As

filed with the Securities and Exchange Commission on December 29, 2023

Registration

No. 333- __________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

| AMERICAN

BATTERY TECHNOLOGY COMPANY |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

33-1227980 |

(State

or jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

100

Washington Street, Suite 100,

Reno,

NV 89503 |

|

| |

Tel:

(775) 473-4744 |

|

| |

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices) |

|

| |

|

|

| |

Ryan

Melsert |

|

| |

Chief

Executive Officer |

|

| |

100 Washington Street, Suite 100, |

|

| |

Reno, NV 89503 |

|

| |

Tel:

(775) 473-4744 |

|

| |

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service) |

|

The Commission is requested to send copies of all communications to:

Amy Bowler

Holland & Hart LLP

555 17th Street, Suite 3200

Denver, CO 80202

(303) 295-8000

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering: ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I. D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐ |

Large

accelerated filer |

☐ |

Accelerated

filer |

| ☒ |

Non-accelerated

filer |

☒ |

Smaller

reporting company |

| |

|

☐ |

Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting

an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED DECEMBER 29, 2023

PROSPECTUS

$150,000,000

AMERICAN

BATTERY TECHNOLOGY COMPANY

Common

Stock

Preferred

Stock

Warrants

Units

This

registration statement on Form S-3 is being filed to replace the registration statement on Form S-3 that became effective on March 15,

2021 (the “Prior Registration Statement”), which registered an aggregate amount of $250,000,000 of common stock, preferred

stock, warrants and units to be offered by the registrant from time to time. Due to the pending expiration of the Prior Registration

Statement, the Company is filing this registration statement and Prospectus to continue its ready access to the market to engage in offerings

of securities as it determines from time to time.

We

may from time to time offer up to $150,000,000 of the securities listed above in one or more offerings in amounts, at prices and

on terms determined at the time of such offering or offerings. When we use the term “securities” in this prospectus, we mean

any of the securities we may offer with this prospectus, unless we say otherwise.

This

prospectus provides you with a general description of the securities and the general manner in which such securities may be offered.

The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in a supplement

to this prospectus or incorporated into this prospectus by reference. You should read this prospectus and any supplement carefully before

you invest. Each prospectus supplement will indicate if the securities offered thereby will be listed or quoted on a securities exchange

or quotation system.

We

may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters,

dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are

involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement

between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms

of the offering of such securities.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. WE STRONGLY RECOMMEND THAT YOU READ CAREFULLY THE RISKS WE DESCRIBE IN THIS PROSPECTUS AND IN ANY ACCOMPANYING

PROSPECTUS SUPPLEMENT, AS WELL AS THE RISK FACTORS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS FROM OUR FILINGS MADE WITH

THE SECURITIES AND EXCHANGE COMMISSION. SEE “RISK FACTORS” ON PAGE 6 OF THIS PROSPECTUS.

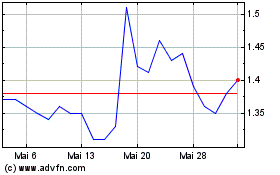

Our

common stock, par value $0.001 per share (“Common Stock”), is listed on The Nasdaq Stock Market LLC (“Nasdaq”)

under the symbol “ABAT”. The trading price of our Common Stock has historically been highly volatile and could continue to

be subject to wide fluctuations in response to various factors. On December 26, 2023 the last reported sale price of our Common Stock

on Nasdaq was $4.99 per share. During the first fiscal quarter ended September 30, 2023, the market price of our Common Stock fluctuated

from a high of $13.78 per share to a low of $7.53 per share, and our stock price continues to fluctuate. During the 12 months prior to

the date of this prospectus, our Common Stock has traded at a low of $3.33 and a high of $21.75. From October 1, 2023 through the date

hereof, our Common Stock has traded at a low of $3.33 and a high of $8.84 per share. Such high trading price volatility of our Common

Stock could adversely affect your ability to sell your shares of our Common Stock or, if you are able to sell your shares, to sell your

shares at a price that you determine to be fair or favorable. We believe that our recent stock price volatility and stock trading volume

fluctuations have been unrelated or disproportionate to any existing changes to our financial conditions or results of operations during

the most recent completed fiscal quarter and the comparative period in 2022.

You

should carefully read this prospectus, any applicable prospectus supplement and the information described under the headings “Where

You Can Find More Information” and “Incorporation by Reference” before you invest in any of these securities. This

prospectus may not be used to sell securities in a primary offering by us unless it is accompanied by a prospectus supplement that describes

the securities being offered.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved the securities we may be offering

or determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is December 29, 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf”

registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings

up to a total dollar amount of $150,000,000 as described in this prospectus. Each time that we offer and sell securities, we will

provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and

the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain

material information relating to these offerings. The prospectus supplement or free writing prospectus may also add, update or change

information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this

prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free

writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and the applicable

prospectus supplement (and any applicable free writing prospectuses), together with the additional information described under the headings

“Where You Can Find More Information” and “Incorporation by Reference.”

We

have not authorized any other person to provide you with any information or to make any representations other than those contained in

this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we

have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others

may give you. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should

assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only

as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as

of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the

document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects

may have changed since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus

may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications

and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness

of this information and we have not independently verified this information. In addition, the market and industry data and forecasts

that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus

may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those

discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable

free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly,

investors should not place undue reliance on this information.

When

we refer to “American Battery Technology Company,” “ABAT,” “we,” “our,” “us”

and the “Company” in this prospectus, we mean American Battery Technology Company and its consolidated subsidiaries, unless

otherwise specified. When we refer to “you,” we mean the potential holders of the applicable series of securities.

INCORPORATION

BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed

to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently

filed document incorporated by reference modifies or replaces that statement.

