- Annual GAAP revenue of $171.6 million; 42.3% growth over 2009;

pro forma revenue of $182.9 million; 7.1% growth over 2009 and 8.3%

growth on a constant-currency basis

- Adjusted EBITDA of $18.9 million; 32.2% growth over 2009

Alphatec Holdings, Inc. (Nasdaq:ATEC), the parent company of

Alphatec Spine, Inc., a medical device company that designs,

develops, manufactures and markets products for the surgical

treatment of spine disorders, with a focus on treating conditions

related to the aging spine, announced today financial results for

the fourth quarter and full year ended December 31, 2010.

2010 Performance Highlights

- Positioned Alphatec as a global leader within the spine

market.

- Completed acquisition of Scient'x S.A.

- Acquisition created global scale with sales in over 50

countries in all major markets.

- Combined entity is the third-largest global pure-play spinal

implant company.

- Alphatec Spine products launched in all major European markets

and several other major international markets.

- Achieved significant revenue growth in key markets.

- Achieved annual U.S. revenue of $119.9 million, representing

14.7% year-over-year growth on a GAAP basis, and 6.1%

year-over-year growth on a pro forma basis.

- With expanded European product distribution, achieved annual

Europe revenue of $24.2 million, representing more than 490%

year-over-year growth on a GAAP basis, and 16.9% year-over-year

growth on a pro forma basis.

- Achieved annual Asia revenue of $20.0 million, representing

66.8% year-over-year growth on a GAAP basis, and 16.8%

year-over-year growth on a pro forma basis.

- Enhanced product offerings in the Biologics market.

- Launched PureGenTM Osteoprogenitor Cell Allograft in September

2010.

- Established Biologics Division with dedicated sales specialists

and biologics experts to drive biologics product adoption and

provide support for the surgeon community with respect to the

Company's biologics products.

- Enhanced product offerings in the Aging Spine and MIS

markets.

- All proprietary aging spine products, including Osseofix®,

OsseoScrew®, and HelifixTM have been launched in Europe.

- OsseoFix has been used in approximately 1,900 patients and

OsseoScrew has been used in approximately 200 patients in

Europe.

- Illico SE® Percutaneous MIS Screw System, as well as SolusTM

Locking ALIF System, have been launched in Europe.

- MIS revenues for full year 2010 increased more than 480% from

full year 2009.

Dirk Kuyper, the Company's President and Chief Executive

Officer, stated: "I am proud of the performance and results that

our company delivered in 2010. We have successfully positioned

Alphatec Spine as a leader within the spine market, with a broad

and expanded global reach, integrated R&D and manufacturing and

continued focus on both the core spine market as well as

differentiated technologies in Aging Spine, MIS and

Biologics." Mr. Kuyper continued, "As we enter 2011, we remain

confident in our ability to grow faster than the overall spine

market and to drive towards our goal of being the leading global

pure-play spine company. We have the team, the products and the

strategic plan to achieve long-term revenue growth, profitability,

and generation of free cash flow."

Fourth Quarter 2010 Financial Results

Consolidated revenues for the fourth quarter 2010 were $46.0

million, an increase of 38.4% from the $33.3 million reported for

the fourth quarter 2009. U.S. revenues for the fourth quarter

2010 were $32.1 million, an increase of 13.5% from the $28.3

million reported for the fourth quarter 2009. International

revenues (including Europe, Asia and Rest of World) for the fourth

quarter 2010 were $13.9 million, an increase of $8.9 million from

the $5.0 million reported for the fourth quarter 2009.

Gross profit for the fourth quarter 2010 was $31.5 million, an

increase of $9.5 million over fourth quarter 2009 of $22.0 million.

Fourth quarter 2010 gross margin of 68.4% increased over fourth

quarter 2009 gross margin of 66.0%.

Total operating expenses for the fourth quarter 2010 were $33.2

million, an increase of $10.8 million compared to fourth quarter

2009 of $22.4 million. Included in operating expenses for the

fourth quarter 2010 are $6.8 million of expenses that were

generated from the acquired Scient'x subsidiaries. The

additional increase in operating expenses was primarily related to

both sales and marketing expenses and general and administrative

expenses, specifically driven by an increase of legal fees related

to litigation matters.

