Analog Devices

(ADI) reported first-quarter 2013 earnings of 44 cents per share,

in line with the Zacks Consensus Estimate. Adjusted earnings per

share exclude one-time items, but include stock-based compensation

expense.

Revenues

Analog Devices generated revenues

of $622.1 million, down 10.0% sequentially and 4.0% year over year

and at the lower end of the management’s revenue guidance range of

$612-$653 million (a 6%-12% sequential decline).

Revenues by End

Market

The industrial

market generated 45% of Analog Devices’ total revenue (down 8.0%

sequentially and 3.0% year over year). This is a diversified market

for Analog Devices, including the industrial automation,

instrumentation, energy, defense and healthcare segments.

Management optimism gave way in the last quarter, as the macro

weakness had Analog’s industrial customers (both distribution and

OEM) cutting inventories and orders.

Management expects the industrial

end market to register strong growth in the second quarter as order

rates have been improving since early January.

Communications

generated 20% of total revenue, down 12.0% sequentially but up 2.0%

year over year. The decline was broad based, with the largest

sequential decrease coming from the wireless infrastructure

sub-segment. Though the market performed poorly in the last

quarter, management expects the business to improve, as there is

great focus on 4G and LTE by leading phone makers, such as Samsung

and Apple (AAPL). Analog Devices has offerings for

both the traditional and 4G networks, so it stands to gain when

there is any increase in demand. Additionally, it has higher

content in the 4G segment, which along with its position at leading

OEMs should remain a positive factor influencing revenue

growth.

The Consumer

segment, which Analog clubs with the computing and handset

businesses, was down 22.0% sequentially and 6% year over year, due

to seasonality.

The automotive

segment generated around 17% of Analog Devices’ first quarter

revenues, down 3.0% sequentially and 11.0% from the year-ago

quarter. Sluggish demand in Europe due to weaker sales affected

Analog’s automotive revenues in the last quarter. The growing

electronic content in vehicles remained a positive however, with

demand for products like driver assistance and powertrain

efficiency systems remaining strong.

Revenues by Product

Line

The sequential and year-over-year

decline in revenues was broad-based across product lines.

Analog signal processing products

(85% of total revenue) were down 11.0% sequentially and 3.0% year

over year. Converters were down 10.0% sequentially and 3.0% year

over year. Amplifier revenues declined 10.0% sequentially and 4.0%

year over year. Other analog products were down 15.0% and 1.0% from

the previous and year-ago quarters, respectively.

Power management and reference

products remained at roughly 6% of revenues, down 14.0%

sequentially and 12.0% from the year-ago quarter. These products

are generally sold into the consumer/computing markets. Management

has refocused the business over the last few years to concentrate

on this fast-growing product line.

Digital Signal Processing (DSPs)

(8% of total revenue) were down 10.0% sequentially and 4.0% from

the year-ago level.

Margins

Reported gross margin for the

quarter was 62.7%, down 110 basis points (bps) sequentially and 50

bps year over year. The primary reason for the gross margin decline

was the change in sales mix, which favored lower-margin products in

the last quarter.

Analog reported operating expenses

of $222.8.0 million, down 0.3% from $223.4 million incurred in the

year-ago quarter. Research and development and selling, general and

administrative costs, were both up as a percentage of sales from

the year-ago quarters. The net result was a GAAP operating margin

of 24.7% compared with 28.3% in the year-ago quarter.

Net Profit

On a GAAP basis, Analog recorded a

net profit of $131.2 million or 42 cents per share compared with

$139.4 million or 46 cents per share in the year-ago quarter.

Analog generated adjusted net

profit of $136.5 million compared with$140.5 million in the

year-ago quarter. Pro-forma earnings per share came in at 44 cents,

compared with 46 cents in the last quarter.

Balance Sheet

Analog exited the first quarter

with cash and short-term investments of approximately $3.99

billion, up from $3.90 billion in the prior quarter. Trade

receivables were $329.6 million, down from $339.9 million in the

prior quarter.

Cash generated from operations was

around $158.0 million. Analog Devices spent $18.3 million on capex,

$90.7 million on cash dividends and $17.0 million on share

repurchases in the last quarter.

During the quarter, the company

announced that its board of directors has approved a 13% increase

in its regular quarterly dividend, from $0.30 to $0.34 30 cents to

34 cents per outstanding share of common stock. The dividend will

be paid on Mar 12, 2013, to all shareholders of record at the close

of business on as of Mar 1, 2013.

Guidance

Management expects second-quarter

revenues to increase 4%–8% sequentially with a gross margin of 64%,

operating expenses of around $224 million, a tax rate of 17% and

EPS of 49–55 cents.

Our Take

Analog Devices has a significant

percentage of its revenues coming from the industrial and

automotive markets, both of which are expected to see strong demand

in the near term due to an improved demand environment and healthy

order rates expected in the industrial market. The dividend hike

was also quite encouraging in the last quarter.

Given these positives, it is not

surprising that the revenue guidance was up sequentially but below

the consensus expectations of $666 million. However, with continued

uncertainty in key markets, the shares may remain range bound in

the near term.

Currently, Analog has a Zacks Rank

#3 (Hold). Other stocks that have been performing well and are

worth a look include Autodesk Inc. (ADSK) and

Netflix Inc. (NFLX), both with a Zacks Rank #2

(Buy).

APPLE INC (AAPL): Free Stock Analysis Report

ANALOG DEVICES (ADI): Free Stock Analysis Report

AUTODESK INC (ADSK): Free Stock Analysis Report

NETFLIX INC (NFLX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

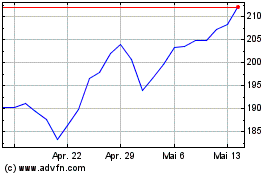

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024