0001048477false00010484772024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2024

BioMarin Pharmaceutical Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware | 000-26727 | 68-0397820 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| |

770 Lindaro Street | San Rafael | California | 94901 | |

(Address of Principal Executive Offices) | | (Zip Code) | |

(415) 506-6700

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 | | BMRN | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

o

Item 2.02 Results of Operations and Financial Condition.

On August 5, 2024, BioMarin Pharmaceutical Inc. (the Company) announced financial results for its second quarter ended June 30, 2024. The Company’s press release issued on August 5, 2024 is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information in this Form 8-K, including in the press release furnished as Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities under that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the Securities Act), nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | Press Release of the Company dated August 5, 2024 |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | BioMarin Pharmaceutical Inc.,

a Delaware corporation |

| | |

Date: August 5, 2024 | By: | /s/ G. Eric Davis |

| | G. Eric Davis |

| | Executive Vice President, Chief Legal Officer |

| | | | | | | | |

| Contact: | | |

| Investors: | | Media: |

| Traci McCarty | | Marni Kottle |

| BioMarin Pharmaceutical Inc. | | BioMarin Pharmaceutical Inc. |

| (415) 455-7558 | | (650) 374-2803 |

BioMarin Announces 20% Y/Y Total Revenue Growth in the Second Quarter and Increase in Full-year 2024 Guidance

Second Quarter 2024 Total Revenues of $712 million (+20% Y/Y and +25% at Constant Currency Y/Y); First Half 2024 Total Revenues of $1.36 billion (+14% Y/Y and +19% at Constant Currency Y/Y)

Second Quarter 2024 GAAP Diluted EPS of $0.55 (+90% Y/Y); First Half 2024 GAAP Diluted EPS of $1.01

(+80% Y/Y)

Second Quarter 2024 Non-GAAP Diluted Earnings per Share (EPS) of $0.96 (+78% Y/Y); First Half 2024 Non-GAAP Diluted EPS of $1.67 (+46% Y/Y)

Strong VOXZOGO® Demand in the Quarter Resulted in 73% Y/Y Increase in the Number of Children Receiving Treatment

Conference Call and Webcast Scheduled Today at 4:30 p.m. ET

SAN RAFAEL, Calif., August 5, 2024 – BioMarin Pharmaceutical Inc. (NASDAQ: BMRN) today announced financial results for the quarter and six months ended June 30, 2024.

“Strong execution across our business resulted in record double-digit revenue growth in the second quarter and first half of 2024. These top-line results, along with a focus on operational efficiency, resulted in a 78% year-over-year improvement in quarterly non-GAAP earnings per share,” said Alexander Hardy, President and Chief Executive Officer of BioMarin. “Strong global demand for VOXZOGO led to nearly 900 new patient starts in the first half of 2024, the highest in VOXZOGO’s history. Record VOXZOGO contributions in the quarter, driven by patient growth in all geographies, combined with double-digit growth from our enzyme therapies drove today’s increased 2024 full-year guidance.”

Mr. Hardy added, “During the quarter, global demand for VOXZOGO continued to increase as more families sought treatment with the only approved and genetically-targeted medicine for achondroplasia. Approximately 3,500 children were receiving VOXZOGO by the end of the second quarter, with more than half of new treatment starts in the United States for children under the age of 5. We are seeing strong interest from families in the United States seeking VOXZOGO treatment for their children and we expect this market to continue to drive significant expansion over the coming quarters.” Mr. Hardy continued, “With VOXZOGO’s safety and efficacy well-established, based on nearly 6,000 patient years of demonstrated and durable evidence, we are confident in our rapidly expanding leadership. Enrollment in our pivotal study with VOXZOGO for the treatment of hypochondroplasia is proceeding well, and enrollment in our separate studies for idiopathic short stature, Noonan Syndrome, Turner Syndrome and SHOX deficiency are advancing this year as planned, following alignment with health authorities.”

Financial Highlights:

•Total Revenues for the second quarter of 2024 were $712.0 million, an increase of 20%, compared to the same period in 2023, driven by strong VOXZOGO contributions from new patient starts, high compliance rates, and customer stock levels normalizing facilitated by ample supply. In the quarter, demand across BioMarin’s enzyme therapies (VIMIZIM®, NAGLAZYME®, ALDURAZYME®, BRINEURA® and PALYNZIQ®) drove 15% growth compared to the second quarter of 2023. This increase was partially driven by NAGLAZYME product revenues due to the timing of large government orders in certain regions outside the United States and higher PALYNZIQ revenues in the United States driven by new patient starts. Partially offsetting the increase were lower KUVAN® product revenues attributed to continued generic competition as a result of the loss of market exclusivity.

