false

0001576873

0001576873

2024-09-23

2024-09-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 23, 2024

| AMERICAN

BATTERY TECHNOLOGY COMPANY |

| (Exact

name of registrant as specified in its charter) |

| Nevada

|

|

001-41811

|

|

33-1227980 |

| (State

or other jurisdiction of |

|

(Commission |

|

(IRS

Employer |

| incorporation

or organization) |

|

File

No.) |

|

Identification

Number) |

100

Washington Street, Suite 100

Reno,

NV |

|

89503

|

| (Address

of principal executive offices) |

|

(Zip

Code) |

(775)

473-4744

(Registrant’s

telephone number including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

stock, $0.001 par value |

|

ABAT |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

September 23, 2024, American Battery Technology Company (the “Company”) issued a press release announcing that it would hold

an earnings call on September 23, 2024, to discuss its financial results for the fiscal year ended June 30, 2024. The full text of the

press release issued in connection with the announcement is furnished hereto as Exhibit 99.1.

On

September 23, 2024, the Company posted an investor presentation to its website used in the earnings call pertaining to the financial

results for the fiscal year ended June 30, 2024. On September 24, 2024, the Company issued a press release announcing the Company’s

financial results for the fiscal year ended June 30, 2024. The presentation and the press release are furnished hereto as Exhibit 99.2

and Exhibit 99.3, respectively.

The

information in this Current Report on Form 8-K, including Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3, shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any other filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item

8.01 Other Events.

On

September 23, 2024, the Company issued a press release announcing that it has been selected for a highly competitive grant for $150 million

dollars of federal investment by the U.S. Department of Energy to be applied towards the construction of a new lithium-ion battery recycling

facility.

A

copy of the Company’s press release is attached as Exhibit 99.4 to this Current Report on Form 8-K and is incorporated herein by

reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

AMERICAN

BATTERY TECHNOLOGY COMPANY |

| |

|

|

| Date:

September 25, 2024 |

By: |

/s/

Ryan Melsert |

| |

Name:

|

Ryan

Melsert |

| |

Title:

|

Chief

Executive Officer |

Exhibit 99.1

American

Battery Technology Company Hosts Fiscal Year 2024 Earnings Call Today, Monday, September 23, 2024

Reno,

Nev., September 23, 2024 — American Battery Technology Company (ABTC) (NASDAQ: ABAT), an integrated critical battery

materials company that is commercializing its technologies for both primary battery minerals manufacturing and secondary minerals lithium-ion

battery recycling, will release FY24 financial results and host company earnings call today, Monday, September 23, 2024, at 4:30 p.m.

ET.

Those

interested in viewing the Livestream can visit: American Battery Technology Company Livestream FY24. The press release, Livestream

replay, and presentation will be available at www.americanbatterytechnology.com/events-presentations.

About

American Battery Technology Company

American

Battery Technology Company (ABTC), headquartered in Reno, Nevada, has pioneered first-of-kind technologies to unlock domestically manufactured

and recycled battery metals critically needed to help meet the significant demand from the electric vehicle, stationary storage, and

consumer electronics industries. Committed to a circular supply chain for battery metals, ABTC works to continually innovate and master

new battery metals technologies that power a global transition to electrification and the future of sustainable energy.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.”

Although the American Battery Technology Company’s (the “Company”) management believes that such forward-looking statements

are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number

of risks and uncertainties, which could cause the Company’s future results to differ materially from those anticipated. Potential

risks and uncertainties include, among others, risks and uncertainties related to the Company’s ability to continue as a going

concern; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory

requirements and approvals; fluctuating mineral and commodity prices. Additional information regarding the factors that may cause actual

results to differ materially from these forward-looking statements is available in the Company’s filings with the Securities and

Exchange Commission, including the Annual Report on Form 10-K for the year ended June 30, 2023. The Company assumes no obligation to

update any of the information contained or referenced in this press release.

###

American

Battery Technology Company

Media

Contact:

Tiffiany

Moehring

tmoehring@batterymetals.com

720-254-1556

Exhibit 99.2

Exhibit 99.3

American

Battery Technology Company Releases Fiscal Year 2024 Financial Results

Achieves

major milestone by generating first revenue from recycled lithium-ion battery products sold to domestic battery manufacturing supply

chain

Reno,

Nev., September 24, 2024 — American Battery Technology Company (ABTC) (NASDAQ: ABAT), an integrated critical battery

materials company that is commercializing its technologies for both primary battery minerals manufacturing and secondary minerals lithium-ion

battery recycling, announced its fiscal year (FY) 2024 financial results for the 12 months ended June 30, 2024.