We

incorporate by reference the following documents in this prospectus, which you should review in connection with this prospectus, as well

as each of the documents that we file with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, between the date of

this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however, incorporating

by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed”

with the SEC, including any information furnished pursuant to Item 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to

Item 9.01 of Form 8-K.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC:

| ● |

Our

Annual Report on Form 10-K for the annual period ended June 30, 2023, filed with the SEC on September 28, 2023; |

| |

|

| ● |

Our

Quarterly Reports on Form 10-Q for the quarterly period ended September 30, 2023, filed with the SEC on November 14, 2023, as amended

on Form 10-Q/A filed with the SEC on November 15, 2023; |

| |

|

| ● |

Our

Current Reports on Form 8-K filed on the following dates: September 28, 2023; November 22, 2023; December 4, 2023; December 13, 2023;

December 21, 2023 (as amended by Form 8-KA filed on December 22, 2023; and December 22, 2023; and |

| |

|

| ● |

The

description of our capital stock in our Form 8-A filed with the SEC on October 17, 2013, and any amendment or report filed with the

SEC for the purpose of updating the description. |

You

may request a copy of any of the documents incorporated by reference in this prospectus, at no cost to you, by writing or telephoning

us at the following address:

American

Battery Technology Company

100

Washington Street, Suite 100

Reno,

Nevada 89503

Tel:

(775) 473-4744

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or

any accompanying prospectus supplement.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains, in addition to historical information, certain forward-looking statements within the meaning of Section 27A of the

Securities Act and Section 21E of the Exchange Act. These statements involve known and unknown risks, uncertainties and other factors

which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements

expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,”

“believes,” “seeks,” “could,” “estimates,” “expects,” “intends,”

“may,” “plans,” “potential,” “predicts,” “projects,” “should,”

“would,” and similar expressions intended to identify forward-looking statements. Accordingly, these statements involve estimates,

assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. Forward-looking statements

reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these

uncertainties, you should not place undue reliance on these forward-looking statements. Such statements may include, but are not limited

to, information related to: anticipated operating results; relationships with our customers; consumer demand; financial resources and

condition; changes in revenues; changes in profitability; changes in accounting treatment; cost of sales; selling, general and administrative

expenses; interest expense; the ability to produce the liquidity or enter into agreements to acquire the capital necessary to continue

our operations and take advantage of opportunities; and legal proceedings and claims.

You

should read this prospectus and the documents we have filed as exhibits to the registration statement, of which this prospectus is part,

completely and with the understanding that our actual future results may be materially different from our expectations. You should not

assume that the information contained in this prospectus or any prospectus supplement is accurate as of any date other than the date

on the front cover of such documents.

THE

COMPANY

This

summary description about us and our business highlights selected information contained elsewhere in this prospectus supplement or the

accompanying prospectus, or incorporated by reference in this prospectus supplement or the accompanying prospectus. This summary does

not contain all of the information that you should consider before buying securities in this offering. You should carefully read this

entire prospectus supplement and the accompanying prospectus, including each of the documents incorporated herein or therein by reference,

before making an investment decision.

Overview

American

Battery Technology Company is a new entrant in the lithium–ion battery industry that is working to increase the domestic U.S. production

of battery materials, such as lithium, nickel, cobalt, and manganese through its exploration of new primary resources of battery metals,

development and commercialization of new technologies for the extraction of these battery metals from primary resources, and commercialization

of an internally developed integrated process for the recycling of lithium–ion batteries. Through this three–pronged approach

the Company is working to both increase the domestic production of these battery materials, and to ensure spent batteries have their

elemental battery metals returned to the domestic manufacturing supply chain in an economical, environmentally-conscious, closed–loop

fashion.

To

implement this business strategy, the Company is currently commissioning and operating its first integrated lithium–ion battery

recycling facility, which takes in waste and end–of–life battery materials from the electric vehicle, stationary storage,

and consumer electronics industries. The retrofitting, commissioning, and operation of this facility are of the highest priority to the

Company, and as such it has significantly increased the resources devoted to its execution including the further internal hiring of technical

staff, expansion of laboratory facilities, and purchasing of equipment. The Company has been awarded a competitively bid grant from the

U.S. Advanced Battery Consortium to support a $2 million project to accelerate the development and demonstration of this pre–commercial

scale integrated lithium–ion battery recycling facility, and the Company has been awarded an additional grant to support a $20

million project under the Bipartisan Infrastructure Law to validate, test, and deploy three disruptive advanced separation and processing

technologies.

Additionally,

the Company is accelerating the demonstration and commercialization of its internally developed low–cost and low–environmental

impact processing train for the manufacturing of battery grade lithium hydroxide from Nevada–based sedimentary claystone resources.

The Company has been awarded a grant cooperative agreement from the U.S. Department of Energy’s Advanced Manufacturing and Materials

Technologies Office through the Critical Materials Innovation program to support a $4.5 million project for the construction and operation

of a multi–ton per day integrated continuous demonstration system to support the scale–up and commercialization of these

technologies. The Company has been awarded an additional grant award under the Bipartisan Infrastructure Law to support a $115 million

project to design, construct, and commission the first phase of a first-of-kind commercial manufacturing facility to produce battery-grade

lithium hydroxide from this resource.

The

Company’s corporate headquarters are in Reno, Nevada, USA and its exploration office is located in Tonopah, Nevada, USA. It is

also constructing a pilot plant for recycling lithium-ion batteries in Fernley, Nevada, USA, and completing a build-out of a commercial

lithium-ion battery recycling facility in the Tahoe-Reno Industrial Center in Nevada, USA.

Background

The

Company was incorporated as Oroplata Resources, Inc. under the laws of the State of Nevada on October 6, 2011, for the purpose of acquiring

rights to mineral properties with the eventual objective of being a producing mineral company. On August 8, 2016, the Company formed

Lithortech Resources Inc. as a wholly owned subsidiary of the Company to serve as its operating subsidiary for lithium resource exploration

and development. On June 29, 2018, the Company changed the name of Lithortech Resources to LithiumOre Corp. (“LithiumOre”);

on May 3, 2019, the Company changed its name to American Battery Metals Corporation; and on August 12, 2021, the Company changed its

name to American Battery Technology Company, which better aligns with the Company’s current business activities and future objectives.

The Company has limited operating history and has not yet generated or realized revenues from its primary business activities.

Smaller

Reporting Company

We

are a “smaller reporting company” as defined by Rule 12b-2 of the Exchange Act. We may take advantage of certain

of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for

so long as the market value of our Common Stock held by non-affiliates is less than $250.0 million measured on the last business day

of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and the

market value of our Common Stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal

quarter. For example, as a smaller reporting company we may choose to present only the two most recent fiscal years of audited financial

statements in our Annual Report on Form 10-K and we have reduced disclosure obligations regarding executive compensation.