•GAAP Net Income increased by $51.2 million to $107.2 million in the second quarter of 2024 compared to the same period in 2023. The increase was primarily due to higher gross profit driven by the factors noted above. The increase was partially offset by higher spend in Selling, General and Administrative (SG&A), primarily due to severance and other restructuring costs associated with the Company’s portfolio strategy review and the associated organizational redesign efforts announced in the second quarter of 2024.

•Non-GAAP Income increased by $83.7 million to $188.9 million in the second quarter of 2024 compared to the same period in 2023. The increase in Non-GAAP Income was primarily due to higher gross profit, partially offset by higher SG&A expenses primarily related to sales and marketing activities for VOXZOGO, higher partner distribution fees, incremental administrative expenses, as well as higher Research and Development (R&D) expenses related to expansion into new VOXZOGO indications and our prioritized pipeline products.

2Q Update on 2024 Strategic Priorities

In the second quarter, BioMarin continued to deliver on its four strategic priorities, first outlined in January, and focused on value creation through accelerating growth, optimizing efficiencies and driving operational excellence.

Accelerate and maximize the VOXZOGO opportunity

•During the second quarter, the number of children with achondroplasia benefiting from VOXZOGO treatment increased to approximately 3,500 across 44 countries. Global access to VOXZOGO from infancy had a significant impact on uptake as families pursued maximum therapeutic benefit by starting treatment early.

•In the U.S., the largest potential market, the majority of new patient starts in the quarter were for children under the age of 5 years. VOXZOGO's extensive safety and efficacy profile led more families to begin therapeutic intervention early to potentially impact greater improvements in craniofacial growth, foramen magnum compression, body proportionality and quality of life, in addition to durable increases in growth velocity.

•During the quarter, new, multi-year data demonstrating that treating achondroplasia with VOXZOGO improved health related quality of life and proportionality, which are important benefits, beyond height, for affected children and their families. These results were presented at the Pediatric Endocrine Society (PES) annual meeting (press release), and the 2024 International Conference on Children’s Bone Health (ICCBH) (press release). In addition, positive results with VOXZOGO from Phase 2 in children with Noonan Syndrome, idiopathic short stature and other growth-related conditions were presented.

◦At PES on May 4, results from a Phase 3 extension study in children with achondroplasia who began VOXZOGO treatment at 10 years of age or older, demonstrated that meaningful height gains were observed despite the age of participants at treatment initiation. Results from a Phase 2 extension study showed that VOXZOGO maintained positive effects on linear growth over 4 years in children who began treatment under age five. Results from an investigator-sponsored Phase 2 in children 3-11 years old with several genetic growth-related conditions demonstrated marked improvement in annualized growth velocity and height standard deviation across all conditions studied.

◦At ICCBH on June 17, a new investigator-led study showed VOXZOGO significantly increased bone length while maintaining bone strength through 5 years of observation in children with achondroplasia, an essential functional outcome for children receiving multi-year treatment. Phase 2

and Phase 3 data on VOXZOGO demonstrated durable safety and efficacy, and improvements on proportionality and health-related quality of life in children with achondroplasia.

•Building on its leadership in achondroplasia, BioMarin’s clinical programs across multiple new growth-related conditions are underway. The pivotal study with VOXZOGO for hypochondroplasia is actively enrolling. Clinical programs in idiopathic short stature, Noonan Syndrome, Turner Syndrome and SHOX deficiency are all on track for enrollment later this year.

•During the second quarter, through extensive supply chain efforts, BioMarin secured ample VOXZOGO supply to support patient demand worldwide. As of the end of the quarter, the company was able to provide VOXZOGO supply to new patients immediately, as identified. Additionally, the company has ample supply capacity to support all ongoing VOXZOGO clinical programs in hypochondroplasia, idiopathic short stature, Noonan Syndrome, Turner Syndrome and SHOX deficiency, as well as expected commercial demand.

Establish ROCTAVIAN® opportunity

•Today, the company announced its updated strategy for ROCTAVIAN. The strategy will enable ROCTAVIAN to contribute to BioMarin’s long-term profitability. By focusing commercial, research and manufacturing programs in three prioritized countries, including the United States, Germany and Italy, BioMarin anticipates reducing annual direct ROCTAVIAN expenses to approximately $60 million, beginning in 2025. The company has already begun to operationalize the reduction of ROCTAVIAN expenses this year to achieve $60 million in expenses beginning in full-year 2025. As a result of these changes, the company expects ROCTAVIAN to be profitable by the end of 2025.