Bringing

first-of-kind technologies to market, ABTC’s two business units of lithium-ion battery recycling and primary battery metals manufacturing

are working to build a domestically-sourced, lithium-ion battery metals circular supply chain for North America.

“I

am extremely proud of the ABTC team for rapidly progressing through purchasing a vacant facility, installing our internally developed

battery recycling equipment, commissioning the processing train, and selling first product to customers within a single year,”

stated ABTC CEO Ryan Melsert. “Equally impressive, within this fiscal year in our primary battery metals manufacturing business

unit, we evolved from bench scale trials, to designing and constructing a multi-tonne per day integrated demonstration facility, to commissioning

this full system, to manufacturing our first large batch of battery grade lithium hydroxide, to hosting a visit from the U.S. Secretary

of Energy Jennifer Granholm to personally examine our progress and witness our operations. Our employees are going above and beyond each

day to accomplish these groundbreaking achievements to bring to life our company’s vision.”

Battery

Recycling Business Milestones from Fiscal Year 2024:

| ● | Implementation

of First Battery Recycling Facility: ABTC purchased a vacant building in Summer 2023,

implemented its internally-developed lithium-ion battery recycling processing train in this

facility, and completed construction and commenced commissioning of a 20,000 tonnes/year

train in Fall 2023.

|

| ● | First

Revenue from Battery Recycling Operations: ABTC manufactured commercial quantities

of recycled products within this year and generated its first revenue from the sale of these

products to its strategic domestic customers. Once fully ramped, this facility has the capacity

to manufacture multiple streams of battery grade metals and other recycled products. |

| ● | ABTC

was selected by the U.S. Department of Energy (DOE) and IRS for a highly competitive

tax credit award under the 48C Qualifying Energy Project Credit program for approximately

$20 million to be applied towards the capital expenditures of its first lithium-ion battery

recycling facility near Reno, Nevada.

|

| ● | ABTC

was selected by the U.S. DOE and IRS for a highly competitive tax credit award under

the 48C Qualifying Energy Project Credit program for approximately $40 million to be applied

towards the capital expenditures of its second lithium-ion battery recycling facility.

|

| ● | ABTC

was selected for a competitive grant by the U.S. DOE to support its $115 million project

for its commercial-scale lithium hydroxide refinery, and this prime agreement was issued

with a project start date of September 1, 2023. The company began receiving funds related

to this award during the quarter ending September 30, 2023.

|

| ● | ABTC

was selected for a competitive grant by the U.S. DOE to support its $20 million project

for its next-generation advanced battery recycling technologies, and this prime agreement

was issued with a project start date of October 1, 2023. The company began receiving funds

related to this award during the quarter ending December 31, 2023.

|

| ● | ABTC

was selected for a competitive grant by the U.S. DOE for $150 million to support the

design and construction of its second commercial scale lithium-ion battery recycling facility.

This award is currently in the contracting phase and project kickoff is expected in 2025. |

Primary

Battery Metals Manufacturing Business Milestones from Fiscal Year 2024:

| ● | Successful

Manufacturing Nevada Claystone-to-Lithium Hydroxide: ABTC completed the construction

and commissioning of its multi-tonne per day claystone-to-battery grade lithium hydroxide

(LiOH) pilot plant and successfully manufactured LiOH from claystone specifically collected

from its Tonopah Flats Lithium Projects (TFLP), marking a significant milestone in

the commercialization of its internally-developed processes to access an unrealized domestic

primary lithium resource.

|

| ● | Initial

Assessment of Tonopah Flats Lithium Project: ABTC released the Initial Assessment

(Preliminary Economic Assessment) for its Tonopah Flats Lithium Project, which has been identified

as one of the largest lithium deposits in the U.S., and demonstrates an economically competitive

project with total production costs of approximately $4,600 per tonne of LiOH and a NPV@10%

of $4.7 billion. This SK-1300 compliant Initial Assessment raised the material amount

of the resource to Measured and Indicated status and provides a commercialization pathway

that allows for an engineered phased development, with improved access to the higher quality

portions of the resource, and improved project economics. |

Financial

Highlights from Fiscal Year 2024:

| ● | First revenue from the sale of commercial quantities of Black Mass produced by its first integrated lithium-ion battery recycling facility. Once fully ramped, this facility has the capacity to process approximately 20,000 MT/year of battery materials and to produce multiple streams of battery grade metals and other byproducts.

|

| ● | Government grant funding increased to $3.3 million for the fiscal year ended June 30, 2024, compared to $0.9 million during the prior year.

|

| ● | Cash used in investing activities was $12.9 million for the acquisition of property, construction, equipment, mineral rights, and water rights for the fiscal year ended June 30, 2024. Cash used in the same period of the prior year totaled $36.7 million, primarily for acquisition of its first battery recycling facility, water rights, and equipment.

