HBM Shares Jump 65% on Deal With AstraZeneca

07 April 2022 - 4:32AM

Dow Jones News

By Ben Otto

HBM Holdings Ltd. shares jumped after the company said it would

sell rights for a tumor antibody under development to AstraZeneca

PLC in a deal that could be worth as much as $350 million.

Shares of the Shanghai-based biopharmaceutical company rose as

much as 65% in early trading Thursday, its biggest one-day jump

since it listed in Hong Kong in late 2020.

HBM said it had entered into a deal to allow Anglo-Swedish

pharmaceutical giant AstraZeneca to develop and commercialize an

antibody that targets the elimination of tumors. The novel

bispecific antibody, known as HBM7002, is currently in the

pre-clinical stage.

HBM will receive an upfront payment of $25 million, with the

potential for up to $325 million more based on hitting development

and commercialization milestones. The company is also entitled to

receive royalties from AstraZeneca, it said.

The deal "marks a major milestone in business development of the

company, validating the potential of the company's technology

platform and innovation capabilities," HBM said.

Shares were last up 31% at 4.84 Hong Kong dollars (62 U.S.

cents).

Write to Ben Otto at ben.otto@wsj.com

(END) Dow Jones Newswires

April 06, 2022 22:17 ET (02:17 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

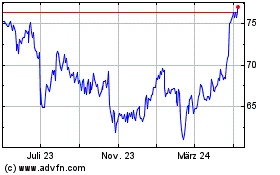

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

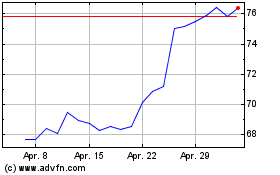

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024