Interim Results

20 Dezember 2004 - 8:00AM

UK Regulatory

RNS Number:5874G

Intercede Group PLC

20 December 2004

INTERCEDE GROUP PLC

INTERIM RESULTS

FOR THE 6 MONTHS ENDED 30 SEPTEMBER 2004

CHAIRMAN'S STATEMENT

Business and Product Development

I am pleased to report that the Company has continued to make excellent progress

towards our strategic goal of becoming a major global developer of software for

the smart card and identity management market.

Business activity with customers and partners in the last six months has been

building rapidly and the number of invitations to tender for projects worldwide

has exceeded expectations. Intercede has welcomed major new channel partners in

the US, France, Japan and Austria and additional key contracts have been secured

with customers in the UK, Ireland, Israel, Russia and Austria.

Against this background of measurable commercial progress, it is disappointing

to report that sales revenues in the first half are, nevertheless, depressed

compared to the prior year. This is because a number of anticipated orders

slipped into the second half of the year. The majority of these orders have now

been received and the Company is on track to show revenue growth for the year as

a whole.

Important milestones achieved during the period include:

1. MyID(TM) has been selected by the Irish Department of Transport, to power

the issuance and management of digital tachograph smart cards to all

commercial vehicle drivers in Ireland.

2. MyID has been deployed in support of a major health care provider.

Medical staff throughout one of the main European countries are now

receiving smart cards issued and managed by MyID.

3. Intercede has continued to work with a major global bank to commission a

high volume smart card personalisation service driven by MyID. Change

orders for this contract are generating incremental revenues during the

current year.

4. MyID has been installed to control physical and logical access in an

Israeli telecommunications company. This project was delivered in

partnership with a major systems integrator and a leading smart card

company.

5. Thales e-Security has completed the integration of MyID into their SafeSign

product range. Thales e-Security addresses the business, government and

finance industries' need for cryptographic security products and solutions.

Over half of the world's banks, together with the majority of the busiest

exchanges, currently use Thales technology.

6. Intercede's sales channels have been extended into Asia with Athena Smart

Card Systems, Japan, signing an OEM contract to adopt MyID as the Athena

Smart Card Manager. Two major customers have already been secured under

this contract.

7. Intercede has deepened its penetration into the top five smart card

manufacturers with an announcement that Axalto's new smart card management

system will be based on MyID. Co-marketing to new and existing Axalto

customers has already begun and sales are expected within the current

financial year. Axalto, formerly trading as Schlumberger, has supplied more

than 3 billion smart cards to customers worldwide.

8. Intercede has also entered into a reseller agreement with Atos Origin who

are looking to bid MyID on a number of identity solution projects. Atos

Origin is an international IT services company employing 47,000 people in

50 countries.

9. Intercede launched MyID version 6.8. This is an advanced release of our

MyID smart card management system featuring enhanced interoperability,

extended scalability and greater deployment flexibility.

Results

As outlined above, the Group continues to make good progress with its evolution

from being a UK distributor and integrator of third party security products to

being a global business developing its own technology for long term profitable

growth. However, whilst the Group's technology has achieved widespread industry

acceptance and endorsement, this will not be reflected in the numbers until

sufficient projects have been won and started to roll out to a substantial

number of users.

As a result, sales have fallen from #878,000 to #535,000, the rate of growth in

own technology sales as yet not compensating for the fall off in sales of third

party products. Gross profit margins have increased from 82% to 87% as the

proportion of own technology sales has increased from 65% to 76%.

Costs have been maintained at a similar level to last year's reduced level, with

#36,000 of the #39,000 year on year increase reflecting the exceptional cost of

engaging Ernst & Young to assist with the Group's outstanding Research &

Development tax claims. This was successful as it resulted in the receipt of

payments from the Inland Revenue totalling #182,000 for the 2002/03 and 2003/04

financial years.

As at 30 September 2004, the Group had net cash balances totalling #615,000.