•During the quarter, BioMarin treated 3 patients in the U.S. and 2 in Italy, generating $7 million in revenue. BioMarin’s global commercial team will continue to focus on key elements critical to supporting ROCTAVIAN uptake in with the U.S., Germany and Italy.

Focus R&D on the most promising assets

•During the quarter, BioMarin progressed development of its prioritized pipeline products: BMN 351, BMN 349, and BMN 333. BMN 351, BioMarin’s next generation oligonucleotide for Duchenne Muscular Dystrophy, has completed enrollment of the first dose cohort, with data expected by year-end. With BMN 349, a potential best-in-class, oral therapeutic for Alpha-1 antitrypsin deficiency (AATD)-associated liver disease, the company will begin enrolling its first-in-human study with healthy volunteers later this year. BMN 333, a long-acting C-type natriuretic peptide (CNP) for multiple growth disorders, is completing IND-enabling activities and is expected to enter the clinic in early 2025.

•During the quarter, the company chose to discontinue development of BMN 293, a gene therapy for hypertrophic cardiomyopathy. Applying its focused approach to investing in only those assets that have the highest potential impact for patients, the time and resources anticipated to bring BMN 293 through development and to market no longer met BioMarin’s high bar for advancement.

Accelerate EPS growth and expand margins

•Sustained strong performance in the second quarter highlighted BioMarin’s ongoing execution of its financial strategy to drive year-over-year Non-GAAP Operating Margin expansion and Non-GAAP EPS growth faster than revenues.

•The company raised full-year 2024 guidance for Total Revenues, Non-GAAP Operating Margin, and Non-GAAP Diluted EPS. The improved guidance reflects the underlying strength of enzyme products and continued high demand for VOXZOGO, along with BioMarin’s commitment to accelerate profitability while continuing to invest in innovation. BioMarin’s updated full-year 2024 guidance does not reflect the impact of potential additional future business decisions that may result from its ongoing strategic business review.

Investor Day to be held Wednesday, September 4th. Event details will be available later in August.

Financial Highlights (in millions of U.S. dollars, except per share data, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| | | | | | | | | | | |

| Total Revenues | $712.0 | | $595.3 | | 20% | | $1,360.9 | | $1,191.7 | | 14% |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net Product Revenues by Product: | | | | | | | | | | | |

| VOXZOGO | $183.9 | | $113.3 | | 62% | | $336.7 | | $201.2 | | 67% |

| VIMIZIM | $178.0 | | $177.4 | | 0% | | $370.5 | | $366.6 | | 1% |

| NAGLAZYME | $132.0 | | $90.1 | | 47% | | $237.7 | | $213.1 | | 12% |

| PALYNZIQ | $88.3 | | $74.9 | | 18% | | $164.0 | | $137.2 | | 20% |

| BRINEURA | $45.3 | | $38.1 | | 19% | | $84.4 | | $77.2 | | 9% |

| ALDURAZYME | $38.6 | | $40.3 | | (4)% | | $73.8 | | $74.7 | | (1)% |

| KUVAN | $28.6 | | $50.6 | | (43)% | | $64.5 | | $101.1 | | (36)% |

| ROCTAVIAN | $7.4 | | $— | | nm | | $8.3 | | $— | | nm |

| | | | | | | | | | | |

| GAAP Net Income | $107.2 | | $56.0 | | 91% | | $195.8 | | $106.9 | | 83% |

Non-GAAP Income (1) | $188.9 | | $105.2 | | 80% | | $328.6 | | $221.0 | | 49% |

GAAP Operating Margin %(2) | 16.9% | | 11.0% | | | | 15.4% | | 10.7% | | |

Non-GAAP Operating Margin %(2) | 31.2% | | 21.7% | | | | 27.6% | | 22.1% | | |

| GAAP Diluted Earnings per Share (EPS) | $0.55 | | $0.29 | | 90% | | $1.01 | | $0.56 | | 80% |

Non-GAAP Diluted EPS (3) | $0.96 | | $0.54 | | 78% | | $1.67 | | $1.14 | | 46% |

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Total cash, cash equivalents & investments | $ | 1,781.4 | | | $ | 1,684.9 | |

(1) Non-GAAP Income is defined by the company as reported GAAP Net Income, excluding amortization of intangible assets, stock-based compensation expense and, in certain periods, certain other specified items. The company also includes a Non-GAAP adjustment for the estimated income tax impact of reconciling items. Refer to Non-GAAP Information beginning on page 10 of this press release for a complete discussion of the company’s Non-GAAP financial information and reconciliations to the comparable information reported under U.S. GAAP. (2) GAAP Operating Margin percentage is defined by the company as GAAP Income from Operations divided by Total Revenues. Non-GAAP Operating Margin percentage is defined by the company as GAAP Income from Operations, excluding amortization of intangible assets, stock-based compensation expense and, in certain periods, certain specified items divided by Total Revenues.