Net loss for the fourth quarter 2010 was $2.9 million, or

($0.03) per share (basic and diluted), compared with a net loss of

$1.3 million, or ($0.03) per share (basic and diluted) for the

fourth quarter 2009. Contributing to the net loss were costs

associated with the refinancing of our credit facility that

amounted to $1.4 million.

Adjusted EBITDA for the fourth quarter 2010 was $4.4 million

compared to adjusted EBITDA of $5.8 million for the fourth quarter

2009. Adjusted EBITDA represents net income (loss) excluding the

effects of interest, taxes, depreciation, amortization, stock-based

compensation costs, and other non-recurring income or expense

items, such as in-process research and development expense and

transaction-related expenses.

Full Year 2010 Financial Results

Consolidated revenues for full year 2010 were $171.6 million, an

increase of 42.3% from the $120.6 million reported for full year

2009. U.S. revenues for full year 2010 were $119.9 million, an

increase of 14.7% from the $104.5 million reported for full year

2009. International revenues (including Europe, Asia and Rest

of World) for full year 2010 were $51.7 million, an increase of

$35.6 million from the $16.1 million reported for full year

2009.

Pro forma revenues for full year 2010 were $182.9 million, an

increase of 7.1% from the $170.8 million for full year 2009.

Gross profit for full year 2010 was $112.8 million, an increase

of $31.8 million over full year 2009 of $81.0 million. Full year

2010 gross margin was 65.7%, a decrease of 1.5% from full year 2009

gross margin of 67.2%.

Total operating expenses for full year 2010 were $124.6 million,

an increase of $33.4 million over full year 2009 of $91.2 million.

Included in operating expenses for full year 2010 are $17.3 million

of expenses that were generated from the acquired Scient'x

subsidiaries, as well as $6.1 million in transaction and

restructuring-related expenses. The additional increase in

operating expenses was primarily related to both sales and

marketing expenses and general and administrative expenses.

Net loss for full year 2010 was $14.4 million, or ($0.18) per

share (basic and diluted), compared with a net loss of $13.3

million, or ($0.27) per share (basic and diluted) for full year

2009.

Adjusted EBITDA for full year 2010 was $18.9 million compared to

adjusted EBITDA of $14.3 million for full year 2009.

2011 Financial Guidance

The Company anticipates annual 2011 revenues of $195.0 million

to $205.0 million, and $25.0 million to $28.0 million in annual

adjusted EBITDA. The Company anticipates generating

both net income and positive free cash flow in 2011.

Conference Call

Alphatec Spine will host a conference call today at 2:00 p.m. PT

/ 5:00 p.m. ET to discuss the results. To participate in the

conference call, please visit the investor relations section of the

Alphatec Spine website at www.alphatecspine.com. The dial-in

numbers are (877) 556-5251 for domestic callers and (720) 545-0036

for international. A live webcast of the conference call will be

available online from the investor relations section of the

Alphatec Spine website at www.alphatecspine.com. The webcast will

be recorded and will remain available on the investor relations

section of Alphatec Spine's website for at least 30 days.

About Alphatec Spine

Alphatec Spine, Inc. is a wholly owned subsidiary of Alphatec

Holdings, Inc. (Nasdaq:ATEC). Alphatec Spine is a medical device

company that designs, develops, manufactures and markets products

for the surgical treatment of spine disorders, primarily focused on

the aging spine. The Company's mission is to combine

world-class customer service with innovative, surgeon-driven design

that will help improve the aging patient's quality of

life. The Company is poised to achieve its goal through new

solutions for patients with osteoporosis, stenosis and other aging

spine deformities, improved minimally invasive products and

techniques and integrated biologics solutions. In addition to

its U.S. operations, the Company also markets its products in over

50 international markets through its subsidiary, Scient'x S.A.S.,

via a direct sales force in France, Italy and the United Kingdom

and via independent distributors in the rest of Europe, the Middle

East and Africa, South America and Latin America. In Asia and

Australia, the Company markets its products through its subsidiary,

Alphatec Pacific, Inc, and through Scient'x's distributors in

China, Korea and Australia.

