UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2024

ATLANTIC COASTAL ACQUISITION CORP. II

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-41224 |

|

87-1013956 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 6 St Johns Lane, Floor 5

New York, NY |

|

10013 |

| (Address of principal executive offices) |

|

(Zip Code) |

(248) 890-7200

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| Units, each consisting of one share of Series A common stock, $0.0001 par value, and one-half of one redeemable warrant |

|

ACABU |

|

The Nasdaq Stock Market LLC |

| Shares of Series A common stock included as part of the units |

|

ACAB |

|

The Nasdaq Stock Market LLC |

| Warrants included as part of the units, each whole warrant exercisable for one share of Series A common stock at an exercise price of $11.50 |

|

ACABW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

On January 22, 2024, Atlantic Coastal Acquisition Corp. II (“ACAB”) issued a press release announcing that it filed a

Registration Statement on Form S-4 with the Securities and Exchange Commission (“SEC”) on January 19, 2024 in connection with the previously announced proposed business combination with

Abpro Corporation (the “Company”) (the “Business Combination”). The press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Furnished as Exhibit 99.2 hereto and incorporated into this Item 7.01 by reference is the investor presentation that ACAB and the Company have

prepared for use in connection with the Business Combination.

The foregoing (including Exhibits 99.1 and 99.2) is being furnished

pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Exchange Act of 1934 (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be

incorporated by reference in any filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act.

Important

Information and Where to Find It

In connection with the Business Combination and the transactions contemplated thereby (the

“Proposed Transactions”), ACAB has filed a Registration Statement on Form S-4, with the SEC (the “Registration Statement”), which includes the Proxy Statement to be

distributed to holders of ACAB’s common stock in connection with ACAB’s solicitation of proxies for the vote by ACAB’s stockholders with respect to the Proposed Transactions and other matters as described in the Registration

Statement, a prospectus relating to the offer of the securities to be issued to stockholders in connection with the Proposed Transactions. After the Registration Statement has been declared effective, ACAB will mail a definitive proxy

statement/prospectus, when available, to its stockholders. Investors and security holders and other interested parties are urged to read the proxy statement/prospectus, any amendments thereto and any other documents filed with the SEC carefully and

in their entirety when they become available because they will contain important information about ACAB, the Company and the Proposed Transactions. When available, investors and security holders may obtain free copies of the definitive proxy

statement/prospectus and other documents filed with the SEC by ACAB through the website maintained by the SEC at http://www.sec.gov, or by directing a request to: Atlantic Coastal Acquisition Corp. II, 6 St Johns Lane, Floor 5 New York, NY 10013.

Participants in the Solicitation

ACAB and the Company and their respective directors and certain of their respective executive officers and other members of management and

employees may be considered participants in the solicitation of proxies with respect to the Proposed Transactions. Information about the directors and executive officers of ACAB is set forth in its Annual Report on Form 10-K for the fiscal year ended December 30, 2022 and the Registration Statement. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, is included in the Registration Statement and other relevant materials filed, or to be filed, with the SEC regarding the Proposed Transactions. Stockholders, potential investors and other interested

persons should read the Registration Statement carefully when it becomes available before making any voting or investment decisions. When available, these documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current

Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act.

Forward-Looking Statements

This Current Report on Form 8-K includes certain statements that are not historical facts but are

forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe”,

“project”, “expect”, “anticipate”, “estimate”, “intend”, “strategy”, “future”, “opportunity”, “plan”, “may”, “should”, “will”,

“would”, “will be”, “will continue”, “will likely result” or similar expressions. that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking

statements include, but are not limited to, statements regarding estimates and forecasts of revenue and other financial and performance metrics and projections of market opportunity and expectations, ACAB’s ability to enter into definitive

agreements or consummate a transaction with the Company; ACAB’s ability to obtain the financing necessary consummate the Proposed Transactions; and the expected timing of completion of the Proposed Transactions. These statements are based on

various assumptions and on the current expectations of ACAB’s and the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to

serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from

assumptions. Many actual events and circumstances are beyond the control of ACAB and the Company. These forward looking statements are subject to a number of risks and uncertainties, including general economic, financial, legal, political and

business conditions and changes in domestic and foreign markets; the outcome of judicial proceedings to which the Company is, or may become a party; the inability of the parties to enter into definitive agreements or successfully or timely

consummate the Proposed Transactions or to satisfy the other conditions to the closing of the Proposed Transactions, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions

that could adversely affect the combined company; the risk that the approval of the stockholders of ACAB for the Proposed Transactions is not obtained; failure to realize the anticipated benefits of the Proposed Transactions, including as a result

of a delay in consummating the Proposed Transaction or difficulty in, or costs associated with, integrating the businesses of ACAB and the Company; the amount of redemption requests made by ACAB’s stockholders; the occurrence of events that may

give rise to a right of one or both of ACAB and the Company to terminate the Business Combination Agreement; risks related to the rollout of the Company’s business and the timing of expected business milestones; the effects of competition on

the Company’s future business; and those factors discussed in ACAB’s Registration Statement on Form S-1 filed with the SEC on January 18, 2022, Annual Report on Form 10-K for the fiscal year ended December 31, 2022, Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2023, June 30, 2023 and

September 30, 2023 and the Registration Statement under the heading “Risk Factors,” and other documents of ACAB filed, or to be filed, with the SEC. If the risks materialize or assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking statements. There may be additional risks that neither ACAB nor the Company presently know or that ACAB and the Company currently believe are immaterial that could also cause actual

results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect ACAB’s and the Company’s expectations, plans or forecasts of future events and views as of the date of this Current

Report on Form 8-K. ACAB and the Company anticipate that subsequent events and developments will cause their assessments to change. However, while ACAB and the Company may elect to update these forward-looking

statements at some point in the future, ACAB and the Company specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing ACAB’s or the Company’s assessments as of any date

subsequent to the date of this Current Report on Form 8-K. Accordingly, undue reliance should not be placed upon the forward-looking statements. Neither ACAB nor the Company gives any assurance that either

ACAB or the Company, or the combined company, will achieve its objectives.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated January 22, 2024 |

|

|

| 99.2 |

|

Form of Investor Presentation |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ATLANTIC COASTAL ACQUISITION CORP. II |

|

|

|

|

|

|

|

|

By: |

|

/s/ Shahraab Ahmad |

|

|

|

|

|

|

Name: Shahraab Ahmad |

|

|

|

|

|

|

Title: Chief Executive Officer |

|

|

|

|

| Dated: January 22, 2024 |

|

|

|

|

|

|

Exhibit 99.1

Abpro Announces Filing of Registration Statement on Form S-4 in

Connection with Business Combination Agreement with Atlantic Coastal Acquisition Corp. II

Woburn, Mass. & New York, NY — January 22,

2024—Abpro Corporation (“Abpro”), a biotech company with the mission of improving the lives of mankind facing severe and life-threatening diseases with next-generation antibody therapies, and Atlantic Coastal Acquisition Corp. II

(NASDAQ: ACAB), a special purpose acquisition company (“Atlantic Coastal”), today announced the filing of a registration statement on Form S-4 (the “Registration Statement”) with the U.S.

Securities and Exchange Commission (“SEC”) on January 19, 2024, which includes a preliminary proxy statement and prospectus in connection with its proposed business combination.

Upon the closing of the proposed business combination, the combined company is expected to be named “Abpro Corporation” and to list its common stock

on Nasdaq under the new ticker symbol “ABP”. The proposed business combination sets Abpro’s implied pre-money equity valuation at $500 million. Consistent with the recent signing of the

Business Combination Agreement, the Atlantic Coastal and Abpro boards of directors have approved the proposed business combination, which is expected to be completed in the first half of 2024 subject to, among other things, the approval by Atlantic

Coastal and Abpro stockholders, and other customary closing conditions.

“We are thrilled to be one step closer to fulfilling our public journey to

advance our pipeline of next-generation antibody therapeutics, and to be closer to providing critical therapies to those who need it most,” stated Ian Chan, CEO and co-founder of Abpro. “We have made

significant strides in advancing our lead candidates in oncology and ophthalmology, which are two areas of significant unmet medical need. With this filing, we are excited for what lies ahead for both our company and the future of antibody-driven

therapeutics.”

“We are excited to be partnering with Abpro and recognize the potential of the company’s robust drug discovery platform,

novel candidates and significant strategic partnerships,” said Shahraab Ahmad, CEO of Atlantic Coastal. “Abpro is supported by an experienced leadership team and board that we believe will lead the company to create significant value for

shareholders.”

“In my experience as a long-term biotech investor, I have been most impressed with the caliber of the team at Abpro and have

confidence in their ability to achieve the targets that they have set for themselves,” added Tony Eisenberg, CSO of Atlantic Coastal. “Advancing towards a listing on Nasdaq is the next step in the company’s journey to bring its

pioneering research and drug development platform to market.”

While the Registration Statement has not yet become effective, and the information

contained therein is subject to change, it provides important information about Abpro, Atlantic Coastal, and the proposed business combination.

Abpro

at a Glance

| |

• |

|

By leveraging its

proprietary DiversImmune®

and MultiMabTM antibody discovery and engineering platforms, Abpro is advancing a pipeline of next-generation antibodies, both independently and through

collaborations with global pharmaceutical and research institutions. |

| |

• |

|

Abpro’s lead candidate ABP-102, a next generation immuno-oncology

TetraBi antibody targeting HER2 and CD3, is in development for the treatment of HER2+ solid tumors, including breast and gastric cancer. ABP-102 is being developed and commercialized through a worldwide

strategic partnership with Celltrion, Inc. (“Celltrion”) (KRX: 068270) a leading Korean biopharmaceutical company. Celltrion is conducting a dose range finding study in a xenograft mouse model. An in vivo efficacy study in a xenograft

mouse is planned for the first half of 2024. |

| |

• |

|

Abpro is advancing its lead candidate ABP-201, a TetraBi antibody format

designed to simultaneously inhibit VEGF and ANG-2, into the clinic for the treatment of wet age-related macular degeneration. |

| |

• |

|

Abpro is advancing a broad pipeline of immuno-oncology agents that redirect T cells to a diverse range of liquid

and solid tumors. ABP-110, targeting GPC3 on hepatocellular carcinoma, and ABP-150, targeting Claudin 18.2 on gastric cancer, are currently in preclinical development.

|

Advisors

Brookline Capital

Markets, a division of Arcadia Securities, LLC, acted as a financial advisor to Abpro Corporation.

Cohen & Company Capital Markets, a division

of J.V.B. Financial Group, LLC, is serving as financial advisor to Atlantic Coastal.

About Abpro

Abpro Corporation is a biotechnology company located in Woburn, Massachusetts. The company’s mission is to improve the lives of mankind facing severe and

life-threatening diseases with next-generation antibody therapies. For more information, please visit www.abpro.com.

About Atlantic Coastal

Acquisition Corp. II

Atlantic Coastal Acquisition Corp. II (NASDAQ: ACAB) is a special purpose acquisition company. On January 13, 2022, Atlantic

Coastal announced the closing of its IPO and listing on Nasdaq. The Atlantic Coastal team is led by Chairman and CEO Shahraab Ahmad, President and Director Burt Jordan, CSO and Director Tony Eisenberg, and CFO and Director Jason Chryssicas. For more

information, please visit www.atlantic-coastal.com.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential

transaction between Atlantic Coastal and Abpro. This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities of Atlantic Coastal and Abpro, nor shall there be any sale of

securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Participants in the Solicitation

Atlantic Coastal and Abpro and their respective directors and certain of their respective executive officers and other members of management and employees may

be considered participants in the solicitation of proxies with respect to the proposed transaction. Information about the directors and executive officers of Atlantic Coastal is set forth in its Annual Report on Form

10-K for the fiscal year ended December 31, 2022. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation of the shareholders of

Atlantic Coastal and a description of their direct and indirect interests in Atlantic Coastal, by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the

proposed transaction when they become available. Shareholders, potential investors and other interested persons should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. When

available, these documents can be obtained free of charge from the sources indicated above.

Additional Information and Where To Find It

In connection with the proposed transaction, Atlantic Coastal has filed a registration statement on Form S-4 (the

“Registration Statement”) with the SEC, which includes a preliminary proxy statement to be distributed to holders of Atlantic Coastal’s ordinary shares in connection with Atlantic Coastal’s solicitation of proxies for the vote by

Atlantic Coastal’s shareholders with respect to the proposed transaction and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of securities to be issued to Abpro stockholders in

connection with the proposed transaction. After the Registration Statement has been declared effective, Atlantic Coastal will mail a definitive proxy statement, when available, to its shareholders. The Registration Statement will include information

regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Atlantic Coastal’s shareholders in connection with the proposed transaction. Atlantic Coastal will also file other documents regarding the

proposed transaction with the SEC. Before making any voting decision, investors and security holders of Atlantic Coastal and Abpro are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant

documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be

filed with the SEC by Atlantic Coastal through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Atlantic Coastal may be obtained free of charge from Atlantic Coastal’s website at

www.atlantic-coastal.com or by written request to Atlantic Coastal at Atlantic Coastal Acquisition Corp., 6 St Johns Lane, Floor 5, New York, NY 10013.

Investor Inquiries:

ICR Westwicke

Stephanie Carrington

stephanie.carrington@westwicke.com

646-277-1282

Media Inquires

ICR Westwicke

Sean Leous

sean.leous@westwicke.com

646-866-4012

Exhibit 99.2 1

2 Disclaimers This presentation (this “Presentation”) is

provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Abpro Corporation (“Abpro”) and Atlantic Coastal

Acquisition Corp. II (“ACAB”) and related transactions (the “Proposed Business Combination”) and for no other purpose. No representations or warranties express or implied are given in or respect of this Presentation. To the

fullest extent permitted by law in no circumstances will Abpro, ACAB or any of their respective subsidiaries stockholders affiliates representatives partners directors officers employees advisers or agents be responsible, or liable for any direct

indirect or consequential loss or loss of profit arising from use of this Presentation its contents its omissions reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection

therewith. This Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Abpro or the Proposed Business Combination. Viewers of this Presentation should each make their

own evaluation of Abpro and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward-Looking Statements This Presentation contains certain forward-looking statements within the

meaning of the federal securities laws with respect to the Proposed Business Combination, including statements regarding the benefits of the Proposed Business Combination, the anticipated timing of the Proposed Business Combination, the products and

services offered by Abpro and the markets in which it operates and Abpro’s projected future results. These forward-looking statements generally are identified by the words “believe”, “project”, “expect”,

“anticipate”, “estimate”, “intend”, “strategy”, “future”, “opportunity”, “plan”, “may”, “should”, “will”, “would”,

“will be”, “will continue”, “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and

assumptions, and as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Presentation, including but not limited to: (i) the risk that the

Proposed Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of ACAB’s securities; (ii) the risk that the Proposed Business Combination may not be completed by ACAB’s business

combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by ACAB; (iii) the failure to satisfy the conditions to the consummation of the Proposed Business Combination, including the receipt

of the requisite approvals of ACAB’s and Abpro’s stockholders, the satisfaction of the minimum trust account amount following redemptions by ACAB’s public shareholders and the receipt of certain governmental and regulatory

approvals; (iv) the lack of a third party valuation in determining whether or not to pursue the Proposed Business Combination; (v) the occurrence of any event change or other circumstance, that could give rise to the termination of the agreement and

plan of merger; (vi) the effect of the announcement or pendency of the Proposed Business Combination on Abpro’s business relationships, performance and business generally; (vii) risks that the Proposed Business Combination disrupts current

plans of Abpro and potential difficulties in Abpro’s employee retention as a result of the Proposed Business Combination; (viii) the outcome of any legal proceedings that may be instituted against Abpro or against ACAB related to the agreement

and plan of merger or the Proposed Business Combination; (ix) the ability to maintain the listing of ACAB’s securities on The Nasdaq Stock Market LLC; (x) the price of ACAB’s securities may be volatile due to a variety of factors

including changes in the competitive and regulated industries in which Abpro plans to operate, variations in performance across competitors, changes in laws and regulations affecting Abpro’s business and changes in the combined capital

structure; (xi) the ability to implement business plans forecasts and other expectations, after the completion of the Proposed Business Combination and identify and realize additional opportunities; (xii) the enforceability of Abpro’s

intellectual property rights including its copyrights patents trademarks and trade secrets and the potential infringement on the intellectual property rights of others; (xiii) risks related to Abpro’s ability to achieve and maintain

profitability and generate cash; (xiv) costs related to the Proposed Business Combination and the failure to realize anticipated benefits of the Proposed Business Combination or to realize estimated pro forma results and underlying assumptions,

including with respect to estimated stockholder redemptions; (xv) the potential inability of Abpro to manage growth effectively; (xvi) Abpro’s dependence on senior management and other key employees; (xvii) risks related to general economic

conditions, including demand, interest rates, inflation, supply chains and the effect of the conflicts in Ukraine and the Middle East; (xviii) cyberattacks on ACAB’s or Abpro’s information technology systems; (xix) the ability to attract

and retain staff with the skills and expertise needed; (xx) increases in the cost of labor and research and development; (xxi) the effects of natural disasters, adverse weather conditions or public health crises; geopolitical, economic and

climate-or weather-related risks in regions with a significant concentration of Abpro’s operations; (xxii) the inability to successfully bring Abpro’s products to market (including obtaining regulatory approval); and (xxiii) the early

termination of any of Abpro’s existing agreements to develop its products; (xxiv) the acceptance and efficacy of Abpro’s products; (xxv) damage to Abpro’s reputation through the actions or inactions of third parties; investigative

or legal actions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of ACAB’s Registration Statement

on Form S-1 filed on December 2, 2021 (as amended), ACAB’s Annual Report on Form 10-K for the year ended December 31, 2022, ACAB’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30,

2023, the Registration Statement (as defined below) and the proxy statement/prospectus to be contained therein and the other documents filed by ACAB from time to time with the U.S. Securities and Exchange Commission (the “SEC”). These

filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they

are made. Readers are cautioned not to put undue reliance on forward-looking statements and Abpro and ACAB assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future

events, or otherwise. Neither Abpro nor ACAB gives any assurance that either Abpro or ACAB respectively will achieve its expectations.