During the six months ended 30 September 2004, the cash outflow before financing

was #451,000 compared with #274,000 during the comparative period.

Outlook

After an extended period of depressed expenditure in the IT sector, there is

clear evidence that an increasing number of organisations are allocating budgets

to identity management and smart card projects. I believe that Intercede has the

contracts and the channels to market, to deliver a strong finish to the 2004/05

financial year and to continue the trend towards profitability and rapid revenue

growth.

Richard Parris

Chairman

20 December 2004

ENQUIRIES:

Intercede Group plc Tel. 01455 558111

Richard Parris, Chairman & Chief Executive

Andrew Walker, Finance Director

Consolidated Profit and Loss Account

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2004 2003 2004

#'000 #'000 #'000

Turnover 535 878 1,605

Cost of sales (71) (161) (266)

----------- ----------- -----------

Gross profit 464 717 1,339

Other operating expenses (1,002) (963) (1,960)

----------- ----------- -----------

Operating loss (538) (246) (621)

Interest receivable and similar

income 16 14 34

Interest payable and similar

charges (36) (37) (74)

----------- ----------- -----------

Loss on ordinary activities

before taxation (558) (269) (661)

Tax on loss on ordinary

activities 182 78 (202)

----------- ----------- -----------

Loss on ordinary activities after

taxation and

retained loss for the period (376) (191) (863)

=========== =========== ===========

Basic and diluted loss per

ordinary share (1.1)p (0.8)p (2.9)p

=========== =========== ===========

Consolidated Balance Sheet

As at As at As at

30 September 30 September 31 March

2004 2003 2004

#'000 #'000 #'000

Fixed assets

Tangible assets 30 53 42

----------- ----------- -----------

Current Assets

Debtors 138 415 119

Cash at bank and in hand 615 1,303 1,068

----------- ----------- -----------

753 1,718 1,187

Creditors: Amounts falling due within

one year (708) (648) (778)

----------- ----------- -----------

Net current assets 45 1,070 409

----------- ----------- -----------

Total assets less current liabilities 75 1,123 451

----------- ----------- -----------

Creditors: Amounts falling due after

more than one year

Convertible debt (1,432) (1,432) (1,432)

----------- ----------- -----------

Net liabilities (1,357) (309) (981)

=========== =========== ===========

Capital and reserves

Called-up share capital 4,271 4,271 4,271

Share premium account 2,107 2,107 2,107

Other reserves 1,508 1,508 1,508

Profit and loss account (9,243) (8,195) (8,867)

----------- ----------- -----------

Shareholders' deficit - all equity (1,357) (309) (981)

=========== =========== ===========

Consolidated Cash Flow Statement

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2004 2003 2004

#'000 #'000 #'000

Net cash outflow from operating

activities (649) (284) (525)

----------- ----------- -----------

Returns on investments and

servicing of finance

Interest received 18 13 31

Interest paid - - (1)

Interest element of finance

lease rentals - (1) (2)

----------- ----------- -----------

Net cash inflow from returns on

investments and servicing of

finance 18 12 28

----------- ----------- -----------

Taxation received 182 - -

----------- ----------- -----------

Capital expenditure (2) (2) (6)

----------- ----------- -----------

Cash outflow before financing (451) (274) (503)

Financing

Issue of ordinary share capital - 1,270 1,270

Repayment of secured loan (2) (5) (10)

Capital element of finance

lease rentals - (5) (6)

----------- ----------- -----------

Net cash (outflow)/inflow from

financing (2) 1,260 1,254

----------- ----------- -----------

(Decrease)/increase in cash in

the period (453) 986 751

=========== =========== ===========

Notes to the Accounts

1. Preparation of the interim financial statements

The interim financial statements have been prepared on the basis of the

accounting policies set out in the Group's 2004 statutory accounts.

The interim financial statements are unaudited and do not constitute statutory

accounts as defined in Section 240 of the Companies Act 1985. The figures for

the year ended 31 March 2004 are an abridged version of the Group's statutory

accounts for that year which have been filed with the Registrar of Companies.

