American Lithium Corp. (“American Lithium” or the “Company”)

(TSX-V:LI | Nasdaq:AMLI | Frankfurt:5LA1) is announcing that its

Board of Directors has approved the voluntary delisting of its

common shares (“American Lithium Shares”) from the Nasdaq Capital

Market (“Nasdaq”) and the deregistration with the U.S. Securities

and Exchange Commission (the “SEC”). American Lithium has notified

Nasdaq of its intention to voluntarily delist the American Lithium

Shares. The Company currently anticipates that it will file with

the SEC a Form 25, Notification of Removal of Listing and/or

Registration under Section 12(b) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), relating to the delisting

and deregistration on or about December 20, 2024, with the

delisting of American Lithium Shares taking effect ten calendar

days thereafter. As a result, the last trading day of the American

Lithium Shares on the Nasdaq Capital Market will be December 27,

2024.

The American Lithium Shares will continue their

listing on the TSX Venture Exchange and the Frankfurt Stock

Exchange. In addition, American Lithium has applied for the

American Lithium Shares to be quoted on the OTCQX Markets in the

United States, operated by OTC Markets Group Inc. The Company

anticipates transferring their shares on to the OTCQX Best® Market

immediately following the Nasdaq delist. American Lithium will

continue to provide information to its shareholders and take such

actions to enable a trading market in the American Lithium Shares

to exist in the United States.

Following satisfaction of the relevant

deregistration conditions under the applicable U.S. federal

securities laws, the Form 25 will also terminate the Company’s

reporting obligations under the Exchange Act. The Company expects

that its reporting obligations will be suspended upon filing of the

Form 25.

As previously disclosed, on March 8, 2024,

Nasdaq notified the Company that it was not in compliance with the

minimum bid price requirement of US$1.00 per share under Nasdaq

Listing Rule 5550(a)(2) based upon the closing bid price of the

American Lithium Shares for the thirty consecutive business days

from January 25, 2024 to March 7, 2024. The Company was initially

provided 180 calendar days from the date of the notice, or until

September 4, 2024, to regain compliance with the minimum bid

requirement. On September 11, 2024 Nasdaq notified the Company that

it was eligible for an additional 180 calendar period, or until

March 3, 2025, to regain compliance with the minimum bid price

requirement of US$1.00 per share.

The Board of Directors of the Company believes

that the decision to delist the American Lithium Shares from Nasdaq

and to terminate its reporting obligations under the Exchange Act

is in the best interest of the Company and its shareholders. The

Board has determined that the burdens associated with operating as

a company listed on the Nasdaq outweigh any advantages to the

Company and its shareholders at this time. The Board’s decision was

based on careful review of numerous factors, including the

following:

- the ongoing

direct and indirect costs of Exchange Act compliance and

maintaining a continued listing of the American Lithium Shares on

Nasdaq, including director and officer insurance premiums, audit

fees, legal fees and regulatory fees, and the disproportionate

impact of the foregoing costs on the Company’s results of

operations;

- the significant

burden on Management involved in the preparation of the Company’s

public reports, shorter public reporting deadlines in Canada, and

compliance with accounting and other requirements of the Exchange

Act;

- the limited

benefits to the Company and its unaffiliated shareholders from the

Company’s status as a SEC reporting issuer in light of, among other

things, the fact that due to market conditions, the low share

price, market capitalization, lack of institutional interest and

liquidity in the United States for the American Lithium

Shares;

- the Company is

not currently in a position to use its public Company status to

issue meaningful amounts of equity securities in the United States

or make acquisitions due to market conditions; and

- the opposition

by many large shareholders to a share capital consolidation.

American Lithium reserves the right, for any

reason, to delay any of the filings described above, to withdraw

them prior to effectiveness, and to otherwise change its plans in

respect of delisting and deregistration and termination of its

reporting obligations under applicable U.S. federal securities laws

in any way. Completion of any listing on the OTCQX Markets remains

subject to the satisfaction of customary listing conditions and

regulatory approval, and there can be no assurance that the

American Lithium Shares will be listed for trading on the OTCQX

Markets.

About American

Lithium

American Lithium is developing two of the

world’s largest, advanced-stage lithium projects, along with the

largest undeveloped uranium project in Latin America. They include

the TLC claystone lithium project in Nevada, the Falchani hard rock

lithium project and the Macusani uranium deposit, both in southern

Peru. All three projects have been through robust preliminary

economic assessments, exhibit significant expansion potential and

enjoy strong community support.

For more information, please contact the Company

at info@americanlithiumcorp.com or visit our website

at www.americanlithiumcorp.com.

Follow us

on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of

American Lithium Corp.

