TIDMIGP

RNS Number : 8003S

Intercede Group PLC

28 December 2016

28 December 2016

INTERCEDE GROUP plc

('Intercede', the 'Company' or the 'Group')

Interim Results for the Six Months Ended 30 September 2016

Intercede, the software and service company specialising in

identity, credential management and secure mobility, today

announces its interim results for the six months ended 30 September

2016.

Highlights

-- Revenues of GBP2.8m (2015: GBP5.5m), a decrease of 49%.

-- Operating expenses increased to GBP6.4m (2015: GBP5.7m), as a

result of continuing investment in infrastructure, technology

development and sales capacity.

-- Headcount increased to 127 at 30 September 2016 (30 September 2015: 125).

-- Operating loss of GBP3.7m (2015: GBP0.4m).

-- Loss for the period of GBP2.8m (2015: profit of GBP0.5m).

-- Basic loss per share 5.7p (2015: basic earnings per share 1.0p).

-- Cash balances of GBP1.4m at 30 September 2016 (30 September

2015: GBP5.8m). Subsequently increased to GBP2.6m at 30 November

2016.

-- Approximately GBP5.0m to be raised via a Convertible Loan

Note instrument and Subscription Shares (announced separately

today).

-- New contracts, which will all contribute to revenues during

the current financial year and beyond, include:

- Initial proof of concept order from a major German car

manufacturer, targeting the provision of secure digital trust to

more than 500,000 employees and devices.

- New license sale to a subsidiary of a major aerospace and defence company.

- Initial tranche of licenses sold to a global biopharmaceutical

company serving patients in 50 countries.

- Further GBP0.7m of orders secured from a major US aerospace

company for a MyID upgrade and support contract renewal.

Richard Parris, Chairman & Chief Executive of Intercede,

said:

"The reduction in revenues in the first half of the financial

year should not mask the scale of the market opportunity which we

are positioned to exploit. We are very pleased at the support we

have received from both new and existing investors who also

understand this opportunity and are endorsing our strategy by

subscribing for convertible loan notes and equity. We remain

confident that the deferred orders which have affected the first

half of the year will soon come to fruition and the outlook for the

full year is in line with expectations. In the more medium term, we

are equally confident that the technology we have developed to

build a secure bond of trust between connected people and their

devices will assume more and more importance in the markets for

cloud-based applications, secure mobility and the Internet of

Things."

ENQUIRIES

Intercede Group plc Tel. +44 (0)1455 558 111

Richard Parris, Chairman & Chief Executive

Andrew Walker, Finance Director

finnCap Tel. +44 (0)20 7220 0500

Stuart Andrews, Corporate Finance

Simon Hicks, Corporate Finance

Bell Pottinger Tel. +44 (0)7802 442486

Archie Berens

About Intercede

Intercede is a software and service company specializing in

identity, credential management and secure mobility. Its solutions

create a foundation of trust between connected people, devices and

apps and combine expertise with innovation to provide world-class

cybersecurity. Intercede has been delivering solutions to high

profile customers, from the US and UK governments to some of the

world's largest corporations, telecommunications providers and

information technology firms, for over 20 years. Intercede's

product portfolio includes MyID, an identity and credential

management system that assigns trusted digital identities to

employees citizens and machines. In 2015, Intercede launched MyTAM,

enabling trusted applications to be loaded into a mobile device's

Trusted Execution Environment (TEE), providing hardware-level

security for Android apps. In 2016, Intercede launched RapID, a

secure, easy to implement authentication service for mobile apps

and cloud services to completely eliminate the need for

passwords.

For more information visit: www.intercede.com

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Interim Results for the Six Months Ended 30 September 2016

Chairman's Statement

Introduction

Intercede has benefited from six months of important strategic

progress measured in terms of new partnerships, positive market

developments and the initiation of critical proof of concept

deployments for secure mobility and the Internet of Things.

Unfortunately, during the same period we were affected by the

deferment of a small number of particularly large orders. While

none of these external delays are a comment on the fundamental

strength of the business, the short term impact of more than GBP2m

of sales being deferred is significant in terms of our ability to

continue the scale of our investment in business expansion.

The Company has therefore implemented a plan to raise additional

funding to ensure we are adequately resourced to exploit the

opportunities we have created around future looking mobile and IOT

digital trust solutions. I am pleased to say this fund raising has

been successful and the Company has conditionally secured

approximately GBP5.0m of additional cash via a conditional

convertible loan note instrument and equity. This new funding will

be principally deployed to ramp sales over the next two years in

newly emerging regulatory markets in UK, Europe, Korea and the US.

