UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 333-226308

COLOR STAR TECHNOLOGY CO., LTD.

(Translation of registrant’s name into English)

80 Broad Street, 5th Floor

New York, NY 10005

Tel: +1 (929) 317-2699

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Entry into a Material Agreement

Color Star Technology Co., Ltd. (the "Company")

entered into certain copyright acquisition agreement ("Copyright Agreement") dated as of December 17, 2023, by and among

Nine Star Parties and Entertainment LLC., an Ohio limited liability company, (“Nine Star"), the Company, and Color Star

DMCC, a United Arab Emirates corporation (“Color Star DMCC”) and wholly owned subsidiary of the Company. Pursuant to

the Agreement, Nine Star agreed to sell to Color Star DMCC all of Nine Star’s right, title and interests in and to 24 pieces of

music works created by Nine Star (the “Works”), for an aggregate consideration of US$7,200,000, to be paid in 24,000,000

restricted Class A Ordinary Shares, par value $0.04 per share, of the Company (the “Shares”).

The Shares to be issued as consideration to Nine

Star are exempt from registration pursuant to Regulation S of the Securities and Exchange Act of 1934. The transaction contemplated by

the Copyright Agreement closed on December 19, 2023 when all of the closing conditions in the Copyright Agreement were satisfied.

The Agreement is attached hereto as Exhibit 99.1

and is incorporated herein by reference. The foregoing summary of the terms of the Agreement is subject to, and qualified in its entirety

by, such document.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: December 19, 2023

| |

COLOR STAR TECHNOLOGY CO., LTD. |

| |

|

|

| |

By: |

/s/ Louis Luo |

| |

Name: |

Louis Luo |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

COPYRIGHT ACQUISITION AGREEMENT

This COPYRIGHT ACQUISITION

AGREEMENT (“Agreement”), dated as of December 17, 2023, is made by and between Nine Star Parties and Entertainment LLC, an

Ohio limited liability company (“Seller”), Color Star DMCC, a United Arab Emirates Corporation with offices located

at Unit No. 3376 DMCC Business Center Level No. 1 Jewelry & Gemplex 3 Dubai (“Buyer”), and Color Star Technology

Co., Ltd. (“ADD”), a Cayman Islands exempt company with offices located at 7 World Trade Center, Suite 4621, New York,

NY 10007.

WHEREAS, Buyer is a wholly

owned subsidiary of ADD.

WHEREAS, Seller wishes to

sell to Buyer, and Buyer wishes to purchase from Seller, all of Seller’s right, title, and interest in and to certain Works (as

defined below), including all copyrights and related rights in the Works, subject to the terms and conditions set forth herein.

NOW THEREFORE, in consideration

of the mutual covenants and agreements set forth herein and for other good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, the parties hereto agree as follows:

1. Purchase and Sale of

Copyrights. Subject to the terms and conditions set forth herein, Seller hereby irrevocably sells, assigns, transfers, and conveys

to Buyer, and Buyer hereby accepts, all of Seller’s right, title, and interest in and to the following (collectively, “Acquired

Rights”):

(a) all copyrights

in the 24 pieces of music works made by Seller (“Works”) listed in Schedule 1, whether registered or unregistered, arising

under any applicable law of any jurisdiction throughout the world or any treaty or other international convention, including but not limited

to, the right (i) to reproduce the Works in copies or phonorecords; (ii) to prepare derivative works based upon the Works; (iii) to distribute

copies or phonorecords of the Works to the public by sale or other transfer of ownership, or by rental, lease, or lending; (iv) to perform

the Works publicly; and (v) to display the Works publicly (collectively, “Acquired Copyrights”);

(b) all claims and

causes of action with respect to any of the foregoing arising under any applicable law, treaty, or other international convention throughout

the world, whether accruing before, on, or after the date hereof including all rights to and claims for damages, restitution, and injunctive

and other legal and equitable relief for past, present, and future infringement, misappropriation, violation, breach, or default; and

(c) all other rights,

privileges, and protections of any kind whatsoever of Seller accruing under any of the foregoing provided by any applicable law, treaty,

or other international convention throughout the world.

2. No Liabilities.

Buyer neither assumes nor is otherwise liable for any obligations, claims, or liabilities of Seller of any kind, whether known or unknown,

contingent, matured, or otherwise, whether currently existing or hereafter arising (collectively, “Excluded Liabilities”).

3. Purchase Price.

(a) The aggregate

purchase price for the Acquired Rights shall be $7,200,000 USD (the “Purchase Price”).

(b) Seller agrees

and acknowledges that the Purchase Price may be paid through the issuance of 24,000,000 restricted ordinary shares, par value $0.04 per

share (“Ordinary Shares”), issued by Color Star Technology Co., Ltd. (NASDAQ symbol of ADD) (the “Restricted Shares”

or “Payment”) as substitute consideration for the payment of $7,200,000 USD calculated at a price of $0.3 USD per share. Seller

shall be entitled to appoint any agent (“Agent”) to receive

such Restricted Shares.