“Alex Tsakumis”

Interim CEO

Tel: 604 428 6128

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward

Looking InformationThis news release contains certain

forward-looking information and forward-looking statements

(collectively “forward-looking statements”) within the meaning of

applicable securities legislation. All statements, other than

statements of historical fact, are forward-looking statements.

Forward-looking statements in this news release include, but are

not limited to, statements regarding the business plans,

expectations and objectives of American Lithium; the voluntary

delisting of the American Lithium Shares from the Nasdaq Capital

Market; the deregistration with the SEC; the quotation on the OTC

Markets in the United States; and continued listing on the TSX

Venture Exchange. Forward-looking statements are frequently

identified by such words as "may", "will", "plan", "expect",

"anticipate", "estimate", "intend", “indicate”, “scheduled”,

“target”, “goal”, “potential”, “subject”, “efforts”, “option” and

similar words, or the negative connotations thereof, referring to

future events and results. Forward-looking statements are based on

the current opinions and expectations of management and are not,

and cannot be, a guarantee of future results or events. Although

American Lithium believes that the current opinions and

expectations reflected in such forward-looking statements are

reasonable based on information available at the time, undue

reliance should not be placed on forward-looking statements since

American Lithium can provide no assurance that such opinions and

expectations will prove to be correct. All forward-looking

statements are inherently uncertain and subject to a variety of

assumptions, risks and uncertainties, including risks,

uncertainties and assumptions related to: American Lithium’s

ability to achieve its stated goals, which could have a material

adverse impact on many aspects of American Lithium’s businesses

including but not limited to: the ability to access mineral

properties for indeterminate amounts of time, the health of the

employees or consultants resulting in delays or diminished

capacity, social or political instability in Peru which in turn

could impact American Lithium’s ability to maintain the continuity

of its business operating requirements, may result in the reduced

availability or failures of various local administration and

critical infrastructure, reduced demand for the American Lithium’s

potential products, availability of materials, global travel

restrictions, and the availability of insurance and the associated

costs; the ongoing ability to work cooperatively with stakeholders,

including but not limited to local communities and all levels of

government; the potential for delays in exploration or development

activities; the interpretation of drill results, the geology, grade

and continuity of mineral deposits; the possibility that any future

exploration, development or mining results will not be consistent

with our expectations; risks that permits will not be obtained as

planned or delays in obtaining permits; mining and development

risks, including risks related to accidents, equipment breakdowns,

labour disputes (including work stoppages, strikes and loss of

personnel) or other unanticipated difficulties with or

interruptions in exploration and development; risks related to

commodity price and foreign exchange rate fluctuations; risks

related to foreign operations; the cyclical nature of the industry

in which American Lithium operates; risks related to failure to

obtain adequate financing on a timely basis and on acceptable terms

or delays in obtaining governmental approvals; risks related to

environmental regulation and liability; political and regulatory

risks associated with mining and exploration; risks related to the

uncertain global economic environment and the effects upon the

global market generally, any of which could continue to negatively

affect global financial markets, including the trading price of

American Lithium’s shares and could negatively affect American

Lithium’s ability to raise capital and may also result in

additional and unknown risks or liabilities to American Lithium.

Other risks and uncertainties related to prospects, properties and

business strategy of American Lithium are identified in the “Risk

Factors” section of American Lithium’s Management’s Discussion and

Analysis filed on October 15, 2024, and in recent securities

filings available at www.sedarplus.ca. Actual events or results may

differ materially from those projected in the forward-looking

statements. American Lithium undertakes no obligation to update

forward-looking statements except as required by applicable

securities laws. Investors should not place undue reliance on

forward-looking statements.

Cautionary Note Regarding 32

Concessions

Thirty-two of the one-hundred-seventy-four

concessions comprising the Falchani and Macusani Projects are

currently subject to Administrative and Judicial processes in Peru

to overturn resolutions issued by INGEMMET and the Mining Council

of MINEM in February 2019 and July 2019, respectively, which

declared title to thirty-two concessions invalid due to late

receipt of the annual validity payments. On November 2, 2021,

American Lithium was awarded a favorable ruling in regard to title

to the concessions, but on November 26, 2021, appeals of the

judicial ruling were lodged by INGEMMET and MINEM. A three-judge

tribunal of Peru’s Superior Court unanimously upheld the ruling in

a decision reported in November 2023. American Lithium was

subsequently notified that INGEMMET and MINEM have filed petitions

to the Supreme Court of Peru to assume jurisdiction in the

proceedings. Given the precedent of the original ruling it is hoped

that the Supreme Court will not assume jurisdiction; however, there

is no assurance of the outcome at this time.

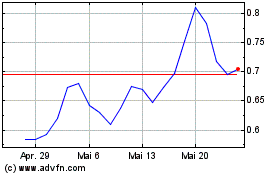

American Lithium (NASDAQ:AMLI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

American Lithium (NASDAQ:AMLI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024