Recent

Events

On

September 11, 2023, the Company effected a one-for-fifteen (1:15) reverse stock split of the Company’s authorized, issued and outstanding

shares of Common Stock, and the authorized shares of preferred stock, $0.001 par value per share (“Preferred Stock”). Except

as otherwise indicated, all information in this prospectus supplement gives effect to the reverse stock split. However, certain of the

documents incorporated by reference herein dated prior to September 11, 2023, have not been adjusted to give effect to the reverse stock

split.

Corporate

Information

Our

mailing address and telephone number of our principal executive offices are:

American

Battery Technology Company

100

Washington Street, Suite 100

Reno,

Nevada 89503

Tel:

(775) 473-4744

RISK

FACTORS

In

addition to other information contained in this prospectus supplement and in the accompanying base prospectus, before investing in our

securities, you should carefully consider the risks described under the heading “Risk Factors” in our most recent Annual

Report on Form 10-K and Quarterly Report on Form 10-Q and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K

and in any other documents incorporated by reference into this prospectus, as updated by our future filings. These risks are not the

only ones faced by us. Additional risks not known or that are deemed immaterial could also materially and adversely affect our financial

condition, results of operations, our products, business and prospects. Any of these risks might cause you to lose all or a part of your

investment. See also “Cautionary Note Regarding Forward-Looking Statements.”

RISKS

RELATING TO OUR COMPANY

Since

we have a limited operating history and have not had product sales yet, it is difficult for potential investors to evaluate our business.

The

Company is commissioning a recycling plant but has no product sales to date. Our operations have consisted of the prior exploratory activities,

development and limited testing of our recycling process and the development of our business plan. Our limited operating history makes

it difficult for potential investors to evaluate our technology or prospective operations. As an early-stage company, we are subject

to all the risks inherent in the initial organization, financing, expenditures, complications and delays in a new business. Investors

should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. There

can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

We

may need additional financing, which additional financing may not be available on reasonable terms or at all.

We

believe that we will require significant working capital in the near term in order to fund our current operations. We will likely need

to raise capital over the next 12 months to satisfy such requirements, the receipt of which cannot be assured. We will also require additional

capital in order to fully develop our recycling facilities. We intend to seek additional funds through various financing sources, including

the private sale of our equity and debt securities, joint ventures with capital partners and project financing of our recycling facilities.

However, there can be no guarantees that such funds will be available on commercially reasonable terms, if at all. If such financing

is not available on satisfactory terms, we may be unable to further pursue our business plan and we may be unable to continue operations,

in which case you may lose your entire investment.

We

must effectively manage the growth of our operations, or our company will suffer.

Our

ability to successfully implement our business plan requires an effective planning and management process. If funding is available, we

may elect to increase the scope of our operations and acquire complementary businesses. Implementing our business plan will require significant

additional funding and resources. If we grow our operations, we will need to hire additional employees and make significant capital investments.

If we grow our operations, it will place a significant strain on our existing management and resources. Additionally, we will need to

improve our financial and managerial controls and reporting systems and procedures, and we will need to expand, train and manage our

workforce. Any failure to manage any of the foregoing areas efficiently and effectively would cause our business to suffer.

We

may be unable to maintain an effective system of internal control over financial reporting, and as a result we may be unable to accurately

report our financial results.

Our

reporting obligations as a public company place a significant strain on our management, operational and financial resources and systems.

We do not currently have effective internal controls. If we fail to maintain an effective system of internal control over financial reporting,

we could experience delays or inaccuracies in our reporting of financial information, or non-compliance with the Commission, reporting

and other regulatory requirements. This could subject us to regulatory scrutiny and result in a loss of public confidence in our management,

which could, among other things, cause our stock price to drop.

We

have been and expect to be significantly dependent on consulting agreements for the development of our battery recycling facilities,

which exposes us to the risk of reliance on the performance of third parties.

In

developing our battery recycling technology, we rely to some extent on consulting agreements with third parties as the Company does not

have the resources to employ all the necessary staff required for such activities. The failure to obtain and maintain such consulting

agreements would substantially disrupt or delay our battery recycling activities. Any such loss would likely increase our expenses and

materially harm our business, financial condition and results of operation.

If

we are not successful in attracting and retaining highly qualified personnel, we may not be able to successfully implement our business

strategy. In addition, the loss of the services of certain key employees would adversely impact our business prospects.

If

we are not successful in attracting and retaining highly qualified personnel, we may not be able to successfully implement our business

strategy. In addition, the loss of the services of certain key employees, including our Chief Executive Officer and our Chief Technology

Officer, would adversely impact our business prospects. Our ability to compete in the highly competitive battery recycling technology

business depends in large part upon our ability to attract highly qualified managerial, scientific, and engineering personnel. In order

to induce valuable employees to remain with us, we intend to provide employees with stock grants that vest over time. The value to employees

of stock grants that vest over time will be significantly affected by movements in our stock price that we will not be able to control

and may at any time be insufficient to counteract more lucrative offers from other companies. Other technology companies with which we

compete for qualified personnel have greater financial and other resources, different risk profiles, and a longer history in the industry

than we do. They also may provide more diverse opportunities and better chances for career advancement. Some of these characteristics

may be more appealing to high-quality candidates than what we have to offer. If we are unable to continue to attract and retain high-quality

personnel, the rate and success at which we can develop and commercialize products would be limited.

RISKS

RELATING TO OUR BUSINESS AND INDUSTRY

Battery

recycling is a highly competitive and speculative business and we may not be successful in seeking available opportunities.

The

process of battery recycling is a highly competitive and speculative business. In seeking available opportunities, we will compete with

a number of other companies, including established, multi-national companies that have more experience and resources than we do. There

also may be other small companies that are developing similar processes and are farther along than the Company. Because we may not have

the financial and managerial resources to compete with other companies, we may not be successful in our efforts to develop technology

which is commercially viable.

Our

new business model has not been proven by us or anyone else.

