| Prospectus

Supplement |

Filed

pursuant to Rule 424(b)(5) |

| (To

Prospectus dated January 29, 2024) |

Registration

No. 333-276577 |

367,870 common shares

Pre-funded warrants to purchase up to 373,002

common shares

AKANDA

CORP.

We are offering 367,870 of

our common shares, no par value per share, pursuant to this prospectus supplement and the accompanying prospectus, directly to certain

institutional or accredited investors.

We are also offering pre-funded

warrants to purchase up to an aggregate of 373,002 common shares, or the pre-funded warrants, in lieu of common shares, to any investor

whose purchase of common shares in this offering would otherwise result in the investor, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our outstanding common shares immediately

following the consummation of this offering. The purchase price of each pre-funded warrant is equal to the price at which one common share

is sold in this offering, minus $0.0001, and the exercise price of each pre-funded warrant is $0.0001 per share. The pre-funded warrants

are immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full.

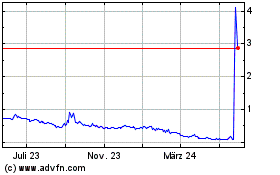

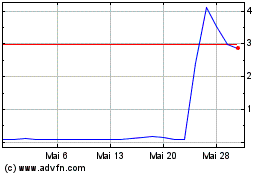

Our common shares are listed

on The Nasdaq Capital Market, or the Nasdaq, under the symbol “AKAN.” On March 4, 2024, the last reported sale price of our

common shares as reported on Nasdaq was $0.2109 per common share. For a more detailed description of our common shares, see the

section entitled “Description of the Securities We Are Offering” beginning on page S-13 of this prospectus supplement.

As of March 1, 2024, the

aggregate market value of our outstanding common shares held by non-affiliates, or public float, was approximately US$1,660,790

based on: (i) 7,372,137 common shares outstanding, of which 6,467,250 shares were held by non-affiliates as of such date, and (ii) a

price of US$0.49 per share, which was the highest reported closing sale price of our common shares on the Nasdaq in the 60 days

prior to such date. Accordingly, we are subject to the limitations set forth in General Instruction I.B.5 of Form F-3.

Except for the offer and sale of $858,000 in securities, during the 12-month period prior to and including the date of this

prospectus supplement, we did not offer any securities pursuant to General Instruction I.B.5 of Form F-3. Pursuant to General

Instruction I.B.5. of Form F-3, in no event will we sell securities registered on the registration statement to which this

prospectus supplement forms a part in a public primary offering with a value exceeding more than one-third of our public float in

any 12-month period so long as our public float remains below US$75 million. As a result, we are eligible to offer and sell up to an

aggregate of US$198,318 of our common shares pursuant to General Instruction I.B.5. of Form F-3.

At

present, there is a very limited market for our common shares. The trading price of our common shares has been, and may continue to be,

subject to wide price fluctuations due to various factors, many of which are beyond our control, including those described in “Risk

Factors.”

We

are an “emerging growth company” and a “foreign private issuer” as defined under the U.S. federal securities

laws, and, as such, are eligible for reduced public company reporting requirements for this and future filings. See “Prospectus

Summary—Implications of Being an Emerging Growth Company” and “Prospectus Summary—Implications of Being

a Foreign Private Issuer.”

We are not considered a “controlled

company” under Nasdaq corporate governance rules as we do not currently expect that more than 50% of our voting power will be held

by an individual, a group or another company immediately following the consummation of this offering.

As

a foreign private issuer, we have the option to follow certain Canadian corporate governance practices, except to the extent that such

laws would be contrary to U.S. securities laws, and provided that we disclose the requirements we are not following and describe

the Canadian practices we follow instead. In accordance with the laws in the Province of Ontario, Canada, we did not hold our annual

shareholders meeting in the fiscal year 2023 and will instead hold it in fiscal year 2024 pursuant to an order to delay the calling of

the annual meeting granted by the Ontario Superior Court of Justice pursuant to subsection 106(1) of the Business Corporations

Act (Ontario). We may in the future elect to follow additional home country practices in Canada with regard to certain corporate

governance matters. See “Risk Factors — Risks Related to Our Common Shares.”

| | |

| Per Common

Share | | |

| Per

Pre-Funded

Warrant | | |

| Total | |

| | |

| | | |

| | | |

| | |

| Offering price | |

US$ | 0.16872 | | |

US$ | 0.16862 | | |

US$ | 125,000 | |

| Financial advisory fee | |

US$ | 0.00136 | | |

US$ | 0.00134 | | |

US$ | 500 | |

| Proceeds, before other expenses,

to us | |

US$ | 0.16736 | | |

US$ | 0.16727 | | |

US$ | 124,500 | |

We have not retained a placement

agent in connection with this offering. We have engaged Univest Securities, LLC (“Univest” or the “financial advisor”)

to act as our exclusive financial advisor in connection with this offering. The financial advisor has no obligation to buy any of the

securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay

the financial advisor certain fees in connection with this offering. See “Plan of Distribution” beginning on page S-11

of this prospectus supplement for more information regarding these arrangements.

Investing in our securities

involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement and the documents incorporated

by reference therein for a discussion of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

We expect to deliver the securities

offered pursuant to this prospectus supplement on or about March 5, 2024.

The date of this prospectus supplement is March

5, 2024

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

You

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus.

We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state

or jurisdiction where the offer is not permitted.

This

prospectus supplement and the accompanying base prospectus are part of a registration statement on Form F-3 (Registration No. 333-276577)

we filed with the Securities and Exchange Commission, or the “SEC,” using a “shelf” registration process. Under

this shelf process, we may, from time to time, sell or issue any of the combination of securities described in the base prospectus, and

one or more selling securityholders may also offer and sell securities under the base prospectus in one or more offerings with a maximum

aggregate offering price of up to $5,000,000. We will not receive any of the proceeds from the sale or other disposition of common shares

by the selling shareholders. The base prospectus provides you with a general description of us and the securities we, or selling

securityholders may offer, most of which do not apply to this offering. Each time we sell securities using the base prospectus, we provide

a prospectus supplement that contains specific information about the terms of that offering. A prospectus supplement may also add, update

or change information contained in the base prospectus and the documents incorporated by reference into the prospectus supplement or

the base prospectus.

This prospectus supplement

provides specific details regarding the offering of 367,870 of our common shares and pre-funded warrants to purchase 373,002 of our common

shares. To the extent there is a conflict between the information contained in this prospectus supplement and the base prospectus, you

should rely on the information in this prospectus supplement. This prospectus supplement, the base prospectus and the documents we incorporate

by reference herein and therein include important information about us and our securities, and other information you should know before

investing. You should read both this prospectus supplement and the base prospectus, together with the additional information in “Where

You Can Find More Information” and “Information Incorporated by Reference.”

