AstraZeneca Swung to 4Q Loss Despite Revenue Rise; Expects $2.1 Billion Restructuring Charge -- Update

10 Februar 2022 - 10:36AM

Dow Jones News

By Cecilia Butini

AstraZeneca PLC said Thursday that it swung to a fourth-quarter

loss despite posting higher revenue as charges related to its

acquisition of Alexion Pharmaceuticals weighed on earnings, and

said it expects to incur in a $2.1 billion post-acquisition

restructuring charge.

The Anglo-Swedish pharma giant posted a net loss of $347 million

for the last quarter of the year compared with a net profit of

$1.01 billion the year prior. However, revenue rose to $12.01

billion from $7.41 billion as sales grew in most therapeutic

areas.

Losses per share for the quarter were $0.22 compared with

earnings per share of $0.78 the year prior.

The company posted earnings before interest, taxes, depreciation

and amortization of $1.90 billion in the quarter, down from $2.28

billion as the Alexion acquisition negatively affected the metric

with an unwind of inventory fair value uplift and restructuring

charges.

Sales of the company's Covid-19 vaccine contributed $1.87

billion to revenue in the quarter, but it said that it expects

sales of the shot to decline in 2022. Overall, total revenue from

Covid-19 medicines is expected to decline by a low-to-mid 20s

percentage in 2022, though the expected decline in vaccine sales

should be offset by growth in sales of monoclonal-antibody

combination Evusheld, AstraZeneca said. Gross profit margin from

Covid-19 medicines is expected to be lower than company average. It

added that the majority of vaccine revenue in 2022 is expected to

come from initial contracts.

The company said in its third-quarter statement in November that

it would start selling its Covid-19 jab at cost after pledging to

make no profit from it.

AstraZeneca said it has initiated a "comprehensive review" in

conjunction with the acquisition of Alexion, which it is aimed at

integrating systems, structure and processes, and which it expects

to complete by the end of 2025. The review is expected to produce

$2.1 billion restructuring costs.

Revenue is seen increasing by a high-teens percentage in 2022,

while core earnings per share are expected to rise in the

mid-to-high 20s percentage, AstraZeneca said, adding that the

growth rates include the full-year contribution of its Covid-19

vaccine, Vaxzeviria, in both 2021 and 2022.

Research-and-development costs and other operating expenses

increased both during the fourth quarter and overall in 2021, as

the company continued to invest in its coronavirus vaccine and in

its Evusheld Covid-19 treatment. Other expenses included increased

amortization of intangible assets related to the Alexion

acquisition and heightened investment in oncology launches.

Write to Cecilia Butini at cecilia.butini@wsj.com

(END) Dow Jones Newswires

February 10, 2022 04:21 ET (09:21 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

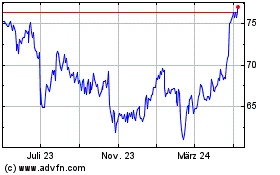

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

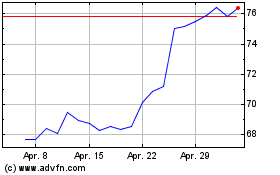

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024