- Company achieved $57.2 million in total net revenue and $55.0

million in net product revenue for the second quarter of 2024,

representing year-over-year growth of approximately 38% and 34%

respectively

- Company generated approximately $15.8 million in free cash flow

in the second quarter and had cash, cash equivalents, restricted

cash and investments of $330.7 million as of June 30, 2024

- Company announces development strategy for AUR200, its

potential next generation pipeline asset for autoimmune diseases

targeting BAFF (B-cell Activating Factor) and APRIL (A

Proliferation-Inducing Ligand)

- Company narrows 2024 net product revenue guidance range to $210

to $220 million

Conference call to be hosted today at 8:30 a.m.

ET

Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) (Aurinia or the

Company) today issued its financial results for the second quarter

and six months ended June 30, 2024. Amounts are expressed in U.S.

dollars.

Total net revenue was $57.2 million for the three months ended

June 30, 2024, and $41.5 million for the same period in 2023,

representing growth of approximately 38%. Year to date total net

revenue was $107.5 million for the six months ended June 30, 2024,

compared to $75.9 million for the same period in 2023, representing

growth of approximately 42%.

Net product revenue was $55.0 million for the three months ended

June 30, 2024, and $41.1 million for the same period in 2023,

representing growth of approximately 34%. Net product revenue was

$103.1 million for the six months ended June 30, 2024, and $75.4

million for the same period in 2023, representing growth of

approximately 37%. Net product revenue in the second quarter

included sales of semi-finished product to Otsuka Pharmaceutical

Co., Ltd. (Otsuka) for distribution in Europe and in anticipation

of product approval in Japan.

“Our quarter-over-quarter growth in the second quarter is a

result of our continued focus on commercial execution and business

fundamentals. We are well prepared as we exit the first half of

2024, with upcoming innovative commercial initiatives targeting

rheumatologists, the advancement of our AUR200 pipeline asset, and

the anticipated approval of LUPKYNIS® in Japan. Additionally,

achieving positive free cash flow ahead of our initial projections

further strengthens our financial position and allows more

flexibility to explore opportunities to diversify our portfolio,”

said Peter Greenleaf, President and Chief Executive Officer of

Aurinia.

The Company anticipates Japanese regulatory authorities'

approval of LUPKYNIS in the second half of this year, based on the

JNDA that Otsuka filed in November 2023 for approval of LUPKYNIS to

treat adults with LN. Upon approval, the Company expects to receive

a milestone payment of $10 million with low double-digit royalties

on net sales once launched.

Additionally, the Company is moving forward with development of

its pipeline asset AUR200, a differentiated, potential next

generation therapy for autoimmune diseases that targets both BAFF

(B-cell Activating Factor) and APRIL (A Proliferation-Inducing

Ligand).

“We are thrilled to advance AUR200, which has the potential to

serve as a best-in-class treatment in disease areas with high unmet

need. We intend to develop it in disease states where there are

currently few market entrants, including exploring one larger

indication and one fast-to-market smaller indication that meets the

FDA criteria for orphan and rare diseases,” said Dr. Greg Keenan,

Chief Medical Officer of Aurinia.

First patients are expected to enter the Phase 1 Single

Ascending Dose (SAD) study of AUR200 in the third quarter of 2024.

Data from the SAD study, including safety, tolerability,

pharmacokinetics, and biomarkers, is anticipated in the first half

of 2025. The Company anticipates funding this development program

with available cash flow, which is not anticipated to impact

previously announced post restructuring operating expense targets.

As previously reported, the Company expects to recognize $50 to $55

million in annual cost savings following the restructuring, with

approximately 75% of that recognized in 2024.

For the fiscal year 2024, the Company is narrowing its net

product revenue guidance range to $210 to $220 million, from the

previously established range of $200 to $220 million. The guidance

range is based on assumptions regarding historical run rates for

patient start forms (PSF), patients restarting therapy, hospital

fills, conversion rates, time to convert, persistency, and

pricing.

Second Quarter 2024 Highlights

In the second quarter of 2024 the Company:

- Achieved 22% growth in patients on LUPKYNIS therapy, with

approximately 2,336 patients on therapy as of June 30, 2024,

compared to 1,911 as of June 30, 2023.

- Added 428 PSFs and approximately 127 new patients who were

either restarting LUPKYNIS or receiving it through a hospital

pharmacy in the second quarter, compared to 451 PSFs in the prior

year second quarter.

