TIDMRQIH

RNS Number : 3246C

R&Q Insurance Holdings Ltd

12 June 2023

R&Q Insurance Holdings Ltd

R&Q raises up to $60 million of new equity into the Group;

completes internal reorganisation to separate Program Management

and Legacy Insurance; provides an update on strategic alternatives

being explored; and provides an update on Q1 Program Management

trading

12 June 2023

R&Q Insurance Holdings Ltd, (AIM-RQIH) ("R&Q" or the

"Group"), the leading non-life global specialty insurance company

focusing on Program Management ("Accredited") and Legacy Insurance

("R&Q Legacy") businesses, announces a capital raise of $50

million of non-voting, perpetual preferred equity issued by Randall

& Quilter PS Holdings Inc., an indirect wholly-owned subsidiary

of R&Q (the "R&Q PS Investment"), from investment funds

affiliated with one of its largest shareholders, Scopia Capital

Management ("Scopia"), with the opportunity to increase the amount

of equity raised to $60 million. The preferred stock will, in

certain circumstances, be exchangeable at Scopia's election into

new ordinary shares of R&Q at 60.98p (representing a 10%

premium to the 20-day volume weighted average price prior to the

date of the Agreement).

Further to R&Q's announcement on 4 April 2023 on its

strategic initiative to separate Accredited and R&Q Legacy,

R&Q has received all necessary approvals to complete this

internal reorganisation. Accredited and R&Q Legacy will now

operate under two separate holding companies within the Group. This

separation is part of the requirement for Accredited to receive its

own separate subgroup financial strength rating from AM Best.

Furthermore, as also announced on 4 April 2023, R&Q

continues to explore strategic transactions with third parties as

part of the separation to enable Accredited to operate

independently. A process is underway for the potential sale of

Accredited with interest expressed from a number of parties. In

addition, a variety of strategic alternatives are being explored in

relation to R&Q Legacy.

The proceeds from the R&Q PS Investment will be used to

increase the capitalization of R&Q Legacy, which is providing

reinsurance support for completed legacy transactions originated by

Accredited. Proceeds will also be used for general corporate

purposes due to Accredited no longer paying intra-group dividends

to R&Q as part of a requirement to secure its financial

strength rating from AM Best.

Q1 Program Management Update

R&Q announces strong results for Accredited in Q1 2023:

-- Q1 2023 Gross Written Premium ('GWP') of $0.5 billion (Q1

2022: $0.4 billion), a 34% increase

-- Q1 2023 Program Fee Income of $22 million (Q1 2022: $18 million), a 24% increase

-- Accredited continues to partner with leading Managing General

Agents in Europe, the UK and the US, and has added five new

programs in 2023. Accredited maintains a strong pipeline and

expects to add additional partnerships over the remainder of the

year

William Spiegel , Chief Executive Officer, commented: "This

additional capital, alongside our completed internal

reorganisation, means Accredited and R&Q Legacy can be

established as stand-alone entities within R&Q. 2023 has seen

Accredited continue its strong momentum and leadership position in

the program market, achieving a record first quarter in terms of

GWP and Fee Income. For the 12 months ended 31 March 2023,

Accredited's GWP is $2.0 billion, an increase of $200 million from

year end 2022 where we reported GWP of $1.8 billion. We are

currently working very closely with AM Best to secure a subgroup

rating for Accredited and have completed the key reorganisational

requirements. R&Q Legacy has seen three transactions signed or

completed this year and has a strong pipeline of transactions to

grow Reserves Under Management beyond $1.0 billion. R&Q Legacy

continues to focus its efforts on its key areas of strength, medium

sized legacy transactions, while exploring potential further

corporate liability opportunities. I am pleased with the progress

we are making to enable both Accredited and R&Q Legacy to

maximise their potential by having the right ownership and capital

structures in place."

Details of the R&Q PS Investment

Under the terms of the agreement relating to the R&Q PS

Investment (the "Agreement"), Scopia has conditionally subscribed

for a new series of preferred stock (the "Preferred Stock") issued

by Randall & Quilter PS Holdings Inc. ("R&Q PS") for an

aggregate subscription price of US$50 million. On issue, the

Preferred Stock will be perpetual and non-voting. The Preferred

Stock will remain outstanding unless and until it is either so

exchanged or redeemed, in each case subject to satisfaction of

certain conditions as described below.