You

should not assume the information appearing in this prospectus supplement or the base prospectus is accurate as of any date other than

the date on the front cover of the respective documents. You should not assume the information contained in the documents incorporated

by reference in this prospectus supplement or the base prospectus is accurate as of any date other than the respective dates of those

documents. Our business, financial condition, results of operations, and prospects may have changed since such date.

Unless

otherwise indicated or the context otherwise requires, all references in this prospectus supplement to the terms “Akanda,”

“the company,” “we,” “us” and “our” refer to Akanda Corp. and its subsidiaries.

All

references to “$” or “dollars”, are expressed in Canadian dollars unless otherwise indicated. All reference to

“U.S. dollars”, “USD”, or to “US$” are to United States dollars.

For investors outside the

United States: We have not done anything that would permit this offering or possession or distribution of this prospectus supplement

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who

come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering

of the securities and the distribution of this prospectus supplement outside the United States.

This

prospectus supplement includes statistical and other industry and market data that we obtained from industry publications and research,

surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate

that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness

of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, you are

cautioned not to give undue weight to this information.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus supplement. This summary is not complete and does not

contain all of the information that you should consider before deciding whether to invest in our common shares. You should carefully

read the entire prospectus supplement, including the risks associated with an investment in our company discussed in the “Risk

Factors” section of this prospectus supplement, before making an investment decision. Some of the statements in this prospectus

supplement are forward-looking statements. See the section titled “Special Note Regarding Forward-Looking Statements.”

In

this prospectus supplement, “we,” “us,” “our,” “our company,” “Akanda” and

similar references refer to Akanda Corp. and its consolidated subsidiaries.

Overview

We

are a cannabis cultivation, manufacturing and distribution company whose mission is to provide premium quality medical cannabis products

to patients worldwide. We are an early stage, emerging growth company headquartered in London, United Kingdom. We have a limited operating

history and minimal revenues to date. Canmart Ltd. (“Canmart”) and RPK Biopharma Unipessoal, LDA (“RPK”)

are our operating and wholly-owned subsidiaries. We expect to expand their local operations and develop sales channels of our medicinal-grade

cannabis products and cannabis based medical and wellness products in international markets and in particular, in Europe.

Canmart

Ltd

Our

indirect wholly-owned subsidiary Canmart, a company incorporated under the laws of England and Wales, is a licensed importer and

distributor of CBPMs in the United Kingdom (UK). Canmart holds a Controlled Drug License issued by the Home Office to possess and supply

CBPMs in the UK. This license expired on February 3, 2022 and needs to be renewed annually. We applied for the license renewal in

January 2022, coinciding with an application to increase import capabilities to Schedule 1 (bulk product) and we are currently awaiting

a response from the UK Home Office. We have decided to not take up the Schedule 1 license and focus on where our expertise lie in the

distribution of goods safely and effectively. Until such time that the renewal application is approved by the UK Home Office, Canmart

can continue with its day to day business under the conditions of its existing license. Canmart continues to receive new import licenses

issued by the UK Home Office for every specific shipment of CBPMs and Canmart has thus far successfully imported over 100kgs of product

for distribution in the UK. Canmart holds both a Manufacturer’s Specials License for importation of CBPMs and a Wholesale Distribution

Authorization from the Medicines and Healthcare Products Regulatory Agency.

Canmart commenced importing

and distributing CBPMs in 2020. Under the current controlled drugs regulatory regime, Canmart is only able to supply to dispensing pharmacists

and other wholesale distributors, tied in with prescribing and clinic partners. However, Canmart has reduced its plan for Canmart-owned and

operated clinics and pharmacies to instead provide third party and specialist import and distribution services for Schedule 2 products

including CBPMs. Canmart continues to work further with premium product suppliers to bring safe, effective and required products to market

that patients demand, and work with existing and new clinical cannabis operations in the UK to provide third party products.

Cannahealth

Limited

Our

direct wholly-owned subsidiary Cannahealth Limited (“Cannahealth”), a Republic of Malta company, is a holding company

of all the ownership interests in Canmart and Holigen Holdings Limited (“Holigen”). Cannahealth does not engage in

any operations.

Holigen

Holdings Limited

In

May 2022, our wholly owned subsidiary, Cannahealth, acquired 100% of the ordinary shares of Holigen and its wholly-owned operating subsidiary,

RPK, from the Flowr Corporation. Through its operations in RPK, Holigen is a producer of premium EU GMP grade indoor grown cannabis flower.

The acquisition of Holigen enabled us to produce EU GMP grade cannabis flower for the European market, in particular Germany and the

UK.

RPK

Biopharma Unipessoal, LDA

RPK’s operations consist

of a 20,000 square foot indoor EU GMP certified grow facility located near Sintra, Lisbon, Portugal, dedicated to the cultivation of high-tetrahydrocannabinol

(THC) premium cannabis and yielding over 2,000 kg of flower per year. This outdoor and greenhouse expansion site in Portugal affords scalable

cultivation as well as a large seven million square foot outdoor facility located in Aljustrel, Portugal.

On

February 28, 2024, the Company entered into a share purchase agreement with Cannahealth, Holigen and Somai Pharmaceuticals Unipressoal,

LDA. and an escrow agreement with Somai Pharmaceuticals LTD. and Lawson Lundell LLP, for the sale

of RPK (the “Purchase Agreement”). The purchase price includes $2,000,000 in cash and up to approximately $4,000,000 Euros

of RPK’s liabilities. In addition, a deposit of $500,000 was placed in an escrow account with the remainder of the balance due upon

closing of the contemplated transaction. The closing of the contemplated transaction will be subject to customary due diligence, representations

and warranties, covenants, indemnities and closing conditions. There can be no assurance or guarantee that the contemplated transaction

will be consummated, or upon the terms and conditions currently outlined in the Purchase Agreement.

Bophelo

Bio Science and Wellness (Pty) Ltd

Our

indirect wholly-owned subsidiary Bophelo Bio Science and Wellness (Pty) Ltd (“Bophelo”), a Lesotho company, is focused

on the cultivation of cannabis, the production of medical cannabis products including dried flower, oils, and other concentrates and

the supply of such medical cannabis products to wholesalers in international markets. As a result of Bophelo’s liquidation, during

the year ended December 31, 2022, we determined that we no longer controlled Bophelo. As a result of the loss of control, we derecognized

the net assets of Bophelo and accounted for the operating results as discontinued operation.

1900

Ferne Road, Gabriola Island, British Columbia

In

September 2023, Akanda acquired the right to develop a Canadian farming property in British Columbia, including farming land and related

operations and licenses. We plan to develop THC and cannabinoid (CBD) facilities at this site. Additional payments to the seller will

be made based upon milestones achieved from the development, including THC cultivation, sales of product, CBD cultivation, and hemp cultivation.

