persons entitled to rely upon it pursuant to the applicable provisions of the Securities Act. We consent to your filing this opinion as an exhibit to the Registration Statement and to the reference to our firm in the prospectus contained therein under the heading “Legal Matters.” In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

| | | | | | | | |

Sincerely, | |

| | |

/s/ Latham & Watkins LLP | |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-3 of Cadence Design Systems, Inc. of our report dated February 13, 2024 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Cadence Design Systems, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2023. We also consent to the reference to us under the heading “Experts” in such Registration Statement.

/s/ PricewaterhouseCoopers LLP

San Jose, California

June 5, 2024

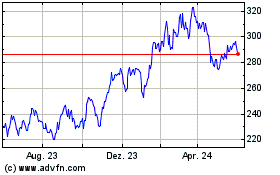

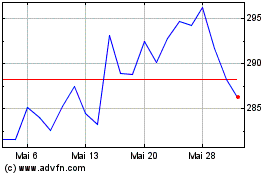

Cadence Design Systems (NASDAQ:CDNS)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Cadence Design Systems (NASDAQ:CDNS)

Historical Stock Chart

Von Jun 2023 bis Jun 2024