The Alphatec Holdings, Inc. logo is available

athttp://www.globenewswire.com/newsroom/prs/?pkgid=3520

Non-GAAP Information

Non-GAAP earnings included in this press release is a non-GAAP

(generally accepted accounting principles) financial measure that

represents net income (loss) excluding the effects of in-process

research and development expenses, transaction-related expenses and

litigation settlement expenses. Management does not consider these

expenses when it makes certain evaluation of the operations of the

Company. Non-GAAP earnings, as defined above, may not be similar to

non-GAAP earnings measures used by other companies and is not a

measurement under GAAP.

Adjusted EBITDA included in this press release is a non-GAAP

financial measure that represents net income (loss) excluding the

effects of interest, taxes, depreciation, amortization, stock-based

compensation costs, and other non-recurring income or expense

items, such as in-process research and development expense and

transaction-related expenses. Adjusted EBITDA, as defined above,

may not be similar to adjusted EBITDA measures used by other

companies and is not a measurement under GAAP.

Though management finds non-GAAP-based earnings or loss and

EBITDA useful for evaluating aspects of the Company's business, its

reliance on these measures are limited because excluded items often

have a material effect on the Company's earnings and earnings per

common share calculated in accordance with GAAP. Therefore,

management uses non-GAAP adjusted EBITDA in conjunction with GAAP

earnings and earnings per common share measures. The Company

believes that non-GAAP adjusted EBITDA provides investors with an

additional tool for evaluating the Company's core performance,

which management uses in its own evaluation of continuing operating

performance, and a base-line for assessing the future earnings

potential of the Company. While the GAAP results are more complete,

the Company prefers to allow investors to have supplemental metrics

since, with reconciliation to GAAP, they may provide greater

insight into the Company's financial results.

Forward Looking Statements

This press release may contain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995 that involve risks and uncertainty. Such statements are

based on management's current expectations and are subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Alphatec Spine cautions investors that there can be no

assurance that actual results or business conditions will not

differ materially from those projected or suggested in such

forward-looking statements as a result of various factors,

including, but not limited to, the following: Alphatec Spine's

ability to meet its 2011 revenue, adjusted EBITDA, free cash flow

and earnings projections, the ability to successfully integrate

Scient'x and Alphatec, the growth rate of the spine market related

to aging and elderly patients, uncertainty of success in developing

new products or products currently in Alphatec Spine's pipeline,

the successful global launch of the Company's new products and the

products in its development pipeline including OsseoFix,

OsseoScrew, HeliFix, Solus, PureGen and Illico SE, failure to

achieve acceptance of Alphatec Spine's products by the surgeon

community, failure to obtain FDA clearance or approval for new

products, or unexpected or prolonged delays in the process,

Alphatec Spine's ability to develop and expand its U.S. and/or

global revenues, continuation of favorable third party payor

reimbursement for procedures performed using Alphatec Spine's

products, unanticipated expenses or liabilities or other adverse

events affecting cash flow or Alphatec Spine's ability to

successfully control its costs or achieve profitability,

uncertainty of additional funding, Alphatec Spine's ability to

compete with other competing products and with emerging new

technologies, product liability exposure, patent infringement

claims and claims related to Alphatec Spine's intellectual

property. Please refer to the risks detailed from time to time in

Alphatec Spine's SEC reports, including quarterly reports on Form

10-Q, reports on Form 8-K and annual reports on Form 10-K. Alphatec

Spine disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, unless required by law.

