TIDMRQIH

RNS Number : 2372V

R&Q Insurance Holdings Ltd

04 April 2023

R&Q Insurance Holdings Ltd

Strategic Initiative to Separate Program Management and Legacy

Insurance & Trading Update

4 April 2023

R&Q Insurance Holdings Ltd, (AIM-RQIH) ("R&Q" or the

"Group"), the leading non-life global specialty insurance company

focusing on Program Management and Legacy Insurance businesses,

announces that the Board of R&Q is reviewing strategic options

to separate its Program Management business, Accredited, and its

Legacy Insurance business. In addition, R&Q also provides a

trading update on the Group's expected operating performance for

the financial year ended 31 December 2022.

Strategic Initiative to Separate Accredited and Legacy

Insurance

R&Q's Program Management business, Accredited, has grown

significantly over the past three years, achieving record Gross

Written Premium and Fee Income (excluding minority stakes in MGAs)

of $1.8 billion and $80 million, respectively, in 2022. It is now

one of the largest program managers globally.

Accredited relies on an 'A' credit rating to conduct business

and historically relied on the financial strength of the broader

Group to obtain its credit rating. However, given Accredited's

current size and scale, R&Q believes it is in the best

interests of R&Q's shareholders for Accredited to stand on its

own. Therefore, the Board of R&Q is reviewing strategic

alternatives to separate Accredited and Legacy Insurance, which

will include a legal reorganisation followed by strategic

transactions with third parties to achieve this objective. R&Q

expects the separation will set each of Accredited and Legacy

Insurance on more favourable footing to deliver profitable growth,

each with their own appropriate capital structures.

The legal reorganisation is subject to regulatory and lender

consents, which R&Q expects to obtain in Q2 2023.

Preliminary FY 2022 Trading Update

Based on preliminary and unaudited information, R&Q

anticipates that it will realise a Pre-Tax Operating Profit (Loss)

for the financial year ended 31 December 2022 of $(30)-(40)

million, comprising $55-60 million in Program Management,

$(55)-(60) million in Legacy Insurance and $(35) million in

Corporate and Other, which is primarily interest expense. (1)

Program Management

Program Management is expected to realise a Pre-Tax Operating

Profit of $55-60 million, driven by Gross Written Premium of $1.8

billion and Fee Income (excluding minority stakes in MGAs) of $80

million, which increased 80% and 78%, respectively, over the prior

year. Pre-Tax Operating Profit includes $12 million of earnings

from the Group's minority stake in Tradesman Program Managers,

which has subsequently been sold to its controlling shareholder in

Q1 2023.

Legacy Insurance

Legacy Insurance is expected to realise a Pre-Tax Operating

(Loss) of $(55)-(60) million, driven by fewer transactions

completed, with Gross Reserves Acquired of $70 million and net

adverse development of 3-4% of the Group's net reserves. We expect

Reserves Under Management at year-end 2022 to be $400 million ($1

billion as of January 2023). Prior to new accounting rules

effective from 1 January 2023, the IFRS accounting regime allowed

"Day-1 gains", which meant that a majority of a transaction's

profits could be recorded upfront upon closing of the transaction.

As a result, any net reserve development after a transaction had

closed created heightened volatility in earnings but did not mean

that the underlying returns of the transaction would not meet

expectations when taking into account the Day-1 gain and investment

income.

Corporate and Other

Corporate and Other is expected to be $(35) million. This

comprises interest expense on debt, unallocated expenses and

foreign exchange impact on reevaluation of net assets.

William Spiegel , Chief Executive Officer, commented:

"Our Program Management business, Accredited, has seen

remarkable growth in Gross Written Premium, Fee Income and

profitability over the past five years. Accredited currently

partners with MGAs to offer over 80 different insurance programs

and has over 200 reinsurance partnerships. Accredited has grown to

become one of the largest program managers in the world and has the

appropriate size and scale to stand on its own as an independent

business. The Board has concluded that it is in shareholders' best

interests to evaluate strategic options that allow for a separation

of Accredited and Legacy Insurance. This will ensure both

Accredited and Legacy Insurance have the strongest foundations from

which to grow.

In Legacy Insurance, we continue to focus on transitioning to a

fee-based and capital efficient model and remain confident that

this will create a more profitable, sustainable and valuable

business. While in 2022 we didn't complete as many transactions as

in prior years, we maintained prudence in only pursuing deals that

are profitable for both R&Q and Gibson Re. As announced on 6

January 2023, we have grown Reserves Under Management to in excess

of $1 billion, starting from zero in the fourth quarter of 2021.

While our Q4 2022 actuarial review process shows a need to

strengthen reserves, it is important to note that the IFRS

accounting regime recognised a large portion of total lifetime

earnings at transaction close, which is a significant part of how

we assess the overall profitability of historical legacy

transactions.

Due to the planned separation, we expect to announce our final

audited results in June 2023."

[1] Financial figures are estimates and therefore dependent on

finalising full year 2022 results. Any reserve strengthening is a

significant accounting estimate that involves management making

assumptions and considering future events that are inherently

uncertain. There is a risk that such judgements are not made in

accordance with IFRS and thus there may be material differences

once the auditors/actuaries have undertaken their review as part of

the year end audit process which is yet to be completed.

Ends

Enquiries to: R&Q Insurance Holdings Ltd

William Spiegel Tel: +44 020 7780 5850

Tom Solomon Tel: +44 020 7780 5850

Numis Securities Limited (Nominated Adviser, Joint Broker, and Financial

Adviser)

Giles Rolls Tel: +44 020 7260 1000

Charles Farquhar Tel: +44 020 7260 1000

Barclays Bank PLC (Joint Broker and Financial Adviser)

Gary Antenberg Tel: +1 212 526 9051

Nishant Amin Tel: +44 020 7632 2322

Andrew Tusa Tel: +44 020 7632 2322

Fenchurch Advisory Partners (Financial Adviser)

Kunal Gandhi Tel: +44 020 7382 2222

Brendan Perkins Tel: +44 020 7382 2222

John Sipp Tel: +1 917 603 2932

Howden Tiger (Financial Adviser)

Rob Bredahl Tel: +1 646 685 4937

Leo Beckham Tel: +44 079 276 4458

John Stamatis Tel: +1 646 685 4943

FTI Consulting (Media Relations) Tel: +44 020 3727 1051

Tom Blackwell / Shipra Khanna

Notes to Editors:

About R&Q

R&Q is a global non-life specialty insurance company. We

operate two core businesses: Program Management and Legacy

Insurance. Both these businesses are leaders in their respective

markets.

Our approach is to deploy our origination and underwriting

capabilities, alongside our licensed and rated carriers in the US,

EU, and the UK, to generate attractive fee returns in Program

Management and Legacy Insurance.

Legal Entity Identifier (LEI): 2138006K1U38QCGLFC94

Website: www.rqih.com

This announcement contains inside information as stipulated

under the UK market abuse regulation no 596/2014, which is part of

English law by virtue of the European (withdrawal) act 2018, as

amended. On publication of this announcement via a regulatory

information service, this information is considered to be in the

public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFXLLBXZLEBBE

(END) Dow Jones Newswires

April 04, 2023 02:00 ET (06:00 GMT)

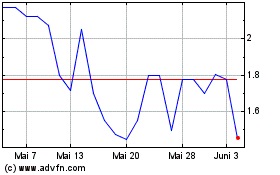

R&q Insurance (LSE:RQIH)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

R&q Insurance (LSE:RQIH)

Historical Stock Chart

Von Jan 2024 bis Jan 2025