true

Amendment no. 1 to Form 8-k

0001173313

0001173313

2024-01-16

2024-01-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K/A

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 29, 2024 (January 16, 2024)

ABVC

BIOPHARMA, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

44370

Old Warm Springs Blvd.

Fremont,

CA |

|

94538 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number including area code: (510) 668-0881

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common Stock, par value

$0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive

Agreement.

On January 17, 2024, ABVC BioPharma, Inc. (the

“Company”) reported in the initial Current Report on Form 8-K that it entered into a securities purchase agreement

(the “Securities Purchase Agreement”) with Lind Global Fund II, LP (“Lind”), pursuant to which the

Company issued Lind a secured, convertible note in the principal amount of $1,000,000 (the “Offering”), for a purchase

price of $833,333 (the “Note”), on that same date (the “Initial 8K”). Pursuant to the Offering, Lind also

received a 5-year, common stock purchase warrant (the “Warrant”) to purchase up to 1,000,000 shares of the Company’s

common stock at an initial exercise price of $2 per share, subject to adjustment.

We are filing this amendment to disclose that due to Nasdaq requirements, the parties entered into an amendment to the Note, pursuant

to which the conversion price shall have a floor price of $1.00 (the “Amendment”). Additionally, the Amendment requires the

Company to make a cash payment to Lind if in connection with a conversion, the conversion price is deemed to be the floor price.

The foregoing description of the Amendment is qualified by reference to the full text of the Amendment, which is filed as an Exhibit hereto

and incorporated herein by reference.

The parties also agreed that the Company has an

additional month, until April 17, 2024 to hold the initial shareholder meeting required under the Securities Purchase Agreement.

Neither this Current Report on Form 8-K, nor any

exhibit attached hereto, is an offer to sell or the solicitation of an offer to buy the Securities described herein. Such disclosure does

not constitute an offer to sell, or the solicitation of an offer to buy nor shall there be any sales of the Company’s securities

in any state in which such offer, solicitation or sale would be unlawful. The securities mentioned herein have not been registered under

the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements under the Securities Act and applicable state securities laws.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| February 29, 2024 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

2

Exhibit 10.2

AMENDMENT NO. 1 TO SECURED CONVERTIBLE PROMISSORY

NOTE

This Amendment No. 1 to Senior

Convertible Promissory Note (this “Amendment”) is entered into as of February [ ], 2024 (the “Amendment Date”),

by and between Lind Global fund II LP, a Delaware limited partnership (“Holder”),

and ABVC BioPharma, Inc., a Nevada corporation (“Maker”). Capitalized

terms used in this Amendment without definition shall have the meanings given to them in the Note (as defined below).

A. Maker

previously issued to Holder a Senior Convertible Promissory Note dated January 17, 2024 in the principal amount of $1,000,000.00 (the

“Note”) pursuant to that certain Securities Purchase Agreement, dated January 17, 2024 (the “November Purchase

Agreement” and, together with the Note, the “Transaction Documents”).

B. The

Holder and Maker have agreed to amend certain terms and conditions under the Note; specifically, to establish a floor price for the conversion

of the Note.

NOW, THEREFORE, for good and

valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1. Recitals.

Each of the parties hereto acknowledges and agrees that the recitals set forth above in this Amendment are true and accurate and are hereby

incorporated into and made a part of this Amendment.

2. Amendments.

| (a) | Section 3.1(b) of the Note is hereby deleted and replaced in its entirety with the following: |

Conversion Price. The “Conversion

Price” means the lesser of (i) $3.50 (the “Fixed Price”) and (ii) 90% of the average of the three lowest

VWAPs during the 20 trading days prior to conversion (“Variable Price”), and shall be subject to adjustment as provided

herein. Notwithstanding the foregoing, provided that no Event of Default shall have occurred, conversions hereunder shall be at the Fixed

Price for the first one hundred eighty days (180) following the date hereof. Provided, further that in no event shall the Variable Price

be less than the Floor Price (as defined below), and in the event that the calculation as set forth above would result in a Variable Price

less than the Floor Price, the “Conversion Price” for the purposes of this Section 3.01(b) shall be the Floor Price.

| (b) | A new Section 3.1(d) and Section 3.1(e) is hereby added to the Note, immediately following Section 3.1(c),

and providing as follows: |

| (c) | Floor Price. For purposes herein, the “Floor

Price” means $1.00, subject to adjustment as set forth herein. If the Maker shall at any time or from time to time after the Amendment

Date effect a split or other subdivision of the outstanding Common Stock, the Floor Price in effect immediately prior to the stock split

shall be proportionately decreased, and if the Maker shall at any time or from time to time after the Amendment Date combine the outstanding

Common Stock, the Floor Price in effect immediately prior to the combination shall be proportionately increased, with any adjustments

pursuant to this sentence being effective at the close of business on the date the stock split or combination occurs. |

| (d) | Cash Payment. At the option of the Holder, if in connection

with a conversion under this Note, the Conversion Price is deemed to be the Floor Price, then in addition to issuing the Conversion Shares

at the Floor Price, the Maker will also pay to the Holder a cash amount equal to the following formula: |

(A – B) x C

Where:

A = Number of shares of Common

Stock that would be issued to the Holder on such Conversion Date determined by dividing the Conversion Amount being paid in shares of

Common Stock by ninety percent (90%) of the lowest single VWAP during the twenty (20) Trading Days prior to the applicable Conversion

Date (notwithstanding the Floor Price);

B = Number of Conversion Shares

issued to the Holder in connection with the conversion at the Floor Price; and

C = the VWAP on

the Conversion Date.