| ALPHATEC HOLDINGS,

INC. |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (in thousands -

unaudited) |

| |

|

|

| |

|

|

| |

December 31, |

December 31, |

| |

2010 |

2009 |

| ASSETS |

|

|

| Current assets: |

|

|

| Cash and cash

equivalents |

$ 23,168 |

$ 10,085 |

| Accounts receivable,

net |

39,777 |

24,766 |

| Inventories,

net |

51,635 |

29,515 |

| Prepaid expenses and

other current assets |

6,652 |

3,128 |

| Deferred income tax

assets |

1,592 |

128 |

| Total current assets |

122,824 |

67,622 |

| |

|

|

| Property and equipment, net |

38,440 |

30,356 |

| Goodwill |

170,194 |

60,113 |

| Intangibles, net |

43,148 |

2,296 |

| Other assets |

2,410 |

1,501 |

| Total assets |

$ 377,016 |

$ 161,888 |

| |

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

| Current liabilities: |

|

|

| Accounts

payable |

$ 15,957 |

$ 12,781 |

| Accrued

expenses |

22,530 |

16,439 |

| Deferred

revenue |

3,396 |

2,135 |

| Current portion of

long-term debt |

1,708 |

6,724 |

| Total current liabilities |

43,591 |

38,079 |

| |

|

|

| Total long term

liabilities |

43,388 |

25,377 |

| Redeemable preferred

stock |

23,603 |

23,603 |

| Stockholders'

equity |

266,434 |

74,829 |

| Total liabilities and stockholders'

equity |

$ 377,016 |

$ 161,888 |

| |

| ALPHATEC HOLDINGS,

INC. |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (in thousands,

except per share amounts - unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