(3) Non-GAAP Diluted EPS is defined by the company as Non-GAAP Income divided by Non-GAAP diluted weighted-average shares outstanding. Non-GAAP weighted-average diluted shares outstanding is defined by the company as GAAP weighted-average diluted shares outstanding, adjusted to include any common shares issuable under the company’s equity plans and convertible debt in periods when they are dilutive under Non-GAAP.

nm Not meaningful

2024 Full-Year Financial Guidance (in millions, except % and EPS amounts) (Updated)

BioMarin does not provide guidance for GAAP reported financial measures (other than revenue) or a reconciliation of forward-looking Non-GAAP financial measures to the most directly comparable GAAP reported financial measures because the company is unable to predict with reasonable certainty the financial impact of changes resulting from its strategic portfolio and business operating model reviews; potential future asset impairments; gains and losses on investments; and other unusual gains and losses without unreasonable effort. These items are uncertain, depend on various factors, and could have a material impact on GAAP reported results for the guidance period. As such, any reconciliations provided would imply a degree of precision that could be confusing or misleading to investors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Item | | Provided April 24, 2024 | | Updated August 5, 2024 | | |

| Total Revenues | | $2,700 | | to | | $2,800 | | $2,750 | | to | | $2,825 | | | | | | |

Non-GAAP Operating Margin % (1) | | 24% | | to | | 25% | | 26% | | to | | 27% | | | | | | |

Non-GAAP Diluted EPS (1)(2) | | $2.75 | | to | | $2.95 | | $3.10 | | to | | $3.25 | | | | | | |

(1) Refer to Non-GAAP Information beginning on page 10 of this press release for definitions of Non-GAAP Operating Margin and Non-GAAP Diluted EPS. (2) Non-GAAP Diluted EPS guidance assumes approximately 200 million weighted-average diluted shares outstanding.

BioMarin will host a conference call and webcast to discuss second quarter 2024 financial results today, Monday, August 5, 2024, at 4:30 p.m. ET. This event can be accessed through this link or on the investor section of the BioMarin website at www.biomarin.com.

| | | | | |

U.S./Canada Dial-in Number: 888-596-4144 | Replay Dial-in Number: 800-770-2030 |

International Dial-in Number: 646-968-2525 | Replay International Dial-in Number: 609-800-9909 |

No Conference ID: 1816377 | Conference ID: 1816377 |

About BioMarin

Founded in 1997, BioMarin is a global biotechnology company dedicated to transforming lives through genetic discovery. The company develops and commercializes targeted therapies that address the root cause of genetic conditions. BioMarin's robust research and development capabilities have resulted in multiple innovative commercial therapies for patients with rare genetic disorders. The company's distinctive approach to drug discovery has produced a diverse pipeline of commercial, clinical, and pre-clinical candidates that address a significant unmet medical need, have well-understood biology, and provide an opportunity to be first-to-market or offer a substantial benefit over existing treatment options. For additional information, please visit www.biomarin.com.

Forward-Looking Statements

This press release and the associated conference call and webcast contain forward-looking statements about the business prospects of BioMarin Pharmaceutical Inc. (BioMarin), including, without limitation, statements about: future financial performance, including the expectations of Total Revenues, Non-GAAP Operating Margin percentage, and Non-GAAP Diluted EPS for the full-year 2024 and the underlying drivers of those results; BioMarin’s new corporate strategy, including the timing of the completion and announcement; BioMarin’s ability to accelerate the VOXZOGO opportunity; the anticipated benefits from its ongoing strategic review and the associated organizational redesign efforts; BioMarin’s updated strategy for ROCTAVIAN and its anticipated benefits, including BioMarin’s expectations regarding reduction of annual direct ROCTAVIAN expenses beginning in 2025 and ROCTAVIAN being profitable by the end of 2025; the timing of orders for commercial products; BioMarin’s ability to meet product demand; the timing of BioMarin’s clinical development and commercial prospects, including announcements of data from clinical studies and trials; the clinical development and commercialization of BioMarin’s product candidates and commercial products, including (i) the potential to leverage VOXZOGO in conditions beyond achondroplasia, such as hypochondroplasia, idiopathic short stature, Noonan Syndrome, Turner Syndrome, SHOX deficiency and other genetic short stature pathway conditions, (ii) the expected expansion of VOXZOGO in the U.S. and the anticipated start and growth of commercial sales of VOXZOGO in additional countries, (iii) the commercialization of ROCTAVIAN for the treatment of severe hemophilia A in the U.S., Germany and Italy, (iv) BioMarin’s expectation to receive data regarding the first dose cohort for BMN 351 by year-end, (v) BioMarin’s plans to enroll its first-in-human study with BMN 349 later this year, and (vi) BioMarin’s plans to initiate a clinical program with BMN 333 in early 2025; the expected benefits and availability of BioMarin’s product candidates; and potential growth opportunities and trends, including BioMarin’s expectation that VOXZOGO product growth will continue to expand rapidly.