3 Disclaimers Additional Information and Where to Find It This document

relates to the Proposed Business Combination between Abpro and ACAB. ACAB filed a registration statement on Form S-4 relating to the Proposed Business Combination (the “Registration Statement”) which will includes a proxy

statement/prospectus of ACAB. The proxy Statement/prospectus will be sent to all ACAB and Abpro stockholders. ACAB will also file other documents regarding the Proposed Business Combination with the SEC. Before making any voting decision, investors

and security holders of ACAB and Abpro are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant documents filed or that will be filed with the SEC in connection with the Proposed Business

Combination as they become available because they will contain important information about the Proposed Business Combination. Investors and security holders will be able to obtain free copies of the proxy Statement/prospectus and all other relevant

documents filed or that will be filed with the SEC by ACAB through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by ACAB may be obtained free of charge by written request to ACAB at Atlantic Coastal Acquisition

Corp. II, 6 St. Johns Lane, Floor 5, New York, New York, 10013 Participants in Solicitation ACAB and Abpro and their respective directors and officers may be deemed to be participants in the solicitation of proxies from ACAB’s stockholders in

connection with the Proposed Business Combination. Information about ACAB’s directors and executive officers and their ownership of ACAB’s securities is set forth in ACAB’s filings with the SEC, including ACAB’s Registration

Statement on Form S-1 filed with the SEC on December 2, 2021. To the extent that holdings of ACAB’s securities have changed since the amounts printed in ACAB’s Registration Statement on Form S-1, such changes have been or will be

reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the Proposed Business Combination may be obtained by

reading the proxy Statement/prospectus regarding the Proposed Business Combination when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. Industry and Market Data This presentation has been

prepared by Abpro and ACAB and includes market data and other statistical information from sources believed by Abpro and ACAB to be reliable, including independent industry publications, governmental publications or other published independent

sources. Some data is also based on the good faith estimates of Abpro or ACAB, which in each case are derived from its review of internal sources as well as the independent sources described above. Although Abpro and ACAB believe these sources are

reliable, Abpro and ACAB have not independently verified the information and cannot guarantee its accuracy and completeness. Financial Information; Non-GAAP Financial Measures The financial information and data contained in this Presentation is

unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in the Registration Statement to be filed by ACAB with the SEC and the proxy

Statement/prospectus contained therein. Certain measures in this presentation do not have any standardized meaning as prescribed by Generally Accepted Accounting Principles (“GAAP”) in the United States and, therefore, are considered

non-GAAP measures. These measures may not be comparable to similar measures presented by other companies and should not be viewed as a substitute for measures reported under U.S. GAAP. These measures are commonly used by Abpro and ACAB to provide

shareholders and potential investors with additional information regarding Abpro’s or ACAB’s liquidity and their ability to finance their operations. You should review Abpro’s audited financial statements, which will be included in

the Registration Statement. Please see the Appendix for the accompanying non-GAAP reconciliations. No Offer or Solicitation This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except

by means of a prospectus meeting the requirements of the U.S. Securities Act of 1933, as amended. Use of Projections This Presentation contains projected financial information with respect to Abpro and ACAB. Such projected financial information

constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are

inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward-Looking Statements” above. Actual results may differ materially from the results

contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts are

achieved. Trademarks Solely for convenience, the trademarks, trade names and service marks may appear in this presentation without the ® and ™ symbols, but any such references are not intended to indicate, in any way, that we forgo or

will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names and service marks appearing in this presentation are

the property of their respective owners.

44 Transaction Overview Market Forecasts 1 2 Experienced Team Investment

Highlights 3 4 Table of Pipeline and Technology Lead Candidates 5 6 Platforms Contents Additional Pipeline Program Development 7 8 Candidates Timeline Appendix 9

5 5 Key Presenters Miles Suk Shahraab Ahmad Ian Chan CEO CEO &

Co-Founder Board Member Atlantic Coastal Acquisition Abpro Corporation Abpro Corporation Corp. II (ACAB)

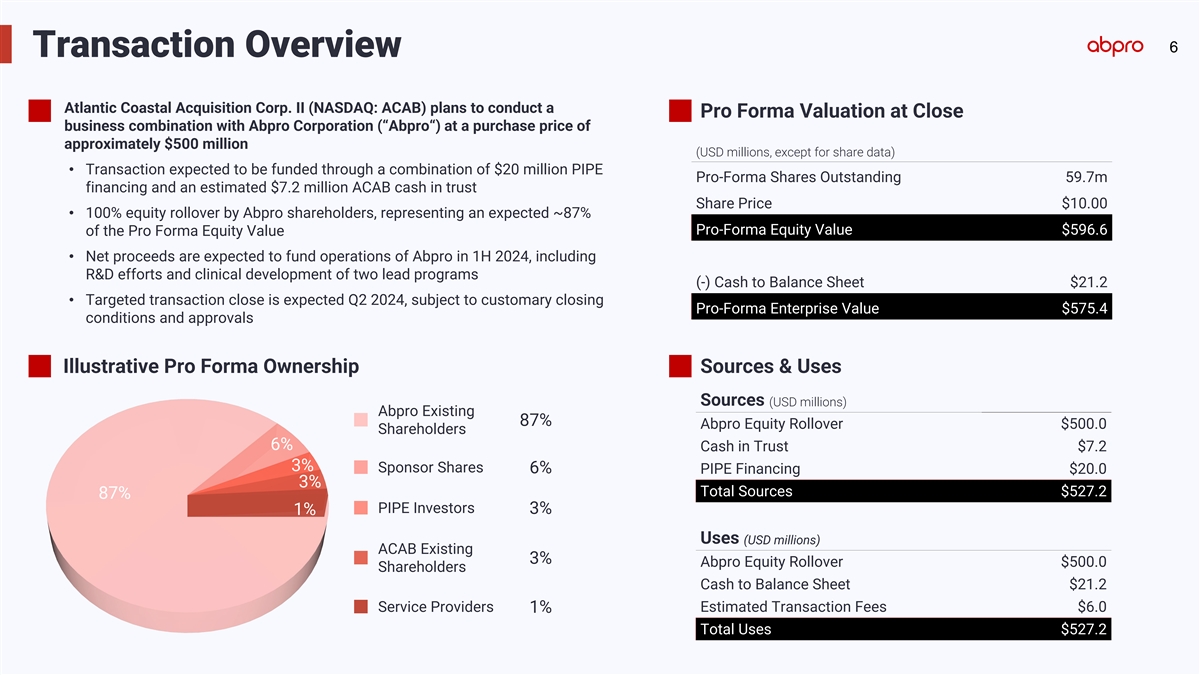

6 Transaction Overview Atlantic Coastal Acquisition Corp. II (NASDAQ:

ACAB) plans to conduct a Pro Forma Valuation at Close business combination with Abpro Corporation (“Abpro“) at a purchase price of approximately $500 million (USD millions, except for share data) • Transaction expected to be funded

through a combination of $20 million PIPE Pro-Forma Shares Outstanding 59.7m financing and an estimated $7.2 million ACAB cash in trust Share Price $10.00 • 100% equity rollover by Abpro shareholders, representing an expected ~87% Pro-Forma

Equity Value $596.6 of the Pro Forma Equity Value • Net proceeds are expected to fund operations of Abpro in 1H 2024, including R&D efforts and clinical development of two lead programs (-) Cash to Balance Sheet $21.2 • Targeted

transaction close is expected Q2 2024, subject to customary closing Pro-Forma Enterprise Value $575.4 conditions and approvals Illustrative Pro Forma Ownership Sources & Uses Sources (USD millions) Abpro Existing 87% Abpro Equity Rollover $500.0

Shareholders 6% Cash in Trust $7.2 3% Sponsor Shares 6% PIPE Financing $20.0 3% Total Sources $527.2 87% PIPE Investors 3% 1% Uses (USD millions) ACAB Existing 3% Abpro Equity Rollover $500.0 Shareholders Cash to Balance Sheet $21.2 Service

Providers Estimated Transaction Fees $6.0 1% Total Uses $527.2

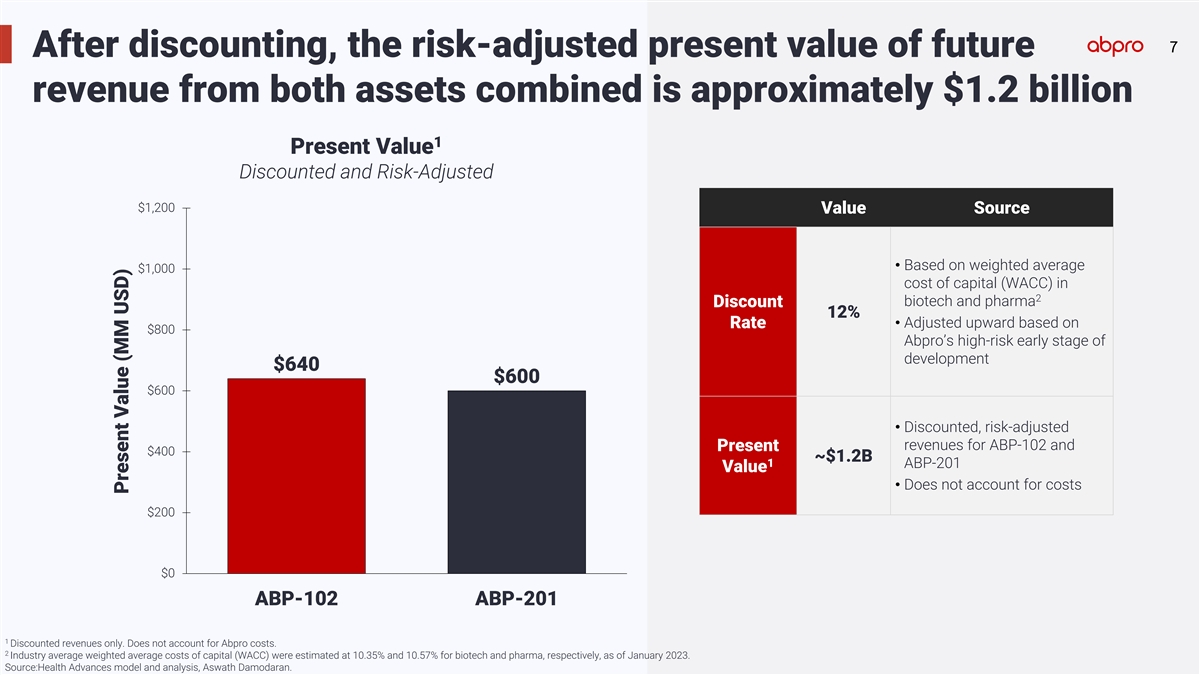

77 After discounting, the risk-adjusted present value of future revenue

from both assets combined is approximately $1.2 billion 1 Present Value Discounted and Risk-Adjusted $1,200 Value Source • Based on weighted average $1,000 cost of capital (WACC) in 2 biotech and pharma Discount 12% • Adjusted upward

based on Rate $800 Abpro’s high-risk early stage of development $640 $600 $600 • Discounted, risk-adjusted revenues for ABP-102 and Present $400 ~$1.2B 1 ABP-201 Value • Does not account for costs $200 $0 ABP-102 ABP-201 1

Discounted revenues only. Does not account for Abpro costs. 2 Industry average weighted average costs of capital (WACC) were estimated at 10.35% and 10.57% for biotech and pharma, respectively, as of January 2023. Source:Health Advances model and

analysis, Aswath Damodaran. Present Value (MM USD)

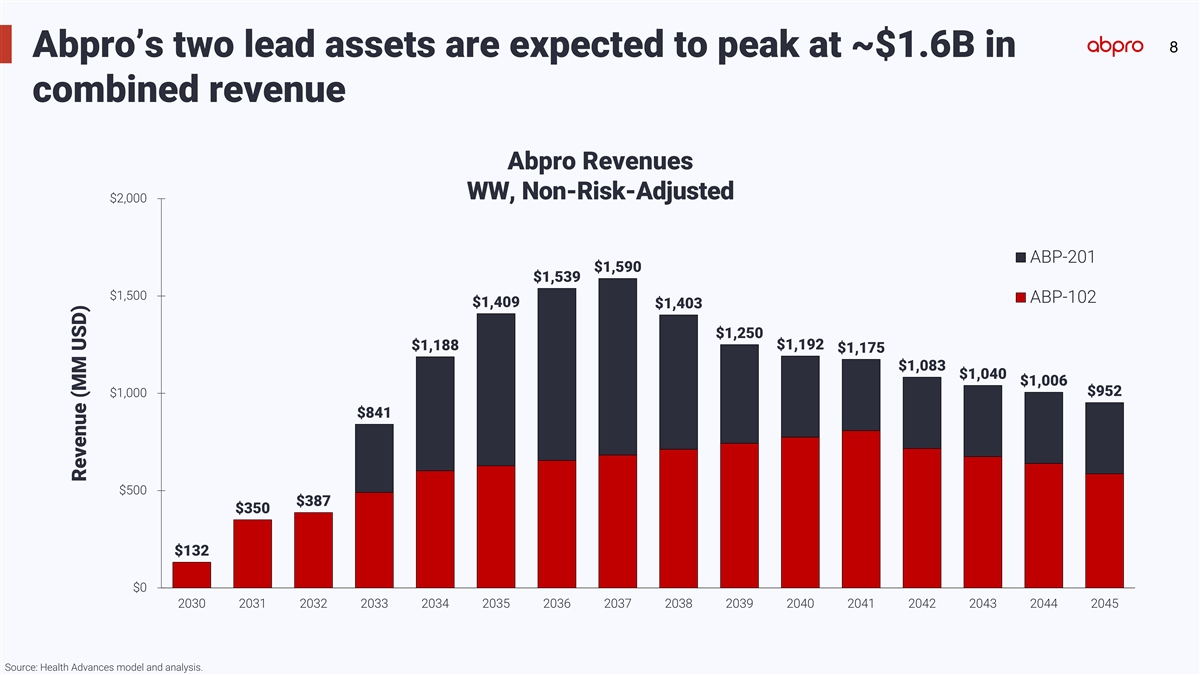

8 Abpro’s two lead assets are expected to peak at ~$1.6B in

combined revenue Abpro Revenues WW, Non-Risk-Adjusted $2,000 ABP-201 $1,590 $1,539 $1,500 ABP-102 $1,409 $1,403 $1,250 $1,192 $1,188 $1,175 $1,083 $1,040 $1,006 $952 $1,000 $841 $500 $387 $350 $132 $0 2030 2031 2032 2033 2034 2035 2036 2037 2038