Year Ended |

| |

December 31, |

December 31, |

| |

2010 |

2009 |

2010 |

2009 |

| |

|

|

|

|

| Revenues |

$ 46,018 |

$ 33,260 |

$ 171,610 |

$ 120,618 |

| Cost of revenues |

14,141 |

11,295 |

57,657 |

39,606 |

| Amortization of acquired intangible

assets |

394 |

-- |

1,136 |

-- |

| Total cost of

revenues |

14,535 |

11,295 |

58,793 |

39,606 |

| Gross profit |

31,483 |

21,965 |

112,817 |

81,012 |

| |

|

|

|

|

| Operating expenses: |

|

|

|

|

| Research and

development |

4,084 |

3,554 |

16,431 |

13,487 |

| In-process research and

development |

-- |

550 |

2,967 |

6,383 |

| Sales and marketing |

18,971 |

12,778 |

66,542 |

49,396 |

| General and

administrative |

9,578 |

4,117 |

31,078 |

19,333 |

| Amortization of acquired

intangible assets |

533 |

-- |

1,535 |

-- |

| Transaction related

expenses |

20 |

1,358 |

3,671 |

2,598 |

| Restructuring

expenses |

(7) |

-- |

2,382 |

-- |

| Total operating

expenses |

33,179 |

22,357 |

124,606 |

91,197 |

| Operating loss |

(1,696) |

(392) |

(11,789) |

(10,185) |

| Interest and other income

(expense), net |

(2,335) |

(685) |

(4,698) |

(3,193) |

| Loss from continuing operations before

taxes |

(4,031) |

(1,077) |

(16,487) |

(13,378) |

| Income tax benefit |

(1,155) |

(70) |

(2,054) |

(138) |

| Loss from continuing

operations |

(2,876) |

(1,007) |

(14,433) |

(13,240) |

| Income (loss) from

discontinued operations, net of tax |

-- |

(313) |

78 |

(49) |

| |

|

|

|

|

| Net loss |

$ (2,876) |

$ (1,320) |

$ (14,355) |

$ (13,289) |

| |

|

|

|

|

| |

|

|

|

|

| Net loss per common share: |

|

|

|

|

| Basic and diluted net

loss from continuing operations |

$ (0.03) |

$ (0.02) |

$ (0.18) |

$ (0.27) |

| Basic and diluted net

income (loss) from discontinued operations |

-- |

(0.01) |

0.00 |

(0.00) |

| Basic and diluted net

loss per share |

$ (0.03) |

$ (0.03) |

$ (0.18) |

$ (0.27) |

| |

|

|

|

|

| Weighted-average shares - basic and

diluted |

88,078 |

51,908 |

78,590 |

49,292 |

| |

| ALPHATEC HOLDINGS,

INC. |

| RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES |

| (in thousands, except

per share amounts - unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

Year Ended |

| |

December 31, |

December 31, |

| |

2010 |

2009 |

2010 |

2009 |

| |

|

|

|

|

| Operating loss, as reported |

$ (1,696) |

$ (392) |

$ (11,789) |

$ (10,185) |

| Add back: |

|

|

|

|

| Depreciation |

3,664 |

2,393 |

13,126 |

8,627 |

| Amortization of intangible assets |

204 |

919 |

1,449 |

3,329 |

| Amortization of acquired intangible

assets |

927 |

-- |

2,671 |

-- |

| Total EBITDA |

3,099 |

2,920 |

5,457 |

1,771 |

| |

|

|

|

|

| Add back significant items: |

|

|

|

|

| Stock-based compensation |

851 |

1,008 |

3,177 |

3,571 |

| In-process research and

development |

-- |

550 |

2,967 |

6,383 |

| Acquisition-related inventory

step-up |

449 |

-- |

1,281 |

-- |

| Transaction related expenses |

20 |

1,358 |

3,671 |

2,598 |

| Restructuring expenses |

(7) |

-- |

2,382 |

-- |

| |

|

|

|

|

| EBITDA, as adjusted for significant

items |

$ 4,412 |

$ 5,836 |

$ 18,935 |

$ 14,323 |

| |

|

|

|

|

| |

|

|

|

|

| Net loss, as reported |

$ (2,876) |

$ (1,320) |

$ (14,355) |

$ (13,289) |

| Add back: |

|

|

|

|

| In-process research and

development |

-- |

550 |

2,967 |

6,383 |

| Acquisition-related inventory

step-up |

449 |

-- |

1,281 |

-- |

| Amortization of acquired intangible

assets |

927 |

-- |

2,671 |

-- |

| Transaction related expenses |

20 |

1,358 |

3,671 |

2,598 |

| Restructuring expenses |

(7) |

-- |

2,382 |

-- |

| |

|

|

|

|

| Net income (loss), as adjusted for

significant items |

$ (1,487) |

$ 588 |

$ (1,383) |

$ (4,308) |

| |

|

|

|

|

| |

|

|

|

|

| Net loss per common share - basic and

diluted |

$ (0.03) |

$ (0.03) |

$ (0.18) |

$ (0.27) |

| Add back: |

|

|

|

|

| In-process research and

development |

-- |

0.01 |

0.04 |

0.13 |

| Acquisition-related inventory

step-up |

0.00 |

-- |

0.01 |

-- |

| Amortization of acquired intangible

assets |

0.01 |

-- |

0.03 |

-- |

| Transaction related expenses |

0.00 |

0.03 |

0.05 |

0.05 |

| Restructuring expenses |

(0.00) |

-- |

0.03 |

-- |

| |

|

|

|

|

| Net loss per common share - basic and

diluted, as adjusted for significant items |

$ (0.02) |

$ 0.01 |

$ (0.02) |

$ (0.09) |

| |

| ALPHATEC HOLDINGS,

INC. |