- Added approximately 538 PSFs and approximately 155 new patients

from restarts and the hospital channel from April 1, 2024, through

July 31, 2024.

- Sustained conversion rates, with approximately 85% of PSFs

converted to patients on therapy.

- Sustained time to convert, with approximately 60% of patients

on therapy by 20 days.

- Maintained high overall adherence rate at approximately

88%.

- Continued strong persistency, with approximately 56% of

patients remaining on therapy at 12 months, 51% at 15 months, and

46% at 18 months.

Financial Results for the Three and Six Months Ended June 30,

2024

Total net revenue was $57.2 million and $41.5 million for the

three months ended June 30, 2024 and June 30, 2023, respectively.

Total net revenue was $107.5 million and $75.9 million for the six

months ended June 30, 2024 and June 30, 2023, respectively.

Net product revenue was $55.0 million and $41.1 million for the

three months ended June 30, 2024 and June 30, 2023, respectively.

Net product revenue was $103.1 million and $75.4 million for the

six months ended June 30, 2024 and June 30, 2023, respectively. The

increase is primarily due to an increase in sales of LUPKYNIS to

the Company’s two main specialty pharmacies, driven predominantly

by further penetration of the LN market. Additionally, Aurinia had

sales of semi-finished product to Otsuka as Otsuka continues to

commercialize in its territories.

The U.S. penetration can be demonstrated by a total of

approximately 2,336 patients on therapy as of June 30, 2024,

compared to approximately 1,911 patients on therapy as of June 30,

2023. Additionally, the 12-month persistency rate has increased to

56% at June 30, 2024 from approximately 54% at June 30, 2023.

License, collaboration and royalty revenue was $2.2 million and

$0.4 million for the three months ended June 30, 2024 and June 30,

2023, respectively. License, collaboration and royalty revenue was

$4.4 million and $0.5 million for the six months ended June 30,

2024 and June 30, 2023, respectively. The increase is primarily due

to manufacturing services revenue from Otsuka related to shared

capacity services that commenced in late June 2023.

Total cost of sales and operating expenses, inclusive of a

restructuring charge in the second quarter of 2024, were $58.7

million and $57.7 million for the three months ended June 30, 2024

and June 30, 2023, respectively. Total cost of sales and operating

expenses inclusive of a restructuring charge were $122.3 million

and $121.7 million for the six months ended June 30, 2024 and June

30, 2023, respectively. Further breakdown of cost of sales and

operating expense drivers and fluctuations are highlighted in the

following paragraphs.

Cost of sales were $8.9 million and $1.6 million for the three

months ended June 30, 2024 and June 30, 2023, respectively. Cost of

sales were $16.7 million and $2.0 million for the six months ended

June 30, 2024 and June 30, 2023, respectively. The increase is

primarily due to the amortization of the monoplant finance right of

use asset, which was placed into service in late June 2023,

semi-finished product sales to Otsuka and increased sales of

LUPKYNIS (voclosporin).

Gross margin was approximately 84% and 96% for the three months

ended June 30, 2024 and June 30, 2023, respectively. Gross margin

was approximately 85% and 97% for the six months ended June 30,

2024 and June 30, 2023, respectively.

SG&A expenses, inclusive of share-based compensation, were

$44.9 million and $47.1 million for the three months ended June 30,

2024 and June 30, 2023, respectively. SG&A expenses, inclusive

of share-based compensation, were $92.6 million and $97.2 million

for the six months ended June 30, 2024 and June 30, 2023,

respectively. The decrease is primarily due to lower employee and

overhead costs as a result of a reduction in general and

administrative headcount, which occurred late in the first quarter

of 2024 partially offset by an increase in legal fees.

Non-cash SG&A share-based compensation expense included

within SG&A expenses was $8.1 million and $9.8 million for the

three months ended June 30, 2024 and June 30, 2023, respectively.

Non-cash SG&A share-based compensation expense included within

SG&A expenses was $15.6 million and $17.4 million for the six

months ended June 30, 2024 and June 30, 2023, respectively.

R&D expenses, inclusive of share-based compensation expense,

were $4.1 million and $12.7 million for the three months ended June

30, 2024 and June 30, 2023, respectively. R&D expenses,

inclusive of share-based compensation expense, were $9.6 million

and $25.8 million for the six months ended June 30, 2024 and June

30, 2023, respectively. The primary drivers for the decrease were

lower employee costs due to a reduction in headcount, which

occurred late in the first quarter of 2024, a decrease of CRO and

developmental expenses related to ceasing development of Aurinia’s

AUR300 program and timing of expenses related to AUR200.