The audit opinion on those statutory accounts was unqualified and did not

include a statement under Section 237(2) or (3) of the Companies Act 1985.

The Interim Report will be mailed to shareholders and copies will be available

on the website (www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire, LE17 4PS.

2. Basic and diluted loss per ordinary share

The calculations of loss per ordinary share are based on the loss for the period

and the weighted average number of ordinary shares in issue during each period.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2004 2003 2004

#'000 #'000 #'000

Loss for the period (376) (191) (863)

Number Number Number

Weighted average number of

shares 33,963,438 25,220,142 29,672,863

Pence Pence Pence

Basic and diluted loss per

ordinary share (1.1) (0.8) (2.9)

======================= =========== =========== ===========

The increase in the weighted average number of shares reflects the Placing of

17,582,672 ordinary shares which took place on 1 July 2003.

3. Reconciliation of movement in shareholders' deficit

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2004 2003 2004

#'000 #'000 #'000

Opening shareholders' deficit (981) (1,388) (1,388)

Loss for the period (376) (191) (863)

Issue of shares - 1,270 1,270

----------- ----------- -----------

Closing shareholders' deficit (1,357) (309) (981)

=========== =========== ===========

4. Reconciliation of operating loss to operating cash flow

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2004 2003 2004

#'000 #'000 #'000

Operating loss (538) (246) (621)

Depreciation charge 13 18 34

Decrease in stock - 2 2

(Increase)/decrease in debtors (20) 208 226

Decrease in creditors (104) (266) (166)

----------- ----------- -----------

Net cash outflow from operating

activities (649) (284) (525)

=========== =========== ===========

5. Analysis and reconciliation of net debt

As at As at

31 March 30 September

2004 Cash Flow 2004

#'000 #'000 #'000

Cash at bank and in hand 1,068 (453) 615

----------- ----------- -----------

Debt due within one year (2) 2 -

Debt due after one year (1,432) - (1,432)

----------- ----------- -----------

(1,434) 2 (1,432)

----------- ----------- -----------

Net debt (366) (451) (817)

=========== =========== ===========

The reconciliation of net cash flow to the movement in net debt is as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2004 2003 2004

#'000 #'000 #'000

(Decrease)/increase in cash in

the period (453) 986 751

Cash outflow from decrease in

debt and lease financing 2 10 16

----------- ----------- -----------

Change in net debt resulting

from cash flows (451) 996 767

Net debt at the beginning of

the period (366) (1,133) (1,133)

----------- ----------- -----------

Net debt at the end of the

period (817) (137) (366)

=========== =========== ===========

6. Creditors: Amounts falling due after more than one year

The convertible debt totalling #1,432,000 represents two issues of convertible

loan stock, both carrying an interest coupon of 5%. The first issue totalling

#982,000 is convertible at the option of the holder into fully paid ordinary

shares of the Company at 60.0p per ordinary share (up to a maximum of 1,636,048

shares) at any time prior to 11 December 2006. The second issue totalling

#450,000 is convertible at the option of the holder into fully paid ordinary

shares of the Company at 41.4p per ordinary share (up to a maximum of 1,086,800

shares) at any time prior to 31 March 2007. Unless previously redeemed or

converted, the debt will be redeemed at par on 11 December 2006 and 31 March

2007 respectively.

In recognition of the dilution to be faced by the loan stockholders following

the Placing on 1 July 2003, they were granted warrants to subscribe for up to

2,982,919 ordinary shares at the Placing Price of 7.8p at any time up to the

existing conversion dates referred to above.

7. Dividend

The Directors do not recommend the payment of a dividend.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFFDFLLDLIS

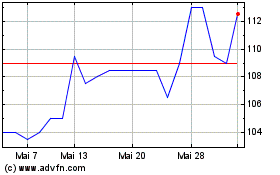

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024