By Jenny Strasburg and Cecilia Butini

LONDON -- AstraZeneca PLC said sales of its Covid-19 vaccine --

which it has promised to sell initially without profit -- haven't

kept up with its costs, resulting in a hit to earnings and a

warning the vaccine effort could continue to affect margins.

The drug giant booked $275 million in revenue in the first three

months of the year from sales of its Covid-19 vaccine, developed in

partnership with the University of Oxford. The company delivered 68

million doses globally during the first quarter, far short of

targets.

In Europe, AstraZeneca shortfalls totaling tens of millions of

doses have inflamed political tensions. This week, the European

Union sued the company, alleging failure to satisfy its vaccine

contract with the bloc. AstraZeneca has said it is working to catch

up with supply pledges.

Most of AstraZeneca's vaccine sales revenue in the quarter, $224

million, came from Europe, with $43 million in sales to

emerging-market countries. The numbers pale in comparison with

multibillion-dollar sales forecasts of other vaccine makers

including Pfizer Inc. and Moderna Inc.

For AstraZeneca, initially at least, the vaccine effort was a

drain on earnings during an otherwise strong quarter. Shares were

up 3% in early trading on better-than-expected sales and profits.

Costs from the vaccine effort shaved 3 cents off its per-share

earnings for the quarter, which came in at $1.18, versus 59 cents

in the comparable quarter of 2020.

The company and its manufacturing partners have supplied 300

million vaccine doses around the world so far, a year after

AstraZeneca agreed to join Oxford's effort to roll out a pandemic

shot globally.

The company said it was costly to provide "equitable supply" of

the vaccine at no profit, with a substantial impact on overall

profit margins. Core gross profit margins declined 3 percentage

points in the quarter, to 74.6%.

"These variations in gross margin performance between quarters

can be expected to continue," AstraZeneca said. On a call with

reporters, executives said the fluctuations will stabilize as

deliveries continue, and the company expects to break even over

time.

Chief Executive Pascal Soriot said that AstraZeneca, despite

facing disappointments and criticism, doesn't regret its Covid-19

vaccine effort or no-profit approach with Oxford. He pointed to

India, which is grappling with soaring infections and deaths, where

the AstraZeneca vaccine is the dominant shot available.

Dr. Soriot said that more than a hundred Covid-19 vaccines were

in development last year, and only a handful have made it to

market. "Where are all those vaccines? They're nowhere." He said

that even with AstraZeneca's big supply shortfalls to Europe, it

will have delivered 50 million doses to the bloc between February

and the end of April.

The British-Swedish drugmaker also said Friday it plans to apply

to the U.S. Food and Drug Administration for authorization for the

vaccine in coming weeks.

AstraZeneca's U.S. rollout plans have faced prolonged delays,

after early estimates that the shot might be available in late

2020. The drugmaker said in March this year it would apply for FDA

review by mid-April. The Wall Street Journal reported Thursday that

AstraZeneca had told U.S. officials in recent days it might need

until mid-May to finish its application.

The company has struggled to pull together the full data

required for the report, which includes efficacy and safety

statistics from almost four months of vaccinations in the U.K.,

plus data from large-scale U.S. and U.K. human trials, The Journal

reported.

Overall first-quarter profit beat analyst expectations at $1.56

billion, roughly double a year ago, on increased revenue of $7.3

billion. A key benchmark, product sales, increased 15% on strong

performance of core cancer drugs and new products in the company's

pipeline.

Last year, the company doubled its full-year profit and struck a

$39 billion deal to buy Boston-based Alexion Pharmaceuticals Inc.,

a maker of rare-disease drugs and therapies. But public attention

has been heavily focused on the Covid-19 vaccine AstraZeneca

brought to market in January, when the first mass vaccinations

using the shot took place in the U.K. It is now in use in more than

100 countries.

The vaccine effort has faced a series of hurdles, from confusing

clinical-trial results and production delays to questions about the

shot's precise efficacy and rare blood-clotting problems among a

small percentage of people post-vaccination.

Still, it is a major focus of global hopes for curbing the

pandemic, especially among developing countries with less access to

more expensive vaccines bought up by wealthier countries.

AstraZeneca said the company, together with the Serum Institute of

India, has delivered more than 48 million doses to a global funding

initiative known as Covax focused on supplying shots to

less-wealthy countries.

AstraZeneca reiterated its full-year outlook for total revenue

increasing by a low-teens percentage, and core earnings per share

rising to between $4.75 and $5.00 from $4.00, all at constant

exchange rates. The guidance doesn't incorporate revenue or profit

impact from Covid-19 vaccine sales or the proposed Alexion

acquisition.

Write to Jenny Strasburg at jenny.strasburg@wsj.com

(END) Dow Jones Newswires

April 30, 2021 07:54 ET (11:54 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

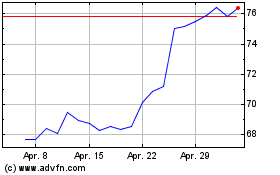

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

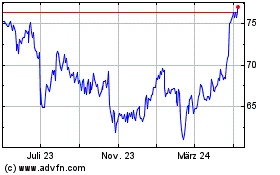

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024