Non-cash R&D share-based compensation expense included

within R&D expense was $0.1 million and $2.1 million for the

three months ended June 30, 2024 and June 30, 2023, respectively.

Non-cash R&D share-based compensation expense included within

R&D expense was $(2.1) million and $3.7 million for the six

months ended June 30, 2024 and June 30, 2023, respectively. The

non-cash R&D share-based compensation credit in the six months

ended June 30, 2024 is due to the reversals of expense for

forfeitures related to a reduction in headcount in the first

quarter of 2024.

Restructuring expenses were approximately $1.1 million and nil

for the three months ended June 30, 2024 and June 30, 2023,

respectively. Restructuring expenses were approximately $7.8

million and nil for the six months ended June 30, 2024 and June 30,

2023, respectively. Restructuring expenses primarily included

employee severance, one-time benefit payments and contract

termination expenses.

Other income, net was $0.3 million and $3.6 million for the

three months ended June 30, 2024 and June 30, 2023, respectively.

Other income, net was $4.4 million and $3.3 million for the six

months ended June 30, 2024 and June 30, 2023, respectively. The

change is primarily driven by changes in the fair value assumptions

related to Aurinia’s deferred compensation liability and the

foreign exchange remeasurement of the monoplant lease liability,

which commenced in June 2023 and is denominated in CHF.

Interest income was $4.2 million and $4.1 million for the three

months ended June 30, 2024 and June 30, 2023, respectively.

Interest income was $8.7 million and $7.9 million for the six

months ended June 30, 2024 and June 30, 2023, respectively.

Interest expense was $1.2 million and $0.1 million for the three

months ended June 30, 2024 and June 30, 2023, respectively.

Interest expense was $2.5 million and $0.1 million for the six

months ended June 30, 2024 and June 30, 2023, respectively. The

interest expense is due to the monoplant finance lease, which

commenced in June 2023.

For the three months ended June 30, 2024, Aurinia recorded net

income of $0.7 million or $0.01 net income per common share, as

compared to a net loss of $11.5 million or $(0.08) net loss per

common share for the three months ended June 30, 2023. For the six

months ended June 30, 2024, Aurinia recorded a net loss of $10.0

million or $(0.07) net loss per common share, as compared to a net

loss of $37.7 million or $(0.26) net loss per common share for the

three months ended June 30, 2023.

Financial Liquidity at June 30, 2024

As of June 30, 2024, Aurinia had cash, cash equivalents,

restricted cash and investments of $330.7 million compared to

$350.7 million at December 31, 2023. The decrease is primarily

related to the continued investment in commercialization activities

and post approval commitments of our approved drug, LUPKYNIS,

monoplant payments, share repurchases and restructuring related

payments, partially offset by an increase in cash receipts from

sales of LUPKYNIS and cash payments from Otsuka.

Cash generated from operations and non-GAAP free cash flow

generated were $15.8 million for the three months ended June 30,

2024 compared to cash used in operations of $2.8 million and

non-GAAP free cash flow used of $3.0 million for the three months

ended June 30, 2023. Cash used in operations and non-GAAP free cash

flow used were $2.8 million for the six months ended June 30, 2024

compared to cash used in operations of $34.5 million and non-GAAP

free cash flow used of $35.0 million for the six months ended June

30, 2023.

Free cash flow is a non-GAAP financial measure calculated by

subtracting purchases of property and equipment from net cash

provided by or used in operating activities. Free cash flow

reflects a view of Aurinia’s liquidity that, when viewed with the

Company’s GAAP results, provides a more complete understanding of

factors and trends affecting Aurinia’s cash flows. The Company

believes it is a more conservative measure of cash flow since

capital expenditures are necessary for ongoing operations. Free

cash flow has limitations due to the fact that it does not

represent the residual cash flow available for discretionary

expenditures. For example, free cash flow does not incorporate the

principal portion of payments made or expected to be made on

finance lease obligations. Therefore, the Company believes it is

important to view free cash flow as a complement to its entire

consolidated statements of cash flows.

A reconciliation of free cash flow to its most directly

comparable GAAP measure, net cash provided by or used in operating

activities, is set out in the Condensed Consolidated Statement of

Cash Flows included at the end of this press release.