These forward-looking statements are predictions and involve risks and uncertainties such that actual results may differ materially from these statements. These risks and uncertainties include, among others: BioMarin’s success in the commercialization of its commercial products; impacts of macroeconomic and other external factors on BioMarin’s operations; results and timing of current and planned preclinical studies and clinical trials and the release of data from those trials; BioMarin’s ability to successfully manufacture its commercial products and product candidates; the content and timing of decisions by the Food and Drug Administration, the European Commission and other regulatory authorities concerning each of the described products and product candidates; the market for each of these products; actual sales of BioMarin’s commercial products; and those factors detailed in BioMarin's filings with the Securities and Exchange Commission, including, without limitation, the factors contained under the caption "Risk Factors" in BioMarin's Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 as such factors may be updated by any subsequent reports. Stockholders are urged not to place undue reliance on forward-looking statements, which speak only as of the date hereof. BioMarin is under no obligation, and expressly disclaims any obligation to update or alter any forward-looking statement, whether as a result of new information, future events or otherwise.

BioMarin®, BRINEURA®, KUVAN®, NAGLAZYME®, PALYNZIQ®, ROCTAVIAN®, VIMIZIM® and VOXZOGO® are registered trademarks of BioMarin Pharmaceutical Inc., or its affiliates. ALDURAZYME® is a registered trademark of BioMarin/Genzyme LLC. All other brand names and service marks, trademarks and other trade names appearing in this release are the property of their respective owners.

BIOMARIN PHARMACEUTICAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Three and Six Months Ended June 30, 2024 and 2023

(In thousands of U.S. dollars, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| REVENUES: | | | | | | | |

| Net product revenues | $ | 702,129 | | | $ | 584,698 | | | $ | 1,339,944 | | | $ | 1,171,124 | |

| Royalty and other revenues | 9,900 | | | 10,577 | | | 20,918 | | | 20,566 | |

| Total revenues | 712,029 | | | 595,275 | | | 1,360,862 | | | 1,191,690 | |

| OPERATING EXPENSES: | | | | | | | |

| Cost of sales | 130,459 | | | 130,619 | | | 255,639 | | | 266,091 | |

| Research and development | 183,787 | | | 177,363 | | | 388,774 | | | 349,209 | |

| Selling, general and administrative | 263,032 | | | 206,103 | | | 488,938 | | | 417,126 | |

| Intangible asset amortization | 14,299 | | | 15,624 | | | 28,597 | | | 31,294 | |

| Gain on sale of nonfinancial assets | — | | | — | | | (10,000) | | | — | |

| Total operating expenses | 591,577 | | | 529,709 | | | 1,151,948 | | | 1,063,720 | |

| INCOME FROM OPERATIONS | 120,452 | | | 65,566 | | | 208,914 | | | 127,970 | |

| | | | | | | |

| Interest income | 19,785 | | | 12,612 | | | 39,150 | | | 24,555 | |

| Interest expense | (3,574) | | | (3,755) | | | (7,121) | | | (7,458) | |

| Other expense, net | (4,527) | | | (3,613) | | | (3,260) | | | (17,500) | |

| INCOME BEFORE INCOME TAXES | 132,136 | | | 70,810 | | | 237,683 | | | 127,567 | |

| Provision for income taxes | 24,962 | | | 14,770 | | | 41,847 | | | 20,675 | |

| NET INCOME | $ | 107,174 | | | $ | 56,040 | | | $ | 195,836 | | | $ | 106,892 | |

| EARNINGS PER SHARE, BASIC | $ | 0.56 | | | $ | 0.30 | | | $ | 1.03 | | | $ | 0.57 | |

| EARNINGS PER SHARE, DILUTED | $ | 0.55 | | | $ | 0.29 | | | $ | 1.01 | | | $ | 0.56 | |

| Weighted average common shares outstanding, basic | 190,114 | | | 187,948 | | | 189,490 | | | 187,311 | |

| Weighted average common shares outstanding, diluted | 200,505 | | | 194,998 | | | 200,137 | | | 194,756 | |