Corporate

Information

Akanda

was incorporated in the Province of Ontario, Canada on July 16, 2021 under the Business Corporations Act (Ontario).

Our

principal executive offices and mailing address are located at 1a, 1b Learoyd Road, New Romney, TN28 8XU, United Kingdom, and our telephone

number is (202) 498-7917. Our website is www.akandacorp.com. Information contained on our website is not part of this prospectus supplement.

Our agent for service of process in the United States is CT Corporation System.

Implications

of Being an Emerging Growth Company

We

qualify as an “emerging growth company” under the Jumpstart Our Business Act of 2012, as amended, or the JOBS Act. As a result,

we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. These provisions include exemption from

the auditor attestation requirement under Section 404 of the Sarbanes-Oxley Act of 2002 in the assessment of the emerging growth

company’s internal control over financial reporting. In addition, Section 107 of the JOBS Act also provides that an emerging growth

company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with

new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards

until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended

transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised

accounting standards.

We

will remain an emerging growth company until the earliest of (i) the last day of the fiscal year during which we have total annual

gross revenues of at least US$1.07 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion

of our initial public offering; (iii) the date on which we have, during the preceding three year period, issued more than US$1.0 billion

in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange

Act, which could occur if the market value of our common shares that are held by non-affiliates exceeds US$700 million as of the

last business day of our most recently completed second fiscal quarter. Once we cease to be an emerging growth company, we will not be

entitled to the exemptions provided in the JOBS Act discussed above.

Implications

of Being a Foreign Private Issuer

We are a “foreign

private issuer”, as such term is defined in Rule 405 under the Securities Act, and are not subject to the same

requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations

that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. As a result, we do

not file the same reports that a U.S. domestic issuer files with the SEC, although we are required to file with or furnish to the

SEC any disclosure documents that we are required to file in Canada under Canadian securities laws, if applicable. In addition, our

officers, directors, and principal shareholders are exempt from the reporting and “short swing” profit recovery

provisions of Section 16 of the Exchange Act. Therefore, our shareholders may not know on as timely a basis when our officers,

directors and principal shareholders purchase or sell shares.

As a foreign private issuer,

we are exempt from the rules and regulations under the Exchange Act related to the furnishing and content of proxy statements.

We are also exempt from Regulation FD, which prohibits issuers from making selective disclosures of material non-public

information. While we comply with the corresponding requirements relating to proxy statements and disclosure of material non-public

information under Canadian securities laws, if applicable, these requirements differ from those under the Exchange Act and

Regulation FD and shareholders should not expect to receive the same information at the same time as such information is

provided by U.S. domestic companies. In addition, we have more time than U.S. domestic companies after the end of each

fiscal year to file our annual report with the SEC and are not required under the Exchange Act to file quarterly reports with

the SEC.

In

addition, as a foreign private issuer, we have the option to follow certain Canadian corporate governance practices, except to the extent

that such laws would be contrary to U.S. securities laws, and provided that we disclose the requirements we are not following and describe

the Canadian practices we follow instead. We may in the future elect to follow home country practices in Canada with regard to certain

corporate governance matters.

As

a result, our shareholders may not have the same protections afforded to shareholders of U.S. domestic companies that are subject to

all corporate governance requirements.

Share

Consolidation (a “Reverse Split”)

On

March 9, 2023, we effectuated a one-for-ten reverse stock split of our common shares, or the Reverse Split. The Reverse Split combined

each ten of our common shares into one common share. Following the 1:10 Reverse Split, Akanda consolidated its outstanding common shares

from 48,847,904 common shares outstanding to 3,884,786 common shares outstanding.

The

Offering

| Shares offered by us |

|

367,870

common shares. |

| |

|

|

| Pre-funded warrants |

|

We are also offering pre-funded warrants to purchase up to an aggregate

of 373,002 common shares to any investor whose purchase of common shares in this offering would otherwise result in such investor, together

with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our

outstanding common shares immediately following the consummation of this offering, in lieu of common shares. The purchase price of each

pre-funded warrant is equal to the price at which one common share is being sold in this offering, minus $0.0001, and the exercise price

of each pre-funded warrant is $0.0001 per share. The pre-funded warrants are exercisable immediately and may be exercised at any time

until all of the pre-funded warrants are exercised in full. This offering also relates to the common shares issuable upon exercise of

the pre-funded warrants sold in this offering. See “Description of Securities We Are Offering” for a discussion on the terms

of the pre-funded warrants. |

| |

|

|

| Common shares outstanding immediately before and after the offering |

|

8,101,979 common shares prior to the offering and 8,469,849 shares

after the offering. |

| |

|

|

| Use of proceeds |

|

We estimate the net proceeds from this offering will be approximately

$94,500, after deducting fees payable to the financial advisor and other estimated offering expenses payable by us. We intend to use the

net proceeds from this offering solely for capital expenditures, operating capacity, working capital, general corporate purposes and the

refinancing or repayment of existing indebtedness and acquisitions of complementary products, technologies or businesses. However, we

currently have no present agreements or commitments for any such acquisitions. |

| |

|

|

| Risk factors |

|

Investing in our common shares involves a high degree of risk and purchasers of our common shares may lose part or all of their investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in our common shares. |

| |

|

|

| Nasdaq Capital Market Symbol |

|

Our common shares are listed on The Nasdaq Capital Market under the symbol “AKAN.” |

The number of common shares

outstanding is based on 8,469,849 shares outstanding as of the date of this prospectus supplement and excludes:

| |

● |

zero common shares reserved for future issuance under our Equity Incentive Plan (the “Plan”) as well as any automatic evergreen increases in the number of common shares reserved for future issuance under our Plan; and |

| |

|

|

| |

● |

373,002 common shares issuable upon exercise of the pre-funded warrants

issued as part of this offering. |

RISK

FACTORS

An

investment in our securities is highly speculative and involves a high degree of risk. We operate in a dynamic and rapidly changing industry

that involves numerous risks and uncertainties. You should carefully consider the factors described below, together with all of the other

information contained in this prospectus supplement, including our financial statements, pro forma combined financial statements and

the related notes included in this prospectus supplement, before deciding whether to invest in our securities. These risk factors are

not presented in the order of importance or probability of occurrence. If any of the following risks actually occurs, our business, financial

condition and results of operations could be materially and adversely affected. In that event, the market price of our securities could

decline, and you could lose part or all of your investment. Some statements in this prospectus supplement, including statements in the

following risk factors, constitute forward-looking statements. Please refer to the section entitled “Cautionary Note Regarding

Forward-Looking Statements.”

Risks Related to this Offering

Purchasers of securities will experience immediate and substantial

dilution in the book value of their investment. You may experience further dilution upon exercise of our outstanding options and warrants.