2039 2040 2041 2042 2043 2044 2045 Source: Health Advances model and analysis. Revenue (MM USD)

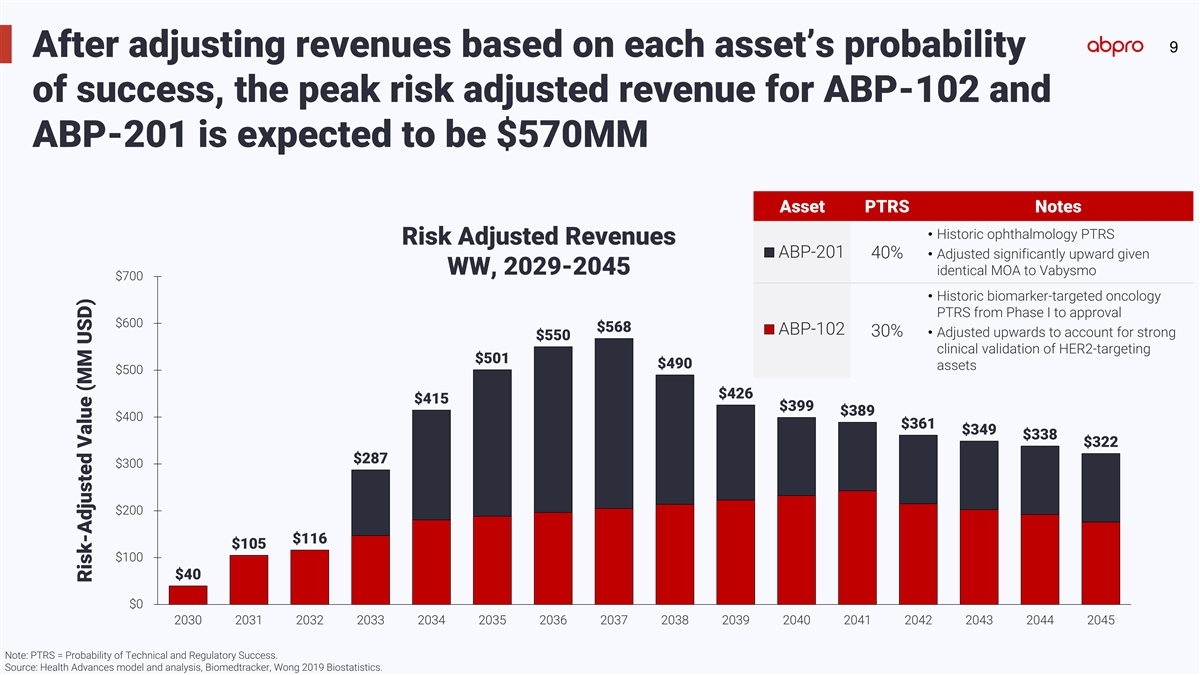

9 After adjusting revenues based on each asset’s probability of

success, the peak risk adjusted revenue for ABP-102 and ABP-201 is expected to be $570MM Asset PTRS Notes • Historic ophthalmology PTRS Risk Adjusted Revenues ABP-201 40% • Adjusted significantly upward given WW, 2029-2045 identical MOA

to Vabysmo $700 • Historic biomarker-targeted oncology PTRS from Phase I to approval $600 $568 ABP-102 30% • Adjusted upwards to account for strong $550 clinical validation of HER2-targeting $501 $490 assets $500 $426 $415 $399 $389 $400

$361 $349 $338 $322 $287 $300 $200 $116 $105 $100 $40 $0 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2043 2044 2045 Note: PTRS = Probability of Technical and Regulatory Success. Source: Health Advances model and analysis,

Biomedtracker, Wong 2019 Biostatistics. Risk-Adjusted Value (MM USD)

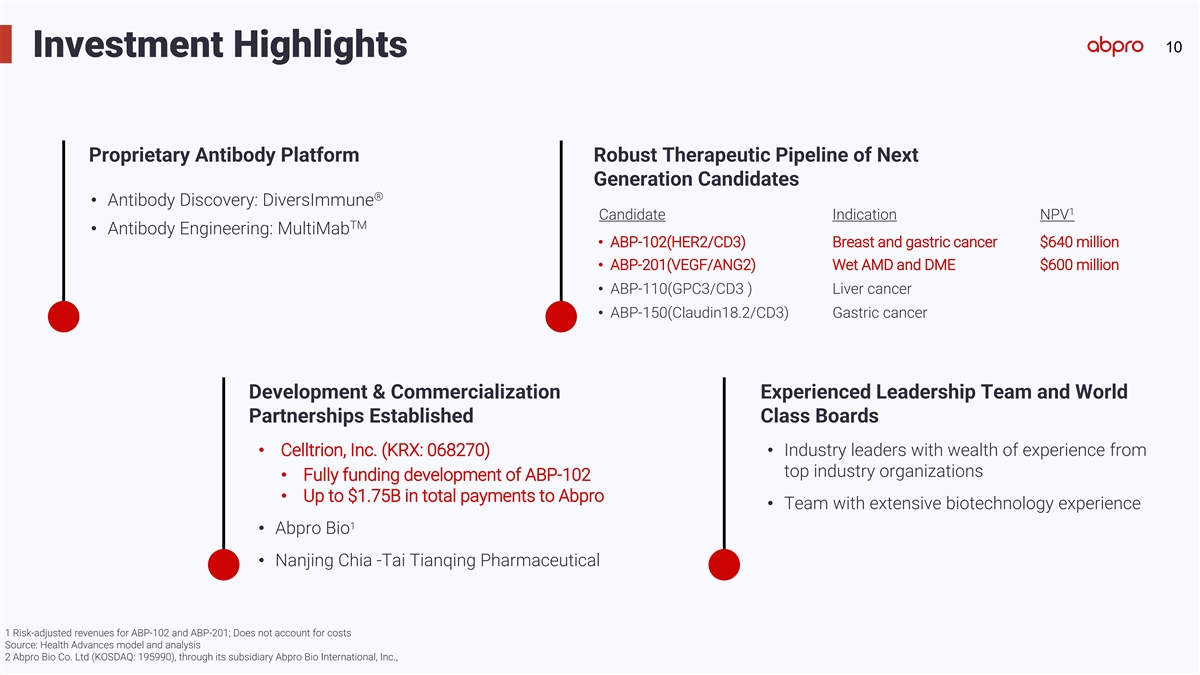

10 Investment Highlights Proprietary Antibody Platform Robust

Therapeutic Pipeline of Next Generation Candidates ® • Antibody Discovery: DiversImmune 1 Candidate Indication NPV TM • Antibody Engineering: MultiMab • ABP-102(HER2/CD3) Breast and gastric cancer $640 million •

ABP-201(VEGF/ANG2) Wet AMD and DME $600 million • ABP-110(GPC3/CD3 ) Liver cancer • ABP-150(Claudin18.2/CD3) Gastric cancer Development & Commercialization Experienced Leadership Team and World Partnerships Established Class Boards

• Celltrion, Inc. (KRX: 068270) • Industry leaders with wealth of experience from top industry organizations • Fully funding development of ABP-102 • Up to $1.75B in total payments to Abpro • Team with extensive

biotechnology experience 1 • Abpro Bio • Nanjing Chia -Tai Tianqing Pharmaceutical 1 Risk-adjusted revenues for ABP-102 and ABP-201; Does not account for costs Source: Health Advances model and analysis 2 Abpro Bio Co. Ltd (KOSDAQ:

195990), through its subsidiary Abpro Bio International, Inc.,

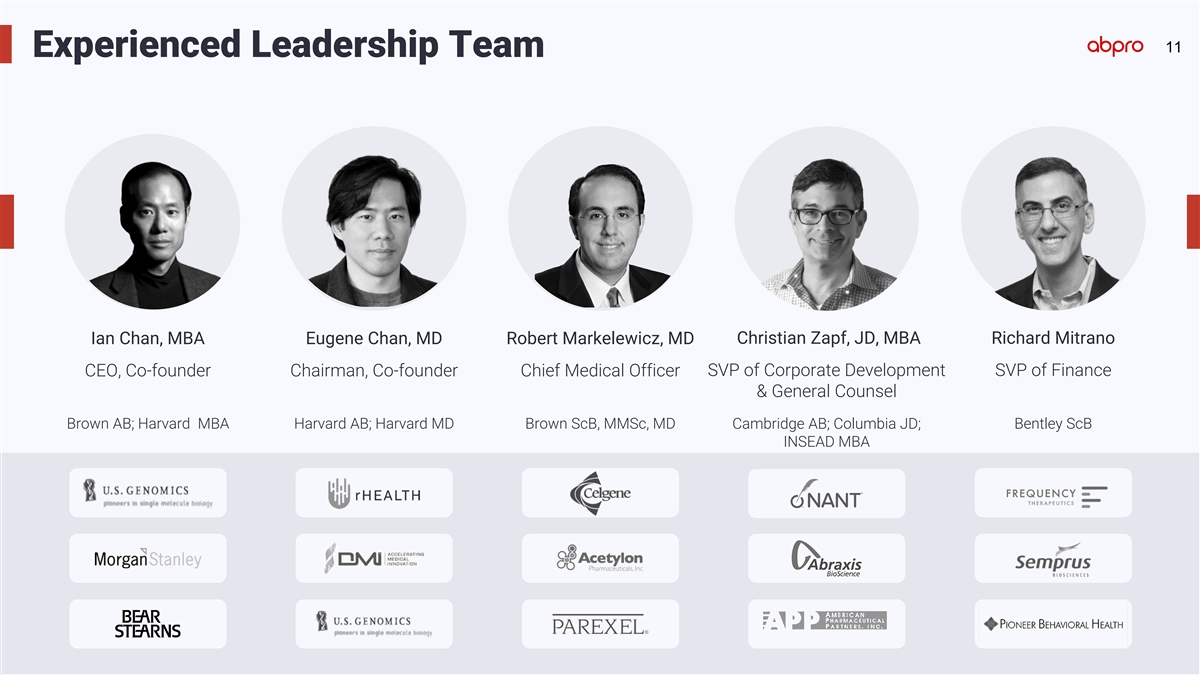

11 Experienced Leadership Team Ian Chan, MBA Eugene Chan, MD Robert

Markelewicz, MD Christian Zapf, JD, MBA Richard Mitrano SVP of Corporate Development SVP of Finance CEO, Co-founder Chairman, Co-founder Chief Medical Officer & General Counsel Brown AB; Harvard MBA Harvard AB; Harvard MD Brown ScB, MMSc, MD

Cambridge AB; Columbia JD; Bentley ScB INSEAD MBA

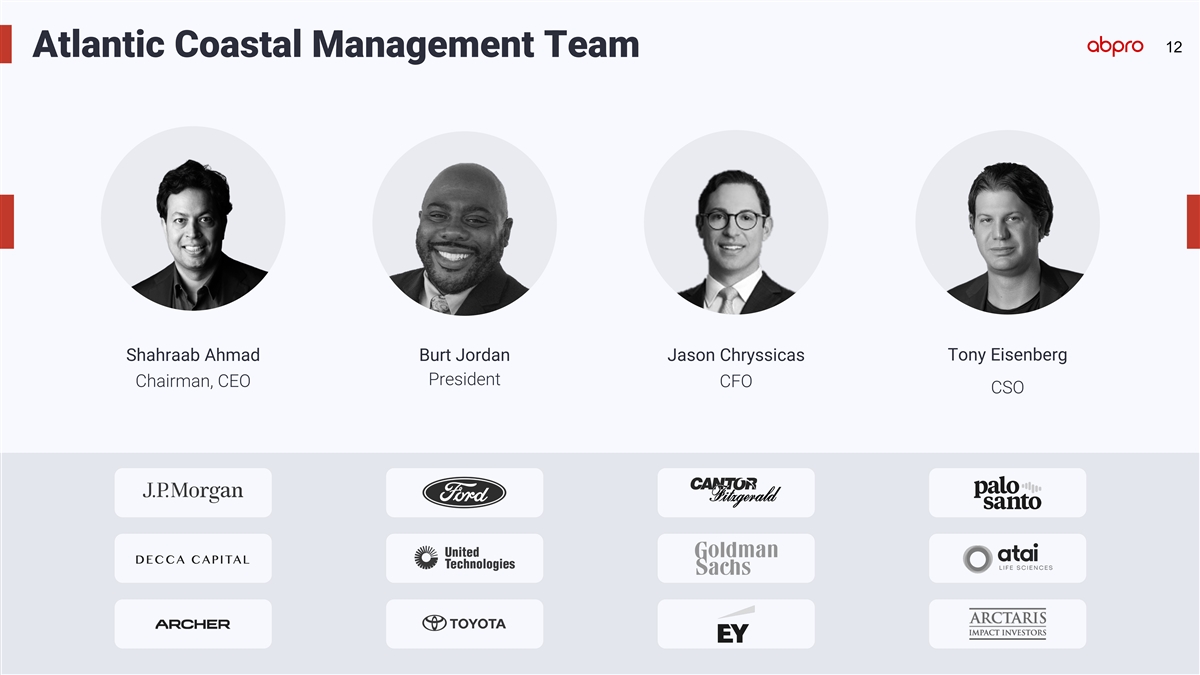

12 Atlantic Coastal Management Team Shahraab Ahmad Burt Jordan Jason

Chryssicas Tony Eisenberg President Chairman, CEO CFO CSO

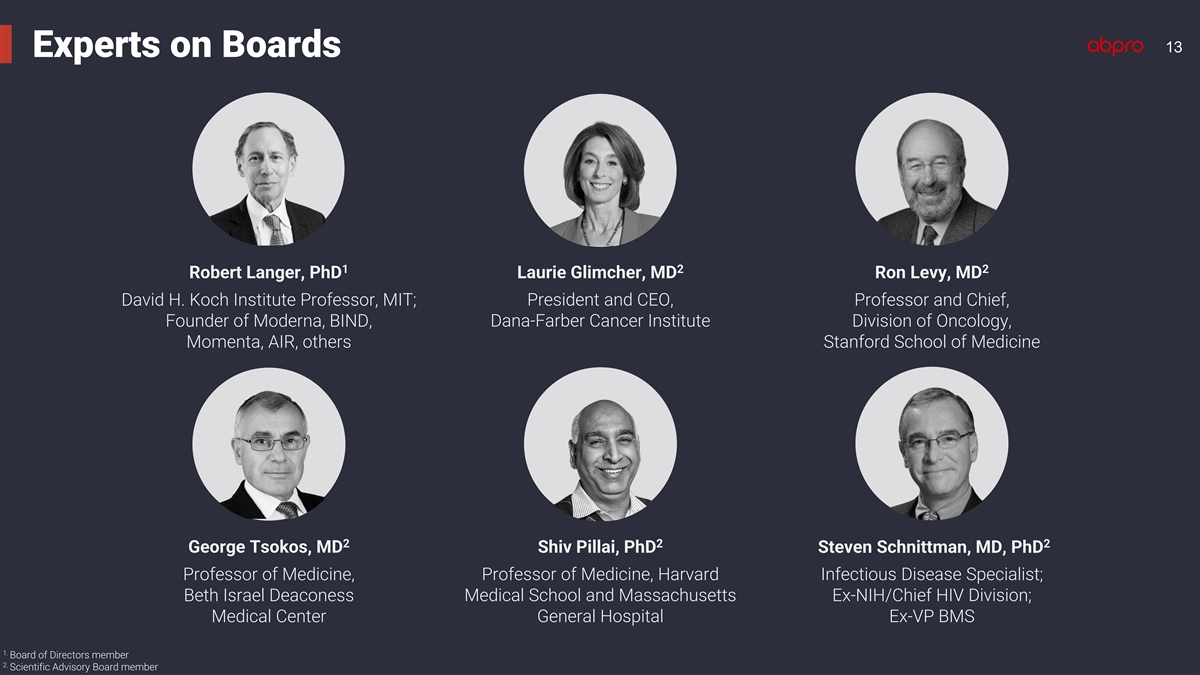

13 13 Experts on Boards 1 2 2 Robert Langer, PhD Laurie Glimcher, MD

Ron Levy, MD David H. Koch Institute Professor, MIT; President and CEO, Professor and Chief, Founder of Moderna, BIND, Dana-Farber Cancer Institute Division of Oncology, Momenta, AIR, others Stanford School of Medicine 2 2 2 George Tsokos, MD Shiv