(c) Within ten (10)

business days from parties’ full execution of this Agreement, Buyer shall deliver or cause to be delivered to the Seller, mutually

agreed upon by the parties, the Restricted Shares.

(d) ADD and the

Buyer shall consent to remove the restriction on 24,000,000 Restricted Shares after the recordation of the Works in the name of Buyer

or any party designated by Buyer, in the records of the United States Copyright Office (“US Copyright Office”), provided

that a minimum of six (6) months has elapsed since the Restricted Shares have been held by Rich America so as to satisfy the holding period

requirement set forth in paragraph (d) of Rule 144 of the Securities Act of 1933.

4. Deliverables. Upon

execution of this Agreement, Seller shall deliver to Buyer the following:

(a) an assignment

in the form set out in Exhibit A (the “Assignment”) and duly executed by Seller, transferring all of Seller’s

right, title, and interest in and to the Acquired Rights to Buyer; and

(b) the complete

prosecution files, if any, for all Acquired Copyrights in such form and medium as requested by Buyer and all such other documents, correspondence,

and information as are reasonably requested by Buyer to register, own, or otherwise use the Acquired Rights.

5. Moral Rights. Seller

shall have provided to Buyer, on or before execution of this Agreement, a written, absolute, irrevocable waiver, in favor of Buyer, from

each individual who is an author (sole or joint) of any of the Works, in relation to all rights of paternity, integrity, attribution,

disclosure, withdrawal, and any other rights that may be known as “moral rights” (“Moral Rights”) vested

in such author in relation to the Works.

6. Further Assurances;

Recordation.

(a) From and after

the date hereof, each of the parties hereto shall execute and deliver such additional documents, instruments, conveyances, and assurances,

and take such further actions, as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated

by this Agreement and the documents to be delivered hereunder.

(b) Without limiting

the foregoing, and without limiting Section 4(a), Seller shall execute and deliver to Buyer, such assignments and other documents, certificates,

and instruments of conveyance in a form satisfactory to Buyer and suitable for filing with the US Copyright Office and the registries

and other recording governmental authorities in all applicable jurisdictions (including with respect to legalization, notarization, apostille,

certification, and other authentication) as necessary to record and perfect the Assignment, and to vest in Buyer all right, title, and

interest in and to the Acquired Rights in accordance with applicable law. As between Seller and Buyer, Buyer shall be responsible, at

Buyer’s expense, for filing the Assignment and other documents, certificates, and instruments of conveyance with the applicable

governmental authorities; provided that, upon Buyer’s request, Seller shall take such steps and actions, and provide such cooperation

and assistance, to Buyer and its successors, assigns, and legal representatives, including the execution and delivery of any affidavits,

declarations, oaths, exhibits, assignments, powers of attorney, or other documents, as may be necessary to effect, evidence, or perfect

the registration and assignment of the Acquired Rights to Buyer, or any of Buyer’s successors or assigns.

7. Representations and

Warranties of Seller. Seller represents and warrants to Buyer that the statements contained in this Section 7 are true and correct

as of the date hereof.

(a) Authority

of Seller; Enforceability. Seller is duly organized, validly existing, and in good standing as a limited liability company as represented

herein under the laws of its jurisdiction of organization. Seller has the full right, power, and authority to enter into this Agreement

and perform its obligations hereunder. The execution, delivery, and performance of this Agreement by Seller’s representative whose

signature is set forth herein has been duly authorized by all necessary organizational action of Seller and, when executed and delivered

by both parties, this Agreement will constitute a legal, valid, and binding obligation of Seller, enforceable against Seller in accordance

with its terms and conditions.

(b) No Conflicts;

Consents. The execution, delivery, and performance by Seller of this Agreement, and the consummation of the transactions contemplated

hereby, do not and will not: (i) violate or conflict with the by-laws, or other organizational documents of Seller; (ii) violate or conflict

with any judgment, order, decree, statute, law, ordinance, rule, or regulation; (iii) conflict with, or result in (with or without notice

or lapse of time or both), any violation of or default under, or give rise to a right of termination, acceleration, or modification of

any obligation or loss of any benefit under, any contract or other instrument to which this Agreement or any of the Acquired Rights are

subject; or (iv) result in the creation or imposition of any encumbrances on the Acquired Rights. No consent, approval, waiver, or authorization

is required to be obtained by Seller from any person or entity (including any governmental authority) in connection with the execution,

delivery, and performance by Seller of this Agreement, or to enable Buyer to register, own, and use the Acquired Rights.

(c) Ownership.

Seller owns all right, title, and interest in and to the Acquired Rights, free and clear of liens, security interests, and other encumbrances.