If you purchase our common

shares or pre-funded warrants in this offering, you will experience immediate and substantial dilution, as the offering price of our common

shares will be substantially greater than the as adjusted net tangible book value per common share before giving effect to this offering.

Accordingly, if you purchase the securities in this offering, you will incur immediate substantial dilution of approximately $0.001 per

share, representing the difference between the offering price per common share and our as adjusted net tangible book value as of June 30,

2023. The exercise of the pre-funded warrants sold in this offering may result in further dilution of your investment. For a further description

of the dilution that you will experience immediately after this offering, see the section titled “Dilution” beginning on page S-10

of this prospectus supplement.

Future sales of our common shares, or the perception that such

future sales may occur, may cause our stock price to decline.

Sales of a substantial number of our common shares

in the public market, or the perception that these sales could occur, following this offering could cause the market price of our common

shares to decline. A substantial majority of the outstanding shares of our common shares are, and the shares of common shares sold in

this offering upon issuance will be, freely tradable without restriction or further registration under the Securities Act of 1933, as

amended.

We have broad discretion to determine how to use the funds raised

in this offering, and may use them in ways that may not enhance our operating results or the price of our common shares.

Our management will have broad discretion over the

use of proceeds from this offering, and we could spend the proceeds from this offering in ways our stockholders may not agree with or

that do not yield a favorable return, if at all. We intend to use the net proceeds from this offering for capital expenditures, operating

capacity, working capital, general corporate purposes and the refinancing or repayment of existing indebtedness and acquisitions of complementary

products, technologies or businesses. However, we currently have no present agreements or commitments for any such acquisitions. See “Use

of Proceeds” beginning on page S-9 of this prospectus supplement for additional detail. However, our use of these proceeds

may differ substantially from our current plans. If we do not invest or apply the proceeds from this offering in ways that improve our

operating results, we may fail to achieve expected financial results, which could cause our stock price to decline.

There is no public market for the pre-funded

warrants being offered in this offering.

There is no established public

trading market for the pre-funded warrants being offered in this offering, and we do not expect a market to develop. In addition, we

do not intend to apply to list the pre-funded warrants on any securities exchange or nationally recognized trading system. Without an

active market, the liquidity of the pre-funded warrants will be limited.

The holder of pre-funded warrants purchased

in this offering will have no rights as a common shareholder until such holder exercises its pre-funded warrants and acquires our common

shares.

Until a holder of pre-funded

warrants acquires the common shares upon exercise of the pre-funded warrants, as applicable, a holder of pre-funded warrants will have

no rights with respect to the common shares underlying such pre-funded warrants, except as set forth in the pre-funded warrants. Upon

exercise of the pre-funded warrants, the holder will be entitled to exercise the rights of a common shareholder only as to matters for

which the record date occurs after the exercise date.

The pre-funded warrants are speculative

in nature.

The pre-funded warrants do

not confer any rights of common share ownership on their holders, such as voting rights or the right to receive dividends, but rather

merely represent the right to acquire common shares at a fixed price. Specifically, holders of the pre-funded warrants may exercise their

right to acquire common shares and pay an exercise price of $0.0001 per share, subject to certain adjustments, commencing immediately

upon issuance. There can be no assurance that the market price of the common shares will ever equal or exceed the exercise price of the

pre-funded warrants, and consequently, it may not ever be profitable for holders of the pre-funded warrants to exercise the pre-funded

warrants.

We do not expect to pay dividends in the foreseeable future.

As a result, you must rely on stock appreciation for any return on your investment.

We have never declared or paid cash dividends on

our common shares and do not anticipate paying cash dividends on our common shares in the foreseeable future. Any payment of cash dividends

will also depend on our financial condition, results of operations, capital requirements and other factors and will be at the discretion

of our board of directors, subject to limitations under applicable law. Accordingly, you will have to rely on capital appreciation, if

any, to earn a return on your investment in our common shares.

Risks

Related to Our Business and Industry

Risks

and uncertainties related to our business and industry include, but are not limited to, the following:

| ● | We

are an early-stage company with limited operating history and may never become profitable. |

| ● | Our

financial situation creates doubt as to whether we will continue as a going concern. |

| ● | Our

subsidiary, Bophelo, is currently in insolvency proceedings. |

| ● | We

may become involved in litigation matters that are expensive and time consuming, and, if resolved adversely, could harm our reputation,

business, financial condition or results of operations. |

| ● | Future

acquisitions and strategic investments could be difficult to integrate, divert the attention of key management personnel, disrupt our

business, dilute shareholder value, and harm our results of operations and financial condition. |

| ● | Demand

for cannabis and its derivative products could be adversely affected and significantly influenced by scientific research or findings,

regulatory proceedings, litigation, or media attention. |

| ● | Our

success will depend, in part, on our ability to continue to enhance our product offerings to respond to technological and regulatory

changes and emerging industry standards and practices. |

| ● | We

are subject to the inherent risk of exposure to product liability claims and product recalls. |

| ● | Research

regarding the medical benefits, viability, safety, efficacy, use and social acceptance of cannabis or isolated cannabinoids (such as

cannabidiol and tetrahydrocannabinol) remains in early stages. |

| ● | We

may not be able to maintain effective quality control systems. |

| ● | The

medical cannabis industry and market may not continue to exist or develop as we anticipate and we may ultimately be unable to succeed

in this industry and market. |

| ● | We,

or the medical cannabis industry more generally, may receive unfavorable publicity or become subject to negative patient, physician or

investor perception. |

| ● | We

are subject to significant competition by new and existing competitors in the cannabis industry. |

| ● | The

legalization of adult-use, recreational cannabis may reduce sales of medical cannabis. |

| ● | We

are dependent upon our management and key employees, and the loss of any member of our management team or any key employee, conflicts

of interest of or director and officer, or executive officers serving roles outside of the Company, could have a material adverse effect

on our operations. |

| ● | We

could be subject to a security breach that could result in significant damage or theft of products and equipment. |

| ● | We

may incur significant costs to defend our intellectual property and other proprietary rights. |

| ● | If

we sustain cyber-attacks or other privacy or data security incidents that result in security breaches that disrupt our operations or

result in the unintended dissemination of protected personal information or proprietary or confidential information, or if we are found

by regulators to be non-compliant with statutory requirements for the protection and storage of personal data, we could suffer a loss

of revenue, increased costs, exposure to significant liability, reputational harm and other serious negative consequences. |

Risk

Related to Our International Operations

Risks

and uncertainties related to our international operations include, but are not limited to, the following:

| ● | As

a company based outside of the United States, we are subject to economic, political, regulatory and other risks associated with international

operations. |

| ● | The

United Kingdom’s withdrawal from the European Union could lead to increased market volatility, which could make it more difficult

for us to do business in Europe or have other adverse effects on our business. |

| ● | We

expect to increase our international sales in the future, and such sales may be subject to unexpected exchange rate fluctuations, regulatory

requirements and other barriers. |

| ● | Tax

regulations and challenges by tax authorities could have a material adverse effect on our business. |

