Analog Devices, Inc. (NASDAQ: ADI), a global leader in

high-performance semiconductors for signal processing applications,

today announced financial results for its first quarter of fiscal

year 2013, which ended February 2, 2013.

Results for the First Quarter of Fiscal

2013

- Revenue totaled $622.1 million

- Gross margin was 62.7% of revenue

- Operating margin was 26.9% of revenue,

excluding special items, and was 24.7% on a GAAP basis

- Diluted EPS was $0.44, excluding

special items, and was $0.42 on a GAAP basis

- Cash flow from operations was $158

million, or 25.4% of revenue

“Results for the first quarter were within the range we

communicated and represented a generally weak macroeconomic

environment exacerbated by year-end inventory reductions at many

customers. Nevertheless, our operating performance remained strong,

as we carefully managed our business to balance the long term

opportunities for ADI with the realities of current market

conditions,” said Jerald G. Fishman, CEO. “In January, order rates

began to improve across most markets and geographies and have

remained strong so far this quarter. As a result, we are planning

for solid revenue growth in our second quarter, in the range of

4-8% sequentially with significant operating leverage.”

ADI also announced that its Board of Directors has approved a 13

percent increase in its regular quarterly dividend, from $0.30 to

$0.34 per outstanding share of common stock. The dividend will be

paid on March 12, 2013 to all shareholders of record at the close

of business on March 1, 2013.

Please refer to the schedules provided for a summary of revenue

and earnings, selected balance sheet information, and the cash flow

statement for the first quarter of fiscal year 2013, as well as the

immediately prior and year-ago quarters. The first quarter of

fiscal year 2012 was a 14-week period. Additional information on

revenue by end market and revenue by product type is provided on

Schedules D and E. A more complete table covering prior periods is

available at investor.analog.com.

Outlook for the Second Quarter of

Fiscal 2013

The following statements are based on current expectations.

These statements are forward- looking and actual results may differ

materially, as a result of, among other things, the important

factors discussed at the end of this release. These statements

supersede all prior statements regarding our business outlook set

forth in prior ADI news releases, and ADI disclaims any obligation

to update these forward-looking statements.

- Revenue estimated to increase in the

range of 4% to 8% sequentially

- Gross margin estimated to be

approximately 64%

- Operating expenses estimated to be

approximately $224 million

- Tax rate estimated to be approximately

17%

- Diluted EPS estimated at $0.49 to

$0.55

Conference Call Scheduled for 5:00 pm ET

ADI will host a conference call to discuss the first quarter

results and short-term outlook today, beginning at 5:00 pm ET.

Investors may join via webcast, accessible at investor.analog.com,

or by telephone (call 706-634-7193 ten minutes before the call

begins and provide the password "ADI.").

A replay will be available two hours after the completion of the

call. The replay may be accessed for up to two weeks by dialing

855-859-2056 (replay only) and providing the conference ID:

92068413, or by visiting investor.analog.com.

Non-GAAP Financial Information

This release includes non-GAAP financial measures that are not

in accordance with, nor an alternative to, generally accepted

accounting principles and may be different from non-GAAP measures

used by other companies. In addition, these non-GAAP measures are

not based on any comprehensive set of accounting rules or

principles.

Schedule F of this press release provides the reconciliation of

the Company’s non-GAAP measures to its GAAP measures.

Manner in Which Management Uses the

Non-GAAP Financial Measures

Management uses non-GAAP operating expenses, non-GAAP operating

income, non-GAAP operating margins, and non-GAAP diluted earnings

per share to evaluate the Company’s operating performance from

continuing operations against past periods and to budget and

allocate resources in future periods. These non-GAAP measures also

assist management in understanding and evaluating the Company’s

operating results and trends in the Company’s business.

Economic Substance Behind Management’s

Decision to Use Non-GAAP Financial Measures

The items excluded from the non-GAAP measures were excluded

because they are of a non-recurring or non-cash nature.

The following item is excluded from our non-GAAP operating

expenses, non-GAAP operating income, non-GAAP operating margin, and

non-GAAP diluted earnings per share:

Restructuring-Related Expenses. These expenses are incurred in

connection with facility closures, consolidation of manufacturing

facilities, and other cost reduction efforts. Apart from ongoing

expense savings as a result of such items, these expenses and the

related tax effects have no direct correlation to the operation of

our business in the future.

The following item is excluded from our non-GAAP diluted

earnings per share:

Tax-Related Item. In the first quarter of fiscal year 2013, the

Company recorded a $6.3 million tax benefit related to the

reinstatement of the R&D tax credit in January 2013,

retroactive to January 1, 2012. We excluded this tax-related item

from our non-GAAP measures because it is not associated with the

tax expense on our current operating results.