We

intend to engage in the business of lithium recycling through a proprietary recycling technology. While the production of lithium-ion

recycling is an established business, to date most lithium-ion recycling has been produced by way of performing bulk high temperature

calcinations or bulk acid dissolutions. We have developed a highly strategic recycling processing train that does not employ any high

temperature operations or any bulk chemical treatments of the full battery. We have tested our recycling process on a small scale and

to a limited degree; however, there can be no assurance that we will be able to produce battery metals in commercial quantities at a

cost of production that will provide us with an adequate profit margin. The uniqueness of our process presents potential risks associated

with the development of a business model that is untried and unproven.

While

the testing of our recycling process has been successful to date, there can be no assurance that we will be able to replicate the process,

along with all of the expected economic advantages, on a large commercial scale.

As

of the date of this prospectus, we have built and operated our recycling process on a very small scale. While we believe that our development

and testing to date has proven the concept of our recycling process, we have not undertaken the build-out or operation of a large-scale

facility capable of recycling large commercial quantities. There can be no assurance that as we commence large scale manufacturing or

operations that we will not incur unexpected costs or hurdles that might restrict the desired scale of our intended operations or negatively

impact our projected gross profit margin.

Our

intellectual property rights may not be adequate to protect our business.

We

currently do not hold any patents for our products. Although we expect to file applications related to our technology, no assurances

can be given that any patent will be issued on such patent applications or that, if such patents are issued, they will be sufficiently

broad to adequately protect our technology. In addition, we cannot assure you that any patents that may be issued to us will not be challenged,

invalidated, or circumvented. Even if we are issued patents, they may not stop a competitor from illegally using our patented processes

and materials. In such event, we would incur substantial costs and expenses, including lost time of management in addressing and litigating,

if necessary, such matters. Additionally, we rely upon a combination of trade secret laws and nondisclosure agreements with third parties

and employees having access to confidential information or receiving unpatented proprietary know-how, trade secrets and technology to

protect our proprietary rights and technology. These laws and agreements provide only limited protection. We can give no assurance that

these measures will adequately protect us from misappropriation of proprietary information.

Our

processes may infringe on the intellectual property rights of others, which could lead to costly disputes or disruptions.

The

applied science industry is characterized by frequent allegations of intellectual property infringement. Though we do not expect to be

subject to any of these allegations, any allegation of infringement could be time consuming and expensive to defend or resolve, result

in substantial diversion of management resources, cause suspension of operations or force us to enter into royalty, license, or other

agreements rather than dispute the merits of such allegation. If patent holders or other holders of intellectual property initiate legal

proceedings, we may be forced into protracted and costly litigation. We may not be successful in defending such litigation and may not

be able to procure any required royalty or license agreements on acceptable terms or at all.

Our

business strategy includes entering into joint ventures and strategic alliances. Failure to successfully integrate such joint ventures

or strategic alliances into our operations could adversely affect our business.

We

propose to commercially exploit our recycling process, in part, by entering into joint ventures and strategic relationships with parties

involved in the manufacture and recycling of lithium-ion products. Joint ventures and strategic alliances may involve significant other

risks and uncertainties, including distraction of management’s attention away from normal business operations, insufficient revenue

generation to offset liabilities assumed and expenses associated with the transaction, and unidentified issues not discovered in our

due diligence process, such as product quality, technology issues and legal contingencies. In addition, we may be unable to effectively

integrate any such programs and ventures into our operations. Our operating results could be adversely affected by any problems arising

during or from any joint ventures or strategic alliances.

If

we are unable to manage future expansion effectively, our business, operations and financial condition may suffer significantly, resulting

in decreased productivity.

If

our recycling process proves to be commercially valuable, it is likely that we will experience a rapid growth phase that could place

a significant strain on our managerial, administrative, technical, operational and financial resources. Our organization, procedures

and management may not be adequate to fully support the expansion of our operations or the efficient execution of our business strategy.

If we are unable to manage future expansion effectively, our business, operations and financial condition may suffer significantly, resulting

in decreased productivity.

The

global economic conditions could negatively affect our prospects for growth and operating results.

Our

prospects for growth and operating results will be directly affected by the general global economic conditions of the industries in which

our suppliers, partners and customer groups operate. We believe that the market price of our principal product, recycled lithium- ion,

is relatively volatile and reacts to general global economic conditions. A decline in the price of lithium-ion resulting from over supply

or a global economic slowdown and the other global economic conditions could negatively affect our business. There can be no assurance

that global economic conditions will not, at times, negatively impact our liquidity, growth prospects and results of operations.

Government

regulation and environmental, health and safety concerns may adversely affect our business.

Our

operations in the United States will be subject to the Federal, State and local environmental, health and safety laws applicable to the

reclamation of lithium-ion batteries. Depending on how any particular operation is structured, our facilities will probably have to obtain

environmental permits or approvals to operate, including those associated with air emissions, water discharges, and waste management

and storage. We may face opposition from local residents or public interest groups to the installation and operation of our facilities.

Failure to secure (or significant delays in securing) the necessary approvals could prevent us from pursuing some of our planned operations

and adversely affect our business, financial results and growth prospects. In addition to permitting requirements, our operations are

subject to environmental health, safety and transportation laws and regulations that govern the management of and exposure to hazardous

materials such as the heavy metals and acids involved in battery reclamation. These include hazard communication and other occupational

safety requirements for employees, which may mandate industrial hygiene monitoring of employees for potential exposure to hazardous materials.

Failure to comply with these requirements could subject our business to significant penalties (civil or criminal) and other sanctions

that could adversely affect our business.

The

nature of our operations involves risks, including the potential for exposure to hazardous materials such as heavy metals, that could

result in personal injury and property damage claims from third parties, including employees and neighbors, which claims could result

in significant costs or other environmental liability. Our operations also pose a risk of releases of hazardous substances, such as heavy

metals or acids, into the environment, which can result in liabilities for the removal or remediation of such hazardous substances from

the properties at which they have been released, liabilities which can be imposed regardless of fault, and our business could be held

liable for the entire cost of cleanup even if we were only partially responsible. Like any manufacturer, we are also subject to the possibility

that we may receive notices of potential liability in connection with materials that were sent to third-party recycling, treatment, or

disposal facilities under the Federal Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (“CERCLA”),

and comparable state statutes, which impose liability for investigation and remediation of contamination without regard to fault or the

legality of the conduct that contributed to the contamination, and for damages to natural resources. Liability under CERCLA is retroactive,

and, under certain circumstances, liability for the entire cost of a cleanup can be imposed on any responsible party.