The funding has come from new institutions and seasoned technology

entrepreneurs as well as some of our major existing investors. This

demonstrates the confidence of our long term backers as well as

illustrating that our strategic story resonates strongly with a new

generation of technology and security savvy investors.

Additionally, we have removed more than GBP0.6m of annualized

costs from the business compared to the start of the financial year

without impacting our core delivery capabilities.

Financial Results

Revenues in the period totaled GBP2,828,000, a 49% reduction

compared to the corresponding period last year. For the MyID

platform, a large proportion of revenue is generated from US

Government agencies, which have stalled investment decisions while

bigger political events play out. We believe the conclusion of the

US presidential race will result in a pick-up in the revenue run

rate as business returns to normal and significant deferred orders

- which, as noted above, amount to more than GBP2m - are

realised.

For the Company's newer products, RapID and MyTAM, the work put

into business development has resulted in the identification of

target markets and talks with reference customers in each of those

markets. A RapID solution with a wealth management company is

expected to go live later in the year, along with a pilot for a

large group of Italian banks. Intercede also continues to build on

relationships with all of the major silicon designers and believes

that the combined offering of RapID and MyTAM to the Internet of

Things future is unmatched on the global stage. Both products are

expected to generate significant revenues in future periods.

Planned investment in marketing and PR and business development

of new markets, as outlined above, has resulted in a 14% increase

in operating expenses from GBP5,670,000 to GBP6,448,000. The

combined effect of planned investment and revenue deferment has

resulted in an increase in operating losses from GBP447,000 to

GBP3,678,000.

Staff costs continue to represent the main area of expense,

representing 77% of total operating costs (2015: 78%). Intercede

had 127 employees and contractors as at 30 September 2016 (30

September 2015: 125). The average number of employees and

contractors during the period has risen to 128 (2015: 121).

An GBP898,000 taxation credit for the period (2015: GBP912,000

taxation credit) primarily reflects the 2016 Research &

Development ("R&D") claim as a result of the investment

activities outlined above. Whilst the 2015 R&D claim was

received during September 2015, the 2016 claim was received during

October 2016. The Group is a beneficiary of the UK Government's

efforts to encourage innovation by allowing 130% (2015: 125%) of

qualifying R&D expenditure to be offset against taxable profits

and allowing 14.5% of the lower of R&D losses or taxable losses

to be paid as tax credits.

A loss for the period of GBP2,773,000 (2015: profit of

GBP480,000) resulted in a basic and a fully diluted loss per share

of 5.7p (2015: basic earnings per share of 1.0p and a fully diluted

earnings per share of 0.9p).

Cash balances as at 30 September 2016 totaled GBP1,377,000

compared to GBP5,289,000 as at 31 March 2016 and GBP5,767,000 as at

30 September 2015. As at 30 November 2016, cash balances had

recovered to GBP2,567,000 due to the receipt of the 2016 R&D

claim post period end and receipts from customers. Growth will

continue to be funded through a combination of existing cash

balances and the additional funding that has been announced

separately to the Stock Exchange today.

Operational Highlights

There have been key wins in respect of product development and

customer engagement, all of which will contribute to revenues in

the current financial year and beyond:

-- The successful completion of a proof of concept of a MyID

virtual smartcard solution for a major German car manufacturer.

-- Development of a RapID solution into an e-wallet application

that is currently in trial and will be used by a large group of

Italian banks.

-- RapID has been implemented into an app for a London-based

wealth management company that is expected to go live before the

end of the year. This will enable their customers to perform

transactions easily and securely, rather than calling to transact

through a broker.

-- Initial tranche of licenses sold to a global

biopharmaceutical company serving patients in 50 countries.

-- Signed memorandum of understandings with a number of silicon

and IoT IP companies to develop collaborative digital trust

solutions for connected devices.

-- Taken leadership roles in a number of industry initiatives

relating to digital trust and cyber security.

Strategy and Outlook

Intercede's strategy remains unchanged, despite the short term

challenges: to grow its digital trust service and software business

from a core of existing high value reference customers to a much

broader range of industry sectors and customer size.

Intercede plans to achieve this by continuing to generate

revenues in its historically strong markets and to reinvest in the

significantly higher growth opportunity that is anticipated in the

Cloud-enabled, application service centric, mobile and Internet of

Things markets. Intercede has already developed much of the

required core technology, such as its MyID and MyTAM platforms. The

strategic focus is now moving to packaging Intercede's portfolio of

IP assets into new combinations to provide innovative solutions to

some of the most intractable challenges of the digital economy.

