false000107049400010704942024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2024 |

Acadia Pharmaceuticals Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-50768 |

06-1376651 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

12830 El Camino Real, Suite 400 |

|

San Diego, California |

|

92130 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 558-2871 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

ACAD |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, Acadia Pharmaceuticals Inc. issued a press release announcing its financial results for the third quarter and nine months ended September 30, 2024. A copy of this press release is furnished herewith as Exhibit 99.1. Pursuant to the rules and regulations of the Securities and Exchange Commission, such exhibit and the information set forth therein and in this Item 2.02 have been furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing regardless of any general incorporation language.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Acadia Pharmaceuticals Inc. |

|

|

|

|

Date: |

November 6, 2024 |

By: |

/s/ Jennifer J. Rhodes |

|

|

|

Jennifer J. Rhodes

Executive Vice President, Chief Legal Officer & Secretary |

Acadia Pharmaceuticals Reports Third Quarter 2024 Financial Results and Operating Overview

- 3Q24 total revenues of $250.4 million, up 18% year-over-year

- 3Q24 NUPLAZID® (pimavanserin) net product sales of $159.2 million, up 10% year-over-year

- 3Q24 DAYBUE™ (trofinetide) net product sales of $91.2 million, up 36% year-over-year

SAN DIEGO, CA, November 6, 2024 – Acadia Pharmaceuticals Inc. (Nasdaq: ACAD) today announced its financial results for the third quarter ended September 30, 2024.

“The success of Acadia’s two growing commercial franchises is clearly reflected in our third quarter 2024 results, where we delivered $250.4 million in total revenues, putting us on track to reach an impressive milestone of more than $1 billion in annualized sales in 2025,” said Catherine Owen Adams, Chief Executive Officer. “In my new role as CEO, I’m inspired and excited by the possibilities that lie ahead for Acadia, both with our current portfolio and the exciting innovations in our pipeline. The opportunity to deliver additional groundbreaking therapies to patients who need them is truly compelling. Furthermore, I see significant potential to enhance shareholder value as we continue to execute our commercial priorities and advance our pipeline assets.”

Company Updates

•In August, world-renowned actor/entrepreneur and Parkinson’s disease advocate Ryan Reynolds announced with the Company the launch of a multi-faceted disease education campaign, More to Parkinson’s®, to raise awareness among caregivers, patients and their care providers about a common, yet under-recognized aspect of Parkinson’s disease – Parkinson’s-related hallucinations and delusions.

•Advancing the science in Parkinson’s disease with data presentations at the International Congress of Parkinson’s Disease and Movement Disorders Society in October on the topics of sleep improvements and the value of early treatment of Parkinson’s disease psychosis with pimavanserin versus treating later in disease progression.

•In October, Health Canada granted marketing authorization of DAYBUE (trofinetide) for the treatment of Rett syndrome in adult and pediatric patients two years of age and older under its Priority Review process. The Notice of Compliance authorization of DAYBUE makes it the first and only drug approved in Canada for the treatment of Rett syndrome.

•In November, the Company announced it entered into a definitive asset purchase agreement to sell its Rare Pediatric Disease Priority Review Voucher (PRV) for $150 million, following the closing of the sale. Pursuant to the license agreement, Acadia is required to pay Neuren Pharmaceuticals Limited one-third of the net proceeds received from the sale of the PRV.

Financial Results

Revenues

Net product sales of NUPLAZID were $159.2 million and $144.8 million for the three months ended September 30, 2024 and 2023, respectively. The 10% year-over-year increase in net product sales of NUPLAZID included 7% volume growth in 2024 compared to 2023. Net product sales of NUPLAZID were $446.5 million and $405.3 million for the nine months ended September 30, 2024 and 2023, respectively.

Net product sales of DAYBUE were $91.2 million and $66.9 million for the three months ended September 30, 2024 and 2023, respectively. Net product sales of DAYBUE were $251.7 million and

$90.1 million for the nine months ended September 30, 2024 and 2023, respectively. The increase in net product sales of DAYBUE for both periods was primarily due to the growth in unit sales.

Research and Development

Research and development expenses were $66.6 million, compared to $157.0 million for the three months ended September 30, 2024 and 2023, respectively. The decrease was mainly due to decreased business development payments, which in the period ending September 30, 2023 included the $100.0 million payment to Neuren under the license agreement for trofinetide. For the nine months ended September 30, 2024 and 2023, research and development expenses were $202.5 million and $284.9 million, respectively. The decrease was mainly due to the aforementioned payment, partially offset by increased costs from clinical stage programs.