Pillai, PhD Steven Schnittman, MD, PhD Professor of Medicine, Professor of Medicine, Harvard Infectious Disease Specialist; Beth Israel Deaconess Medical School and Massachusetts Ex-NIH/Chief HIV Division; Medical Center General Hospital Ex-VP BMS

1. Board of Directors member 2. Scientific Advisory Board member

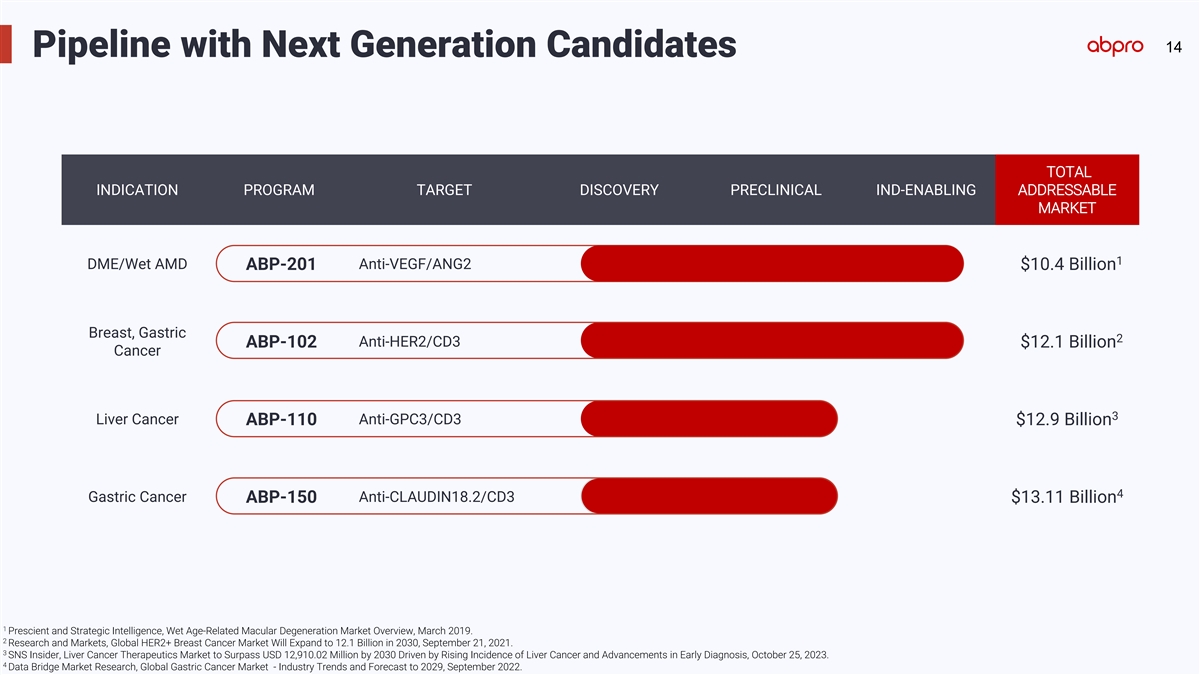

14 Pipeline with Next Generation Candidates TOTAL INDICATION PROGRAM

TARGET DISCOVERY PRECLINICAL IND-ENABLING ADDRESSABLE MARKET 1 DME/Wet AMD Anti-VEGF/ANG2 ABP-201 $10.4 Billion Breast, Gastric 2 Anti-HER2/CD3 ABP-102 $12.1 Billion Cancer 3 Liver Cancer Anti-GPC3/CD3 ABP-110 $12.9 Billion 4 Gastric Cancer

Anti-CLAUDIN18.2/CD3 ABP-150 $13.11 Billion 1 Prescient and Strategic Intelligence, Wet Age-Related Macular Degeneration Market Overview, March 2019. 2 Research and Markets, Global HER2+ Breast Cancer Market Will Expand to 12.1 Billion in 2030,

September 21, 2021. 3 SNS Insider, Liver Cancer Therapeutics Market to Surpass USD 12,910.02 Million by 2030 Driven by Rising Incidence of Liver Cancer and Advancements in Early Diagnosis, October 25, 2023. 4 Data Bridge Market Research, Global

Gastric Cancer Market - Industry Trends and Forecast to 2029, September 2022.

TECHNOLOGY PLATFORM

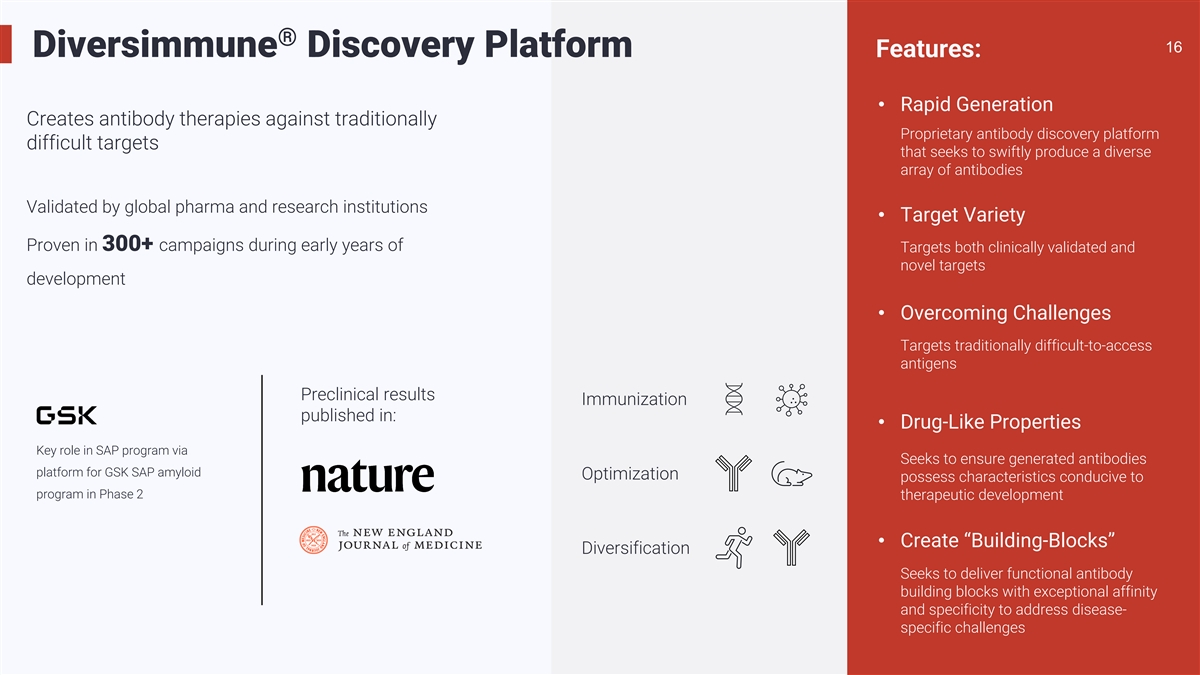

® 16 16 Diversimmune Discovery Platform Features: • Rapid

Generation Creates antibody therapies against traditionally Proprietary antibody discovery platform difficult targets that seeks to swiftly produce a diverse array of antibodies Validated by global pharma and research institutions • Target

Variety Proven in 300+ campaigns during early years of Targets both clinically validated and novel targets development • Overcoming Challenges Targets traditionally difficult-to-access antigens Preclinical results Immunization published in:

• Drug-Like Properties Key role in SAP program via Seeks to ensure generated antibodies platform for GSK SAP amyloid Optimization possess characteristics conducive to program in Phase 2 therapeutic development • Create

“Building-Blocks” Diversification Seeks to deliver functional antibody building blocks with exceptional affinity and specificity to address disease- specific challenges

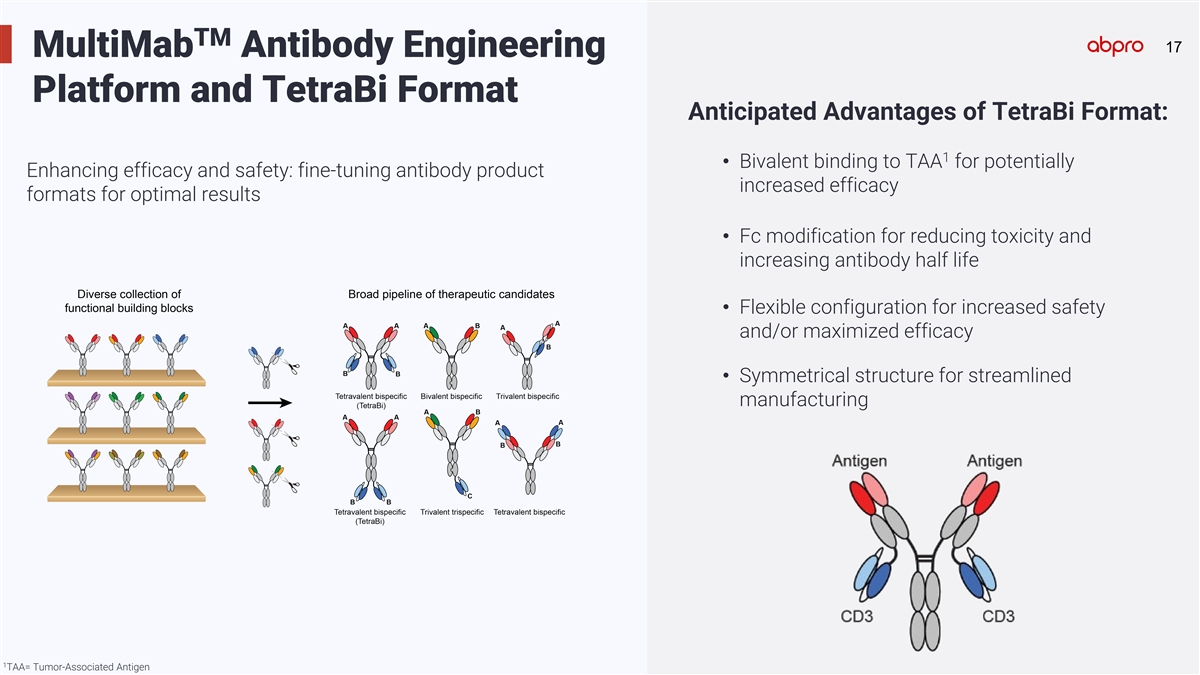

TM 17 17 MultiMab Antibody Engineering Platform and TetraBi Format

Anticipated Advantages of TetraBi Format: 1 • Bivalent binding to TAA for potentially Enhancing efficacy and safety: fine-tuning antibody product increased efficacy formats for optimal results • Fc modification for reducing toxicity and

increasing antibody half life • Flexible configuration for increased safety and/or maximized efficacy • Symmetrical structure for streamlined manufacturing 1 TAA= Tumor-Associated Antigen

LEAD PROGRAMS • ABP-102 • ABP-201

ABP-102 HER2/CD3 T-Cell Engager Treatment for HER2+ Breast Cancer &

Gastric Cancer

20 20 ABP-102: Strategic Partnership Global Development & with

Celltrion Commercialization Partnership Highlights Leading biopharmaceutical company headquartered in Incheon, South Korea; KRX: 068270 Fully Funded Anticipated Development Plan • Celltrion funds all development costs, including preclinical

and clinical • Investigational New Drug (IND) enabling studies underway studies • 1H 2025: File IND application • 2H 2025: Initiate Phase 1/2 clinical trial $1.75B • Abpro to receive payments up to Indication: $1.75B,

including equity investment, development/commercial milestone Progressive HER2+ Breast and Gastroesophageal Adenocarcinomas payments Design: 1 First-In-Human, multicenter, open-label, single-agent, Phase 1/2 trial 50% • Abpro retains a 50%

share of profits worldwide 1 The proceeds from commercialization are subject to a 50/50 profit split. Amounts that may be paid by third party collaborators, for example upfronts, milestones and/or royalty payments from territorial commercialization

partners, are also subject to a 50/50 split. Following commercial approval of ABP-102, we have agreed to reimburse Celltrion 87.5% of its direct and certain indirect costs and expenses incurred through first commercial sale. Celltrion is entitled to

offset amounts otherwise due to us under the agreement until our share of these costs has been paid back; provided that we are entitled to a minimum 25% of profit from commercial sales and from third party collaborators regardless of the amount of

unreimbursed development costs outstanding (and then 50% once the reimbursement has been made in full). In addition, we are entitled to up to over $1.75 billion in development and sales milestones. We are responsible for world-wide patent

prosecution, with Celltrion reimbursing 50% of our out-of-pocket costs.

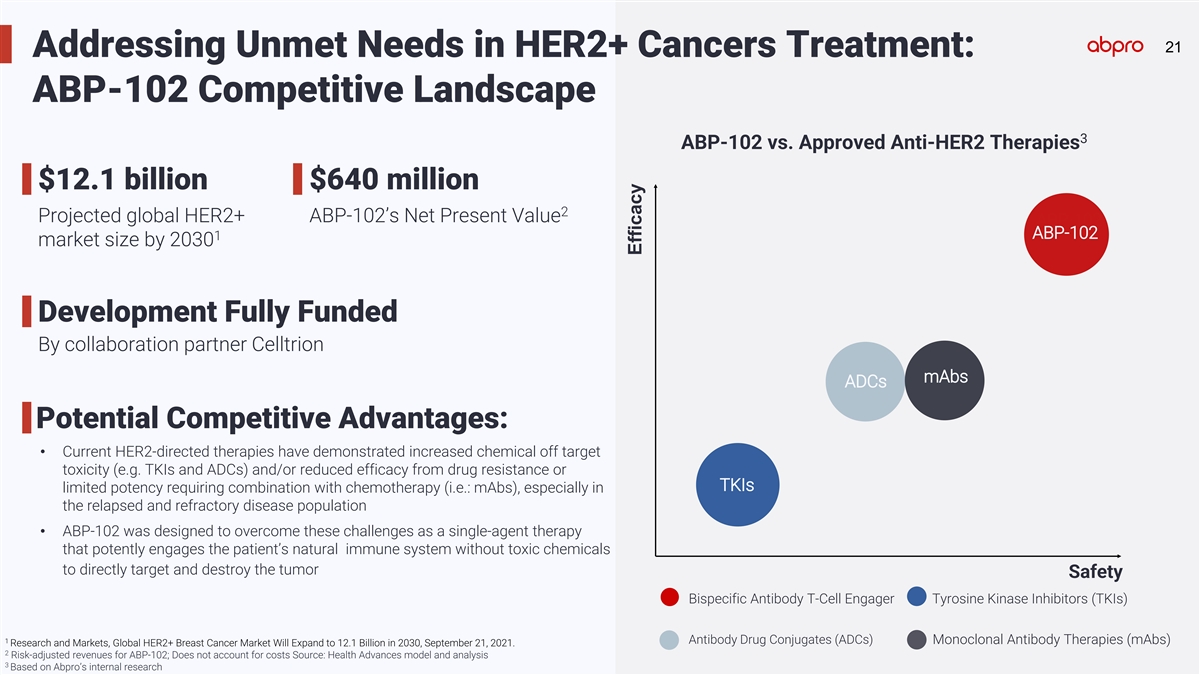

21 21 Addressing Unmet Needs in HER2+ Cancers Treatment: ABP-102

Competitive Landscape 3 ABP-102 vs. Approved Anti-HER2 Therapies $12.1 billion $640 million 2 Projected global HER2+ ABP-102’s Net Present Value ABP-102 ABP-102 1 market size by 2030 Development Fully Funded By collaboration partner Celltrion

mAbs ADCs Potential Competitive Advantages: • Current HER2-directed therapies have demonstrated increased chemical off target toxicity (e.g. TKIs and ADCs) and/or reduced efficacy from drug resistance or TKIs limited potency requiring

combination with chemotherapy (i.e.: mAbs), especially in the relapsed and refractory disease population • ABP-102 was designed to overcome these challenges as a single-agent therapy that potently engages the patient’s natural immune

system without toxic chemicals to directly target and destroy the tumor Safety Bispecific Antibody T-Cell Engager Tyrosine Kinase Inhibitors (TKIs) 1 Antibody Drug Conjugates (ADCs) Monoclonal Antibody Therapies (mAbs) Research and Markets, Global