Once issued, the Preferred Stock will, in certain circumstances,

be exchangeable at Scopia's election into new ordinary shares of

R&Q at a 10% premium to the 20-day volume weighted average

price prior to the date of the Agreement, or 60.98p (an

"Exchange"). Any such Exchange will be conditional upon, among

other things, Scopia obtaining any necessary regulatory approvals

and receipt of any required R&Q shareholder approval.

The Preferred Stock is redeemable by R&Q PS in certain

limited circumstances, including, at Scopia's election, where

Accredited is sold outside of the Group, where there is no

transaction for the separation of Accredited from the Group within

twelve months from the date of issue of the Preferred Stock, where

R&Q does not obtain the required R&Q shareholder approval

for an Exchange within 15 months from the date of issue of the

Preferred Stock or where an Exchange has not taken place within 24

months of the date of issue of the Preferred Stock. No redemption

can take place while the Group has any outstanding indebtedness

senior to the Preferred Stock unless the consent of R&Q's then

lenders is obtained for such redemption. Any redemption shall take

place at a price which is equal to the value of the initial

investment increased by a 12 per cent annual return on the

Preferred Stock (subject to an increase to 20% in certain

circumstances, including the failure to obtain the approval of the

R&Q shareholders in connection with an Exchange) or, if

greater, the implied value of the ordinary shares which Scopia

would have received upon the Exchange of the Preferred Stock

determined at the time of such redemption event.

Following the issue of the Preferred Stock and prior to any

exchange or redemption of the Preferred Stock, R&Q has agreed

to allow Scopia to nominate one person as a director to the R&Q

board for so long as Scopia owns at least 15 per cent of the

ordinary shares of R&Q (on an as exchanged and fully diluted

basis) or, should Scopia so elect, to appoint such number of

directors as is proportionate to Scopia's aggregate pro rata

ownership of ordinary shares on an as exchanged and fully diluted

basis. Any such persons' ongoing appointment to the R&Q board

shall be subject to R&Q's bye-laws, and therefore will be

subject to re-election at R&Q annual general meeting.

Scopia's acquisition of the Preferred Stock is conditional upon

R&Q obtaining the required consent of its lenders to the issue

of the Preferred Stock.

Ends

Enquiries to: R&Q Insurance Holdings Ltd

William Spiegel Tel: +44 020 7780 5850

Tom Solomon Tel: +44 020 7780 5850

Numis Securities Limited (Nominated Adviser and Joint Broker)

Giles Rolls Tel: +44 020 7260 1000

Charles Farquhar Tel: +44 020 7260 1000

Barclays Bank PLC (Joint Broker)

Andrew Tusa Tel: +44 020 7632 2322

FTI Consulting (Media Relations)

Tom Blackwell / Shipra Khanna Tel: +44 020 3727 1051

Notes to Editors:

About R&Q

R&Q is a global non-life specialty insurance company. We

operate two core businesses: Program Management and Legacy

Insurance. Both these businesses are leaders in their respective

markets.

Our approach is to deploy our origination and underwriting

capabilities, alongside our licensed and rated carriers in the US,

EU, and the UK, to generate attractive fee returns in Program

Management and Legacy Insurance.

Legal Entity Identifier (LEI): 2138006K1U38QCGLFC94

Website: www.rqih.com

This announcement contains inside information as stipulated

under the UK market abuse regulation no 596/2014, which is part of

English law by virtue of the European (withdrawal) act 2018, as

amended. On publication of this announcement via a regulatory

information service, this information is considered to be in the

public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKDBPFBKDPAD

(END) Dow Jones Newswires

June 12, 2023 02:00 ET (06:00 GMT)

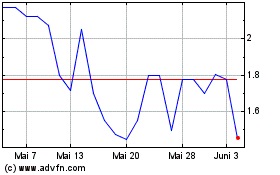

R&q Insurance (LSE:RQIH)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

R&q Insurance (LSE:RQIH)

Historical Stock Chart

Von Jan 2024 bis Jan 2025