In the medium term, RapID will contribute more to revenue than

MyTAM. Target markets for RapID include those that are impacted by

new regulations in the financial services and consumer sectors such

as Payment Services Directive 2 (PSD2) and the General Data

Protection Regulations (GDPR). MyTAM will be essential for

solutions to the Internet of Things market and we believe the

upside of success in this market is huge. For example, trusted

applications on mobile devices will increase convenience, privacy

and security for everyday consumer and business applications and,

by 2020, the Internet of Things market is estimated to be in excess

of 50 billion devices with each 'thing' needing to validate the

trustworthiness of its peers across a network. Each point of trust

is an opportunity for Intercede to provide an enabling service.

Our expectations are for accelerating year on year growth and

turning the tens of millions of MyID identities into hundreds of

millions of RapID/MyTAM app users. Our confidence is growing

commensurately that, in the longer term, Intercede is exceptionally

well placed to capitalise on the market for digital trust

services.

Richard Parris

Chairman & Chief Executive

28 December 2016

Consolidated Statement of

Comprehensive Income

For the period ended 30 September

2016

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2016 2015 2016

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 2,828 5,547 11,004

Cost of sales (58) (324) (410)

__________ __________ __________

Gross profit 2,770 5,223 10,594

Operating expenses (6,448) (5,670) (12,511)

__________ __________ __________

Operating loss (3,678) (447) (1,917)

Finance income 7 15 32

__________ __________ __________

Loss before tax (3,671) (432) (1,885)

Taxation 898 912 892

__________ __________ __________

(Loss)/profit for the period (2,773) 480 (993)

__________ __________ __________

Total comprehensive (expense)/income

attributable to owners of

the parent company (2,773) 480 (993)

__________ __________ __________

(Loss)/earnings per share

(pence)

- basic (5.7)p 1.0p (2.1)p

- diluted (5.7)p 0.9p (2.1)p

__________ __________ __________

Consolidated Balance Sheet

As at 30 September 2016

As at As at As at

30 September 30 September 31 March

2016 2015 2016

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 822 835 864

__________ __________ __________

Current assets

Trade and other receivables 2,718 1,812 1,146

Cash and cash equivalents 1,377 5,767 5,289

__________ __________ __________

4,095 7,579 6,435

__________ __________ __________

Total assets 4,917 8,414 7,299

__________ __________ __________

Equity

Share capital 491 487 487

Share premium account 232 232 232

Other reserves 1,508 1,508 1,508

Retained earnings (1,441) 2,453 1,131

__________ __________ __________

Total equity attributable

to owners of the parent company 790 4,680 3,358

__________ __________ __________

Non-current liabilities

Deferred revenue 77 210 122

__________ __________ __________

Current liabilities

Trade and other payables 1,745 1,109 1,795

Deferred revenue 2,305 2,415 2,024

__________ __________ __________

4,050 3,524 3,819

__________ __________ __________

Total liabilities 4,127 3,734 3,941

__________ __________ __________

Total equity and liabilities 4,917 8,414 7,299

__________ __________ __________

Consolidated Statement

of Changes in Equity

For the period ended

30 September 2016

Share Share Other Retained

capital premium reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2016 487 232 1,508 1,131 3,358

Issue of ordinary shares 4 - - - 4

Purchase of own shares - - - (68) (68)

Employee share option

plan charge - - - 47 47

Employee share incentive

plan charge - - - 222 222

Loss for the period

and total comprehensive

income - - - (2,773) (2,773)

________ ________ ________ ________ _______

At 30 September 2016 491 232 1,508 (1,441) 790

__--______ ________ ________ ___________ _______

At 1 April 2015 487 232 1,508 2,257 4,484

Purchase of own shares - - - (488) (488)

Employee share option

plan charge - - - 57 57

Employee share incentive

plan charge - - - 147 147

Profit for the period

and total comprehensive

expense - - - 480 480

________ ________ ________ ________ _______

At 30 September 2015 487 232 1,508 2,453 4,680

__--______ ________ ________ ___________ _______

At 1 April 2015 487 232 1,508 2,257 4,484

Purchase of own shares - - - (610) (610)

Employee share option

plan charge - - - 115 115

Employee share incentive

plan charge - - - 334 334

Employee treasury share

transfer - - - 28 28

Loss for the year and

total comprehensive

expense - - - (993) (993)

________ ________ ________ ________ _______

At 31 March 2016 487 232 1,508 1,131 3,358

__--______ ________ ________ ___________ _______

Consolidated Cash Flow Statement

For the period ended 30 September

2016

6 months 6 months

ended 30 ended 30 Year ended

September September 31 March

2016 2015 2016

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Operating loss (3,678) (447) (1,917)

Depreciation 103 89 186

Employee share option plan

charge 47 57 115

Employee share incentive

plan charge 222 147 334

Employee unit incentive plan

(credit)/charge (4) 15 58

Employee treasury share transfer - - 28

(Increase) in trade and other

receivables (821) (737) (100)