HER2+ Breast Cancer Market Will Expand to 12.1 Billion in 2030, September 21, 2021. 2 Risk-adjusted revenues for ABP-102; Does not account for costs Source: Health Advances model and analysis 3 Based on Abpro’s internal research

Efficacy

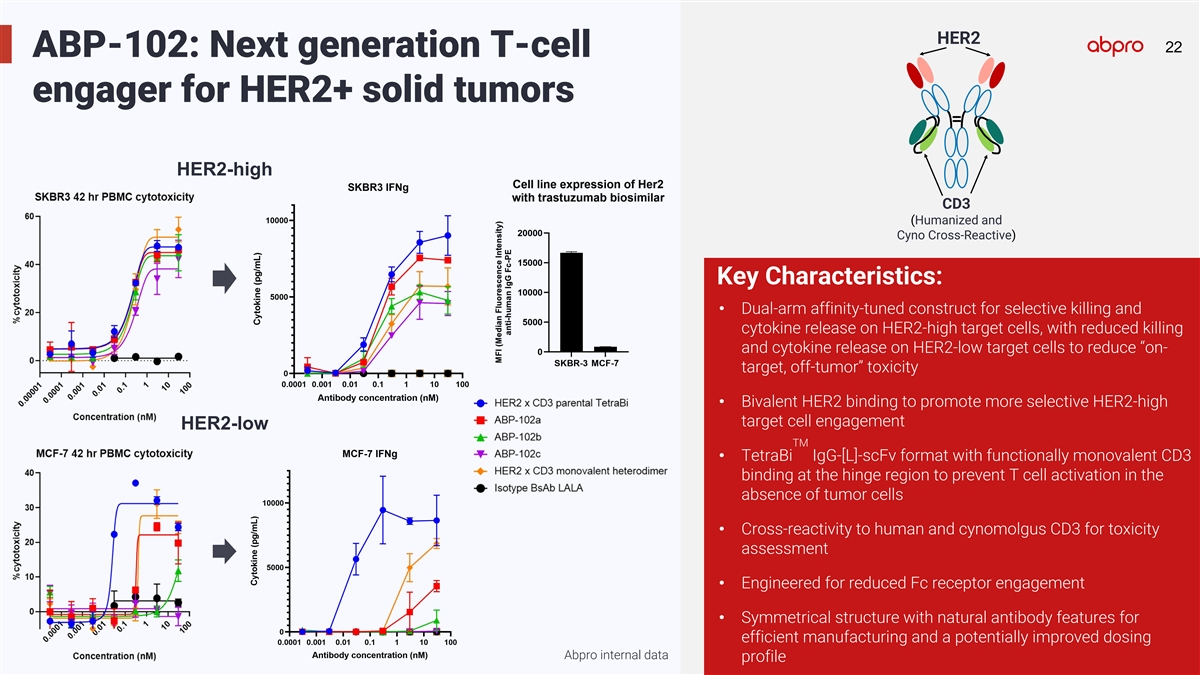

HER2 22 22 ABP-102: Next generation T-cell engager for HER2+ solid

tumors HER2-high CD3 (Humanized and Cyno Cross-Reactive) Key Characteristics: • Dual-arm affinity-tuned construct for selective killing and cytokine release on HER2-high target cells, with reduced killing and cytokine release on HER2-low

target cells to reduce “on- target, off-tumor” toxicity • Bivalent HER2 binding to promote more selective HER2-high target cell engagement HER2-low TM • TetraBi IgG-[L]-scFv format with functionally monovalent CD3 binding at

the hinge region to prevent T cell activation in the absence of tumor cells • Cross-reactivity to human and cynomolgus CD3 for toxicity assessment • Engineered for reduced Fc receptor engagement • Symmetrical structure with natural

antibody features for efficient manufacturing and a potentially improved dosing Abpro internal data profile

ABP-201 VEGF/ANG-2 BISPECIFIC ANTIBODY Treatment for Diabetic Macular

Edema (“DME”) & Wet Age-related Macular Degeneration (”AMD”)

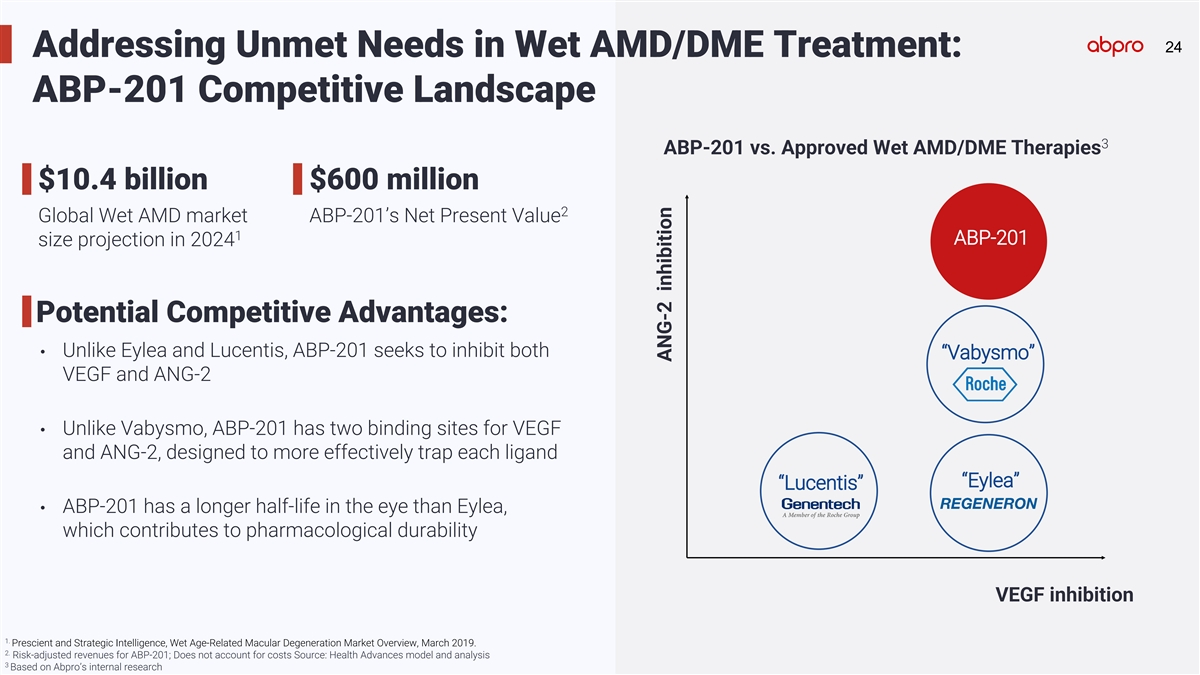

24 24 Addressing Unmet Needs in Wet AMD/DME Treatment: ABP-201

Competitive Landscape 3 ABP-201 vs. Approved Wet AMD/DME Therapies $10.4 billion $600 million 2 Global Wet AMD market ABP-201’s Net Present Value 1 ABP-201 size projection in 2024 Potential Competitive Advantages: • Unlike Eylea and

Lucentis, ABP-201 seeks to inhibit both “Vabysmo” VEGF and ANG-2 • Unlike Vabysmo, ABP-201 has two binding sites for VEGF and ANG-2, designed to more effectively trap each ligand “Eylea” “Lucentis” •

ABP-201 has a longer half-life in the eye than Eylea, which contributes to pharmacological durability VEGF inhibition 1. Prescient and Strategic Intelligence, Wet Age-Related Macular Degeneration Market Overview, March 2019. 2. Risk-adjusted

revenues for ABP-201; Does not account for costs Source: Health Advances model and analysis 3 Based on Abpro’s internal research ANG-2 inhibition

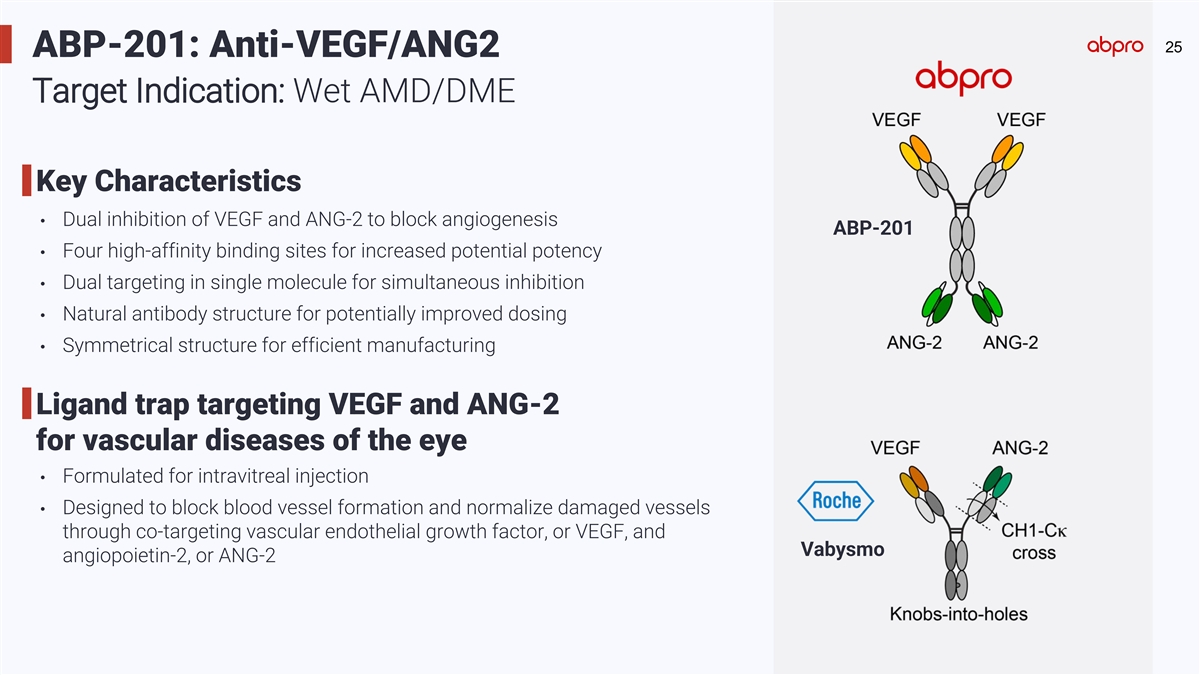

25 ABP-201: Anti-VEGF/ANG2 Target Indication: Wet AMD/DME Key

Characteristics • Dual inhibition of VEGF and ANG-2 to block angiogenesis ABP-201 • Four high-affinity binding sites for increased potential potency • Dual targeting in single molecule for simultaneous inhibition • Natural

antibody structure for potentially improved dosing • Symmetrical structure for efficient manufacturing Ligand trap targeting VEGF and ANG-2 for vascular diseases of the eye • Formulated for intravitreal injection • Designed to

block blood vessel formation and normalize damaged vessels through co-targeting vascular endothelial growth factor, or VEGF, and Vabysmo angiopoietin-2, or ANG-2

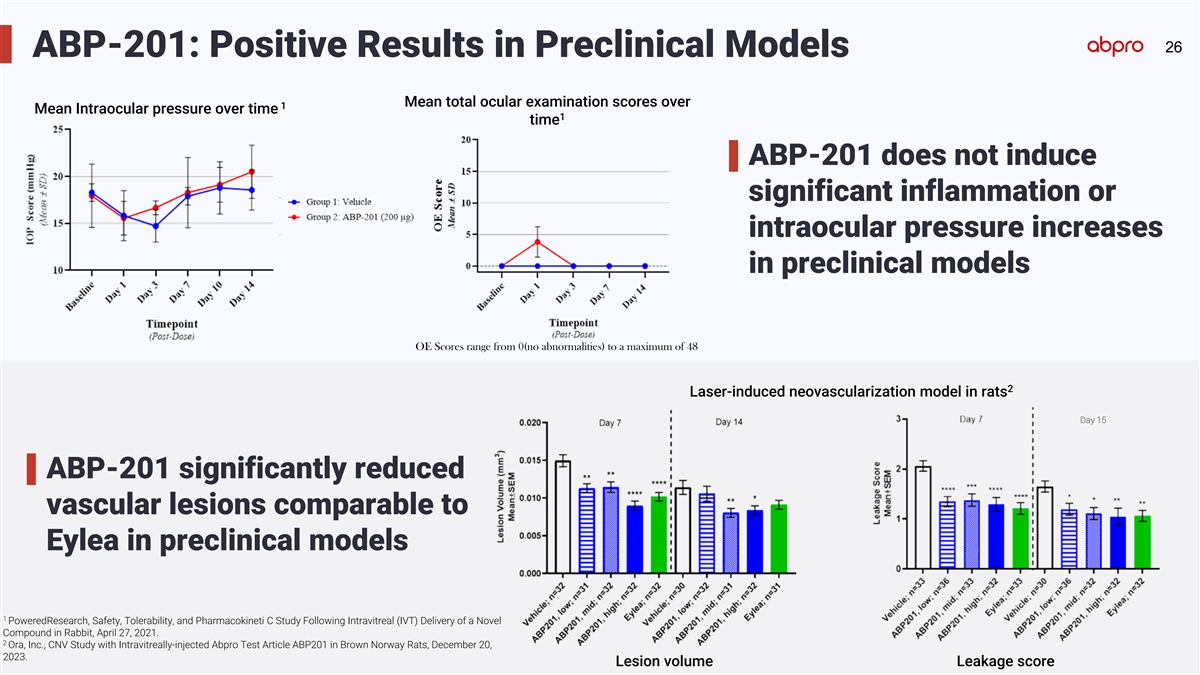

26 ABP-201: Positive Results in Preclinical Models Mean total ocular

examination scores over 1 Mean Intraocular pressure over time 1 time ABP-201 does not induce significant inflammation or intraocular pressure increases in preclinical models OE Scores range from 0(no abnormalities) to a maximum of 48 2 Laser-induced

neovascularization model in rats Day 15 ABP-201 significantly reduced vascular lesions comparable to Eylea in preclinical models 1 PoweredResearch, Safety, Tolerability, and Pharmacokineti C Study Following Intravitreal (IVT) Delivery of a Novel

Compound in Rabbit, April 27, 2021. 2 Ora, Inc., CNV Study with Intravitreally-injected Abpro Test Article ABP201 in Brown Norway Rats, December 20, 2023. Lesion volume Leakage score

27 27 Current Status: • Investigation New Drug (IND) enabling

studies underway Anticipated Development Plan • 1H 2025: File IND application • 2H 2025: Initiate a Phase 1 trial in ABP-201 patients with Wet AMD Development • Following the identification of the maximum tolerated dose (MTD) in

Collaboration Highlights: Strategy Phase 1, a larger randomized Phase 2 dose ranging trial to be conducted • Co-development via a territorial 1 partnership with Abpro Bio • Abpro retains U.S. and European Union Five commercial rights 1.

Abpro Bio Co. Ltd (KOSDAQ: 195990), through its subsidiary Abpro Bio International, Inc., holds territory rights primarily in Asia and Middle East, and is an equity investor of Abpro Corporation.

