UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 1)

Under the Securities Exchange Act of 1934

ATLANTICUS HOLDINGS CORPORATION

(Name of Issuer)

Common Stock, no par value per share

(Title of Class of Securities)

04914Y102

(CUSIP Number)

Jeffrey A. Howard

Atlanticus Holdings Corporation

Five Concourse Parkway, Suite 300

Atlanta, Georgia 30328

With a copy to:

Paul Davis Fancher

Troutman Pepper Hamilton Sanders LLP

600 Peachtree Street N.E., Suite 3000

Atlanta, Georgia 30308

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

September 7, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAME OF REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

Jeffrey A. Howard

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ☐ (b) ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

PF, OO (See Item 3 below.)

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

608,700 (a)

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

567,538 (b)

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

608,700 (a)

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) ☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.2% (c)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

IN

|

(a) Includes (i) 566,538 shares of Atlanticus Holdings Corporation’s (the “Issuer”) common stock held directly by the reporting person, (ii) 41,162 shares underlying restricted stock awards, over which the reporting person holds sole voting power and no dispositive power prior to vesting and (iii) 1,000 shares of common stock underlying a stock option award that is currently exercisable or exercisable within 60 days.

(b) Includes (i) 566,538 shares of the Issuer’s common stock held directly by the reporting person and (ii) 1,000 shares of common stock underlying a stock option award that is currently exercisable or exercisable within 60 days.

(c) Based on 14,431,072 shares of the Issuer’s common stock outstanding as of July 31, 2023, as reported in the Issuer’s Form 10-Q for the quarter ended June 30, 2023, filed with the Securities and Exchange Commission on August 9, 2023.

Explanatory Note:

This Amendment No. 1 to Schedule 13D (this “Amendment”) is being filed by Jeffrey A. Howard. Mr. Howard serves as President, Chief Executive Officer and Director of Atlanticus Holdings Corporation (the “Issuer”). This Amendment is being filed to report (i) grants of restricted stock awards to the reporting person from the Issuer, (ii) the withholding of shares of common stock to satisfy tax withholding obligations upon the vesting of a restricted stock award held be the reporting person and (iii) the exercise of stock options held by the reporting person and the withholding of shares of common stock underlying such stock options to satisfy the exercise price and tax withholding obligations upon the exercise of such stock options. As a result of these transactions, Mr. Howard ceased to be the beneficial owner of more than 5% of the Issuer’s common stock.

Information given in response to each item of this Amendment shall be deemed incorporated in all other items of this Amendment, as applicable.

|

Item 1.

|

Security and Issuer.

|

This Amendment relates to the common stock, no par value per share of the Issuer. The principal executive offices of the Issuer are located at Five Concourse Parkway, Suite 300, Atlanta, Georgia 30328.

|

Item 2.

|

Identity and Background.

|

| |

(a)

|

This statement is filed by Jeffrey A. Howard (the “reporting person”).

|

| |

(b)

|

The principal business address of the reporting person is Atlanticus Holdings Corporation, Five Concourse Parkway, Suite 300, Atlanta, Georgia 30328.

|

| |

(c)

|

The reporting person’s principal occupation is President and Chief Executive Officer of the Issuer.

|

| |

(d)

|

The reporting person has not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

| |

(e)

|

The reporting person has not, during the last five years, been party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

| |

(f)

|

The reporting person is a citizen of the United States of America.

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

The reporting person acquired beneficial ownership of 607,700 shares of common stock and 1,000 shares of common stock underlying a stock option that is currently exercisable or exercisable within 60 days pursuant to the Issuer’s equity compensation plans. The Issuer granted these equity awards to the reporting person in exchange for his service as an officer of the Issuer. Other than personal funds that the reporting person paid to exercise stock options and purchase common stock under the Issuer’s employee stock purchase plan, the reporting person has not paid any additional consideration in connection with the receipt of these equity awards or the exercise thereof.

|

Item 4.

|

Purpose of Transaction.

|

On March 14, 2022, the Issuer’s Compensation Committee granted the reporting person (i) an award of 18,649 shares of restricted stock, which vests in three substantially equal installments on March 14, 2023, March 14, 2024 and March 14, 2025 and (ii) an award of 220 shares of restricted stock, which vests on March 14, 2027. On March 13, 2023, the Issuer’s Compensation Committee granted the reporting person an award of 28,509 shares of restricted stock, which vests in three equal installments on March 13, 2024, March 13, 2025 and March 13, 2026. On March 14, 2023, the Issuer withheld 1,876 shares of common stock to satisfy tax withholding obligations upon the vesting of a restricted stock award held by the reporting person. On September 5, 2023 and September 7, 2023, the reporting person exercised three stock options to purchase an aggregate of 500,000 shares of the common stock by having 274,935 shares of common stock underlying the stock options withheld to satisfy the exercise price and tax withholding obligations. These stock option exercises resulted in the reporting person receiving 225,065 shares of common stock pursuant to such exercises.