Seller is in full compliance with all legal requirements applicable to the Acquired Rights and Seller’s ownership and use thereof.

(d) Status of

the Works. The Works are original except for (i) material in the public domain, and (ii) those excerpts from other works as maybe

included with the written permission of the copyright owners. The Works (i) are unpublished and no applications to register the copyrights

therein have been made to date; (ii) have not been publicly performed in any manner; (iii) do not contain any defamatory material or injurious

instructions; (iv) do not violate any right of privacy or any other right of any other person; and (v) are not in the public domain.

(e) Validity

and Enforceability. The Acquired Rights are valid, subsisting, and enforceable in all applicable jurisdictions.

(f) Non-Infringement.

The registration, ownership, and/or exercise of the Acquired Rights did not, do not, and will not infringe, misappropriate, or otherwise

violate the intellectual property or other rights of any third party or violate any applicable regulation or law. No person has infringed,

misappropriated, or otherwise violated, or is currently infringing, misappropriating, or otherwise violating, any of the Acquired Rights.

(g) Legal Actions.

There are no actions settled, pending, or threatened (including in the form of offers to obtain a license): (i) alleging any infringement,

misappropriation, or other violation of the intellectual property rights of any third party based on the use or exploitation of any Acquired

Rights; (ii) challenging the validity, enforceability, registrability, or ownership of any Acquired Rights or Seller’s rights with

respect thereto; or (iii) by Seller alleging any infringement, misappropriation, or other violation by any third party of any Acquired

Rights.

(h) Licenses.

The Seller has not licensed or authorized the publication or performance of the Works in any manner and has not entered into any agreements

or granted any rights, the performance of which would in any way prevent, limit

or restrict the performance of any of the terms of this Agreement.

8. Indemnification.

(a) Survival.

All representations, warranties, covenants, and agreements contained herein and all related rights to indemnification shall continue in

full force and effect following the date hereof regardless of the expiration or termination of this Agreement.

(b) Seller shall

defend, indemnify, and hold harmless Buyer, Buyer’s affiliates, and their respective shareholders, directors, officers, employees,

agents, licensees, successors, and assigns (each, a “Buyer Indemnified Party”) from and against all losses, damages,

liabilities, deficiencies, claims, actions, judgments, settlements, interest, awards, penalties, fines, fees, costs, or expenses of whatever

kind, including attorneys’ fees, the cost of enforcing any right to indemnification hereunder, and the cost of pursuing any insurance

providers (collectively, “Losses”) arising out of or in connection with any third-party claim, suit, action, or proceeding

(each, a “Third-Party Claim”) related to any: (i) actual or alleged inaccuracy in or breach or non-fulfillment of any

representation, warranty, covenant, agreement, or obligation of Seller contained in this Agreement or any document to be delivered hereunder;

(ii) Excluded Liabilities; or (iii) Seller’s breach of any of its obligations hereunder.

(c) A Buyer Indemnified

Party shall promptly notify the Seller upon becoming aware of a Third-Party Claim with respect to which Seller is obligated to provide

indemnification under this Section 8 (“Indemnified Claim”). Seller shall promptly assume control of the defense and

investigation of the Indemnified Claim, with counsel reasonably acceptable to the Buyer Indemnified Party, and the Buyer Indemnified Party

shall reasonably cooperate with Seller in connection therewith, in each case at Seller’s sole cost and expense. The Buyer Indemnified

Party may participate in the defense of such Indemnified Claim, with counsel of its own choosing and at its own cost and expense. Seller

shall not settle any Indemnified Claim on any terms or in any manner that adversely affects the rights of any Buyer Indemnified Party

without the Buyer Indemnified Party’s prior written consent. If Seller fails or refuses to assume control of the defense of such

Indemnified Claim, the Buyer Indemnified Party shall have the right, but no obligation, to defend against such Indemnified Claim, including

settling such Indemnified Claim after giving notice to Seller, in each case in such manner and on such terms as the Buyer Indemnified

Party may deem appropriate. Neither the Buyer Indemnified Party’s failure to perform any obligation under this Section 8(c) nor

any act or omission of the Buyer Indemnified Party in the defense or settlement of any Indemnified Claim shall relieve Seller of its obligations

under this Section 8, including with respect to any costs incurred by the Buyer Indemnified Party in defending such Indemnified Claim

and any other Losses.

9. Equitable Remedies.

Seller acknowledges that: (a) a breach or threatened breach by Seller of any of its obligations under this Agreement would give rise to

irreparable harm to Buyer for which monetary damages would not be an adequate remedy; and (b) if a breach or a threatened breach by Seller

of any such obligations occurs, Buyer will, in addition to any and all other rights and remedies that may be available to such party at

law, at equity, or otherwise in respect of such breach, be entitled to equitable relief, including a restraining order, an injunction,

specific performance, and any other relief that may be available from a court of competent jurisdiction, without any requirement to: (i)

post a bond or other security; or (ii) prove actual damages or that monetary damages will not afford an adequate remedy.