| RECONCILIATION OF

GEOGRAPHIC SEGMENT REVENUES AND GROSS PROFIT |

| (in thousands, except

percentages - unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

|

Impact from |

| |

December 31, |

|

Foreign |

| |

2010 |

2009 |

% Change |

Currency |

| |

|

|

|

|

| Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 32,117 |

$ 28,288 |

13.5% |

0.0% |

| Europe |

5,699 |

1,686 |

238.0% |

-7.2% |

| Asia |

5,733 |

3,286 |

74.5% |

-1.6% |

| Rest of world |

2,469 |

-- |

100.0% |

-7.2% |

| Total revenues |

$ 46,018 |

$ 33,260 |

38.4% |

-1.6% |

| |

|

|

|

|

| Gross profit by geographic segment |

|

|

|

|

| U.S. |

$ 25,082 |

$ 19,301 |

|

|

| Europe |

2,337 |

777 |

|

|

| Asia |

3,267 |

1,887 |

|

|

| Rest of world |

797 |

-- |

|

|

| Total gross profit |

$ 31,483 |

$ 21,965 |

|

|

| |

|

|

|

|

| Gross profit margin by geographic

segment |

|

|

|

|

| U.S. |

78.1% |

68.2% |

|

|

| Europe |

41.0% |

46.1% |

|

|

| Asia |

57.0% |

57.4% |

|

|

| Rest of world |

32.3% |

0.0% |

|

|

| Total gross profit margin |

68.4% |

66.0% |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

Year Ended |

|

Impact from |

| |

December 31, |

|

Foreign |

| |

2010 |

2009 |

% Change |

Currency |

| |

|

|

|

|

| Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 119,880 |

$ 104,531 |

14.7% |

0.0% |

| Europe |

24,242 |

4,101 |

491.1% |

-7.3% |

| Asia |

19,998 |

11,986 |

66.8% |

2.6% |

| Rest of world |

7,490 |

-- |

100.0% |

-7.3% |

| Total revenues |

$ 171,610 |

$ 120,618 |

42.3% |

-1.2% |

| |

|

|

|

|

| Gross profit by geographic segment |

|

|

|

|

| U.S. |

$ 89,226 |

$ 72,401 |

|

|

| Europe |

9,616 |

1,742 |

|

|

| Asia |

11,173 |

6,869 |

|

|

| Rest of world |

2,802 |

-- |

|

|

| Total gross profit |

$ 112,817 |

$ 81,012 |

|

|

| |

|

|

|

|

| Gross profit margin by geographic

segment |

|

|

|

|

| U.S. |

74.4% |

69.3% |

|

|

| Europe |

39.7% |

42.5% |

|

|

| Asia |

55.9% |

57.3% |

|

|

| Rest of world |

37.4% |

0.0% |

|

|

| Total gross profit margin |

65.7% |

67.2% |

|

|

| |

|

|

|

|

| |

|

|

|

|

| Footnotes: |

|

|

|

|

| 1) IMC operating results

have been removed from Asia revenues and gross profit for the

periods presented. |

| |

|

|

|

|

| 2) The impact from foreign

currency represents the percentage change in 2010 revenues due to

the change in foreign |

| exchange rates for the periods

presented. |

|

|

|

|

| |

| ALPHATEC HOLDINGS,

INC. |

| PRO FORMA REVENUES BY

GEOGRAPHIC SEGMENT |

| (in thousands, except

percentages - unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

Three Months Ended |

% Change |

| |

December 31, |

|

Constant |

| |

2010 |

2009 |

Reported |

Currency |

| |

|

|

|

|

| Pro Forma Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 32,117 |

$ 31,219 |

2.9% |

2.9% |

| Europe |

5,699 |

7,366 |

-22.6% |

-16.6% |

| Asia |

5,733 |

4,878 |

17.5% |

19.4% |

| Rest of world |

2,469 |

3,167 |

-22.0% |

-16.0% |

| Total revenues |

$ 46,018 |

$ 46,630 |

-1.3% |

0.2% |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

Year Ended |

% Change |

| |

December 31, |

|

Constant |

| |

2010 |

2009 |

Reported |

Currency |

| |

|

|

|

|

| Pro Forma Revenues by geographic segment |

|

|

|

|

| U.S. |

$ 122,855 |

$ 115,826 |

6.1% |

6.1% |

| Europe |

29,097 |

24,887 |

16.9% |

24.6% |

| Asia |

21,657 |

18,548 |

16.8% |

14.0% |

| Rest of world |

9,336 |

11,582 |

-19.4% |

-14.3% |

| Total revenues |

$ 182,945 |

$ 170,843 |

7.1% |

8.3% |

| |

|

|

|

|

| |

|

|

|

|

| Footnotes: |

|

|

|

|

| 1) IMC operating results

have been removed from Asia pro forma revenues for the periods

presented. |

|

| |

|

|

|

|

| 2) Pro Forma revenues for

the perods presented include the results of Scient'x as if the

Scient'x acquisition had occurred on |

| January 1, 2009. |

|

|

|

|

| |

|

|

|

|

| 3) % Change - Constant

Currency represents the change in 2010 pro forma revenue had the

2010 foreign exchange |

| rates remained constant with 2009

foreign exchange rates. |

|

|

|

CONTACT: Michael O'Neill

Chief Financial Officer

Alphatec Spine, Inc.

(760) 494-6746

investorrelations@alphatecspine.com

Westwicke Partners

Lynn C. Pieper

(415) 202-5678

lynn.pieper@westwicke.com

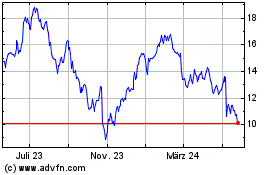

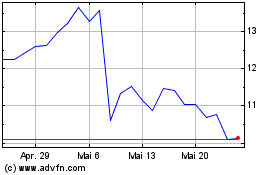

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024