- Achieved $50.3 million in total net revenue and $48.1 million

in net product revenue for the first quarter of 2024, representing

year over year growth of approximately 46% and 40% respectively,

and extending the trend of consistent growth in LUPKYNIS®

(voclosporin) sales

- Rapidly completed restructuring while maintaining focus on

commercial execution

- Ahead of prior projections, Company expects to be cash flow

positive, excluding share repurchases, in second quarter 2024, with

estimated cost savings of $50 to $55 million annually

- Company reiterates 2024 net product revenue guidance of $200 to

$220 million

Conference call to be hosted today at 8:30 a.m.

ET

Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) (Aurinia or the

Company) today issued its financial results for the first quarter

ended March 31, 2024. Amounts are expressed in U.S. dollars.

Total net revenue was $50.3 million for the three months ended

March 31, 2024 and $34.4 million for the same period in 2023.

representing growth of approximately 46%. Net product revenue was

$48.1 million for the three months ended March 31, 2024 and $34.3

million for the same period in 2023, representing growth of

approximately 40%.

Aurinia rapidly completed its corporate restructuring in the

first quarter, reducing employee headcount by approximately 25%.

The Company discontinued its AUR300 research and development

program and is exploring alternative approaches for AUR200 to

maintain its development momentum. As previously reported, the

Company expects to recognize $50 to $55 million in annual cost

savings, with 75% of those savings recognized in 2024, excluding a

one-time restructuring charge of approximately $7 million incurred

in the first quarter. Following the restructuring, the Company

expects total annualized operating expenses on a go-forward basis

to be in the range of $185 to $195 million, with cash-based

operating expenses of approximately $155 to $165 million.

“We are pleased to be on track to reach positive free cash

flows, excluding share repurchases, in the second quarter of 2024,

ahead of prior projections, further strengthening our financial

position, and with further balance sheet growth, allowing more

strategic flexibility for the Company,” said Peter Greenleaf,

President and Chief Executive Officer of Aurinia. “We recently

achieved several key milestones, including FDA approval of a label

update for LUPKYNIS which now includes long-term efficacy data from

our AURORA Clinical Program. We have also launched an innovative

new marketing campaign to further educate rheumatologists on the

seriousness of lupus nephritis and the urgent need for appropriate

treatment. This momentum demonstrates our full commitment to solid

execution and driving growth, as we continue in our work of

delivering LUPKYNIS to patients in need.”

Earlier this week, Aurinia announced that the FDA has approved a

label update for LUPKYNIS that provides physicians with important

information to treat and manage their lupus nephritis (LN)

patients. Notably, the updated label no longer includes language

indicating that the safety and efficacy of LUPKYNIS has not been

established beyond one year. The label now includes long-term data

from a post-hoc analysis of the AURORA 2 extension study showing

that patients receiving LUPKYNIS achieved sustained complete renal

response at every time point assessed through three years, compared

to mycophenolate mofetil (MMF) and low-dose glucocorticoids alone.

Additionally, the updated label now requires quarterly, rather than

monthly kidney function assessment after the first year of

treatment. The safety profile of LUPKYNIS in the updated label

remains unchanged and is aligned with the safety findings in the

AURORA Clinical Program.

Aurinia recently launched “Know the Signs,” a disease state

education campaign designed to increase awareness among

rheumatologists around the severity of LN, the critical need to

prioritize kidney health for people with systemic lupus

erythematosus (SLE), and to increase screening for LN among people

with SLE.

In addition to the Company’s operational execution, Aurinia has

also released its 2023 ESG report, which details the holistic

approach the Company takes to address environmental, social and

governance priorities, including energy and emissions, addressing

barriers to care among LN patients, (Diversity, Equity and

Inclusion) DE&I practices, employee engagement, and risk

management. The full report is available here.

For the fiscal year 2024, the Company maintains its established

net product revenue guidance for a range of $200 to $220 million.