In

the event we are unable to present and operate our recycling process and operations as safe and environmentally responsible, we may face

opposition from local governments, residents or public interest groups to the installation and operation of our facilities.

RISKS

RELATED TO AN INVESTMENT IN OUR SECURITIES

We

expect to experience volatility in the price of our Common Stock, which could negatively affect stockholders’ investments.

The

trading price of our Common Stock has been highly volatile and could continue to be subject to wide fluctuations in response to various

factors, some of which are beyond our control. On December 26, 2023 the last reported sale price of our Common Stock on Nasdaq was $4.99

per share. During the first fiscal quarter ended September 30, 2023, the market price of our Common Stock fluctuated from a high of $13.78

per share to a low of $7.53 per share, and our stock price continues to fluctuate. During the 12 months prior to the date of this prospectus,

our Common Stock has traded at a low of $3.33 and a high of $21.75. From October 1, 2023 through the date hereof, our Common Stock has

traded at a low of $3.33 and a high of $8.84 per share. We believe that our recent stock price volatility and stock trading volume fluctuations

have been unrelated or disproportionate to any existing changes to our financial conditions or results of operations during the most

recent completed fiscal quarter and the comparative period in 2022. Investors of our Common Stock may experience rapid and substantial

decreases in our stock price, including decreases unrelated to our operating performance or business prospects.

The

stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the

operating performance of companies with securities traded in those markets. Broad market and industry factors may seriously affect the

market price of companies’ stock, including ours, regardless of actual operating performance. All of these factors could adversely

affect your ability to sell your shares of Common Stock or, if you are able to sell your shares, to sell your shares at a price that

you determine to be fair or favorable.

The

relative lack of public company experience of our management team could adversely impact our ability to comply with the reporting requirements

of U.S. securities laws.

Our

management team lacks significant public company experience, which could impair our ability to comply with legal and regulatory requirements

such as those imposed by the Sarbanes-Oxley Act of 2002. Our senior management has little experience in managing a publicly traded company.

Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management

may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal,

regulatory compliance and reporting requirements, including the establishing and maintaining of internal controls over financial reporting.

Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting

requirements of the Exchange Act, which is necessary to maintain our public company status. If we were to fail to fulfill those obligations,

our ability to continue as a U.S. public company would be in jeopardy, we could be subject to the imposition of fines and penalties and

our management would have to divert resources from attending to our business plan.

The

elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification

rights for or obligations to our directors, officers and employees may result in substantial expenditures by us and may discourage lawsuits

against our directors, officers and employees.

Our

articles of incorporation (as amended, “Articles of Incorporation”) contain a provision permitting us to eliminate the personal

liability of our directors to us and our stockholders for damages for the breach of a fiduciary duty as a director or officer to the

extent provided by Nevada law. We may also have contractual indemnification obligations under any future employment agreements with our

officers. The foregoing indemnification obligations could result in us incurring substantial expenditures to cover the cost of settlement

or damage awards against directors and officers, which we may be unable to recoup. These provisions and the resulting costs may also

discourage us from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage

the filing of derivative litigation by our stockholders against our directors and officers even though such actions, if successful, might

otherwise benefit us and our stockholders.

We

may issue additional shares of Common Stock or Preferred Stock in the future, which could cause significant dilution to all stockholders.

Our

Articles of Incorporation authorize the issuance of up to 81,666,667 shares, including 80,000,000 shares of Common Stock and 1,666,667

shares of Preferred Stock, each with a $0.001 par value per share. As of December 26, 2023, we had 49,152,300 shares of Common Stock

outstanding and no shares of Preferred Stock outstanding; however, we may issue additional shares of Common Stock or Preferred Stock

in the future in connection with a financing or an acquisition. Such issuances may not require the approval of our stockholders. In addition,

certain of our outstanding rights to purchase additional shares of Common Stock or securities convertible into our Common Stock are subject

to some form of anti-dilution protection, which could result in the right to purchase significantly more shares of Common Stock being

issued or a reduction in the purchase price for any such shares or both. Any issuance of additional shares of our Common Stock, or equity

securities convertible into our Common Stock, including but not limited to, preferred stock, warrants and options, will dilute the percentage

ownership interest of all stockholders, may dilute the book value per share of our Common Stock, may negatively impact the market price

of our Common Stock, and may also negatively affect stockholders’ investments. If we are able to sell all of the shares of Common

Stock registered in this Registration Statement in the aggregate gross amount of $150,000,000 at an assumed price of $4.99 per

share, the closing price quoted on Nasdaq on December 26, 2023, we will have to issue a total of 30,060,120 shares to the investors,

representing approximately 61% of our total issued and outstanding Common Stock. The supply of a large number of shares of our

Common Stock to the public market may suppress the trading prices of our Common Stock, cause our stock prices to fluctuate in an undesirable

way, and therefore could negatively affect our investors’ ability to sell our Common Stock at their desired or profitable prices

or at all.

Anti-takeover

effects of certain provisions of Nevada state law hinder a potential takeover of us.

Certain

provisions of the Nevada Revised Statutes have anti-takeover effects and may inhibit a non-negotiated merger or other business combination.

These provisions are intended to encourage any person interested in acquiring us to negotiate with, and to obtain the approval of, our

board of directors (the “Board of Directors” or “Board”) in connection with such a transaction. However, certain

of these provisions may discourage a future acquisition of us, including an acquisition in which the stockholders might otherwise receive

a premium for their shares. As a result, stockholders who might desire to participate in such a transaction may not have the opportunity

to do so.

USE

OF PROCEEDS

Unless

otherwise indicated in a prospectus supplement relating to a specific offering, we intend to use the net proceeds from the sale of securities

by us under this prospectus for general corporate purposes, which may include working capital, capital expenditures, operational purposes

and potential acquisitions.