Risk

Related to Our Regulatory Framework

Risks

and uncertainties related to our regulatory framework include, but are not limited to, the following:

| ● | The

medicinal cannabis regulatory regime is restrictive and new in the United Kingdom and Europe, and laws and enforcement could rapidly

change again. |

| ● | There

are risks associated with the regulatory regime and permitting requirements of our operations. |

| ● | Any

failure on our part to comply with applicable regulations or to obtain and maintain the necessary licenses and certifications could prevent

us from being able to carry on our business, and there may be additional costs associated with any such failure. |

| ● | The

legal cannabis market is a relatively new industry. As a result, the size of our target market is difficult to quantify, and investors

will be reliant on their own estimates on the accuracy of market data. |

Risk

Related to Financials And Accounting

Risks

and uncertainties related to our financial and accounting include, but are not limited to, the following:

| ● | There

are tax risks we may be subject to in carrying out our business in multiple jurisdictions. |

| ● | There

is a risk that we will be a passive foreign investment company (“PFIC”) for U.S. federal income tax purposes for the current

or any future taxable year, which could result in material adverse U.S. federal income tax consequences if you are a U.S. Holder. |

| ● | Failure

to develop our internal controls over financial reporting as we grow could have an adverse effect on our operations. |

Risks Related to Our Common Shares

Risks

and uncertainties related to our common shares include, but are not limited to, the following:

| ● | We

will need to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital

when needed may force us to delay, limit or terminate our product and business development efforts or other operations. |

| ● | We

have significant shareholders, which may limit your ability to influence corporate matters and may give rise to conflicts of interest,

and our executive officers, directors, significant shareholder and their respective affiliates may exercise significant control

over us, which will limit your ability to influence corporate matters and could delay or prevent a change in corporate control. |

| ● | Future

sales and issuances of our capital stock or rights to purchase capital stock could result in additional dilution of the percentage

ownership of our stockholders and could cause the price of our common shares to decline. |

| ● | If

we fail to meet applicable listing requirements, Nasdaq may delist our common shares from trading, in which case the liquidity and market

price of our common shares could decline. |

| ● | We

are a foreign private issuer and take advantage of the less frequent and detailed reporting obligations applicable to foreign private

issuers, but we may lose our status as a foreign private issuer in the United States, which would result in increased costs related to

regulatory compliance under United States securities laws. |

| ● | We

do not intend to pay dividends on our common shares in the near future, and, consequently, your ability to achieve a return on your investment

will depend on appreciation in the price of our common shares. |

USE

OF PROCEEDS

We estimate that the net proceeds to us from this offering of securities

will be approximately $94,500, after deducting the financial advisor fees and other estimated expenses relating to the offering.

We

intend to use the net proceeds from this offering for capital expenditures, operating capacity, working capital, general corporate purposes

and the refinancing or repayment of existing indebtedness and acquisitions of complementary products, technologies or businesses. However,

we currently have no present agreements or commitments for any such acquisitions.

This

expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions. Our

management will have discretion in allocating the net proceeds in accordance with the above priorities and purposes. The amounts

and timing of our actual expenditures will depend upon numerous factors, including the progress of our expansion and development efforts,

whether or not we enter into strategic transactions, our general operating costs and expenditures, and the changing needs of our business.

DILUTION

If you invest in the securities

being offered by this prospectus supplement, you will suffer immediate and substantial dilution in the net tangible book value per common

share. Our net tangible book value as of June 30, 2023 was approximately US$676,533, or approximately US$0.168 per share. Net tangible

assets per share represents our total tangible assets less total tangible liabilities, divided by the number of common shares outstanding

as of June 30, 2023.

Dilution in net tangible book value per share represents the difference

between the offering price per share paid by purchasers in this offering and the net tangible book value per share of our common shares

immediately after this offering. After giving effect to the sale by us of shares in this offering at an offering price of US$0.16872 per

common share and $0.16862 per pre-funded warrant, after deducting the financial advisor fees and estimated offering expenses payable by

us, and assuming exercise of the pre-funded warrants for cash in full, our net tangible book value as of June 30, 2023 would have been

approximately US$801,533, or approximately US$0.168 per common share. This represents an immediate increase of US$0.000 in net tangible

book value per share to our existing shareholders and an immediate dilution of US$0.001 per share to purchasers of securities in this

offering. The following table illustrates this per share dilution:

| Offering price per share |

|

US$ |

0.16872 |

|

| Net tangible book value per share as of June 30, 2023 |

|

US$ |

0.168 |

|

| Increase in net tangible book value per share attributable to new investors |

|

US$ |

0.000 |

1 |

| Adjusted net tangible book value per share as of June 30, 2023, after giving effect to the offering |

|

US$ |

0.168 |

1 |

| Dilution per share to new investors in the offering |

|

US$ |

0.001 |

1 |

| 1 | Includes 373,002 common shares issuable upon exercise of the pre-funded warrants as part of this offering |

The above discussion and table are based on 4,766,333 shares outstanding

as of June 30, 2023 and excludes:

| |

● |

Zero common shares reserved for future issuance under our Equity Incentive Plan (the “Plan”) as well as any automatic evergreen increases in the number of common shares reserved for future issuance under our Plan. |

| |

|

|

| |

● |

The settlement of debenture owing to Halo Collective Inc. by way of

an issuance of 582,193 common shares. |

| |

|

|

| |

● |

The issuance of 879,895 common shares to 1107385 B.C. Ltd. pursuant

to first option payment to acquire certain land property. |

| |

|

|

| |

● |

The issuance of 280,851 common shares pursuant to the public offering

completed in February 2024 and issuance of 1,462,911 common shares pursuant to the exercise of 1,462,911 pre-funded warrants from the

public offering completed in February 2024. |

| |

|

|

| |

● |

The issuance of 367,870 common shares pursuant to the public offering

completed on March 4, 2024 and issuance of 361,972 common shares pursuant to the exercise of 361,972 pre-funded warrants from the public

offering completed on March 4, 2024. |

PLAN

OF DISTRIBUTION

We are offering 367,870 common shares and pre-funded warrants to purchase

373,002 common shares for gross proceeds of approximately $125,000 before deduction of financial advisor fees and offering expenses payable

by us.

We have entered into a securities

purchase agreement directly with certain institutional or accredited investors in connection with this offering. The offering prices of

the common shares and pre-funded warrants offered by this prospectus supplement have been determined based upon arm’s length negotiations

between the investors and us.

Our obligation to issue and sell the common shares and pre-funded warrants

to the investors is subject to the conditions set forth in a securities purchase agreement between us and the investors, which may be

waived by us at our discretion. An investor’s obligation to purchase common shares and pre-funded warrants is subject to the conditions

set forth in the securities purchase agreement, which may also be waived.