The guidance range is based on assumptions regarding historical

patient start form (PSF) run rates, consistent conversion rates,

time to convert, persistency, and pricing.

First Quarter 2024 and Recent Highlights

- There were approximately 2,178 patients on LUPKYNIS therapy as

of March 31, 2024, compared to 1,731 as of March 31, 2023.

- In the first quarter, the Company added 448 patient start forms

and approximately 148 new patients who were either restarting

LUPKYNIS or receiving it through a hospital pharmacy, compared to

466 PSFs in the prior year first quarter, representing significant

year-over-year growth.

- From January 1, 2024, through April 28, 2024, the Company added

approximately 582 PSFs and approximately 170 new patients from

restarts and the hospital channel.

- Conversion rates were sustained, with approximately 85% of PSFs

converted to patients on therapy.

- Time to convert was sustained with approximately 60% of

patients on therapy by 20 days.

- The overall adherence rate remained high at approximately 87%

through the first quarter of 2024.

- Persistency continues to improve, with approximately 56% of

patients remaining on therapy at 12 months, 50% at 15 months, and

46% at 18 months.

Financial Results for the Three Months Ended March 31,

2024

Total net revenue was $50.3 million and $34.4 million for the

three months ended March 31, 2024 and March 31, 2023, respectively.

Net product revenue was $48.1 million and $34.3 million for the

three months ended March 31, 2024 and March 31, 2023, respectively.

The Company currently sells to two main specialty pharmacies for

U.S. commercial sales of LUPKYNIS and pursuant to a collaboration

partnership with Otsuka for sales of semi-finished product and

license, collaboration and royalty revenue in Otsuka Territories.

The increase is primarily due to an increase in product sales to

our two specialty pharmacies for LUPKYNIS, driven predominantly by

further penetration of the LN market.

This penetration can be demonstrated by a total of 2,178

patients on therapy as of March 31, 2024, compared to 1,731

patients on therapy as of March 31, 2023. The increase in patients

was driven by 448 additional patients start forms and 148 new

patients who were either restarting LUPKYNIS or receiving it

through a hospital pharmacy during the three months ended March 31,

2024, compared to 466 PSFs received during the three months ended

March 31, 2023. Additionally, our 12-month persistency rate has

increased to 56% at March 31, 2024 from approximately 51% at March

31, 2023.

License, collaboration and royalty revenue was $2.2 million and

$0.1 million for the three months ended March 31, 2024 and March

31, 2023, respectively. The increase is due to manufacturing

services revenue from Otsuka related to shared capacity services

that commenced in the third quarter of 2023.

Total cost of sales and operating expenses, inclusive of a

one-time restructuring charge in Q1 2024, were $63.6 million and

$64.0 million for the three months ended March 31, 2024 and March

31, 2023, respectively. Further breakdown of cost of sales and

operating expense drivers and fluctuations are highlighted in the

following paragraphs.

Cost of sales were $7.8 million and $0.4 million for the three

months ended March 31, 2024 and March 31, 2023, respectively. The

increase is primarily due to increased sales of LUPKYNIS

(voclosporin), coupled with the amortization of the monoplant

finance right of use asset, which was placed into service in late

June 2023.

Gross margin was approximately 85% and 99% for the three months

ended March 31, 2024 and March 31, 2023, respectively.

SG&A expenses, inclusive of share-based compensation, were

$47.7 million and $50.1 million for the three months ended March

31, 2024 and March 31, 2023, respectively. The decrease is

primarily due to lower employee costs due to a reduction in general

and administrative headcount, which occurred late in the first

quarter of 2024, lower corporate costs related to insurance and

information technology and lower spend for travel and business

meetings.

Non-cash SG&A share-based compensation expense included

within SG&A expenses was $7.5 million and $7.6 million for the

three months ended March 31, 2024 and March 31, 2023,

respectively.