BIOMARIN PHARMACEUTICAL INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

June 30, 2024 and December 31, 2023

(In thousands of U.S. dollars, except per share amounts)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 ⁽¹⁾ |

| ASSETS | (unaudited) | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 972,150 | | | $ | 755,127 | |

| Short-term investments | 252,201 | | | 318,683 | |

| Accounts receivable, net | 691,232 | | | 633,704 | |

| Inventory | 1,183,621 | | | 1,107,183 | |

| Other current assets | 160,426 | | | 141,391 | |

| Total current assets | 3,259,630 | | | 2,956,088 | |

| Noncurrent assets: | | | |

| Long-term investments | 557,083 | | | 611,135 | |

| Property, plant and equipment, net | 1,052,898 | | | 1,066,133 | |

| Intangible assets, net | 265,533 | | | 294,701 | |

| Goodwill | 196,199 | | | 196,199 | |

| Deferred tax assets | 1,545,006 | | | 1,545,809 | |

| Other assets | 190,772 | | | 171,538 | |

| Total assets | $ | 7,067,121 | | | $ | 6,841,603 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 572,500 | | | $ | 683,147 | |

| Short-term convertible debt, net | 494,837 | | | 493,877 | |

| | | |

| Total current liabilities | 1,067,337 | | | 1,177,024 | |

| Noncurrent liabilities: | | | |

| Long-term convertible debt, net | 594,116 | | | 593,095 | |

| | | |

| Other long-term liabilities | 119,369 | | | 119,935 | |

| Total liabilities | 1,780,822 | | | 1,890,054 | |

| Stockholders’ equity: | | | |

Common stock, $0.001 par value: 500,000,000 shares authorized; 190,355,517 and 188,598,154 shares issued and outstanding, respectively | 190 | | | 189 | |

| Additional paid-in capital | 5,696,701 | | | 5,611,562 | |

| Company common stock held by the Nonqualified Deferred Compensation Plan | (11,673) | | | (9,860) | |

| Accumulated other comprehensive income (loss) | 26,799 | | | (28,788) | |

| Accumulated deficit | (425,718) | | | (621,554) | |

| Total stockholders’ equity | 5,286,299 | | | 4,951,549 | |

| Total liabilities and stockholders’ equity | $ | 7,067,121 | | | $ | 6,841,603 | |

| | | |

(1) December 31, 2023 balances were derived from the audited Consolidated Financial Statements included in the company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (SEC) on February 26, 2024.

BIOMARIN PHARMACEUTICAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Six Months Ended June 30, 2024 and 2023

(In thousands of U.S. dollars)

(unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 195,836 | | | $ | 106,892 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | |

| Depreciation and amortization | 53,813 | | | 51,840 | |

| Non-cash interest expense | 1,981 | | | 2,058 | |

| Accretion of discount on investments | (4,678) | | | (4,533) | |

| Stock-based compensation | 106,163 | | | 103,857 | |

| Gain on sale of nonfinancial assets | (10,000) | | | — | |

| Impairment of assets and other non-cash adjustments | 14,204 | | | 12,650 | |

| Deferred income taxes | 1,537 | | | (5,108) | |

| Unrealized foreign exchange loss (gain) | (19,958) | | | 7,455 | |

| | | |

| Other | (858) | | | 361 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | (56,081) | | | (145,831) | |

| Inventory | (47,409) | | | (56,476) | |

| Other current assets | 1,615 | | | (53,430) | |

| Other assets | (22,880) | | | (5,616) | |

| Accounts payable and other short-term liabilities | (54,261) | | | (25,093) | |

| Other long-term liabilities | 6,709 | | | 7,104 | |

| Net cash provided by (used in) operating activities | 165,733 | | | (3,870) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of property, plant and equipment | (47,431) | | | (46,039) | |

| Maturities and sales of investments | 317,649 | | | 491,063 | |

| Purchases of investments | (195,462) | | | (444,049) | |

| Proceeds from sale of nonfinancial assets | 10,000 | | | — | |

| Purchase of intangible assets | (8,512) | | | (1,457) | |

| | | |

| | | |

| Net cash provided by (used in) investing activities | 76,244 | | | (482) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from exercises of awards under equity incentive plans | 36,618 | | | 50,193 | |

| Taxes paid related to net share settlement of equity awards | (66,739) | | | (67,862) | |

| | | |

| | | |

| | | |

| | | |

| Payments of contingent consideration | — | | | (9,475) | |

| Principal repayments of financing leases | (60) | | | (1,635) | |

| | | |

| Net cash used in financing activities | (30,181) | | | (28,779) | |

| Effect of exchange rate changes on cash | 5,227 | | | 2,981 | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 217,023 | | | (30,150) | |