Selling, General and Administrative

Selling, general and administrative expenses were $133.3 million and $97.9 million for the three months ended September 30, 2024 and 2023, respectively. For the nine months ended September 30, 2024 and 2023, selling, general and administrative expenses were $358.3 million and $295.1 million, respectively. The increase for this period was primarily driven by the costs related to the consumer activation program to support the NUPLAZID franchise, increased marketing costs in the U.S. to support DAYBUE and investments to support commercialization of DAYBUE outside the U.S.

Net Income (Loss)

For the three months ended September 30, 2024, Acadia reported net income of $32.8 million, or $0.20 per common share, compared to net loss of $65.2 million, or $0.40 per common share, for the same period in 2023. Net income for the three months ended September 30, 2024 included $26.2 million of non-cash stock-based compensation expense. Net loss for the three months ended September 30, 2023 included $18.5 million of non-cash stock-based compensation expense. For the nine months ended September 30, 2024, Acadia reported net income of $82.7 million, or $0.50 per common share, compared to a net loss of $107.1 million, or $0.65 per common share. Net income for the nine months ended September 30, 2024 included $56.6 million of non-cash stock-based compensation expense. Net loss for the nine months ended September 30, 2023 included $48.4 million of non-cash stock-based compensation expense.

Cash and Investments

At September 30, 2024, Acadia’s cash, cash equivalents and investment securities totaled $565.3 million, compared to $438.9 million at December 31, 2023.

Full Year 2024 Financial Guidance

Acadia is updating its 2024 guidance:

•NUPLAZID net product sales guidance is narrowed to the high end of the prior range and is now expected to be $600 to $610 million.

•DAYBUE net product sales guidance is narrowed to the low end of the prior range and is now expected to be $340 to $350 million.

•Total revenue guidance is revised to a range of $940 to $960 million.

•R&D expense guidance is lowered and is now expected to be between $280 to $290 million.

•SG&A expense guidance is increased and is now expected to be between $480 to $495 million.

Conference Call and Webcast Information

Acadia will host a conference call to discuss the third quarter 2024 results today, Wednesday, November 6, 2024 at 1:30 p.m. PT/4:30 p.m. ET. The conference call may be accessed by registering for the call here. Once registered, participants will receive an email with the dial-in number and unique PIN number to use for accessing the call.

About NUPLAZID® (pimavanserin)

Pimavanserin is a selective serotonin inverse agonist and antagonist preferentially targeting 5-HT2A receptors. These receptors are thought to play an important role in neuropsychiatric disorders. In vitro, pimavanserin demonstrated no appreciable binding affinity for dopamine (including D2), histamine, muscarinic, or adrenergic receptors. Pimavanserin was approved for the treatment of hallucinations and delusions associated with Parkinson’s disease psychosis by the U.S. Food and Drug Administration in April 2016 under the trade name NUPLAZID.

About DAYBUE™ (trofinetide)

Trofinetide is a synthetic version of a naturally occurring molecule known as the tripeptide glycine-proline-glutamate (GPE). The mechanism by which trofinetide exerts therapeutic effects in patients with Rett syndrome is unknown. Trofinetide was approved for the treatment of Rett syndrome in adults and pediatric patients 2 years of age and older by the U.S. Food and Drug Administration in March 2023 under the trade name DAYBUE.