R&D expenses, inclusive of share-based compensation expense,

were $5.6 million and $13.2 million for the three months ended

March 31, 2024 and March 31, 2023, respectively. The primary

drivers for the decrease were lower employee costs due to a

reduction in headcount, which occurred late in the first quarter of

2024 and a decrease of clinical supply and distribution costs

related to ceasing development of our AUR200 and AUR300

programs.

Non-cash R&D share-based compensation expense included

within R&D expense was $(2.2) million and $1.6 million for the

three months ended March 31, 2024 and March 31, 2023, respectively.

The non-cash R&D share-based compensation credit in the three

months ended March 31, 2024 is due to the reversals of expense for

forfeitures related to a reduction in headcount.

Restructuring expenses were approximately $6.7 million and nil

for the three months ended March 31, 2024 and March 31, 2023,

respectively. Restructuring expenses included employee severance,

one-time benefit payments and contract termination expenses. The

company recognized the majority of the planned restructuring costs

in the first quarter of 2024.

Other (income) expense, net was $(4.1) million and $0.3 million

for the three months ended March 31, 2024 and March 31, 2023,

respectively. The increase was primarily due the foreign exchange

remeasurement of the monoplant lease liability, which commenced in

June 2023 and is denominated in CHF.

Interest income was $4.5 million and $3.8 million for the three

months ended March 31, 2024 and March 31, 2023, respectively. The

increase is due to higher yields on our investments as a result of

increased interest rates.

For the three months ended March 31, 2024, Aurinia recorded a

net loss of $10.7 million or $(0.07) net loss per common share, as

compared to a net loss of $26.2 million or $(0.18) net loss per

common share for the three months ended March 31, 2023.

Financial Liquidity at March 31, 2024

As of March 31, 2024, Aurinia had cash, cash equivalents and

restricted cash and investments of $320.1 million compared to

$350.7 million at December 31, 2023. The decrease is primarily

related to the continued investment in commercialization activities

and post approval commitments of our approved drug, LUPKYNIS,

monoplant payments, share repurchases and restructuring related

payments, partially offset by an increase in cash receipts from

sales of LUPKYNIS and payments from Otsuka.

Cash used in operations and non-GAAP free cash flow used were

$18.6 million for the three months ended March 31, 2024 compared to

cash used in operations of $31.7 million and non-GAAP free cash

flow used of $32.0 million for the three months ended March 31,

2023.

Free cash flow is a non-GAAP financial measure calculated by

subtracting purchases of property and equipment from net cash

provided by or used in operating activities. Free cash flow

reflects a view of our liquidity that, when viewed with our GAAP

results, provides a more complete understanding of factors and

trends affecting our cash flows. We believe it is a more

conservative measure of cash flow since capital expenditures are

necessary for ongoing operations. Free cash flow has limitations

due to the fact that it does not represent the residual cash flow

available for discretionary expenditures. For example, free cash

flow does not incorporate the principal portion of payments made or

expected to be made on finance lease obligations. Therefore, we

believe it is important to view free cash flow as a complement to

our entire consolidated statements of cash flows.

A reconciliation of free cash flow to its most directly

comparable GAAP measure, net cash provided by or used in operating

activities, is set out in the Condensed Consolidated Statement of

Cash Flows included at the end of this press release.

Share Repurchase Program

As previously announced, Aurinia’s Board of Directors approved a

share repurchase program of up to $150 million common shares of the

Company. Canadian securities regulators also granted exemptive

relief for the Company’s share repurchase program, authorizing the

Company to purchase up to 15 percent of its issued and outstanding

shares in any 12-month period for up to 36 months. Through April

30th, Aurinia has repurchased 3.4 million shares for approximately

$18.4 million at an average cost of $5.37. The Company expects to

fund its future discretionary share repurchases from cash flows

from operations and cash currently on hand.