|

| ● | As of June 30, 2024, the company had total cash on hand of $7 million.

|

| ● | Cash used in operations for the fiscal year ended June 30, 2024 was $16.9 million, compared to $13.4 million during the fiscal year ended June 30, 2023.

|

| ● | On

August 29, 2023, the company entered into a Securities Purchase Agreement for up to $51 million

of a new series of senior secured convertible notes. To date, $25 million of these notes

have been issued and as of June 30, 2024, $18 million of these notes have been redeemed or

converted, and the company has no plans to use the remaining facility. |

The

company remains diligently focused on accelerated commercialization and long-term sustainable growth to operationalize its first-of-kind

low-environmental-impact technologies within the lithium-ion battery recycling and primary battery metals manufacturing sectors.

ABTC

hosted FY 2024 earnings call on Monday, September 23, 2024. The press release, webcast replay, and presentation are available at www.americanbatterytechnology.com/events-presentations.

About

American Battery Technology Company

American

Battery Technology Company (ABTC), headquartered in Reno, Nevada, has pioneered first-of-kind technologies to unlock domestically manufactured

and recycled battery metals critically needed to help meet the significant demand from the electric vehicle, stationary storage, and

consumer electronics industries. Committed to a circular supply chain for battery metals, ABTC works to continually innovate and master

new battery metals technologies that power a global transition to electrification and the future of sustainable energy.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.”

Although the American Battery Technology Company’s (the “Company”) management believes that such forward-looking statements

are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number

of risks and uncertainties, which could cause the Company’s future results to differ materially from those anticipated. Potential

risks and uncertainties include, among others, risks and uncertainties related to the Company’s ability to continue as a going

concern; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory

requirements and approvals; fluctuating mineral and commodity prices. Additional information regarding the factors that may cause actual

results to differ materially from these forward-looking statements is available in the Company’s filings with the Securities and

Exchange Commission, including the Annual Report on Form 10-K for the year ended June 30, 2024. The Company assumes no obligation to

update any of the information contained or referenced in this press release.

###

American

Battery Technology Company

Media

Contact:

Tiffiany

Moehring

tmoehring@batterymetals.com

720-254-1556

Exhibit 99.4

American

Battery Technology Company Selected for Highly Competitive $150 Million Federal Grant to be Applied Towards the Construction of its Second

Lithium-Ion Battery Recycling Facility

Company

expanding critical commercial operations of next-generation lithium-ion battery recycling technologies for North American closed-loop

battery metals supply chain supporting America’s transition to electrification

Reno,

Nev., September 23, 2024 — American Battery Technology Company (NASDAQ: ABAT), an integrated critical battery materials

company that is commercializing its technologies for both primary battery minerals manufacturing and secondary minerals lithium-ion battery

recycling, has been selected for a highly competitive grant for $150 million dollars of federal investment by the U.S. Department

of Energy to be applied towards the construction of a new lithium-ion battery recycling facility.

This

facility will be the company’s second commercial-scale lithium-ion battery recycling facility and is designed to process approximately

100,000 tonnes of battery materials per year from its battery manufacturer, automotive OEM, and community partners.

“We

are extremely honored to be selected for this government investment to further expand our domestic battery recycling operations, and

after having gone through nearly one-year of technical and economic evaluation, we appreciate the level of diligence that the government

employed in making this decision,” stated ABTC CEO Ryan Melsert. “We are greatly appreciative of the confidence and support

we have received from our partners throughout this process and are energized to move forward with our feedstock supply, product offtake,

and strategic stakeholders in this critical expansion of our domestic capabilities.”

True

to the company’s strategic model to engage a diverse portfolio of partners and stakeholders to bring advanced battery technologies

online and establish a commercial battery metals supply chain for North America, this project will leverage multiple partners including

feedstock supplier and critical mineral product offtaker BASF, global engineering firm Siemens, the Clemson University International

Center for Automotive Research (CU-ICAR), the Argonne National Laboratory (ANL) ReCell Center, the Argonne National Laboratory Sustainable

Transportation Education & Partnerships (STEP) department, and the South Carolina Electric Transportation Network (SCETNetwork).

ABTC

constructed and commissioned its first lithium-ion battery recycling facility near Reno, Nevada in Fall 2023, which implements its internally-developed

processes for the strategic de-manufacturing and targeted chemical extraction of battery materials in order to manufacture battery grade

products at competitive costs and with low environmental footprint. These processes are fundamentally different than conventional methods

of battery recycling, which generally utilize either high temperature smelting or non-strategic shredding systems.