About Acadia Pharmaceuticals

Acadia is advancing breakthroughs in neuroscience to elevate life. Since our founding we have been working at the forefront of healthcare to bring vital solutions to people who need them most. We developed and commercialized the first and only FDA-approved drug to treat hallucinations and delusions associated with Parkinson’s disease psychosis and the first and only approved drug in the United States and Canada for the treatment of Rett syndrome. Our clinical-stage development efforts are focused on Prader-Willi syndrome, Alzheimer’s disease psychosis and multiple other programs targeting neuropsychiatric symptoms in central nervous system disorders. For more information, visit us at Acadia.com and follow us on LinkedIn and X.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements other than statements of historical fact and can be identified by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential,” “continue” and similar expressions (including the negative thereof) intended to identify forward-looking statements. Forward-looking statements contained in this press release, include, but are not limited to, statements about: (i) our business strategy, objectives and opportunities, including support for and innovations in our pipeline assets and business development opportunities, and potential for enhanced shareholder value; (ii) plans for, including timing, development and progress of commercialization or regulatory timelines for, NUPLAZID, DAYBUE (both within and outside the U.S.) and our product candidates; (iii) benefits to be derived from and efficacy of our products, including the potential advantages of NUPLAZID and DAYBUE; (iv) the timing and conduct of our clinical trials, including continued enrollment of our clinical trials in Prader-Willi syndrome and Alzheimer’s disease psychosis, and the timing and content of our presentations regarding our clinical trials; (v) our estimates regarding our future financial performance, profitability or capital requirements, including our full year 2024 financial guidance and potential achievement of our milestone of annualized sales in 2025 ; and (vi) the closing of the sale of the PRV, receipt of payment for the PRV in connection with the closing, HSR clearance of the sale and the anticipated use of proceeds from the sale of the PRV. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our

forward-looking statements. Such risks, uncertainties and other factors include, but are not limited to: our dependency on the continued successful commercialization of NUPLAZID and DAYBUE and our ability to maintain or increase sales of NUPLAZID or DAYBUE; our plans to commercialize DAYBUE outside the U.S., including in Canada; the costs of our commercialization plans and development programs, and the financial impact or revenues from any commercialization we undertake; our ability to satisfy or waive all required closing conditions for the sale of the PRV and ultimately close the PRV sale; our ability to obtain HSR clearance in a timely manner or at all; our ability to successfully deploy the proceeds of the PRV sale as anticipated; our ability to obtain necessary regulatory approvals for our product candidates and, if and when approved, market acceptance of our products; the risks associated with clinical trials and their outcomes, including risks of unsuccessful enrollment and negative or inconsistent results; our dependence on third-party collaborators, clinical research organizations, manufacturers, suppliers and distributors; the impact of competitive products and therapies; our ability to generate or obtain the necessary capital to fund our operations; our ability to grow, equip and train our specialized sales forces; our ability to manage the growth and complexity of our organization; our ability to maintain, protect and enhance our intellectual property; and our ability to continue to stay in compliance with applicable laws and regulations. Given the risks and uncertainties, you should not place undue reliance on these forward-looking statements. For a discussion of these and other risks, uncertainties and other factors that may cause our actual results, performance or achievements to differ, please refer to our quarterly report on Form 10-Q for the quarter ended June 30, 2024 as well as our subsequent filings with the Securities and Exchange Commission (SEC) from time to time, including our quarterly report on Form 10-Q for the quarter ended September 30, 2024 being filed with the SEC today, which will be available at www.sec.gov. The forward-looking statements contained herein are made as of the date hereof, and we undertake no obligation to update them after this date, except as required by law.