ADDITIONAL T-CELL ENGAGERS ABP-150: Anti-Claudin 18.2/ CD3 against

Gastric Cancer ABP-110: Anti-GPC3/CD3 against Liver Cancer

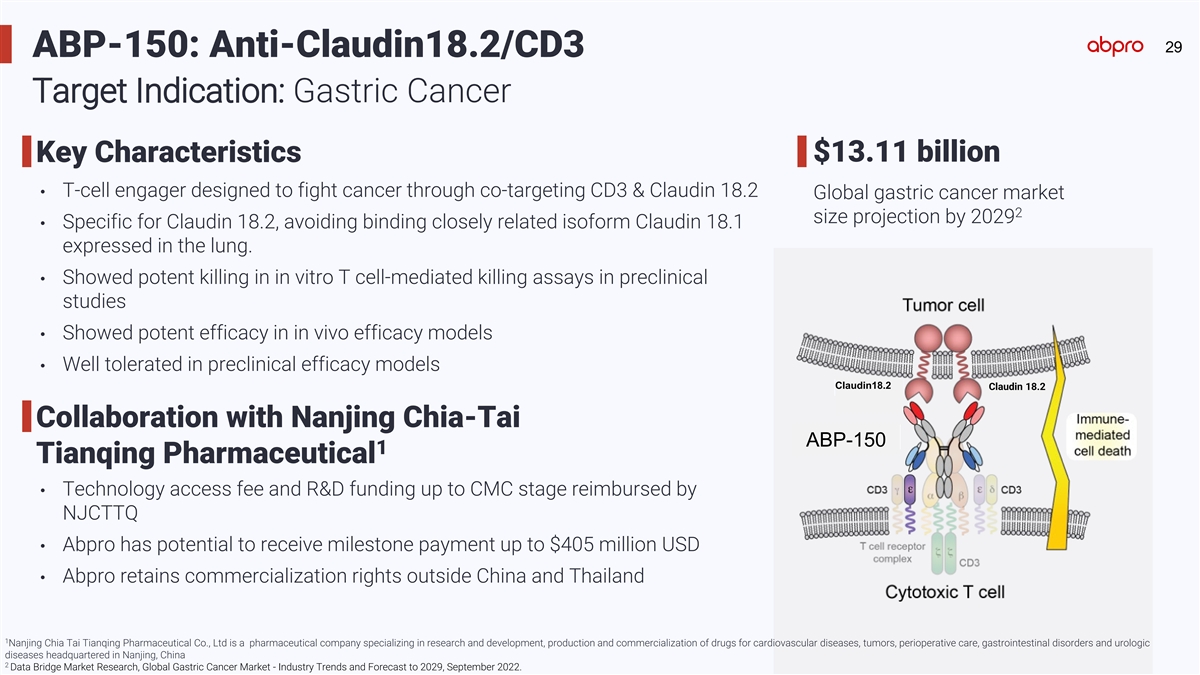

29 ABP-150: Anti-Claudin18.2/CD3 Target Indication: Gastric Cancer

$13.11 billion Key Characteristics • T-cell engager designed to fight cancer through co-targeting CD3 & Claudin 18.2 Global gastric cancer market 2 size projection by 2029 • Specific for Claudin 18.2, avoiding binding closely related

isoform Claudin 18.1 expressed in the lung. • Showed potent killing in in vitro T cell-mediated killing assays in preclinical studies • Showed potent efficacy in in vivo efficacy models • Well tolerated in preclinical efficacy

models Claudin18.2 Claudin 18.2 Claudin 18.2 Collaboration with Nanjing Chia-Tai ABP-150 1 Tianqing Pharmaceutical • Technology access fee and R&D funding up to CMC stage reimbursed by NJCTTQ • Abpro has potential to receive

milestone payment up to $405 million USD • Abpro retains commercialization rights outside China and Thailand 1 Nanjing Chia Tai Tianqing Pharmaceutical Co., Ltd is a pharmaceutical company specializing in research and development, production

and commercialization of drugs for cardiovascular diseases, tumors, perioperative care, gastrointestinal disorders and urologic diseases headquartered in Nanjing, China 2 Data Bridge Market Research, Global Gastric Cancer Market - Industry Trends

and Forecast to 2029, September 2022.

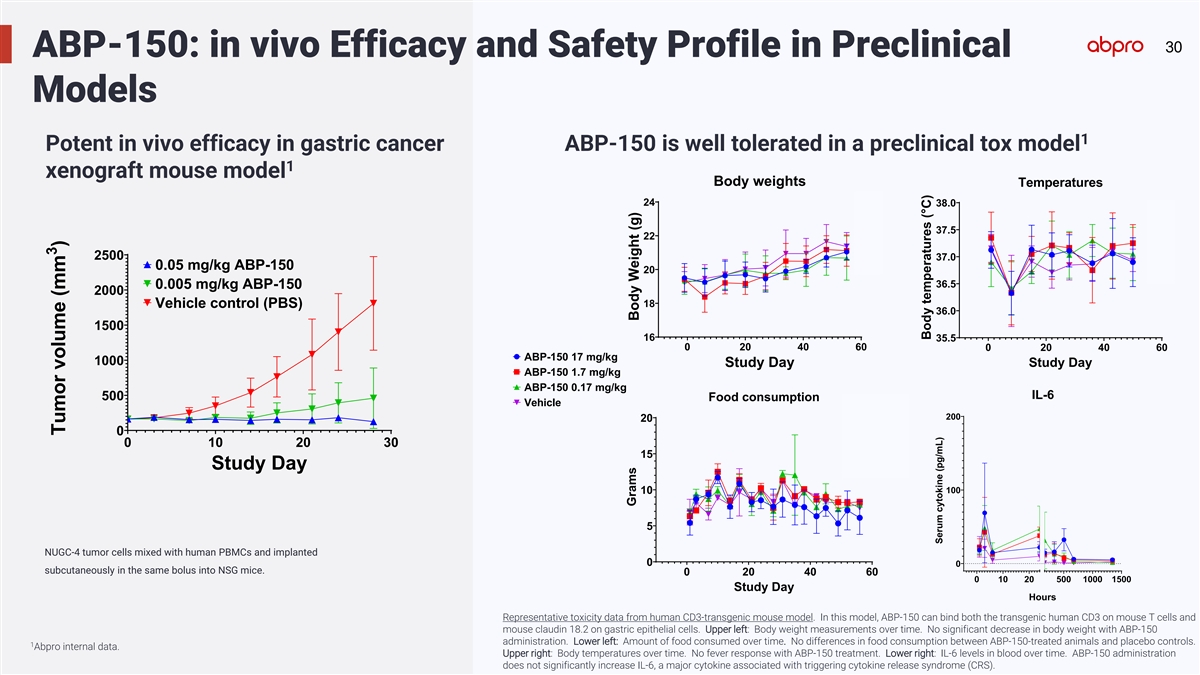

30 ABP-150: in vivo Efficacy and Safety Profile in Preclinical Models 1

Potent in vivo efficacy in gastric cancer ABP-150 is well tolerated in a preclinical tox model 1 xenograft mouse model Body weights Temperatures 24 38.0 ABP ABP 37.5 22 ABP Veh 2500 37.0 0.05 mg/kg ABP-150 20 36.5 0.005 mg/kg ABP-150 2000 18 Vehicle

control (PBS) 36.0 1500 16 35.5 0 20 40 60 0 20 40 60 ABP-150 17 mg/kg 1000 Study Day Study Day ABP-150 1.7 mg/kg ABP-150 0.17 mg/kg IL-6 500 Food consumption Vehicle 200 20 ABP-15 0 0 10 20 30 ABP-15 15 ABP-15 Study Day Vehicle 100 10 5 NUGC-4

tumor cells mixed with human PBMCs and implanted 0 0 subcutaneously in the same bolus into NSG mice. 0 20 40 60 0 10 20 500 1000 1500 Study Day Hours Representative toxicity data from human CD3-transgenic mouse model. In this model, ABP-150 can bind

both the transgenic human CD3 on mouse T cells and mouse claudin 18.2 on gastric epithelial cells. Upper left: Body weight measurements over time. No significant decrease in body weight with ABP-150 administration. Lower left: Amount of food

consumed over time. No differences in food consumption between ABP-150-treated animals and placebo controls. 1 Abpro internal data. Upper right: Body temperatures over time. No fever response with ABP-150 treatment. Lower right: IL-6 levels in blood

over time. ABP-150 administration does not significantly increase IL-6, a major cytokine associated with triggering cytokine release syndrome (CRS). 3 Tumor volume (mm ) Grams Body Weight (g) Body temperatures (°C) Serum cytokine

(pg/mL)

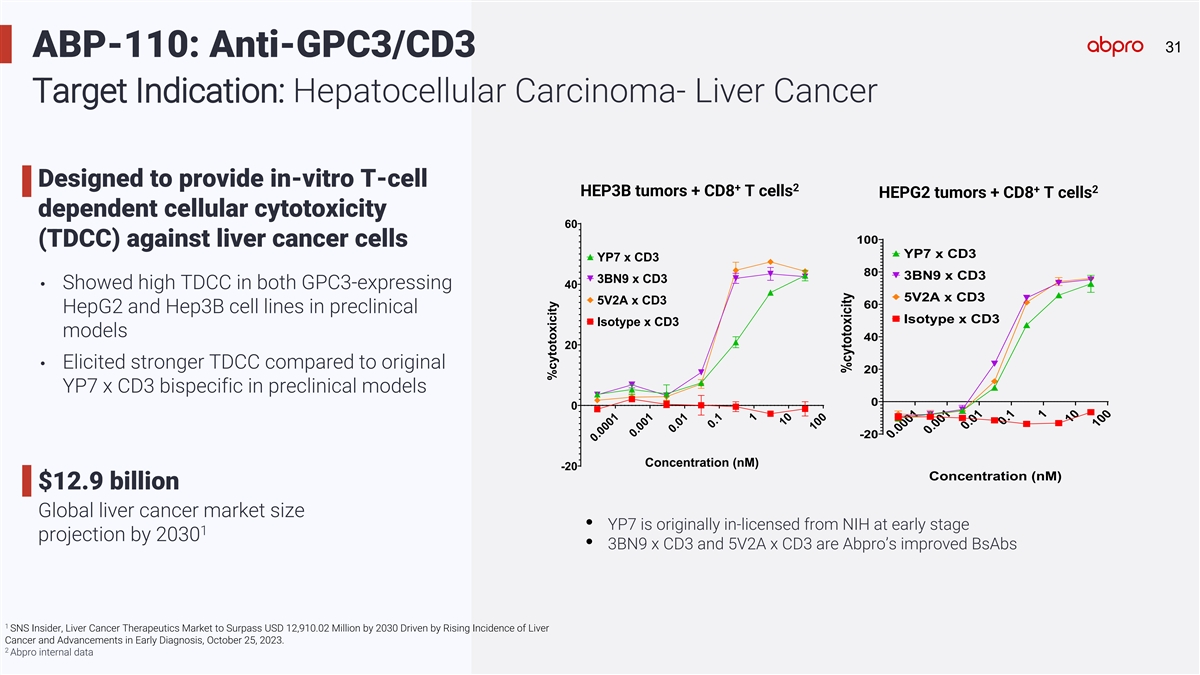

31 31 ABP-110: Anti-GPC3/CD3 Target Indication: Hepatocellular

Carcinoma- Liver Cancer Designed to provide in-vitro T-cell + 2 + 2 HEP3B tumors + CD8 T cells HEPG2 tumors + CD8 T cells dependent cellular cytotoxicity 60 100 (TDCC) against liver cancer cells YP7 x CD3 YP7 x CD3 80 3BN9 x CD3 3BN9 x CD3 40

• Showed high TDCC in both GPC3-expressing 5V2A x CD3 5V2A x CD3 60 HepG2 and Hep3B cell lines in preclinical Isotype x CD3 Isotype x CD3 models 40 20 • Elicited stronger TDCC compared to original 20 YP7 x CD3 bispecific in preclinical

models 0 0 -20 Concentration (nM) -20 Concentration (nM) $12.9 billion Global liver cancer market size • YP7 is originally in-licensed from NIH at early stage 1 projection by 2030 • 3BN9 x CD3 and 5V2A x CD3 are Abpro’s improved

BsAbs 1 SNS Insider, Liver Cancer Therapeutics Market to Surpass USD 12,910.02 Million by 2030 Driven by Rising Incidence of Liver Cancer and Advancements in Early Diagnosis, October 25, 2023. 2 Abpro internal data 0.0001 0.001 0.01 0.1 1 10 100 0

0001 0.001 10 . 0.01 0.1 1 100 %cytotoxicity %cytotoxicity

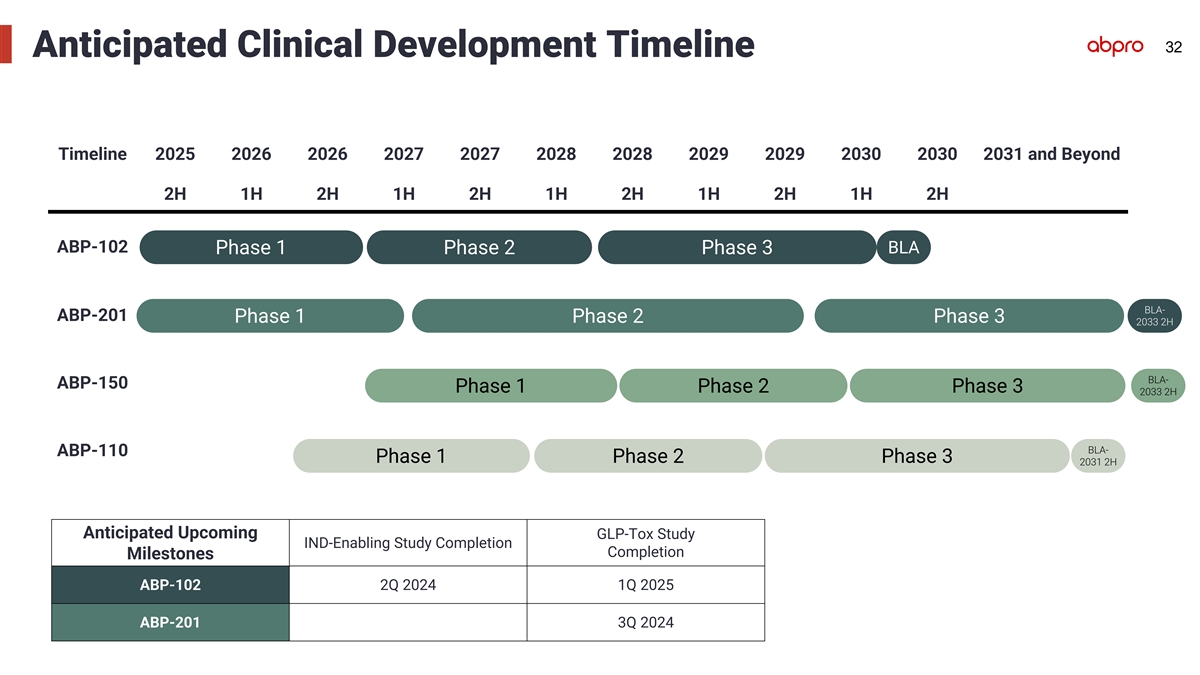

32 Anticipated Clinical Development Timeline Timeline 2025 2026 2026

2027 2027 2028 2028 2029 2029 2030 2030 2031 and Beyond 2H 1H 2H 1H 2H 1H 2H 1H 2H 1H 2H ABP-102 BLA Phase 1 Phase 2 Phase 3 BLA- ABP-201 Phase 1 Phase 2 Phase 3 2033 2H BLA- ABP-150 Phase 1 Phase 2 Phase 3 2033 2H BLA- ABP-110 Phase 1 Phase 2 Phase

3 2031 2H Anticipated Upcoming GLP-Tox Study IND-Enabling Study Completion Completion Milestones ABP-102 2Q 2024 1Q 2025 ABP-201 3Q 2024

• Additional Data for Abpro Technology Platform •

Additional Key Team Members Appendix • Additional Data for ABP-102(HER2/CD3) • Additional Data for ABP-201(VEGF/ANG2)