This press release is intended to be read in conjunction with

the Company’s unaudited condensed consolidated financial statements

and Management's Discussion and Analysis for the quarter ended

March 31, 2024 in the Company’s Quarterly Report on Form 10-Q and

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, including risk factors disclosed therein, which

will be accessible on Aurinia's website at www.auriniapharma.com,

on SEDAR at www.sedarplus.ca or on EDGAR at www.sec.gov/edgar.

Conference Call Details

Aurinia will host a conference call and webcast to discuss the

quarter ended March 31, 2024 financial results today, Thursday, May

2, 2024 at 8:30 a.m. ET. The link to the audio webcast is available

here or on Aurinia’s corporate website at www.auriniapharma.com

under “News/Events” through the Investors section. To join the

conference call, please dial +1 (877) 407-9170 / +1 201-493-6756

(Toll-free U.S. & Canada). A replay of the webcast will be

available on Aurinia’s website.

About Lupus Nephritis

Lupus Nephritis (LN) is a serious manifestation of systemic

lupus erythematosus (SLE), a chronic and complex autoimmune

disease. LN affects approximately 120,000 people in the U.S. and

disproportionately affects women and people of color. People living

with LN have high unmet needs and often face significant barriers

to optimal care. If poorly controlled, LN can lead to permanent and

irreversible tissue damage within the kidney. Medical guidelines

recommend that all SLE patients receive routine LN screenings at

every visit. Guidelines also note that delaying LN diagnosis has

profound prognostic repercussions. Yet, research shows that

approximately 50% of SLE patients are not screened for LN and 77%

of people with LN go untreated. Aurinia is committed to improving

health outcomes for people living with LN by educating patients and

providers on the critical need for routine screening and

transformative therapies that can help improve health outcomes.

About Aurinia

Aurinia Pharmaceuticals is a fully integrated biopharmaceutical

company focused on delivering therapies to people living with

autoimmune diseases with high unmet medical needs. In January 2021,

the Company introduced LUPKYNIS® (voclosporin), the first

FDA-approved oral therapy dedicated to the treatment of adult

patients with active lupus nephritis. The Company’s head office is

in Edmonton, Alberta, with its U.S. commercial office in Rockville,

Maryland. The Company focuses its development efforts globally.

Forward-Looking Statements

Certain statements made in this press release may constitute

forward-looking information within the meaning of applicable

Canadian securities law and forward-looking statements within the

meaning of applicable United States securities law. These

forward-looking statements or information include but are not

limited to statements or information with respect to: Aurinia’s

expectations to be free cash flow positive (excluding share

repurchases) in the second quarter of 2024; Aurinia’s estimates as

to annual net product revenue from sales of LUPKYNIS in the range

of $200 to $220 million in 2024; Aurinia’s expectations to

recognize $50 to $55 million in annual cost savings, with 75% of

those savings recognized in 2024, excluding a one-time

restructuring charge of approximately $7 million incurred in the

first quarter; Aurinia’s expectations that its total annualized

operating expenses on a go-forward basis will be in the range of

$185 to $195 million, with cash-based operating expenses of

approximately $155 to $165 million; and Aurinia’s estimates as to

the number of patients with SLE in the U.S. and the proportion of

those persons who have developed LN at time of SLE diagnosis. It is

possible that such results or conclusions may change. Words such as

“anticipate”, “will”, “believe”, “estimate”, “expect”, “intend”,

“target”, “plan”, “goals”, “objectives”, “may” and other similar

words and expressions, identify forward-looking statements. We have

made numerous assumptions about the forward-looking statements and

information contained herein, including among other things,

assumptions about: the accuracy of reported data from third party

studies and reports; the number, and timing of receipt, of PSFs and

their rate of conversion into patients on therapy; assumptions

relating to pricing for LUPKYNIS and patient persistency on the

product; that Aurinia’s intellectual property rights are valid and

do not infringe the intellectual property rights of third parties;

Aurinia’s assumptions relating to the capital required to fund

operations; the assumption that Aurinia’s current good

relationships with its suppliers, service providers and other third

parties will be maintained; assumptions relating to the burn rate

of Aurinia’s cash for operations; assumptions related to timing of

interactions with regulatory bodies; and that Aurinia’s third party

service providers will comply with their contractual obligations.