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Product sales, net |

|

$ |

250,401 |

|

|

$ |

211,699 |

|

|

$ |

698,195 |

|

|

$ |

495,396 |

|

Total revenues |

|

|

250,401 |

|

|

|

211,699 |

|

|

|

698,195 |

|

|

|

495,396 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales (1)(2) |

|

|

18,857 |

|

|

|

14,622 |

|

|

|

60,038 |

|

|

|

23,747 |

|

Research and development (2) |

|

|

66,606 |

|

|

|

156,963 |

|

|

|

202,518 |

|

|

|

284,878 |

|

Selling, general and administrative (2) |

|

|

133,294 |

|

|

|

97,890 |

|

|

|

358,348 |

|

|

|

295,094 |

|

Total operating expenses |

|

|

218,757 |

|

|

|

269,475 |

|

|

|

620,904 |

|

|

|

603,719 |

|

Income (loss) from operations |

|

|

31,644 |

|

|

|

(57,776 |

) |

|

|

77,291 |

|

|

|

(108,323 |

) |

Interest income, net |

|

|

6,586 |

|

|

|

4,125 |

|

|

|

18,451 |

|

|

|

12,475 |

|

Other income (loss) |

|

|

576 |

|

|

|

1,508 |

|

|

|

1,248 |

|

|

|

5,109 |

|

Income (loss) before income taxes |

|

|

38,806 |

|

|

|

(52,143 |

) |

|

|

96,990 |

|

|

|

(90,739 |

) |

Income tax expense |

|

|

6,041 |

|

|

|

13,033 |

|

|

|

14,281 |

|

|

|

16,344 |

|

Net income (loss) |

|

$ |

32,765 |

|

|

$ |

(65,176 |

) |

|

$ |

82,709 |

|

|

$ |

(107,083 |

) |

Earnings (net loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.20 |

|

|

$ |

(0.40 |

) |

|

$ |

0.50 |

|

|

$ |

(0.65 |

) |

Diluted |

|

$ |

0.20 |

|

|

$ |

(0.40 |

) |

|

$ |

0.50 |

|

|

$ |

(0.65 |

) |

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

165,974 |

|

|

|

164,234 |

|

|

|

165,443 |

|

|

|

163,488 |

|

Diluted |

|

|

166,178 |

|

|

|

164,234 |

|

|

|

166,136 |

|

|

|

163,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes license fees and royalties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Includes the following stock-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales, license fees and royalties |

|

$ |

383 |

|

|

$ |

276 |

|

|

$ |

898 |

|

|

$ |

644 |

|

Research and development |

|

$ |

3,863 |

|

|

$ |

5,063 |

|

|

$ |

11,705 |

|

|

$ |

12,701 |

|

Selling, general and administrative |

|

$ |

21,918 |

|

|

$ |

13,200 |

|

|

$ |

43,996 |

|

|

$ |

35,053 |

|

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2024 |

|

|

December 31,

2023 |

|

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents and investment securities |

|

$ |

565,330 |

|

|

$ |

438,865 |

|

Accounts receivable, net |

|

|

98,209 |

|

|

|

98,267 |

|

Interest and other receivables |

|

|

12,154 |

|

|

|

4,083 |

|

Inventory |

|

|

61,041 |

|

|

|

35,819 |

|

Prepaid expenses |

|

|

51,550 |

|

|

|

39,091 |

|

Total current assets |

|

|

788,284 |

|

|

|

616,125 |

|

Property and equipment, net |

|

|

3,988 |

|

|

|

4,612 |

|

Operating lease right-of-use assets |

|

|

44,253 |

|

|

|

51,855 |

|

Intangible assets, net |

|

|

105,515 |

|

|

|

65,490 |

|

Restricted cash |

|

|

8,770 |

|

|

|

5,770 |

|

Long-term inventory |

|

|

25,699 |

|

|

|

4,628 |

|

Other assets |

|

|

359 |

|

|

|

476 |

|

Total assets |

|

$ |

976,868 |

|

|

$ |

748,956 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Accounts payable |

|

$ |

19,081 |

|

|

$ |

17,543 |

|

Accrued liabilities |

|

|

324,864 |

|

|

|

236,711 |

|

Total current liabilities |

|

|

343,945 |

|

|

|

254,254 |

|

Operating lease liabilities |

|

|

40,421 |

|

|

|

47,800 |

|

Other long-term liabilities |

|

|

15,322 |

|

|

|

15,147 |

|

Total liabilities |

|

|

399,688 |

|

|

|

317,201 |

|

Total stockholders’ equity |

|

|

577,180 |

|

|

|

431,755 |

|

Total liabilities and stockholders’ equity |

|

$ |

976,868 |

|

|

$ |

748,956 |

|

Investor Contact:

Acadia Pharmaceuticals Inc.

Al Kildani

(858) 261-2872

ir@acadia-pharm.com

Media Contact:

Acadia Pharmaceuticals Inc.

Deb Kazenelson

(818) 395-3043

media@acadia-pharm.com

v3.24.3

Document And Entity Information

|

Nov. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

Acadia Pharmaceuticals Inc.

|

| Entity Central Index Key |

0001070494

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-50768

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

06-1376651

|

| Entity Address, Address Line One |

12830 El Camino Real, Suite 400

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92130

|

| City Area Code |

(858)

|

| Local Phone Number |

558-2871

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ACAD

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

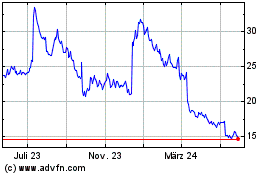

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

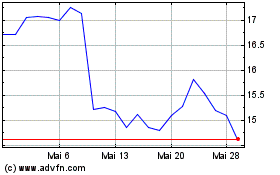

Von Nov 2024 bis Dez 2024

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024