We will deliver the common

shares and pre-funded warrants being issued to the investors electronically upon receipt of investor funds for the purchase of the common

shares and pre-funded warrants offered pursuant to this prospectus supplement and accompanying prospectus. We expect to deliver the securities

to investors on or about March 5, 2024, subject to satisfaction of customary closing conditions.

Financial

Advisor

Pursuant

to an engagement agreement dated January 29, 2024, we have engaged Univest Securities, LLC, (“Univest” or the “financial

advisor”) to act as our exclusive financial advisor in connection with this offering of securities pursuant to this prospectus

supplement and accompanying prospectus. Under the terms of the engagement agreement, the financial advisor agreed to be our exclusive

financial advisor, on a reasonable best-efforts basis, in connection with the issuance and sale by us of our securities in this offering.

The terms of this offering were subject to market conditions and negotiations between us, the financial advisor and prospective investors.

The financial advisor agreement does not give rise to any commitment by the financial advisor to purchase any of our securities, and

the financial advisor will have no authority to bind us by virtue of the financial advisor agreement. Further, the financial advisor

does not guarantee that it will be able to raise new capital in any prospective offering.

The forms of financial advisor

agreement and securities purchase agreement have been filed on February 2, 2024 as an exhibit to a Current Report on Form 6-K with the

SEC and is incorporated by reference into this prospectus supplement and the registration statement of which this prospectus supplement

forms a part.

Financial

advisor Fees, Commissions and Expenses

We have agreed to pay the financial advisor a total cash fee equal

to $500.00. We will also reimburse the financial advisor for out-of-pocket expenses, including up to $10,000 of legal counsel expenses.

We estimate the total expenses payable by us for this offering will be approximately $30,500, which amount includes the financial advisor’s

fees and reimbursable expenses.

The

following table shows the offering price, financial advisor fees and proceeds, before expenses, to us.

| |

|

Total |

|

| Offering price |

|

US$ |

125,000 |

|

| Financial advisor fees |

|

US$ |

500 |

|

| Proceeds to Akanda Corp., before expenses |

|

US$ |

124,500 |

|

Indemnification

We

have agreed to indemnify the financial advisor and specified other persons against certain liabilities relating to or arising out of

the financial advisor’s activities under the financial advisor agreement and to contribute to payments that the financial advisor

may be required to make in respect of such liabilities.

Determination

of Offering Price

The

actual offering price of the securities we are offering will be negotiated between us, the financial advisor and the investors in the

offering based on the trading of our common shares prior to the offering, among other things. Other factors to be considered in determining

the offering price of the securities we are offering may include our history and prospects, the stage of development of our business,

our business plans for the future and the extent to which they have been implemented, an assessment of our management, the general conditions

of the securities markets at the time of the offering and such other factors as were deemed relevant.

DESCRIPTION

OF THE SECURITIES WE ARE OFFERING

Common Shares

In this offering, we are offering 367,870 common shares at a purchase

price of US$0.16872 per share.

Immediately prior to the offering 8,101,979 common shares was outstanding,

and upon consummation of the offering, 8,469,849 common shares will be outstanding, this amount does not include the shares of our common

shares issuable upon the exercise or conversion of our outstanding options, warrants or convertible securities, or the common shares reserved

for issuance under our Equity Incentive Plan. We are authorized to issue an unlimited number of common shares, no par value per share

and an unlimited number of preferred shares, issuable in series, no par value per share, none of which are issued and outstanding. For

a more complete description of our common shares, please see “Description of Share Capital” in the accompanying

base prospectus.

Pre-Funded Warrants

The following is a summary of the material terms and provisions of

the pre-funded warrants that are being offered hereby. This summary is subject to and qualified in its entirety by the form of pre-funded

warrants, which has been provided to the investors in this offering and which will be filed with the SEC as an exhibit to a Current Report

on Form 6-K in connection with this offering and incorporated by reference into the registration statement of which this prospectus supplement

and the accompanying prospectus form a part. Prospective investors should carefully review the terms and provisions of the form of pre-funded

warrant for a complete description of the terms and conditions of the pre-funded warrants. All pre-funded warrants will be issued in uncertificated

form and maintained in book entry.

Duration and Exercise Price

Each pre-funded warrant offered hereby will have an initial exercise

price per share equal to $0.0001. The pre-funded warrants will be immediately exercisable and may be exercised at any time until the pre-funded

warrants are exercised in full. The exercise price and number of common shares issuable upon exercise is subject to appropriate adjustment

in the event of stock dividends, stock splits, reorganizations or similar events affecting our common shares and the exercise price.

Exercisability

The pre-funded warrants will

be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by

payment in full for the number of common shares purchased upon such exercise (except in the case of a cashless exercise as discussed below).

A holder (together with its affiliates) may not exercise any portion of the pre-funded warrants to the extent that the holder would own

more than 4.99% of the outstanding common shares immediately after exercise, except that upon at least 61 days’ prior notice from

the holder to us, the holder may increase the amount of ownership of outstanding shares after exercising the holder’s pre-funded

warrants up to 9.99% of the number of common shares outstanding immediately after giving effect to the exercise, as such percentage ownership

is determined in accordance with the terms of the pre-funded warrants. Purchasers of pre-funded warrants in this offering may also elect

prior to the issuance of the pre-funded warrants to those purchasers to have the initial exercise limitation set at 9.99% of our outstanding

common shares.

Transferability

Subject to applicable laws,

the pre-funded warrants are separately tradeable immediately after issuance at the option of the holders and may be transferred at the

option of the holders upon surrender of the pre-funded warrants to us together with the appropriate instruments of transfer.

No Listing

There is no established public

trading market for the pre-funded warrants and we do not expect a market to develop. In addition, we do not intend to apply for listing

of the pre-funded warrants on any securities exchange or trading system. Without an active market, the liquidity of the pre-funded warrants

will be limited.

Fundamental Transactions

In the event

we effect certain mergers, consolidations, sales of substantially all of our assets, tender or exchange offers, reclassifications or share

exchanges in which our common share is effectively converted into or exchanged for other securities, cash or property, we consummate a

business combination in which another person acquires 50% of the outstanding common shares, or any person or group becomes the beneficial

owner of 50% of the aggregate ordinary voting power represented by our issued and outstanding common shares, then, upon any subsequent

exercise of the pre-funded warrants, the holders of the pre-funded warrants will have the right to receive any shares of the acquiring

corporation or other consideration it would have been entitled to receive if it had been a holder of the number of common shares then

issuable upon exercise of the pre-funded warrants.

Cashless Exercise

If at the time

of exercise there is no effective registration statement registering, or the prospectus contained therein is not available for issuance

of, the shares issuable upon exercise of the pre-funded warrants, the holder may only exercise the pre-funded warrants on a cashless basis.