(Decrease)/increase in trade

and other payables (46) (32) 611

Increase/(decrease) in deferred

revenue 236 413 (66)

Interest received 9 19 36

__________ __________ __________

Cash used in operations (3,932) (476) (715)

Taxation (paid)/received (24) 912 892

__________ __________ __________

Net cash (used in)/generated

from operating activities (3,956) 436 177

__________ __________ __________

Investing activities

Purchases of property, plant

and equipment (61) (71) (197)

__________ __________ __________

Cash used in investing activities (61) (71) (197)

__________ __________ __________

Financing activities

Purchase of own shares (64) (488) (610)

__________ __________ __________

Cash used in financing activities (64) (488) (610)

__________ __________ __________

Net decrease in cash and

cash equivalents (4,081) (123) (630)

Cash and cash equivalents

at the beginning of the period 5,289 5,895 5,895

Exchange gains/(losses) on

cash and cash equivalents 169 (5) 24

__________ __________ __________

Cash and cash equivalents

at the end of the period 1,377 5,767 5,289

__________ __________ __________

Notes to the Consolidated Accounts

For the period ended 30 September 2016

1 Preparation of the interim financial statements

These interim financial statements have been prepared under IFRS

as adopted by the European Union and on the basis of the accounting

policies set out in the Group's Annual Report for the year ended 31

March 2016.

The Group is not required to apply IAS 34 Interim Financial

Reporting at this time.

These interim financial statements have not been audited and do

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31 March

2016 have been delivered to the Registrar of Companies. The

Auditors' Report on those accounts was unqualified and did not

contain any statement under Section 498 (2) or (3) of the Companies

Act 2006.

The Interim Report will be mailed to shareholders within the

next few weeks and copies will be available on the website

(www.intercede.com) and at the registered office: Intercede Group

plc, Lutterworth Hall, St Mary's Road, Lutterworth, Leicestershire,

LE17 4PS.

2 Revenue

All of the Group's revenue, operating (losses)/profits and net

assets originate from operations in the UK. The Directors consider

that the activities of the Group constitute a single business

segment.

The split of revenue by geographical destination of the end

customer can be analysed as follows:

6 months 6 months

ended ended 30 Year ended

30 September September 31 March

2016 2015 2016

GBP'000 GBP'000 GBP'000

UK 139 313 462

Rest of Europe 461 570 1,312

North America 1,987 4,410 8,699

Rest of World 241 254 531

__________ __________ __________

2,828 5,547 11,004

__________ __________ __________

3 Taxation

Taxation represents the net effect of amounts receivable from

HMRC in respect of R&D claims and US corporation tax

payable.

4 (Loss)/earnings per share

The calculations of the (loss)/earnings per ordinary share are

based on the (loss)/profit for the period and the weighted average

number of ordinary shares in issue during each period. The basic

and diluted loss per share are the same as potential dilution

cannot be applied to a loss making period.

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2016 2015 2016

GBP'000 GBP'000 GBP'000

(Loss)/profit for the

period (2,773) 480 (993)

__________ __________ __________

Number Number Number

Weighted average number

of shares

- basic 48,507,555 48,426,005 48,429,489

- diluted 48,507,555 50,751,688 48,429,489

__________ __________ __________

Pence Pence Pence

Earnings/(loss) per

share

- basic (5.7)p 1.0p (2.1)p

- diluted (5.7)p 0.9p (2.1)p

__________ __________ __________

The weighted average number of shares used in the calculation of

basic and diluted earnings per share for each period were

calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2016 2015 2016

Number Number Number

Issued ordinary shares

at start of period 48,735,005 48,735,005 48,735,005

Issue of ordinary shares 66,550 - -

Effect of purchase of

treasury shares (294,000) (309,000) (305,516)

__________ __________ __________

Weighted average number

of shares

- basic 48,507,555 48,426,005 48,429,489

__________ __________ __________

Add back effect of purchase

of treasury shares N/A 309,000 N/A

Effect of share options

in issue N/A 2,016,683 N/A

__________ __________ __________

Weighted average number

of shares

- diluted 48,507,555 50,751,688 48,429,489

__________ __________ __________

5 Dividend

The Directors do not recommend the payment of a dividend.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LDLLLQLFEFBB

(END) Dow Jones Newswires

December 28, 2016 02:00 ET (07:00 GMT)

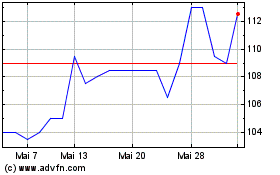

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024