Assembly Biosciences Reports Second Quarter 2024 Financial Results and Recent Updates

08 August 2024 - 10:05PM

Assembly Biosciences, Inc. (Nasdaq: ASMB), a biotechnology company

developing innovative therapeutics targeting serious viral

diseases, today reported financial results and recent updates for

the second quarter ended June 30, 2024.

“Entering the second half of the year, I’m incredibly proud of

our team’s accomplishments on our path to delivering novel

therapeutics for individuals living with serious viral diseases,”

said Jason Okazaki, chief executive officer and president of

Assembly Bio. “We are rapidly progressing toward key inflection

points for our clinical development programs and remain on track

with the data sets we plan to deliver in 2024. Specifically, in the

third quarter, we look forward to sharing interim Phase 1a data for

ABI-5366 in healthy participants. The pharmacokinetic data in this

study will enable us to assess ABI-5366's ability to reach the

target concentrations we have established for antiviral efficacy

and to support our once-weekly oral dosing profile, while also

informing dose selection in the Phase 1b part of the study in

participants with recurrent genital herpes.”

Second Quarter 2024 and Recent Highlights

- First participants were dosed in two clinical trials:

- The Phase 1a portion of a Phase 1a/b clinical study of

ABI-5366, a long-acting herpes simplex virus (HSV) helicase-primase

inhibitor candidate; the Phase 1a portion in healthy participants

and the Phase 1b portion to be conducted in participants with

recurrent genital herpes

- A Phase 1b study of ABI-4334, a next-generation, highly potent

capsid assembly modulator candidate, in participants with chronic

hepatitis B virus (HBV) infection

- Scientific conference presentations highlighted:

- Preclinical data for ABI-5366 (poster presentation) and

ABI-1179 (poster and oral presentation) featured at the

International Herpesvirus Workshop held July 13-17, 2024. ABI-1179

is the long-acting HSV helicase-primase inhibitor candidate

contributed by Gilead Sciences, Inc. (Gilead) under the

collaboration between Assembly Bio and Gilead

- Preclinical data for ABI-6250, an oral, small molecule

HBV/hepatitis delta virus (HDV) entry inhibitor candidate, featured

in a poster presentation at the European Association for the Study

of the Liver (EASL) Congress™ 2024 held June 5-8, 2024

- Preclinical data for ABI-6250 featured in an oral presentation

at the Science of HBV Cure Meeting 2024 held July 26-27, 2024

- Strengthened balance sheet with equity investments that

resulted in aggregate gross proceeds to Assembly Bio of

approximately $12.6 million, supporting advancement of antiviral

portfolio and extending cash runway into Q1 2026

Upcoming Anticipated Milestones

- ABI-5366 Phase 1a interim clinical data in healthy participants

expected in Q3 2024 and interim Phase 1b data in participants with

recurrent genital herpes expected in the first half of 2025

- ABI-4334 Phase 1b interim clinical data expected by the end of

2024

- Two additional candidates, ABI-1179 and ABI-6250, are

anticipated to enter the clinic by the end of 2024

Upcoming Conferences

- Abstract highlighting preclinical data for ABI-6250 accepted

for poster presentation at the International HBV Meeting taking

place September 11-15, 2024, in Chicago

Second Quarter 2024 Financial Results

- Cash, cash equivalents and marketable

securities were $109.2 million as of June 30, 2024,

compared to $113.0 million as of March 31, 2024. Assembly Bio’s

cash position is projected to fund operations into Q1 2026.

- Revenue from collaborative research was $8.5

million for the three months ended June 30, 2024. There was no

revenue recognized for the same period in 2023. Revenue for the

three months ended June 30, 2024, consists of amounts recognized

under the collaboration with Gilead.

- Research and development expenses were $16.3

million for the three months ended June 30, 2024, compared to $12.5

million for the same period in 2023. The increase is attributable

to having more candidates in development in 2024.

- General and administrative expenses were $4.5

million for the three months ended June 30, 2024, compared to $5.0

million for the same period in 2023. The decrease is primarily due

to a decrease in non-cash stock-based compensation expense.

- Net loss attributable to common stockholders

was $11.2 million, or $1.98 per basic and diluted share, for the

three months ended June 30, 2024, compared to $16.9 million, or

$3.88 per basic and diluted share, for the same period in

2023.

The investigational products and investigational product

candidates referenced here have not been approved anywhere

globally, and their safety and efficacy have not been

established.

About Assembly BiosciencesAssembly

Biosciences is a biotechnology company dedicated to the development

of innovative small-molecule therapeutics designed to change the

path of serious viral diseases and improve the lives of patients

worldwide. Led by an accomplished team of leaders in virologic drug

development, Assembly Bio is committed to improving outcomes for

patients struggling with the serious, chronic impacts of

herpesvirus, hepatitis B virus (HBV) and hepatitis delta virus

(HDV) infections. For more information, visit assemblybio.com.

