AM Best Maintains Under Review With Negative Implications Status for Credit Ratings of Accredited Specialty Insurance Company, Accredited Surety and Casualty Company, Inc. and Accredited Insurance (Europe) Limited

23 Juni 2023 - 8:29PM

Business Wire

AM Best has maintained the under review with negative

implications status for the Financial Strength Rating of A-

(Excellent) and the Long-Term Issuer Credit Ratings (Long-Term ICR)

of “a-” (Excellent) of Accredited Specialty Insurance Company (ASI)

(Phoenix, AZ), Accredited Surety and Casualty Company, Inc. (ASC)

(Orlando, FL) and Accredited Insurance (Europe) Limited (AIEL)

(Malta). ASI, ASC and AIEL, collectively known as Accredited, are

wholly owned subsidiaries of R&Q Insurance Holdings Ltd

(R&Q) (Bermuda) [AIM: RQIH].

The Credit Ratings (ratings) reflect Accredited’s balance sheet

strength, which AM Best assesses as very strong, as well as its

adequate operating performance, limited business profile and

appropriate enterprise risk management. In addition, the ratings

reflect a neutral impact from the sub-group’s ownership by

R&Q.

The rating actions follow the announcement by R&Q on 12 June

2023, that it has completed the internal reorganisation to separate

program management and legacy insurance businesses following

receiving all necessary internal and external approvals.

Furthermore, R&Q announced that it continues to explore

strategic transactions with third parties as part of the separation

to enable Accredited to operate independently. A process is

underway for the potential sale of Accredited with interest

expressed from a number of parties.

The Accredited subsidiaries previously received full rating

enhancement from R&Q. Since AM Best no longer views these

subsidiaries to be integral to R&Q, Accredited now forms an

independent rating unit, distinct from R&Q.

These rating actions pertain only to Accredited. An assessment

of the R&Q group will be conducted in the near term, after it

publishes its 2022 year-end results; this could lead potentially to

further rating actions. Despite pressure on R&Q’s risk-adjusted

capitalisation, AM Best expects Accredited’s balance sheet to be

somewhat insulated over the near term, given that contracts are

expected to be put in place that restrict capital extraction.

The ratings are expected to remain under review until AM Best

has sufficient clarity over the rating fundamentals of Accredited

and R&Q, subsequent to the sale of Accredited.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use and

limitations of Credit Rating opinions, please view Guide to Best’s

Credit Ratings. For information on the proper use of Best’s Credit

Ratings, Best’s Performance Assessments, Best’s Preliminary Credit

Assessments and AM Best press releases, please view Guide to Proper

Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specialising in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2023 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230623525220/en/

Kanika Thukral Associate Director, Analytics

+44 20 7397 0327 kanika.thukral@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Billiah Moturi Financial Analyst +1 908 882

2191 billiah.moturi@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

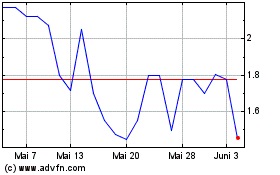

R&q Insurance (LSE:RQIH)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

R&q Insurance (LSE:RQIH)

Historical Stock Chart

Von Jan 2024 bis Jan 2025