0001782303false00017823032024-08-122024-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 12, 2024 |

Boundless Bio, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41989 |

83-0751369 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9880 Campus Point Drive, Suite 120, |

|

San Diego, California |

|

92121 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 766-9912 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

BOLD |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 12, 2024, Boundless Bio, Inc. (the Company) issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the Securities Act), or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BOUNDLESS BIO, INC. |

|

|

|

|

Date: |

August 12, 2024 |

By: |

/s/ Jessica Oien |

|

|

|

Name: Jessica Oien

Title: Chief Legal Officer and Corporate Secretary |

Boundless Bio Provides Business Updates Focused on Key Value Drivers and Reports Second Quarter 2024 Financial Results

BBI-355 POTENTIATE clinical trial ongoing with initiatives implemented to expedite enrollment in combination cohorts; initial proof-of-concept data now expected in the second half of 2025

BBI-825 STARMAP clinical trial ongoing with initial proof-of-concept data expected in the second half of 2025

ECHO ecDNA diagnostic analytically validated and IRB-approved for use as a clinical trial assay in BBI-355 POTENTIATE trial

Streamlined operations expected to extend operating runway into the fourth quarter of 2026

SAN DIEGO, August 12, 2024 – Boundless Bio (Nasdaq: BOLD), a clinical-stage oncology company interrogating extrachromosomal DNA (ecDNA) biology to deliver transformative therapies to patients with previously intractable oncogene amplified cancers, today provided business updates for the company’s top strategic priorities and reported financial results for the second quarter of 2024.

“At Boundless, we’re on a bold mission to pioneer a new category of cancer treatment for patients with oncogene amplified cancer who are in dire need of new therapeutic options,” said Zachary Hornby, President and Chief Executive Officer of Boundless Bio. “In the second quarter of 2024, we continued to advance our first clinical-stage ecDTx, BBI-355, began dosing patients with our second ecDTx, BBI-825, and completed the analytical validation and received IRB approval of our novel ecDNA diagnostic, ECHO, for deployment as a clinical trial assay in our BBI-355 POTENTIATE trial. Though we have made progress toward our goals, the number of patients enrolled thus far in the combination cohorts of the BBI-355 POTENTIATE trial is lower than originally projected. While we implement measures to accelerate enrollment, we have chosen to scale back our early discovery efforts and streamline our operations to extend our runway and help ensure we have the necessary capital for our core ecDTx programs. Moving forward, we believe we are well-positioned to move our lead programs through initial clinical proof-of-concept data readouts and remain steadfast in advancing this innovative approach for patients with high unmet need.”

Strategic Priorities for Core Programs

Boundless Bio has outlined its core portfolio priorities to support the achievement of potential near-term catalysts and long-term patient impact. Through 2025, the company’s core strategic priorities remain:

•Executing the ongoing Phase 1/2 POTENTIATE (Precision Oncology Trial Evaluating Novel Therapeutic Interrupting Amplifications Tied to ecDNA) clinical trial of its lead ecDNA directed therapeutic candidate (ecDTx), BBI-355, a novel, oral CHK1 inhibitor, to generate initial proof-of-concept in solid tumor cancer patients with driver oncogene amplifications;

•Executing the ongoing Phase 1/2 STARMAP (Study Targeting Acquired Resistance: MAPK Amplifications) clinical trial of its second ecDTx, BBI-825, a novel, oral RNR inhibitor, to generate initial proof-of-concept in colorectal cancer patients with BRAFV600E or KRASG12C mutations and resistance oncogene amplifications;

•Advancing the company’s third ecDTx program, directed to a novel, previously undrugged kinesin target essential for ecDNA segregation, into IND-enabling studies; and

•Deploying its proprietary ecDNA diagnostic in the clinic to identify ecDNA+ patients who are most likely to benefit from its ecDTx therapeutics.