Additional Data for Abpro Technology Platform 34

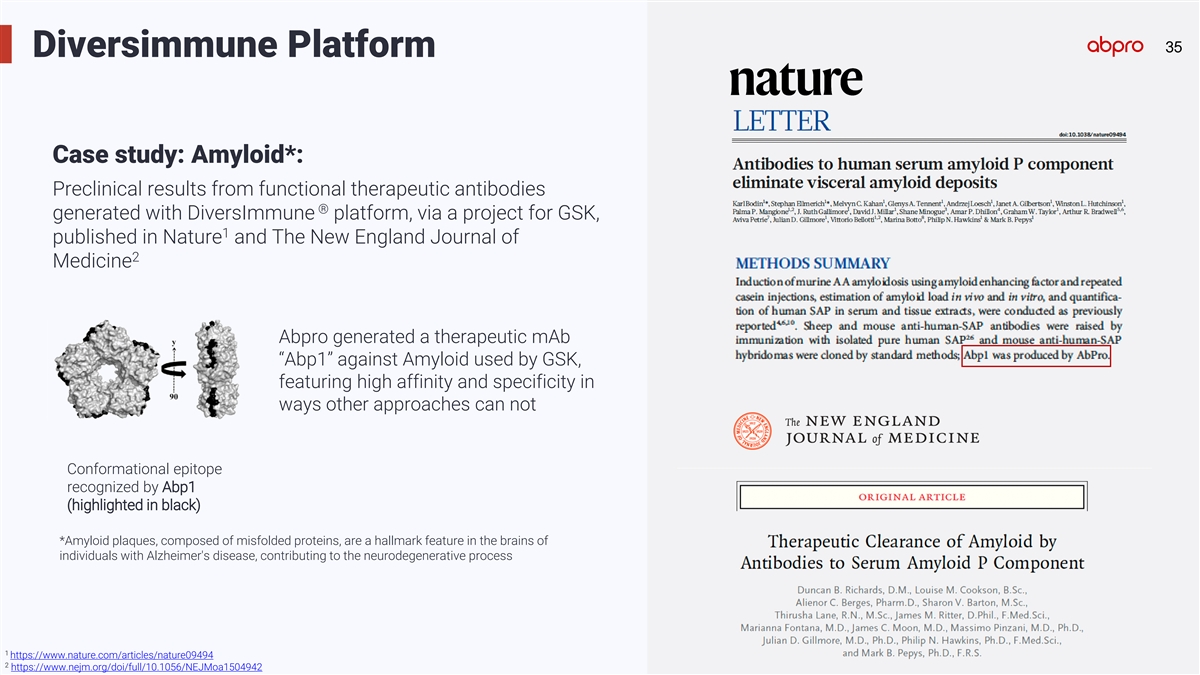

35 35 Diversimmune Platform Case study: Amyloid*: Preclinical results

from functional therapeutic antibodies ® generated with DiversImmune platform, via a project for GSK, 1 published in Nature and The New England Journal of 2 Medicine Abpro generated a therapeutic mAb “Abp1” against Amyloid used by

GSK, featuring high affinity and specificity in ways other approaches can not Conformational epitope recognized by Abp1 (highlighted in black) *Amyloid plaques, composed of misfolded proteins, are a hallmark feature in the brains of individuals with

Alzheimer's disease, contributing to the neurodegenerative process 1 https://www.nature.com/articles/nature09494 2 https://www.nejm.org/doi/full/10.1056/NEJMoa1504942

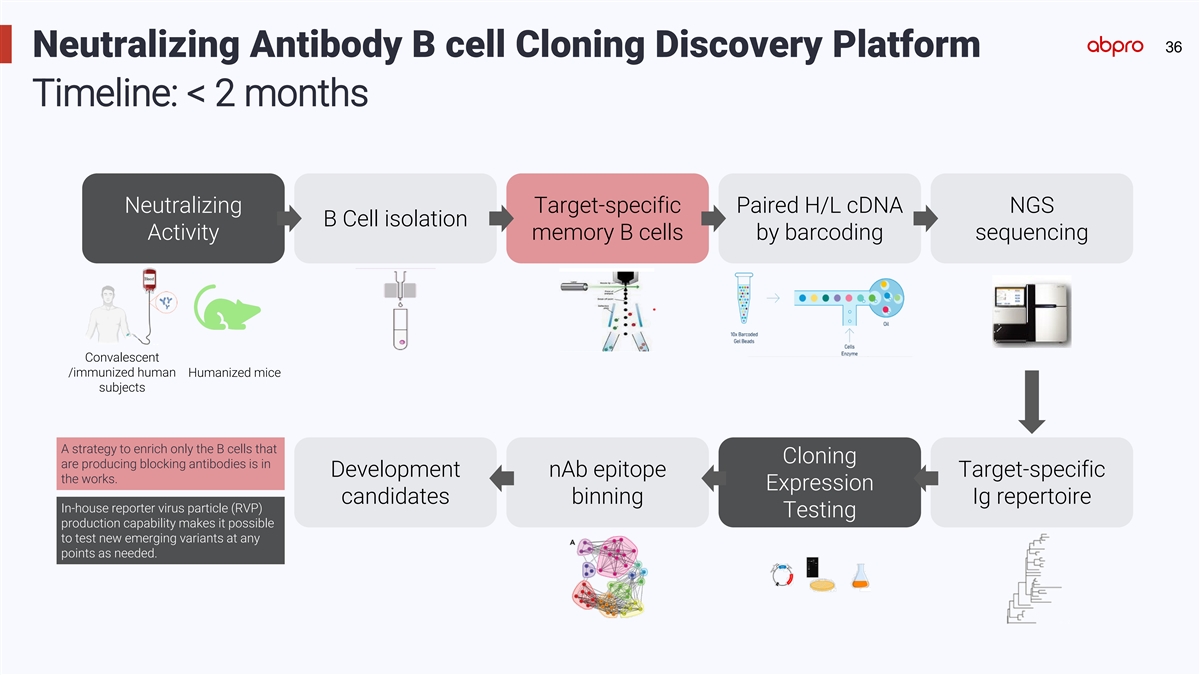

36 Neutralizing Antibody B cell Cloning Discovery Platform Timeline:

< 2 months Neutralizing Target-specific Paired H/L cDNA NGS B Cell isolation Activity memory B cells by barcoding sequencing Convalescent /immunized human Humanized mice subjects A strategy to enrich only the B cells that Cloning are producing

blocking antibodies is in Development nAb epitope Target-specific the works. Expression candidates binning Ig repertoire In-house reporter virus particle (RVP) Testing production capability makes it possible to test new emerging variants at any

points as needed.

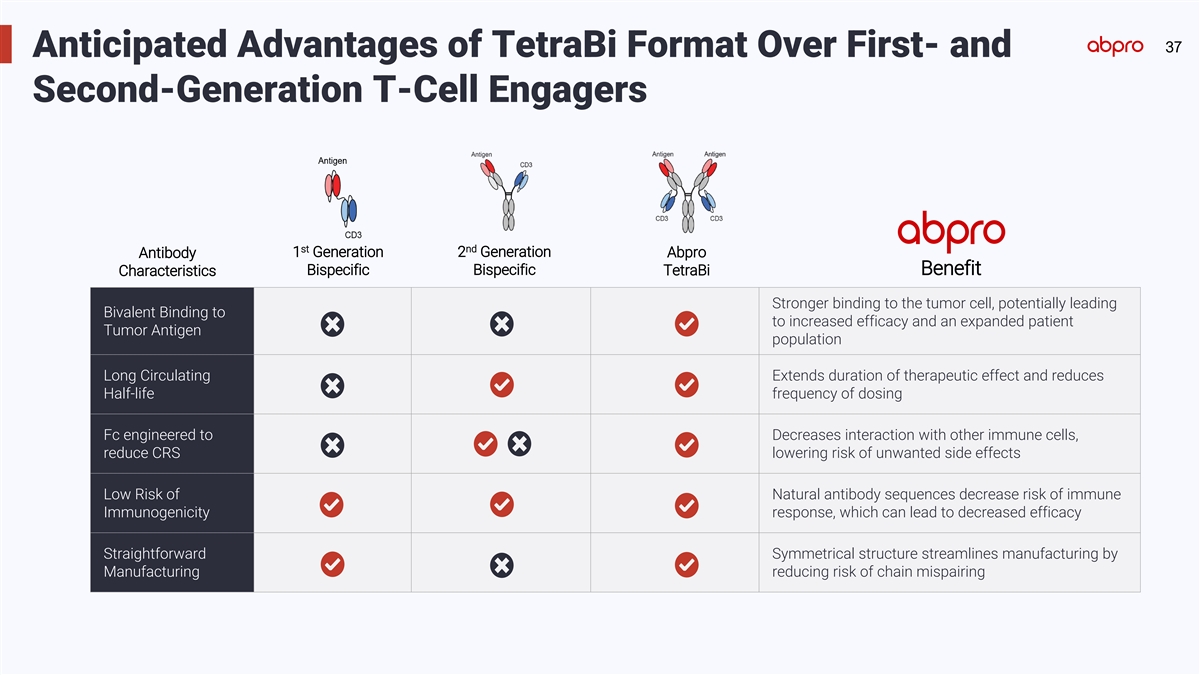

37 Anticipated Advantages of TetraBi Format Over First- and

Second-Generation T-Cell Engagers nd st 1 Generation 2 Generation Abpro Antibody Bispecific Benefit Bispecific TetraBi Characteristics Stronger binding to the tumor cell, potentially leading Bivalent Binding to to increased efficacy and an expanded

patient Tumor Antigen population Long Circulating Extends duration of therapeutic effect and reduces Half-life frequency of dosing Fc engineered to Decreases interaction with other immune cells, reduce CRS lowering risk of unwanted side effects Low

Risk of Natural antibody sequences decrease risk of immune Immunogenicity response, which can lead to decreased efficacy Straightforward Symmetrical structure streamlines manufacturing by Manufacturing reducing risk of chain mispairing

Additional Key Team Members 38

39 Additional Key Team Members Askar Kuchumov, PhD Awo Kankam Shaun

Murphy, PhD Mengsha Wang, MBA VP of Business VP of Clinical Operations; VP of Immunology Director of Corporate Development Head of Program Management Development Lomonosov Moscow State, BS Cranfield UK, Brown PhD, Clark U MSc. Finance, MBA Wayne

State U School of Medicine, PhD MSc Research Harvard Medical School Lactocore (Interim CEO), Astrotide (Co- Bill & Melinda Gates Medical Joined Abpro in 2014 Joined Abpro in 2014 founder/CEO), Cleveland Biolabs Research Institute, Moderna,

Previously at Toxikon (Director of BD) GSK, Novartis, AstraZeneca

Additional Data for ABP-102 HER2/CD3 T-Cell Engager 40

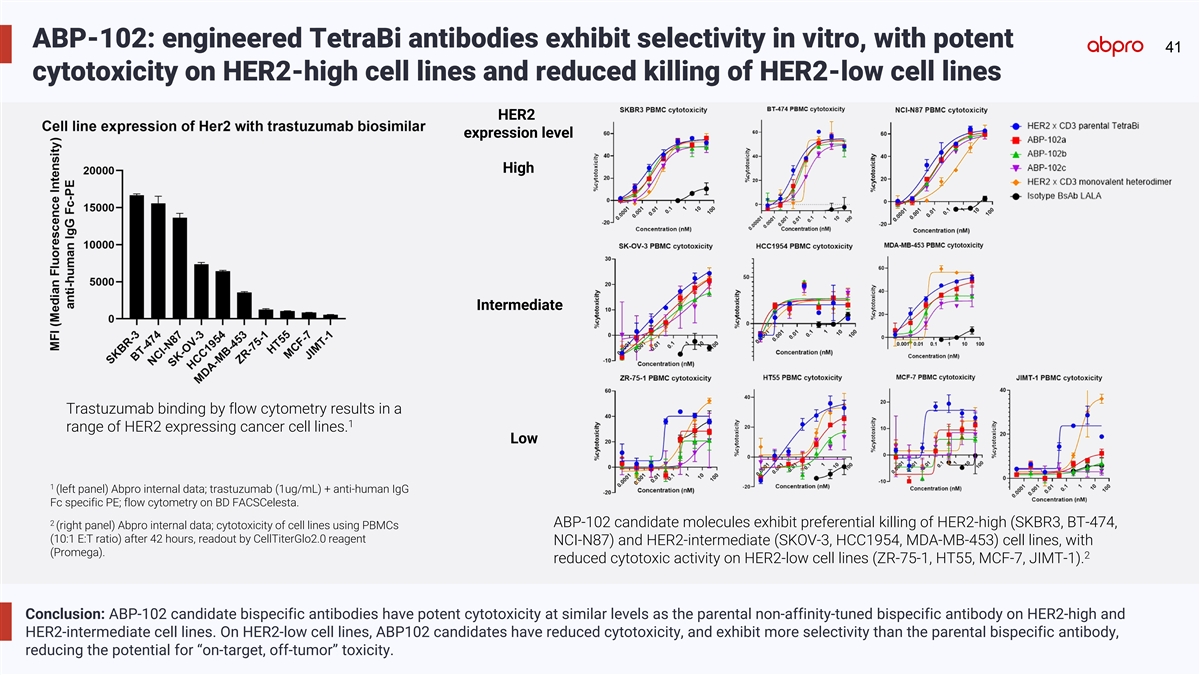

ABP-102: engineered TetraBi antibodies exhibit selectivity in vitro,

with potent 41 cytotoxicity on HER2-high cell lines and reduced killing of HER2-low cell lines HER2 expression level High Intermediate Trastuzumab binding by flow cytometry results in a 1 range of HER2 expressing cancer cell lines. Low 1 (left

panel) Abpro internal data; trastuzumab (1ug/mL) + anti-human IgG Fc specific PE; flow cytometry on BD FACSCelesta. 2 ABP-102 candidate molecules exhibit preferential killing of HER2-high (SKBR3, BT-474, (right panel) Abpro internal data;

cytotoxicity of cell lines using PBMCs (10:1 E:T ratio) after 42 hours, readout by CellTiterGlo2.0 reagent NCI-N87) and HER2-intermediate (SKOV-3, HCC1954, MDA-MB-453) cell lines, with (Promega). 2 reduced cytotoxic activity on HER2-low cell lines

(ZR-75-1, HT55, MCF-7, JIMT-1). Conclusion: ABP-102 candidate bispecific antibodies have potent cytotoxicity at similar levels as the parental non-affinity-tuned bispecific antibody on HER2-high and HER2-intermediate cell lines. On HER2-low cell

lines, ABP102 candidates have reduced cytotoxicity, and exhibit more selectivity than the parental bispecific antibody, reducing the potential for “on-target, off-tumor” toxicity.

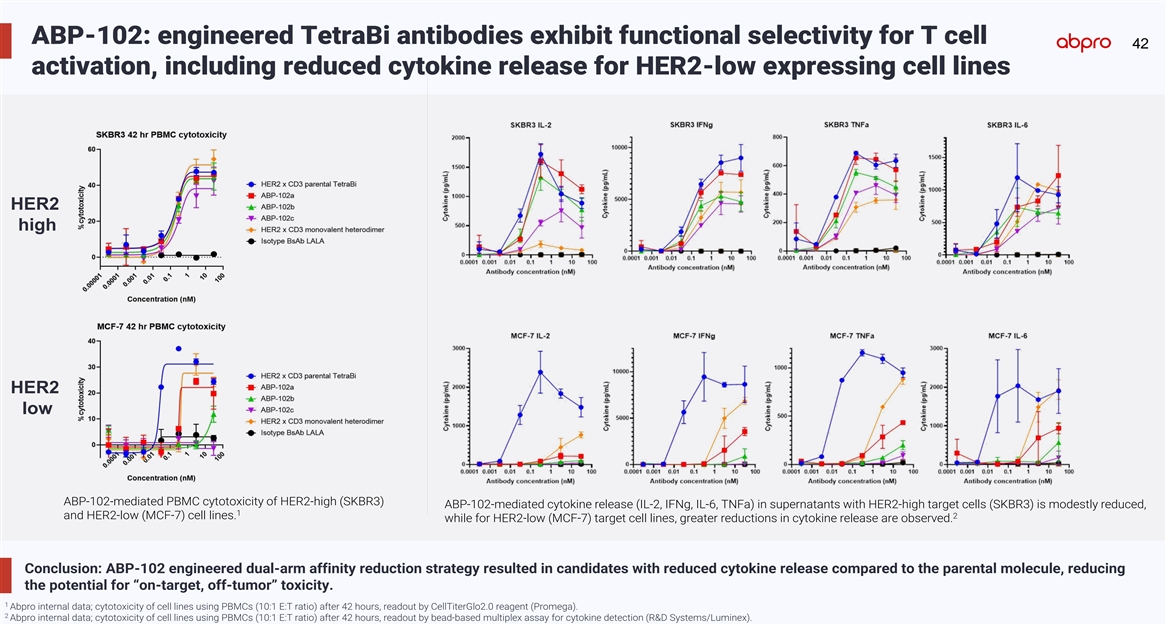

ABP-102: engineered TetraBi antibodies exhibit functional selectivity

for T cell 42 activation, including reduced cytokine release for HER2-low expressing cell lines HER2 high HER2 low ABP-102-mediated PBMC cytotoxicity of HER2-high (SKBR3) ABP-102-mediated cytokine release (IL-2, IFNg, IL-6, TNFa) in supernatants

with HER2-high target cells (SKBR3) is modestly reduced, 1 2 and HER2-low (MCF-7) cell lines. while for HER2-low (MCF-7) target cell lines, greater reductions in cytokine release are observed. Conclusion: ABP-102 engineered dual-arm affinity

reduction strategy resulted in candidates with reduced cytokine release compared to the parental molecule, reducing the potential for “on-target, off-tumor” toxicity. 1 Abpro internal data; cytotoxicity of cell lines using PBMCs (10:1

E:T ratio) after 42 hours, readout by CellTiterGlo2.0 reagent (Promega). 2 Abpro internal data; cytotoxicity of cell lines using PBMCs (10:1 E:T ratio) after 42 hours, readout by bead-based multiplex assay for cytokine detection (R&D

Systems/Luminex).