Why Management Believes the Non-GAAP

Financial Measures Provide Useful Information to

Investors

Management believes that the presentation of non-GAAP operating

expenses, non-GAAP operating income, non-GAAP operating margins,

and non-GAAP diluted EPS is useful to investors because it provides

investors with the operating results that management uses to manage

the Company.

Material Limitations Associated with

Use of the Non-GAAP Financial Measures

Analog Devices believes that non-GAAP operating expenses,

non-GAAP operating income, non-GAAP operating margins, and non-GAAP

diluted EPS have material limitations in that they do not reflect

all of the amounts associated with our results of operations as

determined in accordance with GAAP and that these measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP measures. In addition, our non-GAAP

measures may not be comparable to the non-GAAP measures reported by

other companies. The Company’s use of non-GAAP measures, and the

underlying methodology when excluding certain items, is not

necessarily an indication of the results of operations that may be

expected in the future, or that the Company will not, in fact,

record such items in future periods.

Management’s Compensation for

Limitations of Non-GAAP Financial Measures

Management compensates for these material limitations in

non-GAAP operating expenses, non-GAAP operating income, non-GAAP

operating margins, and non-GAAP diluted EPS by also evaluating our

GAAP results and the reconciliations of our non-GAAP measures to

the most directly comparable GAAP measures. Investors should

consider our non-GAAP financial measures in conjunction with the

corresponding GAAP measures.

About Analog Devices

Innovation, performance, and excellence are the cultural pillars

on which Analog Devices has built one of the longest standing,

highest growth companies within the technology sector. Acknowledged

industry-wide as the world leader in data conversion and signal

conditioning technology, Analog Devices serves over 60,000

customers, representing virtually all types of electronic

equipment. Analog Devices is headquartered in Norwood,

Massachusetts, with design and manufacturing facilities throughout

the world. Analog Devices' common stock is included in the S&P

500 Index.

This release may be deemed to contain forward-looking statements

intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, among other things, our

statements regarding expected revenue, earnings per share,

operating expenses, gross margin, tax rate, and other financial

results, expected production and inventory levels, expected market

trends, and expected customer demand and order rates for our

products, that are based on our current expectations, beliefs,

assumptions, estimates, forecasts, and projections about our

business and the industry and markets in which Analog Devices

operates. The statements contained in this release are not

guarantees of future performance, are inherently uncertain, involve

certain risks, uncertainties, and assumptions that are difficult to

predict, and do not give effect to the potential impact of any

mergers, acquisitions, divestitures, or business combinations that

may be announced or closed after the date hereof. Therefore, actual

outcomes and results may differ materially from what is expressed

in such forward-looking statements, and such statements should not

be relied upon as representing Analog Devices’ expectations or

beliefs as of any date subsequent to the date of this press

release. We do not undertake any obligation to update

forward-looking statements made by us. Important factors that may

affect future operating results include: sovereign debt issues

globally, any faltering in global economic conditions or the

stability of credit and financial markets, erosion of consumer

confidence and declines in customer spending, unavailability of raw

materials, services, supplies or manufacturing capacity, changes in

geographic, product or customer mix, adverse results in litigation

matters, and other risk factors described in our most recent

filings with the Securities and Exchange Commission. Our results of

operations for the periods presented in this release are not

necessarily indicative of our operating results for any future

periods. Any projections in this release are based on limited

information currently available to Analog Devices, which is subject

to change. Although any such projections and the factors

influencing them will likely change, we will not necessarily update

the information, as we will only provide guidance at certain points

during the year. Such information speaks only as of the original

issuance date of this release.

Analog Devices and the Analog Devices logo are registered

trademarks or trademarks of Analog Devices, Inc. All other

trademarks mentioned in this document are the property of their

respective owners.

Analog Devices, First Quarter, Fiscal

2013

Schedule

A

Revenue and Earnings Summary (GAAP) (In thousands, except

per-share amounts)

Three Months Ended 1Q 13 4Q 12

1Q 12 Feb. 2, 2013 Nov. 3,

2012 Feb. 4, 2012 Revenue $ 622,134 $ 694,964 $

648,058 Year-to-year change -4 % -3 % -11 % Quarter-to-quarter

change -10 % 2 % -10 % Cost of sales (1) 231,850

251,682 238,668

Gross margin 390,284 443,282 409,390 Gross margin percentage 62.7 %

63.8 % 63.2 % Year-to-year change (basis points) -50 -50 -300

Quarter-to-quarter change(basis points) -110

-180 -110 Operating

expenses: R&D (1) 125,164 130,394 124,378 Selling, marketing

and G&A (1) 97,560 97,609 99,045 Special charges

14,071 - 2,595

Total operating expenses 236,795 228,003 226,018 Total operating

expenses percentage 38.1 % 32.8 % 34.9 % Year-to-year change (basis

points) 320 140 430 Quarter-to-quarter change (basis points)