| Cash and cash equivalents: | | | |

| Beginning of period | $ | 755,127 | | | $ | 724,531 | |

| End of period | $ | 972,150 | | | $ | 694,381 | |

Non-GAAP Information

The results presented in this press release include both GAAP information and Non-GAAP information. Non-GAAP Income is defined by the company as GAAP Net Income excluding amortization of intangible assets, stock-based compensation expense and, in certain periods, certain other specified items, as detailed below when applicable. The company also includes a Non-GAAP adjustment for the estimated tax impact of the reconciling items. Non-GAAP Operating Margin percentage is defined by the company as GAAP Income from Operations, excluding amortization of intangible assets, stock-based compensation expense and, in certain periods, certain other specified items, divided by GAAP Total Revenues. Non-GAAP Diluted EPS is defined by the company as Non-GAAP Income divided by Non-GAAP diluted shares outstanding. The company’s presentation of percentage changes in total revenues at constant currency rates, which is computed using current period local currency sales at the prior period’s foreign exchange rates, is also a Non-GAAP financial measure. This measure provides information about growth (or declines) in the company’s total revenue as if foreign currency exchange rates had not changed between the prior period and the current period.

BioMarin regularly uses both GAAP and Non-GAAP results and expectations internally to assess its financial operating performance and evaluate key business decisions related to its principal business activities: the discovery, development, manufacture, marketing and sale of innovative biologic therapies. Because Non-GAAP Income, Non-GAAP Operating Margin percentage, Non-GAAP Diluted EPS, Non-GAAP Diluted Shares outstanding and constant currency are important internal measurements for BioMarin, the company believes that providing this information in conjunction with BioMarin’s GAAP information enhances investors’ and analysts’ ability to meaningfully compare the company’s results from period to period and to its forward-looking guidance, and to identify operating trends in the company’s principal business. BioMarin also uses Non-GAAP Income internally to understand, manage and evaluate its business and to make operating decisions, and compensation of executives is based in part on this measure.

Non-GAAP Income and its components are not meant to be considered in isolation or as a substitute for, or superior to comparable GAAP measures and should be read in conjunction with the consolidated financial information prepared in accordance with GAAP. Investors should note that the Non-GAAP information is not prepared under any comprehensive set of accounting rules or principles and does not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP. Investors should also note that these Non-GAAP financial measures have no standardized meaning prescribed by GAAP and, therefore, have limits in their usefulness to investors. In addition, from time to time in the future there may be other items that the company may exclude for purposes of its Non-GAAP financial measures; likewise, the company may in the future cease to exclude items that it has historically excluded for purposes of its Non-GAAP financial measures. Because of the non-standardized definitions, the Non-GAAP financial measure as used by BioMarin in this press release and the accompanying tables may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies.

The following tables present the reconciliation of GAAP reported to Non-GAAP adjusted financial information:

Reconciliation of GAAP Reported Net Income to Non-GAAP Income(1)

(In millions of U.S. dollars)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| GAAP Reported Net Income | $ | 107.2 | | | $ | 56.0 | | | $ | 195.8 | | | $ | 106.9 | |

| Adjustments | | | | | | | |

| Stock-based compensation expense - COS | 3.8 | | | 4.7 | | | 7.0 | | | 9.1 | |

| Stock-based compensation expense - R&D | 12.9 | | | 15.1 | | | 33.6 | | | 34.9 | |

| Stock-based compensation expense - SG&A | 31.2 | | | 30.4 | | | 65.6 | | | 59.9 | |

| Amortization of intangible assets | 14.3 | | | 15.6 | | | 28.6 | | | 31.3 | |

| | | | | | | |

Gain on sale of nonfinancial assets (2) | — | | | — | | | (10.0) | | | — | |

Severance and restructuring costs (3) | 39.1 | | | (2.2) | | | 42.5 | | | (0.1) | |

Loss on investments (4) | 4.5 | | | — | | | 4.5 | | | 12.6 | |

| Income tax effect of adjustments | (24.1) | | | (14.4) | | | (39.0) | | | (33.6) | |

| Non-GAAP Income | $ | 188.9 | | | $ | 105.2 | | | $ | 328.6 | | | $ | 221.0 | |

Reconciliation of Certain GAAP Reported Information to Non-GAAP Information(1)

(in millions of U.S. dollars, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, | |

| | | | | 2024 | | | | 2024 | | |

| | | | | Dollar | | Percentage | | | | | | Dollar | | Percentage | | | | |

GAAP Change in Total Revenues | | | | | $ | 116.7 | | | 20 | % | | | | | | $ | 169.2 | | | 14 | % | | | | |

