false0001720580NONE00017205802024-10-162024-10-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 16, 2024 |

Adicet Bio, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38359 |

81-3305277 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

131 Dartmouth Street, Floor 3 |

|

Boston, Massachusetts |

|

02116 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 503-9095 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

ACET |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On October 16, 2024, Adicet Bio, Inc. (the “Company”) issued a press release titled “Adicet Bio Announces FDA Clearance of IND Amendment to Evaluate ADI-001 in Idiopathic Inflammatory Myopathy and Stiff Person Syndrome,” a copy of which is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On October 16, 2024, the Company announced that the U.S. Food and Drug Administration cleared the Company’s Investigational New Drug amendment to evaluate ADI-001 in idiopathic inflammatory myopathy (IIM) and stiff person syndrome (SPS). The Company plans to initiate enrollment for IIM and SPS patients as part of the ongoing Phase 1 trial in autoimmune diseases in the first quarter of 2025. The ADI-001 Phase 1 program in autoimmune diseases will have four separate arms, enrolling lupus nephritis and systemic lupus erythematosus patients into one arm, systemic sclerosis patients into a second arm, anti-neutrophil cytoplasmic autoantibody-associated vasculitis patients into a third arm, and IIM and SPS patients into a fourth arm. The fourth cohort combines several rare autoimmune muscle diseases into a single dose-finding population, including SPS and the following IIM subtypes: dermatomyositis, anti-synthetase syndrome, immune-mediated necrotizing myopathy, polymyositis, and overlap myositis.

Item 9.01 Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ADICET BIO, INC. |

|

|

|

|

Date: |

October 16, 2024 |

By: |

/s/ Nick Harvey |

|

|

Name: Title: |

Nick Harvey

Chief Financial Officer |

Adicet Bio Announces FDA Clearance of IND Amendment to Evaluate ADI-001 in Idiopathic Inflammatory Myopathy and Stiff Person Syndrome

ADI-001 clinical development program now addresses six autoimmune diseases

Patient enrollment for idiopathic inflammatory myopathy and stiff person syndrome cohort expected to be initiated in the first quarter of 2025

Company plans to report initial clinical data from Phase 1 study in multiple autoimmune diseases in the first half of 2025

REDWOOD CITY, Calif. & BOSTON – October 16, 2024 – Adicet Bio, Inc. (Nasdaq: ACET), a clinical stage biotechnology company discovering and developing allogeneic gamma delta T cell therapies for autoimmune diseases and cancer, today announced that the U.S. Food and Drug Administration (FDA) has agreed to an amendment to the Company’s Investigational New Drug (IND) application to evaluate ADI-001 in idiopathic inflammatory myopathy (IIM) and stiff person syndrome (SPS) as part of the ongoing Phase 1 trial in autoimmune diseases. The Company plans to initiate enrollment for IIM and SPS patients in the first quarter of 2025. This announcement follows the FDA’s recent agreements on amendments to the Company’s ADI-001 IND application to evaluate three additional indications beyond lupus nephritis (LN), including systemic lupus erythematosus (SLE), systemic sclerosis (SSc) and anti-neutrophil cytoplasmic autoantibody (ANCA)-associated vasculitis (AAV).

“The FDA’s acceptance of our IND amendment to evaluate ADI-001 in patients with IIM and SPS builds on our recent momentum in autoimmune diseases, expanding our efforts to six autoimmune indications as we aim to bring our differentiated gamma delta T cell therapy candidates to more patients in need of new treatment options,” said Chen Schor, President and Chief Executive Officer at Adicet Bio. “Following our recent announcement highlighting clinical biomarker data which demonstrated robust B-cell depletion and preferential trafficking to tissues and organs, we believe in ADI-001’s best-in-class potential for the treatment of autoimmune diseases, and we look forward to initiating patient enrollment in IIM and SPS in the first quarter of 2025 in our ongoing Phase 1 clinical program.”

The ADI-001 Phase 1 program in autoimmune diseases will have four separate arms, enrolling LN and SLE patients into one arm, SSc patients into a second arm, AAV patients into a third arm, and IIM and SPS patients into a fourth arm. The fourth cohort combines several rare autoimmune muscle diseases into a single dose-finding population, including SPS and the following IIM subtypes: dermatomyositis, anti-synthetase syndrome, immune-mediated necrotizing myopathy, polymyositis, and overlap myositis. Enrolled patients will receive a single dose of ADI-001. The dose-limiting toxicity window is 28 days with response and safety assessments conducted on Day 28 and during the follow up period on months 3, 6, 9, 12, 18 and 24. The primary objectives of the study are to evaluate the safety and tolerability of ADI-001. Secondary objectives include measuring cellular kinetics, pharmacodynamics, changes in autoantibody titers, and appropriate disease activity scores in each indication.

About Idiopathic Inflammatory Myopathy

Idiopathic inflammatory myopathy (IIM, or myositis) refers to a group of rare autoimmune disorders characterized by chronic muscle inflammation and progressive muscle weakness. IIM primarily affects skeletal muscles but can also involve other organs such as the lungs, heart and skin. Five of the main subtypes include dermatomyositis, anti-synthetase syndrome, immune-mediated necrotizing myopathy, polymyositis, and overlap myositis, all of which can lead to significant functional impairment and have the potential to be life-threatening. There is no available cure for IIM and many patients on current treatments have refractory disease and may experience significant side effects.