The reporting person is the President and Chief Executive Officer of the Issuer. In this capacity, the reporting person takes, and will continue to take, an active role in the Issuer’s management and strategic direction. Subject to the factors discussed below, applicable law and the policies of the Issuer, the reporting person may from time to time purchase or receive additional securities of the Issuer, or rights or options to purchase such securities, through equity awards, open market or privately negotiated transactions or exercises of derivative securities, or may determine to sell, trade or otherwise dispose of all or some holdings in the Issuer in the public markets, in privately negotiated transactions or otherwise, or take any other lawful action the reporting person deems to be in his best interests, or otherwise, depending upon existing market conditions, the price and availability of such securities and other considerations discussed in this paragraph. The reporting person intends to review on a continuing basis various factors relating to his investment in the Issuer, including but not limited to the Issuer’s business and prospects, the price and availability of the Issuer’s securities, subsequent developments affecting the Issuer, other investment and business opportunities available to the reporting person, the reporting person’s general investment and trading practices, market conditions, estate planning considerations or other factors. The reporting person has not yet determined which of the courses of actions specified in this paragraph he may ultimately take.

Except as set forth herein and other than in the reporting person’s capacity as President and Chief Executive Officer of the Issuer, the reporting person does not have any present plans or proposals which relate to or would result in any of the following: (a) the acquisition of additional securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; (d) any change in the present Board or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the Board; (e) any material change in the present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s business or corporate structure; (g) changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person; (h) causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association; (i) a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended; or (j) any action similar to any of those enumerated in the foregoing clauses (a) through (i); provided that the reporting person may, at any time and subject to applicable law and the policies of the Issuer, review or reconsider his position with respect to the Issuer and reserves the right to develop such plans or proposals that would relate to or result in the transactions described above and may hold discussions with or make proposals to management, the Board, other shareholders of the Issuer or other third parties regarding such matters.

|

Item 5.

|

Interest in Securities of the Issuer.

|

| |

(a)

|

Items 7 through 11 and 13 of the cover page of this Amendment and the footnotes thereto are incorporated herein by reference.

|

| |

(b)

|

Items 7 through 11 and 13 of the cover page of this Amendment and the footnotes thereto are incorporated herein by reference.

|

| |

(c)

|

Other than as described in this Amendment, the reporting person has not effected any transaction in the Issuer’s securities in the last 60 days.

|

| |

(d)

|

To the knowledge of the reporting person, other than as described in this Amendment, no other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities of the Issuer owned by the reporting person.

|

| |

(e)

|

As of September 7, 2023, the reporting person ceased to be the beneficial owner of more than 5% of the Issuer’s common stock.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Except as set forth herein, including under Item 7 and the exhibits hereto, there are no contracts, arrangements, understandings or relationships between the reporting person and any other person with respect to the securities of the Issuer.

|

Item 7.

|

Material to Be Filed as Exhibits.

|

|

Exhibit

|

|

Description

|

| |

|

|

A

|

|

Fourth Amended and Restated 2014 Equity Incentive Plan (incorporated by reference from Appendix A to the Issuer’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”) on April 11, 2019)

|

| |

|

|

|

B

|

|

Form of Stock Option Agreement – Employees (incorporated by reference from Exhibit 10.5 to the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on August 14, 2019)

|

SIGNATURE

After reasonable inquiry and to the best of the undersigned’s knowledge and belief, the undersigned hereby certifies that the information set forth in this statement is true, complete and correct.

| |

/s/ Jeffrey A. Howard

Jeffrey A. Howard

Date: September 15, 2023

|

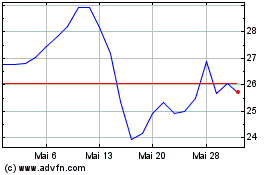

Atlanticus (NASDAQ:ATLC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Atlanticus (NASDAQ:ATLC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024