Additional Data for ABP-201 VEGF/ANG-2 BISPECIFIC ANTIBODIES

43

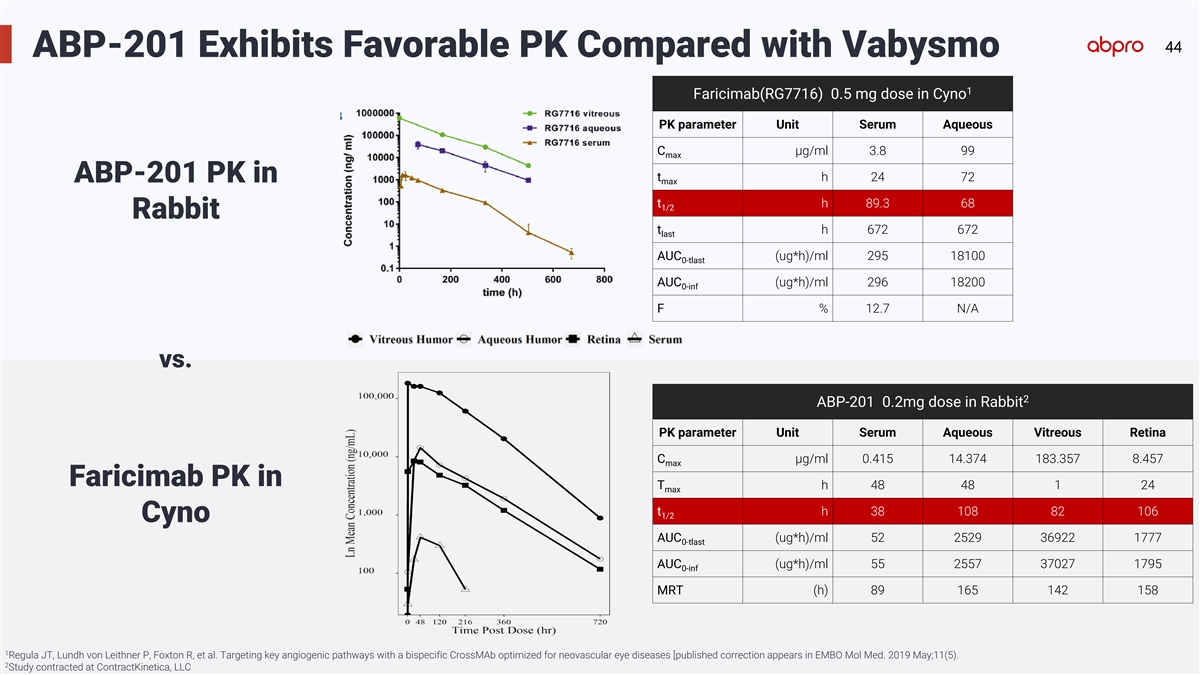

44 ABP-201 Exhibits Favorable PK Compared with Vabysmo 1

Faricimab(RG7716) 0.5 mg dose in Cyno PK parameter Unit Serum Aqueous C µg/ml 3.8 99 max t h 24 72 ABP-201 PK in max t h 89.3 68 1/2 Rabbit t h 672 672 last AUC (ug*h)/ml 295 18100 0-tlast AUC (ug*h)/ml 296 18200 0-inf F % 12.7 N/A vs. 2

ABP-201 0.2mg dose in Rabbit PK parameter Serum Aqueous Vitreous Retina Unit C µg/ml 0.415 14.374 183.357 8.457 max Faricimab PK in T h 48 48 1 24 max t h 38 108 82 106 1/2 Cyno AUC (ug*h)/ml 52 2529 36922 1777 0-tlast AUC (ug*h)/ml 55 2557

37027 1795 0-inf MRT (h) 89 165 142 158 1 Regula JT, Lundh von Leithner P, Foxton R, et al. Targeting key angiogenic pathways with a bispecific CrossMAb optimized for neovascular eye diseases [published correction appears in EMBO Mol Med. 2019

May;11(5). 2 Study contracted at ContractKinetica, LLC

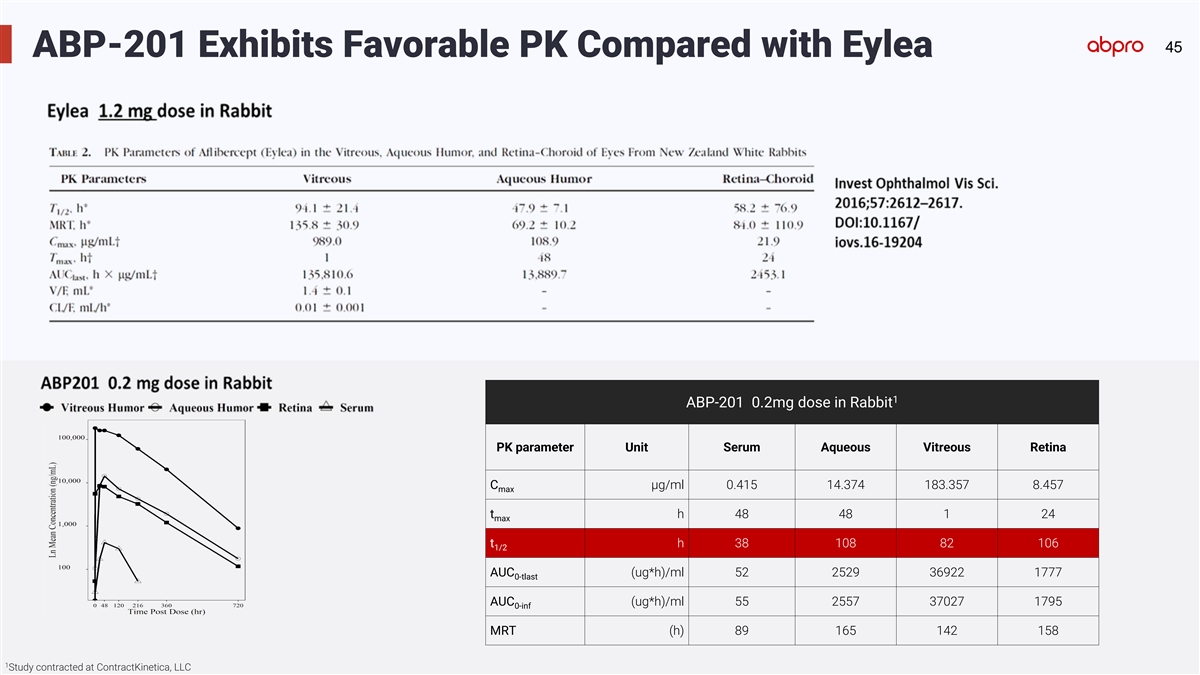

45 ABP-201 Exhibits Favorable PK Compared with Eylea 1 ABP-201 0.2mg

dose in Rabbit PK parameter Unit Serum Aqueous Vitreous Retina C µg/ml 0.415 14.374 183.357 8.457 max t h 48 48 1 24 max t h 38 108 82 106 1/2 AUC (ug*h)/ml 52 2529 36922 1777 0-tlast AUC (ug*h)/ml 55 2557 37027 1795 0-inf MRT (h) 89 165 142

158 1 Study contracted at ContractKinetica, LLC

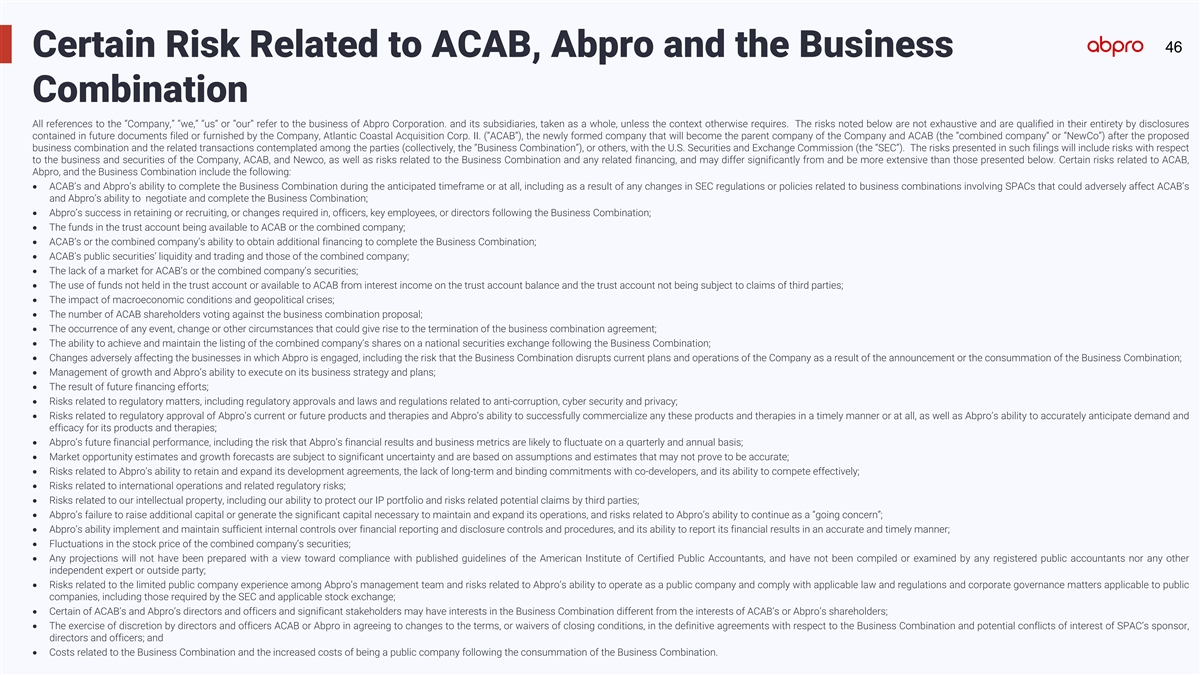

46 Certain Risk Related to ACAB, Abpro and the Business Combination All

references to the “Company,” “we,” “us” or “our” refer to the business of Abpro Corporation. and its subsidiaries, taken as a whole, unless the context otherwise requires. The risks noted below are not

exhaustive and are qualified in their entirety by disclosures contained in future documents filed or furnished by the Company, Atlantic Coastal Acquisition Corp. II. (“ACAB”), the newly formed company that will become the parent company

of the Company and ACAB (the “combined company” or “NewCo”) after the proposed business combination and the related transactions contemplated among the parties (collectively, the “Business Combination”), or

others, with the U.S. Securities and Exchange Commission (the “SEC”). The risks presented in such filings will include risks with respect to the business and securities of the Company, ACAB, and Newco, as well as risks related to the

Business Combination and any related financing, and may differ significantly from and be more extensive than those presented below. Certain risks related to ACAB, Abpro, and the Business Combination include the following: • ACAB’s and

Abpro’s ability to complete the Business Combination during the anticipated timeframe or at all, including as a result of any changes in SEC regulations or policies related to business combinations involving SPACs that could adversely affect

ACAB’s and Abpro’s ability to negotiate and complete the Business Combination; • Abpro’s success in retaining or recruiting, or changes required in, officers, key employees, or directors following the Business Combination;

• The funds in the trust account being available to ACAB or the combined company; • ACAB’s or the combined company’s ability to obtain additional financing to complete the Business Combination; • ACAB’s public

securities’ liquidity and trading and those of the combined company; • The lack of a market for ACAB’s or the combined company’s securities; • The use of funds not held in the trust account or available to ACAB from

interest income on the trust account balance and the trust account not being subject to claims of third parties; • The impact of macroeconomic conditions and geopolitical crises; • The number of ACAB shareholders voting against the

business combination proposal; • The occurrence of any event, change or other circumstances that could give rise to the termination of the business combination agreement; • The ability to achieve and maintain the listing of the combined

company’s shares on a national securities exchange following the Business Combination; • Changes adversely affecting the businesses in which Abpro is engaged, including the risk that the Business Combination disrupts current plans and

operations of the Company as a result of the announcement or the consummation of the Business Combination; • Management of growth and Abpro’s ability to execute on its business strategy and plans; • The result of future financing

efforts; • Risks related to regulatory matters, including regulatory approvals and laws and regulations related to anti-corruption, cyber security and privacy; • Risks related to regulatory approval of Abpro’s current or future

products and therapies and Abpro’s ability to successfully commercialize any these products and therapies in a timely manner or at all, as well as Abpro’s ability to accurately anticipate demand and efficacy for its products and

therapies; • Abpro’s future financial performance, including the risk that Abpro’s financial results and business metrics are likely to fluctuate on a quarterly and annual basis; • Market opportunity estimates and growth

forecasts are subject to significant uncertainty and are based on assumptions and estimates that may not prove to be accurate; • Risks related to Abpro’s ability to retain and expand its development agreements, the lack of long-term and

binding commitments with co-developers, and its ability to compete effectively; • Risks related to international operations and related regulatory risks; • Risks related to our intellectual property, including our ability to protect our

IP portfolio and risks related potential claims by third parties; • Abpro’s failure to raise additional capital or generate the significant capital necessary to maintain and expand its operations, and risks related to Abpro’s

ability to continue as a “going concern”; • Abpro’s ability implement and maintain sufficient internal controls over financial reporting and disclosure controls and procedures, and its ability to report its financial results

in an accurate and timely manner; • Fluctuations in the stock price of the combined company’s securities; • Any projections will not have been prepared with a view toward compliance with published guidelines of the American

Institute of Certified Public Accountants, and have not been compiled or examined by any registered public accountants nor any other independent expert or outside party; • Risks related to the limited public company experience among

Abpro’s management team and risks related to Abpro’s ability to operate as a public company and comply with applicable law and regulations and corporate governance matters applicable to public companies, including those required by the

SEC and applicable stock exchange; • Certain of ACAB’s and Abpro’s directors and officers and significant stakeholders may have interests in the Business Combination different from the interests of ACAB’s or Abpro’s

shareholders; • The exercise of discretion by directors and officers ACAB or Abpro in agreeing to changes to the terms, or waivers of closing conditions, in the definitive agreements with respect to the Business Combination and potential

conflicts of interest of SPAC’s sponsor, directors and officers; and • Costs related to the Business Combination and the increased costs of being a public company following the consummation of the Business Combination.

Mission: Developing antibody therapies to improve the lives of patients

Thank you! facing severe and life- threatening diseases https://abpro.com/ ABPRO CORPORATION IR@abpro.com 68 Cummings Park, Woburn, MA 01801

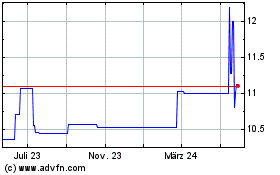

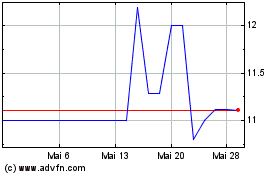

Atlantic Coastal Acquisi... (NASDAQ:ACABU)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Atlantic Coastal Acquisi... (NASDAQ:ACABU)

Historical Stock Chart

Von Nov 2023 bis Nov 2024