Share Repurchase Program

As previously announced, Aurinia’s Board of Directors approved a

share repurchase program of up to $150 million common shares of the

Company. Canadian securities regulators also granted exemptive

relief for the Company’s share repurchase program, authorizing the

Company to purchase up to 15 percent of its issued and outstanding

shares in any 12-month period for up to 36 months. Through July 31,

2024 Aurinia has repurchased 3.4 million shares for approximately

$18.6 million at an average cost of $5.36. The Company expects to

fund any future discretionary share repurchases from cash flows

from operations and cash currently on hand.

This press release is intended to be read in conjunction with

the Company’s unaudited condensed consolidated financial statements

and Management's Discussion and Analysis for the quarter and six

months ended June 30, 2024 in the Company’s Quarterly Report on

Form 10-Q and the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023, including risk factors disclosed therein,

which will be accessible on Aurinia's website at

www.auriniapharma.com, on SEDAR at www.sedarplus.ca or on EDGAR at

www.sec.gov/edgar.

Conference Call Details

Aurinia will host a conference call and webcast today, August 1,

2024, at 8:30 AM ET to discuss the quarter and six months ended

June 30, 2024, financial results. The link to the audio webcast is

available here or on Aurinia’s corporate website at

www.auriniapharma.com under “News/Events” through the Investors

section. To join the conference call, please dial +1 (866) 682-6100

/ +1 (862) 298-0702 (Toll-free U.S. & Canada). A replay of the

webcast will be available on Aurinia’s website.

About Lupus Nephritis

Lupus Nephritis (LN) is a serious manifestation of systemic

lupus erythematosus (SLE), a chronic and complex autoimmune

disease. LN affects approximately 120,000 people in the U.S. and

disproportionately affects women and people of color. People living

with LN have high unmet needs and often face significant barriers

to optimal care. If poorly controlled, LN can lead to permanent and

irreversible tissue damage within the kidney. Medical guidelines

recommend that all SLE patients receive routine LN screenings at

every visit. Guidelines also note that delaying LN diagnosis has

profound prognostic repercussions. Yet, research shows that

approximately 50% of SLE patients are not screened for LN and 77%

of people with LN go untreated. Aurinia is committed to improving

health outcomes for people living with LN by educating patients and

providers on the critical need for routine screening and

transformative therapies that can help improve health outcomes.

About Aurinia

Aurinia Pharmaceuticals is a fully integrated biopharmaceutical

company focused on delivering therapies to people living with

autoimmune diseases with high unmet medical needs. In January 2021,

the Company introduced LUPKYNIS® (voclosporin), the first

FDA-approved oral therapy dedicated to the treatment of adult

patients with active lupus nephritis. The Company’s head office is

in Edmonton, Alberta, with its U.S. commercial office in Rockville,

Maryland. The Company focuses its development efforts globally.

Forward-Looking Statements

Certain statements made in this press release may constitute

forward-looking information within the meaning of applicable

Canadian securities law and forward-looking statements within the

meaning of applicable United States securities law. These

forward-looking statements or information include but are not

limited to statements or information with respect to: Aurinia’s

expectation to recognize $50 to $55 million in annual cost savings

following its corporate restructuring, with approximately 75% of

that recognized in 2024; Aurinia’s estimates as to annual net

product revenue from sales of LUPKYNIS in the range of $210 to $220

million in 2024; Aurinia’s expectations to achieve several key

milestones in the second half of 2024; Aurinia’s belief that AUR200

has the potential to serve as a best-in-class treatment in disease

areas with high unmet need; the anticipated timing of approval of

voclosporin in Japan; the anticipated timeline for the development

plan for AUR200, including manner of funding, and timing first

patients enrolled in, and timing of data read out for, studies; and

Aurinia’s estimates as to the number of patients with SLE in the

U.S. and the proportion of those persons who have developed LN at

time of SLE diagnosis. It is possible that such results or

conclusions may change. Words such as “anticipate”, “will”,

“believe”, “estimate”, “expect”, “intend”, “target”, “plan”,

“goals”, “objectives”, “may” and other similar words and

expressions, identify forward-looking statements. The Company has

made numerous assumptions about the forward-looking statements and

information contained herein, including among other things,

assumptions about: the accuracy of reported data from third party

studies and reports; the number, and timing of receipt, of PSFs and

their rate of conversion into patients on therapy; assumptions

relating to pricing for LUPKYNIS and patient persistency on the

product; that Aurinia’s intellectual property rights are valid and

do not infringe the intellectual property rights of third parties;