In alignment with its strategic priorities, Boundless Bio has narrowed its discovery research work and, as a result, modestly reduced its workforce. The company believes the combination of these operational efficiencies and its cash, cash equivalents, and short-term investments of $179.3 million as of June 30, 2024, provides an operating runway into the fourth quarter of 2026.

BBI-355, a novel, oral, potent, selective CHK1 inhibitor targeting replication stress for cancer patients with driver oncogene amplifications

•The company presented preclinical and clinical pharmacodynamic data on BBI-355 at the American Association for Cancer Research (AACR) Annual Meeting in April 2024.

•Enrollment is progressing in the Phase 1/2 POTENTIATE clinical trial evaluating BBI-355 as a single agent and in combination with targeted therapies in patients with locally advanced or metastatic solid tumors with oncogene amplifications.

•To date, no new safety signals have been observed, and there has been no evidence of combinatorial toxicity in the dose escalation cohorts evaluating BBI-355 in combination with either the EGFR inhibitor erlotinib or the FGFR inhibitor futibatinib.

•The initial pace of enrollment in the combination cohorts has been slower than anticipated. The company has recently implemented multiple initiatives to help accelerate enrollment, including engaging with next-generation sequencing vendors to identify patients, adding new clinical sites in the US, and preparing for the initiation of ex-US sites.

•Based on its current projections, the company now anticipates reporting initial clinical proof-of-concept data from POTENTIATE in the second half of 2025.

BBI-825, a novel, oral, potent, selective RNR inhibitor targeting ecDNA assembly and repair for cancer patients with resistance oncogene amplifications

•In April 2024, the company announced the first patient had been dosed with BBI-825 in the Phase 1/2 STARMAP clinical trial.

•Multiple dose levels have been completed in the single-agent, dose-escalation portion of the STARMAP clinical trial and, to date, BBI-825 has demonstrated oral bioavailability

and has been generally well-tolerated. Initial clinical proof-of-concept data from the trial are expected in the second half of 2025.

ecDTx 3, a novel kinesin program involved in ecDNA segregation

•The company’s third ecDTx program, directed to a previously undrugged kinesin target essential for ecDNA segregation whose inhibition is synthetic lethal to ecDNA-enabled cancer cells, is currently advancing through lead optimization.

ECHO, a proprietary diagnostic for detection of ecDNA amplified oncogenes

•The company’s proprietary ecDNA diagnostic, referred to as ECHO (ecDNA Harboring Oncogenes), is designed to detect ecDNA in patient tumor specimens. ECHO was previously determined by the FDA to be a non-significant risk device for use as a clinical trial assay (CTA) in the BBI-355 POTENTIATE trial.

•ECHO has now been analytically validated and institutional review board (IRB)-approved for use as a CTA in the BBI-355 POTENTIATE trial.

Second Quarter 2024 Financial Results

•Cash Position: Cash, cash equivalents, and short-term investments totaled $179.3 million as of June 30, 2024.

•R&D Expenses: Research and development (R&D) expenses were $14.7 million for the second quarter of 2024 compared to $11.1 million for the same period in 2023.

•G&A Expenses: General and administrative (G&A) expenses were $4.7 million for the second quarter of 2024 compared to $2.9 million for the same period in 2023.

•Net Loss: Net loss totaled $17.0 million for the second quarter of 2024 compared to $12.4 million for the same period in 2023.

About BBI-355

Boundless Bio’s lead ecDTx, BBI-355, is a novel, oral, selective small molecule inhibitor of checkpoint kinase 1 (CHK1) being studied in the ongoing, first-in-human, Phase 1/2 POTENTIATE clinical trial (NCT05827614) in cancer patients with oncogene amplifications. CHK1 is a master regulator of cells’ response to replication stress (RS). RS is elevated in cancer cells with oncogene amplification, including on ecDNA, and, because of this, represents a key vulnerability of those cells. BBI-355 was designed to exploit the elevated RS in ecDNA-enabled oncogene amplified cancer cells by disrupting proper CHK1 function in regulating RS and thereby facilitating catastrophic RS to preferentially kill cancer cells relative to healthy cells.