When exercised on a cashless basis, a portion of the pre-funded warrants is cancelled in payment of the purchase price payable in respect

of the number of common shares purchasable upon such exercise.

Rights as a Stockholder

Except as otherwise provided

in the pre-funded warrants or by virtue of a holder’s ownership of common shares, the holders of the pre-funded warrants do not

have the rights or privileges of holders of our common shares, including any voting rights, until they exercise their pre-funded warrants.

Amendments and Waivers

The provisions of each pre-funded

warrant may be modified or amended or the provisions thereof waived with the written consent of us and the holder.

No Fractional Shares

No fractional shares or scrip

representing fractional shares shall be issued upon the exercise of the pre-funded warrants. As to any fraction of a share which the

holder would otherwise be entitled to purchase upon such exercise, we shall or shall cause, at our option, the payment of a cash adjustment

in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price of the pre-funded warrants per

whole share or round such fractional share up to the nearest whole share.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common shares is Endeavor Trust Corporation.

Listing

Our

common shares are listed on The Nasdaq Capital Market under the symbol “AKAN”.

LEGAL

MATTERS

We

are being represented by Rimon, P.C., with respect to certain legal matters as to United States federal securities and state securities

law. The validity of the common shares offered in this offering and certain legal matters as to Canadian law will be passed upon for

us by Gowling WLG (Canada) LLP.

EXPERTS

BF

Borgers CPA PC (“BF Borgers”), an independent registered public accounting firm, has audited our financial statements

for the year ended December 31, 2021, and Green Growth CPAs (“Green Growth”), an independent registered public accounting

firm, has audited our financial statements for the year ended December 31, 2022. We have included such financial statements in this prospectus

supplement in reliance on the reports of such firms given on their authority as experts in accounting and auditing. BF Borgers and Green

Growth are independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations

of the SEC and the PCAOB on auditor independence. BF Borgers’ headquarters are located at 5400 W Cedar Ave, Lakewood, CO 80226.

Green Growth’s headquarters are located at 10250 Constellation Blvd., Los Angeles, CA 90067.

ENFORCEABILITY

OF CIVIL LIABILITIES

We

are a corporation organized under the laws of the Province of Ontario, Canada. Most of our directors and executive officers reside in

the United Kingdom and Canada, and significantly all of our assets and the assets of such persons are located outside of the United States.

As a result, it may not be possible for investors to effect service of process within the United States upon these persons or us, or

to enforce against them or us judgments obtained in U.S. courts, whether or not predicated upon the civil liability provisions of the

federal securities laws of the United States or of the securities laws of any state of the United States. There is doubt as to the enforceability

in foreign jurisdictions, either in original actions or in actions for enforcement of judgments of U.S. courts, of civil liabilities

predicated solely on the federal securities laws of the United States or the securities laws of any state of the United States.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” the information into this document prior to the completion of this offering. This means that we can disclose important

information to you by referring you to another document that we have filed separately with the SEC. The information incorporated by reference

is considered a part of this prospectus supplement and you should read that information carefully. Certain information in this prospectus

supplement supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus supplement.

Certain information that we file later with the SEC will automatically update and supersede the information in this prospectus supplement.

Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus

supplement.

We incorporate by reference

into this prospectus supplement the following documents, including any amendments to such filings:

| ● | our

Annual Report on Form 20-F for fiscal 2022, filed with the SEC on May 2, 2023; |

| ● | our

Current Report on Form 6-K filed with the SEC on December 29, 2023, that contains our unaudited condensed consolidated interim financial

statements as of and for the six months ended June 30, 2023; |

| |

● |

our

Current Reports on Form 6-K filed with the SEC on May

30, 2023, July 6, 2023, August

18, 2023, September 20, 2023, September

25, 2023, December 12, 2023, January

4, 2024, February 2, 2024, February

13, 2024, February 20,

2024, February 21, 2024, February

29, 2024, March 1, 2024 and March 5, 2024; |

| ● | our

Registration Statement on Form F-1

filed with the SEC on January 31, 2022, that contains a description of our common shares; |

| ● | any Annual Report on Form 20-F filed with the SEC after the date of

this prospectus supplement; and |

| ● | any other report on Form 6-K submitted to the SEC after the date of

this prospectus supplement and prior to the termination of this offering, but only to the extent that the report expressly states that

we incorporate such report by reference into this prospectus supplement. |

We have not authorized anyone

else to provide you with additional or different information to the information included in and incorporated by reference to this prospectus

supplement. You should rely only on the information provided by and incorporated by reference to this prospectus supplement.

Upon written or oral request,

we shall provide without charge to each person to whom a copy of this prospectus supplement is delivered a copy of any or all of the documents

that are incorporated by reference to this prospectus supplement but not delivered with this prospectus supplement. You may request a

copy of these filings by contacting us at Akanda Corp., 1a, 1b Learoyd Road, New Romney TN28 8XU, United Kingdom; telephone (202) 498-7917.

WHERE YOU CAN FIND MORE INFORMATION

We file annual reports on

Form 20-F, reports on Form 6-K, and other information with the SEC under the Exchange Act. The SEC maintains an Internet site that contains

reports and other information that we file electronically with the SEC and which are available at the SEC’s website at http://www.sec.gov.

In addition, we maintain an Internet website at www.akandacorp.com. Information contained on or accessible through our website

is not incorporated into or made a part of this prospectus supplement or the accompanying prospectus or the registration statement of

which this prospectus supplement and the accompanying prospectus forms a part.

This prospectus supplement

is part of a registration statement that we filed with the SEC. The registration statement contains more information than this prospectus

regarding us and our securities, including certain exhibits. You can obtain a copy of the registration statement from the SEC at the address

listed above or from the SEC’s website listed above.

Prospectus

Akanda Corp.

$5,000,000

common shares

Warrants

Units

We may from time to time

sell our common shares, warrants and units described in this prospectus in one or more offerings. The aggregate initial offering price

of the securities that we may offer and sell under this prospectus will not exceed $5,000,000.

We refer to the common shares,

warrants and units collectively as “securities” in this prospectus.

This prospectus provides

a general description of these securities, which we may offer and sell in amounts, at prices and on terms to be determined at the time

of sale and set forth in a supplement to this prospectus. Each time we sell the securities described in this prospectus, we will provide

specific terms of the securities offered in a supplement to this prospectus. The prospectus supplement may also add, update or change

information contained in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you

invest in any of our securities. This prospectus may not be used to consummate a sale of our securities unless accompanied by an applicable

prospectus supplement.