Aurinia’s assumptions relating to regulatory review processes and

timelines; Aurinia’s assumptions relating to the clinical

development opportunities for its pipeline products; Aurinia’s

assumptions relating to the capital required to fund operations;

the assumption that Aurinia’s current good relationships with its

suppliers, service providers and other third parties will be

maintained; assumptions relating to the burn rate of Aurinia’s cash

for operations; assumptions related to timing of interactions with

regulatory bodies; and that Aurinia’s third party service providers

will comply with their contractual obligations. Even though the

management of Aurinia believes that the assumptions made, and the

expectations represented by such statements or information are

reasonable, there can be no assurance that the forward-looking

information will prove to be accurate.

Forward-looking information by their nature are based on

assumptions and involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance, or

achievements of Aurinia to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking information. Should one or more of these risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

in forward-looking statements or information. Such risks,

uncertainties and other factors include, among others, the

following: Aurinia’s actual future financial and operational

results may differ from its expectations; difficulties Aurinia may

experience in completing the commercialization of voclosporin;

challenges in the conduct of clinical trials; the market for the LN

business may not be as estimated; Aurinia may have to pay

unanticipated expenses; Aurinia may not be able to obtain

sufficient supply to meet commercial demand for voclosporin in a

timely fashion; unknown impact and difficulties imposed by the

widespread health concerns on Aurinia’s business operations

including nonclinical, clinical, regulatory and commercial

activities; the results from Aurinia’s clinical studies and from

third party studies and reports may not be accurate; Aurinia’s

third party service providers may not, or may not be able to,

comply with their obligations under their agreements with Aurinia;

regulatory bodies may not grant approvals on conditions acceptable

to Aurinia and its business partners, or at all; and Aurinia’s

assets or business activities may be subject to disputes that may

result in litigation or other legal claims. Although Aurinia has

attempted to identify factors that would cause actual actions,

events, or results to differ materially from those described in

forward-looking statements and information, there may be other

factors that cause actual results, performances, achievements, or

events to not be as anticipated, estimated or intended. Also, many

of the factors are beyond Aurinia’s control. There can be no

assurance that forward-looking statements or information will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

you should not place undue reliance on forward-looking statements

or information. All forward-looking information contained in this

press release is qualified by this cautionary statement. Additional

information related to Aurinia, including a detailed list of the

risks and uncertainties affecting Aurinia and its business, can be

found in Aurinia’s most recent Annual Report on Form 10-K and its

other public available filings available by accessing the Canadian

Securities Administrators’ System for Electronic Document Analysis

and Retrieval (SEDAR) website at www.sedarplus.ca or the U.S.

Securities and Exchange Commission’s Electronic Document Gathering

and Retrieval System (EDGAR) website at www.sec.gov/edgar, and on

Aurinia’s website at www.auriniapharma.com.

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

June 30, 2024

December 31, 2023

ASSETS

Current assets

Cash, cash equivalents and restricted

cash

$

33,407

$

48,875

Short-term investments

297,068

301,614

Accounts receivable, net

25,522

24,089

Inventories, net

38,853

39,705

Prepaid expenses

7,840

9,486

Other current assets

6,976

1,031

Total current assets

409,666

424,800

Non-current assets

Long-term investments

199

201

Other non-current assets

867

1,517

Property and equipment, net

3,043

3,354

Acquired intellectual property and other

intangible assets, net

4,621

4,977

Finance right-of-use asset, net

100,845

108,715

Operating right-of-use assets, net

4,288

4,498

Total assets

$

523,529

$

548,062

LIABILITIES

Current liabilities

Accounts payable and accrued

liabilities

56,460

54,389

Deferred revenue

4,367

4,813

Other current liabilities

1,162

2,388

Finance lease liability

13,906

14,609

Operating lease liabilities

1,008

989

Total current liabilities

76,903

77,188

Non-current liabilities

Finance lease liability

64,923

75,479

Operating lease liabilities

6,146

6,530

Deferred compensation and other

non-current liabilities

10,941

10,911

Total liabilities

158,913

170,108

SHAREHOLDER’S EQUITY

Common shares - no par value, unlimited

shares authorized, 142,984 and 143,833 shares issued and

outstanding at June 30, 2024 and December 31, 2023,

respectively

1,205,554

1,200,218

Additional paid-in capital

112,270

120,788

Accumulated other comprehensive loss

(859)