Even though the management of Aurinia believes that the assumptions

made, and the expectations represented by such statements or

information are reasonable, there can be no assurance that the

forward-looking information will prove to be accurate.

Forward-looking information by their nature are based on

assumptions and involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance, or

achievements of Aurinia to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking information. Should one or more of these risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

in forward-looking statements or information. Such risks,

uncertainties and other factors include, among others, the

following: Aurinia’s actual future financial and operational

results may differ from its expectations; difficulties Aurinia may

experience in completing the commercialization of voclosporin; the

market for the LN business may not be as estimated; Aurinia may

have to pay unanticipated expenses; Aurinia may not be able to

obtain sufficient supply to meet commercial demand for voclosporin

in a timely fashion; unknown impact and difficulties imposed by the

widespread health concerns on Aurinia’s business operations

including nonclinical, clinical, regulatory and commercial

activities; the results from Aurinia’s clinical studies and from

third party studies and reports may not be accurate; Aurinia’s

third party service providers may not, or may not be able to,

comply with their obligations under their agreements with Aurinia;

regulatory bodies may not grant approvals on conditions acceptable

to Aurinia and its business partners, or at all; and Aurinia’s

assets or business activities may be subject to disputes that may

result in litigation or other legal claims. Although Aurinia has

attempted to identify factors that would cause actual actions,

events, or results to differ materially from those described in

forward-looking statements and information, there may be other

factors that cause actual results, performances, achievements, or

events to not be as anticipated, estimated or intended. Also, many

of the factors are beyond Aurinia’s control. There can be no

assurance that forward-looking statements or information will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

you should not place undue reliance on forward-looking statements

or information. All forward-looking information contained in this

press release is qualified by this cautionary statement. Additional

information related to Aurinia, including a detailed list of the

risks and uncertainties affecting Aurinia and its business, can be

found in Aurinia’s most recent Annual Report on Form 10-K and its

other public available filings available by accessing the Canadian

Securities Administrators’ System for Electronic Document Analysis

and Retrieval (SEDAR) website at www.sedarplus.ca or the U.S.

Securities and Exchange Commission’s Electronic Document Gathering

and Retrieval System (EDGAR) website at www.sec.gov/edgar, and on

Aurinia’s website at www.auriniapharma.com.

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

March 31, 2024

December 31, 2023

ASSETS

Current assets

Cash, cash equivalents and restricted

cash

$

64,459

$

48,875

Short-term investments

255,453

301,614

Accounts receivable, net

28,909

24,089

Inventories, net

39,761

39,705

Prepaid expenses

7,646

9,486

Other current assets

1,995

1,031

Total current assets

398,223

424,800

Non-current assets

Long-term investments

199

201

Other non-current assets

1,502

1,517

Property and equipment, net

3,198

3,354

Acquired intellectual property and other

intangible assets, net

4,760

4,977

Finance right-of-use asset, net

104,358

108,715

Operating right-of-use assets, net

4,394

4,498

Total assets

$

516,634

$

548,062

LIABILITIES

Current liabilities

Accounts payable and accrued

liabilities

50,270

54,389

Deferred revenue

4,909

4,813

Other current liabilities

1,150

2,388

Finance lease liability

13,724

14,609

Operating lease liabilities

999

989

Total current liabilities

71,052

77,188

Non-current liabilities

Finance lease liability

67,475

75,479

Operating lease liabilities

6,339

6,530

Deferred compensation and other

non-current liabilities

12,292

10,911

Total liabilities

157,158

170,108

SHAREHOLDER’S EQUITY

Common shares - no par value, unlimited

shares authorized, 143,690 and 143,833 shares issued and

outstanding at March 31, 2024 and December 31, 2023,

respectively

1,207,982

1,200,218

Additional paid-in capital

105,419

120,788

Accumulated other comprehensive loss

(854

)