About BBI-825

Boundless Bio’s second ecDTx, BBI-825, is a novel, oral, selective small molecule inhibitor of ribonucleotide reductase (RNR) being studied in the ongoing, first-in-human, Phase 1/2 STARMAP clinical trial (NCT06299761) in colorectal cancer patients with BRAFV600E or KRASG12C mutations and resistance gene amplifications. In preclinical studies, BBI-825 demonstrated low double digit nanomolar RNR inhibition and tumor growth inhibition, including regressions, in both the prevention and treatment of amplification-mediated resistance in mitogen-activated protein kinase (MAPK) pathway-activated tumors. RNR is the rate-limiting

enzyme responsible for cellular de novo synthesis of deoxynucleotide triphosphates (dNTPs), the building blocks of DNA, and is essential to the assembly and repair of ecDNA. BBI-825 was shown to dysregulate ecDNA-reliant cancer cell dNTP pools, deplete ecDNA, and was synthetic lethal in multiple oncogene amplified preclinical cancer models.

About Boundless Bio

Boundless Bio is a clinical-stage oncology company dedicated to unlocking a new paradigm in cancer therapeutics to address the significant unmet need of patients with oncogene amplified tumors by targeting extrachromosomal DNA (ecDNA), a root cause of oncogene amplification observed in more than 14% of cancer patients. Boundless Bio is developing the first ecDNA-directed therapeutic candidates (ecDTx), BBI-355, which is an oral inhibitor of checkpoint kinase 1 (CHK1) being evaluated in a Phase 1/2 clinical trial in cancer patients with oncogene amplifications. Boundless Bio’s second ecDTx, BBI-825, is an oral inhibitor of ribonucleotide reductase (RNR) being evaluated in a Phase 1/2 clinical trial in colorectal cancer patients with BRAFV600E or KRASG12C mutations and resistance gene amplifications. Leveraging its Spyglass platform, Boundless Bio has an additional program (ecDTx 3) advancing through preclinical development and discovery. Boundless Bio is headquartered in San Diego, CA.

For more information, visit www.boundlessbio.com. Follow us on LinkedIn and X.

Forward-Looking Statements

Boundless Bio cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. The forward-looking statements are based on our current beliefs and expectations and include but are not limited to: the potential to achieve catalysts and long-term patient impact; the potential to expedite enrollment in the POTENTIATE trial; the timing of expected data readouts; the impact on our cash runway of our streamlining efforts and the sufficiency of our cash position and such efforts to fund operations and initial clinical proof-of-concept data readouts; and the potential safety and therapeutic benefits of our ecDTx in treating patients with oncogene amplified cancers. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in our business, including, without limitation: we are early in our development efforts and our approach to discover and develop ecDTx directed against ecDNA in oncogene amplified cancers is novel and unproven; results from preclinical studies or early clinical trials not necessarily being predictive of future results; potential delays in the commencement, enrollment, data readouts or completion of clinical trials or preclinical studies; our dependence on third parties in connection with clinical trials, preclinical studies, ecDNA diagnostic development, and manufacturing; unfavorable results from clinical trials or preclinical studies; we may expend our limited resources to pursue a particular ecDTx and fail to capitalize on ecDTx with greater development or commercial potential; unexpected adverse side effects or inadequate efficacy of our ecDTx that may limit their development, regulatory approval, and/or commercialization; the potential for our programs and prospects to be negatively impacted by developments relating to our competitors, including the results of studies or regulatory determinations relating to our competitors; regulatory developments in the United States and foreign countries; efforts to streamline operations may not produce the efficiencies expected; we may use our capital resources sooner than we expect; and

other risks described in our filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in our quarterly report on Form 10-Q for the quarter ended June 30, 2024 and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Investor Contacts:

Ben Flaum, Boundless Bio

bflaum@boundlessbio.com

Renee Leck, THRUST Strategic Communications

renee@thrustsc.com

Media Contact:

Dan Budwick, 1AB

Dan@1abmedia.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOUNDLESS BIO, INC. |

|

Condensed Financial Information |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Statements of Operations Data: |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

(In thousands, except per share amounts) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

14,735 |

|

|

$ |

11,075 |

|

|

$ |

27,864 |

|

|

$ |

20,577 |

|

General and administrative |

|

4,656 |

|

|

|

2,885 |

|

|

|

8,410 |

|

|

|

5,470 |

|

Total operating expenses |

|

19,391 |

|

|

|

13,960 |

|

|

|

36,274 |

|

|

|

26,047 |

|

Loss from operations |

|

(19,391 |

) |

|

|

(13,960 |

) |

|

|

(36,274 |

) |

|

|

(26,047 |

) |

Other income, net: |

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

2,382 |

|

|

|

1,551 |

|

|

|

3,803 |

|

|

|

1,914 |

|

Other income, net |

|

33 |

|

|

|

11 |

|

|

|

65 |

|

|

|

16 |

|

Total other income, net |

|

2,415 |

|

|

|

1,562 |

|

|

|

3,868 |

|

|

|

1,930 |

|

Net loss |

$ |

(16,976 |

) |

|

$ |

(12,398 |

) |

|

$ |

(32,406 |

) |

|

$ |

(24,117 |

) |

Net loss per share, basic and diluted |

$ |

(0.77 |

) |

|

$ |

(10.28 |

) |

|

$ |

(2.78 |

) |

|

$ |

(20.18 |

) |

Weighted-average shares used in calculation |

|

22,023 |

|

|

|

1,206 |

|

|

|

11,641 |

|

|

|

1,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Balance Sheet Data: |

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

(In thousands) |

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Cash, cash equivalents, and short-term investments |

|

|

|

|

|

|

$ |

179,290 |

|

|

$ |

120,752 |

|

Total assets |

|

|

|

|

|

|

$ |

188,203 |

|

|

$ |

129,894 |

|

Total liabilities |

|

|

|

|

|

|

$ |

8,957 |

|

|

$ |

9,359 |

|

Convertible preferred stock |

|

|

|

|

|

|

$ |

- |

|

|

$ |

247,617 |

|

Accumulated deficit |

|

|

|

|

|

|

$ |

(168,515 |

) |

|

$ |

(136,109 |

) |

Total stockholders' equity (deficit) |

|

|

|

|

|

|

$ |

179,246 |

|

|

$ |

(127,082 |

) |

Working capital (1) |

|

|

|

|

|

|

$ |

174,175 |

|

|

$ |

114,845 |

|

__________ |

|

|

|

|

|

|

|

|

|

|

|

(1) We define working capital as current assets less current liabilities. |

|

|

|

|

|

|

|

|

|

|

#####

v3.24.2.u1

Document And Entity Information

|

Aug. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 12, 2024

|

| Entity Registrant Name |

Boundless Bio, Inc.

|

| Entity Central Index Key |

0001782303

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-41989

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

83-0751369

|

| Entity Address, Address Line One |

9880 Campus Point Drive, Suite 120,

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

(858)

|

| Local Phone Number |

766-9912

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

BOLD

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

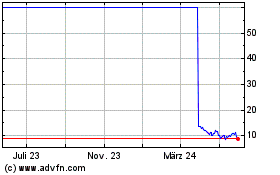

Boundless Bio (NASDAQ:BOLD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

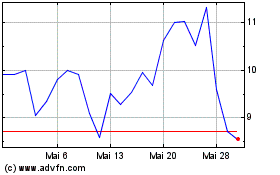

Boundless Bio (NASDAQ:BOLD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025