Adjustment for unfavorable impact of foreign currency exchange rates on product sales denominated in currencies other than U.S. dollars | | | | | 29.9 | | | | | | | | | 52.6 | | | | | | | |

Non-GAAP change in Total Revenues at Constant Currency | | | | | $ | 146.6 | | | 25 | % | | | | | | $ | 221.8 | | | 19 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | Percent of GAAP Total Revenue | 2023 | Percent of GAAP Total Revenue | | 2024 | Percent of GAAP Total Revenue | 2023 | Percent of GAAP Total Revenue |

| | | | | | | | | |

| GAAP Income from Operations | $ | 120.5 | | 16.9 | % | $ | 65.6 | | 11.0 | % | | $ | 208.9 | | 15.4 | % | $ | 128.0 | | 10.7 | % |

| Adjustments | | | | | | | | | |

| Stock-based compensation expense | 47.9 | | 6.8 | % | 50.2 | | 8.5 | % | | 106.2 | | 7.7 | % | 103.9 | | 8.8 | % |

| Amortization of intangible assets | 14.3 | | 2.0 | % | 15.6 | | 2.6 | % | | 28.6 | | 2.1 | % | 31.3 | | 2.6 | % |

Gain on sale of nonfinancial assets (2) | — | | — | % | — | | — | % | | (10.0) | | (0.7) | % | — | | — | % |

Severance and restructuring costs (3) | 39.1 | | 5.5 | % | (2.2) | | (0.4) | % | | 42.5 | | 3.1 | % | (0.1) | | — | % |

| Total Non-GAAP adjustments | 101.3 | | 14.3 | % | 63.6 | | 10.7 | % | | 167.3 | | 12.2 | % | 135.1 | | 11.4 | % |

| Non-GAAP Income from Operations | $ | 221.8 | | 31.2 | % | $ | 129.2 | | 21.7 | % | | $ | 376.2 | | 27.6 | % | $ | 263.1 | | 22.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| GAAP Diluted EPS | $ | 0.55 | | | $ | 0.29 | | | $ | 1.01 | | | $ | 0.56 | |

| Adjustments | | | | | | | |

| Stock-based compensation expense | 0.24 | | | 0.25 | | | 0.53 | | | 0.52 | |

| Amortization of intangible assets | 0.07 | | | 0.08 | | | 0.14 | | | 0.16 | |

Gain on sale of nonfinancial assets (2) | — | | | — | | | (0.05) | | | — | |

Severance and restructuring costs (3) | 0.20 | | | (0.01) | | | 0.21 | | | — | |

| | | | | | | |

Loss on investments (4) | 0.02 | | | — | | | 0.02 | | | 0.06 | |

| Income tax effect of adjustments | (0.12) | | | (0.07) | | | (0.19) | | | (0.16) | |

| Non-GAAP Diluted EPS | $ | 0.96 | | | $ | 0.54 | | | $ | 1.67 | | | $ | 1.14 | |

(1) Certain amounts may not sum or recalculate due to rounding.

(2) Represents a payment triggered by a third party's attainment of a regulatory approval milestone related to previously sold intangible assets.

(3) These amounts were included in SG&A and represent severance and restructuring costs related to the company's 2024 portfolio strategy review and the associated organizational redesign efforts announced in the second quarter of 2024. These amounts also include impairments of certain right-of-use and fixed assets.

(4) Represents a downward adjustment to non-marketable equity securities recorded in Other expense, net.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| GAAP Weighted-Average Dilutive Shares Outstanding | 200.5 | | | 195.0 | | | 200.1 | | | 194.8 | |

| Adjustments | | | | | | | |

| | | | | | | |

Common stock issuable under the company’s convertible debt (1) | — | | | 4.4 | | | — | | | 4.4 | |

| Non-GAAP Weighted-Average Dilutive Shares Outstanding | 200.5 | | | 199.4 | | | 200.1 | | | 199.2 | |

(1) Common stock issuable under the company’s convertible debt was excluded from the computation of GAAP Weighted-Average Dilutive Shares Outstanding when they were anti-dilutive. If converted, for the prior year comparative period, the company would have issued 4.4 million shares under the convertible notes due in 2027.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

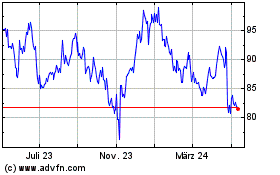

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

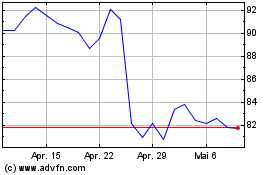

BioMarin Pharmaceutical (NASDAQ:BMRN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025