One of the biggest security challenges faced by organisations

today is verifying the identity of people and devices that attempt

to access their networks, data and premises. Many firms rely on

usernames and passwords, but these are an inherently insecure form

of authentication, while proving especially awkward to use on

mobile devices. To address this, we have increased our

collaboration with Microsoft so that organisations can now give

their employees secure access to corporate networks and resources

straight from their Windows device, whether it is a PC, tablet or

phone. Intercede announced in June 2014 that it was the first

company to provide virtual smart card (VSC) management - a form of

authentication that uses a device's inbuilt secure element (known

as a TPM) - for Windows Phone 8.1.

The advantage of Windows VSC solutions is the low cost and ease

of deployment, making it an ideal way to provide higher levels of

cyber security and identity assurance to mid-market customers.

A significant amount of man time has been invested during the

period in supporting Microsoft on a number of internal and external

facing proofs of concept and pilots that involve key security

components and the Azure Cloud services.

As a further sign of our strengthening relationship, Intercede

was a bronze sponsor at Microsoft's World Partner Conference in

July 2014.

3. FIPS 201-2 Derived Credentials - mobile solutions for

governments and security sensitive large scale organisations

Intercede's US Federal market for secure identities is about to

go through a revolution as government agencies seek to improve

productivity and reduce costs through the mobile enablement of

their workforce. Intercede has invested to ensure it can ride this

wave of opportunity. In September 2014 we announced that a

high-profile US Federal government agency had placed an initial

order for MyID v10.1 credential management software to provide its

employees with secure identity on mobile devices to meet the new

FIPS 201-2 standard.

Launched September 2014, MyID v10.1 is the US's first derived

credential solution that can securely issue and manage trusted

personal identity verification (PIV) credentials for mobile.

Meeting the technical and business process standards for FIPS 201-2

compliance, MyID combines technology independence with an easy

"mobile first" self-service interface to enable fast

enterprise-wide deployment of derived credentials.

The use of derived credentials enables Federal employees to

securely access mobile resources that they could previously only

get to with their PIV smart card, leading to higher productivity

while simultaneously strengthening security.

Intercede previewed MyID v10.2 at the Smart Card Alliance on

29-30 October 2014. This is Intercede's inaugural "Cloud-first,

Mobile-first" product. Designed to be run by end-user organisations

or service providers in a cloud environment, MyID v10.2 enables any

Federal agency to manage their derived credentials using MyID

irrespective of their existing PIV provider. This opens up a large

premium government market to Intercede.

Strategy and Outlook

Intercede's strategy is to continue to grow its identity and

credential management business in its historically strong markets

and to reinvest in the significantly higher growth opportunity that

is anticipated in the mobile and Internet of Things (IoT) markets.

Our diverse product portfolio and long term 'sticky' customers

enable the Company to ride the inherent risks associated with

selling products based on new technology and to focus on maximising

market penetration ahead of nascent competition.

We believe the upside of success is huge. For example, Trustonic

TEE technology alone already protects more than 250 million smart

devices, empowering service providers to protect their applications

in hardware to simplify access and enhance the services provided.

The technology enables usernames and passwords to be replaced with

strong identity and authentication credentials that increase

convenience, privacy and security for consumer and business

applications. This population is expected to grow significantly in

the next 12-24 months and by 2020 the Internet of Things market is

estimated to be in excess of 50 billion devices. Each of those

digital identities needs to be managed and this therefore

represents a massive potential market for Intercede.

The commercial upside of the Microsoft VSC and Derived

Credential markets, while smaller in terms of number of licenses

than the TEE opportunity, carry higher unit prices and have the

scope for generating significant returns in the medium term.

In the markets in which we operate orders can be delayed and the

adoption of new products and services can be slower than planned.

However, we see encouraging signs based on the level of customer

engagement in the current financial year to date. Our expectations

are thus for year on year growth and further upside potential based

on a strong pipeline of opportunities, more and more of which is

developing in new markets. In the longer term it has become clear

that Intercede is very well placed to capitalise on a market in

which it has been recognised that passwords are not enough.

Richard Parris

Chairman & Chief Executive

6 November 2014

Consolidated Statement of Comprehensive Income

For the period ended 30 September 2014

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 4,045 4,614 9,783

Cost of sales (296) (18) (99)

------------ ------------ ----------

Gross profit 3,749 4,596 9,684

Operating expenses (4,868) (4,376) (9,366)

------------ ------------ ----------

Operating (loss)/profit (1,119) 220 318

Finance income 31 36 77

------------ ------------ ----------

(Loss)/profit before tax (1,088) 256 395

Taxation 383 396 385

------------ ------------ ----------

(Loss)/profit for the period (705) 780

------------ ------------ ----------

Total comprehensive (expense)/income

attributable to owners of the parent

company (705) 652 780

------------ ------------ ----------

(Loss)/earnings per share (pence)

- basic (1.4)p 1.3p 1.6p

- diluted (1.4)p 1.3p 1.6p

------------ ------------ ----------

Consolidated Balance Sheet

As at 30 September 2014

As at As at As at

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 786 658 757

------------ ------------ --------

Current assets

Trade and other receivables 1,744 1,575 1,785

Cash and cash equivalents 6,301 7,429 7,247

------------ ------------ --------

8,045 9,004 9,032

------------ ------------ --------

Total assets 8,831 9,662 9,789

------------ ------------ --------

Equity

Share capital 487 487 487

Share premium account 232 232 232

Other reserves 1,508 1,508 1,508

Retained earnings 3,010 4,250 3,972

------------ ------------ --------

Total equity attributable to owners

of the parent company 5,237 6,477 6,199

------------ ------------ --------

Current liabilities

Trade and other payables 1,396 1,225 1,719

Deferred revenue 2,198 1,960 1,871

------------ ------------ --------

3,594 3,185 3,590

------------ ------------ --------

Total equity and liabilities 8,831 9,662 9,789

------------ ------------ --------

Consolidated Statement of Changes in Equity

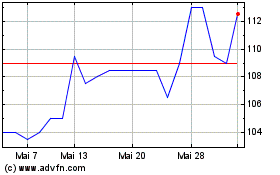

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024