530 -170 350

Operating income 153,489 215,279 183,372 Operating income

percentage 24.7 % 31.0 % 28.3 % Year-to-year change (basis points)

-360 -190 -730 Quarter-to-quarter change (basis points)

-630 -10 -460

Other expense 3,380 2,755

3,286 Income before income tax 150,109

212,524 180,086 Provision for income taxes 18,887 33,337 40,704 Tax

rate percentage 12.6 % 15.7 %

22.6 % Net income $ 131,222 $ 179,187

$ 139,382 Shares used for EPS - basic

303,484 300,679 297,788 Shares used for EPS - diluted 310,275

307,954 305,531 Earnings per share - basic $ 0.43 $ 0.60 $

0.47 Earnings per share - diluted $ 0.42 $ 0.58 $ 0.46

Dividends paid per share $ 0.30 $ 0.30

$ 0.25 (1) Includes stock-based compensation

expense as follows: Cost of sales $ 1,667 $ 1,905 $ 1,807 R&D $

5,600 $ 6,124 $ 5,885 Selling, marketing and G&A $ 5,794 $

6,248 $ 5,640

Analog Devices, First Quarter, Fiscal

2013

Schedule

B

Selected Balance Sheet Information (GAAP) (In

thousands) 1Q 13 4Q 12 1Q

12 Feb. 2, 2013 Nov. 3, 2012

Feb. 4, 2012 Cash & short-term investments $

3,986,979 $ 3,900,378 $ 3,667,398 Accounts receivable, net 329,578

339,881 301,999 Inventories (1) 307,263 313,723 297,160 Other

current assets 190,115 142,203

128,611 Total current assets 4,813,935 4,696,185 4,395,168

PP&E, net 491,431 500,867 475,689 Investments 32,720 30,242

30,954 Goodwill and intangible assets 313,084 312,605 286,339 Other

65,638 80,448 89,684

Total assets $ 5,716,808 $ 5,620,347 $

5,277,834 Deferred income on shipments to distributors, net

$ 243,396 $ 238,541 $ 227,261 Other current liabilities 265,139

286,538 270,794 Long-term debt, non-current 759,672 807,098 855,662

Non-current liabilities 124,804 122,811 81,682 Shareholders' equity

4,323,797 4,165,359

3,842,435 Total liabilities & equity $ 5,716,808

$ 5,620,347 $ 5,277,834

(1) Includes $2,381, $2,517, and $2,428

related to stock-based compensation in 1Q13, 4Q12, and 1Q12,

respectively.

Analog Devices, First Quarter, Fiscal 2013

Schedule

C

Cash Flow Statement (GAAP) (In thousands)

Three Months

Ended 1Q 13 4Q 12 1Q 12 Feb. 2,

2013 Nov. 3, 2012 Feb. 4, 2012 Cash

flows from operating activities: Net Income $ 131,222 $ 179,187 $

139,382 Adjustments to reconcile net income to net cash provided by

operations: Depreciation 27,755 27,484 28,243 Amortization of

intangibles 55 54 - Stock-based compensation expense 13,061 14,277

13,332 Excess tax benefit - stock options (5,975 ) (2,678 ) (1,896

) Other non-cash activity (1,362 ) (1,417 ) 591 Deferred income

taxes (9,635 ) (5,696 ) 3,623 Changes in operating assets and

liabilities 2,848 24,836

31,545 Total adjustments 26,747

56,860 75,438 Net

cash provided by operating activities 157,969

236,047 214,820 Percent

of total revenue 25.4 % 34.0 %

33.1 % Cash flows from investing activities:

Additions to property, plant and equipment (18,269 ) (37,511 )

(25,289 ) Purchases of short-term available-for-sale investments

(1,653,593 ) (1,882,319 ) (2,192,874 ) Maturities of short-term

available-for-sale investments 1,551,147 1,713,973 1,659,792 Sales

of short-term available-for-sale investments 283,164 99,843 151,841

(Increase) decrease in other assets (2,048 )

(447 ) 327 Net cash provided by (used

for) investing activities 160,401

(106,461 ) (406,203 ) Cash flows from

financing activities: Term loan repayments (60,108 ) (33,625 )

(15,625 ) Dividend payments to shareholders (90,679 ) (91,372 )

(74,416 ) Repurchase of common stock (17,001 ) (20,830 ) (78,591 )

Proceeds from employee stock plans 113,770 80,527 48,858 Contingent

consideration payment (3,752 ) - (1,991 ) (Decrease) increase in

other financing activities (1,027 ) (1,125 ) 5,166 Excess tax

benefit - stock options 5,975

2,678 1,896 Net cash used for financing

activities (52,822 ) (63,747 )