10. Confidentiality.

The parties shall have keep the monetary payment provided in this Agreement confidential.

11. Miscellaneous.

(a) Severability.

If any term or provision of this Agreement is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or

unenforceability will not affect the enforceability of any other term or provision of this Agreement or invalidate or render unenforceable

such term or provision in any other jurisdiction.

(b) Successors

and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors

and assigns.

(c)

Governing Law and Arbitration. This Agreement and all matters arising out of or relating to this Agreement, including tort

and statutory claims, are governed by, and construed in accordance with, the laws of the State of New York, without giving effect to any

conflict of laws provisions thereof that would result in the application of the laws of a different jurisdiction. Given the international

nature of this Agreement, any and all disputes arising out of or related to this Agreement shall be resolved by binding arbitration to

be conducted in the English language in New York, New York under the administration of the International Centre for Dispute Resolution

(ICDR) pursuant to the ICDR International Arbitration Rules. Any award resulting from the arbitration shall be binding and enforceable

in courts of applicable jurisdiction. The parties further agree that any court proceedings with respect to this Agreement shall be held

in the United States District Court for the Southern District of New York or, if federal jurisdiction is not available, in a state court

located in New York County, New York and the parties consent to the jurisdiction of the federal and state courts in and for the State

of New York, New York County.

(d) Entire Agreement.

This Agreement contains the entire understanding of the parties with respect to the subject matter hereof and supersedes all prior and

contemporaneous written or oral understandings, agreements, representations, and warranties with respect to such subject matter. There

are no restrictions, promises, representations, warranties, covenants or undertakings, other than those expressly set forth or referred

to herein or the documents or instruments referred to herein, which collectively supersede all prior agreements and the understandings

among the parties with respect to the subject matter contained herein.

(e) Severability.

The invalidity, illegality, or unenforceability of any provision herein does not affect any other provision herein or the validity, legality,

or enforceability of such provision in any other jurisdiction. Upon such determination that any term or other provision is invalid, illegal

or incapable of being enforced, the parties will substitute for any invalid, illegal or unenforceable provision a suitable and equitable

provision that carries out, so far as may be valid, legal and enforceable, the intent and purpose of such invalid, illegal or unenforceable

provision.

(f) Amendment.

The parties may not amend this Agreement except by written instrument signed by the parties.

(g) Waiver.

No waiver of any right, remedy, power, or privilege under this Agreement (“Right(s)”) is effective unless contained in a writing

signed by the party charged with such waiver. No failure to exercise, or delay in exercising, any Right operates as a waiver thereof.

No single or partial exercise of any Right precludes any other or further exercise thereof or the exercise of any other Right. The Rights

under this Agreement are cumulative and are in addition to any other rights and remedies available at law or in equity or otherwise. This

Agreement is binding upon and inures to the benefit of the parties and their respective successors and permitted assigns. Except for the

parties, their successors and permitted assigns, there are no third-party beneficiaries under this Agreement.

(h) Counterparts.

The parties may execute this Agreement in counterparts, each of which shall be deemed an original, and all of which taken together shall

constitute one and the same instrument. Delivery of an executed counterpart’s signature page of this Agreement by facsimile, email

in portable document format (.pdf), or by any other electronic means (including DocuSign) intended to preserve the original graphic and

pictorial appearance of a document has the same effect as delivery of an executed original of this Agreement.

[signature page follows]

IN WITNESS WHEREOF, Seller and Buyer have caused

this Agreement to be executed as of the date first written above by their respective duly authorized officers.

| |

Nine Star Parties and Entertainment LLC |

| |

|

| |

By: |

/s/ Shahid Mehmood |

| |

Name: |

Shahid Mehmood |

| |

Title: |

CEO |

| |

Color Star DMCC |

| |

|

| |

By: |

/s/ Ao Qi |

| |

Name: |

Ao Qi |

| |

Title: |

CEO |

| |

|

| |

Color Star Technology Co., Ltd. |

| |

|

| |

By : |

/s/ Haixiang Luo |

| |

Name: |

Haixiang Luo |

| |

Title: |

CEO |

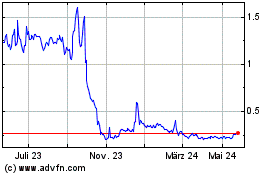

Color Star Technology (NASDAQ:ADD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

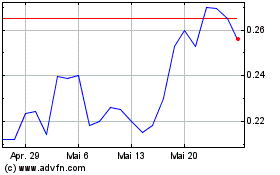

Color Star Technology (NASDAQ:ADD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025