The

intended application of proceeds from the sale of any particular offering of securities using this prospectus will be described in the

accompanying prospectus supplement relating to such offering. The precise amount and timing of the application of these proceeds will

depend on our funding requirements and the availability and costs of other funds.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our Common Stock. We currently intend to retain all available funds and any future

earnings to support our operations and finance the growth and development of our business. We do not intend to pay cash dividends on

our Common Stock for the foreseeable future. Any future determination related to dividend policy will be made at the discretion of our

Board of Directors. The holders of the Series B and Series C Preferred Stock are entitled to receive an 8% per annum dividend on their

stated value which can be paid in cash or Common Stock at the discretion of the Company (see description of Series B and Series C Preferred

Stock below). As of December 26, 2023, there were 0 shares of Series A Preferred Stock, 0 shares of Series B Preferred Stock, and 0 shares

of Series C Preferred Stock issued and outstanding.

The

current and future holders of our Common Stock are entitled to receive dividends pro rata based on the number of shares held, when and

if declared by our Board of Directors, from funds legally available for that purpose. Nevada Revised Statutes prohibits us from declaring

dividends where, after giving effect to the distribution of the dividend, we would not be able to pay our debts as they become due in

the ordinary course of business, or our total assets would be less than the sum of our total liabilities.

Our

Articles of Incorporation and Bylaws do not contain provisions restricting our ability to pay dividends of our Common Stock.

Description

of CAPITAL STOCK

The

following description of our capital stock is not complete and may not contain all the information you should consider before investing

in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our Articles of Incorporation

and Bylaws which have been publicly filed with the SEC. These documents are also incorporated by reference into the registration statement

of which this prospectus forms a part. See “Where You Can Find More Information” and “Incorporation by Reference.”

Authorized

and Outstanding Securities

The

Company is authorized to issue two classes of shares, designated “Common Stock” and “Preferred Stock.” The total

number of shares that the Company is authorized to issue is 81,666,667. The Company is authorized to issue 1,666,667 shares of Preferred

Stock, of which the Company has designated 33,334 shares as Series A Preferred Stock with a $0.001 par value per share, 133,334 shares

as Series B Preferred Stock with a $10.00 par value per share, and 66,667 shares as Series C Preferred Stock with a $10.00 par value

per share. The number of shares of Common Stock which the Company is authorized to issue is 80,000,000 with a $0.001 par value per share.

As of December 26, 2023, there were 0 shares of Series A Preferred Stock, 0 shares of Series B Preferred Stock, 0 shares of Series C

Preferred Stock, and 49,152,300 shares of Common Stock issued and outstanding.

Common

Stock

The

holders of our Common Stock are entitled to one vote per share on all matters requiring a vote of the stockholders, including the election

of directors. Holders of Common Stock do not have cumulative voting rights. Holders of Common Stock are entitled to share ratably in

dividends, if any, as may be declared from time to time by the Board in its discretion from funds legally available therefor, subject

to preferences that may be applicable to preferred stock, if any, then outstanding. At present, we have no plans to issue dividends.

See “Dividend Policy” for additional information. In the event of a liquidation, dissolution or winding up of the Company,

the holders of Common Stock are entitled to share pro rata all assets remaining after payment in full of all liabilities, subject to

prior distribution rights of preferred stock, if any, then outstanding. The Common Stock has no preemptive or conversion rights or other

subscription rights. There are no redemption or sinking fund provisions applicable to the Common Stock.

Preferred

Stock

Our

Articles of Incorporation authorize shares of preferred stock and provide that shares of preferred stock may be issued from time to time

in one or more series. Our Board of Directors will be authorized to fix the voting rights, if any, designations, powers, preferences,

the relative, participating, optional or other special rights and any qualifications, limitations and restrictions thereof, applicable

to the shares of each series. Our Board of Directors will be able to, without stockholder approval, issue shares of preferred stock with

voting and other rights that could adversely affect the voting power and other rights of the holders of the Common Stock and could have

anti-takeover effects. The ability of our Board of Directors to issue shares of preferred stock without stockholder approval could have

the effect of delaying, deferring or preventing a change of control of us or the removal of existing management.

Series

A Preferred Stock

Designation

The

Company has designated 33,334 shares of its preferred stock as Series A Preferred Stock, par value $0.001 per share.

Ranking

The

Series A Preferred Stock ranks senior to the Common Stock of the Company and to all other Preferred Stock of the Company.

Voting

Rights

On

all matters submitted to a vote of the shareholders of the Company, each share of Series A Preferred Stock will have 67 votes and holders

of Series A Preferred Stock will vote with the holders of the Common Stock as one class.

Conversion

Rights

The

Series A Preferred Stock does not have any conversion rights into the Common Stock of the Company.

Dividends

The

holders of the Series A Preferred Stock are not eligible to participate with respect to any dividends that may be declared by the Board

of Directors.

Redemption

Subject

to applicable law, the Company may, at any time and from time to time, purchase any shares of the Series A Preferred Stock from the holders.

Liquidation

Preference

The

Series A Preferred Stock is entitled to liquidation rights according to its rank (as set forth above) and at its par value.

Transfer

Restrictions

The

outstanding shares of the Series A Preferred Stock may not be transferred, assigned, hypothecated or otherwise conveyed to any party

without the affirmative vote of the Board of Directors.

Series

B Preferred Stock

Designation

The

Company has designated 133,334 shares of its preferred stock as Series B preferred stock. The stated value of the Series B Preferred

Stock is $10.00 per share.

Ranking

The

Series B Preferred Stock ranks senior to the Common Stock of the Company and to all other Preferred Stock of the Company, except Series

A Preferred Stock.

Voting

Rights

The

holders of the Series B Preferred Stock do not have voting rights.

Conversion

Rights

Each

share of Series B Preferred Stock is convertible into three (3) shares of the Company’s common stock.

Dividends

The

holders of the Series B Preferred Stock are entitled to receive, and the Company shall pay, non-cumulative dividends at the rate per

share (as a percentage of the stated value of the Series B Preferred Stock) of 8% per annum. The dividends shall be payable at the Company’s

option either in cash or in shares of Common Stock of the Company.

Liquidation

Preference

The

Series B Preferred Stock is entitled to liquidation rights according to its rank (as set forth above) and at its stated value.