Forward-Looking StatementsThe information in

this press release contains forward-looking statements that are

subject to certain risks and uncertainties that could cause actual

results to materially differ. These risks and uncertainties

include: Assembly Bio’s ability to realize the potential benefits

of its collaboration with Gilead Sciences, Inc., including all

financial aspects of the collaboration and equity investments;

Assembly Bio’s ability to initiate and complete clinical studies

involving its therapeutic product candidates, including studies

contemplated by Assembly Bio’s collaboration with Gilead, in the

currently anticipated timeframes or at all; safety and efficacy

data from clinical or nonclinical studies may not warrant further

development of Assembly Bio’s product candidates; clinical and

nonclinical data presented at conferences may not differentiate

Assembly Bio’s product candidates from other companies’ candidates;

results of nonclinical studies may not be representative of disease

behavior in a clinical setting and may not be predictive of the

outcomes of clinical studies; and other risks identified from time

to time in Assembly Bio’s reports filed with the U.S. Securities

and Exchange Commission (the SEC). You are urged to consider

statements that include the words may, will, would, could, should,

might, believes, hopes, estimates, projects, potential, expects,

plans, anticipates, intends, continues, forecast, designed, goal or

the negative of those words or other comparable words to be

uncertain and forward-looking. Assembly Bio intends such

forward-looking statements to be covered by the safe harbor

provisions contained in Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. More information about Assembly Bio’s risks and

uncertainties are more fully detailed under the heading “Risk

Factors” in Assembly Bio’s filings with the SEC, including its most

recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K. Except as required by law,

Assembly Bio assumes no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts Investor and

Corporate: Shannon Ryan SVP, Investor Relations,

Corporate Affairs and Alliance Management (415)

738-2992 investor_relations@assemblybio.com

Media: Sam Brown Inc.Hannah Hurdle(805)

338-4752ASMBMedia@sambrown.com

|

ASSEMBLY BIOSCIENCES, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands except for share amounts and par value) |

| |

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

19,208 |

|

|

$ |

19,841 |

|

|

Marketable securities |

90,011 |

|

|

110,406 |

|

|

Accounts receivable from collaboration |

— |

|

|

43 |

|

|

Prepaid expenses and other current assets |

3,712 |

|

|

3,497 |

|

|

Total current assets |

112,931 |

|

|

133,787 |

|

| |

|

|

|

|

|

|

Property and equipment, net |

349 |

|

|

385 |

|

|

Operating lease right-of-use assets |

1,731 |

|

|

2,339 |

|

|

Other assets |

312 |

|

|

312 |

|

|

Total assets |

$ |

115,323 |

|

|

$ |

136,823 |

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

801 |

|

|

$ |

461 |

|

|

Accrued research and development expenses |

2,531 |

|

|

885 |

|

|

Other accrued expenses |

3,587 |

|

|

5,744 |

|

|

Deferred revenue from a related party - short-term |

33,060 |

|

|

30,915 |

|

|

Operating lease liabilities - short-term |

1,295 |

|

|

1,220 |

|

|

Total current liabilities |

41,274 |

|

|

39,225 |

|

|

|

|

|

|

|

|

|

Deferred revenue from a related party - long-term |

38,916 |

|

|

55,379 |

|

|

Operating lease liabilities - long-term |

451 |

|

|

1,122 |

|

|

Total liabilities |

80,641 |

|

|

95,726 |

|

| |

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

| |

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; no

shares issued or outstanding |

— |

|

|

— |

|

|

Common stock, $0.001 par value; 150,000,000 shares authorized as of

June 30, 2024 and December 31, 2023; 6,345,561 and 5,482,752

shares issued and outstanding as of June 30, 2024 and December

31, 2023, respectively |

6 |

|

|

5 |

|

|

Additional paid-in capital |

840,946 |

|

|

826,921 |

|

|

Accumulated other comprehensive loss |

(293 |

) |

|

(81 |

) |

|

Accumulated deficit |

(805,977 |

) |

|

(785,748 |

) |

|

Total stockholders' equity |

34,682 |

|

|

41,097 |

|

|

Total liabilities and stockholders' equity |

$ |

115,323 |

|

|

$ |

136,823 |

|

|

ASSEMBLY BIOSCIENCES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

(In thousands except for share and per share amounts) |

|

(Unaudited) |

| |

| |

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Collaboration revenue from a related party |

$ |

8,533 |

|

|

$ |

— |

|

|

$ |

14,318 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

16,259 |

|

|

12,523 |

|

|

28,138 |

|

|

27,070 |

|

|

General and administrative |

4,477 |

|

|

4,965 |

|

|

9,112 |

|

|

9,977 |

|

| Total operating expenses |

20,736 |

|

|

17,488 |

|

|

37,250 |

|

|

37,047 |

|

| Loss from

operations |

(12,203 |

) |

|

(17,488 |

) |

|

(22,932 |

) |

|

(37,047 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other

income |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other income, net |

1,457 |

|

|

592 |

|

|

3,109 |

|

|

1,201 |

|

| Total other income |

1,457 |

|

|

592 |

|

|

3,109 |

|

|

1,201 |

|

| Loss before income

taxes |

(10,746 |

) |

|

(16,896 |

) |

|

(19,823 |

) |

|

(35,846 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

406 |

|

|

— |

|

|

406 |

|

|

— |

|

| Net loss |

$ |

(11,152 |

) |

|

$ |

(16,896 |

) |

|

$ |

(20,229 |

) |

|

$ |

(35,846 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

loss |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized (loss) gain on marketable securities |

(54 |

) |

|

188 |

|

|

(212 |

) |

|

478 |

|

| Comprehensive

loss |

$ |

(11,206 |

) |

|

$ |

(16,708 |

) |

|

$ |

(20,441 |

) |

|

$ |

(35,368 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and

diluted |

$ |

(1.98 |

) |

|

$ |

(3.88 |

) |

|

$ |

(3.64 |

) |

|

$ |

(8.33 |

) |

| Weighted average common shares

outstanding, basic and diluted |

5,642,752 |

|

|

4,355,007 |

|

|

5,563,033 |

|

|

4,303,244 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

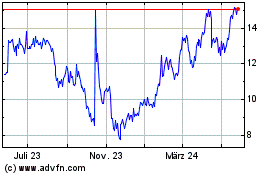

Assembly Biosciences (NASDAQ:ASMB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Assembly Biosciences (NASDAQ:ASMB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024