(730

)

Accumulated deficit

(953,071

)

(942,322

)

Total shareholders' equity

359,476

377,954

Total liabilities and shareholders'

equity

$

516,634

$

548,062

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

Three months ended

March 31,

2024

2023

(unaudited)

Revenue

Product revenue, net

$

48,073

$

34,337

License, collaboration and royalty

revenue

2,230

72

Total revenue, net

50,303

34,409

Operating expenses

Cost of sales

7,752

421

Selling, general and administrative

47,695

50,124

Research and development

5,551

13,158

Restructuring expenses

6,683

—

Other (income) expense, net

(4,125

)

290

Total cost of sales and operating

expenses

63,556

63,993

Loss from operations

(13,253

)

(29,584

)

Interest expense

(1,283

)

—

Interest income

4,526

3,814

Net loss before income taxes

(10,010

)

(25,770

)

Income tax expense

739

436

Net loss

$

(10,749

)

$

(26,206

)

Basic and diluted loss per share

$

(0.07

)

$

(0.18

)

Weighted-average common shares outstanding

used in computation of basic and diluted loss per share

144,013

142,641

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Three Months Ended March

31,

2024

2023

(in thousands)

(unaudited)

Cash flows used in operating

activities:

Net loss

$

(10,749

)

$

(26,206

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

4,847

717

Net amortization of premiums and discounts

on short-term investments

(3,206

)

(2,611

)

Share-based compensation expense

5,737

9,467

Foreign exchange on finance lease

liability

(6,025

)

—

Other, net

1,559

217

Net changes in operating assets and

liabilities

Accounts receivable, net

(4,820

)

(5,559

)

Inventories, net

(56

)

(6,993

)

Prepaid expenses and other current

assets

873

3,588

Non-current operating assets

17

(17

)

Accounts payable, accrued and other

liabilities

(6,594

)

(4,117

)

Operating lease liabilities

(181

)

(156

)

Net cash used in operating activities

(18,598

)

(31,670

)

Cash flows used in investing

activities:

Purchase of investments

(121,260

)

(142,397

)

Proceeds from investments

170,505

167,766

Purchase of property and equipment

—

(347

)

Capitalized patent costs

(12

)

(162

)

Net cash provided by investing

activities

49,233

24,860

Cash flows from financing activities

Repurchase of common shares, net of

transaction costs

(12,301

)

—

Finance lease payments

(2,778

)

—

Proceeds from exercise of stock

options

28

1,639

Cash (used in) provided by financing

activities

(15,051

)

1,639

Net increase (decrease) in cash, cash

equivalents and restricted cash

15,584

(5,171

)

Cash, cash equivalents and restricted

cash, beginning of period

48,875

94,172

Cash, cash equivalents and restricted

cash, end of period

$

64,459

$

89,001

Reconciliation of free cash flow(1)

Net cash used in operating activities

$

(18,598

)

$

(31,670

)

Purchases of property and equipment

—

(347

)

Free cash flow

$

(18,598

)

$

(32,017

)

(1) Free cash flow is a non-GAAP financial

measure and is calculated as net cash provided by or used in

operating activities reduced by purchases of property and

equipment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240502430931/en/

Media and Investor Inquiries: Andrea Christopher

Corporate Communications and Investor Relations, Aurinia

achristopher@auriniapharma.com ir@auriniapharma.com

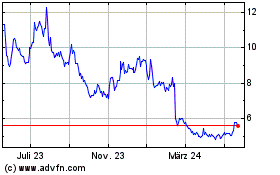

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

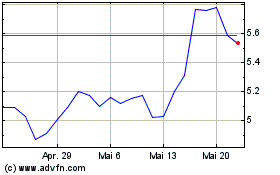

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Nov 2023 bis Nov 2024