Transfer

Restrictions

The

Series B Preferred Stock may only be sold, transferred, assigned, pledged or otherwise disposed of in accordance with state and federal

securities laws.

Series

C Preferred Stock

Designation

The

Company has designated 66,667 shares of its preferred stock of Series C preferred stock. The stated value of the Series C Preferred Stock

is $10.00 per share.

Ranking

The

Series C Preferred Stock ranks senior to the common stock of the Company and to all other Preferred Stock of the Company, except Series

A Preferred Stock and Series B Preferred Stock.

Voting

Rights

The

holders of the Series C Preferred stock do not have voting rights.

Conversion

Rights

Each

share of Series C Preferred Stock is convertible into six (6) shares of the Company’s common stock.

Dividends

The

holders of the Series C Preferred Stock are entitled to receive, and the Company shall pay, non-cumulative dividends at the rate per

share (as a percentage of the stated value of the Series C Preferred Stock) of 8% per annum. The dividends shall be payable at the Company’s

option either in cash or in shares of Common Stock the Company.

Liquidation

Preference

The

Series C Preferred Stock is entitled to liquidation rights according to its rank (as set forth above) and at its stated value.

Transfer

Restrictions

The

Series C Preferred Stock may only be sold, transferred, assigned, pledged or otherwise disposed of in accordance with state and federal

securities laws.

Anti-Takeover

Effects of Nevada Law and Our Charter Documents

Certain

provisions of Nevada law and our Articles of Incorporation and Bylaws could make more difficult the acquisition of us by means of a tender

offer or otherwise, and the removal of incumbent officers and directors. These provisions are expected to discourage certain types of

coercive takeover practices and inadequate takeover bids and to encourage persons seeking to acquire control of us.

Nevada

Revised Statutes (as amended, the “NRS”)

Business

Combinations

The

“business combination” provisions of Sections 78.411 to 78.444, inclusive, of the Nevada Revised Statutes, or NRS, generally

prohibit a Nevada corporation with at least 200 stockholders from engaging in various “combination” transactions with any

interested stockholder for a period of two years after the date of the transaction in which the person became an interested stockholder,

unless the transaction is approved by the board of directors prior to the date the interested stockholder obtained such status or the

combination is approved by the board of directors and thereafter is approved at a meeting of the stockholders by the affirmative vote

of stockholders representing at least 60% of the outstanding voting power held by disinterested stockholders, and extends beyond the

expiration of the two-year period, unless:

| ● | the

combination was approved by the board of directors prior to the person becoming an interested

stockholder or the transaction by which the person first became an interested stockholder

was approved by the board of directors before the person became an interested stockholder

or the combination is later approved by a majority of the voting power held by disinterested

stockholders; or |

| ● | if

the consideration to be paid by the interested stockholder is at least equal to the highest

of: (a) the highest price per share paid by the interested stockholder within the two years

immediately preceding the date of the announcement of the combination or in the transaction

in which it became an interested stockholder, whichever is higher, (b) the market value per

share of common stock on the date of announcement of the combination and the date the interested

stockholder acquired the shares, whichever is higher, or (c) for holders of preferred stock,

the highest liquidation value of the preferred stock, if it is higher. |

A

“combination” is generally defined to include mergers or consolidations or any sale, lease exchange, mortgage, pledge, transfer,

or other disposition, in one transaction or a series of transactions, with an “interested stockholder” having: (a) an aggregate

market value equal to 5% or more of the aggregate market value of the assets of the corporation, (b) an aggregate market value equal

to 5% or more of the aggregate market value of all outstanding shares of the corporation, (c) 10% or more of the earning power or net

income of the corporation, and (d) certain other transactions with an interested stockholder or an affiliate or associate of an interested

stockholder.

In

general, an “interested stockholder” is a person who, together with affiliates and associates, owns (or within two years,

did own) 10% or more of a corporation’s voting stock. The statute could prohibit or delay mergers or other takeover or change in

control attempts and, accordingly, may discourage attempts to acquire our Company even though such a transaction may offer our stockholders

the opportunity to sell their stock at a price above the prevailing market price. The Articles of Incorporation expressly elect not to

be governed by these provisions of the NRS. Accordingly, the business combination statutes will not be applicable to us unless our Articles

of Incorporation are amended in accordance with applicable law and the Articles of Incorporation to remove our election to opt out of

the application of the statutes.

Control

Share Acquisitions

The

“control share” provisions of Sections 78.378 to 78.3793, inclusive, of the NRS apply to “issuing corporations”

that are Nevada corporations with at least 200 stockholders, including at least 100 stockholders of record who are Nevada residents,

and that conduct business directly or indirectly in Nevada. The control share statute prohibits an acquirer, under certain circumstances,

from voting its shares of a target corporation’s stock after crossing certain ownership threshold percentages, unless the acquirer

obtains approval of the target corporation’s disinterested stockholders. The statute specifies three thresholds: one-fifth or more

but less than one-third, one-third but less than a majority, and a majority or more, of the outstanding voting power. Generally, once

an acquirer crosses one of the above thresholds, those shares in an offer or acquisition and acquired within 90 days thereof become “control

shares” and such control shares are deprived of the right to vote until disinterested stockholders restore the right. These provisions

also provide that if control shares are accorded full voting rights and the acquiring person has acquired a majority or more of all voting

power, all other stockholders who do not vote in favor of authorizing voting rights to the control shares are entitled to demand payment

for the fair value of their shares in accordance with statutory procedures established for dissenters’ rights.

The

effect of the Nevada control share statutes is that the acquiring person, and those acting in association with the acquiring person,

will obtain only such voting rights in the control shares as are conferred by a resolution of the stockholders at an annual or special

meeting. The Nevada control share law, if applicable, could have the effect of discouraging takeovers of our Company. A corporation may

elect to not be governed by, or “opt out” of, the control share provisions by making an election in its articles of incorporation

or bylaws, provided that the opt-out election must be in place on the 10th day following the date an acquiring person has acquired a

controlling interest, that is, crossing any of the three thresholds described above. The Articles of Incorporation expressly elect not

to be governed by these provisions of the NRS. Accordingly, the control share statutes will not be applicable to us unless our Articles

of Incorporation are amended in accordance with applicable law and the Articles of Incorporation to remove our election to opt out of

the application of the statutes.

