Amended Current Report Filing (8-k/a)

24 September 2021 - 10:03PM

Edgar (US Regulatory)

0000006281trueAs reported in the Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) by Analog Devices, Inc. (the “Company”) on August 26, 2021 (the “Original Filing”), the Company completed the acquisition of Maxim Integrated Products, Inc. (“Maxim”) on the same date. This Amendment No. 1 amends and supplements the Original Filing to provide the historical financial statements of Maxim and the pro forma financial information required by Item 9.01 of Form 8-K that were omitted from the Original Filing as permitted by Item 9.01(a)(3).00000062812021-08-262021-08-26

_________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________________________________

FORM 8-K/A

(Amendment No. 1)

_____________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 26, 2021

_____________________________________________________________________________________________________

|

|

|

|

|

|

|

Analog Devices, Inc.

|

|

(Exact name of Registrant as Specified in its Charter)

|

|

|

______________________________________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts

|

|

1-7819

|

|

04-2348234

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Analog Way,

|

Wilmington,

|

MA

|

01887

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

|

|

|

Registrant's telephone number, including area code: (781) 329-4700

Not Applicable

|

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

______________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange

on which registered

|

|

Common Stock $0.16 2/3 par value per share

|

ADI

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

As reported in the Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) by Analog Devices, Inc. (the “Company”) on August 26, 2021 (the “Original Filing”), the Company completed the acquisition of Maxim Integrated Products, Inc. (“Maxim”) on the same date. This Amendment No. 1 amends and supplements the Original Filing to provide the historical financial statements of Maxim and the pro forma financial information required by Item 9.01 of Form 8-K that were omitted from the Original Filing as permitted by Item 9.01(a)(3).

Item 9.01. Financial Statements and Exhibits

(a) Financial Statements of Business Acquired

Attached hereto and incorporated by reference herein are the following exhibits, which contain the financial statements required to be filed pursuant to Rule 3-05 of Regulation S-X and are incorporated by reference:

99.2 Audited Consolidated Financial Statements of Maxim as of June 26, 2021 and June 27, 2020 and for the three years in the period ended June 26, 2021, and the related notes to such audited consolidated financial statements, including Item 9a. Controls and Procedures and Item 15-2-a Financial Statement Schedule filed as part of Maxim's Annual Report on Form 10-K for the fiscal year ended June 26, 2021 filed with the SEC on August 20, 2021.

(b) Pro forma financial information

Attached hereto and incorporated by reference herein is the following exhibit, which contains the pro forma financial information of the Company required to be filed and is incorporated by reference:

99.3 Unaudited pro forma condensed combined statements of income for the fiscal year ended October 31, 2020, and for the nine months ended July 31, 2021, which gives effect to the acquisition of Maxim as if it had occurred on November 3, 2019, the unaudited pro forma condensed combined balance sheet as of July 31, 2021, which gives effect to the acquisition of Maxim as if it had occurred on July 31, 2021, and the related notes to such unaudited pro forma condensed combined financial statements.

(d) Exhibits

The following exhibits are filed with this Current Report:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

2.1*

|

|

Agreement and Plan of Merger, dated as of July 12, 2020, by and among Analog Devices, Inc., Maxim Integrated Products, Inc. and Magneto Corp. (incorporated by reference to Exhibit 2.1 of the Company’s Current Report on Form 8-K filed with the SEC on July 15, 2020).

|

|

23.1**

|

|

|

|

99.1*

|

|

|

|

99.2

|

|

Audited consolidated financial statements of Maxim as of June 26, 2021 and June 27, 2020 and for the three years in the period ended June 26, 2021, and the related notes to such audited consolidated financial statements, including Item 9a. Controls and Procedures and Item 15-2-a Financial Statement Schedule (incorporated by reference to Maxim’s Annual Report on Form 10-K for the fiscal year ended June 26, 2021 filed with the SEC on August 20, 2021).

|

|

99.3**

|

|

Unaudited pro forma condensed combined statements of income for the fiscal year ended October 31, 2020, and for the nine months ended July 31, 2021, which gives effect to the acquisition of Maxim as if it had occurred on November 3, 2019, the unaudited pro forma condensed combined balance sheet as of July 31, 2021, which gives effect to the acquisition of Maxim as if it had occurred on July 31, 2021, and the related notes to such unaudited pro forma condensed combined financial statements.

|

|

101.INS

|

|

The instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the inline XBRL document.**

|

|

101.SCH

|

|

Inline XBRL Schema Document.**

|

|

101.CAL

|

|

Inline XBRL Calculation Linkbase Document.**

|

|

101.LAB

|

|

Inline XBRL Labels Linkbase Document.**

|

|

|

|

|

|

|

|

|

|

|

|

101.PRE

|

|

Inline XBRL Presentation Linkbase Document.**

|

|

101.DEF

|

|

Inline XBRL Definition Linkbase Document.**

|

|

104

|

|

Cover page Interactive Data File (formatted as inline XBRL with applicable taxonomy extension information contained in Exhibits 101).

|

|

*

|

|

Previously filed as an exhibit to the Original Filing.

|

|

**

|

|

Submitted electronically herewith.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

September 24, 2021

|

ANALOG DEVICES, INC.

|

|

|

|

|

By:

|

/s/ Prashanth Mahendra-Rajah

|

|

|

|

|

|

Prashanth Mahendra-Rajah

|

|

|

|

|

|

Senior Vice President, Finance and Chief Financial Officer

|

|

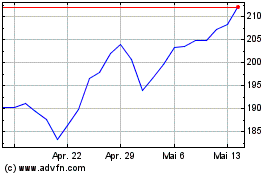

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024