Through

this new facility construction project, ABTC will employ a proactive, community-driven engagement model to build an energy equity, sustainable

circular manufacturing ecosystem that aims to create 1,200 construction jobs and 300 operations jobs. The company will work in direct

partnership between communities, educational institutions, industry, government, the National Laboratory system, and the next generation

workforce to support equitable and sustainable initiatives that benefit and strengthen in local communities, including in underserved

communities that have historically been left behind.

ABTC

is partnering with government entities and local educational institutions, such as ANL’s STEP department and Clemson University,

to create career pathways in battery recycling and establish a talent pipeline for the domestic battery recycling industry.

Bringing

first-of-kind technologies to market, ABTC’s battery recycling and primary battery metals commercialization efforts support the

buildout of a domestically-sourced battery metals circular supply chain. ABTC has been selected for several competitive awards supporting

the advancement and commercialization of its first-of-kind technologies for both battery recycling and primary claystone-to-lithium hydroxide

manufacturing.

U.S.

DOE Investments in ABTC Lithium-Ion Battery Recycling

| ● | October

2021: ABTC was awarded a competitive grant for a $2 million project from the United

States Advanced Battery Consortium (USABC) supported by funding from US DOE to foster the

recycling of battery packs and extraction of battery metals, with USABC cost contributions

of $500k. |

| | | |

| ● | November

2022: ABTC was awarded for a competitive grant for a $20 million project from the

U.S. DOE to scale, optimize, and commercialize three next generation technologies to

even further enhance the performance of its recycling operations, with a federal contribution

of $10 million. |

| | | |

| ● | March

2024: ABTC awarded qualifying advanced energy project tax credits (48C) for $20 million

to be applied towards capital expenditures of its first battery recycling facility near

Reno, Nevada. |

| | | |

| ● | March

2024: ABTC awarded qualifying advanced energy project tax credits (48C) for $40 million

to be applied towards capital expenditures of its second battery recycling facility. |

| | | |

| ● | TBD

2025: ABTC was selected for this competitive grant for a $150 million project from

the U.S. DOE to construct a second battery recycling facility. |

U.S.

DOE Investments in ABTC Lithium Hydroxide (LiOH) from Claystone Manufacturing

| ● | October

2021: ABTC was awarded a competitive grant supporting a $4.5 million project from

the U.S. DOE for the demonstration of its battery-grade lithium hydroxide production from

Nevada claystone resources, with federal contributions of $2.27 million. |

| | | |

| ● | October

2022: ABTC was awarded a competitive grant supporting a $115 million project from

the U.S. DOE to construct a commercial-scale lithium hydroxide refinery, with a federal contribution

of $57.7 million. |

These

battery recycling technologies were developed in-house by the ABTC R&D, project management, and engineering team members, many of

whom were previously members of the founding Tesla Gigafactory design and engineering teams. ABTC intends to utilize these significant

experiences in collaboration with project partners to scale processes and bring first-of-kind commercial-scale facilities online and

leveraging this expertise to de-risk ABTC’s commercialization of this second battery recycling facility.

As

ABTC has now completed the technical and economic evaluations and been selected for this competitive grant award, it will next enter

the grant award contracting phase of this process with an expected project kickoff in 2025.

About

American Battery Technology Company

American

Battery Technology Company (ABTC), headquartered in Reno, Nevada, has pioneered first-of-kind technologies to unlock domestically manufactured

and recycled battery metals critically needed to help meet the significant demand from the electric vehicle, stationary storage, and

consumer electronics industries. Committed to a circular supply chain for battery metals, ABTC works to continually innovate and master

new battery metals technologies that power a global transition to electrification and the future of sustainable energy.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.”

Although the American Battery Technology Company’s (the “Company”) management believes that such forward-looking statements

are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number

of risks and uncertainties, which could cause the Company’s future results to differ materially from those anticipated. Potential

risks and uncertainties include, among others, risks and uncertainties related to the Company’s ability to continue as a going

concern; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory

requirements and approvals; fluctuating mineral and commodity prices. Additional information regarding the factors that may cause actual

results to differ materially from these forward-looking statements is available in the Company’s filings with the Securities and

Exchange Commission, including the Annual Report on Form 10-K for the year ended June 30, 2023. The Company assumes no obligation to

update any of the information contained or referenced in this press release.

###

American

Battery Technology Company

Media

Contact:

Tiffiany

Moehring

tmoehring@batterymetals.com

720-254-1556

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

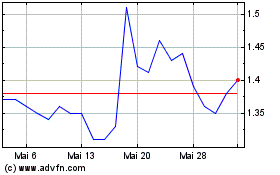

American Battery Technol... (NASDAQ:ABAT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

American Battery Technol... (NASDAQ:ABAT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024