3. Representations

and Warranties. In order to induce Holder to enter into this Amendment, Maker, for itself, and for its affiliates, successors and

assigns, hereby acknowledges, represents, warrants and agrees as follows:

(a) Maker has full

power and authority to enter into this Amendment and to incur and perform all obligations and covenants contained herein, all of which

have been duly authorized by all proper and necessary action. No consent, approval, filing or registration with or notice to any governmental

authority is required as a condition to the validity of this Amendment or the performance of any of the obligations of Maker hereunder.

(b) There is no fact

known to Maker or which should be known to Maker which Maker has not disclosed to Holder on or prior to the date of this Amendment which

would or could materially and adversely affect the understanding of Holder expressed in this Amendment or any representation, warranty,

or recital contained in this Amendment.

(c) Except as expressly

set forth in this Amendment, Maker acknowledges and agrees that neither the execution and delivery of this Amendment nor any of the terms,

provisions, covenants, or agreements contained in this Amendment shall in any manner release, impair, lessen, modify, waive, or otherwise

affect the liability and obligations of Maker under the terms of the Transaction Documents.

(d) Maker has no defenses,

affirmative or otherwise, rights of setoff, rights of recoupment, claims, counterclaims, actions or causes of action of any kind or nature

whatsoever against Holder, directly or indirectly, arising out of, based upon, or in any manner connected with, the transactions contemplated

hereby, whether known or unknown, which occurred, existed, was taken, permitted, or begun prior to the execution of this Amendment and

occurred, existed, was taken, permitted or begun in accordance with, pursuant to, or by virtue of any of the terms or conditions of the

Transaction Documents. To the extent any such defenses, affirmative or otherwise, rights of setoff, rights of recoupment, claims, counterclaims,

actions or causes of action exist or existed, such defenses, rights, claims, counterclaims, actions and causes of action are hereby waived,

discharged and released. Maker hereby acknowledges and agrees that the execution of this Amendment by Holder shall not constitute an acknowledgment

of or admission by Holder of the existence of any claims or of liability for any matter or precedent upon which any claim or liability

may be asserted.

4. Events

of Defaults. To the extent any Event of Default has occurred prior to the date hereof under the Transaction Documents, the Holder

hereby waives any such Event of Default.

5. Certain

Acknowledgments. Each of the parties acknowledges and agrees that no property or cash consideration of any kind whatsoever has been

or shall be given by Holder to Maker in connection with this Amendment or any other amendment to the Note granted herein.

6. Other

Terms Unchanged. The Note, as amended by this Amendment, remains and continues in full force and effect, constitutes legal, valid,

and binding obligations of each of the parties, and is in all respects agreed to, ratified, and confirmed. Any reference to the Note after

the date of this Amendment is deemed to be a reference to the Note as amended by this Amendment. If there is a conflict between the terms

of this Amendment and the Note, the terms of this Amendment shall control. Except as expressly set forth herein, the execution, delivery,

and performance of this Amendment shall not operate as a waiver of, or as an amendment to, any right, power, or remedy of Holder under

the Note, as in effect prior to the date hereof. For the avoidance of doubt, this Amendment shall be subject to the governing law, venue,

and Arbitration Provisions, as set forth in the Note.

7. No

Reliance. Maker acknowledges and agrees that neither Holder nor any of its officers, directors, members, managers, equity holders,

representatives or agents has made any representations or warranties to Maker or any of its agents, representatives, officers, directors,

or employees except as expressly set forth in this Amendment and the Transaction Documents and, in making its decision to enter into the

transactions contemplated by this Amendment, Maker is not relying on any representation, warranty, covenant or promise of Holder or its

officers, directors, members, managers, equity holders, agents or representatives other than as set forth in this Amendment.

8. Counterparts.

This Agreement may be executed in two (2) or more counterparts, each of which shall be deemed an original, but all of which together shall

constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method and any counterpart

so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

9. Further

Assurances. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall execute

and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to

carry out the intent and accomplish the purposes of this Amendment and the consummation of the transactions contemplated hereby.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned have executed

this Amendment as of the date set forth above.

| |

HOLDER: |

| |

|

| |

Lind Global Fund II LP |

| |

|

| |

By: |

|

| |

Printed Name: |

Jeff Easton |

| |

Title: |

Managing Member |

| |

|

| |

MAKER: |

| |

|

| |

ABVC BioPharma, Inc. |

| |

|

| |

By: |

|

| |

Printed Name: |

Uttam Patil |

| |

Title: |

CEO |

[Signature Page to Amendment to Senior Convertible

Promissory Note]

4

v3.24.0.1

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

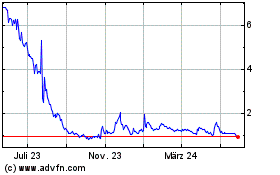

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

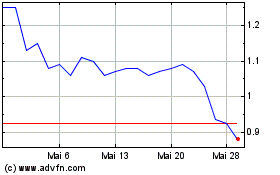

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024