About Stiff-Person Syndrome

Stiff person syndrome (SPS) is a rare neurological autoimmune disorder characterized by severe muscle stiffness and spasms, primarily affecting the torso and limbs. Muscle stiffness caused by SPS often impairs mobility, making it difficult for patients to walk, bend, or perform daily activities. Muscle spasms can be triggered by sudden stimuli such as loud noises, physical contact, or emotional distress, and can result in a "statue-like" posture when severe. Due to its rarity and overlapping symptoms with other conditions, SPS is frequently misdiagnosed, often as an anxiety disorder or movement disorder. There is currently no available cure for SPS.

About ADI-001

ADI-001 is an investigational allogeneic gamma delta chimeric antigen receptor (CAR) T cell therapy targeting CD20 for the treatment of autoimmune diseases. ADI-001 was granted Fast Track Designation by the FDA for the treatment of relapsed/refractory class III or class IV lupus nephritis (LN), and the ongoing Phase 1 study is also evaluating ADI-001 for the treatment of systemic lupus erythematosus (SLE), systemic sclerosis (SSc), anti-neutrophil cytoplasmic autoantibody (ANCA)-associated vasculitis (AAV), idiopathic inflammatory myopathy (IIM, or myositis) and stiff person syndrome (SPS). In the Phase 1 GLEAN trial, ADI-001 was shown to target B-cells via an anti-CD20 CAR and demonstrated robust exposure and complete CD19+ B cell depletion both in peripheral blood and secondary lymphoid tissue.

About Adicet Bio, Inc.

Adicet Bio, Inc. is a clinical stage biotechnology company discovering and developing allogeneic gamma delta T cell therapies for autoimmune diseases and cancer. Adicet is advancing a pipeline of “off-the-shelf” gamma delta T cells, engineered with chimeric antigen receptors (CARs), to facilitate durable activity in patients. For more information, please visit our website at https://www.adicetbio.com.

Forward-Looking Statements

This press release contains “forward-looking statements” of Adicet within the meaning of the Private Securities Litigation Reform Act of 1995 relating to the business and operations of Adicet. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, but are not limited to, express or implied statements regarding: clinical development of Adicet’s product candidates, including future plans or expectations for ADI-001 and the potential safety, tolerability and efficacy of ADI-001 for the treatment of autoimmune diseases; the potential for ADI-001 to be a best-in-class treatment for autoimmune diseases; the clinical development of

ADI-001 in LN, SLE, SSc and AAV; and the expected progress, timing and success of the Phase 1 clinical study of ADI-001 in IIM and SPS, including timing and expectations for enrollment and future data releases.

Any forward-looking statements in this press release are based on management’s current expectations and beliefs of future events, and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements, including without limitation, the effect of global economic conditions and public health emergencies on Adicet’s business and financial results, including with respect to disruptions to our preclinical and clinical studies, business operations, employee hiring and retention, and ability to raise additional capital; Adicet’s ability to execute on its strategy including obtaining the requisite regulatory approvals on the expected timeline, if at all; that positive results, including interim results, from a preclinical or clinical study may not necessarily be predictive of the results of future or ongoing studies; clinical studies may fail to demonstrate adequate safety and efficacy of Adicet’s product candidates, which would prevent, delay, or limit the scope of regulatory approval and commercialization; and regulatory approval processes of the U.S. Food and Drug Administration and comparable foreign regulatory authorities are lengthy, time-consuming, and inherently unpredictable; and Adicet’s ability to meet production and product release expectations. For a discussion of these and other risks and uncertainties, and other important factors, any of which could cause Adicet’s actual results to differ from those contained in the forward-looking statements, see the section entitled “Risk Factors” in Adicet’s most recent annual report on Form 10-Q and subsequent filings with the U.S. Securities and Exchange Commission (SEC), as well as discussions of potential risks, uncertainties, and other important factors in Adicet’s other filings with the SEC. All information in this press release is as of the date of the release, and Adicet undertakes no duty to update this information unless required by law.

Adicet Bio, Inc.

Investor and Media Contacts

Investors:

Anne Bowdidge

abowdidge@adicetbio.com

Janhavi Mohite

Precision AQ

212-362-1200

janhavi.mohite@precisionaq.com

Media:

Kerry Beth Daly

kbdaly@adicetbio.com

v3.24.3

Document And Entity Information

|

Oct. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 16, 2024

|

| Entity Registrant Name |

Adicet Bio, Inc.

|

| Entity Central Index Key |

0001720580

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38359

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-3305277

|

| Entity Address, Address Line One |

131 Dartmouth Street, Floor 3

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02116

|

| City Area Code |

(650)

|

| Local Phone Number |

503-9095

|

| Entity Information, Former Legal or Registered Name |

Not applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ACET

|

| Security Exchange Name |

NONE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

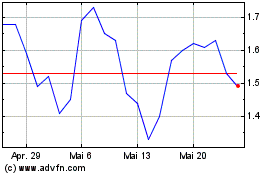

Adicet Bio (NASDAQ:ACET)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Adicet Bio (NASDAQ:ACET)

Historical Stock Chart

Von Mär 2024 bis Mär 2025