Articles

of Incorporation and Bylaws

The

Company’s Articles of Incorporation and Bylaws include anti-takeover provisions that:

| ● |

authorize

the Board of Directors, without further action by the stockholders, to issue shares of Preferred Stock in one or more series, and

with respect to each series, to fix the number of shares constituting that series, and establish the rights and terms of that series; |

| |

|

| ● |

establish

advance notice procedures for stockholders to submit nominations of candidates for election to the Board of Directors to be brought

before a stockholders meeting; |

| |

|

| ● |

allow

the Company’s directors to establish the size of the Board of Directors and fill vacancies on the Board created by an increase

in the number of directors (subject to the rights of the holders of any series of Preferred Stock to elect additional directors under

specified circumstances); |

| |

|

| ● |

require

the affirmative vote of the holders of at least two-thirds (2/3) of the voting power of all of the then-outstanding shares of capital

stock of the Company entitled to vote generally in the election of directors in order to remove a director or the entire Board of

Directors for cause; |

| |

|

| ● |

do

not provide stockholders cumulative voting rights with respect to director elections; and |

| |

|

| ● |

provide

that the Company’s Bylaws may be amended by the Board of Directors without stockholder approval. |

Provisions

of the Company’s Articles of Incorporation and Bylaws may delay or discourage transactions involving an actual or potential change

in the Company’s control or change in the Company’s Board of Directors or management, including transactions in which stockholders

might otherwise receive a premium for their shares or transactions that the Company’s stockholders might otherwise deem to be in

their best interests. Therefore, these provisions could adversely affect the price of our common stock.

Authorized

and Unissued Shares

The

Company’s authorized and unissued shares of Common Stock are available for future issuance without stockholder approval except

as may otherwise be required by applicable stock exchange rules or Nevada law. The Company may issue additional shares for a variety

of purposes, including future offerings to raise additional capital, to fund acquisitions and as employee and consultant compensation.

The existence of authorized but unissued shares of Common Stock could render more difficult, or discourage an attempt, to obtain control

of the Company by means of a proxy contest, tender offer, merger or otherwise.

The

issuance of shares of Preferred Stock by the Company could have certain anti-takeover effects under certain circumstances, and could

enable the Board of Directors to render more difficult or discourage an attempt to obtain control of the Company by means of a merger,

tender offer, or other business combination transaction directed at the Company by, among other things, placing shares of Preferred Stock

with investors who might align themselves with the Board of Directors.

Transfer

Agent

The

transfer agent for our Common Stock is Securities Transfer Corporation at 2901 N. Dallas Parkway, Suite 380, Plano, TX 75093. The transfer

agent’s telephone number is (469) 633-0101.

DESCRIPTION

OF WARRANTS

We

may issue warrants to purchase Common Stock, Preferred Stock, or units. Each issue of warrants will be the subject of a warrant agreement

which will contain the terms of the warrants. In the event that we issue warrants, we will distribute a prospectus supplement with regard

to each issue of warrants. Each prospectus supplement will describe, as to the warrants to which it relates:

| |

● |

the

securities which may be purchased by exercising the warrants (which may be Common Stock, Preferred Stock, or units consisting of

two or more of those types of securities); |

| |

|

|

| |

● |

the

exercise price of the warrants (which may be wholly or partly payable in cash or wholly or partly payable with other types of consideration); |

| |

|

|

| |

● |

the

period during which the warrants may be exercised; |

| |

|

|

| |

● |

any

provision adjusting the securities which may be purchased on exercise of the warrants and the exercise price of the warrants in order

to prevent dilution or otherwise; |

| |

|

|

| |

● |

the

place or places where warrants can be presented for exercise or for registration of transfer or exchange; and |

| |

|

|

| |

● |

any

other material terms of the warrants. |

Exercise

of Warrants

Each

warrant will entitle the holder of the warrant to purchase for cash the amount of Common Stock, Preferred Stock, or units at the exercise

price stated or determinable in the applicable prospectus supplement for the warrants. Warrants may be exercised at any time up to the

close of business on the expiration date shown in the applicable prospectus supplement, unless otherwise specified in such prospectus

supplement. After the close of business on the expiration date, unexercised warrants will become void. Warrants may be exercised as described

in the applicable prospectus supplement.

Until

a holder exercises the warrants to purchase any securities underlying the warrants, the holder will not have any rights as a holder of

the underlying securities by virtue of ownership of warrants.

DESCRIPTION

OF UNITS

The

following description, together with the additional information we may include in any applicable prospectus supplements, summarizes the

material terms and provisions of the units that we may offer under this prospectus. While the terms summarized below will apply generally

to any units that we may offer, we will describe the particular terms of any series of units in more detail in the applicable prospectus

supplement. If we indicate in the prospectus supplement, the terms of any units offered under that prospectus supplement may differ from

the terms described below. Specific unit agreements will contain additional important terms and provisions and will be incorporated by

reference as an exhibit to the registration statement that includes this prospectus.

We

may issue units composed of one or more of the other securities described in this prospectus in any combination. Each unit will be issued

so that the holder of the unit is also the holder of each security included in the unit. If we issue units, the prospectus supplement

relating to the units will contain the information described above with regard to each of the securities that is a component of the units.

In addition, each prospectus supplement relating to units will:

| |

● |

state

how long, if at all, the securities that are components of the units must be traded in units, and when they can be traded separately; |

| |

|

|

| |

● |

state

whether we will apply to have the units traded on a securities exchange or securities quotation system; and |

| |

|

|

| |

● |

describe

how, for U.S. federal income tax purposes, the purchase price paid for the units is to be allocated among the component securities. |

The

provisions described in this section, as well as those described under “Description of Our Capital Stock” and “Description

of Warrants” will apply to each unit, as applicable, and to any Common Stock, Preferred Stock and warrant included in each unit,

as applicable.

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus and applicable prospectus supplements in one or more of the following ways from

time to time: (i) to or through underwriters or dealers, (ii) directly to one or more purchasers, including our affiliates, (iii) through