By Don Clark

Slowing growth and rising costs are driving a historic wave of

consolidation among semiconductor makers looking to streamline

their organizations and product lines.

So far this year, chip companies have announced $100.6 billion

in mergers and acquisitions, according Dealogic, exceeding the

$37.7 billion total for all of 2014.

There have been fewer deals--276 announced so far this year,

compared with 369 in 2014, Dealogic says. But the deals are larger,

including Avago Technologies Ltd.'s sector-record $37 billion

purchase of Broadcom Corp., announced in May.

The totals could go higher. Bloomberg reported last week that

four chip companies-- Analog Devices Inc., Maxim Integrated

Products Inc., SanDisk Corp. and Fairchild Semiconductor

International Inc.--were in talks concerning different deal

options. Representatives of those companies declined to

comment.

"It's buy or be sold," summed up Alex Lidow, chief executive of

Efficient Power Conversion Corp., a startup he co-founded in 2007

after 30 years leading chip maker International Rectifier Corp.

Chip makers have long used acquisitions to obtain new

technology. But many recent deals resemble consolidation waves in

older industries, motivated mainly by trimming costs in areas like

manufacturing, sales and engineering.

Avago, for example, has projected it can wring $750 million in

annual savings beginning in 2017 after swallowing Broadcom. That

transaction was the largest high-tech acquisition on record before

Dell Inc. announced its $67 billion plan to buy EMC Corp. last

week.

In part, chip makers are responding to intense competition that

is crimping revenue. Chips are as important as ever, and now appear

in a broader range of everyday products, including cars, appliances

and other gadgets in homes and businesses.

But Gartner Inc. this month projected that world-wide

semiconductor revenue would decline 0.8% this year, the first dip

since 2012. The research firm predicts sales will grow 1.9% in

2016, to $344.1 billion.

Reducing the number of suppliers can ease price competition, and

help the survivors combine complementary product lines, industry

executives say. That saves money on sales efforts while allowing

companies to sell a great number of chips that in some cases can be

tailored to work better together. For example, Intel Corp. says its

planned $16.7 billion acquisition of Altera Corp. will let it craft

new products to improve hardware like server systems.

"Customers more and more want to have fewer suppliers and more

value, and pieces that work together," said Jalal Bagherli, chief

executive of U.K.-based Dialog Semiconductor PLC, after announcing

a $4.6 billion acquisition of its deal for Atmel Corp. last

month.

At the same time, the cost of designing new chips continues to

escalate, as Moore's Law allows chip makers to squeeze more

circuitry on each square of silicon. Designing a chip with more

transistors takes longer and costs tens of millions of dollars more

than earlier technology.

Companies like Intel that sell huge volumes of particular

products can take those costs in stride. But others developing

products for smaller markets can't expect to generate enough

revenue to cover development costs. New entrants from China and

Taiwan add to pricing pressure.

"We now have a combination of slowing growth in a mature market,

along with an increase in the cost and the complexity of being in

the semiconductor industry," said Mark Edelstone, a managing

director at Morgan Stanley, which advises chip makers on mergers

and acquisitions. "That combination is challenging."

Some chip makers that specialize in older analog

technologies--used for chores like converting voltages and

measuring temperatures--have suffered less from competition. But

they have begun feeling pressures from slowing growth, too.

One example is Mr. Lidow's former company, founded in 1947 by

his father and grandfather. International Rectifer in January was

acquired by Germany's Infineon Technologies AG for about $3

billion, a deal whose stated motivations included melding two lines

of power-management chips. Mr. Lidow, shying away from the battle

to build a new business in silicon chips, opted after leaving

International Rectifier in 2007 to start a company focusing on

gallium nitride, an alternative material that is being used instead

of silicon for applications like managing power in electronic

devices.

As the chip industry matures, the age of some leaders is also a

factor. One example is Raymond Zinn, 78 years old, who led Silicon

Valley chip maker Micrel Corp. for 37 years. The company agreed to

an $839 million buyout from Microchip Technology Inc. that closed

in July.

"You have CEOs who are getting older," said Dan Niles, a

longtime industry watcher and founding partner at investment

management firm Alpha One Capital Partners. "To some extent it's

the changing of the guard."

Write to Don Clark at don.clark@wsj.com

Access Investor Kit for "FAIRCHILD SEMICONDUCTOR INTERNATIONAL

INC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US3037261035

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 18, 2015 16:59 ET (20:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

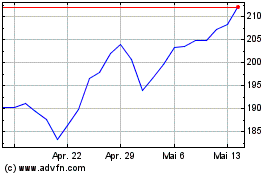

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024