We may offer the securities

from time through public or private transactions, and in the case of our common shares, on or off The Nasdaq Capital Market (“Nasdaq”),

at prevailing market prices or at privately negotiated prices. These securities may be offered and sold in the same offering or in separate

offerings, to or through underwriters, dealers and agents, or directly to purchasers. The names of any underwriters, dealers, or agents

involved in the sale of our securities registered hereunder and any applicable fees, commissions or discounts will be described in the

applicable prospectus supplement. Our net proceeds from the sale of securities will also be set forth in the applicable prospectus supplement.

Our common shares are listed

on Nasdaq under the symbol “AKAN.” On January 16, 2024, the last reported sale price of our common shares as reported on Nasdaq

was $0.4795 per common share.

INVESTING IN OUR COMMON

SHARES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 3 TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE

BUYING OUR SECURITIES.

Neither the Securities

and Exchange Commission nor any U.S. state or other securities commission has approved or disapproved of these securities or passed upon

the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 29, 2024

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement we filed with the Securities and Exchange Commission, or the “Commission” or the “SEC,”

using the “shelf” registration process. Under the shelf registration process, using this prospectus, together with a prospectus

supplement, we may sell from time to time any combination of the securities described in this prospectus in one or more offerings. This

prospectus provides you with a general description of the securities that may be offered. Each time we sell securities pursuant to this

prospectus, we will provide a prospectus supplement that will contain specific information about the terms of the securities being offered.

A prospectus supplement may include a discussion of any risk factors or other special considerations applicable to those securities or

to us. The prospectus supplement may also add to, update or change information contained in this prospectus and, accordingly, to the extent

inconsistent, the information in this prospectus will be superseded by the information in the prospectus supplement. You should read this

prospectus, any applicable prospectus supplement and any related issuer free writing prospectus, as well as the additional information

incorporated by reference in this prospectus described below under “Where You Can Find More Information” and “Information

Incorporated by Reference” or in any applicable prospectus supplement and any related issuer free writing prospectus, before making

an investment in our securities.

This prospectus contains

summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for

complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of the documents referred to

herein have been filed, or will be filed or incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

Neither the delivery of

this prospectus, any accompanying prospectus supplement or any free writing prospectus prepared by us, nor any sale made under this prospectus,

any accompanying prospectus supplement or any free writing prospectus prepared by us, implies that there has been no change in our affairs

or that the information therein is correct as of any date after the date of this prospectus or of such prospectus supplement or free writing

prospectus, as applicable. You should not assume that the information in this prospectus, including any information incorporated in this

prospectus by reference, the accompanying prospectus supplement or any free writing prospectus prepared by us, is accurate as of any date

other than the date on the front of those documents. Our business, financial condition, results of operations and prospects may have changed

since that date.

You may rely only on the

information contained or incorporated by reference in this prospectus. Neither we nor any other person has authorized anyone to provide

any information other than that contained or incorporated by reference in this prospectus, any accompanying prospectus supplement or in

any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can provide

no assurance as to the reliability of, any other information that others may give you. Neither this prospectus nor any accompanying prospectus

supplement nor any free writing prospectus prepared by or on behalf of us or to which we have referred you constitutes an offer to sell

nor a solicitation of an offer to buy any securities other than those registered by this prospectus, or an offer to sell or a solicitation

of an offer to buy securities where an offer or solicitation would be unlawful. This prospectus does not contain all of the information

included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration

statement, including its exhibits.

Unless otherwise indicated

or the context implies otherwise:

| ● | “Akanda,”

“we,” “us” or “our” refer to Akanda Corp., and its subsidiaries; |

| ● | “common

shares” refers to our common shares, of no par value; |

| ● | “IFRS”

refers to the International Financial Reporting Standards as issued by the International Accounting Standards Board, or IASB; |

| ● | “Nasdaq”

refers to The Nasdaq Capital Market, where our common shares are listed under the symbol “AKAN”; and |

| ● | “US$”

or “U.S. dollars” refers to the legal currency of the United States. |

Except as otherwise stated,

all monetary amounts in this prospectus are presented in U.S. dollars. Unless otherwise indicated, the financial statements and related

notes included, or incorporated by reference, in this prospectus have been prepared in accordance with IFRS as issued by the International

Accounting Standards Board, which differs in certain significant respects from Generally Accepted Accounting Principles in the United

States. Our fiscal year ends on December 31 of each year. References to “fiscal 2022” means the 12-month period ended December

31, 2022, and other fiscal years are referred to in a corresponding manner.

We own or have rights to

trademarks and trade names that we use in connection with the operation of our business, including our corporate name, logos, product

names and website names. Other trademarks and trade names appearing in this prospectus and the documents incorporated by reference are

the property of their respective owners. Solely for your convenience, some of the trademarks and trade names referred to in this prospectus

and the documents incorporated by reference are listed without the ® and TM symbols, but we will assert, to the fullest extent under

applicable law, our rights to our trademarks and trade names.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this

prospectus, any prospectus supplement and in the documents incorporated by reference may constitute forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange

Act of 1934, as amended, or the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for

forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements relate to

future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause

our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity,

performance or achievements expressed or implied by these forward-looking statements.

Words such as, but not limited

to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,”

“targets,” “likely,” “will,” “would,” “could,” and similar expressions or

phrases identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and future

events and financial trends that we believe may affect our financial condition, results of operation, business strategy and financial

needs. Forward-looking statements include, but are not limited to, statements about:

| ● | our

limited operating history; |

| ● | unpredictable

events, such as the COVID-19 outbreak, and associated business disruptions; |

| ● | changes

in cannabis laws, regulations and guidelines; |

| ● | decrease

in demand for cannabis and cannabis-derived products; |

| ● | exposure

to product liability claims and actions; |

| ● | damage

to our reputation due to negative publicity; |

| ● | risks

associated with product recalls; |

| ● | the

viability of our product offerings; |

| ● | our

ability to attract and retain skilled personnel; |

| ● | maintenance

of effective quality control systems; |

| ● | regulatory

compliance risks; |

| ● | risks

inherent in an agricultural business; |

| ● | increased

competition in the markets in which we operate and intend to operate; |

| ● | the

success of our continuing research and development efforts; |

| ● | risks

associated with expansion into new jurisdictions; |

| ● | risks

related to our international operations in Europe; |

| ● | our

ability to obtain and maintain adequate insurance coverage; |

| ● | our

ability to identify and integrate strategic acquisitions, investments and partnerships and to manage our growth; |

| ● | our

ability to raise capital and the availability of future financing; |

| ● | our

ability to maintain the listing of our securities on Nasdaq; and |

| ● | other

risks and uncertainties, including those listed under the caption “Risk Factors” in our reports and filings we make with the SEC from time

to time. |

You should read thoroughly

this prospectus, any prospectus supplement and the documents incorporated by reference with the understanding that our actual future results

may be materially different from and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary

statements. Other sections of this prospectus and in the documents incorporated by reference include additional factors which could adversely

impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time

and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or

the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements.

This prospectus and documents