(730)

Accumulated deficit

(952,349)

(942,322)

Total shareholders' equity

364,616

377,954

Total liabilities and shareholders'

equity

$

523,529

$

548,062

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

Three months ended

Six months ended

June 30,

June 30,

2024

2023

2024

2023

(unaudited)

Revenue

Product revenue, net

$

55,028

$

41,100

$

103,101

$

75,437

License, collaboration and royalty

revenue

2,164

394

4,394

466

Total revenue, net

57,192

41,494

107,495

75,903

Operating expenses

Cost of sales

8,909

1,563

16,661

1,984

Selling, general and administrative

44,934

47,081

92,629

97,205

Research and development

4,080

12,650

9,631

25,808

Restructuring expenses

1,072

—

7,755

—

Other income, net

(290)

(3,630)

(4,415)

(3,340)

Total cost of sales and operating

expenses

58,705

57,664

122,261

121,657

Loss from operations

(1,513)

(16,170)

(14,766)

(45,754)

Interest expense

(1,198)

(65)

(2,481)

(65)

Interest income

4,189

4,101

8,715

7,915

Net income (loss) before income taxes

1,478

(12,134)

(8,532)

(37,904)

Income tax expense (benefit)

756

(642)

1,495

(206)

Net income (loss)

$

722

$

(11,492)

$

(10,027)

$

(37,698)

Net income (loss) per share:

Basic

$

0.01

$

(0.08)

$

(0.07)

$

(0.26)

Diluted

$

0.01

$

(0.08)

$

(0.07)

$

(0.26)

Weighted-average common shares

outstanding:

Basic

143,327

142,777

143,507

142,904

Diluted

144,110

142,777

143,507

142,904

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Six Months Ended June

30,

2024

2023

(in thousands)

(unaudited)

Cash flows from operating

activities

Net loss

$

(10,027)

$

(37,698)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

9,690

1,436

Net amortization of premiums and discounts

on short-term investments

(6,331)

(5,599)

Share-based compensation expense

14,323

21,735

Foreign exchange on finance lease

liability

(5,705)

417

Other, net

275

(3,652)

Net changes in operating assets and

liabilities

Accounts receivable, net

(1,433)

(6,016)

Inventories, net

852

(8,403)

Prepaid expenses and other current

assets

(4,305)

2,374

Non-current operating assets

(12)

(16)

Accounts payable, accrued and other

liabilities

283

1,245

Operating lease liabilities

(365)

(319)

Net cash used in operating activities

(2,755)

(34,496)

Cash flows from investing

activities

Purchase of investments

(318,126)

(256,439)

Proceeds from investments

328,877

288,291

Upfront lease payment

(44)

(11,864)

Purchase of property and equipment

—

(524)

Capitalized patent costs

(96)

(212)

Net cash provided by investing

activities

10,611

19,252

Cash flows from financing

activities

Repurchase of common shares

(18,435)

—

Principal portion of finance lease

payments

(6,001)

—

Proceeds from exercise of stock options

and employee share purchase plan

1,112

2,779

Cash (used in) provided by financing

activities

(23,324)

2,779

Net decrease in cash, cash equivalents and

restricted cash

(15,468)

(12,465)

Cash, cash equivalents and restricted

cash, beginning of period

48,875

94,172

Cash, cash equivalents and restricted

cash, end of period

$

33,407

$

81,707

Reconciliation of free cash

flow(1)

Net cash used in operating activities

$

(2,755)

$

(34,496)

Purchases of property and equipment

—

(524)

Free cash flow

$

(2,755)

$

(35,020)

(1) Free cash flow is a non-GAAP financial

measure and is calculated as net cash provided by or used in

operating activities reduced by purchases of property and

equipment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801207622/en/

Media and Investor Inquiries: Andrea Christopher

Corporate Communications and Investor Relations, Aurinia

achristopher@auriniapharma.com ir@auriniapharma.com

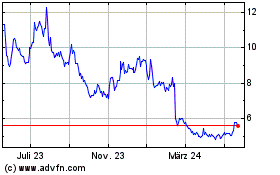

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

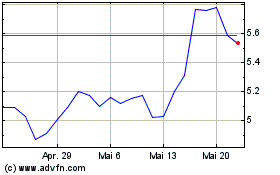

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Nov 2023 bis Nov 2024