(114,703 ) Effect of exchange rate changes on cash

1,416 845 (1,572 )

Net increase (decrease) in cash and cash equivalents 266,964

66,684 (307,658 ) Cash and cash equivalents at beginning of period

528,833 462,149

1,405,100 Cash and cash equivalents at end of period

$ 795,797 $ 528,833 $ 1,097,442

Analog Devices, First Quarter, Fiscal

2013

Schedule

D

Revenue Trends by

End Market

The categorization of revenue by end market is determined using a

variety of data points including the technical characteristics of

the product, the “sold to” customer information, the "ship to"

customer information and the end customer product or application

into which our product will be incorporated. As data systems for

capturing and tracking this data evolve and improve, the

categorization of products by end market can vary over time. When

this occurs we reclassify revenue by end market for prior periods.

Such reclassifications typically do not materially change the

sizing of, or the underlying trends of results within, each end

market.

Three Months Ended

Feb. 2, 2013

Nov. 3, 2012

Feb. 4, 2012 Revenue %*

Q/Q % Y/Y % Revenue Revenue

Industrial $ 282,654 45 % -8 % -3 % $ 306,042

$ 290,660 Automotive 107,581 17 % -3 % -11 % 110,401 120,588

Consumer 106,929 17 % -22 % -6 % 136,379 114,261 Communications

124,970 20 % -12 % 2 % 142,142 122,549

Total Revenue $ 622,134 100 %

-10 % -4 % $ 694,964

$ 648,058 * The sum of the individual

percentages does not equal the total due to rounding

Analog Devices, First Quarter, Fiscal 2013

Schedule

E

Revenue Trends by

Product Type

The categorization of our products into broad categories is based

on the characteristics of the individual products, the

specification of the products and in some cases the specific uses

that certain products have within applications. The categorization

of products into categories is therefore subject to judgment in

some cases and can vary over time. In instances where products move

between product categories we reclassify the amounts in the product

categories for all prior periods. Such reclassifications typically

do not materially change the sizing of, or the underlying trends of

results within, each product category.

Three Months Ended Feb. 2, 2013 Nov.

3, 2012 Feb. 4, 2012 Revenue

%* Q/Q % Y/Y % Revenue

Revenue Converters $ 277,637 45 % -10 %

-3 % $ 307,252 $ 285,135 Amplifiers / Radio Frequency 157,853 25 %

-10 % -4 % 174,521 164,454 Other analog 95,693 15 % -15 % -1

% 112,083 96,238 Subtotal Analog Signal Processing

531,183 85 % -11 % -3 % 593,856 545,827 Power

management & reference 39,460 6 % -14 % -12 %

45,808 44,865

Total Analog Products $

570,643 92 % -11 % -3

% $ 639,664 $ 590,692 Digital

Signal Processing 51,491 8 % -7 % -10 % 55,300

57,366

Total Revenue $ 622,134 100

% -10 % -4 % $

694,964 $ 648,058 * The sum of the

individual percentages does not equal the total due to rounding

Analog Devices, First Quarter, Fiscal 2013

Schedule

F

Reconciliation from Non-GAAP to GAAP Data (In thousands, except

per-share amounts) See "Non-GAAP

Financial Information" in this press release for a description of

the items excluded from our non-GAAP measures.

Three Months Ended 1Q 13 4Q

12 1Q 12 Feb. 2, 2013 Nov. 3, 2012

Feb. 4, 2012 GAAP Operating Expenses

$ 236,795 $ 228,003 $

226,018 Percent of Revenue 38.1 %

32.8 % 34.9 % Restructuring-Related

Expense (14,071 ) - -

Non-GAAP Operating Expenses $ 222,724

$ 228,003 $

226,018 Percent of Revenue 35.8

% 32.8 % 34.9 % GAAP

Operating Income/Margin $ 153,489 $

215,279 $ 183,372 Percent of Revenue

24.7 % 31.0 % 28.3 %

Restructuring-Related Expense 14,071 -

-

Non-GAAP Operating

Income/Margin $ 167,560 $

215,279 $ 183,372

Percent of Revenue 26.9 % 31.0 %

28.3 % GAAP Diluted EPS $

0.42 $ 0.58 $ 0.46 Impact of the

Reinstatement of the R&D Tax Credit (0.02 ) - -

Restructuring-Related Expense 0.04 -

-

Non-GAAP Diluted EPS $

0.44 $ 0.58

$ 0.46

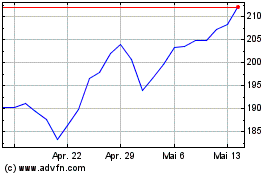

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024